Archive for April, 2025

-

Morning News: April 23, 2025

Eddy Elfenbein, April 23rd, 2025 at 6:56 amTrump’s Trade War With China Puts Japan in a Tight Spot

Trump Tries to Push Tariff Fight to Trade Court With Better Odds

Trump Floats ‘Substantial’ China Tariffs Cuts in Trade Deal

China Has an Army of Robots on Its Side in the Tariff War

US Chaos Is an Opportunity Europe Should Seize

Trump Says He Won’t Fire Powell. His Fed Battle May Not Be Over Yet.

White House is Right to Back Off the Fed

Trump Tariffs Place Trucking Industry in the Crosshairs

$1 Trillion of Wealth Was Created for the 19 Richest U.S. Households Last Year

CEO Gloom Rivals Financial Crisis as Tariffs Hit S&P 500 Stocks

Flash Boys Emerge From Shadows to Reorder Stock Trading

Pimco Says Treasuries Are Starting to Look Attractive After Rout

David Solomon’s Pay Hinges on Whether Goldman Is More Than Just a Bank

NatWest Chief’s Pay Rises as Government Nears Share Exit

DC’s Special Status Gets Ripped Up by DOGE’s Job and Cost Cuts

Yale Signals That Private Equity May Have Peaked

As Harvard Is Hailed a Hero, Some Donors Still Want It to Strike a Deal

Apple and Meta Are First to Be Hit by E.U. Digital Competition Law

Remember When Facebook Was Cool? Recalling a Bygone Era at Meta’s Trial.

The Headlines Alone Reveal the DOJ’s Weak Case Against Google

Intel to Announce Plans This Week to Cut Over 20% of Staff

SAP Shares Jump After Earnings Beat Forecasts Despite Tariff Uncertainty

Tesla Has a Deep Hole to Pull Out Of

Elon Musk Warns Rare Earth Magnet Shortage May Delay Tesla’s Robots

AT&T Beats on Mobile-Phone Customers After Verizon Miss

Chobani, Seeing Rising Demand, Plans Giant Factory in New York

From Hermès Bags to Sally Hansen Nail Polish: The Art of Jacking Up Prices

Be sure to follow me on Twitter.

-

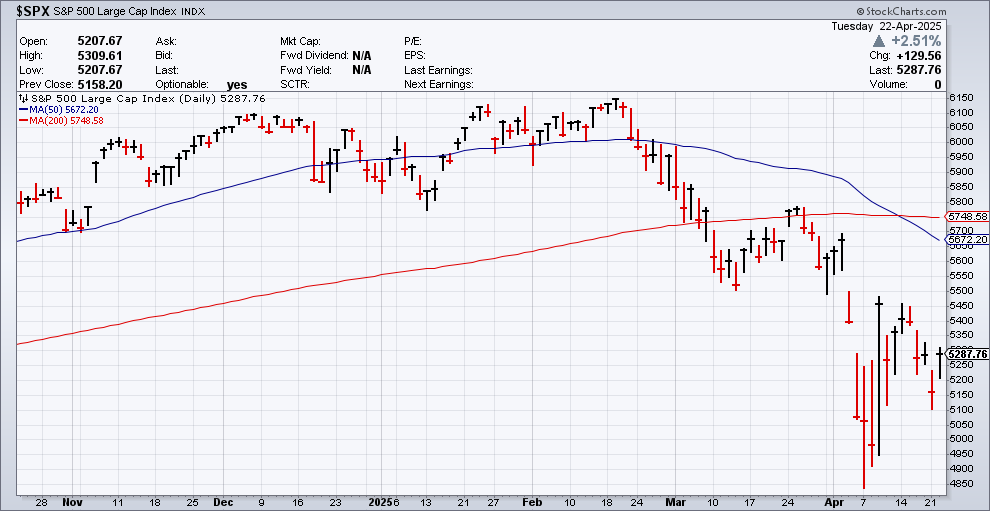

CWS Market Review – April 22, 2025

Eddy Elfenbein, April 22nd, 2025 at 5:24 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Before this week, the battle on Wall Street was over tariffs. Now it’s over tariffs and interest-rate policy. President Trump took to social media to call Federal Reserve Chairman Jerome Powell, “a major loser.”

In the history of White House/Central Bank relations, that’s probably one of the more polite salvos (Google “Andrew Jackson” and the “Bank War” if you want to see what I mean.)

