CWS Market Review – May 2, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

JPMorgan Chase Buys First Republic

A few weeks ago, when Silicon Valley Bank went to the great clearinghouse in the sky, one of the points I stressed is that in a banking crisis, you never know who’s next. Some folks thought the banking mess was over and that we could get on with our lives.

Not so fast. Investors were keeping a close eye on any bank that had a high percentage of uninsured assets. That naturally led them to First Republic (FRC).

That’s hardly a surprise because in many respects, FRC is quite similar to Silicon Valley Bank. It’s based in California. It catered to the tech community. It had a high percentage of uninsured deposits.

(This chart is like a real-life version of Nassim Taleb’s chart of the days in the life of a Thanksgiving turkey.)

Low rates and lots of cash funded a boom for many of these regional banks. Once interest rates turned northward, the business model unraveled. FRC tried to borrow to fill the gap, but that made the problem worse.

The FRC story is different in one key respect: it was thought to have a good chance of making it through this chaos. If you recall, several big banks, including JPMorgan, injected $30 billion into FRC to keep it running.

First Republic had a simple business model: focus on very wealthy customers and give them top-of-the-line service. Being based in San Francisco, FRC also had an important toehold in the tech world.

First Republic opened branches in wealthy neighborhoods. The bank even had a branch inside Facebook’s HQ. Under one deal, Google employees could get a $2,000 bonus by opening an FRC account. The bank gave the Zuck a $6 million mortgage with a rate of 1.05%.

With rates at 0%, all was sunny. FRC paid very low interest on deposits and used its money to fund high-end projects or to mortgage second homes. The loans rarely went bad.

What Went Wrong

The problems started when rates started going up. Rich people like money and they really like it when their money makes money. FRC had to compete or face losing customers. They chose the latter.

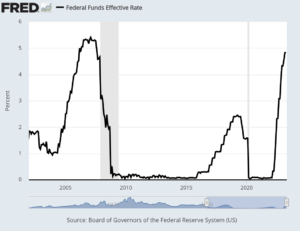

Let me clear something up. The real problem wasn’t interest rates going down, or rates going up. Instead, it was the jolt from rates going down, then quickly going up. These banks were caught off guard.

To give you an idea of the impact that higher rates had, in Q4 of 2022, FRC paid $428 million in interest. In Q4 of 2021, they only paid $20 million. The bank felt it was fine because it had a ton of mortgages on its books. The only problem that could possibly arise would be if it had to dump those mortgages to pay off fleeing depositors. Take a wild guess what happened.

In FRC’s Q1 earnings report, the bank confirmed that depositors had taken out $100 billion worth of deposits. That’s staggering, but the CEO was telling a different story.

Since it was losing depositors at such a fantastic rate, FRC had to turn to the Federal Reserve to borrow money. Lots of it—and not particularly cheap debt, either. Recently, FRC accounted for roughly three-fourths of all of the Fed’s lending.

Things went from bad to worse. On FRC’s earnings call, CEO Michael Roffler tried to reassure investors. That didn’t work. The bank withdrew its previous guidance, and Roffler didn’t take any questions. Bear in mind that more than two-thirds of FRC’s deposit base was uninsured.

FRC was looking for another round of capital from the big banks. The plan was that the banks would overpay for FRC’s bonds. As a result, FRC could more easily borrow money. That wasn’t exactly popular with the banks. FRC’s stock dropped in half in one day.

In the old days, you did a bank run by lining up outside the bank. Nowadays you do it with a smartphone. Same idea, just a lot faster.

Over the weekend, the regulators had seen enough, and they stopped the fight. After 38 years in business, First Republic is no more. The bank has (had) $233 billion in assets. That makes it the second-largest bank failure in U.S. history, just behind Washington Mutual in 2008.

The banking regulators in California turned FRC over to the FDIC which held an auction for FRC’s assets. The regulators wanted to see who was interested and how much they were willing to pay.

We don’t know the precise details, but the key players were JPM and PNC Bank. Bank of America reportedly pulled out. In the end, JPM was the winner. JPMorgan will pay the FDIC $10.6 billion for the remains of FRC.

There’s little doubt that JPM is getting a very good deal. Ultimately, JPMorgan Chase will get all of FRC’s deposits plus a “substantial majority of assets.” JPMorgan will get about $92 billion in deposits. The bank is also taking on $173 billion in loans and $30 billion in securities.

It doesn’t end there. The FDIC will share losses on any mortgages and commercial loans that JPM will assume. For good measure, the FDIC also threw in a $50 billion line of credit. The FDIC clearly wanted a deal done fast. The key part is that depositors will be protected, and shareholders won’t. At one point on Monday, shares of JPM were up close to 4%.

