Archive for March, 2023

-

Morning News: March 31, 2023

Eddy Elfenbein, March 31st, 2023 at 7:01 amDogged Inflation Shades Rebound

Eurozone Core Inflation Hits Record High

2023 Has Been Bad for the Bears. Here are 5 Reasons Why It’s Going to Get Even Worse

The Fed Is Doing Too Much, All at Once

How Big Tech Camouflaged Wall Street’s Crisis in March

Has Bitcoin Benefited From the Banking Crisis? Not in the Way Its Fans Hoped.

Jamie Dimon Reprises 2008 Role as Rescuer of a Failing Bank

Massachusetts Regulator Probes First Republic Insiders’ Stock Sales

BofA Says Investors Poured $508 Billion Into Cash This Quarter

Flight to Money Funds Is Adding to the Strains on Small Banks

DeSantis’s Allies Discover Disney Evaded Florida’s Move to Rein It In

‘Hurry Up and Get It Done’: Norfolk Southern Set Railcar Safety Checks at One Minute

Bed Bath & Beyond Ends Hudson Bay Deal, Turns to Market for $300 Million to Avoid Bankruptcy

Jack Ma Engineered Alibaba’s Breakup From Overseas

Netflix Restructures Film Group as It Scales Back Movie Output

Tetris Movie Shows Apple’s Ambition to Crack the Hollywood Puzzle

How We Know the Super-Rich are Finally Clamping Down on Spending

Be sure to follow me on Twitter.

-

Morning News: March 30, 2023

Eddy Elfenbein, March 30th, 2023 at 7:04 amThe World’s Most Important Oil Price Is About to Change for Good

A $3 Trillion Threat to Global Financial Markets Looms in Japan

The Triumph of UBS Is Also the Humbling of Swiss Banking

Swiss Authorities Reveal Cost of Credit Suisse’s Liquidity Lifeline

The $59 Billion Swiss Franc Debt Sales Market Is Up for Grabs

Shorting Global Banks Fetches $14.3 Billion in Paper Profit in March

Janet Yellen to Say Bank Rules Might Have Become Too Loose

A Rapid-Finance World Must Ready for a Slow-Motion Banking Crisis

FDIC Considers Forcing Big Banks to Pay Up After $23 Billion Hit

Morgan Stanley Downgrades Charles Schwab for First Time, Slashes Target

Average Wall Street Bonus Plunges 26% to $176,700

Why Banks Are Waging a Digital-Wallet War With Apple

TikTok’s Owner Pushes a New App, While Under Washington’s Glare

Publishers Worry A.I. Chatbots Will Cut Readership

The Delusion at the Center of the A.I. Boom

F.D.A. Approves Narcan for Over-the-Counter Sales

The Class of 2023 Faces a Jittery Job Market: ‘The World Seems to Have Flipped on Its Head.’

It’s Schultz Not Starbucks That Seems to Be Lost

The Undoing of Guo Wengui, Billionaire Accused of Fraud on 2 Continents

Ramen for Breakfast? Cup Noodles’ New Flavor Tastes Like Egg, Sausage and Maple Syrup Pancakes

Be sure to follow me on Twitter.

-

Morning News: March 29, 2023

Eddy Elfenbein, March 29th, 2023 at 7:05 amHow Ukraine’s Battered Steel Industry Galvanized Its War Effort

U.S. Pushes for Business Investment in Africa to Counter China’s Reach

SVB Mess Festered Under Fed’s Bureaucracy and Feel-Good Culture

SVB’s Collapse Shows the World’s Favorite Safe Asset Isn’t Risk-Free

UBS Veteran Ermotti Returns to Lead Credit Suisse Takeover

US 30-Year Fixed Mortgage Rate Eases to Six-Week Low

SES, Intelsat Near Deal to Create $10 Billion Satellite Giant

Alibaba’s $32 Billion Day Signals Breakups for China Tech

Rift Between Gaming Giants Shows Toll of China’s Economic Crackdown

What’s Hot on TikTok? Defending Its C.E.O.