Wall Street was not particularly pleased with the president’s remarks. The U.S. stock market is now off to its worst start for a presidential term since at least 1928. The Dow is on pace for its worst April since the Great Depression.

Somebody call T.S. Eliot!

At one point in yesterday’s trading session, the S&P 500 was off by 3.4%. To put that in context, that day was worse than every single trading day in 2023 and 2024. Yet for this April, it would only be the fourth worst. Fortunately, we were spared somewhat as the market did rally off yesterday’s low.

One interesting side note to yesterday’s sell-off was how broad it was. It’s as if every stock lost around 2.5% plus or minus 1%. Of course, that’s not literally true, but in no sense did we see the massive rotation action that we saw earlier this month. By this, I’m referring to days when growth stocks were through the floor but value stocks shot up. Or the opposite. Yesterday, most everything was down.

Today’s recovery was perhaps even broader than yesterday’s. For example, the S&P 500 Growth ETF was up 2.71% today while the Value ETF was up 2.34%. That’s very narrow, especially for a big day.

The narrowness of this market suggests that the market is most concerned with valuations on a broad level, not with any specific sector or industry. In plain English, yesterday Wall Street thought stock prices were too high. It walked some of that back today.

Another optimistic item came today when Bloomberg reported that Treasury Secretary Scott Bessent believes that the “tariff standoff with China is unsustainable and that he expects the situation to de-escalate.”

“Bessent also said the world’s top two countries essentially have a trade embargo in place, with both slapping tariffs of more than 125% on each other’s goods.”

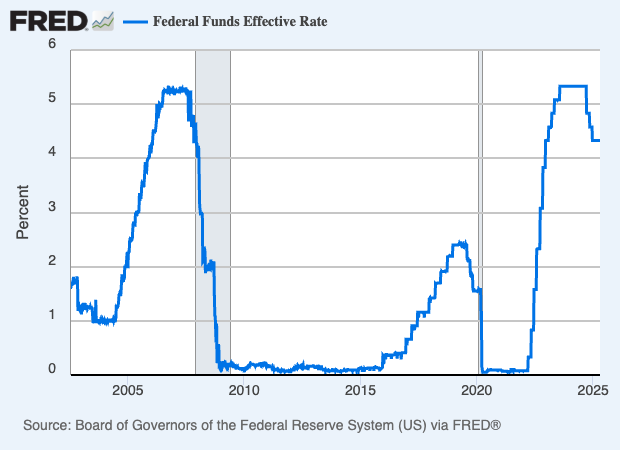

As for the Trump-Fed squabbles, the president may soon get his way. The FOMC meets again in two weeks, and I doubt anything will happen. After that, however, the Fed meets in June and I think there’s a very good chance that the central bank will cut rates by 0.25%.

That may not be enough for the president’s liking, but traders expect three more rate cuts this year after the cut in June. It’s broadly understood that the president can’t fire the Fed chief unless it’s for cause, meaning something like misconduct. The Fed chairman can’t be dismissed because of a policy disagreement. Powell’s term isn’t up until May of next year, and things may be quite different then.

Earnings from Moody’s and Mueller

We had two Buy List earnings reports. I’ll cover these in greater depth in our premium newsletter (which you can sign up for here). I also want to stress how well our Buy List is doing against the broader market. In fact, in relative terms, the last several weeks have been some of our best in the 20-year history of our Buy List.

Let’s start with Mueller Industries (MLI). This is one of those well-run small-to-mid caps that’s not well known on Wall Street. The company has a market value of roughly $8 billion. Since early 1992, the stock is up by 40,000%. You’d think that would attract more interest, but that’s not the case.

I can’t say it’s completely ignored by Wall Street, but Mueller is currently followed by just one Wall Street analyst. Personally, I love finding little-covered stocks.

Here’s a chart of Mueller. The S&P 500 (in red) looks like a flat line in comparison. It’s actually a gain of 1,150%.

Mueller makes and sells copper, brass, and aluminum products. The company operates through three segments: Piping Systems, Industrial Metals, and Climate.

For Q1, Mueller had operating income of $206.3 million. That’s up 12.4% over last year. Net income increased 13.7% to $156.4 million. Quarterly sales increased 17.6% to $1 billion. Mueller’s EPS rose 14.9% to $1.39. The lone analyst had been expecting $1.31 per share.

During the quarter, the price for copper averaged $4.57 per pound. That’s up 18.4% over last year’s Q1.

Mueller said that the increase in sales was attributable to the inclusion of sales from two recently acquired businesses, and also to higher selling prices related to the rise in raw material costs and tariffs. At the end of the quarter, MLI had a cash balance of $830.1 million.

