CWS Market Review – March 14, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

This week’s news on Wall Street has been dominated by the stunning collapse of Silicon Valley Bank. This is the second-largest bank failure in U.S. history. Investors are still feeling the shockwaves. We’re not done. There could be others.

In this week’s issue, I want to explain what happened and why. I also want to discuss potential ramifications.

Banks Are Different

Before we dig into the remains of Silicon Valley Bank, I should explain that free enterprise is often referred to as the “profit system,” but that’s not quite right. It’s really the profit and loss system. It’s the “and loss” part that helps make it so successful.

When a business goes bust, it’s an unfortunate thing, but it’s necessary to close unprofitable enterprises. You don’t want zombie businesses that are kept alive by endless streams of funding.

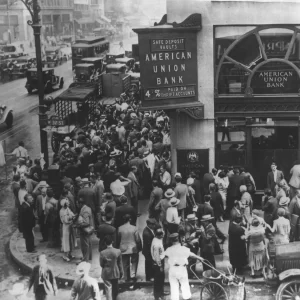

A crowd of outside the American Union Bank during the Great Depression.

When a business goes bankrupt, there’s a standard playbook to follow. The business goes to a bankruptcy court. A judge orders all the assets to be sold. The creditors get first dibs, and the equity holders get whatever’s left. That’s basically it.

Again, it’s unpleasant but necessary. The worst part is that employees lose their jobs. While that’s also unpleasant, most people can find something new rather quickly. Of course, there’s also unemployment insurance.

Some studies have shown that being laid off can often be a blessing in disguise in that it forces people to leave an unsatisfying job for something more rewarding. I’ve seen many examples of that personally. I’m sure you have as well.

The other downside of a bankruptcy is that your suppliers lose your business, but, for the most part, the world moves on. The ending of one business leaves a wound that tends to heal surprisingly quickly.

Now we come to the one, giant exception to what I’ve said. When a bank goes under, it’s a very big deal because the damage isn’t limited to a few parties. If a bank goes under, it can take all its depositors with it.

That means that several other businesses could go bust even though they were perfectly healthy. Bank runs can quickly become self-reinforcing cycles. That’s happened many times in history, not just in “Mary Poppins” and “It’s a Wonderful Life.” In fact, it’s the volatile and viral nature of bank runs that led to the creation of the Federal Reserve in the first place.

One of the foundational issues in finance is, “how do we let bad banks fail without ruining the depositors?” Frankly, there are no good answers, but there are several less-bad answers such as deposit insurance and risk capital ratios. We make do the best we can.

What Happened at Silicon Valley Bank

Having said that, let’s turn to what happened at Silicon Valley Bank. What’s interesting is that what impacted SVB was many of the same things we’ve talked about in recent months.

When Covid struck, the Federal Reserve responded quickly by lowering interest rates to the floor. That sparked a furious rally in high-risk assets. Our Buy List certainly felt the effect. In Silicon Valley it led to a venture capital-funded investment boom. Every start-up was getting funding. When rates are at 0.%, why not?

SVB was the banker of choice for Silicon Valley. If you’re a start-up and you got, say, $5 million in Series A funding, then you most likely stuck it in SVB. All the cool kids were doing it.

This led to a large surge in deposits for SVB. As odd as it may sound, that’s not always a good thing for a bank. SVB had to invest those assets to make money to cover its deposits. The bank selected to invest in longer-term government bonds, agency bonds and mortgage-backed bonds.

Then came inflation and game changed. The Fed aggressively raised interest rates and high-risk assets faltered. The venture capital spigot for Silicon Valley was shut off, so the start-ups withdrew money from their SVB accounts. Start-ups can burn through cash at an alarming rate.

To cover those withdrawals, SVB had to sell those bonds. The problem was that the values of the bonds had tanked thanks to the Fed and inflation, so SVB was selling for a big loss. It also didn’t help that for nine months, SVB didn’t have a chief risk officer.

One of our Buy List stocks, Moody’s (MCO), told SVB that it was looking to downgrade the company’s stock credit rating.

SVB came up with an idea. On Wednesday, SVB announced a plan to raise money by selling stock. That was truly a massive flop.

