Author Archive

-

The S&P 500 Breaks 1,400

Eddy Elfenbein, March 15th, 2012 at 2:06 pmFor the first time since 2008, the S&P 500 broke 1,400 today. The index first reached that level in July 1999. To add some perspective, Barack Obama was 37 years old.

By the way, notice how the line has gradually become less jagged over time.

-

Jobless Claims At Four-Year Low

Eddy Elfenbein, March 15th, 2012 at 11:45 amMore good news on the jobs front. The Labor Department reported this morning that the number of Americans filing first-time claims for unemployment benefits dropped to a four-year low. Jobless claims fell by 14,000 to 351,000 last week. That wasn’t the only good news:

Separately, the New York Federal Reserve said its Empire State general business conditions index rose to 20.21 – its highest level since June 2010 – from 19.53 in February.

“This suggests that the recovery is firmly on track,” said Scott Brown, chief economist at Raymond James in St. Petersburg, Florida.

The Philly Fed also reported manufacturing growth in its region. This is good news but we’re not out of the woods just yet.

-

Morning News: March 15, 2012

Eddy Elfenbein, March 15th, 2012 at 5:48 amGreek Restructuring Delay Helps Banks as Risks Shift

Officials Unite Again to Protect Eastern Europe’s Banks

Greek Bonds Signal $2.6 Billion Payout on Credit-Default Swaps

New Day New Tax as Sarkozy Battles Hollande in French Campaign

U.S. May Sanction India Over Level of Iran-Oil Imports

FDIC Shoots to Kill on “Too Big to Fail”

Jobs Bill Stalls as Congress Fights Over Agency

Goldman Roiled by Op-Ed Loses $2.2 Billion for Shareholders

Cisco to Buy NDS for $5 Billion

Avaya Agrees to Acquire Radvision for About $230 Million

Private Businesses Fight Federal Prisons for Contracts

Foreclosures Fall 8% in U.S. With Seizure Increase Coming

Lufthansa’s Main Brand Adds to Malaise as Profit Slide to Deepen

Galaxy Earnings Miss Estimates, Won’t Pay Dividend

What Buffett Knows About Bank Investing That You Don’t

Cullen Roche: On Leaving Goldman Sachs

Howard Lindzon: Encyclopaedia Britannica….’We Have A Better Tool Now’

Be sure to follow me on Twitter.

-

Bed Bath & Beyond Surges to 52-Week High

Eddy Elfenbein, March 14th, 2012 at 2:34 pmShares of Bed Bath & Beyond ($BBBY) are rocking today. The stock has been as high as $65.27.

From Seeking Alpha:

Bed Bath & Beyond (BBBY +4.1%) moves up after its comp estimates are raised at Bernstein to 4.6% from 3.3%. Baird cites the company’s improvement in discrete comp drivers and improving sales trends. The company rates the shares at Outperform with an $80 price target.

The company is due to report fiscal Q4 earnings at the beginning of April. I’m looking for a strong report.

-

Reynolds American Brings Out the Knife

Eddy Elfenbein, March 14th, 2012 at 9:59 amReynolds American ($RAI) announced today that it will cut 10% of its U.S. workforce by the end of 2014. That sounds dramatic but a lot of it will be achieved by normal turnover.

Reynolds said this move will save $25 million this year and $70 million by 2015.

Reynolds American pegged the expected cost of the work-force reduction at about $110 million, which reflects severance payments and other costs. The company noted it will take a charge in the first quarter that will include those costs.

“Our businesses’ four key brands are all on a growth trajectory,” said Chief Executive Daniel M. Delen. “In order to sustain that growth, we need to ensure we have the financial resources and employees aligned behind the right programs and processes.”

As cigarette volumes have declined across the tobacco industry, Reynolds American, the nation’s second-largest tobacco company behind Altria Group Inc. (MO), has shifted its focus toward a few key brands. The company has also diversified into smokeless tobacco.

If the $70 million figure is accurate, we’re talking about 12 cents per share per year. That’s not so small. These cuts are certainly painful, but it’s good to see that Reynolds is staying alert to cutting costs.