Regarding the quarter performance, Greg Christopher, Mueller’s CEO said, “We delivered very good results in the first quarter despite certain manufacturing disruptions, which have since been resolved, and the general economic landscape. We were particularly pleased with the positive contributions that our Nehring Electrical Works and Elkhart Products acquisitions made to our business, and we look forward to their continued improvement.”

Regarding the outlook, Mr. Christopher continued, “While markets and demand are in line with our year end comments and outlook, the tariff and trade policies have presented new challenges. Although we largely manufacture our products in the countries where they are consumed, we are not immune to the effects of tariffs. Where required, our teams are proactively and diligently taking appropriate price actions and will continue to do so as necessary. As we have consistently demonstrated resilience during past periods of disruption, we are confident in our ability to effectively navigate the current environment.”

Mueller is now going for just under 11 times next year’s earnings. The company pays a quarterly dividend of 25 cents per share, which yields about 1.4%. The stock got a nice 2.7% bounce in today’s trading.

Moody’s (MCO) has been a great stock for us. We added it in 2017, and it’s been a big winner for us. I’m glad to see MCO is outpacing the market this year as well, although that means it’s down by less.

For the quarter, Moody’s revenues increased by 8% to $1.9 billion. Moody’s business is really two businesses. There’s Moody’s Investor Service (MIS) and Moody’s Analytics (MA), which is the jewel in the crown.

Last quarter, revenues at MIS increased by 8% to $1.1 billion. Revenue at MA increased by 8% to $859 million. Earnings increased 14% to $3.83 per share. That’s a healthy beat. Wall Street had been expecting $3.54 per share.

Companywide, Moody’s had an operating margin of 51.7%. For MIS, it was 66% and for MA, it was 30%. Cash flow from operations was $757 million and free cash flow was $672 million.

During Q1, Moody’s bought back 800,000 shares at an average cost of $481.77 per share and issued net 400,000 shares as part of its employee stock-based compensation programs.

This was another very good quarter for Moody’s. The only downbeat is that it lowered its guidance for the coming year. Previously, Moody’s had been expecting full-year earnings to range between $14 and $14.50 per share. Now it sees 2025 earnings ranging between $13.25 and $14 per share. I think that’s a sign of the current environment instead of the health of Moody’s business.

Shares of Moody’s rallied 4% today.

Outside of earnings, we’ll have some important news items towards the end of next week. The ADP payrolls report will be out on Wednesday, April 30. The ISM Manufacturing report will be out the following day. After that, the April jobs report will be due out on Friday, May 2.

Also on Wednesday, we’ll get our first report on Q1 GDP growth. Wall Street is not looking forward to this report. The consensus seems to expect Q1 GDP growth between 0% and 1%. That’s not very good. We’re not in a recession yet, but one may not be too far away. As it turns out, the major loser could be the economy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: April 22, 2025

Eddy Elfenbein, April 22nd, 2025 at 7:04 amYen Extends Gains to Break Psychological Level of 140 Per Dollar

Trump’s Tariff Salvos Risk a $2 Trillion Hit to Global Economy

US Imposes Tariffs Up to 3,521% on Southeast Asia Solar Imports

Markets Are Discovering the Real Trump Trade Is ‘Sell America’

Gulf Issuers Plan More Debt Sales, Undeterred by Recent Market Turmoil

Bitcoin Rallies 20% During Market Turmoil to Diverge From Tech

Gold Hits $3,500 as Trump’s Fed Broadside Sparks Flight to Haven

Trump’s Tariffs Will Pay Off — for China

Exceptionalism, Until the Landslide Brings It Down

Yes, Trump’s Tariffs are Worse Than Expected — But Should You Sell Your Stocks?

Trump, Upping Pressure on Powell, Again Calls for Rate Cuts

US Bonds Have Never Been Risk-Free, and Never Will Be

Angst Builds Inside Federal Agency Over Trump’s Moves Against Law Firms

Harvard Sues Trump Administration as Funding Fight Escalates

How Privatizing Social Security Would Impact Retirees

Nomura’s Biggest Deal Since Lehman Creates $770 Billion Funds Unit

Helvetia, Baloise Reach Deal to Create Switzerland’s Second-Largest Insurer

Trump Shuns Europe, and Its Defense Industry Tries to Capitalize

Big Oil Is Offshoring Its Prized Engineering Jobs to India

The Profound and Compounding Growth Implications of Waymo

UK AI Startup Wayve Makes Japan Debut After Nissan Partnership

Canada’s Prime Minister Pushes Country to Become the Housing Factory of the World

Cocoa Crunch Isn’t Over Yet as Top Growers Struggle With Supply

3M Maintains Outlook as Tariffs Add New Risk to Turnaround

Businesses Plead for Tariff Breaks After Trump Spares iPhones

Dealmakers Are Struggling to Make Sense of Trump’s Antitrust Policy

Three Factories, $355,000 and the Maddening Quest to Make a Clear Can

Smiley Faces Are In. Animals Are Out. The Politics of Starbucks Cup Doodles.

