Archive for August, 2024

-

Morning News: August 30, 2024

Eddy Elfenbein, August 30th, 2024 at 7:03 amHow Japan Ignored Climate Critics and Built a Global Gas Empire

Longi Reports Massive First-Half Loss After Solar Prices Crater

Climate Change Means Coffee’s Future May Depend on Niche Growers

Silicon Valley Wants to Fight Fires With Fire

Vanke Reports First Half-Year Loss in More Than Two Decades

China Considers Allowing Refinancing on $5.4 Trillion in Mortgages

ICBC’s Profit Slips as Low Rates Weigh

Russia Payment Hurdles with China Partners Intensified in August

Eurozone Inflation Closes in on ECB Target

US Stock Futures Gain as Rate-Cut View Mounts

Harris and Trump Have Housing Plans. Economists Have Doubts.

Why Interest Rate Cuts Won’t Fix a Global Housing Affordability Crisis

Swap Bonds for Commodities in 60/40 Funds, BofA Strategists Say

Money-Market Funds Attract 2024’s Biggest Monthly Cash Inflow

The Report Card on Guaranteed Income Is Still Incomplete

For More Americans, One Job Isn’t Enough

Singapore Proposes New Law That Lets Police Stop Bank Transfers

Intel Weighs Options Including Foundry Split to Stem Losses

Nokia Shares Slip After Company Denies Mobile-Network Business Sale Talks

Adani Ports Acquires Offshore Shipping Firm for $185 Million

Threat of Strike This Fall Hangs Over U.S. Ports

Budget Airlines Want to Go Premium. That’s Easier Said Than Done.

Dollar General Scales Back Guidance After Quarterly Results Fall Short of Target

The Doctor-Turned-CEO Aiming to Beat Obesity — and Ozempic

Why the NFL Let Private Equity Get Into the Game

YouTube Stars Want Some Respect

Be sure to follow me on Twitter.

-

Morning News: August 29, 2024

Eddy Elfenbein, August 29th, 2024 at 7:03 amWhy Ethiopia’s Bid for Red Sea Access Angers Somalia

China Oil Majors Paint Bleak Picture for Demand in Top Importer

Risks to US Job Market Start to Emerge in Regional Fed Surveys

King Dollar’s Softening Is Good News for Nearly Everyone

Most-Hated Credit Trade Turns Into a Big Winner for Hedge Funds

Warren Buffett’s Berkshire Hathaway Hits $1 Trillion in Market Value

Star Fund Manager’s Free Rein at Wamco Backfired for Franklin

‘Nvidia Day’ Inspires Watch Parties and Memes, but the Fanfare Doesn’t Last

When 50% Margins No Longer Impress, You’re Nvidia

Nvidia Tumbles After Disappointing Forecast, Blackwell Chip Snags

Telegram Founder Charged With Wide Range of Crimes in France

Can China Tech Find a Home in Silicon Valley?

ASML’s China Chip Business Faces New Curbs From Netherlands

US Snowboard Champ Pitches Green Shipping for Maersk

Lithium Startups Bet on High Demand in Battery-Powered Future

Polestar Posts $242 Million Loss Amid EV Demand Slowdown

How America Can Break Its Highway Addiction

Mars’ $36 Billion Deal Faces Tough Review by Lina Khan’s FTC

Dollar General Plunges as Core Customers Feel Budget Crunch

At Costco, Shopping for Clues About Consumers

Australian Winemaker to Benefit as China Uncorks Imports

Absolut Vodka Maker Pernod Ricard Expects Challenges in U.S., China to Persist

Private Equity Is Coming for Youth Sports

Asics to Exit Baseball Business to Focus on Cult Hit Sneakers

Birkenstock Hits Its Stride After Stumbling Earlier in the Year

He Raised Disney Park Prices—and Fans Still Love Him. Now He’s on the CEO Shortlist

Be sure to follow me on Twitter.

