Archive for August, 2024

-

Morning News: August 20, 2024

Eddy Elfenbein, August 20th, 2024 at 7:04 amGlobal Trade Needs a China Alternative. India Needs Better Ports.

A Criminals’ Paradise Is Emerging in the Heart of Southeast Asia

China Unleashes Rapid Drop in New-Home Prices With Relaxed Curbs

Turkey Extends Rate Pause, Shifts Emphasis to Price Expectations

PwC Loses Major Client Bank of China Amid Regulatory Probe

Central Banks Sound Uncertain Ahead of Jackson Hole

Fed Confronts Up to a Million US Jobs Vanishing in Revision

Recession Guesswork Is Just as Reliable as It Sounds

Markets Rebound Like They’re on a Mission From…

Icahn’s Margin Loan Deal With SEC Caps $19 Billion Wealth Plunge

Citadel Nabs Goldman Tech Chief in Latest Poach From Wall Street

Kamala Harris Wants to Ban Price Gouging. What Do Economists Say?

It Hasn’t Been the Summer Oil Bulls Were Hoping For

EU Plans 9% Tariff on Tesla Cars as China EV Probe Advances

The Next Challenge for the US Charging Network: Congestion

XPeng Narrows Quarterly Loss as Revenue, Margins Grow

Malaysia’s Heritage Island Goes Big on Chips

A Nation of Workaholics Has a New Fixation: Working Less

Lowe’s Cuts Guidance on Soft DIY Spending, Housing Market

Alaska Airlines’ Acquisition of Hawaiian Clears Key Antitrust Review

Mpox Surge Raises Fear of Spread Before Patients Show Symptoms

Lilly’s Zepbound Cut Risk of Diabetes by 94% in Obese People

Here’s Why This Jar of Weed Costs $60 at a Legal N.Y.C. Dispensary

Bronfman Makes $4.3 Billion Bid for Control of Paramount Global

Hit Chinese Video Game Seeks to Curb ‘Negative Discourse’

‘The Demand Is Unstoppable’: Can Barcelona Survive Mass Tourism?

Families Are Going Into Debt for Disney Vacations

Be sure to follow me on Twitter.

-

Morning News: August 19, 2024

Eddy Elfenbein, August 19th, 2024 at 7:10 amEurope Faces Diesel Deluge as Giant Supertankers Bring Fuel

Coal Power Defined This Minnesota Town. Can Solar Win It Over?

U.K. Rate Cut Invigorates Property Market

Imports Are Surging Again at US Ports, But Without the Logjams

Lula Is Running Huge Budget Deficits and Scaring Off Investors

Businesses Are Already Girding for Next Phase of the U.S.-China Trade War

Asia Central Banks in Focus as Stage Set for More Rate Cuts

Specter of Trump Tariffs Hangs Over Markets

The Stakes Are High for Powell at Jackson Hole

Traders Need Fed’s Rate-Cut Signal to Keep Stocks Rallying

Big Banks Watched as Con Men Wiped Out a Widow’s Life Savings

US Regional Bank Deals Rise as Lenders Aim to Bolster Balance Sheets

Hedge Funds Sell Planes, Trains, Automobiles; Buy Energy Stocks, Says Goldman

How Buyers and Sellers Are Navigating Real Estate’s Seismic Shakeup

First-Ever Tokenized Church? Colorado Group Turns $2.5M Chapel into Digital Asset

Tech’s Infatuation With AI Spending Comes at Cost of People’s Jobs

AMD to Make $4.9 Billion AI Acquisition as It Steps Up Race Against Nvidia

Tesla Trails Rivals in Offering Driver-Assistance Features in China

Couche-Tard Seeks to Buy $31 Billion Owner of 7-Eleven Stores

How the World Sleepwalked Into the Global Mpox Emergency

Starbucks’s New Boss Gets an Unusual Perk: Remote Work

Starbucks’ New CEO Faces ‘Achilles Heel’ of Mobile Ordering

The Hotelification of Offices, With Signature Scents and Saltwater Spas

Estée Lauder Sees Annual Sales Below Estimates on China Weakness

Estée Lauder’s Longtime CEO Fabrizio Freda to Retire

What NFL Players Really Think About Sports Gambling

Be sure to follow me on Twitter.

