CWS Market Review – October 8, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Economy Created 254,000 Jobs Last Month

Last Monday, the stock market closed out the quarter and month at an all-time high. Through September, this year’s market is on pace for being the strongest market in a presidential election year since 1928.

This has happened despite numerous reasons for investors to be scared. Nevertheless, the stock market keeps on climbing.

There’s an important lesson for investors in this. The long-term trend is very much in your favor. To be a good investor means you simply have to wait out bad times.

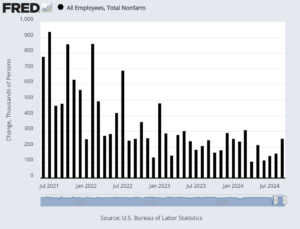

Wall Street then got a big shock on Friday when the Labor Department reported that the U.S. economy created 254,000 net new jobs last month. That was well above expectations for a gain of 150,000 new jobs. The unemployment rate ticked down to 4.1%.

I looked at the decimals, and the unemployment rate was technically 4.051%. In other words, the jobless rate came very close to rounding down to 4.0%.

The unemployment rate is lower today than it was in every single month from February 1970 to November 1999. (To be transparent, they have changed the methodology on that data several times.)

Wall Street liked the news. On Friday, the stock market rallied close to 1%. The market was up another 1% today.

Many of the details in the report are quite good. For example, the labor force participation rate for prime working-age adults is near a multi-decade high.

The jobs gain data for August were revised higher to 159,000. July’s number was increased by 55,000 to a monthly gain of 144,000.

I was very happy to see that average hourly earnings increased by 0.4%. That was 0.1% ahead of expectations. Over the last year, average hourly earnings are up by 4% which is ahead of inflation, but not by much. Still, it’s good to see that workers are finally getting a raise. One concern is that the average workweek fell by 0.1 hours to 34.2 hours.

Here are some details:

Restaurants and bars led job creation for the month, with the hospitality industry adding 69,000 positions in September after averaging just 14,000 over the previous 12 months.

Health care, a consistent leader in job growth, contributed 45,000, while government grew by 31,000. Other gainers included social assistance (27,000) and construction (25,000).

A more encompassing measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons dropped to 7.7%. The share of the workforce either working or looking for work, known as the labor force participation rate, held steady at 62.7%.

One interesting detail in Friday’s report is that many full-time positions were created last month. The number of part-time jobs decreased by 95,000 while fulltime employment increased by 414,000.

Where does this leave the Federal Reserve? That’s a good question. The Fed has made it clear that it wanted to lower rates before the economy skidded off the road and plowed into a ditch. Now it appears that the economy is doing well. Or at least, well enough. So are all these cuts needed?

The answer is probably yes. The Fed meets again early next month, just after the election. The futures market thinks the Fed will go ahead with another 0.25% rate cut, and that’s probably right. Some think the Fed will hit us with another 0.5% but I’m a doubter.

As I’ve said before, the best way to view these rate cuts is as the Fed undoing its aggressive rate hikes from 2022 to 2023.

However, the big news before the Fed meeting will be this Thursday’s CPI report. The last few CPI reports have shown benign inflation, but that was with weaker jobs growth.

For September, Wall Street expects inflation of 0.1% and core inflation of 0.2%. If that’s right, it means that both core and headline inflation are slowly moving to the Fed’s target of 2%.

Some people have suggested that the good jobs numbers will alter the Fed’s course. I think it’s too early to say. Remember the basic formula: lower rates are good for value and higher rates are good for growth stocks. Interestingly, growth stocks have done well over the last few days so there’s been some impact on the mind of the market.

Yesterday, the yield on the 10-year Treasury broke above 4%. This got a lot of attention, and it’s an important psychological level, but the yield is lower than it was during much of this summer.

The overall outlook is that rates are headed lower. The only question now is about speed. The futures market expects the Fed to cut by 0.25% at its December meeting as well. For 2025, traders think the Fed will cut rates by 1%. If inflation continues to fade away, that could be the correct policy.

Tomorrow, the Fed will release the minutes from its last meeting. These are usually pretty dull affairs, but this time could be an exception. For one, the Fed decided to cut rates by 0.5%. Also, there was one dissenting vote. The Fed has made it clear that rates are going down.

Stock Focus: Public Storage

As I’ve said, when rates are headed down, you want to make sure you have some high-yielding stocks in your portfolio. These means sectors like utilities and REITs which brings me to one of my favorite REITs.

Let’s say your boss offers you a big raise and a promotion, but the catch is that the job requires you to move out of the country. You love to see the world, so you jump at the chance.

But there’s one nagging question: what do you do with all your stuff?

Nowadays, there’s an easy answer. You rent a storage unit. There are lots of these facilities all over the country. If you look long enough, you’re bound to come across Public Storage (PSA).

Public Storage is the largest self-storage real estate investment trust (REIT) in the United States. There are currently more than 3,000 Public Storage locations around the world. The company is based in Glendale, CA.

If you’re not familiar with a REIT, it’s basically the landlord of some real estate. If the REIT pays out almost all of its income to shareholders, then it gets preferential tax treatment. As a result, REITs often have good dividend yields. It’s a great way to invest in real estate.

Public Storage was founded in 1972 by B. Wayne Hughes and Kenneth Volk Jr. During a trip to Texas, Hughes saw that local real estate developers had made, in effect, mini storage units, so he decided to bring the idea to Southern California. It was a brilliant idea because he could charge as much as apartments in term of price per square foot. The difference is that the upkeep costs were far less.

The business quickly took off and by 1989, it had grown to 1,000 locations. PSA officially became a REIT in 1995. Today it has a market cap of $61 billion, and PSA is one of the largest REITs around.

More than 90% of PSA’s revenue comes from its self-storage business. The company does a lot more than just provide the space. They also provide a broad range of services for their clients. PSA offers insurance and packing products. The company also has a subsidiary that provides boxes and truck rentals.

It’s an interesting business because the storage lots tend to be located in unforgiving parts of large cities. They’re often located in dense clusters near freeways and intersections. It’s also interesting that PSA has relatively few employees. The lots are automated so customers can access their units at any time.

As any fan of the TV show Storage Wars knows, abandoned units are auctioned off. (Despite what you may have heard, most abandoned or unpaid lots contain useless junk.)

PSA has been a tremendous business over the years.

Thirty years ago, you could have picked up one share of PSA for $7. Since then, the stock has increased by 50-fold. And that doesn’t include dividends. If you include dividends, then PSA gained over 500-fold. All from renting storage units.

I really like PSA’s dividend. The company currently pays out a quarterly dividend of $3 per share, or $12 for the year. Think of it this way: If you had bought PSA 20 years ago, you’d now be yielding over 20% based on your original purchase price.

I also like that PSA is the dominant player in the industry. The company buys up smaller companies all the time. There hasn’t been much self-storage building recently. That means there’s been a scramble to buy out smaller storage companies. There are lots of small operators and they’re happy to sell to PSA.

Public Storage currently yields 3.5% which isn’t that far below the current 10-year Treasury’s yield. The next earnings report is due out in three or four weeks.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on October 8th, 2024 at 5:32 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His