Nvidia’s Sizzling AI-Driven Rally Flashes a Warning

$335,000 Pay for ‘AI Whisperer’ Jobs Appears in Red-Hot Market

In Sudden Alarm, Tech Doyens Call for a Pause on ChatGPT

The Metaverse Is Quickly Turning Into the Meh-taverse

GameStop Decides It Likes Stores After All

Pepsi Unveils New Look First Refresh in 14 Years

Union Showdown: Starbucks’ Howard Schultz Faces Bernie Sanders in the Senate

He Wanted to Unclog Cities. Now He’s ‘Public Enemy No. 1.’

The Hidden Ecosystem of Free Vacation Stuff

Be sure to follow me on Twitter.

-

CWS Market Review – March 28, 2023

Eddy Elfenbein, March 28th, 2023 at 6:19 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

First Citizens Bank Wins the Bidding War for SVB

Two weeks ago, Silicon Valley Bank collapsed in less than 48 hours. The bank lost one-quarter of its deposits in one day. One of the mysteries of this episode is that no one came forward to buy the bank, or even parts of it. The FDIC had to extend the deadline for bids.

Why? How could the collapse happen so quickly yet the bidding on the remains take so long?

Perhaps the remains of SVB were uglier than we were told. Normally, the FDIC likes to sell off any troubled banks as soon as possible to reassure depositors. This time, it had been two weeks and there were still no buyers. There was a deadline, in fact an extended deadline, set for last Friday.

My hunch is that any potential bidder realized that they were in a strong position and could thus extract very lucrative incentives from the FDIC. After all, time was on the bidder’s side and the FDIC isn’t in the bank-running biz.

Then it happened. Just before we got to Friday’s deadline, we learned that Valley National Bancorp and First Citizens BancShares (FCNCA) had both submitted bids to the FDIC. Eventually, First Citizens won the deal, and—boy, oh boy—did they win concessions.

An Indirect Bailout

Let’s start with the price tag. First Citizens will take over $72 billion worth of SVB’s assets at a 23% discount. That works out to $16.5 billion, but that’s not all. The FDIC also said it will be part of a loss-sharing deal on the commercial loans that First Citizen is taking over. The deal is to last for eight years. The bank will also get a special credit line for “contingent liquidity purposes.”

As they say on late-night infomercials, “but wait, there’s more!” The FDIC is also giving First Citizens a $35 billion loan to help finance the deal. In exchange, the FDIC will get equity rights in the bank that could be worth up to $500 million.

If this lasted any longer, First Citizens probably could have gotten free Taylor Swift tickets thrown in. They got a sweet, sweet deal. But don’t just take my word for it: on Monday, shares of First Citizens jumped 53.7%. And yet, the FDIC still isn’t done yet with SVB. It’s currently holding about $90 billion of assets in receivership.

All told, the FDIC will take a hit of about $20 billion from SVB and another $2 billion from Signature Bank. That hole will be replenished by higher charges to member banks, which will ultimately be picked up by depositors. One benefit of the soaring share price is that the FDIC will make some money thanks to the equity rights I mentioned. The FDIC has two weeks to exercise those options.

The auction for SVB got a little complicated because most potential bidders were looking at First Republic as their preferred target. Recently, a group of big banks gave a First Republic a badly-needed cash injection, but that didn’t stem the tide.

With the First Republic deal lingering, that may have taken away more interest in SVB’s remains. There’s also the issue that I’ve mentioned before: once a banking panic starts, you never know where it will go next. Bank A can go under and then you suddenly learn that Bank B lent them tons of money and now Bank B is teetering. Then you learn that Bank C is exposed to Bank B. Once the panic gets going, even a well-run bank can be pulled under.

First Citizens Emerges a Big Winner

So who’s First Citizens? It’s a regional bank based in Raleigh, North Carolina. It’s not that big. Or I should say, it wasn’t that big, but it’s a lot bigger now.

First Citizens is an interesting bank because it enjoys snatching up banks from the FDIC. Since 2009, it’s bought more banks from the FDIC than anybody else.

