CWS Market Review – April 8, 2025

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

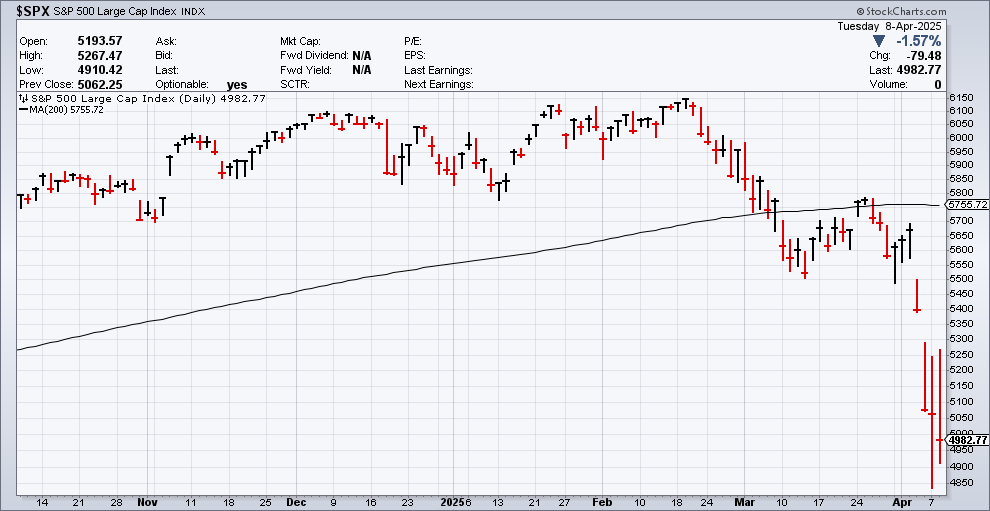

This has been the most raucous week on Wall Street since the Covid panic from five years ago. President Trump’s tariff policies have spooked investors all over the world. In two days last week, Thursday and Friday, the S&P 500 lost a combined 10.5%. If that loss had happened in one day instead of two, it would rank as the fourth worst loss of all time.

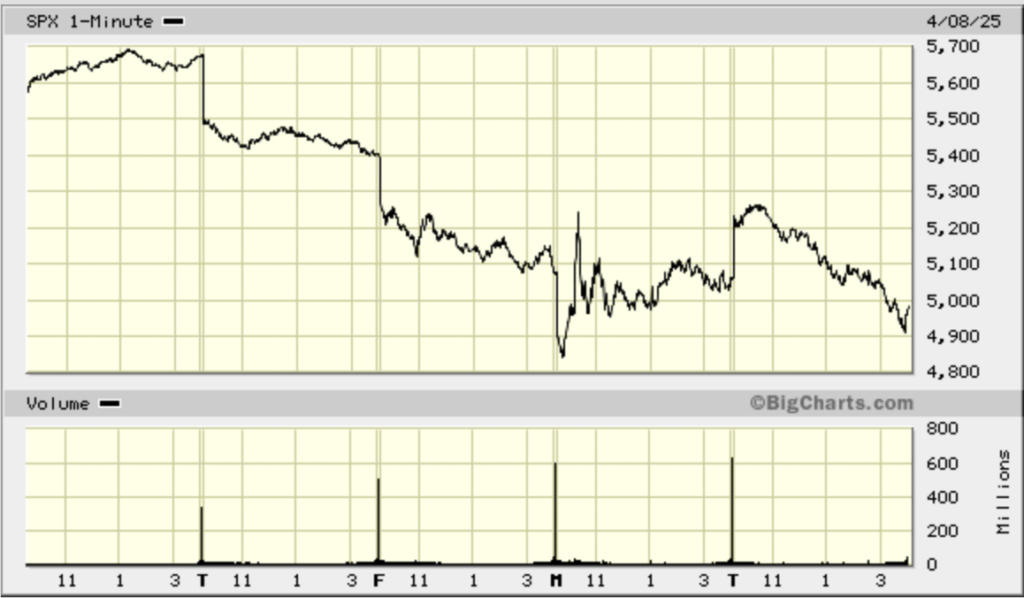

On Monday, the stock market had an especially volatile morning. In just eight minutes, the S&P 500 rallied 5.66%. It then promptly lost 4.37% over the next seven minutes. We’re talking about several trillion dollars magically appearing and disappearing during less time than a lunchbreak.

