CWS Market Review – August 13, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Continues to Rebound

Last week, the stock market fell for the fourth week in a row. Over the course of 14 trading days (July 16 to August 5), the S&P 500 lost 8.5%.

While that’s certainly unpleasant to live through, drops like that are pretty routine for the market. In fact, it’s probably on the light side. Investors should expect to see a 10% drawdown once every two years, give or take.

The shrewd investor keeps his or her head during a market downturn. After all, that’s where the bargains are. Two years ago, at the height of the inflation scare, shares of Moody’s (MCO), one of our Buy List favorites, were trading for $230 per share. Since then, inflation has faded, and shares of Moody’s have doubled.

Thanks to today’s rally, the market has now closed higher for four days in a row. The S&P 500 is currently 4.8% above its closing low from last week. We’re not at a new high yet, but we’ve gained back just over half of what we lost.

Is our summer selloff over? I can’t say, but I wouldn’t mind seeing more of my favorite stocks go for a discount. There are still a lot of threats out there. The Federal Reserve looks ready to cut rates by 0.25% in five weeks. More than a few observers think the Fed will go for a 0.5% cut.

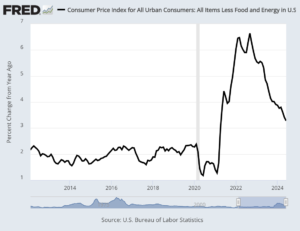

The next test for the market will come tomorrow morning when the government releases the CPI report for July. The consensus on Wall Street is to expect a 0.2% increase for both the headline rate and the core rate. Today’s PPI report increased by 0.1%, which was less than expected.

The last CPI report showed that prices actually fell by 0.1% during June. That had not happened in four years. The drop was largely due to a big slide in energy prices.

The core rate of inflation, which excludes food and energy, increased by only 0.1%. in June. Wall Street had been expecting an increase of 0.2%. The annual increase for the core rate is at its slowest since April 2021.

I should add that one of the key inputs in the CPI is shelter costs, and those tend to lag other costs. As a result, shelter costs are probably helping to weigh down the overall CPI. We’ll get more details tomorrow.

One of the problems of this recent bout with inflation is that more visible prices are increasing. For example, since 2022, electricity costs are up more than 10%. Car insurance is up significantly. As the WSJ points out, shoppers can easily trade down with some items like food, but you really can’t do that with your water bill. Inflation is up 6% since the rate of inflation peaked.

While these numbers are moving in the right direction, the job is not quite done. If tomorrow’s numbers come in hot, that could throw a wet blanket on the Fed’s rate-cutting plans, and traders would not be pleased.

Older investors will recall just how devastating inflation can be to the stock market. Yesterday was the 42nd anniversary of the 1982 low. The Dow closed at 776.92 which is lower than it had been 18 years before; meanwhile, inflation tripled. The 10-year Treasury was going for 13.5%. For context, “Fast Times at Ridgemont High” opened the next day.

With the help of some time passing, we can see that last Monday’s panic was extreme. The carry trade fizzled, Japanese stocks plunged, and the Volatility Index soared to some of its highest levels ever recorded. Still, the hectic times didn’t last very long.

We can also see that the big drop happened a few weeks after the stock market’s peak. That’s also fairly common. Stocks don’t often crash at the peak. Instead, a gradual drop slowly turns into a mad dash for the exits. I call this the “Wile E. Coyote Effect” where the market dashes off the cliff and will hang in mid-air before realizing it’s too late.

When the Bank of Japan decided to raise rates, it was by a puny amount, but that was enough to spook investors. A positive loop can easily become a negative one. No one wants to be last, so they sell, and that causes more folks to sell.

This also raises an uncomfortable question which is, how much money is tied up in the carry trade? The answer is, we don’t know. There are estimates. Some say it’s over $1 trillion, but that’s just a guess. JPMorgan Chase said that three-fourths of the carry trades have already been busted.

The yen carry trade still lives, but it’s not quite the layup it used to be. Last year, being short the yen and long the peso was easy money. The yen will probably continue to rally from here.

Starbucks Jumps 25%

Shares of Starbucks (SBUX) soared 25% in today’s trading. I wish I could say the reason for the move is that the coffee giant is selling lots more coffee. Instead, it’s that they fired their CEO.

I have to admit that if I were CEO of a company and it gained $21 billion on the news of my firing, I’d take it personally. This looks to be SBUX’s best day since its IPO in 1992.

Starbucks has appointed Brian Niccol, the current top banana at Chipotle (CMG) to take over the reins at Starbucks. He will replace Laxman Narasimhan who’s been in charge for the last 16 months. Niccol officially takes over on September 9. Shares of CMG closed lower by 7.5% today.

This is a bold move. To be honest, things were not going well at Starbucks. In April, the coffee people cut their guidance for the second time this year. The problem Starbucks faces is tougher competition in China.

Howard Schultz, the founder and guiding light of Starbucks, was publicly critical of Narasimhan. According to the WSJ, since Narasimhan took over, shares of SBUX are down 22% while the S&P 500 is up more than 36%.

Not surprisingly, activist investors had been pushing Starbucks to make some big changes. These are firms that take a position in a struggling business and urge it to change course. In its last report, Starbucks said that same-store sales are down 3%.

Niccol has been at Chipotle since 2018 and, going by the share price, he’s done a very good job. In March 2018, the stock was going for about $6.50 per share. Yesterday, Chipotle closed at $55.87 per share.

While a lot of restaurants have been feeling the squeeze, Chipotle has prospered. About Niccol, Howard Schultz said, “I believe he is the leader Starbucks needs at a pivotal moment in its history. He has my respect and full support.”

One of the mistakes of investment analysis is to give a CEO too much credit. It’s not that there aren’t better and worse CEOs – there certainly are. However, what you often see is a successful CEO at the right place and right time. Perhaps the business climate turned in their favor or a competitor has made some major mistake. It’s only natural that investors will see that as the magic of the CEO.

The great baseball manager Casey Stengel won seven World Series with the Yankees and had some of the worst records in the modern era with the Mets. Why? Well, the Yankees were a lot better than the Mets. Stengel wasn’t responsible for all of that.

In fact, the successful CEO is often the one who realizes that a big opportunity has come along. I’d love to own Starbucks – it’s a great business – but I want to see proof of a turnaround before I see it as a buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on August 13th, 2024 at 5:14 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His