Author Archive

-

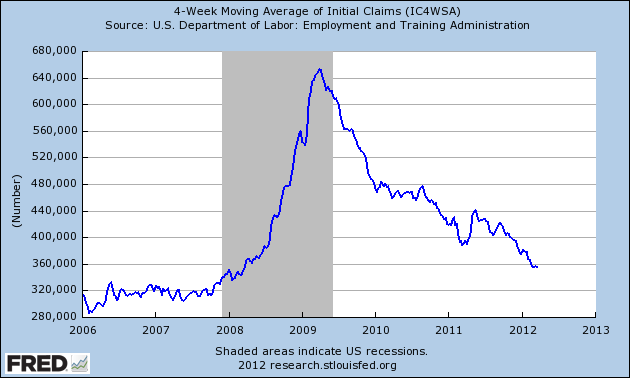

Jobless Claims Lowest Since February 2008

Eddy Elfenbein, March 22nd, 2012 at 10:02 amJobless claims continue to fall:

The Labor Department said Thursday that weekly applications dropped 5,000 to a seasonally adjusted 348,000, the lowest level since February 2008. The four-week average of applications, a less volatile measure, dipped to 355,000. That’s also a four-year low.

Applications have steadily declined since last fall. The drop has coincided with the best three months of hiring in two years. From December through February, employers added an average of 245,000 jobs per month. That’s pushed down the unemployment rate to 8.3%, the lowest in three years.

-

Morning News: March 22, 2012

Eddy Elfenbein, March 22nd, 2012 at 5:36 amDeutsche Bank Changes Legal Status of U.S. Unit

China Preliminary March HSBC PMI Falls, Stoking Market Fears

Japan’s Unexpected Trade Surplus Adds to Rebound Signs

Portugal Strike Against Labor Reform Halts Metro, Ferries

Iceland Woos Microsoft for Part of $41 Billion Data Market

Crude Oil, Metals Lead Gain; Wheat Drops

U.S. Notes Europe’s Progress in Easing Its Debt Crisis

Existing U.S. Home Sales Hold Near Two-Year High

Home Builder Stocks at Highest Point in 2 Years After 6-Month Rise

Baker Hughes Warns of Slow Q1 as Customers Shift to Oil

Kraft’s Name Change to Mondelez Leaves Experts Guessing

Starbucks Details Plans for Energy Drink, International Expansion

General Mills Matches Expectations

Jaguar Said to Invest as Much as $3 Billion With Chery

Jeff Carter: High Frequency Trading Distorts Commodity Prices

Cullen Roche: Where Are Corporate Profits Headed?

Be sure to follow me on Twitter.

-

Stocks Surge as Bonds Fade

Eddy Elfenbein, March 21st, 2012 at 2:17 pmHere’s another graphic which shows investors newly-found appetite for risk. The black line is the S&P 500 while the yellow line is the long-term bond ETF ($TLT).

-

Wright Express Hits 52-Week High

Eddy Elfenbein, March 21st, 2012 at 11:25 amS&P said that it’s adding Wright Express ($WXS) to its S&P Mid-Cap 400 Index. The stock will be leaving the S&P Small-Cap 600 Index.

The news helped propel shares of WXS up to as high as $65.64 today. We already have a 20% YTD gain here. Wright has beaten earnings pretty handily for the last several quarters. I’m looking forward to another strong earnings report in a month.

-

Discussion of Oracle’s Earnings

Eddy Elfenbein, March 21st, 2012 at 9:27 am -

Morning News: March 21, 2012

Eddy Elfenbein, March 21st, 2012 at 5:45 amItalian Group Generali Targets $6.6 Billion Operating Profit

China Quietly Relaxes Controls on Foreign Capital

Sinopec Targets 31% of China’s 2015 Shale Gas Output, China Daily Says

Australian Shares Drop As China Concern Reverberates

U.S. Exempts Japan, 10 EU Nations From Iran Oil Sanctions

Dubai Villa Sales Surge as Bank Lending Gains

Bernanke Says Europe Must Aid Banks Even as Strains Ease

Amazon Wrings Profit From Fulfillment as Spending Soars

Oracle 3Q Profit Climbs 18% On Growth From New Licenses

HP to Merge Printer, PC Arms in Revamp

Generic Drugs Prove Resistant to Damage Suits

Volkswagen Mans Up With Bug Leaving Women Behind in Sales

Remember Datsun? It’s Coming Back From The Scrap Heap

Viterra Deal Gives Glencore Influence in Global Wheat Trade

Epicurean Dealmaker: Three’s a Crowd

Roger Nusbaum: The Apple Party Continues

Be sure to follow me on Twitter.