-

Morning News: August 16, 2024

Eddy Elfenbein, August 16th, 2024 at 7:02 am“The Chainsaw Never Stops.” Milei’s Support Survives His Economic Experiment

China’s Steel Titans Are Finally Bending to Reality

China Manages to Halt Bond Bulls In Their Tracks, for Now

The War on Prices Hits the Campaign Trail

Must-Win Michigan’s Angst Over Inflation, EVs Shapes 2024 Election

Ultra-Luxury Home Sales in US Are On Pace to Set a New Record

The End of Fabulous Money Market Rates Is Near

Five Big Questions for the Fed at Jackson Hole

With US Economy Humming, a Quarter Point Will Do

Carry Trade That Blew Up Markets Is Attracting Hedge Funds Again

Man Group Quants Are Riding Private Boom for Public Stock Trades

BlackRock Says Blended Finance at ‘Turning Point’ as Deals Grow

Cash Sweep Scrutiny Threatens Wealth Managers’ Credit Ratings, Moody’s Says

The Hottest Club in Town Is… Run by Your Credit-Card Company?

Can You Solve This Insider-Trading Puzzle in Seven Clues or Less?

Buying or Selling a Home? The Rules Are Changing.

Revenues Down and Stock Battered as Data Firm Faces Scrutiny

Sports Betting Is Legal, and Sportswriting Might Never Recover

Hey Google, Time to Add China ‘Koreafication’ to Your Search Engine

U.S. Awards $1.6 Billion to Texas Instruments to Build Semiconductor Plants

How Booming Electricity Demand Is Stalling Efforts to Retire Coal and Gas, in Charts

Cheniere Energy, Enriched By a Recent Spike in Gas Prices, Boosts Spending on Buybacks

Carbon-Removal Firms Have One Very Big Backer. That’s a Problem.

JetBlue’s Third-Largest Shareholder Has One Ask: A Status Upgrade

Rivian Pauses Output of Amazon’s Electric Delivery Van Due to Parts Shortage

No Joke: The Onion Thinks Print Is the Future of Media

Olipop Breaks Into the Exclusive World of Stadium Soda

Be sure to follow me on Twitter.

-

Morning News: August 15, 2024

Eddy Elfenbein, August 15th, 2024 at 7:04 amMigrant Workers Lured to Canada Are Being Scammed Out of Their Life Savings

Nigeria Is Turning Itself Into an Oil Market Juggernaut

America’s Promised Hydrogen-Fueled Future Is Stalled Over Tax Credits

China’s Economy Fails to Pick Up After Worst Stretch in Five Quarters

U.K. Economy Buoyed by Reports on Growth, Inflation and Jobs

Why Ethiopia Ended Half a Century of Currency Control

Philippines Central Bank Cuts Rates First Time in Nearly Four Years to Support Economy

Trump and Harris Should Focus on the Minimum Wage, Not Tips

Why Inflation Might Not Win the Election for Trump

Why Falling Mortgage Rates Aren’t a Quick Fix for Frustrated Homebuyers

What’s a Minsky Moment and Why Are There Worries About One?

Jamie Dimon Wants to Hit Millionaires With the ‘Buffett Rule’ to Tackle National Debt

Alphabet Shares Face Months of Uncertainty on New Breakup Risk

Buffett’s Apple Sale Brings Value Back to Quality Investing

Apple Pushes Ahead With Tabletop Robot in Search of New Revenue

Coming to ‘iPhone City’: An Electric Car Factory From Foxconn

Cisco Systems to Cut About 7% of Staff in Second Round of Layoffs

A Chinese Self-Driving Start-Up Is About to Go Public in the U.S.

Alibaba’s Profit, Revenue Miss Expectations Despite Growth Drive

JD.com’s Second-Quarter Profit Nearly Doubled as Revenue Edged Higher

Walmart Lifts Full-Year Outlook on Bargain-Hunting Shoppers

What is Mpox, How Does It Spread and Is There a Vaccine? All You Need to Know

U.S. Announces Prices for First Drugs Picked for Medicare Negotiations

J&J Eyes Texas as Venue for Next Round of Baby Powder Fight

Starbucks’ $113 Million Payday Makes Niccol Among Most-Paid CEOs

Brian Niccol’s Journey From Doritos Locos Tacos to Running Starbucks

Record Heat Is Testing Kraft Heinz’s Efforts to Climate-Proof Its Ketchup

The British Have Finally Learned to Love Peanut Butter

Tapestry Gains as Quarterly Profit Beats Wall Street’s View

Be sure to follow me on Twitter.