-

Morning News: August 28, 2024

Eddy Elfenbein, August 28th, 2024 at 7:04 amDrought Strains Brazil Hydropower Supply, Raising Energy Costs

Oil Market Warnings Grow as OPEC+ Decision Nears

Protests in China on the Rise Amid Housing Crisis, Slowing Economy

Bank of Japan Deputy Governor Reaffirms Readiness for More Rate Hikes

Africa’s Debt Crisis Has ‘Catastrophic Implications’ for the World

Germany ‘Falling Into Crisis’ as Berlin Suffers Vision Deficit

The Geography of Unequal Recovery

The American Dream Feels Out of Reach for Most

Credit Scores Without Debt? Fintech Cards Baffle Credit Industry

Fighting Financial Crime Could Pay for Nasdaq

Warren Buffett Sells More BofA Shares, Reaping $982 Million

HSBC’s Incoming CEO Weighs Cutting Layers of Middle Management

Apple Cuts Jobs in Online Services Group as Priorities Shift

Musk’s Legal Fights Boost Longshot Texas Bid to Become Court Hub

Can Tech Executives Be Held Responsible for What Happens on Their Platforms?

Zuckerberg’s Free-Speech ‘Mea Culpa’ Is a Sleight of Hand

Nvidia’s Earnings Will Test the S&P 500’s $4 Trillion Recovery

The World’s Call Center Capital Is Gripped by AI Fever — and Fear

Li Auto Guides for Stronger Sales After Quarterly Profit Halves

BYD’s First-Half Profit Rose on Strong EV Sales Despite Slowing China Demand

Gloom Falls Over One of China’s Most Successful E-Commerce Giants

Canada Goose, Known for Heavyweight Parkas, Leans Into T-Shirts and Shorts

Abercrombie Boosts Sales Again But Investors Keep Expecting More

Kohl’s Shares Rise as It Lifts Full Year Profit Outlook

Lego Sales Climb Despite Woes in the Toy Market

Lego to Replace Oil In Its Bricks with Pricier Renewable Plastic

Be sure to follow me on Twitter.

-

CWS Market Review – August 27, 2024

Eddy Elfenbein, August 27th, 2024 at 5:29 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

“The time has come for policy to adjust.”

So said Fed Chairman Jerome Powell last Friday at his highly anticipated speech at the Fed’s annual conference in Jackson Hole, Wyoming. He basically said what everyone expected him to say: the time has come to lower interest rates.

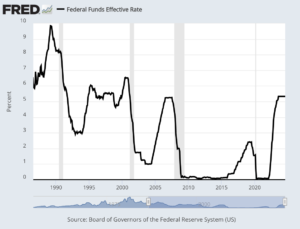

This is a big deal. After all, the Fed hasn’t lowered interest rates since Covid. If you exclude that since Covid was a very unusual event, then the Fed hasn’t cut rates for pure economic reasons in 15 years.

The only questions now are when and by how much. Powell left both unanswered but Wall Street expects action soon. In his remarks, Powell noted how much the economy has improved:

“Inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized.”

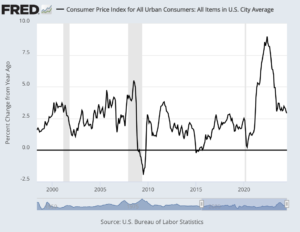

The story is not a complicated one. The Fed responded to Covid by dropping interest rates to the floor. That, and a lot of government money, helped spark the worst bout of inflation in 40 years. Even the lower rate is still higher than where it was during much of the 2010s. Here’s a look at the CPI:

The Fed responded to inflation by jacking up interest rates by 5.25% in 16 months.

It worked. After peaking two years ago, inflation has gradually retreated – not that prices are down – but the rate of increase is down.

“After a pause earlier this year, progress toward our 2 percent objective has resumed. My confidence has grown that inflation is on a sustainable path back to 2 percent.”

Maybe. I have to confess that the Fed’s rate hikes did less damage to the economy than I expected, and higher rates certainly haven’t stopped the stock market. As you may recall, Powell and the Fed initially believed the uptick in inflation was “transitory.” The feeling was that as long as inflation expectations were low, then inflation would be low. That turned out not to be the case, and inflation was anything but transitory.

Why Interest Rates Are So Important for Stocks

I know I spend a lot of time going on about the Fed and interest rates, and I do so because it’s central to the stock market. Interest rates are important for two reasons. One is that interest costs are a major portion of a company’s income statement. Higher rates take a big bite out of the bottom line.

When rates are low, it’s easier for companies to finance expansion plans or to buy out other companies. Higher rates grind that to a halt. Not only are companies impacted but so are consumers. A company like a homebuilder can see its business evaporate when mortgage rates get too high.

