Archive for June, 2023

-

Morning News: June 30, 2023

Eddy Elfenbein, June 30th, 2023 at 6:15 amChina’s Economic Woes Are Multiplying — and Xi Jinping Has No Easy Fix

What Wagner’s Russian Mutiny Means for Putin and the World

Billionaire in Erdogan’s Shadow Thrives From Turkey’s Gold Trade

Eurozone Inflation Slows, but Underlying Price Pressures Persist

The End of LIBOR Is (Finally) Here

Jerome Powell Says Next Phase of Rate Rises Will Be Harder to Predict

SEC Chair Gensler Must Recuse Himself From Crypto Enforcement Decisions

American States Once Awash In Cash See Their Fortunes Suddenly Reversed

Wall St. Foresees a Rosy 6 Months. Corporate America Isn’t So Sure

Allianz Says Pimco Flows ‘Shaky’ as Investors Assess Rates

Scaramucci Says AI Stocks Are a Bubble But Buy Them Anyway

Apple Eyes Historic $3 Trillion Valuation Amid Big Tech Surge

TikTok Dangles Zero Seller Fees Ahead of US Marketplace Debut

You Should Be Getting Paid to Prevent Heat Wave Power Outages

New Mexico Regulators Fine Oil Producer $40 Million for Burning Off Vast Amounts of Natural Gas

Elite US Colleges Lose Diversity ‘Shortcut’ After Affirmative Action Ruling

Nike Increased Prices Along With Everyone Else and Now Discounts Are Mounting

Shein Flew Influencers to China to Help Its Image. A Backlash Ensued

The Summer of ‘Barbie’ Has Only Just Begun

Grimace Shake Trend Mixes Horror with McDonald’s Mascot on TikTok

Be sure to follow me on Twitter.

-

Morning News: June 29, 2023

Eddy Elfenbein, June 29th, 2023 at 7:05 amWhere Did All That Russian Gas Go?

Wind Turbines That Shake and Break Cost Their Maker Billions

China Regulators Step Up Yuan Surveys as Currency Slump Worsens

Top Central Bankers Expect More Rate Increases Amid Stubborn Inflation

Powell Says Likely Need Two or More Hikes to Cool Inflation

Why a US Recession Might Happen in Time for 2024 Election

Biden in a Race to Reverse Voters’ Pessimism About Economy

‘Hot Money’ Is Piling Up at Banks and It’s Starting to Take a Toll

US Bank Stocks Rise as Lenders Sail Through Fed’s Stress Tests

A $100 Billion Wealth Migration Tilts US Economy’s Center of Gravity South

Dealmakers Adrift as $1 Trillion Vanishes in First Half

Jefferies Signals Green Shoots in Wall Street’s Investment Banking Lull

Popularity of Apps for Early Paydays Masks Added Risks

Lina Khan Is Coming for Amazon, Armed With an FTC Antitrust Suit

Beyond Musk vs. Zuck: How the Big Tech Rivalries Are Shifting

Nvidia Warns of Lost Opportunities if U.S. Bans AI Chip Exports to China

The Air Jordan Drop So Hot It Blew Up an Alleged $85 Million Ponzi Scheme

Cheaper Than Water? Retailers Try to Unload Bud Light

How America’s New Favorite Beer Hammered the Competition

Overstock.com Buys Bed Bath & Beyond Intellectual Property for $21.5 Million

Be sure to follow me on Twitter.

-

Morning News: June 28, 2023

Eddy Elfenbein, June 28th, 2023 at 7:07 amCan China Export Its Way Out of Its Economic Slump?