The FDIC’s insurance fund will take a $13 billion hit. SVB caused a $20 billion ding. In a statement, the FDIC said, “First Republic Bank’s 84 offices in eight states will reopen as branches of JPMorgan Chase Bank.” By the way, at the end of Q1, JPM reported total deposits of $2.4 trillion.

In February, shares of FRC were as high as $147 per share. The stock closed Friday at $3.51 per share. JPM CEO Jamie Dimon said, “This part of the crisis is over.” Dimon added, “There may be another smaller one, but this pretty much resolves them all.”

Eh, I’m not sure Jamie’s right about that. The regional bank sector got slammed again today. The Regional Bank ETF (KRE) was down more than 6% on Tuesday. Two of the big losers today were PacWest Bancorp (PACW) and Western Alliance (WAL).

Simple rule: If you’re a bank with some form of “west” in your name, today was probably a rough day.

Banking panics aren’t too dissimilar from zombie movies. You never know who’s been infected until it’s too late. Jamie Dimon said, “everyone should just take a deep breath.” You, first.

The banking mess isn’t over. There are still a number of trouble spots out there. Be very cautious about going bargain-hunting in the regional bank sector. My favorite is still Hingham Institution for Savings (HIFS), and even they’ve been knocked around.

Yesterday, the FDIC proposed increasing the limits for deposit insurance. Congress would still need to sign off on it. It’s easy to blame the fat cats until you realize that many companies keep their payrolls on deposit. When a bank goes under, some small companies may not be able to pay their workers.

There’s a faint ring of familiarity with the events of this spring and the Panic of 1907. The event at the center of that crisis was the failure of the Knickerbocker Trust Company. The trust generously funded a harebrained scheme to corner the market on United Copper.

When that didn’t work, there was a mad scramble to find out who else was exposed to the deal. Just like today, the fear was about contagion. Finally, J.P. Morgan, this time the man, not the company, decided he had seen enough. He publicly said he would stand behind several banks, and the frenzy soon ended. Just like today, the panic ended with JPMorgan.

One important postscript to the Panic of 1907 is that it led to the establishment of the Federal Reserve in 1913.

Expect the Fed to Hike Rates, But Then What?

Speaking of which, the Federal Reserve began its two-day meeting today. The Fed will release its policy statement tomorrow afternoon at 2 p.m. I’ll spare you the suspense. The Fed will almost certainly raise short-term interest rates tomorrow by 0.25%.

There’s been some news lately that suggests that the Fed may want to take a pause for a few months. For example, the most recent GDP report showed that the U.S. economy grew in real terms at an annualized rate of 1.1%. That’s not so hot. Job openings are now at their lowest level in nearly two years.

We’ve also seen better inflation numbers. The year-over-year inflation rate has gradually fallen from 9.1% last June to only 5.0% for March.

On Friday, the government released the PCE price index for March. This is important because it’s the Fed’s preferred measure of inflation. For March, the core PCE increased by 0.3%. That matched Wall Street’s estimate.

Over the last year, the core PCE has increased by 4.6%. Last June, the 12-month core PCE peaked at 7. That was a 41-year high.

On Monday, the ISM for April came in at 47.1. That’s a slight increase over the 46.3 for March. Still, it’s below 50 which indicates that the factory sector of the economy is contracting.

If the Fed hikes this week, it will be the 10th consecutive hike at 10 consecutive meetings. The latest futures prices indicate a 92% chance that the Fed will hike. That would bring the target range for the Fed funds rate to 5% to 5.25%.

After that, the futures market sees the Fed pausing for six months. In November, traders expect the Fed to start cutting rates. Traders see the Fed cutting by a full 2% in just over a year. That pretty much means that a recession is expected.

In the entire yield curve, the highest-yielding Treasuries are the ones maturing this August. That also suggests that the Fed may start lowering rates soon.

Lowering interest rates tends to be beneficial for stock market valuations like the Price/Earnings Ratio. Notice that I didn’t say stocks. That’s because the valuations tend to increase at the same time that earnings are decreasing. The P/E Ratio goes up as the E goes down.

The April jobs report will be out this Friday. Wall Street expects an increase of just 180,000 net new jobs. The report for March showed an increase of 236,000 jobs. That was the smallest increase in more than two years. The April CPI report is due out on Wednesday, May 10. If inflation and jobs come in lower than expected, we may see the Fed cutting rates by this fall.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on May 2nd, 2023 at 6:06 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His