The other key reason is that interest rates are in competition for investors’ money. In 1981, you could have locked in a 15.8% yield in a 10-year Treasury. Why buy stocks when you can get a low-risk return that high? Indeed, stocks had to plunge in value just to keep pace. Around that same time, the S&P 500 was trading for less than 6.5 times earnings.

In retrospect, I think the Fed responded to inflation the way it should have responded to the financial crisis of 2007-2008. The Bernanke Fed was very careful when it should have acted earlier and more aggressively. It was two years ago at Jackson Hole that the Powell Fed finally rejected the transitory idea and made it clear that the Fed would do whatever it takes to beat inflation.

On Friday, Powell also noted that the jobs market is cooling off, but what’s interesting is that it’s not dropping as it would normally ahead of a recession. Instead, the jobs market is seeing “a substantial increase in the supply of workers.” What this means, in the Fed’s view, is that the jobs market probably won’t be a driver of inflation anytime soon. I think that’s the key in why the Fed decided to alter course.

Powell also defended himself with some excuses that might be considered a little convenient. For example, Powell said that once inflation broke, it became a global issue because it rested on “rapid increases in the demand for goods, strained supply chains, tight labor markets, and sharp hikes in commodity prices.” In other words, things were affecting everyone.

Powell strongly wants to prevent the public from having higher inflation expectations. That’s what happened in the 1970s. If people expect inflation to rise, then it’s easier for prices to rise. Once the expectations take hold, they get embedded and it’s not easy to change them. I think Powell is particularly sensitive to the issue of expectations.

By 2022, we had a very unusual economy. The labor market was very tight and there were twice as many jobs as there were unemployed people. So, how come the jobs market wasn’t wrecked by the Fed’s anti-inflation crusade? That’s a puzzle to me.

According to Powell:

“Pandemic-related distortions to supply and demand, as well as severe shocks to energy and commodity markets, were important drivers of high inflation, and their reversal has been a key part of the story of its decline. The unwinding of these factors took much longer than expected but ultimately played a large role in the subsequent disinflation.”

Powell was very reticent on what the Fed has planned. The next FOMC meeting is in three weeks and market participants overwhelmingly expect a rate cut. Right now, the odds are at 65% for a 0.25% cut and at 35% for a 0.50% cut.

The following meeting is in November, shortly after the election. At that meeting, traders narrowly expect a 0.5% cut. Traders expect another 0.25% at the December meeting. Add it up and the Fed is expected to slash rates by a full 1% before the end of the year. For 2025, Wall Street expects more cuts of 1.25% to 1.50%.

Overall, lower interest rates should be good for the stock and the housing markets. Not only are lower rates good for the market, but I expect value stocks to continue to prosper. Many of these issues lagged the market as investors fell in love with the Mag 7. That love affair may have run its course. Tesla (TSLA) hasn’t made a new high in close to three years. Amazon (AMZN), Google (GOOGL) and Microsoft (MSFT) are all off more than 10% from their highs.

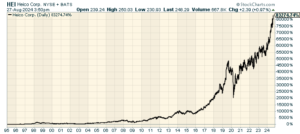

Heico: The Quiet 83,000% Winner

One of our Buy List stocks, Heico (HEI), issued a very good earnings report after yesterday’s close.

Heico has been a great stock for us this year. The shares are up more than 38% YTD. I’ll discuss Heico’s results in greater detail in Thursday’s premium issue, but I’ll highlight a few key stats for you (you can sign up for our premium issues here).

For its fiscal Q3, Heico’s EPS increased 31% to 97 cents per share. That beat Wall Street’s consensus of 92 cents per share. For the first nine months of this fiscal year, Heico’s earnings are up 23% to $2.67 per share.

For the quarter, Heico’s sales were up 37% to $992.2 million. Their operating income increased 45% to a record $216.4 million. I was impressed to see Heico increase its operating margin by 1.1% to 21.8%. Q3 EBITDA rose 45% to $261.4 million.