Be sure to follow me on Twitter.

-

Morning News: April 21, 2025

Eddy Elfenbein, April 21st, 2025 at 7:04 amCrime Syndicates in Southeast Asia Go Global, Defying Crackdowns

China-Owned Supertankers Face $5.2 Million in Fees Per US Call

China Warns Nations Not to Cut US Trade Deals at Its Expense

China Is Finding Ways to Replace American Farmers

China Wins Without Fighting While the US Flails

DHL Suspends High-Value Deliveries to U.S. Consumers Amid Tariff Turmoil

Japan Embraces Lab-Made Fuels Despite Costs, Climate Concerns

BOJ Sees Little Need to Change Basic Rate Hike Stance

Central Banks Stare Into Trade-War Abyss With Rate Cuts Primed

Paul Volcker Never Was Precisely Because Monetarism Never Was, Nor Is

Gold Hits Record as Dollar Sags and Trade War Concerns Persist

Bitcoin Rebounds as Trump’s Push Against Powell Weakens Dollar

Say ‘You’re Fired’ and Watch What Happens

Trump’s Push Against Powell Is Latest Reason to Sell US Assets

Fed’s Goolsbee Hopes US Not Moving to Where Monetary Independence is Questioned

Trump Is Everywhere Except in the Economic Data

The Trade Adviser Who Hates Trade

Zuckerberg, Dimon Are Among Top Sellers Ahead of Tariff Stock Rout

The Trump Billionaires Who Run the Economy and the Things They Say

Trump’s Deals with Big Law Are Shakedowns in ‘Pro Bono’ Clothing

Inside a Union’s Fight Against Trump’s Federal Job Cuts

“More and More Cheating”: DOGE’s Cuts to the IRS May Have a Big Price Tag

Tesla Bull Ives Warns of ‘Code Red’ If Musk Sticks With DOGE

Aramco Agrees With China’s BYD to Explore New EV Technology

Airbus Promised a Green Aircraft. That Bet Is Now Unraveling.

A Weak Dollar and Record Gold Price Are More Bad News for Luxury Stocks

Why It’s So Difficult for Robots to Make Your Nike Sneakers

The Trump Tariffs Are Tilting the Scales in the Coke vs. Pepsi Battle

Be sure to follow me on Twitter.

-

Morning News: April 18, 2025

Eddy Elfenbein, April 18th, 2025 at 7:02 amEU’s Costa Says Russian LNG Phase-Out Makes Room for US Supplies

U.S. Gas Exports to China Stopped After Beijing Imposed Tariffs

Trump Moves to Levy Chinese Vessels in Widening Trade War

President Trump Has Botched His Tariff War With China

China Set to Leave Lending Rates Steady, but Tariffs Raise Easing Bets

European Central Bank Cuts Rates Amid ‘Exceptional’ Tariff Uncertainty

Trump Lashes Out at Fed Chair for Not Cutting Rates

Fed’s Powell is an Exemplary Central Banker, ECB’s Villeroy Says

Fed Proposes Averaging Large Bank Stress Test Results to Reduce Volatility

It’s Gotten Riskier to Be a Long-Term Investor

With Harvard Threat, Trump Tries to Bend the I.R.S. to His Will

Scott Bessent’s Tightrope Walk

Can Trump Really End Birthright Citizenship?

White House Eyes Overhaul of Federal Housing Aid to the Poor

Trump Administration Aims to Sell Housing Department Headquarters

U.S. House Committee Urges Two U.S. Banks to Withdraw From CATL’s Listing

The Dollar’s Monopoly in Payments Will Soon Be History

A Weak Market for ‘Unicorns’ Muscularly Supports Meta Over the FTC

Google Broke the Law to Keep Its Advertising Monopoly, a Judge Rules

Google’s Money-Printing Machine Can Be Easily Dismantled

Now Streaming on Netflix: A Show Where Profits Trump the Trade War

Trump Would Put America First With Nippon Steel/U.S. Steel

Meat Is Back, on Plates and in Politics

Ivory Coast Seizes 594 Tons of Smuggled Cocoa Beans

Gatorade Enlists Kendrick Lamar to Help Keep Its Sports Drink Lead

Is This the End of Impulse Shopping?

