CWS Market Review – October 1, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Best Year for Stocks Since 1997

The stock market closed yesterday at another all-time high, 5,762.48. These new highs are getting repetitive! So much for September being the worst month of the year.

Through September, the S&P 500 is up 20.8% on the year. That’s better than every single major investment firm expected.

Yesterday was the index’s 43rd new high this year. This is the best first nine months to a year in 27 years. Also, this is the best start to a presidential election year on record (going back to 1928).

For the month, the S&P 500 gained just over 2%, and for the third quarter, the index gained 5.5%. This was the fourth quarterly gain in a row for the market.

What’s remarkable is how placid the stock market has been. Despite a flurry of scary headlines, the market keeps quietly chugging along. Except for a quick three-day panic in August, this market has been remarkably calm.

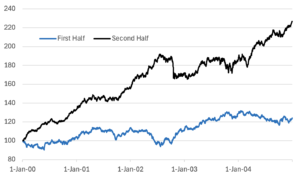

This has also been a tale of two markets. For the first half of the year, growth stocks strongly led value, but in the middle of the year, value started to take the lead.

In recent weeks, value’s surge against growth has started to wane, but I’m not ready to say the value cycle is over. As long as the Fed is committed to lowering interest rates, that’s good news for higher-yielding sectors of the market.

In particular, the areas of the market that are set to do well are defensive areas. By that, I mean staples, healthcare, utilities and REITs. There’s even been talk of “AI fatigue” plaguing some large-cap tech stocks. I wouldn’t be surprised to see more of that.

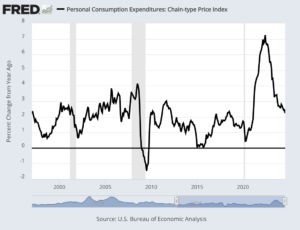

What’s been driving the recent rally? Obviously, the Fed rate cuts are playing a big role. Not only that, but it looks like more rate cuts are on the way. On Friday, we got good inflation news when the government said that the Personal Consumption Expenditures (PCE) price index rose by just 0.1% in August. That was less than expected.

Over the past 12 months, the PCE price index is up by 2.2% (see below). That’s the lowest 12-month rate since February 2021. I don’t want to say that inflation has been defeated, but the price outlook is getting better.

The PCE is important because it’s the Fed’s preferred measure of inflation. Unlike the CPI, the PCE is based on what consumers actually buy.

The core PCE, which excludes food and energy prices, also rose by 0.1% in August, and that was also below expectations. Over the last 12 months, the core PCE is running at 2.7%. That’s still above the Fed’s 2% target for inflation, but the trend is moving in the right direction.

The progress in August came despite continued pressure from housing-related costs, which increased 0.5% on the month for the largest move since January. Services prices overall rose 0.2% while goods declined by 0.2%.

We also learned that personal income rose by 0.2% in August, and spending rose by 0.2% as well. Both numbers were below expectations.

Since today is the first business day of the month, we got the ISM Manufacturing Index. For September, the ISM was 47.2. That’s the same as it was for August. That’s a weak number but nothing terrible. Wall Street had been expecting 47.5.

Tuesday’s report on job openings showed that there are eight million jobs looking to be filled. That’s an increase of 329,000 since July. The next test for the market will come on Friday with the September jobs report. Wall Street expects to see a gain of 150,000 net new jobs.

The Federal Reserve meets on November 6-7, and it’s very likely that the Fed will cut rates again. In fact, yesterday, Jerome Powell spoke at a conference in Nashville, and he said the Fed will keep lowering interest rates to help keep the economy going.

In the most recent projections, Fed members see the central bank cutting by 0.5% before the end of the year. Again, the rate cuts aren’t so much about the Fed helping a weak economy. Truthfully, the economy isn’t weak right now. Instead, it’s better seen as the Fed taking back its extraordinary rate hikes that were used to combat inflation. With inflation receded, so can interest rates recede. At least, that’s how the Fed sees it.

I am concerned about the dockworkers’ strike, especially if it drags on. That could cause disruptions and mess up supply lines. A strike is probably not strong enough to push the whole economy off the lines, but it will have an impact. We can’t say how great it will be right now.

Why Prices Are Better Than Reports

If you follow the government’s economic data long enough, you learn to greet each new report with a bit of skepticism. That’s because nearly every report will, at some point, be revised—and those revisions will, themselves, be revised. And those revisions will be revised yet again. In the realm of economic data, few things are as surprising as the past.

Just recently, the Labor Department conceded that it overcounted the number of jobs in the economy by 818,000. Well, that’s a sizable miss.

It doesn’t end there. Last week, the government said that it under-reported how well the economy recovered from Covid. Originally, the government said the economy grew in real terms by 5.1% from Q2 of 2020 through the end of last year. Now it says the economy grew by 5.5% over that time span. That small-sounding mistake is really a few hundred billion dollars.

The government originally reported negative growth for the first and second quarters of 2022. Some claimed that since it was two quarters of negative growth, that should count as a recession.

While two quarters of negative growth is a good shorthand for a recession, it’s not precisely correct. The official definition of a recession is much broader. In any event, it’s now a moot point since, thanks to the revisions, the government now says the economy grew slightly during Q2 of 2022. Change a few numbers and presto, no more recession.

The Bureau of Economic Analysis (BEA) also revised higher the U.S. savings rate. Previously, the BEA said the savings rate had dropped to 2.9%. That’s really low. Now they said it only got to 4.8%. Goldman Sachs said that number is probably still too low.

This is another reason why I trust prices more than the government reports. Sure, the market can be wrong. It’s wrong all the time. But at least the stock market never revises its old prices.

The Decade Cycle

We’re nearing the midpoint of the decade, and I was curious to see how the stock market performs, on average, each decade. I took all the data for the S&P 500 since 1957. That’s when the index expanded to 500 stocks.

Footnote: I started each decade on January 1 of each year ending in zero.

I found that the stock market performs much better during the latter half of the decade than it has in the first. In fact, during the first three years of each decade, the market has basically gone nowhere.

Even in this decade, the S&P 500 was sitting on an 11% gain for the decade as late as mid-October 2022. That’s a modest gain for nearly three years.

But that back half of each decade is a very different story. In five years, the stock market has gained, on average, more than 120%. Interestingly, the 1987 Crash is still clearly visible on this chart.

I’m not sure what could explain the difference. Maybe it’s a natural cycle? Or it’s a random draw? The Soviet economist Nikolai Kondratiev said there are 45- to 60-year cycles at play in the economy. Beats me. But I wouldn’t mind seeing the market double over the next 5¼ years.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on October 1st, 2024 at 6:22 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His