-

Morning News: August 14, 2024

Eddy Elfenbein, August 14th, 2024 at 7:02 amTo Save the Panama Canal From Drought, a Disruptive Fix

Rooftop Solar Has a Fraud Problem. The Industry Is Working to Build Back Trust

No Respite for Chinese Officials as Economy Shows New Signs of Weakness

Kishida’s Resignation Opens the Door to a Chaotic Era

Global Immigration Crackdown Ensnares Students Abroad

ECB Calls Probe of Riskiest Bank Loans of ‘Fundamental’ Import

U.K. Services Inflation Eases, Keeping Door Open for More Rate Cuts

US Inflation Data to Show Another Modest Increase, Cementing Fed Cut

The Fed Is Setting the Mood, Not Trump or Selloff

Inflation Data Is the Next Hurdle for Investors Weary From Volatility

What Is Momentum Trading and What Just Went Wrong?

US Junk Debt Investors Cautious of Leveraged Loans as Economy Slows

There’s Something Fishy About Insiders’ ‘Other’ Trades

Secretive Dynasty Missed Out on Billions While Advisers Got Rich

UBS to Sell Credit Suisse’s U.S. Mortgage Servicing Business

There’s a Gender Split in How US College Grads Are Tackling a More Difficult Job Market

Global Trade Shows Resilience Amid Recession Talk

US Considers a Rare Antitrust Move: Breaking Up Google

Google’s Stock Falls as the Government Weighs Breaking Up the Company

The Little Streamer That Could

Tencent Profit Surges as Domestic Games Revenue Resumes Growth

Texas Sues G.M. Over Collection and Selling of Driver Data

Elliott to Launch Proxy Fight at Southwest Airlines

Mars to Purchase Snack Maker Kellanova in $36 Billion Deal

‘Stress on Shelves’—the Battle for Space in Store Aisles

Narasimhan’s Ouster at Starbucks Adds Fuel to Record Firing Pace

Be sure to follow me on Twitter.

-

CWS Market Review – August 13, 2024

Eddy Elfenbein, August 13th, 2024 at 5:14 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Stock Market Continues to Rebound

Last week, the stock market fell for the fourth week in a row. Over the course of 14 trading days (July 16 to August 5), the S&P 500 lost 8.5%.

While that’s certainly unpleasant to live through, drops like that are pretty routine for the market. In fact, it’s probably on the light side. Investors should expect to see a 10% drawdown once every two years, give or take.

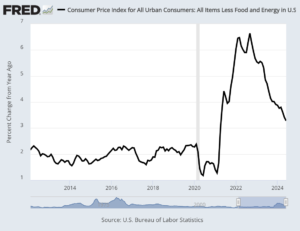

The shrewd investor keeps his or her head during a market downturn. After all, that’s where the bargains are. Two years ago, at the height of the inflation scare, shares of Moody’s (MCO), one of our Buy List favorites, were trading for $230 per share. Since then, inflation has faded, and shares of Moody’s have doubled.

Thanks to today’s rally, the market has now closed higher for four days in a row. The S&P 500 is currently 4.8% above its closing low from last week. We’re not at a new high yet, but we’ve gained back just over half of what we lost.

Is our summer selloff over? I can’t say, but I wouldn’t mind seeing more of my favorite stocks go for a discount. There are still a lot of threats out there. The Federal Reserve looks ready to cut rates by 0.25% in five weeks. More than a few observers think the Fed will go for a 0.5% cut.

The next test for the market will come tomorrow morning when the government releases the CPI report for July. The consensus on Wall Street is to expect a 0.2% increase for both the headline rate and the core rate. Today’s PPI report increased by 0.1%, which was less than expected.

The last CPI report showed that prices actually fell by 0.1% during June. That had not happened in four years. The drop was largely due to a big slide in energy prices.