Heico is a great example of a niche business that’s not well-known. In 30 years, the stock is up 83,000%.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: August 27, 2024

Eddy Elfenbein, August 27th, 2024 at 7:19 amLibyan Oil Shutdown Begins as UN Warns Feud Risks Economic Chaos

To Stay Relevant, a Spanish Energy Giant Turns to Waste

Woodside Gets Interest in Potential Selldown of U.S. Ammonia Project

Indonesia Sells Longest-Ever 40-Year Bond as Easing Pivot Nears

Weak German Consumer Confidence Adds to Economic Woes

PDD’s $55 Billion Stock Crash Sends Warning on China Economy

A $557 Billion Drop in Office Values Eclipses a Revival of Cities

The IPO Hopeful’s Dilemma: Cram Into Fall Window or Wait for ’25

US Lenders Lose Court Battle Over CFPB Rule to Collect Small Business Data

JD.com Unveils $5 Billion Share Buyback as China Concerns Grow

Nvidia’s Nnot Nnormal, Never Mind Earnings

Apple’s Maestri to Hand Off CFO Job, Move to Smaller Role

SpaceX Tightens Its Grip on NASA by Bringing Boeing Crew Home

Canada Joins Nations Using Tariffs to Combat Chinese EV Imports

California’s EV Dreams Face an Awkward Reality

Tesla’s Rivals Still Can’t Use Its Superchargers

How Telegram’s Founder Went From Russia’s Mark Zuckerberg to Wanted Man

Zuckerberg Says White House ‘Pressured’ Meta to Pull Covid Posts

On the Covid ‘Off-Ramp’: No Tests, Isolation or Masks

Lilly Sells Zepbound Vials at 50% Discount to Meet Weight Loss Drug Demand

The U.S. Corn Crop Is Great. Farmers’ Finances, Not So Much

Lowe’s Scraps Some DEI Policies as Activist Claims a New Win

Skydance Set to Seal Paramount Merger After Bronfman Drops Out

Why 7-Eleven Is So Enticing to Circle K’s Owner

The Office Therapist Will See You Now

Private Equity Ownership Is Coming to the NFL

Be sure to follow me on Twitter.

-

Morning News: August 26, 2024

Eddy Elfenbein, August 26th, 2024 at 7:08 amMissed Warnings, $100 Vaccines and Red Tape — Why Mpox Was an Avoidable Emergency

Canada to Hit China With Tariffs on Electric Vehicles, Steel

German Business Increasingly in Trouble, Ifo Survey Says

Riksbank Minutes Show High Bar for Bigger Cuts in Key Rate

Milton Friedman’s Shower Scene Is Back

Powell’s Pivot Leaves Traders Debating Size, Path of Rate Cuts

As US Rate Cuts Near, Economic ‘Soft-Landing’ Odds Could Dictate Stock Performance

How a Corporate Tax Rate Change Could Impact Companies’ Growth, Investment

How Trump Was ‘Orange-Pilled’ by Three Bitcoiners in Puerto Rico and the Promise of $100 Million

Trump’s ‘Made in USA’ Bitcoin Threatens China Juggernaut Bitmain’s Reign

Crypto Bros Aren’t Flipping Watches. That Is an Issue for Luxury Brands

Nvidia Rally Mints Millionaires Too Busy to Bask in New Wealth

Dubai’s Red-Hot Luxury Housing Market Is Still a Bargain

The Breakout Star of the Democratic Convention Was … YIMBY

Soaring Insurance Costs Could ‘End’ Affordable Housing, Developers Warn

A Trial Asks: If Grocery Rivals Merge, Do Workers Suffer?

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

Trump’s Drill-Baby-Drill Vow Is More Ethos Than Policy

US Oil Dominance Hinges on Quiet Corner of New Mexico

Why Nippon Steel’s $15 Billion Takeover of U.S. Steel Is in Peril

‘Dangerous Precedent’ Rattles Chile’s Renewable Energy Market

South Africa Seeks $18 Billion for Municipal Power-Grid Boost

IBM Shuts China R&D Operations in Latest Retreat by U.S. Companies

Uber Hit by Record $324 Million Fine for Data Transfers to US

Telegram Becomes Free Speech Flashpoint After Founder’s Arrest

‘Black Myth: Wukong’ Revives Faith in China’s Game-Making Skill

Apple Rethinks Its Movie Strategy After a String of Misses

Lululemon ‘Dupes’ Are Just as Cool With the TikTok Crowd

Be sure to follow me on Twitter.

