CWS Market Review – April 18, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

More Evidence of a Coming Recession

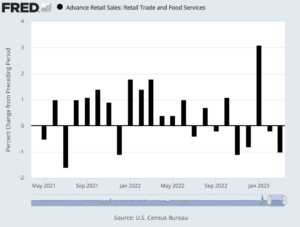

The case for a recession continues to get stronger. On Friday, we learned that consumer spending fell in March. This was the second month in a row that Americans cut back on their shopping.

An economy can withstand a lot, but it’s particularly hard to grow when folks aren’t out there in the malls.

For March, retail sales fell by 1%. That comes after a drop of 0.2% in February. It’s even worse than it sounds because these numbers aren’t adjusted for inflation.

This comes on top of other troubling news. Job openings are down, unemployment claims are up and we’re looking at another weak quarter for corporate earnings.

Still, I’d caution investors against getting too pessimistic. The odds are that we’re facing a brief and shallow recession. This slowdown was caused by the Fed, and the central bank can easily reverse course.

The other factor to watch is the credit markets. The banking sector got a big scare in March, but we still don’t know how widespread the damage was. The fact is that many smaller banks have been losing customers to the big banks.

Friday was the unofficial kickoff of Q1 earnings season as several of the big banks reported earnings. JPMorgan Chase (JPM) led the way with a big earnings beat. For Q1, JPM earned $4.32 per share compared with the Street’s forecast of $3.41.

JPM said that net interest income will be about $81 billion for 2023. That’s an increase of about $7 billion from its previous forecast. But here’s the interesting part. That forecast is based on JPM paying less to depositors later in 2023. In other words, JPMorgan Chase thinks interest rates will go down later this year. I suspect they’re right.

Wells Fargo (WFC) also did well last quarter. For Q1, the bank earned $1.23 per share which was 10 cents more than expectations. WFC’s net interest income increased by 45%. The CEO said, “the majority of our businesses remain strong.”

Citigroup (C) earned $1.86 per share which was 19 cents ahead of expectations. The bank has been cutting back on its international operations. Many of the big banks are going for less than 10 times earnings.

Shares of State Street (STT) got hit hard on Monday after the bank showed an outflow of deposits. Charles Schwab (SCHW) also fell hard after it said it lost $41 billion in deposits during Q1. This stock has been beaten up this year, but the company said that it can withstand customer outflows. On Monday, Schwab said its Q1 earnings rose to 93 cents per share, three cents more than Wall Street’s consensus.

The downfall of Silicon Valley Bank and Signature Bank probably happened too late during Q1 to have a noticeable impact on this round of earnings. The top-tier banks are doing well, but the concern is still among the regional banks. This could still get messy.

On Thursday, one of my favorite regional banks, Hingham Institution for Savings (HIFS), reported disappointing results. For Q1, HIFS said it made $3.87 per share. That’s down from the $5.38 it made in last year’s Q1. The bank provides unlimited deposit insurance for all its depositors.

Shares of HIFS got dinged for an 8% loss on Friday. It was down again on Monday, and it hit a fresh 52-week low. The stock is nearly back to where it was five years ago. Still, I can’t say I’m terribly worried about Hingham. The company has a great long-term track record and it’s still not followed by any analysts on Wall Street. I also like that Hingham often pays a special dividend near the end of the year.

The Bank of Apple

On Monday, Apple (AAPL) and Goldman Sachs (GS) announced a new partnership, the Apple Card savings account. This is a savings account that pays 4.15% per year. That’s far higher than most savings accounts.

So what’s the catch?

Nothing, really. The savings account is for users of Apple’s credit card (also a Goldman partnership). There are no fees. No minimum deposit. The account max is $250,000. It looks simple. You can set up an account from the Wallet app on your iPhone.

Not only that, but Apple Card rewards program offers 3% on purchases. If you want, that money is deposited directly in your Apple savings account.

This offering comes during a rough time for many banks. As rates go higher, there’s more pressure to entice savers with better rates. Over the last year, customers have pulled $800 billion from U.S. commercial banks.

As odd as this may seem, Apple has already taken on some of the trappings of being a bank. Of course, Apple has Apple Pay and Apple Wallet. Apple also has a “buy now, pay later” service. The new savings account should really be seen as logical progression to those businesses.

If you add up all the cash and marketable securities on Apple’s balance sheet, it comes to $169 billion. That’s far larger than all but a few banks.

If you’re interested, here’s how you can set up an Apple savings account in your iPhone.

Bottom-Fishing with Whirlpool

I’ve been looking at shares of Whirlpool (WHR) recently. I wanted to highlight it for you this week because it’s an interesting example of bottom fishing, and why that’s a very hard thing to do.

I’ll try to walk you through my reasoning. By most metrics, Whirlpool is an inexpensive stock. Just going by the dividend, WHR currently yields 5.2%. That’s certainly tempting.

Also, the stock has not performed well. Two years ago, WHR was going for over $250 per share. Lately, it’s been around $135 per share, but a lower stock doesn’t mean it’s inexpensive. That only means that it’s cheaper than where it was before.

Bottom-fishing for stocks is notoriously difficult. Oftentimes, stocks are down for very good reasons. Investors can be tempted by low valuations which prove to illusionary. But if your bottom-fishing works out, you can reel in big profits.

Let’s start with some basics. Whirlpool is a major home appliance company. It was founded by Louis Upton in 1911. (Kate Upton is a descendent.) You’re very likely to find a Whirlpool product in just about every kitchen or laundry room across the U.S.

Business has been rough lately and Whirlpool’s earnings have not done well. In 2021, the company made $26.59 per share. Last year, that fell to $19.64 per share. Wall Street expects it to earn $15.84 per share for this year, and $18.08 for 2024. If the latter figure is correct, that means that Whirlpool is going for about 7.5 times forward earnings. Clearly, traders are wary of WHR.

In January, Whirlpool said it expects earnings to fall slightly this year due to supply-chain issues. WHR’s Q4 sales fell 15%. For the year, sales were down just over 10%.

For this year, Whirlpool sees earnings ranging between $16 and $18 per share on revenues of $19.4 billion. Whirlpool has $1.4 billion in cash from operating activities and about $800 million in free cash flow.

Whirlpool is also working to alter its business. The company has divested its businesses in Europe, Africa and the Middle East, but it’s not leaving Europe. Instead, Whirlpool plans to work with Arcelik, a Turkish company, to make a company that’s focused on the European market. Whirlpool will own 25% of the venture.

The company recently closed on a $3 billion acquisition of Emerson Electric’s InSinkErator business.

Whirlpool has also been cutting costs. The company expects to save between $800 million and $900 million this year. The company is sitting on $2 billion in cash.

If Whirlpool can manage its transition well, then it’s probably a very cheap stock right now. Last week, Goldman Sachs upgraded the shares from neutral to buy. That was the first good news it’s had in some time. Goldman has a price target of $160 per share. (Personally, I think price targets are pointless.)

We’ll soon learn more. Whirlpool will report its Q1 earnings on Monday, April 24. Wall Street expects earnings of $2.20 per share.

For now, I would rate Whirlpool a risky buy. It’s not part of our Buy List but it’s one to keep an eye on.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on April 18th, 2023 at 4:22 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His