CWS Market Review – October 17, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The First Q3 Earnings Reports Are Coming In

We’re getting a look at the first batch of Q3 earnings reports. On Friday, three of the big banks released their earnings reports. I’m not sure why the banks always go first. Perhaps it’s easier for the accountants.

In any event, all three banks beat earnings and all three stocks gapped up in Friday’s trading, although Citigroup eventually gave it all back and closed slightly lower. I’ll be frank, this hasn’t been a great year for many bank stocks.

This is a YTD chart of the S&P 500 Financials:

Let’s start with Citigroup’s (C). The financial behemoth has had a tough year, but it reported Q3 earnings of $1.52 per share. That was a 31-cent beat. I was not expecting results that good. The key stat for any bank is net interest margin. For Citigroup, that was 2.49% last quarter. Wall Street had been expecting 2.41%.

JPMorgan Chase (JPM) is always one to watch. JPM said it made $4.33 per share for Q3. That was well above expectations of $3.90 per share. JPM is probably the most important bank in the country (behind the Federal Reserve). JPM has nearly $4 trillion in assets. Still, deposits are down 4% from last year.

CEO Jamie Dimon said, “Now may be the most dangerous time the world has seen in decades.” I’m afraid he may be right. The good news is that JPM’s economists are saying that a soft landing is more likely than a recession.

Wells Fargo (WFC) is probably in the most difficult spot. The bank has even talked about layoffs and closing branches. WFC’s CEO said, “this company is not efficient—like period, end of story.”

Unfortunately, that’s about the only statement this bank has gotten right in the past three years. For Q3, Wells said it made $1.39 per share. That’s up significantly from the 86 cents per share it made in Q2. The Q3 results beat Wall Street’s forecast of $1.24 per share. Wells has a way to go before it’s healthy again.

On Tuesday, Goldman Sachs (GS) said it made $5.47 per share last quarter. Wall Street had been expecting $5.31 per share. The bank said it had stronger-than-expected trading revenue. Overall profits were down 33% to $2.058 billion.

Interestingly, both Wells Fargo and JPMorgan tapped the bond market after their earnings reports. Wells sold $6 billion in bonds in two parts. JPM did a three-part offering worth a total of $7.25 billion. This could mean the banks think rates and spreads may go even higher. Another possibility is that the banks maybe are adjusting their balance sheets ahead of new capital requirement rules.

This has been a rough stretch for the bond market. Even blue-chip bond yields are the highest they’ve been since 2009.

How Strong Is the Economy?

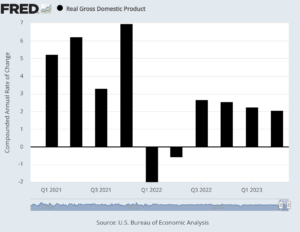

Get ready for next Thursday, October 26. That is when the government will release its first report on Q3 GDP growth. In plain English, this is the report card for the U.S. economy.

This report will be especially interesting because there’s a big divergence among economists. The consensus among Wall Street economists is for growth of just under 3.0%. That’s pretty average, maybe a little on the high side.

On the other side is the Atlanta Fed. Their GDPNow model is very bullish. It currently sees Q3 GDP growth of 5.1%. What does the Atlanta Fed know that no one else does? Beats me.

Growth of more than 5% would be remarkable considering all the rate hikes from the Fed and the fact that the manufacturing sector has been in a recession for more than a year.

Plus, the S&P 500 hasn’t done much since late-July. Mortgage rates are soaring, and the 10-year Treasury just touched 4.8%. Earlier today, we learned that homebuilder confidence fell to a 10-month low. Measures of housing affordability are the lowest on record.

According to stats from S&P Global Market Intelligence, the S&P 500 is now tracking earnings growth of -0.86% for Q3. That’s down from -0.59% one month ago.

The big loser is the Energy Sector. Earnings for that sector are projected to fall by 36.2%. It’s still very early, but so far, 84.2% of companies have beaten earnings estimates while 66.7% have beaten on sales.

The current consensus has the S&P 500 earning $218.67 per share for 2023. That’s the index-adjusted number. That means the S&P 500 is going for almost exactly 20 times this year’s forecasted earnings.

We did have some good economic news on Tuesday. The Commerce Department released the retail sales report for September. Last month, retail sales rose by 0.7%. That more than doubled Wall Street’s forecast for 0.3%.

The retail sales report can be tricky, so we should always look at the details. If we exclude car sales, then retail sales increased by 0.6%. Wall Street had been expecting an increase of 0.2%. All three retail sales reports for Q3 were above expectations.

The retail sales numbers are not adjusted for inflation. Over the last year, retail sales were up 3.8% while inflation increased by 3.7%.

Sales gains were broad-based on the month, with the biggest rise coming at miscellaneous store retailers, which saw an increase of 3%. Online sales climbed 1.1% while motor vehicle parts and dealers saw a 1% increase and food services and drinking places grew by 0.9%, good for a yearly increase of 9.2%, which led all categories.

There were only a few categories that showed a decline; electronics and appliances stores as well as clothing retailers both saw decreases of 0.8% on the month.

Wall Street is up in the air regarding the Fed’s next move. The current consensus is that the Fed won’t do anything in November. That’s probably right. For December or January, however, futures traders think there’s a decent but not overwhelming chance that the Fed will give us another rate hike.

Rite Aid Goes Bust

This weekend, Rite Aid (RADCQ) filed for bankruptcy. This is a sad ending for a company that seemed to offer so much promise.

To be honest, Rite Aid has been in a death spiral for a few years, so the ending wasn’t much of a surprise.

The major problem for Rite Aid is that it faced a slew of lawsuits related to opioid sales. The company has tons of debt, declining sales and mounting legal bills. It’s hard to come back from that.

With Chapter 11, the company will still be in business, but they’ll have to restructure. That means many of the stores will close, but that will take some time. Your local Rite Aid will probably be there for you.

The lawsuits claim that Rite Aid knowingly filled prescriptions for the addictive painkillers. The DOJ has also gotten in on the act.

I remember in the 1990s when Rite Aid was a terrific stock. Check out Rite Aid’s performance from 1990 through 1998:

It seems to have a limitless future. This is a great example of reading too much into a company’s past performance. It’s as if the chart is speaking to you and pointing ever higher.

It’s easy to fall into that trap, but that’s not how investing works. Here’s the same graph but through today:

Well, that’s quite a different story. To quote Warren Buffett, “If past history was all that is needed to play the game of money, the richest people would be librarians.”

Also, notice how long it took. There’s the famous exchange from The Sun Also Rises:

“How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.”

Same for Rite Aid.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want more info on our ETF, you can check out the ETF’s website.

Posted by Eddy Elfenbein on October 17th, 2023 at 6:51 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His