-

Morning News: August 23, 2024

Eddy Elfenbein, August 23rd, 2024 at 7:03 amChina Bond Trading Collapses Amid PBOC Crackdown on Record Rally

In a Likely Overture to China, Nepal Lifts Ban on TikTok

Nepal Asks China to Wipe Away a Loan It Can’t Afford to Pay Back

What a Prolonged Rail Shutdown in Canada Would Mean for Trade

Japan Overall Consumer Prices Stay Above Central Bank’s Target in July

Ueda Keeps Rate Hikes in Play, Talks Down BOJ’s Part in Meltdown

Jackson Hole History Points to Powell Sidestepping Market Shocks

Why Jackson Hole Is the Fed’s Biggest Shindig

A Turbulent Month Shows Markets Are Fickle. So Be Patient

Price-Gouging Crusade Electrifies Democratic Rank and File

The Year Politicians Turned Their Backs on Economics

EY Sheds U.S. Audit Clients in Response to Shortfalls

‘It’s Just Atrocious’: Jobs Data Snafu Stirs Fury on Wall Street

U.S. Plans to Accuse Software Maker of Enabling Collusion on Rents

Easier AP Exams Offer College Students a Path to $30,000 Savings

Wamco Investigation Examining 17,000 Trades Over Three Years

Location Tracking Turns Up the Trust Among Friends

Tesla Finance VP Departs in Latest Executive Exit at Automaker

Tesla’s Steep Price Cuts Help Get the Used EV Market Humming

Zambia Rejects 156% Power-Price Rise as Drought Deepens Cuts

A Small Mining Firm Just Saw Its Stock Surge 91% After It Discovered the World’s 2nd-Largest Diamond

Halliburton Hit by Cyberattack

Starbucks’ New CEO Gets Bigger Mandate as Schultz’s Control Ebbs

Chipotle’s Next Boss Has One Job: Don’t Change Too Much

Nestle CEO Departure Seen as ‘Not Such a Bad Thing’ for Investors, Analyst Says

Private Equity Tycoon Looks to ABBA Toolbox to Reboot the Music Industry

Warner Gave Up on New TNT Dramas. Now It’s Trying to Revive Them

Be sure to follow me on Twitter.

-

Morning News: August 22, 2024

Eddy Elfenbein, August 22nd, 2024 at 7:01 amTurkey’s Next Minimum Wage Rise to Show If Inflation Fight Real

Eurozone Gets Olympics Boost While U.K. Economy Gathers Pace

Eurozone Wages Slow Sharply, Paving Way for ECB Rate Cut

Powell Faces Economic Crossroads as He Prepares to Speak at Jackson Hole

Quantitative Tightening Goes Global for the First Time, in Test for Markets

Trump May Claim Credit for Stock Surges, but the Reality Is Far More Complicated

While the Public Awaited Jobs Data, Wall Street Firms Got a Look

What Kalamazoo (Yes, Kalamazoo) Reveals About the Nation’s Housing Crisis

Wamco’s Longtime Bond King Is Thrust Into Spotlight He Shunned

Hedge Fund Tribeca Says Weak Bank Research Fueled Its 19% Gain

Deutsche Bank Shares Rise 3% After Settlement of Bulk of Claims in Long-Running Postbank Suit

Is Elon Musk the Bankers’ Moby Dick? Not Yet

Dream or Disaster, Flying Cars Face Multibillion Dollar Moment

Tycoons Behind Taiwan’s ‘Silicon Shield’ Build a $50 Billion Fortune

Baidu’s AI Push Powers Profit Beat

Free Whopper? Walmart+ Offers Cheap Burger King as It Chases Amazon Prime

TD Misses Estimates on Wealth Unit After Hit From US Probe

Canada Railways Lock Out Workers as Talks Fail, Snarling Trade

The Wind Power Industry Isn’t Over Its Gloom Loop Yet

Engine Shortages Have Grounded Airlines. This Company Has the Formula to Fix That

Advance Auto Parts to Sell Worldpac to Carlyle for $1.5 Billion

Bavarian Nordic Shares Continue Higher After New Mpox Vaccine Order, Earnings Beat

Sugar Industry Faces Pressure Over Coerced Hysterectomies and Labor Abuses

Peloton Revenue, Profit Beat Estimates Amid Turnaround Effort

Urban Outfitters Shares Sink on Disappointing Sales Growth

Here’s How One Retailer Is Finding Profits in Borrowed Clothing

Why a Dior Bag Given to the First Lady Caused a Stir in South Korean Politics

Crayola Trademarks the Smell of Its Crayons

Be sure to follow me on Twitter.