The core rate of inflation, which excludes food and energy, increased by only 0.1%. in June. Wall Street had been expecting an increase of 0.2%. The annual increase for the core rate is at its slowest since April 2021.

I should add that one of the key inputs in the CPI is shelter costs, and those tend to lag other costs. As a result, shelter costs are probably helping to weigh down the overall CPI. We’ll get more details tomorrow.

One of the problems of this recent bout with inflation is that more visible prices are increasing. For example, since 2022, electricity costs are up more than 10%. Car insurance is up significantly. As the WSJ points out, shoppers can easily trade down with some items like food, but you really can’t do that with your water bill. Inflation is up 6% since the rate of inflation peaked.

While these numbers are moving in the right direction, the job is not quite done. If tomorrow’s numbers come in hot, that could throw a wet blanket on the Fed’s rate-cutting plans, and traders would not be pleased.

Older investors will recall just how devastating inflation can be to the stock market. Yesterday was the 42nd anniversary of the 1982 low. The Dow closed at 776.92 which is lower than it had been 18 years before; meanwhile, inflation tripled. The 10-year Treasury was going for 13.5%. For context, “Fast Times at Ridgemont High” opened the next day.

With the help of some time passing, we can see that last Monday’s panic was extreme. The carry trade fizzled, Japanese stocks plunged, and the Volatility Index soared to some of its highest levels ever recorded. Still, the hectic times didn’t last very long.

We can also see that the big drop happened a few weeks after the stock market’s peak. That’s also fairly common. Stocks don’t often crash at the peak. Instead, a gradual drop slowly turns into a mad dash for the exits. I call this the “Wile E. Coyote Effect” where the market dashes off the cliff and will hang in mid-air before realizing it’s too late.

When the Bank of Japan decided to raise rates, it was by a puny amount, but that was enough to spook investors. A positive loop can easily become a negative one. No one wants to be last, so they sell, and that causes more folks to sell.

This also raises an uncomfortable question which is, how much money is tied up in the carry trade? The answer is, we don’t know. There are estimates. Some say it’s over $1 trillion, but that’s just a guess. JPMorgan Chase said that three-fourths of the carry trades have already been busted.

The yen carry trade still lives, but it’s not quite the layup it used to be. Last year, being short the yen and long the peso was easy money. The yen will probably continue to rally from here.

Starbucks Jumps 25%

Shares of Starbucks (SBUX) soared 25% in today’s trading. I wish I could say the reason for the move is that the coffee giant is selling lots more coffee. Instead, it’s that they fired their CEO.

I have to admit that if I were CEO of a company and it gained $21 billion on the news of my firing, I’d take it personally. This looks to be SBUX’s best day since its IPO in 1992.

Starbucks has appointed Brian Niccol, the current top banana at Chipotle (CMG) to take over the reins at Starbucks. He will replace Laxman Narasimhan who’s been in charge for the last 16 months. Niccol officially takes over on September 9. Shares of CMG closed lower by 7.5% today.

This is a bold move. To be honest, things were not going well at Starbucks. In April, the coffee people cut their guidance for the second time this year. The problem Starbucks faces is tougher competition in China.

Howard Schultz, the founder and guiding light of Starbucks, was publicly critical of Narasimhan. According to the WSJ, since Narasimhan took over, shares of SBUX are down 22% while the S&P 500 is up more than 36%.

Not surprisingly, activist investors had been pushing Starbucks to make some big changes. These are firms that take a position in a struggling business and urge it to change course. In its last report, Starbucks said that same-store sales are down 3%.

Niccol has been at Chipotle since 2018 and, going by the share price, he’s done a very good job. In March 2018, the stock was going for about $6.50 per share. Yesterday, Chipotle closed at $55.87 per share.

While a lot of restaurants have been feeling the squeeze, Chipotle has prospered. About Niccol, Howard Schultz said, “I believe he is the leader Starbucks needs at a pivotal moment in its history. He has my respect and full support.”

One of the mistakes of investment analysis is to give a CEO too much credit. It’s not that there aren’t better and worse CEOs – there certainly are. However, what you often see is a successful CEO at the right place and right time. Perhaps the business climate turned in their favor or a competitor has made some major mistake. It’s only natural that investors will see that as the magic of the CEO.

