CWS Market Review – December 17, 2024

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Growth Stocks Rally

Growth stocks, apparently, have the holiday spirit. Nearly every day for the past three weeks, growth stocks have outpaced the overall market.

Of course, you’ll often see growth or value lead the market for a few days, but this recent turn towards growth has been especially pronounced.

Value is playing the role of the Grinch. The S&P 500 Value Index has closed lower for 13 days in a row. On Tuesday, the Dow closed lower for the ninth day in a row. That’s the index’s longest losing streak since 1978.

Meanwhile, Apple, Google and Tesla all hit new 52-week highs today.

The message is clear as we head into 2025: investors are perfectly fine with shouldering more risk. Tech stocks have done especially well, and the Nasdaq 100 ETF has been on fire.

The point I often stress to investors is that growth and value cycles don’t magically fall out of the sky. They often get a nice push from our friends at the Federal Reserve.

As it turns out, the Fed is meeting this week. In fact, today was the first day of their two-day meeting. The Fed’s policy statement will be out tomorrow afternoon, and I’ll spoil the surprise for you: you can be sure that the Fed will cut interest rates by 0.25%.

At this meeting, the Fed will also update its economic projections. I’ll caution you that the Fed doesn’t exactly have a stellar record when it comes to forecasting the economy. Not many of us do. Still, it’s important to see how they’re wrong.

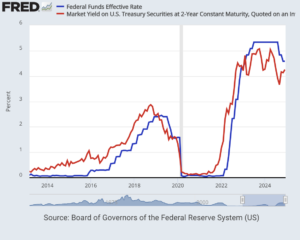

The big question now is what happens in 2025. There’s an emerging consensus that the Fed will pause at its January meeting. Here’s the Fed Funds rate (in blue) being chased by its shadow, the 2-year Treasury yield (in red):

Until now, the Fed has made it clear that it wants to lower interest rates, but now Wall Street thinks they may be getting ahead of things. After all, the last CPI report showed that inflation is being very stubborn, and there are plenty of bright spots in the economy.

Traders even think there’s a decent chance that the Fed will pause at its March meeting. That’s not the majority view, at least not yet.

The undercurrents in the stock market are reacting to the outlook for interest rates. When short-term rates are falling, value stocks tend to outperform. When short-term rates are rising, value stocks tend to lag.

In this instance, rates aren’t even going up. Rather, the recent trend of lower rates is cooling off. This makes sense as the economy appears to be doing well.

Shortly after President-Elect Trump’s election victory, many “old economy” sectors rallied, but that trend came to a quick halt in December.

Retail Sales Were Strong Last Month

Shoppers are in a good mood. This morning, we learned that retail sales increased by 0.7% last month. Wall Street had been expecting a gain of 0.5%. The number for October was revised higher to 0.5%. Over the last year, retail sales are up by 3.8%. This suggests that the economy did well during Q4.

Economists like to look at “core” retail sales which excludes cars, gasoline, building materials and food services. For November, core retail sales were up by 0.4%. That comes after a 0.1% drop in October.

Receipts at food services and drinking places, the only services component in the report, fell 0.4% after increasing 0.9% in October. Economists view dining out as a key indicator of household finances.

Sales at clothing stores decreased 0.2%. Grocery store sales also declined 0.2%. Sales at miscellaneous retailers, which include florists and gift shops, dropped 3.5%, extending the prior month’s decline.

Sales at auto dealerships increased by 2.6%. Online retail sales grew by 1.8%. Building materials and garden equipment store sales rose 0.4%.

There are some weak spots in the economy. This morning, the Federal Reserve said that industrial production fell by 0.1% last month. That was the third month in a row that industrial production fell. Wall Street had been expecting an increase of 0.3%.

The Santa Claus Rally

We’ve also just started the stock market’s happiest time of year which is the Santa Claus Rally. I’ve crunched all the numbers for the S&P 500 going back to 1957 when the index was expanded to 500 stocks.

From December 15 to January 6, the S&P 500 has gained an average of 2.81%. That may not sound like a lot, but as far as 67-year averages go, it’s quite large. This means that historically, one-quarter of the S&P 500’s annual gain has come during a three-week period in the holiday season.

This is what the average year for the S&P 500 looks like:

If we expand our parameters a bit, we see that the S&P 500 has gained an average of 8.24% from October 26 to February 15. That means that nearly three-quarters of the S&P 500’s annual gain has come during a period of less than four months. During the rest of the year, the market hasn’t done much. (Buy the World Series and sell the Super Bowl?)

To be clear, I would never base an investment decision on these calendar effects. I find it fascinating that the markets do seem to have their biases regarding time of year. The monthly cycle is especially impressive.

In the short-term, the market can be highly erratic, but in the long term, its judgments are wise.

That’s all for now. Remember: On Christmas Day, I’ll send you the names of the 25 stocks for the 2025 Buy List. This will be our 20th Buy List!

– Eddy

Posted by Eddy Elfenbein on December 17th, 2024 at 3:24 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His