Biden Pitches Voters on Benefits of Big Government ‘Bidenomics’

Why Bidenomics Gets No Love From Voters

Waiting for the Godot Recession

Andurand’s Oil Hedge Fund Plunge Exceeds 50% in Worst Ever Loss

Some Wall Street Interns Are Raking in $120 an Hour This Summer

Billionaires and Bureaucrats Mobilize China for AI Race With US

Nvidia Drops on Report US Plans More AI Chip Curbs for China

Millennials Feel Shame Asking Their Parents for Money

No Job, No Marriage, No Kid: China’s Workers and the Curse of 35

Too Many Workers, or Too Few: India’s Colossal Employment Challenge

UPS Labor Talks Heat Up as Both Sides Race to Prevent First Strike in 25 Years

After Montana Banned TikTok, Users Sued. TikTok Is Footing Their Bill

Rolex and Patek Prices Fall as Subdial Index Nears Two-Year Low

Homebuyers With Short Memories Are Driving Up Prices in Hurricane-Hit Town

UK Considers Nationalization of Thames Water as Crisis Escalates

Oil, Gas Companies Urged to Pursue Relatively Cheap Fix on Emissions

The Spying Scandal Inside One of America’s Biggest Power Companies

Man Is Sentenced in $9 Million Cow Manure Ponzi Scheme

Everyone in South Korea Is About to Get One or Two Years Younger

Be sure to follow me on Twitter.

-

CWS Market Review – June 27, 2023

Eddy Elfenbein, June 27th, 2023 at 6:39 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

UBS Takes the Axe to Credit Suisse

Spare a kind thought for your friendly neighborhood investment banker. This is a tough time for him or her. All over Wall Street, bankers are being laid off, and it’s not over.

Things are especially bad for Credit Suisse. Earlier this year, the legendary Swiss bank, Credit Suisse, came to an ugly end. UBS, its longtime rival, bought it for $3.2 billion.

The plunge was epic. At the end of last year, Credit Suisse had a balance sheet of half a trillion dollars and 50,000 employees globally. Within weeks, it was a total trainwreck.

In March, I wrote:

To say this was a fire sale badly understates the events. The Swiss government essentially forced this deal to happen. They aimed to stop the banking crisis cold. To give you an idea of how far they went, the settled price for Credit Suisse was less than half of Friday’s closing price. It works out to 7% of CS’s tangible book value.

CS shareholders will get one share of UBS for every 22.48 shares of CS they own. That values a share of CS at 0.76 Swiss francs which is 99% below its high.

Yikes!

Today UBS said that it’s going to cut more than half of Credit Suisse’s workforce. Most of the cuts will be among traders, support staff and investment bankers. Bear in mind that this deal was done to prevent as many job losses as possible.

UBS looks to do three rounds of cuts before the end of the year. By the time they’re done, UBS will have cut their total workforce by 30% or about 35,000.

UBS isn’t alone. Goldman Sachs is also feeling the squeeze. Simply put, nobody is doing any deals this year. In dollar terms, the amount of Wall Street deals is down 40% this year.

Goldman is going to cut 125 managing directors. I’m sure that’s a lot of money. To be a managing director at Goldman is almost like Wall Street’s version of being a “made man.”

This is Goldman’s third round of layoffs in less than a year. In January, Goldman cut a bunch of jobs and the employees didn’t get their year-end bonuses.

JPMorgan Chase is cutting about 40 investment banking jobs. Citigroup will cut 30 investment-banking jobs. Last month, Morgan Stanley said it’s cutting another 3,000 jobs. A few years ago, many of these same banks went on a hiring binge. Now that’s over.

I have to be frank: this doesn’t impact the direction of stocks so much. Stocks can do very well even when the amount of Wall Street wheeling and dealing dries up. Lately, however, the noticeable trend from stocks is the big drop in volatility. We’re not seeing the kind of daily gyrations that characterized recent years.

The Volatility Index Hits a Three-Year Low

Today was a good day for stocks. The S&P 500 closed higher by more than 1.15%. The tech-heavy Nasdaq was up by 1.65%. The cyclical-skewed Russell 2000 also did well as it gained 1.46%. The S&P 500 ended a run of five down days in six sessions.

