Author Archive

-

ADP + 216,000

Eddy Elfenbein, March 7th, 2012 at 9:03 amWe got a preview of Friday’s jobs report today when ADP ($ADP), the private payroll firm, said that employers added 216,000 jobs in February. This came in above economists’ expectations of 208,000.

It looks like this news will give the market a lift this morning.

-

Morning News: March 7, 2012

Eddy Elfenbein, March 7th, 2012 at 5:55 amSocGen, Generali Join Greece Debt Swap

Spain Lags Italy as Growth Concern Halts Rally

An Architect of a Deal Sees Greece as a Model

U.K. Banks Group Backs Away From Libor

Red Sea-Negev Rail May Spur China Trade

Oil Rebounds on China Demand Outlook

Refinancing Fees Are Reduced for Some F.H.A. Borrowers

House Passes Bill to Address China Subsidy

Dividends Emerge in Pressing Apple Over Working Conditions in China

Pandora Loss Widens As Costs Rise, Outlook Disappoints

HSBC Sells General Insurance Business for $914 Million

Web Sites Shine Light on Petty Bribery Worldwide

World’s Richest Lose $11.3B, Mittal Falls Off Index

Stanford Guilty of Bilking Investors of Billions

Cullen Roche: Gary Shilling’s 6 Favored Asset Classes

Jeff Miller: Weighing the Week Ahead: How Worried Should We Be?

Be sure to follow me on Twitter.

-

Follow-Up on Community Health Systems

Eddy Elfenbein, March 6th, 2012 at 4:48 pmLast month, I tweeted:

$CYH is looking very attractive here at $20. Earnings due out on Feb 21. $$

So far, I’m looking pretty smart. CYH is Community Health Systems. At the time, the stock was at $19.85.

The earnings report I mentioned turned out to be good. Community Health earned 85 cents per share, two cents more than estimates.

The stock did very well after the earnings report. Last week, CYH got as high as $25.74. It pulled back today and closed at $23.30. That’s 6.5 times this year’s earnings estimate.

-

Finally, Some Volatility

Eddy Elfenbein, March 6th, 2012 at 11:31 amThis may come as a shock, people, but we actually have some volatility today. Unfortunately, it’s the bad kind. The market is again worried about concerns from Europe. (Will 2011 ever end?)

The S&P 500 is currently down 17 points or 1.3%. If that holds up, it will be the biggest fall all year and it will be nearly twice as big as the second-biggest fall this year.

There’s also a major divide in this market and it closely resembles the opposite of what we’ve seen most of this year. (Today is the opposite of what’s been happening this year which was the opposite of what happened late last year. So today resembles much of last year.)

So far, 2012 has been characterized by low volatility, rising stocks prices led by cyclicals and small-caps. Today, cyclicals, small-caps, financials and gold are getting hit the hardest. Financials are the worst-performing sector. AFLAC ($AFL) is down about 4%.

The only areas that are doing well are the defensive stocks. This means staples, utilities and many dividend stocks. On our Buy List, Reynolds American ($RAI) is slightly up while Sysco ($SYY) is slightly down.

-

Morning News: March 6, 2012

Eddy Elfenbein, March 6th, 2012 at 5:45 amGoldman Secret Greece Loan Reveals Two Sinners

Large Private Sector Investors Agree to a Swap of Greek Debt

Automakers Prepare for Deepening Slump in Europe

IMF Sees Portugal Market Return in 2013

In China’s Annual Assessment, Wen Is Optimistic

In China, Sobering Signs of Slower Growth

India’s Farm Minister Seeks Lifting of Cotton Exports Ban Citing Surplus

Brent Crude Holds Above $123, Oil Creeps Toward Top of Asia’s Worry List

Billionaires Buy Gasoline Ships as Cargoes Expand

Camp David, Not Chicago, to Host G-8

Fed Study of Student Debt Outlines a Growing Burden

After Ratings Drop, Ford Reworks Touch Screens

AIA Shares Slide After $6 Billion AIG Selldown

German Utility Giant RWE’s Profit Slumps 34% on Nuclear Phase-Out

Epicurean Dealmaker: Chesterton’s Fence

Phil Pearlman: Setting Portfolio Stops for Shorter Term Traders

Be sure to follow me on Twitter.

-

Expect a Strong Jobs Report This Friday

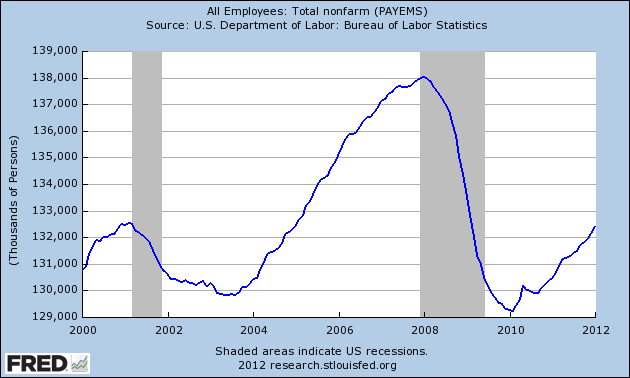

Eddy Elfenbein, March 5th, 2012 at 1:51 pmWall Street is gearing up for the Labor Department’s next report on the jobs market which is due out this Friday. As I’ve discussed, the jobs market has become unusually closely tied to the fortunes of the stock market. Profit margins have gone as far as they can. What this economy needs is more consumers.