Instead of calming investors, the stock sale news frightened depositors and they withdrew their money, nearly all at once. Nowadays, it only involves the click of a mouse to move money, instead of waiting in line at the old Bailey Building & Loan. In one day, depositors withdraw one-quarter of the bank’s total deposits. The bank’s website was having difficulty keeping up which isn’t a good look for anything based in Silicon Valley.

Peter Thiel, an influential figure in Silicon Valley, withdrew his money from SVB. On Thursday, SVB’s stock crashed 60%. The government had seen enough. They stepped in and shut SVB down. A bank hadn’t failed in the U.S. in more than two years.

Typically, when the government takes over a bank, it aims to sell it off quickly to a nearby competitor, even at a steep discount. The Feds would rather do a deal fast than good. The government was desperately looking for a buyer and, apparently, no one was interested.

Even if the government could sell off some of SVB’s assets, that could meet limited withdrawal needs. In 1907, J.P. Morgan famously stopped the financial panic by serving as the lender of last resort. Alas, in 2023, no one on Wall Street wanted anything to do with SVB.

FDIC insurance covers deposits up to $250,000 but that was a tiny portion of SVB’s deposits. The large majority of deposits were uninsured. On Sunday, the government announced a plan to insure all SVB’s deposits, whether they had been insured or not.

Make no mistake – this is a bailout, but it’s different from what happened in 2008. This is more of an indirect bailout. To be clear, SVB’s shareholders are getting nothing and all the top people will be fired.

Still, thanks to the government, lots of Silicon Valley startups have been pulled from the fire. For example, a company called Wrapbook, which does payroll processing for the entertainment industry, said its payments might be delayed. If their deposits were wiped out, that could have hurt a lot of regular Joes. Don’t think this was all about protecting the fat cats.

This is the problem with a financial mess like this. You don’t know who has exposure to whom until the house of cards comes tumbling down.

Over the weekend, there were some panicky voices predicting bank runs on Monday morning. That didn’t happen.

I’ve noticed that people like to overlay a highly moralized narrative on a financial breakdown. That can be a mistake. Not that there aren’t heroes and villains, but that it may cloud what really happened. SVB was in a lousy position – they had bad luck and they made some dumb mistakes. Very dumb. It didn’t help matters that this happened so shortly after FTX and the same time that Silvergate announced its voluntary liquidation.

I am, however, curious about well-timed stock sales from senior SVB management. I hope this will be looked into.

Signature Bank Also Comes to an End

The government also shut down Signature Bank (SBNY) which was a former Buy List stock. The government is also standing by SBNY’s uninsured deposits. We sold out of SBNY three years ago. We even made a small profit. The bank decided to become a major financial resource for crypto. Let’s just say that I don’t have any regrets in selling SBNY.

There’s a Regional Bank ETF (KRE) that’s become an unofficial bellwether for the current crisis. The ETF dropped 4% last Thursday and another 8% on Friday. Yesterday, KRE dropped another 12%.

The other bank that’s teetering on the edge is First Republic (FRC). Its stock plunged 62% on Monday. Trading was halted in several banking stocks yesterday. Wall Street seems to be breathing a lot easier today. Shares of FRC gained 27% today. Charles Schwab (SCHW) was up 9%. KRE closed 2% higher.

I suspect that the worst is behind us, but we’re not out of the woods just yet. Earlier today, Moody’s cut its view on the banking sector from stable to negative.

If you want to take advantage of the crisis, I would say that SCHW is a speculative buy here, but expect a lot of volatility.

There’s also the question of what happens to deposit insurance now. Is there no longer a $250,000 limit? I don’t know, but if you make an exception for one group, then others will expect the same. Some observers have said this will cause an exodus from smaller banks to only the largest banks. I’m not sure if that’s right but it could happen.

It doesn’t seem right to expect every bank customer to review the soundness of each bank. Just insure all bank deposits. This crisis reveals that that’s what would happen anyway.

Another effect of Silicon Valley has been a big jump in Treasuries in the last few days. Over Thursday, Friday and Monday, the yield on the two-year Treasury fell 103 basis points (or 1.03%). Ironically, some of the recent rally certainly helped SVB’s bond portfolio.

The Federal Reserve meets again next week, and the expectations are for a rate increase of 0.25%. Earlier, traders had been expecting an increase of 0.50% but the banking system may be too fragile. Traders also expect to see a few rate cuts later this year. I’m not fully convinced that will happen but it’s not out of the question.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on March 14th, 2023 at 5:52 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His