The bank has over 550 branches, and thanks to this deal, First Citizens has joined the big leagues. Three years ago, First Citizens had assets of $42 billion. That will now increase to $219 billion.

One challenge for First Citizens is that banking for the high-tech community traditionally hasn’t been their main business. But First Citizens knows a lot about taking over troubled banks. Over the past few years, First Citizens has taken over Temecula Valley Bank, Venture Bank, Sun American Bank and United Western Bank in Colorado. It’s become adept at folding these troubled banks into its larger business.

From the WSJ:

The longer-term challenge for First Citizens will be running a bank that has dramatically transformed in a short period. The bank will need to hold on to the $56 billion of deposits left at SVB after the majority fled the bank during its meltdown and seizure by the FDIC. It will also have to manage a book of loans to venture-capital firms and startups, and persuade those companies to continue to do new business with the bank.

Executives will have to do that while still digesting another big deal. First Citizens’s $2.2 billion purchase of commercial lender CIT Group Inc. closed in January 2022. CIT owned the remnants of IndyMac Bank, one of the biggest banks to fail during the 2008 financial crisis.

First Citizens has long been controlled by the Holding family. Frank Holding, Jr. is the current Chairman and CEO. The bank has a special class of shares that gives family members 16 times the voting power of ordinary shares.

The line of credit that First Citizens is getting is highly unusual. The idea is that it will protect First Citizens against a mad flight of capital. Between the lines, this tells me how badly the FDIC wanted a deal. Bear in mind that the folks taking over Signature Bank aren’t getting this nice little present from the FDIC.

To its credit, the FDIC has gone out of its way to show the public that SVB is not getting bailed out. The shareholders certainly aren’t. But you could say that there’s an indirect bailout in play. Instead, it’s the new owners who are benefiting from the government’s largesse. I won’t be surprised to see more of these in the future.

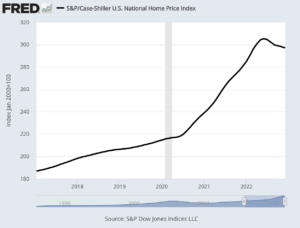

Home Prices Are Falling

Earlier today, we got the latest Case-Shiller report on home prices, and housing seems to be the one area of the economy that’s been cured of inflation. Home prices have now fallen for seven months in a row.

Over the last 12 months, ending in January, home prices increased by just 3.8%. That’s down from the 12-month figure for December of 5.6%. According to the report, “All 20 cities reported lower prices in the year ending January 2023 versus the year ending December 2022.” The hottest housing markets are Miami, Tampa and Atlanta, and the coldest are San Francisco, Seattle and Portland.

It’s no secret what’s happening. Higher mortgage rates have made homebuying more expensive. As a result, many potential homebuyers have been driven from the market.

This is the odd part about the Federal Reserve’s interest rate policy. Higher rates don’t slow down the economy broadly. Instead, the housing market stands in between higher mortgage rates and the Fed’s goal of taming inflation. The Fed started hiking rates one year ago, and we still have inflation in the economy, yet housing is under pressure.

Housing analyst Bill McBride points out that with seasonal adjustment, San Francisco has fallen 13.2% from the peak in May 2022, and Seattle is down 11.4% from the peak.

During Covid, mortgage rates dropped to the floor. In November, the average yield on a 30-year fixed rate mortgage peaked at just over 7%. It’s come down some since then. In fact, lower mortgage rates probably saved today’s Case-Shiller report from being worse than it was.

The outlook for housing may change soon. The latest futures prices show that traders see the Fed pausing on interest rates for the next six months. I’ll caution you that these prices are merely guesses as to what the Fed will do. Actually, the next move traders expect is a Fed rate cut in September. If that’s true, it would very beneficial for stock prices.