The jobs report normally comes out on the first Friday of the month but due to February being temporally challenged, this report will come out on March 9th.

The question is: Will we see another 200,000+ non-farm payrolls report? The current consensus expects a gain of 213,000 jobs which is a very good number.

My take is that we should expect to see a strong report this Friday. There are a few reasons why. The first is that the initial jobless claims reports have been very good recently. Also, and this may sound odd, higher gasoline prices may indicate that the economy is doing better at the ground level. We’ve also seen decent reports on housing and retail sales.

The last few jobs reports have been pretty good. The December report showed a gain of 203,000. We gained another 243,000 in January. I expect to see those numbers revised in Friday’s report.

Still, we shouldn’t get too excited. Over the last 23 months, the U.S. economy has created 3.165 million jobs. That sounds good, but in the 25 months prior to that the economy lost 8.779 million jobs. In other words, as well as we’ve done, we’ve only gained back roughly one-third the number of jobs lost.

-

Stocks Love Gridlock (But Only One Kind)

Eddy Elfenbein, March 5th, 2012 at 9:56 amThis is already the best year for the Dow since 1998. At the WSJ, E.S. Browning finds some interesting facts:

Since 1900, the Dow has averaged a 7.8% annual gain under Democratic presidents, compared with a 3% annual gain under Republicans. With a Democratic president and a Republican Congress, the Dow has gained an average 9.6% a year.

The worst mix has been a Republican president and a split or Democratic Congress, which on average has produced little or no gains.

Bespoke Investment Group, in Harrison, N.Y., has uncovered another fact: Only four presidents elected since 1900 have seen the Dow rise 50% or more during their first three years. One is the current president. For the other three—Franklin Roosevelt, Dwight Eisenhower and Bill Clinton—the Dow’s average gain during the fourth year in office was 19.7%. All three were re-elected.

According to InTrade, it’s quite possible that we’ll see President Obama re-elected and Republicans gain control of both houses of Congress.

-

China Cuts Its Growth Rate to 7.5%

Eddy Elfenbein, March 5th, 2012 at 9:26 amI’m happy to report that I’m back at the helm and I’ve fully recovered from whatever it was. Thanks for the get-well emails.

The stock market looks like it’s going to open lower this morning due to poor economic news from Europe. Also, Wen Jiabao, the Premier of China, said that China’s economy will grow by 7.5% this year. That kind of growth sounds great to us but it’s actually an eight-year low.

There’s some kinda good news from American International Group ($AIG). AIG said it’s going to sell a big chunk of holdings in AIA Group Ltd., the Asian life insurance company, in order to pack back the U.S. Treasury.

AIG currently owns about one-third of AIA and they’re planning to sell a bit less than half of their position. This deal will send about $8 billion the government’s way. Not including this deal, AIG still owes the government about $50 billion.

The U.S. Treasury’s break-even point on AIG is $29 per share and the stock is just above that right now. I would have to think that the Obama Administration would enjoy privatizing AIG just before the election.

-

Morning News: March 5, 2012

Eddy Elfenbein, March 5th, 2012 at 5:47 amMerkel Sees Euros Minted From Marks in Trial of German Integrity

Dallara Says Debt Swap Is on Track

End of Irish Europe Love Affair May Hurt Bonds

Foreign Investment in Europe Starts Anew

Chinese Congress Opens With Upbeat Economic Assessments, and Eyes on the Top

Apple’s Job Creation Data Spurs an Economic Debate

AIG Selling $6 Billion of AIA Shares, To Repay Bail-out

BlackRock’s Bullish Approach to Asia

India’s Hero Eyes Ducati Amid Takeover Quest

BP Gains Most in a Month on Gulf Settlement

Deepwater Oil Drilling Picks Up Again as BP Disaster Fades

Jaguar Land Rover, Chery Seek OK for $2.8 Billion JV

SingTel Unveils New Structure and Strategy, Buys Amobee for $321 Million

James Altucher: Did Obama Really Say He Wants Everyone to Go to College?

Be sure to follow me on Twitter.

-

Wonder Why People Don’t Like Wall Street

Eddy Elfenbein, March 2nd, 2012 at 11:02 pmWell, that’s not much of a mystery. But still. I really want to see this guy punished:

Morgan Stanley’s William Bryan Jennings, the bank’s bond-underwriting chief in the U.S., was charged with a hate crime in the stabbing of a New York City cab driver of Middle Eastern descent over a fare.

William Bryan Jennings?? Seriously?? Who named this guy — Richard Nixon Milhous?

Mohamed Ammar said the banker attacked him Dec. 22 with a 2½-inch blade and used racial slurs after a 40-mile ride from New York to the banker’s $3.4 million Darien, Connecticut home.

Jennings, who had attended a bank holiday party at a boutique hotel in Manhattan before hailing the cab, refused to pay the $204 fare upon arriving in his driveway, the driver said. When Ammar threatened to call the local police, Jennings said they wouldn’t do anything to help because he pays $10,000 in taxes, according to a report by the Darien police department.

Ammar, a native of Egypt, said he then backed out of the driveway to seek a police officer. The banker called him an expletive and said “I’m going to kill you. You should go back to your country,” according to the report, filed in state court in Stamford. A fight ensued as they drove through Darien, and Jennings, 45, allegedly cut Ammar, 44, police said.

The banker, who eventually fled the cab and turned himself in two weeks later after a vacation in Florida, was charged with second-degree assault, theft of services and intimidation by bias or bigotry. He faces as long as 5 years in prison on the assault charge.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His