What happened? Well, that’s a good question. It appears that Kevin Hassett, the Director of the National Economic Council, was being interview on Fox News. During the interview he was asked if the president was considering a 90-day pause for his tariff policies. Hassett clearly gave a non-committal answer (“the president is going to decide what the president is going to decide.”)

Somehow someone on Twitter took that for a yes and tweeted it out. That was from a small account (less than 1,000 followers), but soon a much larger account known as “Walter Bloomberg” reposted it, and suddenly, this was taken as serious news on Wall Street.

I should add that Walter Bloomberg is not connected with Bloomberg, the financial news service. His tweet came out at 10:11 am and by 10:12 am, CNN reported that cheers erupted on the floor of the NYSE. I guess that’s a good barometer of how unpopular the tariffs are on Wall Street.

At CNBC, the anchors were completely baffled by the market’s surge and by 10:15 am, they were reporting on the news. Soon Reuters was referencing CNBC but they were only going on what Twitter was saying. Soon people were referencing people who were referencing people who were just making things up.

Here’s a minute-by-minute chart of the last five days for the S&P 500. You can really see how volatile Monday was:

The White House denied the reports and Walter Bloomberg deleted his tweet, but the damage was already done. This is a good reminder than Wall Street is a place where rumors and fake news can lead to very real panics. Financial markets are made up of normal people and they can be as volatile as anybody, if not more so, especially in the short run. It took some time yesterday for traders to realize they had been duped.

Between yesterday’s high and low, the Dow swung by nearly 2,600 points. Trading volume on Monday reached 29 billion shares which is an all-time record. The previous record was 26.4 billion shares which came on Friday.

Before the ruckus started, Wall Street was having a terrible day on Monday. At one point, shortly after yesterday’s open, the S&P 500 was trading down more than 4.7%. The market was on pace for its third awful day in a row. Measuring from the intra-day peak in February to Monday’s low, the S&P 500 lost 21.35%, making this an official bear market.

By no means will I suggest that the fear has subsided. Any big rally that starts below the 200-day moving average is considered guilty until it can prove its innocence.

This morning’s rally didn’t last either. The S&P 500 rallied by 4% then fell by 6%. Today was the fourth day in a row that the S&P 500 had a trading range of more than 5%. The S&P 500 finished the day at its lowest closing level since February 21, 2024.

Investors are still very concerned about the tariffs, and the White House is showing little signs of reversing course. The duty against China will be 104%. The tariffs are due to kick in at midnight tonight. These will be our highest tariffs since 1909; yes, even higher than Smoot-Hawley.

Every nation in the world will have a minimum 10% tariff plus half of their trade deficit. Saint Pierre and Miquelon, the two small French islands off the coast of Canada, now face 50% tariffs even though they exported a grand total of $3.4 million to us in 2023.

Treasury Secretary Scott Bessent said that 70 countries have approached the U.S. for tariff negotiations. There are hopes that a deal—any deal—can soon be reached, but there’s no concrete evidence that any deal is coming soon.

Name-calling has even broken out between Peter Navarro, a senior counselor to the president, and Elon Musk, the head of DOGE. Navarro said that Musk doesn’t make cars, he assembles them. In response, Musk called Navarro a “moron,” and “dumber than a sack of bricks.”

One of the points I’ve made about investing is that for the vast majority of the time, the stock market is pretty boring. Markets tend to go up slowly but consistently. Then, for a very brief period, markets throw a temper tantrum. In a very short time, stocks fall fast and hard.