The next event coming is this Thursday when the government will revise the Q4 GDP. According to the last report, the U.S. economy grew in real annualized terms of 2.7% for Q4. On Friday, we’ll get the latest numbers for personal income and consumption. The Fed prefers to use this data to measure inflation.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: March 28, 2023

Eddy Elfenbein, March 28th, 2023 at 7:03 amAfter Doling Out Huge Loans, China Is Now Bailing Out Countries

China’s Cities Are Buried in Debt, but They Keep Shoveling It On

For Chip Makers, a Choice Between the U.S. and China Looms

U.S. and Japan Reach Deal on Battery Minerals

New Shell CEO Faces Big Dilemma: Should the Company Pump More Oil?

The Slow-Motion Tidal Wave Consuming Our Economy

Markets Are Wrong on US Rate-Cut Bets, BlackRock Says

Silicon Valley Bank’s Risks Went Deep. Congress Wants to Know Why.

For Battered U.S. Bank Shares, Earnings May Make or Break

Scion of $64 Billion Media Dynasty’s Firm Rides Out SVB Turmoil

Schwab’s $7 Trillion Empire Built on Low Rates Is Showing Cracks

Binance Woes Pile Up as Market Share Dives After Zero-Fees End

Alibaba Splits Into Six, Plans New IPOs in Historic Overhaul

Disney Eliminates Its Metaverse Division as Part of Company’s Layoffs Plan

Walgreens Quarterly Profit Beats Estimates on Strong Pharmacy Performance

Knowing Everyone’s Salaries Can Light a Fire Under Workers

Dollar General Is Deemed a ‘Severe Violator’ by the Labor Dept.

Adidas and Beyoncé to Part Ways After Ivy Park Sales Struggles

Be sure to follow me on Twitter.

-

Morning News: March 27, 2023

Eddy Elfenbein, March 27th, 2023 at 7:03 amMeet the Xi Jinping Loyalist Now Overseeing China’s Economy

Jack Ma’s Retreat Undercuts China’s Pitch to Private Business

In Africa, Kamala Harris Looks to Deepen Relations Amid China’s Influence

As Banking Worries Swirl, Europe’s Policymakers Express Confidence, With Caution

Saudi National Bank Chair Resigns After Credit Suisse Remark

First Citizens Buys Silicon Valley Bank After Run on Lender

Banking Crisis Raises Concerns About Hidden Leverage in the System

Morgan Stanley Strategist Says Earnings Are Next Risk to Equities

Dear Volcker Happy Talkers, How’s the ‘Inflation’ Fight Going?

Volkswagen Says EU Accord on E-Fuels a Boon for Porsche’s 911

The Paper-Thin Steel Needed to Power Electric Cars Is in Short Supply

Pentagon Woos Silicon Valley to Join Ranks of Arms Makers

U.S. ‘Industrial Policy’ Returns With $53 Billion for Chip Manufacturing

The Lure of the ‘Made in America’ Sales Pitch

Why Chinese Apps Are the Favorites of Young Americans

Tech’s AI Armies Are Huge, Yet Struggling to Innovate

Uber Eats to Take Down Thousands of Virtual Brands to Declutter the App

People Bought Crocs During the Pandemic. They Haven’t Stopped

Be sure to follow me on Twitter.

-

Morning News: March 24, 2023

Eddy Elfenbein, March 24th, 2023 at 7:02 amChina’s Economic Lifeline to Russia Gives Beijing Upper Hand

Lawmakers Blast TikTok’s C.E.O. for App’s Ties to China, Escalating Tensions

Evergrande Strikes Deal for $19 Billion Bond Restructuring

Deutsche Bank Shares Plunge in Renewed Bout of Stress

The Curse of Credit Suisse Conjures a New Banking Reality

Banks Can’t Be Trusted. A ‘Golden Share’ Might Help

Yellen Says US Prepared to Take More Action to Keep Bank Deposits Safe

‘Bonkers’ Bond Trading May Be Sending a Grim Signal About the Economy

Accounting-Fraud Indicator Signals Coming Economic Trouble

The Fed Has Targeted 2% Inflation. Should It Aim Higher?

Volcker Slayed Inflation. Bernanke Saved the Banks. Can Powell Do Both?