High beta stocks significantly outperformed low volatility stocks. The S&P 500 High Beta Index gained 2.59% today while the S&P 500 Low Vol Index gained just 0.34%. Interestingly, the growth/value divide wasn’t so large today.

I like to track the VIX which is the Volatility Index, or as some call it, the Fear Index. Last Thursday, the VIX closed at 12.91 which is a three-and-a-half year low. The last time the market was this calm was just before Covid hit.

Traders are gradually resigning themselves to the fact that the Federal Reserve isn’t done with its rate hikes. The Fed won’t meet for another month, but the mood on Wall Street has definitely changed. Traders now realize that the Fed won’t let up until inflation is gone.

The mood change is also apparent in the stock market. For much of this year, growth stocks were leading value stocks. Lately, however, value stocks have struck back. This is likely due to the changing outlook for Fed policy. When rates go higher, investors become more conservative. We can’t say if it’s a meaningful turn, but it’s good to see.

I think too many investors thought that lower rates would bring us back to the free-and-easy investing of the Covid years. When rates are near 0%, P/E Ratios don’t mean much. Now that rates are over 5%, investors have become a lot more discerning.

My concern is that too many growth stocks have been allowed to get rich valuation without any market pressure. A good example, in fact maybe the ideal example, is Tesla (TSLA). I need to preface by stressing that I’m in no way anti-Tesla, but the stock has had a remarkable run this year. At one point, shares of Tesla were up 120% this year. The stock was trading at nearly 100 times this year’s estimated earnings.

I certainly understand that Tesla is a remarkable company, and it’s leading a major change in the automotive sector, but it can’t escape the simple question: how much is too much? In the last week, Tesla has lost more than 10%.

We may be in an odd spot where more good economic news is bad for growth stocks. I’ve been impressed by how resilient the economy has been.

One bright spot for the economy is that the housing market may be on a rebound. This comes after a long, difficult stretch. This morning, the government reported that new home sales surged last month.

Let me take a step back to explain. What happened is that as the Fed raised interest rates, not many new homes were made. As a result, the inventory of new homes dropped very low relative to sales. At the end of May, total housing inventory was 1.08 million units. That’s down 6.1% from last year.

So many people locked in mortgages at low rates that they had little incentive to sell. At some point, you need greater inventory and that means more building. That’s exactly what’s happening.

From April to May, new home sales jumped 12.2%. In the last year, new home sales are up 20%. Sales of single-family homes came in at 763,000 (that’s an annualized figure). That’s up from 680,000 in April. I’m also impressed to see that the quality of mortgage loans is much higher than it was during the financial crisis.

It’s difficult for the broad economy to slip into a recession if the housing market is healthy. This is because housing touches so many different sectors. Median home prices are now down 16% from their peak. The Homebuilders ETF (XHB) touched a new 52-week high today.

It’s not just housing. We also learned this morning that orders for durable goods increased by 1.7% last month. That’s very good. This tells us that companies are probably making more long-term investments.

For durable goods, the key is to watch core capital goods orders. That’s a good proxy for business investment. Core capital goods excludes aircraft and military sales. For May, core capital goods rose by 0.7%. That compares with an increase of 0.6% in April.

Not only is the economy growing, but it may be accelerating. On Thursday, the government will release its second revision to Q1 GDP growth. The last report said that the U.S. economy expanded at a real annualized rate of 1.3% during Q1.

In late July, the government will release its first estimate for Q2 GDP. Most economists expect slightly higher growth for Q2 compared with Q1. According to the latest, Bank of America expects Q2 growth of 1.4%. Goldman is at 1.8% and the Atlanta Fed’s GDP Now model is at 1.9%.

The most widely-expected recession in recent history continues to be a stubborn no-show. Now traders don’t expect the Fed to cut rates until March 2024. That’s a big change from just a few weeks ago.

Until a few years ago, setting the Fed’s interest rate policy was pretty simple. When the economy entered a recession, all you had to do was bring short-term interest rates down to the same level of inflation. That meant that the “real” interest rate was 0%.