Value Retailers Have Been Waiting for the Higher-Income Consumer. They’ve Arrived.

Be sure to follow me on Twitter.

-

Morning News: April 17, 2025

Eddy Elfenbein, April 17th, 2025 at 7:03 amChina’s Economic Protests Spiked to Record Ahead of Tariff Shock

Can China Fight Deflation and Trump’s Tariffs at the Same Time?

Tariff Pauses and Exemptions Prove the Need to Rethink

Pre-Tariff Shopping Spree Comes to US GDP’s Rescue

Fed Chair Lays Out Game Plan in Case of High Inflation and Slower Growth

Powell Faces Pressure From the Markets and Trump Over Rates

Trump Berates Fed’s Powell, Urges ‘Termination’ for Slowness

Blackstone Urges Swift End to Tariff Turmoil as Deal Exits Slow

Economic Uncertainty Has Never Felt This Uncertain

Is This the Brink of the Recession We Had to Have?

Congress Is Prioritizing a Tax Break That Few Americans Will Claim

Harvard Says IRS Revoking Tax-Exempt Status Would Be ‘Unlawful’

Harvard Proves the Only Choice Is to Fight

This CEO Wants You to Know He Didn’t Steal Money While Cooking the Books

Truist Q1 Profit Falls on Weakness in Investment Banking and Trading Business

Global Payments to Acquire Worldpay for $24.25 Billion

Travelers Profit Beats as Underwriting Gains Cushion $2 Billion Wildfire Hit

U.S. Tries to Crush China’s AI Ambitions With Chips Crackdown

Nvidia C.E.O. Meets With Chinese Trade Officials in Beijing

The Trial Mark Zuckerberg Couldn’t Prevent

Infosys Forecasts Slowing Sales Growth on Sluggish IT Spending

D.R. Horton 2Q Results Weaken on Muted Spring Selling Season

Tariffs Risk Higher Costs at New US Nuclear Plant, Says Builder

Trade War Puts Canada’s Energy Security on the Ballot

Trade Tensions With China Clear Path for Salt-Powered Batteries

UnitedHealth Plunges After Cutting Outlook on Care Costs

Lilly Soars After Weight-Loss Pill Results Rival Ozempic’s

Tariffs Make Sour Grapes for American Winemakers

Chinese Tea Chain CEO Becomes a Billionaire at 30 After US IPO

Hermes to Raise Prices in the U.S. to Mitigate Tariff Hit

Be sure to follow me on Twitter.

-

Morning News: April 16, 2025

Eddy Elfenbein, April 16th, 2025 at 7:06 amThe US Has Greenland (and Foreign Policy) Exactly Upside Down

Both Admired and Resented by Trump, Japan Scrambles to Stay Close

Asia’s Promises to Buy More US Gas May Prove Empty

In US-China Trade Battle, Europe Is Seen With Decisive Role

Even Without Add-Ons, Trump’s 10% Tariffs Will Have a Sting

Trump’s Confused Thinking About the Dollar

How Mar-a-Lago Memberships Explain Trump’s Tariff Obsession

Stocks Tumble as Tech Investors Pull Back

Global Tech Stocks Drop as ASML Warning Adds to Nvidia Curbs

Now Is the Time to Ask: How Much Market Risk Can You Take?

The Financial Crisis of 2025? Better to Be Ready

How Supreme Court Ruling Could Weaken Fed Independence, Shake Markets

Harvard’s $9 Billion Battle With Trump Is Bad News for Massachusetts’ Economy

U.S. Bancorp Profit Climbs with Higher Fees, Lower Costs

PwC Shuts Operations in Nine African Countries

The Chipmakers Caught in the Trade War Crossfire

Taiwan’s Chip Companies Are Caught in the U.S.-China Tariff War

Zuckerberg’s Unrelenting Paranoia Emerges in FTC Trial

AI Needs Your Data. That’s Where Social Media Comes In.