-

Morning News: August 21, 2024

Eddy Elfenbein, August 21st, 2024 at 7:08 amA $2 Trillion Reckoning Looms as Ports Become Pawns in Geopolitics

The New Consensus on Trade Is Wrong and Dangerous

Japan Trade Slips into Deficit, Yen’s Rise Clouds Export Outlook

Italy’s Panetta Says EU Needs Immigration to Grow the Economy

Global Stocks Set for Modest Gains, Hinging on Series of Rate Cuts

Indonesia’s Central Bank Holds Rates Steady, as Expected

Bank of Thailand Holds Rates Steady Amid Economic Uncertainty

Powell Confronts Policy Crossroads With All Eyes on Jackson Hole

It’s Not Just Stocks — There’s Another Market Climbing to Thin Air, This Banking Giant Says

Tether to Launch Stablecoin Pegged to UAE’s Dirham

B. Riley’s Money Machine Ensnared Retail Investors $25 at a Time

As the Rich Snap Up Gold Bars, Storage Vaults Brace for Business

Judge Blocks F.T.C.’s Noncompete Rule

Nvidia Eyes Return to Record as AI Spending Bonanza Continues

Texas Instruments Tries to Ease Its Capital Pain

How Big Tech Is Obscuring AI’s Climate Impact

China’s Huge Piles of Coal Are a Climate Success Story

US Coal Miner Consol to Buy Arch Resources for $2.3 Billion

Ford Pulls Back Further From EVs With $1.9 Billion SUV Pivot

Walmart Dumps Entire Stake in China’s JD.com

Target Swings to Sales Growth as Price Cuts Lure Shoppers

Macy’s Reports Lower Sales as Shoppers Cut Back

Edgar Bronfman Jr.’s Long, Tortuous Path to Paramount Offer

America’s Love Affair With Investing in the Premier League Fades

JT Group to Buy US Cigarette Maker Vector for $2.4 Billion

Beyoncé Partners With Moët Hennessy on a New American Whisky

Luxury Brands Have a Strict Hierarchy. Burberry Found Out the Hard Way

Be sure to follow me on Twitter.

-

CWS Market Review – August 20, 2024

Eddy Elfenbein, August 20th, 2024 at 6:16 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

“All money is a matter of belief.” – Adam Smith

Today, the stock market snapped its eight-day winning streak. Frankly, the loss was small potatoes, just 0.20%, but I was hoping for another up day, and not just for wealth’s sake, but because the S&P 500 hasn’t rattled off a nine-day streak in nearly 20 years.

Honestly, Wall Street is pretty quiet right now. The volatility index has settled back to the complacent zone, and much of the financial world has zoomed off to the Hamptons or Martha’s Vineyard. At least, the fat cats have. The last two weeks before Labor Day are usually sedate on Wall Street.

The big event on everyone’s mind right now is the Fed’s annual conference in Jackson Hole, WY. In previous years, the Fed has used the Jackson Hole conference to announce major policy changes. In fact, it was at Jackson Hole two years ago that Fed Chairman Jerome Powell made it clear that he intended to crush inflation.

I doubt we’ll see anything so dramatic this time. This year’s conference is titled “Reassessing the Effectiveness and Transmission of Monetary Policy.” (Yawn!)

Chairman Powell is scheduled to speak on Friday morning. I assume he’ll preemptively justify the case for a 0.25% rate cut at the September FOMC meeting. I’m imagine he’ll be vague about plans after that.

Traders see the Fed lowering rates by 100 basis points before the end of the year. That’s a bold outlook. It implies that the Fed will cut by 50 basis points at the November or December meeting. Traders see the Fed cutting by another 100 points within the first seven months of 2025.

The stock market has rebounded impressively from its downdraft last month. In retrospect, the August swoon appears to be quite silly. Traders were panicking over mostly sideshow issues like the carry trade. The Q2 earnings season was mostly good for corporate America.

The S&P 500 is getting close to a new all-time high. In fact, if we were to exclude the Magnificent 7, then the index —the S&P 493— would already be at an all-time high. The hitch is that the losses in the Mag 7 reflect the tremendous sector rotation we’ve seen.

I want to discuss that in a little more depth because in my mind, that’s been the big story. What happened is that growth stocks were crushing value stocks until early July. Once the stock market peaked in mid-July, investors rushed out of growth stocks while value stocks largely sidestepped the damage. That’s the role of value stocks: provide a safe haven when everyone else gets rattled. All told, the selloff wiped off $6.4 trillion in market value.