During an economic recovery, all you had to do was gradually raise interest rates until they were 3% above the rate of inflation. In other words, the Fed would simply oscillate between real Fed funds rates of 0% to 3%.

I’m exaggerating but not by much. That’s largely what the Fed did for a few decades. Then came the financial crisis and all of that went out the window. Since then, the Fed has kept interest rates well below the rate of inflation. Now it seems that the Fed is willing to raise interest rates much higher than expected. That’s good news for value-oriented portfolios.

Stock Focus: Graco (GGG)

Speaking of which, here’s the latest in our series of great stocks that no one knows about. Graco (GGG) of Minneapolis specializes in fluid-handling systems and products. The company has been in business since 1926.

Graco’s business covers several different areas such painting, anti-corrosion, fluid transfer, gluing and sanitary applications, automotive, aeronautic, body refinish, wood, construction and marine.

I know it sounds boring, but it’s a very good business to be in. Many boring-sounding businesses can be wonderful investments. Last year, Graco did $2.14 billion in sales and net income was $460 million, or $2.63 per share.

Graco has been a big winner for decades. Ten years ago, it made $1.12 per share for the year. Ten years before that, it made 41 cents per share for the year. The company’s earnings don’t rise every year, but it’s a strong upward trend.

Thirty years ago, you could have picked up one share of Graco for $31.50. Adjusted for several stock splits, that works out to less than $1 per share in today’s terms. Meanwhile, the stock is at $85 per share today. That means that Graco has gained more than 90-fold over the last 30 years. If we include dividends, then Graco is up more than 18,500% over the last three decades.

Despite all its success, Graco doesn’t get much attention. Only about ten analysts bother following it. The market cap is about $14 billion.

In April, Graco reported Q1 earnings of 74 cents per share. That beat estimates by 12 cents per share. The stock jumped over 12% on its earnings report. Wall Street expects earnings for this year of $3.04 per share and of $3.19 per share for 2024. The stock is a little pricey but nothing outrageous.

The Q2 earnings report will be out in about a month. Wall Street expects 79 cents per share. Look for another earnings beat.

That’s all for now. There will be no free issue next week. The stock market will close early on Monday, July 3, and it will be closed all day on July 4 for Independence Day. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

Morning News: June 27, 2023

Eddy Elfenbein, June 27th, 2023 at 7:09 amChina Starts to Slow Yuan’s One-Way Slide

Inside Yevgeny Prigozhin’s Money-Making Machine

Inflation Is Proving Persistent as It Moves Through the Eurozone Economy

ECB Staff Preparing for New Era of Tighter Money

Banks Face Growing Capital Scrutiny With Stress Tests Up First

BNP CEO Faces $8.3 Billion Temptation After Ascent to Top

The Stock Market Isn’t as Calm as It Seems

America’s Biggest Power Source Wasn’t Built for Extreme Weather

A Giant Wind Farm Is Taking Root Off Massachusetts

More Data in the Cloud Means More Centers on the Ground to Move It

Tesla May Have Already Won the Charging Wars

Lordstown Files for Bankruptcy After Foxconn Deal Falls Through

Japan Wades Into the Chip Wars

IBM Can’t Acquire Its Way Into Tech’s Top Ranks

J&J’s Push to End Cancer Suits Meets Trial in Bankruptcy Court

AI’s Explosive Growth Exposes Gaps Between EU, US Regulation

Snowflake Adds Partnerships with Nvidia and Microsoft for AI Double Play

A.I. May Someday Work Medical Miracles. For Now, It Helps Do Paperwork

What Is Mark Zuckerberg Thinking?

Magic Mushrooms. LSD. Ketamine. The Drugs That Power Silicon Valley

Pickleball Injuries May Cost Americans Nearly $400 Million This Year, According to UBS

Be sure to follow me on Twitter.