We’re in such a period right now. In fact, we could be behind it already, but we can’t say for certain until after the fact. My guess is that we’re not done quite done yet. Today’s rally is nice, but I won’t fully trust this market until we’re well clear of the 200-day moving average.

The Jobs Market Is Still Healthy

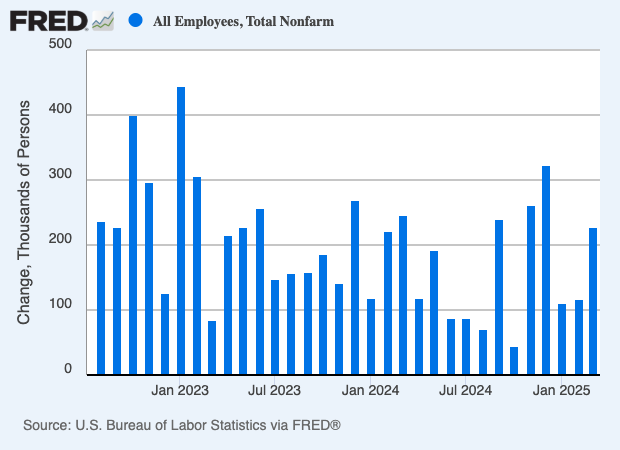

Lately on Wall Street, there’s been a lot of talk about “hard” versus “soft” economic reports. By soft, we mean emotion-based reports like consumer confidence, economic surveys or even the stock market. By hard, we mean concrete data like jobs or industrial production. The soft reports have been quite weak, but the hard data is still holding firm.

I suspect that we’ll soon see some weakness in the hard reports. For example, I’ve always been a believer that the stock market plays a role in consumer spending. Happy stocks make for happy shoppers. When the Dow drops a few thousand points, folks get leery about buying big-ticket items.

On Friday, the Bureau of Labor Statistics released the March jobs report, a very hard data report, and it was mostly a good report. Bear in mind that this was before the stock market started to get nervous.

Last month, the U.S. economy added 228,000 net new jobs. Wall Street had been expecting a gain of 140,000. The unemployment rate ticked higher from 4.1% to 4.2%. I looked at the decimals and found that the real increase was only 0.013%.

The president posted on Truth Social, “GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED. IT’S ALREADY WORKING. HANG TOUGH, WE CAN’T LOSE!!!”

The jobs gain for January was revised down 14,000 to 111,000. February was revised lower by 34,000 to 117,000. Average hourly earnings increased 0.3% last month. That was in line with the consensus.

For March, health care was the leading growth area, consistent with prior months. The industry added 54,000 jobs, almost exactly in line with its 12-month average. Other growth areas included social assistance and retail, which both added 24,000, while transportation and warehousing showed a 23,000 increase.

Federal government positions declined by just 4,000, despite the Elon Musk-led efforts, through the so-called Department of Government Efficiency, to pare the federal workforce. However, the BLS noted that workers on severance or paid leave are counted as employed. A report Thursday from consultancy firm Challenger, Gray & Christmas indicated that DOGE-related layoffs have totaled more than 275,000 so far.

The U-6 rate, which is a broader reading of unemployment, fell to 7.9%. Last month, full-time workers increased by 459,000, while part-timers fell by 44,000.

Tomorrow, the Fed will release the minutes from its most recent meeting. I’ll be curious to see how much they discussed the tariffs. On Thursday, we’ll get the CPI report for March. The last report showed that core inflation fell to a four-year low. Traders are closely divided on the need for two 0.25% Fed rate cuts coming by June. Or possibly, they see one 0.5% rate cut.

Get ready because Friday will also be the unofficial kickoff of Q1 earnings season. Several big banks and financial institutions such as JPMorgan, Bank of New York Mellon, Morgan Stanley, Wells Fargo and BlackRock are due to report. Expect the market to remain volatile.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on April 8th, 2025 at 6:32 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His