The rotation was relentless but brief. In a few days, the market unwound the pro-growth undercurrent of the previous three months. The S&P 500 eventually hit bottom on August 5. Since then, the stock market has regained a lot of lost ground.

Here’s where it gets interesting. Growth has indeed led value in this latest rally but it’s nowhere close to the degree of the previous sector rotation.

Think of the rotation this way. The stock market has gone from Trend X to very strongly anti-X and now back to a watered-down X. I suspect that many investors are conflating this watered down X with the original trend. It’s not. It’s not even close.

Here’s a chart showing the S&P 500 Growth ETF (SPYG) divided by the S&P 500 Value ETF (SPYV). That’s the black line. I’ve also included the S&P 500 ETF (SPY) in green so you can see what the overall market was doing.

You can see that growth is leading value, but that’s after growth was demolished in July and August.

In this case, I’ve used growth and value, but you can use one of several different charts like Nasdaq versus Russell 2000 or S&P 500 equal weight versus not equal weight. They all show the same effect, Wall Street’s changing tolerance for risk. In turn, that’s related to the Fed’s outlook for interest rates. To quote from Lester Freamon, “all the pieces matter.”

I think the move to value stocks is far from over, but it may not be as dramatic as it was earlier this summer. There’s still a lot of uncertainty in this market.

Lowe’s Cuts Guidance

Speaking of which, I like to watch what big retailers have to say because that can often be a good bellwether for the overall economy.

On Tuesday, Lowe’s (LOW) said that it beat its Q2 earnings estimate ($4.10 vs. $3.97), but that was about the only good news. The home improvement company missed on sales expectations ($23.59 billion vs. $23.91 billion), and it lowered its full-year outlook. Lowe’s is not alone. Last week, Home Depot (HD) lowered its outlook for the second half of this year.

Previously, Lowe’s said it was expecting full-year revenues of $84 billion to $85 billion. Now it dropped that to a range of $82.7 billion to $83.2 billion. The company expects comparable store sales to fall by 3.5 to 4%. That’s down from the prior forecast for a decline of 2% to 3%. Lowe’s made $4.56 per share for the same quarter one year ago.

What’s going on? The CEO said shoppers are waiting for the Fed to lower rates. While that may be true, I’m always a bit skeptical when management says outside forces are to blame. Comparable sales fell by 5.1% last quarter.

There are some key differences between the business models of Home Depot and Lowe’s. For example, HD gets a larger share of professionals. About half of HD’s sales are to home professionals while it’s only 25% for Lowe’s.

Lowe’s is just one data point. Last week, Walmart posted good earnings and raised guidance. Goldman Sachs recently raised its odds for a recession from 15% to 25%, and now it’s lowered the odds to 20%.

Tomorrow Is Benchmark Revision Day!

Let me warn you. Tomorrow morning, about one million American jobs will disappear in an instant. Well, let me be a little more accurate—the government’s official count of American jobs will be lowered by a lot.

This is the time of year when the government bean-counters issue their preliminary benchmark jobs revision. This is real technical stuff, but this year, the revision will likely show that job growth has been weaker than originally reported. It could be by a lot.

There’s no need to panic because the time period has long since passed. The revision covers the 12 months through March. The BLS originally said that nearly three million jobs were created in those 12 months. Even after a big revision, jobs growth was going well.

Wall Street has no idea what the revision will be. Goldman and Wells Fargo said the revision will be by 600,000 jobs. It’s all just a guess. JPMorgan said it will be by 360,000. Goldman said it could be as high as one million.

Here’s how Bloomberg describes the revision:

Once a year, the BLS benchmarks the March payrolls level to a more accurate but less timely data source called the Quarterly Census of Employment and Wages, which is based on state unemployment insurance tax records and covers nearly all US jobs. The release of the latest QCEW report in June already hinted at weaker payroll gains last year.

The revision will tell us how robust the jobs recovery was. Since this is an election year, it will certainly get some attention. (And no. No one “cooked the books.”) As to what the Fed is planning, the revision is largely irrelevant.

There’s more to look forward to this week. Of course, Jerome Powell will be speaking at 10 am ET on Friday morning. Tomorrow, the Fed will release the minutes of its most recent meeting. On Thursday, we’ll get the last initial claims report and the report on existing-home sales. That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His