Jack Dorsey’s Wealth Tumbles $526 Million After Hindenburg Short

Most Americans Doubt Their Children Will Be Better Off, WSJ-NORC Poll Finds

Faulty Credits Tarnish Billion-Dollar Carbon Offset Seller

Ford Says It Will Lose $3 Billion on EVs This Year as It Touts Startup Mentality

Accenture to Cut 19,000 Jobs as IT Spending Slows

Pandemic Pet Adoptions Propel Rise of a $500 Billion Global Market

Crypto Fugitive Do Kwon Charged With Fraud by US Prosecutors in New York

The Younger Brother Caught in the Middle of the FTX Investigation

Be sure to follow me on Twitter.

-

Morning News: March 23, 2023

Eddy Elfenbein, March 23rd, 2023 at 6:24 amConsumers Foot the Bill for Traders ‘Manipulating’ UK Power Market

Bank of England to Weigh a Rate Increase After a Jump in Inflation

Swiss Central Bank Lifts Key Rate, Declares End to Bank Crisis

China’s Rise Relied on Ties to the West, Which Xi Is Now Loosening

China Is Starting to Act Like a Global Power

China Voices Strong Opposition to Any Forced Sale of TikTok

TikTok CEO Seeks to Convince Congress App Isn’t Security Threat

Double-Barreled Economic Threat Puts Congress on Edge

Fed Walks Tightrope Between Inflation, Bank Turmoil—but for How Long?

Powell’s Own Guide to Recessions Shows Rate Cuts Are Coming

Citi CEO Fraser Warns Mobile Money is ‘Game Changer’ for Bank Runs

Banks Are Risky. Silicon Valley Bank’s Risk Officer Was AWOL.

Wall Street Eases Hiring Freeze in Grab for Credit Suisse Talent

What Does ‘Made in America’ Mean? In Green Energy, Billions Hinge on the Answer

Twitter Isn’t Making Money. Here’s Why Musk Thinks It Could Soon

Is Working From Home Really Working?

GM to Stop Making Iconic Chevrolet Camaro Following Sales Slump

California Could Ban Skittles Due to Concerns Over Health Impacts

Be sure to follow me on Twitter.

-

Morning News: March 22, 2023

Eddy Elfenbein, March 22nd, 2023 at 7:03 amXi and Putin Bind China and Russia’s Economies Further, Despite War in Ukraine

U.K. Inflation Swings Upward, in a U-Turn

Lagarde Vows ‘Robust’ Policy With ECB Ready to Act as Needed

A New Chapter of Capitalism Emerges From the Banking Crisis

SVB-Fueled Turmoil Junks Lessons of the Global Financial Crisis

First Republic Rescue May Rely on US Backing to Reach a Deal

A Big Question for the Fed: What Went Wrong With Bank Oversight?

Fed Caught Between Inflation and Bank Crisis

Investors Trade Cautiously Ahead of Pivotal Fed Decision

JPMorgan Says Treasuries Coping Amid Worst Liquidity Since 2020

Bank Crisis Could Cast Pall Over Commercial Real Estate Market

30-Year Mortgage Rate Falls to a Five-Week Low

Willy Loman, And When It Is Never Too Late In The Job Market

TikTok CEO Shou Zi Chew Promises Firewall to Shield User Data

Pulling the Plug on TikTok Will Be Harder Than It Looks

Google Launches Bard AI Chatbot to Counter ChatGPT

White Claw Upended Beer. Now It’s Coming for Vodka

‘End of an Era’: Dodge Unveils Last Super-Fast Gasoline Muscle Car

Be sure to follow me on Twitter.

-

CWS Market Review – March 21, 2023

Eddy Elfenbein, March 21st, 2023 at 6:08 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

RIP: Credit Suisse

After 167 years, Credit Suisse is no more. The bank has ceased to be. It is bereft of life. This is an ex-bank.

Over the weekend, UBS bought out its long-time rival, Credit Suisse, for $3.24 billion.

This is a major event in global banking. Consider that at the end of last year, Credit Suisse had a balance sheet of half a trillion dollars and 50,000 employees globally. Shares of CS closed Monday at 94 cents.