The great baseball manager Casey Stengel won seven World Series with the Yankees and had some of the worst records in the modern era with the Mets. Why? Well, the Yankees were a lot better than the Mets. Stengel wasn’t responsible for all of that.

In fact, the successful CEO is often the one who realizes that a big opportunity has come along. I’d love to own Starbucks – it’s a great business – but I want to see proof of a turnaround before I see it as a buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: August 13, 2024

Eddy Elfenbein, August 13th, 2024 at 7:08 amChina Goes to New Extreme in Crackdown on Bond-Market Frenzy

China’s Outbound Investing Quota Crunch Spurs Foreign Asset Managers to Get Creative

Middle East Trillions Force New Concessions From Wall Street

German Economic Expectations Nosedive as Global Slowdown Fears Bite

Can This Country Show Europe How to Compete Again?

Fed Becomes Campaign Issue as Trump, Vance Seek Political Input

Interest-Rate Cuts Rely on Inconvenient Truths About Inflation

Reminder: Inflation Still Matters More Than Anything

Stock Dump Sparked by Yen Spike Will Drag On, Says Goldman Sachs Strategist

The Unraveling of a Crypto Dream

Thousands of Bankers Are Quitting Their Jobs in India

Goldman Investment Arm Joins Firms Quitting Major Climate Club

China’s Oil-Demand Growth Slowdown Weighs on Global Outlook, IEA Says

China Puts Canada’s Mining M&A Restrictions to the Test

GM Cuts China Jobs as It Resets in World’s Biggest Car Market

Austria Sees ‘Massive Risk’ From Halt to Russian Gas Flows

Semiconductor Factory Reshapes Czech Region’s Industrial Past

US Manufacturers Hit by Soaring Property Insurance Costs

Boeing Is in Crisis. Airbus Is Struggling to Power Ahead.

It Was a Hot Real Estate Trade. Now Investors Are Worried.

NYC’s Aging Midtown Buildings Lure Property Mogul Larry Silverstein

Home Depot Cuts Outlook as Consumers Stuck in ‘Deferral Mindset’

Baxter International to Sell Kidney Care Business to Carlyle for $3.8 Billion

Hot Summer Threatens Efficacy of Mail-Order Medications

Starbucks Replaces CEO as Activist Investors Push for Changes

Federer-Backed On Sees 28% Sales Increase on Footwear Demand

Be sure to follow me on Twitter.

-

Morning News: August 12, 2024

Eddy Elfenbein, August 12th, 2024 at 7:05 amChina Touts Olympic Gold Medal Tie With US as New Sign of Power

China Regulators Tell Some Rural Banks to Renege on Bond Trades

U.S. Officials to Visit China for Economic Talks as Trade Tensions Rise

Inflation Hurts Most for the Things We Can’t Skimp On

Americans’ Refusal to Keep Paying Higher Prices May Be Dealing a Final Blow to US Inflation Spike

Tim Walz’s Investment Strategy Makes Him an Outlier

Bonds Are Back as a Hedge After Failing Investors for Years

Private Credit Enters Risky Terrain With Huge Bets on Consumers

Hedge Funds Smell Blood as Lenders Turn on Each Other

‘There Could Be Social Unrest’: Finance Veterans on the Next Big Risk

Drahi’s BT Exit Follows $1.3 Billion Drop in Stake’s Value

Adani Stocks Drop as Hindenburg Row With India Regulator Worsens

Apple and Alphabet’s Freakish Earnings Broke This Market Barometer

Sea Raises Seller Fees to Above TikTok, Temu to Lift Margins

OPEC Slightly Trims Oil Demand Forecast, Citing Softness in China

Gold Fields to Buy Osisko Mining for $1.6 Billion

Coffee Jumps Most in Five Weeks as Market Eyes Brazil Frost Risk

Why Naming Heat Waves Is So Controversial: Green Daily

AI Is About to Boost Power Bills—Who’ll Take Heat for That?

Labor Talks at US East and Gulf Coast Ports Reach an Impasse

McDonald’s Goes to Washington. And Sacramento. And Albany.