A MAGA-Backed AI Health-Care Unicorn Attracts an Unlikely Coalition

Tariff Confusion Leaves Advertisers ‘Paralyzed’ and ‘Somber’

Abbott to Expand US Manufacturing as Tariffs Loom

United Airlines Tops Expectations Despite Travel Demand Worries

How Costco’s Co-Founder Built the $400 Billion Retailer Behind Kirkland

Heineken Tops Revenue View, Reaffirms Outlook Amid Tariff Concerns

LVMH Loses Crown as World’s Most Valuable Luxury Company to Hermes

The Succession Drama Inside Singapore’s Richest Family

Be sure to follow me on Twitter.

-

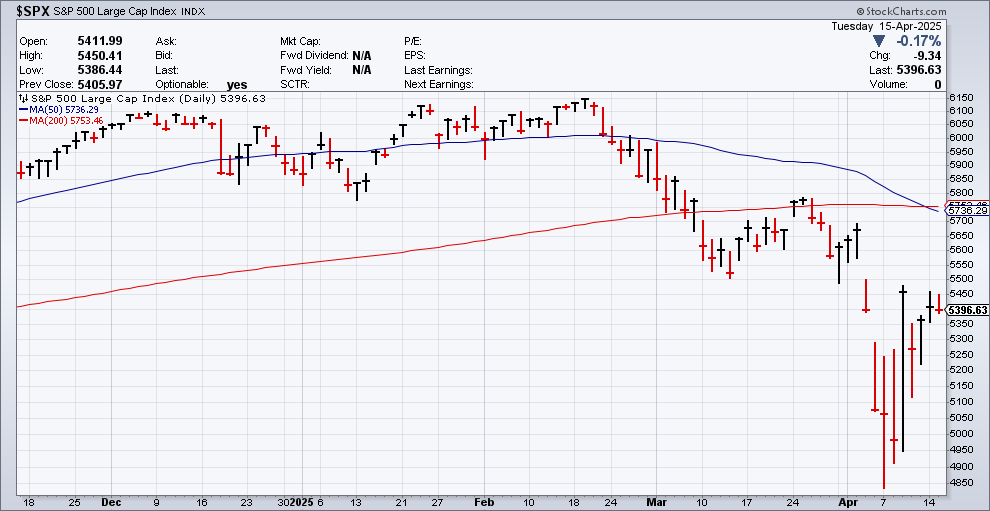

CWS Market Review – April 15, 2025

Eddy Elfenbein, April 15th, 2025 at 6:11 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The stock market has seriously chilled out over the last few days. In fact, we’re not that far (-2.3%) from where the market was on March 13, after the S&P 500’s first leg downward.

If some Rumpelstiltskin investor had fallen asleep one month ago and had awoken today, they’d probably conclude that this has been an uneventful four weeks.

We aren’t seeing the big 3%, 5% or even 10% days that we saw not too long ago. For the last two days, the S&P 500 has closed up or down by less than 1%, and today’s change (-0.17%) is the smallest daily move in three weeks.

I like to track the VIX (^VIX) which is the volatility index. Some investors like to call it the “Fear Index,” which is an apt name. Last week, the VIX jumped from 30 to 60. That’s a huge increase, but earlier today, the VIX fell back to 28.

Are we in the clear? Not a chance. Or rather, even if we are, it’s safest to act as if we’re not. The problem for investors is that the market is still beholden to tariff politics. That means that any intemperate threat coming from the White House can upend the market. Morgan Stanley said to expect to be fooled “many more times” regarding tariffs. I think that’s right.

The simple fact is that the S&P 500 is still below its 200-day moving average. Historically, that’s been a trouble area for the market. The index needs to rally more than 6% from here to be above its 200-DMA.

The good news is that we now have other events to share the headlines with the tariff news. The most prominent is that Q1 earnings season is underway and that’s taken some of the spotlight off of tariff politics.

Remember When the Market Doubled in 18 Months?

One of the rules of thumb on Wall Street is that dramatic markets tend to be symmetrical. That’s a fancy way of saying that sharp drops are often followed by sharp recoveries, and long, drawn-out bears are followed by long, drawn-out bulls.

A good example of this came during the Covid bear in 2020. The stock market peaked on February 19. Interestingly, it peaked on the same day this year.

This was one of the fastest drops in Wall Street history. Thirty-three days later, the S&P 500 had shed 33%. But the bulls came roaring back (thanks to a lot of help from Uncle Sam).

By June 8, the market had soared 44% off its low, and by August, the S&P 500 closed at a new record high. It took less than six months to erase one of the most brutal bear markets on record. In fact, it didn’t stop there. It took 18 months for the S&P 500 to double from its low.

