Author Archive

-

Morning News: April 16, 2012

Eddy Elfenbein, April 16th, 2012 at 5:38 amEuro Area Seeks Bigger IMF War Chest on Spanish Concerns

Spain Feels The Pain As Bonds Tank, CDS Widens

GDF Suez, U.K. Utility Agree on Price

China Stocks Czar Faces Battle to Win Back Investor Trust

Japan 10-Year Yield Falls to 17-Month Low on Haven Demand

South Korea Trims Growth Forecast on Europe Woes

Indian Cash Rate Inches Higher; Rate Action Eyed

Goldman Sachs Said to Raise $2.5 Billion in ICBC Sale

U.S. Treasury Says China Yuan Move Helpful

Solid Results at 2 Banks Bode Well for the Industry

Unanswered Questions in F.C.C.’s Google Case

Buyout Firm Carlyle Seeks $763 Million in IPO

Infosys May Spend Up to $500 Million on European Deal

Piramal Sees $1.5 Billion Revenue From Potential Alzheimer’s Drug

Jeff Miller: Weighing the Week Ahead: Will Q1 Earnings Disappoint?

Ask James: Bubbles, Change the World, Nudity, Sports Betting, Twitter Followers, And…My House

Be sure to follow me on Twitter.

-

“Nearer My God To Thee”

Eddy Elfenbein, April 13th, 2012 at 5:42 pm -

JPMorgan Earns $1.31 Per Share

Eddy Elfenbein, April 13th, 2012 at 2:18 pmThis morning, JPMorgan Chase ($JPM) reported first-quarter earnings of $1.31 per share which was 13 cents more than Wall Street’s estimate (though I saw different reports of what the consensus was). The bank’s net income fell slightly but thanks to stock buybacks, the per-share figure was slightly higher than a year ago.

The stock was up during the pre-market but the shares gradually lost ground and are now down about 2.2% for the day. My take is that the market isn’t pleased with JPM’s investment banking business. Nelson D. Schwartz at Deal Book writes:

Mortgage-related liabilities continued to be a drain on earnings, with the bank adding $2.5 billion in reserves to cover litigation expenses, reducing earnings by 39 cents a share.

Despite the run-up in the stock market, trading volumes in the first quarter haven’t been especially robust. At JPMorgan’s investment bank, revenue was down 11 percent, to $7.3 billion. Its net income was down 29 percent, to $1.7 billion.

The bank also faces tough comparisons with a strong first quarter in 2011, when healthy trading revenue and reserve releases lifted results.

The amount set aside for compensation at the investment bank fell to $2.9 billion, from $3.29 billion in 2011. Headcount dropped to 25,707 from 26,494. Based on those figures, average compensation declined to $112,800, from $124,300 a year ago.

First-quarter results included several one-time items, including a $1.8 billion gain from reduced loan loss reserves, which added 28 cents a share to earnings. It also included a $1.1 billion gain from a bankruptcy settlement linked to the acquisition of Washington Mutual, which raised profit by 17 cents.

Here’s the CFO talking about the earnings on CNBC:

On the earnings calls, Jamie Dimon said that the bank is “very conservative” with its investments. I’ve looked at the numbers and this was a very good quarter for JPM. Delinquencies are down and the credit card and mortgage business is doing well.

-

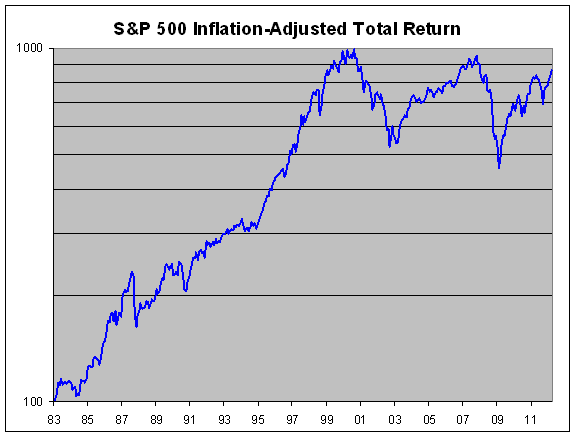

The S&P 500 Adjusted for Dividends and Inflation

Eddy Elfenbein, April 13th, 2012 at 9:32 amSince the March CPI report came out this morning, I decided to take a look at the market’s long-term return.

This is the S&P 500 adjusted for dividends and inflation. I set the index to 100 in January 1983. The chart is logarithmic. In real terms, the stock market is exactly where it was 13 years ago.

-

CWS Market Review – April 13, 2012

Eddy Elfenbein, April 13th, 2012 at 8:20 amThat money talks, I’ll not deny, I heard it once: It said, ‘Goodbye’.