To say this was a fire sale badly understates the events. The Swiss government essentially forced this deal to happen. They aimed to stop the banking crisis cold. To give you an idea of how far they went, the settled price for Credit Suisse was less than half of Friday’s closing price. It works out to 7% of CS’s tangible book value.

CS shareholders will get one share of UBS for every 22.48 shares of CS they own. That values a share of CS at 0.76 Swiss francs which is 99% below its high.

The Swiss government even sweetened the pot for UBS. The government said it would chip in $9 billion to backstop any losses from the deal. The Swiss National Bank said it would provide $100 billion in liquidity. Investor lesson: When the government—any government—wants a financial outcome badly enough, it’s hard to say “no.”

Mind you, the authorities weren’t crazy. The Swiss government strongly preferred a buyout over a wind-down that would be run by courts, lawyers and regulators. Plus, they wanted a deal done fast. The goal was to have something complete before Asian markets opened on Sunday evening. They made it, but barely.

Frankly, they had to do something. The mess at Credit Suisse was bad and getting worse. The bank was hemorrhaging $10 billion a day. Credit Suisse’s Chairman, Axel Lehmann, said, “The acceleration of the loss of trust and the worsening of the last few days made it clear that Credit Suisse cannot continue to exist in its current form.” That statement was one of the few things they got right.

Banking Is About Confidence

This wasn’t a story of garbage loans. Instead, all the customers headed for the exits. Quite simply, no one believed in them anymore.

That’s the thing about banking. Most people think banking runs on money. It doesn’t. A bank runs on confidence. Once that’s gone, the whole game’s up. It doesn’t matter how much money SNB threw at the problem; without confidence, it wasn’t enough, and it never could be enough.

It’s hard not to have some sympathy for Credit Suisse, but they made just about every mistake they could. They recently got a $4 billion cash injection from the Saudi National Bank on the hopes they could engineer a turnaround. That didn’t happen. Perhaps CS’s biggest mistake was going bust so close behind SVB and Signature.

Last Thursday, the Swiss government extended CS a $54 billion lifeline to make sure they would last until the weekend. Later, they had to double that amount.

Not surprisingly, UBS clearly didn’t want any part of a deal. They realized they were in the strong position, so they asked for a lot, and they got it. During any normal time, the hitching of these two would have been an obvious anti-trust red flag. Not this time. Funny how the government can decide which rules to enforce, when and to whom.

The initial deal that UBS offered was for $1 billion. After shareholders complained, the price tag was lifted to $3 billion, which is still very cheap. As a result of the deal, UBS said it would halt its stock buyback program and pare back its plans for CS First Boston, CS’s investment banking business.

One of the big issues is CS’s investment banking business. CS had been looking to spin it off, and that’s probably not going to happen. They could lose a bundle in scrapping the deal. That’s one of the reasons why UBS was so reticent about taking CS on.

Over the weekend, there was one last-ditch attempt to save CS. A group was planning to inject $5 billion into CS if the government promised to make the bondholders whole. The government turned it down.

I had difficulty keeping up with all of Credit Suisse’s misdeeds. Here are a few.

In 2020, the CEO resigned after it was learned that the COO hired a private investigator to spy on the bank’s former head of wealth management. They wanted to see if he was poaching clients or employees as he had recently transferred to UBS.

Even though the CEO resigned, an investigation found that he had no knowledge of the plan, which raised the question of why was he out of the loop. The scandal later took a tragic turn when the hired private investigator committed suicide.

The following year, Credit Suisse was fined after it was revealed that the bank had bribed government officials in Mozambique and accepted kickbacks. The bank was supposed to be organizing loans to help Mozambique’s tuna industry. The fines would have been higher, but CS agreed to write off some of the loans.

Credit Suisse was also involved in the very strange story of Bill Hwang and his firm, Archegos Capital. Hwang seemed to have no idea what he was doing. Naturally, he was managing several billion dollars.