Of course, this behavior is only a rule of thumb. We know well that the market gods love to play with our emotions. What I’ve noticed is that when the market is at its low, no one thinks it is. Instead, everyone’s waiting for the next downward move which never comes. As Peter Lynch said, “I’m always fully invested. It’s a great feeling to be caught with your pants up.”

An Early Look at Q1 Earnings

Let’s take an early look at how the Q1 earnings season is playing out. So far, 72.4% of the companies that have reported have beaten their earnings estimates, 69% have topped their revenue estimates. A total of 55.2% have beaten on both.

The S&P 500 is currently tracking at 6.76% earnings growth for Q1. That’s down from 7.03% from one month ago. The good news is that banks are doing a little better than we expected. Expected earnings for financials have been bumped up to 2.30% from 0.87% last month. The weak spot is energy. Last month, earnings for energy sector entities were expected to be down by 16.55%. Now it’s looking like energy’s earnings will be down by 18.87%.

I also noticed that in the earnings calls, several CEOs had bleak outlooks on the economy. A recent poll of more than 300 CEOS found that 62% see a recession coming within the next six months. That’s up from 48% in March.

It’s no secret what CEOs are concerned with. Three-fourths of them said the tariffs will hurt their businesses this year.

Larry Finke, the head honcho over at BlackRock (BLK) said that we’re very close to a recession, “if not in a recession now.” Fink said, “I think you’re going to see, across the board, just a slowdown until there’s more certainty.”

BlackRock is one of the behemoths of Wall Street. The firm currently has $11.58 trillion in assets under management. On Friday, BlackRock said it made $11.30 per share for Q1. That beat Wall Street’s consensus of $10.14 per share. The problem was revenue. BlackRock had $5.28 billion in revenue which was $60 million short of Wall Street’s consensus.

Goldman Sachs (GS) reported a very good quarter. For Q1, the big bank made $14.12 per share compared with estimates of $12.35 per share. That’s an increase of 15% over last year. Revenue rose 6% to $15.06 billion. That topped estimates by $250 million.

Bank of America (BAC) also posted good results. For Q1, BAC made 90 cents per share. That was eight cents more than estimates. Revenue was $27.51 billion. Expectations were for $26.99 billion. Bank of America said its net interest income was helped by lower deposit costs and higher-yielding investments.

JPMorgan Chase (JPM) reported Q1 earnings of $4.91 per share on revenue of $46.01 billion. Wall Street had been expecting $4.61 per share on revenues of $44.11 billion.

The big winner was equities trading. JPM’s revenue there jumped 48% to $3.8 billion. That beat expectations by $560 million.

CEO Jamie Dimon was optimistic for his bank, but like the other CEOs, he was far more cautious on the overall economy. Dimon said, “The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and ‘trade wars,’ ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility.”

Morgan Stanley (MS) said that its Q1 earnings rose 26% to $2.60 per share for Q1. That beat the Street by 40 cents per share. Equity trading soared 45% to $4.13 billion. That was $840 million more than expected.

Earlier today, Johnson & Johnson (JNJ) said it made $2.77 per share for Q1. That was 17 cents more than estimates. JNJ’s sales rose 2.4% to $21.89 billion. That beat estimates of $21.58 billion.

The company increased its guidance. JNJ now sees 2025 sales ranging between $91 billion and $91.8 billion. The company sees earnings coming in between $10.50 and $10.70 per share.

JNJ also hiked its quarterly dividend from $1.24 to $1.30 per share. The new dividend is payable on June 10, with a record date of May 27. This is the 63rd year in a row that JNJ has increased its dividend. That’s one of the longest such streaks on Wall Street.

There are few things to look out for this week. Tomorrow morning, Abbott Labs (ABT) will report its Q1 earnings. This will be our first Buy List stock to report. The stock is up close to 12% this year.

For this year, Abbott sees its earnings ranging between $5.05 and $5.25 per share. For Q1, Abbott sees earnings between $1.05 and $1.09 per share. Wall Street has split the difference and expects $1.07 per share.

Tomorrow we’ll also get reports on retail sales and industrial production, and Federal Reserve Chairman Jay Powell will be speaking at the Economic Club of Chicago.

