CWS Market Review – May 16, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Is Eerily Quiet

There’s an adage on Wall Street that investors should “sell in May and go away.” There’s some historical evidence to back that up.

A few years ago, I ran through the entire history of the Dow Jones Industrial Average, going back to its start in 1896. What I found was that from May 6 until October 29, the Dow has gained an average of just 0.71%. For the rest of the year, from October 29 to May 6, the Dow has gained an average of 7.16%.

This means that roughly 10% of the Dow’s annual gain has come in one half of the year, while 90% has come during the other half. Well, we’re now in the slow half. Of course, the stock market has already gone more than 16 months without hitting a new high.

What’s been really striking lately is how lethargic this market has been, especially with all the recent talk of an interest rate-hiking pause and the debt ceiling standoff and lingering fears of more regional banks going kaput. Yesterday, the stock market had its lowest volume since August (excluding the half day after Thanksgiving).

Notice in the chart above how narrow the market has become. What’s more is that the S&P 500 hasn’t posted a weekly gain or loss of more than 1% for six weeks in a row. It seems like every day, the market closes about where it started. On 29 of the last 32 trading days, the S&P 500 has closed within 1% of 4,130. There’s just not much action in either direction.

April Retail Sales Grew by 0.4%

Will that change soon? There are no guarantees, but there’s growing evidence of weakness in the economy.

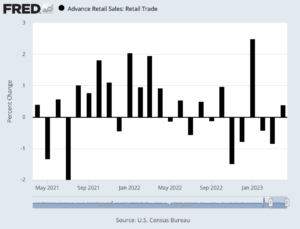

This morning, we got the retail sales report for April, and it came in less than expected. I like to keep a close eye on this report because it tells us what kind of mood shoppers are in. This is important because consumers represent about 70% of the economy.

Last month, retail sales grew by 0.4%. That wasn’t so hot. Economists had been expecting growth of 0.8%. If we exclude auto sales, then retail sales were up by 0.4% which matched estimates.

The April numbers weren’t that bad compared with recent months. In March, retail sales dropped 0.7%. April was the first positive month for retail sales since January.

The problem is that retail sales are coming in largely inline with inflation. Over the last year, retail sales are up by 1.6%, but that’s less than one-third the inflation rate of 4.9%. In other words, people are buying the same volume of stuff; they’re just paying more per unit.

A 0.8% drop in gasoline sales held back the spending figures. Sporting goods, music and book stores posted a 3.3% decline, while furniture and home furnishings saw a 0.7% drop.

Miscellaneous store retailers led gainers with a 2.4% increase, while online sales rose 1.2% and health and personal care retailers saw a 0.9% rise. Food and drink sales climbed 0.6% and were up 9.4% on a 12-month basis.

Except for a blow-out report in January, many of the recent retail sales reports have been rather weak.

We also got the industrial production report for April. It showed an increase of 0.5%. That’s not bad. Economists had been expecting an increase of just 0.1%.

Some Federal Reserve members have been pushing back on the idea of an interest rate pause. Yesterday, Raphael Bostic said he thinks another rate hike is more likely than a rate cut. So far, the futures market isn’t going along with that idea. For now, I’m in the “pause” camp, but I’m afraid the regional bank mess isn’t altering the Fed’s outlook.

A survey by Bank of America found growing pessimism from investors. According to the survey, money managers have their bond allocation at the highest in 14 years. Nearly two-thirds of those polled expect the economy to get weaker. One encouraging takeaway is that most respondents expect a soft landing.

Home Depot Posts Worst Sales Miss in 20 Years

Also today, we got the earnings report from Home Depot (HD) and it was pretty lousy. The quarterly HD earnings report is, in my opinion, a better indicator of the economy than any government report. Just about every home contractor or do-it-yourselfer can be found in the aisles of your local HD.

Simply put, if HD isn’t doing well, then the economy is probably not doing well. (To be fair, I’d include Lowe’s as well.)

For its Q1, Home Depot said it made $3.82 per share. Although that was a two-cent beat, it’s still down from $4.09 per share from last year. HD’s revenue fell 4.2% to $37.26 billion. This was the company’s biggest revenue miss in more than 20 years. Home Depot also lowered its fiscal year sales forecast.

What went wrong? The company said that folks are buying fewer big-ticket items. Instead, consumers are taking on smaller projects. HD was also hurt by colder weather and falling lumber prices. Charlie Bilello notes that in the last two years, lumber prices are down more than 80%.

This was the second quarter in a row that HD missed its revenue forecast. Before that, it beat the Street’s revenue forecast for 12 straight quarters.

By the way, one odd quirk of the Dow Jones Industrial Average is that it’s not weighted by market cap. Instead, it’s weighted by price. As a result, Home Depot has a much greater influence on the index than Walmart does. In fact, HD has about twice the weighting as Walmart even though Walmart does about four times the sales.

HD said that customer transactions were down 5% but the average ticket is about the same. People are literally paying more and getting less. Home Depot now expects full-year sales to be down 2% to 5%. That’s down from its previous forecast for flat sales. Shares of HD fell as much as 4% in today’s trading although it recovered a bit before the closing bell.

Lowe’s is due to report next week. Its shares were down today in sympathy with HD. That’s common on Wall Street. Traders assume that problems in one company must be present in every competitor. I found that not to be the case. For next week, Wall Street expects LOW to report $3.46 per share.

Stock Focus: U.S. Lime and Minerals

This week, I want to revisit a stock I first told you about in January, U.S. Lime and Minerals (USLM). The stock is up more than 22% since then.

U.S. Lime is one of those off-the-beaten-path stocks that I love. Despite its small size ($1 billion in market cap) and archaic sounding name, USLM is a very strong company.

So what does U.S. Lime do? As the name suggests, lime. Lots of it. The company “is a manufacturer of lime and limestone products, supplying primarily the construction (including highway, road and building contractors), industrial (including paper and glass manufacturers), metals (including steel producers), environmental (including municipal sanitation and water treatment facilities and flue gas treatment processes), roof shingle manufacturers, agriculture (including poultry and cattle feed producers), and oil and gas services industries.”

Best of all, no one on Wall Street follows the stock. In January, I told you that I pegged Lime’s Q4 earnings at $1.60 per share. I wasn’t even close. Lime earned $1.90 per share.

The stock has been an amazing performer, and not just recently. Twenty years ago, you could have picked up one share for less than $3. Today that same share is going for more than $180 and, it just hit another new all-time high. You’d think some firm on the Street would start coverage. Alas, that’s not the case.

Two weeks ago, Lime released a very strong Q1 earnings report. Revenues jumped 31% to $66.8 million. Lime’s gross profit grew by 65% to $24 million, and net income nearly doubled to $3 per share. Check out this chart:

I’m not adding Lime to our Buy List but I want to show investors that there are lots of unexpected places to find great stocks. Many of the best stocks shy away from the limelight.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on May 16th, 2023 at 7:08 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His