-

Morning News: June 26, 2023

Eddy Elfenbein, June 26th, 2023 at 7:03 amWagner Mutiny Revives U.S. Fears Over Control of Russia’s Nuclear Weapons

Tech Startup Targets Missile Motors as Silicon Valley Moves Into Weapons

China Economy Gloom Worsens With Weak Consumer Spending Data

The U.S.-China Rivalry Is Complicating the World’s Debt Crisis

Philippines Agrees $1.14 Billion Loans with World Bank for Environment, Farming

Japan’s Top Currency Diplomat Escalates Warning Against Weak Yen

The Bank Robbers Who Are Stealing Their Own Money

Banks Rally, Lira Drops as Turkey Unwinds FX Support Mechanism

Where Stock Market Is Headed After Wild First Half: Five Charts

Morgan Stanley’s Wilson Says Stock Risks Rarely Been Higher

PacWest Sells $3.5 Billion Asset-Backed Loan Portfolio to Ares

Buy Now, Pay Later Programs Are Booming. Here’s Why Their Profits Aren’t

Apollo Leads $2 Billion Private Financing for Semiconductor Firm Wolfspeed

Palantir’s AI Surge Hardens Resolve of Stock’s Bears

What Is Happening in the Housing Market?

The Uneven Effect of Remote Work, in One List

New Rules Aim to Clamp Down on Corporate Greenwashing

China’s ‘Tesla Killer’ Stumbles as EV Price War Takes Toll

Deal for Formula 1 Team Reflects Growing U.S. Interest in the Sport

The Ultimate Score for Rich People? “Golden” Passports

Pill for Obesity Has Wall Street Salivating

Be sure to follow me on Twitter.

-

Morning News: June 23, 2023

Eddy Elfenbein, June 23rd, 2023 at 7:04 amThe World’s Empty Office Buildings Have Become a Debt Time Bomb

Debt Collectors’ Awkward Moment: Their Own Debt Is Now Sinking

Dollars Are So Scarce in Argentina That Yuan Use Is at a Record

Central-Bank Action Finally Cooling Global Economy, Data Indicate

Where’s the Recession We Were Promised?

Forget the Cost of Living. What’s the Cost of Thriving in America?

U.S. Equity Funds See Biggest Outflow in 12 Weeks

Big VC, Tech Got Backstop for Billions in Uninsured SVB Deposits

The 10 AI Startups Leading the Pack

AI Founders Vie for Big Wealth in Unicorn Frenzy

Why Is Apple Getting ‘Spatial’?

Canada Forces Google and Facebook to Pay News Outlets for Linking to Articles

Musk vs. Zuckerberg: The Billionaire Bout for the Social-Media Age

Reddit Wants to Grow Up. Will Its Community Let It?

Overstock.com Wins $21.5 Million Bid for Bed Bath & Beyond’s Assets

Starbucks Workers at Over 150 Stores to Strike Over Pride Décor Row

3M Reaches $10.3 Billion Settlement in ‘Forever Chemicals’ Suits

Beef Dodged Fake Meat’s Threat, But Is Still No Match for Chicken

Sweet and Fruity E-Cigarettes Thrive Despite Teen-Vaping Crackdown

Be sure to follow me on Twitter.

-

Morning News: June 22, 2023

Eddy Elfenbein, June 22nd, 2023 at 7:01 amHow India Profits from Its Neutrality in the Ukraine War

Countries on Front Lines of Climate Change Seek New Lifeline in Paris

Turkish Central Bank Jacks Up Interest Rates in Reversal for Erdogan

Bank of England Pushes Interest Rates Up by a Half Point

Swiss Central Bank Signals More Tightening to Come After Latest Rate Hike

Le Maire: High Investment Key to Avoid Recession

Biden’s Trade Challenge: Kicking the China Dependency Habit

America’s Top Fast-Fashion Retailer Tries to Shed Its Chinese Image

Powell Defies Critics and Makes Case for Why Rates Must Rise

Private Equity’s Race to Poach Junior Bankers Finds Its Limit

On Wall Street, Lawyers Make More Than Bankers Now

After $29 Billion Wipeout, Star Invesco Investor Plots Comeback

Insider Trading Bromance Ends With Betrayal and Guilty Verdict

China’s Cloud Computing Firms Raise Concern for U.S.