-Richard ArmourAfter sliding for five days in a row, the stock market has started to right itself. On the first trading day of April, the S&P 500 closed at a 46-month high but promptly broke up like a North Korean rocket and shed 4.26% in a week. That’s not a major pullback, but it’s one of the biggest slumps we’ve seen in months. Thanks to rallies on Wednesday and Thursday, the market has already made back half of what it lost (in fact, the traceback has been almost exactly 50%).

What’s most surprising about the market so far in April is the recrudescence of volatility on extremely low volume. Consider this: In the first 64 trading days of 2012, the S&P 500 suffered just one daily drop of more than 1%. In 2011, that happened 48 times. Then suddenly, we had three 1% drops in four days. Yet average daily trading volume last month was the lowest since December 2007. What gives?

In this issue of CWS Market Review I want to look at why the market has gotten so jittery all of a sudden. But more importantly, I want to take a look at the first-quarter earnings season. Over the next month, 16 of our Buy List companies are due to report earnings. As always, earnings season is the equivalent of Judgment Day for Wall Street. I’m expecting good news for our stocks, but the outlook may not be so sunny for the rest of Wall Street.

Sorry, Folks. QE3 Is Not Coming

Part of the reason why the stock market got a sudden case of the worries is what I mentioned in the previous two editions of CWS Market Review. Wall Street has been focused on the March jobs report and first-quarter earnings season. The jobs report wasn’t so hot and the market took its pound of flesh. Earnings season is the next hurdle.

Interestingly, the stocks that dropped the most during the five-day selloff were often the ones that rallied the most on Wednesday and Thursday. These tended to be cyclical stocks and financials. It’s also interesting to note that the Morgan Stanley Cyclical Index (^CYC) had peaked on March 19th, two weeks before the rest of the market. This means, the cyclicals had already started to erode before the jobs report pullback.

The stock market was given a boost on Thursday when two Fed officials, Janet Yellen and William Dudley, said that rates will have to stay low for a while longer. That‘s not a big surprise. Let me add a quick note on QE3. Some folks think the weak jobs report will cause Bernanke and his buddies at the Fed to jump in with a third round quantitative easing. Do not believe any of this. We often forget that the C in FOMC stands for “committee” and it’s obvious that the policy-makers are very far from a consensus on this issue. The media has been searching for any hint, no matter how trivial, that QE3 is on the way. It’s not. Plus, the jobs report was hardly a harbinger of a new recession. For now, the talk of QE3 is pure nonsense.

Although the selloff was initially triggered by the jobs report, it was kept alive by bad news from Europe and China. The yield spreads in Europe (specifically, between any country and Germany) have been inching upward, particularly in Spain. I think it’s somewhat amusing that Monsieur Sarkozy is using the example of Spain to scare French voters from supporting the socialist opposition in next month’s election.

The wider spreads signal some nervousness from investors but it’s important to note that we’re a long way from the frenzy we had last year. I want to urge investors not to be carried away by these renewed concerns from Europe. The fears of Spain not being able to pay her bills are greatly overblown. Europe will not sink the U.S. stock market.

Q1 Earnings: The Story Is About Margins

Last earnings season was disappointing. This time around, investors don’t expect much. The numbers vary but the consensus is that first-quarter earnings will be about the same as they were last year. In other words, zero profit growth. How times have changed. Not that long ago, analysts were expecting double-digit earnings growth for Q1.

One of the problems facing many companies is that higher fuel costs are cutting into profits. All 10 sectors of the S&P 500 will see higher sales numbers, but at least seven of those sectors will have a hard time turning those top-line dollars into bottom-line profits.

The story here isn’t that a slowdown is upon us. Rather, it’s that business costs are rising after being held back for so long. Part of this is the cost for new employees, which is a good thing. As I’ve said before, the story here is about margins, not a weakening economy. Even with as much as earnings growth estimates have fallen, the stock market hasn’t responded in kind. That’s because Wall Street correctly sees this as a temporary issue. In fact, the current view is that earnings growth will reaccelerate later this year as Europe comes back online.

The important point for us is that even with little earnings growth, the stock market is still a very good value compared with the competition. Bond yields have climbed, but they’re still way too low. As long as the migration away from super-safe assets continues, our Buy List will thrive.

Now I want to focus on some upcoming earnings reports for our Buy List stocks (you can see an earnings calendar here). Unfortunately, not all of our companies have said when earnings will come out yet.

Expect an Earnings Beat at JPMorgan

On Friday, JPMorgan Chase ($JPM) will be our first Buy List stock to report earnings. With a 34.86% year-to-date gain, the bank is our top-performing stock this year. That’s not bad for a little over three months’ work. (It’s always a surprise to me who the #1 stock will be.) What’s remarkable is that even with as well as the stock has done, the shares are still going for less than 10 times this year’s earnings estimate.