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

Brands Love Influencers (Until Politics Get Involved)

Bari Weiss Knows Exactly What She’s Doing

Why Schools Are Racing to Ban Student Phones

Los Angeles, Next Up for Summer Olympics, Hopes to Turn a Profit

Disney Details Vast Theme Park Expansion Projects

Be sure to follow me on Twitter.

-

Morning News: August 9, 2024

Eddy Elfenbein, August 9th, 2024 at 7:01 amHow Japan’s Central Bank Threw Out Its Playbook for Normalizing

Fed Seen Rejecting Calls for Jumbo Rate Cut in Economist Survey

Wall Street on Edge After a Week of Wild Swings

How to Cope When the Markets Panic

Finance Chiefs Lean on Commercial Paper to Trim Costs, Prepare for Rate Cuts

Trump Restates His Desire for More Say Over the Fed

Has the U.S. Economy Reached a Tipping Point?

Mortgage Rates Drop to 15-Month Low

The Swing-State Economic Realities Shaping the US Election

Who Won Big in the Supreme Court’s Latest Term? The ‘Regulated Community.’

What the History-Making Elections of 2024 Could Mean for Energy

Shale Oil Output Growth Poses Headache for OPEC+

A Lot Was Riding on This Wind Farm. Then Giant Shards Washed Up in Nantucket

The UK Energy Boss Taking (Some) Inspiration From Musk and Bezos

Musk’s Riot Tweets Spur UK to Seek Tougher Online Rules

How China Built Tech Prowess: Chemistry Classes and Research Labs

Temu’s Billionaire Founder Becomes China’s Richest Person

Goldman Partner and M&A Banker David Kamo Exits to Join Evercore

Ponzi Scheme Restitution Deserves Better Math

With US Chips Act Money Mostly Divvied Up, the Real Test Begins

Indian EV Maker Ola Electric Jumps in Trading Debut

Cellnex Sells Unit For €803 Million, Signals Share Buyback

Americans Are Skipping Theme Parks This Summer

Is a Disney Theme Park Vacation Still Worth the Price?

How the Paris Olympics Mascot Went From Bizarre to Beloved

LA Olympics Poised to Be Flag Football’s NFL Dream Team Moment

Be sure to follow me on Twitter.

-

Morning News: August 8, 2024

Eddy Elfenbein, August 8th, 2024 at 7:09 amCentral Banks Get Sand Kicked in Their Face Again

India Central Bank Holds Policy Rate Steady, as Expected

Glynn’s Take: Hawkish RBA Governor Should Brace for Storms to Come

The Fed Has Cut Rates Amid Stock Swoons Before. Not This Time

Consider Yourself Warned on Market Risks

What’s Driving the Topsy-Turvy Markets

JPMorgan Says Three Quarters of Global Carry Trades Now Unwound

As Markets Rock, a Reporter Stays Steady

Cathie Wood Goes on Dip-Buying on Tech Spree as ARKK Hits 2024 Lows

Balyasny Goes on New Hiring Spree With $200 Million in Payouts

$800 Billion Gulf-Wealth Fund Can Face UK Suits After Court Loss

As AI Costs Surge, Investors Embrace Less-Is-More Data Strategy

What Works in Taiwan Doesn’t Always in Arizona, a Chipmaking Giant Learns

Social Media Platforms Show Little Interest in Stopping Spread of Misinformation

Texas Energy So Bountiful, They Pay You to Take It Away

Startups Are Racing to Make Water Out of Thin Air

China’s Sales of EVs, Hybrids Surpass Conventional Cars in July

Indeed and Glassdoor Owner Posts Profit Rise

Eli Lilly Lifts 2024 Sales Outlook as Zepbound Demand Drives Quarter

What Happens When Ozempic Takes Over Your Town

Warner Bros. Discovery Takes $9 Billion Write-Down on Cable Networks

Boeing’s New CEO Is Hands On. He’s Being Handed a Company in Crisis.

Air Canada Says Paris Olympics Are Hurting Sales This Summer

Simone Biles’ Leotards Ignite Sales of Made-in-America Brand

Supplying Saks Was a Soapmaker’s Dream Until He Got a $74 Check

Be sure to follow me on Twitter.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His