Twitter CEO Intervened to Mend Google Relationship After Cloud Payment Issue

FTC Sues Amazon Over ‘Manipulative’ Tactics Used to Enroll Millions in Prime

Ford Gets $9.2 Billion to Help US Catch Up With China’s EV Dominance

Paris Air Show Brings So-So News for Boeing. It’s Better for Airbus

Bosses’ New Task Is Figuring Out Who’s High at Work

How ‘A Hazard of New Fortunes’ Explains America

Be sure to follow me on Twitter.

-

Morning News: June 21, 2023

Eddy Elfenbein, June 21st, 2023 at 7:07 amE.U. Takes Aim at China in Proposed Economic Strategy

The U.K. Moves to Use Frozen Russian Assets to Help Ukraine Rebuild

U.K. Inflation Remains Stuck at 8.7 Percent

Business Leaders Join Biden in Welcoming Modi to the U.S.

Is the Inflation Battle Won? Not Yet

Fed Nominees Pledge to Cool Inflation

Forget the Fed, and Focus on the Economy

Wall Street Buys More T-Bills, Parks Less at Fed

Investors Are Putting America First Again

Money Funds With Record $5.5 Trillion See Case for Pile to Grow

KKR’s McVey Says Investors Too Cautious, Sees Stronger US Growth

Credit Suisse’s Demise Blamed on NY Bankers

If US Companies ‘Go Woke’, Do They Really Go Broke?

Arizona Is Running Out of Cheap Water. Investors Saw It Coming

What the Reddit Revolt Means for Social Media in an AI Era

American Companies Are Hostage to the Whims of TikTok

FedEx Quarterly Sales Fall 10% as Shipping Struggles Continue

At 3M, Lawsuits Threaten to Transform the Company

The Booming Business of Trying to Reach the Ends of the Earth

A Financial Decision That Could Haunt a Big MLB Star

Be sure to follow me on Twitter.

-

CWS Market Review – June 20, 2023

Eddy Elfenbein, June 20th, 2023 at 7:22 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

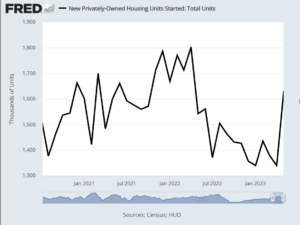

Housing Starts Posts Largest Increase in 33 Years

We’ve been waiting for the housing market to hit rock bottom, and that may have happened. On Tuesday, the Commerce Department said that housing starts soared last month. It was the largest monthly increase in more than 33 years.

This comes at the same time that the Federal Reserve sees itself nearing the end of its rate-hike cycle. Last week, the Federal Reserve declined to raise interest rates. This was the first meeting in over a year in which the Fed decided to pass on a rate hike.

So far, the S&P 500 has been well behaved. At one point, the index reached a 16-month high. This happened even though the Fed stressed that it’s not done with its interest rate hikes. The S&P 500 is even getting to within 9% of a new all-time high.

This week, I want to focus on the Fed’s latest move because it reveals an interesting divide. The language coming from the Fed is very stern and hawkish, yet the expectations for what the Fed will actually do are much less so.

So who’s right? I don’t know, but I generally prefer to take the market’s view over what the Fed says it will do.

Still, there’s no need to be dogmatic on this issue and I concede that there are good reasons for the Fed to continue hiking. That case got a lot stronger this morning with the latest report on housing starts.

This is interesting to see because the housing market got completely walloped by the Fed’s rate hikes. The industry is gradually getting back on its feet.