Wall Street currently expects JPM to report earnings of $1.14 per share for Q1. That’s down a little from one year ago. That estimate, however, has been climbing in recent weeks while estimates for many other companies have been pared back. I’ve looked at the numbers and I expect a small earnings beat from JPM. But I’ll be curious to hear what CEO Jamie Dimon has to say about the bank’s business.

Not only is JPM a big report for us, but it’s also a bellwether for the entire financial sector. Jamie Dimon likes to see himself as the unofficial spokesman for the banking world and a lot of investors want to hear what he has to say. JPM even moved up their earnings call so Jamie could hit the stage before Wells Fargo ($WFC).

I agree with Dimon’s assessment that the last earnings report was “modestly disappointing.” One of the concerns this time around is investment banking, but Jamie has been clear that the division will rebound. For Q1, trading profits will probably be down from a year ago but better than Q4. This is a solid bank and I was particularly impressed by the 20% dividend increase. Bottom line: I’m sticking with Jamie, and I’m raising my buy price on JPMorgan Chase from $45 to $50 per share.

Johnson & Johnson: 50 Straight Years of Dividend Increases

Next Tuesday, we’ll get two more earnings reports—Johnson & Johnson ($JNJ) and Stryker ($SYK). I’m afraid that J&J has been a weak performer this year. In January, the healthcare giant said that earnings-per-share for 2012 will range between $5.05 and $5.15. Wall Street had been expecting $5.21.

J&J has been dogged by a series of quality control problems, and the stock has lagged. Later this month, Alex Gorsky will take over as the new CEO. I think that’s a good choice particularly since he helped the company tackle its internal problems. Wall Street’s consensus for Q1 is for $1.35 per share which is exactly what Johnson & Johnson made one year ago. The stock usually beats by about three cents per share, but I’m not going to get worked up by a result that’s within a few pennies of $1.35. What I want to see is solid proof of a turnaround, although I realize it may take some time.

The best part about J&J is the rich dividend. Going by Thursday’s close, the stock yields 3.55%. But the yield to investors is probably even higher. Later this month, I expect the company to announce its 50th-straight dividend increase. But coming after January’s lower guidance, the quarterly dividend will probably rise from 57 cents to 60 cents per share. If that’s right, J&J now yields 3.74%. I’m keeping my buy price at $70.

Stryker Is a Good Buy Up to $60

Shares of Stryker ($SYK) haven’t done much for the past several weeks which is puzzling because the business has been strong. Stryker has said that it sees “double digit” earnings growth for 2012. I doubt they’ll have trouble hitting that forecast. In fact Stryker is probably low-balling us, but that’s understandable since the year is still so young.

For Q1, the Street expects earnings of 99 cents per share which sounds about right. Stryker rallied last earnings season after they met expectations. The business tends to be very stable. I think the stock is a good value here and I’m raising my buy price to $60 per share.

Before I go, I want to highlight some other good values on the Buy List. Among the financials, AFLAC ($AFL), Nicholas Financial ($NICK) and Hudson City ($HCBK) are all going for a good price. I also think that Ford ($F) has drifted down to bargain territory as well.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: April 13, 2012

Eddy Elfenbein, April 13th, 2012 at 7:55 amECB Seen Favoring Bond Buying Over Bank Loans

Bank Overhaul Mess Is Noose Around EU’s Neck, EBF Says

Spanish Banks’ ECB Borrowing Hits New High In March

Soros: EU Survival Requires More German Pragmatism

Chinese First-quarter GDP Grows 8.1%

Kuka Robots Invade China as Wage Gains Put Machines Over Workers

Argentina Has Oil Firm in Its Sights

Saudi’s Naimi Says Determined to Bring Down Oil Prices

Consumer Bureau Declines to Resist Upfront Credit Card Fees

Google Announces 2-for-1 Stock Split

Google Stock Plan Irks Governance Watchdogs

The Instagram Deal: A Mark Zuckerberg Production

Goldman to Pay $22 Million to Settle “Huddles” Case

Credit Writedowns: Lots of Recent Policy Missteps: What are They Thinking?

Howard Lindzon: Instagram and ZAGG …Sometimes It is More About the Product Than The Financials

Be sure to follow me on Twitter.

-

The S&P 500 Breaks Its 50-DMA

Eddy Elfenbein, April 12th, 2012 at 3:17 pmThe S&P 500 had a very nice run of staying above its 50-day moving average since December 20th. Some of this was due to much lower volatility. This week, however, the index just briefly stepped below its 50-DMA.

-

Upcoming Buy List Earnings Reports

Eddy Elfenbein, April 12th, 2012 at 9:27 amOf the 20 stocks on our Buy List, 16 follow the March/June/September/December quarterly schedule. Here’s a look at when the 16 are due to report. I’ve also included Wall Street’s earnings estimate. Note that not all companies have said when they’re going to report.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His