The Fed doesn’t meet again for another three weeks, and it’s doubtful they’ll make a move at their May meeting. It will be interesting to hear what Powell has to say, especially about tariffs.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: April 15, 2025

Eddy Elfenbein, April 15th, 2025 at 7:03 amOil Goes From Bad to Worse in First Takes on 2026

Trump Throws Another Hail Mary

Trump’s Give-and-Take Tariff Strategy

Trump’s Dilemma: A Trade War That Threatens Every Other Negotiation With China

China’s Port Cargos Start to Slow as Tariff Tensions Escalate

China’s Halt of Critical Minerals Poses Risk for U.S. Military Programs

China Orders Boeing Jet Delivery Halt as Trade War Expands

China’s Murky Bankruptcies Expose Hazards for Foreign Investors

Trump’s Trade War With China Could Be Good for India. But Is It Ready?

Japan Economy Minister Urges ‘Win-Win’ Solutions Ahead of U.S. Trade Talks

German Economic Sentiment Collapses on Trump’s Tariff Chaos

Will Policy Chaos Trigger a Flight From the Dollar?

The Dollar Keeps Falling as Its ‘Safe Haven’ Status Is Questioned

Bitcoin’s Response to Tariffs Says a Lot About the Dollar

Bank of America Profit Boosted by Trading Gains, Interest Income

Bessent Says ‘Everything’s On the Table’ for Taxes on Wealthiest

Harvard’s Vow to Resist Trump Sets Up $9 Billion Funding Fight

Inside Trump’s Plan to Halt Hundreds of Regulations

Apartment Developers Who Overbuilt Luck Out With Tariffs

US Travel Industry Braces for Impact of Foreign-Visitor Slide

The Next TikTok Shutdown Is Likely to Be Longer

Japan’s NTT Has Become an Under-the-Radar AI Powerhouse

AI to Prop Up Fossil Fuels and Slow Emissions Decline, BNEF Says

Ericsson Posts Rise in North American Network Spending Ahead of Tariffs

GM’s Mary Barra Has to Make a $35 Billion EV Bet Work in Trump’s America

American Airlines to Provide Free Wi-Fi, Joining Race to Court Connected Travelers

J&J Increases Outlook After Beating 1Q Expectations

Albertsons’ Profit Outlook Trails Estimates, Stock Declines

Publicis Confirms Outlook After Organic Growth Beats Expectations

Be sure to follow me on Twitter.

-

Morning News: April 14, 2025

Eddy Elfenbein, April 14th, 2025 at 7:01 amEU Top Diplomat Hails Progress in Finding Ammunition for Ukraine

The Former C.I.A. Officer Capitalizing on Europe’s Military Spending Boom

China’s Trade War Leverage Over US Becomes Clearer

A Devastating Trade Spat With China Shows Few Signs of Abating

China Halts Critical Exports as Trade War Intensifies

At China’s Wholesale Hub, U.S. Orders Have Suddenly Halted. One Example: Socks.

Why Wouldn’t China Weaponize Its $760 Billion Treasury Holdings?

Italian Tycoon Eclipses BlackRock in Li Ka-shing’s Port Deal

Trump’s Tariffs Leave No Safe Harbor for American Importers

Trump Has Added Risk to the Surest Bet in Global Finance

Weak Dollar Wishes Are Scary When Granted

Stock Market’s Extreme Moves Portend Lasting Trouble for Traders

Volcker’s Lessons for Restoring Dented US Credibility

The Treasury Secretary Is Wrong About How Most Retirees See the Stock Market

Tether Emerges as Major Crypto Lender Since Collapse of Sector

Goldman’s Stock Traders Ride Volatile Markets to Record Quarter

Citigroup Turns Cold on US Equities, Joining Wall Street Peers

Brookfield Has Billions Riding on a Private Equity Revival in the Middle East

Most CEOs Were Doubting Their Boards Even Before Trump’s Tariff Turmoil, Survey Finds

Elon Musk and the Dangerous Myth of Omnigenius

Cuban Exiles Are Losing Their Privileged Migration Status Under Trump

This Company’s Surveillance Tech Makes Immigrants ‘Easy Pickings’ for Trump

Trump Warns Tariffs Coming for Electronics After Reprieve

Tim Cook’s ‘Long Arc of Time’ Prepared Apple for the Trade War

Intel Close to Unveiling Deal to Sell Altera to Silver Lake

Trump Wants to Reverse Coal’s Long Decline. It Won’t be Easy.

The New Technologies Buoying Efforts to Cut Ship Emissions

RFK Jr. Needs to Explain Himself

Pfizer Abandons Obesity Pill After Liver Injury in Setback

DaVita Says Ransomware Attack Affecting Some Operations

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His