As you might guess, this came to an unpleasant end. Hwang made a giant and highly-leveraged bet on ViacomCBS (now called Paramount Global). The media company announced a stock sale, and the shares took a big hit. Hwang’s leveraged position started to plunge and he got a margin call. One of my first jobs in finance was making margin calls to clients. When you get a margin call, you have two options: put up more money or sell. If you don’t sell, the firm will do it for you.

According to Bloomberg, Hwang lost $20 billion in two days. He had borrowed tons of money from Wall Street banks, and they were suddenly left exposed. Goldman Sachs and Morgan Stanley moved fast to protect themselves. Credit Suisse did not, and the bank got stung for a loss of $5.5 billion.

Hwang was later arrested and charged with racketeering, securities fraud and wire fraud. Credit Suisse’s reputation never recovered.

What Are CoCo Bonds?

Another odd aspect of this Credit Suisse debacle is that the bonds have been far more volatile than the equity. CS shares are getting shares of UBS. That’s pretty straightforward, but some of the bondholders have been wiped out.

Credit Suisse has what are called additional tier 1 (AT1) bonds. More formally, these are called convertible contingency bonds. Less formally, they’re known as CoCos.

CoCos are bonds that convert into stock if some pre-specified event happens. For example, going bankrupt. CoCos can even be declared worthless, and that’s exactly what happened with Credit Suisse.

On Sunday, the Swiss regulators announced that as part of the deal, Credit Suisse’s AT1 bonds will get a brand-new price of $0. The AT1 investors are furious, and I’m sure this will all be headed to court.

This is one of the hidden aspects of a financial blowup. You never know exactly where it will spread. The AT1 bonds are turning into a major issue. According to the regulators, $17.3 billion of CS’s CoCo bonds have gone up in smoke.

So now folks are wondering why the CoCos got torched when the stockholders didn’t. Traditionally, bondholders outrank equity owners. This has roiled the entire CoCo market. For example, Invesco has an ETF that invests in AT1 bonds. On Monday, it lost close to 6%.

CoCos came about after the financial crisis and became popular with many European banks. Today, there’s more than $250 billion of outstanding AT1 bonds. The bonds were popular with investors. They paid a good deal and the prospect of going bust seemed improbable. Raymond DeVoe famously said, “More money has been lost reaching for yield than at the point of a gun.”

In 2020, Credit Suisse was able to float $1.5 billion in AT1s and they got a rate of 5.25%. They were seen as a safe way of shifting bailout risk to bondholders from taxpayers. That’s why they were afterward called bail-ins instead of bailouts.

But now, the whole CoCo market has gone cuckoo. Everyone had assumed these bonds were safe. Hey, what’s the worst that can happen? Well, now we know. I’ve seen several clips this week of investors furious that their Cocos have been zeroed out. Don’t play the game if you don’t know the risks. In Monday’s trading, Deutsche Bank saw its AT1 bonds drop sharply. So did UBS. Importantly, CoCos are not issued by American banks.

Thanks to this deal they didn’t want, UBS is now one of the largest and most important financial institutions in the world.

Expect the Fed to Hike by 0.25%

I got a good response from last week’s issue when I did a deep dive on what happened at Silicon Valley Bank. That’s why I decided to do the same with Credit Suisse.

But I didn’t want to leave without discussing this week’s Fed meeting. The Fed’s two-day meeting began today and will wrap up tomorrow. The policy statement will be released on Wednesday at 2 p.m. ET.

I expect the Fed will once again hike interest rates by 0.25%. Until recently, I was leaning toward a 0.50% increase, but the events of late have changed that outlook.

At the next meeting in May, I expect another 0.25% hike. After that, however, I think things may change. There’s a good chance that the Fed will take a break for a few months and leave rates unchanged. Of course, this is just a guess and much of what the Fed will do will depend on the behavior of inflation and the economy.

There’s even a decent chance that the Fed will soon shift its bias toward rate cuts, especially if the slowdown in housing spreads to other sectors. The simple fact is that the economy will probably weaken as we get closer to 2024. I hope the Fed will address these issues in tomorrow’s press conference. I’ll have more details in our next premium issue.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His