-

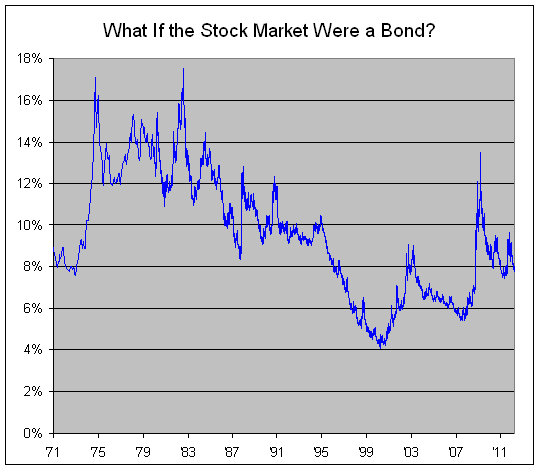

What If the Stock Market Were a Bond?

Eddy Elfenbein, March 14th, 2012 at 9:15 amHere’s an update to one of my crazier/demented/possibly brilliant ideas. I was curious to see what the historical performance of the stock market looks like, but in the form of a bond.

Crazy? Let me explain.

I took the historical market performance of the Wilshire 5000 (including dividends) and invented a hypothetical long-term bond that matched the index’s gains step-for-step.

I assumed that it’s a bond of infinite maturity and pays a fixed coupon.

There’s one hitch, though. I had to choose a starting yield-to-maturity for the beginning of the data series in December 1970. So this isn’t a completely kosher experiment because the starting point is based on my guess.

If I chose a number that was too high, the historical performance wouldn’t be able to keep up, and the yield-to-maturity would grow higher and higher and soon leave orbit. Conversely, if my starting YTM was too low, the yield would gradually get pushed down to microscopic levels.

Fortunately, the data made my job easy. After four decades, the window I had to work with is pretty narrow. Starting with 9.2% was too high, and 8.8% was too low. After playing with the numbers, I finally settled on 8.95%.

Even though this “bond” is completely make-believe, it reflects what the actual stock market really did for the past four decades. Through yesterday, the yield stood at 7.74%.

-

Morning News: March 14, 2012

Eddy Elfenbein, March 14th, 2012 at 5:56 amIn a First, Europeans Act to Suspend Aid to Hungary Unless It Cuts Deficit

China Yuan Down Late On PBOC Guidance, Depreciation Concerns

Tudou Owners Get World’s Best Deal Taking Youku Stock

London Shops Disappear as Olympics Pays $1.2 Billion for Cycling

Enel Targets Renewables, Latin America to Counter Italian Slump

Brent Crude Dips Below $126 Ahead of US Oil Data

U.S. Said to Have Received Saudi Assurances on Ample Oil Supply

Fed Says 15 of 19 Banks Have Adequate Capital in Stress Scenario

In Otherwise Dour Report From Fed, the Tiniest Touch of Optimism

Bayer Sees Healthcare Business Driving Growth

Cathay Pacific Declines on Profit Drop, ‘Challenging’ Outlook

In Private Equity I.P.O., a Shareholder Fear of Losing Favor

Motley Fool: The CPI Is a Conspiracy! (Or Maybe You Just Don’t Understand It)

Epicurean Dealmaker: Welcome to the Sausage Factory

Jeff Miller: The Quest for Yield (Part 6): Enhancing the Yield from Your Dividend Stocks

Be sure to follow me on Twitter.

-

Britain to Offer a 100-Year Gilt

Eddy Elfenbein, March 13th, 2012 at 10:40 pmHere’s an interesting story from our cousins across the pond. The Brits are looking to float a 100-year gilt. The general rule is that the larger your debt, the longer your average maturity should be. Her Majesty’s government currently has a debt of 1 trillion pounds.

Is this a wise move? Well, it depends. If the bond market responds favorably, then yes, it’s a good move. If not, then it’s a bad move. It all depends on what interest rate investors demand. I wouldn’t be surprised if investors like what they see.

The government is also considering never-ending bonds. By the way, something magical happens with perpetuities. When you calculate the yield to maturity, you simply divide the coupon by the price and presto.

If this float goes well, I’d be interested to see the U.S. Treasury give a long-dated bond a try. While we’re at it, I wouldn’t mind seeing a gold-backed bond either.

-

Big Day Today for Our Buy List

Eddy Elfenbein, March 13th, 2012 at 4:35 pmToday was a great day for our Buy List, especially the financial stocks on the list. The Buy List gained 2.19% today compared with 1.81% for the S&P 500. For the year, the Buy List is up 12.25% to the S&P 500’s 11.00%.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His