For May, housing starts rose to 1.631 million. That’s quite good. Housing starts are now at their highest since April 2022. The number for April was revised down to 1.34 million. That increase of 291,000 was the biggest monthly jump since January 1990.

Not only that but building permits were up 5.2% last month. That was much better than expected. Permits are now at the highest level since October 2022. Suddenly, the housing market is getting hot. Of course, there’s been very little building going on, so at some point, the cycle needs to turn.

The difficult part about the Federal Reserve’s interest-rate policy is that it doesn’t impact the broad economy directly. Instead, the housing market stands in between the Fed and the economy. As a result, the housing market can be unfairly slammed whenever there’s an increase in inflation.

The Fed doesn’t meet for another five weeks, but the language coming from the Fed has already unnerved traders. A majority of Fed members thinks the central bank will have to increase rates two more times this year. Market participants disagree.

Inside the futures pits, traders can place bets on the direction of Fed policy. Right now, the latest prices imply a 77% chance that the Fed will hike rates by 0.25% at its meeting next month.

That’s probably right, but after July, the outlook gets a lot fuzzier. Traders simply don’t see the need for another rate hike after July. In fact, they see the Fed cutting rates by early next year. For 2024, traders see the Fed aggressively cutting rates. That’s due to fears of a recession.

Trex Is Up 40% YTD

Can we be headed for a recession if the housing market is getting better? It’s possible, but it’s unlikely. In fact, housing stocks have been rallying for several weeks. I like to keep an eye on the Home Construction ETF (ITB). It’s up over 66% in the last year.

The important thing about housing is that it touches so many different parts of the economy. From finance to lumber and materials to employment, so many economic sectors are beholden to housing.

On our Buy List, one of our favorite housing-related stocks is Trex (TREX). More housing starts means more decks to build. Thanks in part to the Fed, the deck-maker got completely wrecked last year. Not only was it our worst stock in 2022, but it was our worst stock by far.

Fortunately, we held on and Trex is up 40% for us this year. I think this is only the beginning. Last month, Trex said it made 38 cents per share for Q1. That beat Wall Street’s consensus by four cents per share. The stock popped 8% after the earnings came out.

For Q2, Trex said it expects sales to range between $310 million and $320 million. Wall Street had been expecting $309 million. The Q2 report will probably be out in early August.

Trex also got an important vote of confidence from its board of directors. The board approved a repurchase program of up to 10.8 million shares. That’s 10% of all the outstanding shares. This program has no expiration date.

For Q2, Wall Street expects earnings of 53 cents per share. I think we’ll see another nice beat. If the Fed starts lowering rates, that will be even better for Trex.

The Q2 earnings season will begin in less than one month. The upcoming earnings season will be an important one because it may show that not only are earnings growing again, but the rate of growth is increasing.

During last year, corporate earnings declined for Q2, Q3 and Q4. Inflation, the Fed, the war in Ukraine and the supply chain mess all took a toll on earnings growth. For Q1 of this year, the S&P 500 posted earnings growth of 6.4%. That was a relief. As of now, Wall Street expects Q2 earnings growth of 12.6%.

There is an important caveat. As in previous quarters, Wall Street is slashing its earnings estimate as earnings season approaches. Since the start of this year, analysts have pared back their Q2 forecasts by more than 13%. This is part of Wall Street’s typical game of lowering expectations so low that companies can easily exceed them and claim victory.

Interestingly, Wall Street hasn’t cut its forecasts for Q3 or Q4 very much. For this year, analysts expect the S&P 500 to post earnings of $218.22 per share. That’s the index-adjusted number. (Every one point in the index is worth $8.36 billion.) Over the last year, the earnings estimate for this year has been cut back by more than 12%.

For 2024, Wall Street sees the S&P 500 earning $244.81 per share. That means the S&P 500 is going for a tad under 18 times next year’s earnings. That’s not bad. I would expect the earnings multiple to increase if interest rates start to fall.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His