-

Oracle’s Q4 Guidance

Eddy Elfenbein, March 21st, 2012 at 1:10 amThis is from today’s earnings call:

So here goes with the guidance. New software license revenue growth is expected to range from 1% up to 11% up in constant currency. Subtracting the 3 points, you get to negative 2% to 8% in U.S. dollars currently. Now the Hardware business has not turned out to be very seasonal, in fact. So I’m going to give my guidance really sequentially. And what we’re seeing for next quarter is hardware revenues a little more — basically, the low end of my range would be somewhere about where it is this past quarter, Q3, to potentially as much as $100 million to $110 million above where we closed this past quarter. That would be somewhere between I guess $870 million, let’s say, to as high as $980 million.

So total revenue growth on a non-GAAP basis is expected to range from 1% to 5% in constant currency, subtracting the 3 points, it would be negative 2% to 2% in U.S. dollars. On a GAAP basis, we expect total revenue growth from 1% — sorry about that. Non-GAAP EPS is expected — oh, excuse me. On a GAAP basis, we expect total revenue growth basically in the same range as non-GAAP. Non-GAAP EPS is expected to be somewhere between $0.78 and $0.83 in constant currency. That would be up from $0.75 last year or $0.76 to $0.81 in reported dollars. GAAP EPS is expected to be $0.65 to $0.70 in constant currency. That would be up from $0.62 last year, and $0.62 to $0.67 in U.S. dollars. This guidance assumes a GAAP tax rate of 25% and a non-GAAP rate of 24.5%. That would be up from a little over 23%, I think, last year.

-

Professor Bernanke

Eddy Elfenbein, March 20th, 2012 at 6:55 pmHere’s Ben Bernanke’s college lecture given today at George Washington titled: The Federal Reserve and the Financial Crisis.

-

Oracle Earns 62 Cents Per Share

Eddy Elfenbein, March 20th, 2012 at 4:08 pmNice earnings. The Street was expecting 56 cents per share.

Oracle Corporation today announced fiscal 2012 Q3 GAAP total revenues were up 3% to $9.0 billion, and non-GAAP total revenues were up 3% to $9.1 billion. Both GAAP and non-GAAP new software license revenues were up 7% to $2.4 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 8% to $4.1 billion. Both GAAP and non-GAAP hardware systems products revenues were down 16% to $869 million. GAAP operating income was up 11% to $3.3 billion, and GAAP operating margin was 37%. Non-GAAP operating income was up 8% to $4.2 billion, and non-GAAP operating margin was 46%. GAAP net income was up 18% to $2.5 billion, while non-GAAP net income was up 13% to $3.1 billion. GAAP earnings per share were $0.49, up 20% compared to last year while non-GAAP earnings per share were up 15% to $0.62. GAAP operating cash flow on a trailing twelve-month basis was $13.5 billion.

“Oracle is on track to deliver the highest operating margins in our history this year,” said Oracle President and CFO, Safra Catz. “Oracle can achieve these record margins as an integrated hardware and software company because we are focusing on high margin systems where hardware and software are engineered to work together.”

I was wrong about the quarterly dividend. It’s still at six cents per share. The stock is up 2.8% after hours.

-

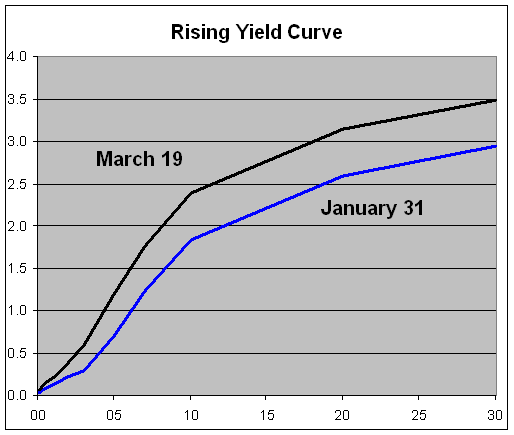

The Rising Yield Curve

Eddy Elfenbein, March 20th, 2012 at 1:29 pmHere’s a graph which illustrates the point I’ve been making about the market’s changing mood. Over the last few weeks, Treasury interest rates along the yield curve have been rising. This is a reflection of the market leaving conservative assets in search of riskier ones.

The increase in rates has been most prominent at the long end of the yield curve. From five years out to 30 years, interest rates have increased by roughly 50 basis points. Rates have climbed especially since March 6th.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His