Author Archive

-

A Look at the Long View

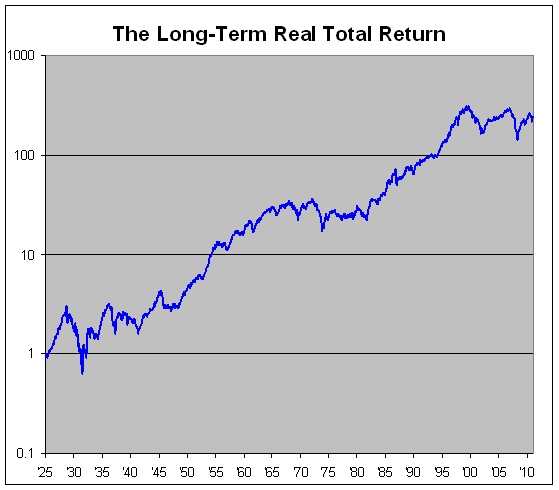

Eddy Elfenbein, January 3rd, 2012 at 11:01 amSince the start of the century (and millennium), the stock market has been a disaster. Taking a step back to look at the numbers, it’s truly remarkable.

From the end of 1999 to the end of 2011, the S&P 500 dropped 13.58%. Dividends added 23.59%. But over those 12 years inflation was 34.69%. That adds up to a real total return of -20.70%.

You would often hear money managers say that the real long-term return of the stock market was 8%, and that’s what it was from 1925 to 1999. But the last 12 years have been so bad that it’s taken that 8% number down to 6.58%.

This means that historically, the stock market more than doubles your money in real terms every 12 years, but over the last 12 years, it’s down 20%.

-

And…We’re Off!

Eddy Elfenbein, January 3rd, 2012 at 10:28 amThe 2012 trading year is underway and it looks to be a very good day. The S&P 500 has been as high as 1,284.41 today. We’re very close to our highest close since August 1st which was 1,285.09 from October 28th.

The ISM Index report for December came out today at 53.9. It was 52.7 in November. This was the 29th-straight month that the ISM was over 50. Wall Street was expecting 53.2.

Our Buy List is rocking it so far. AFLAC ($AFL) is above $45. JPMorgan Chase ($JPM) is up close to 5%. The whole list is up about 2% so far.

-

Morning News: January 3, 2012

Eddy Elfenbein, January 3rd, 2012 at 5:42 amWorld’s Biggest Economies Face $7.6 Trillion Debt

In Euro Zone’s Crisis, Technocrat in Paris Works Behind the Scenes

German Jobless Rate Sees Surprise Fall

Nigeria Braces for Gas-Price Protests

President Hu: West Is Using Cultural Means to Divide China

Crude Advances in New York Amid Manufacturing Expansion, Tension Over Iran

Same-store Sales Seen Up 4.3 Percent in December

For 2012, Signs Point to Tepid Consumer Spending

On Wall Street, a Renewed Optimism for Deals

Total Buys $2.32 Billion Shale Stake, Helping Chesapeake Pare Its Debt

Exxon’s Pursuit of Venezuelan Cash ’Not Over Yet’ After Ruling

Macau Gambling Revenue Rose 42% in 2011

VW’s Bentley 2011 Sales Jump 37% on China

NYTimes Dealbook: Raising a Glass to 2011

Jeff Carter: Stimulus and Debt are Manna From Heaven

James Altucher: My Last Death Threat in 2011

Be sure to follow me on Twitter.

-

Morning News: January 2, 2012

Eddy Elfenbein, January 2nd, 2012 at 6:30 amEuro Leaders Aim to Buy Time to Save Currency

Austerity Reigns Over Euro Zone as Crisis Deepens

China Export Orders Show Threat From Europe

India PMI Expands at Fastest Pace in 6 Months

South Korea Manufacturing Falls

Venezuela Is Ordered to Pay $900 Million to Exxon Mobil

Nigeria to End Gasoline Subsidy Accounting for 25% of Government Spending

India to Allow Individual Foreign Investors to Buy Local Shares Directly

U.S. Consumer in the Slow Lane

Samsung, Hyundai Workers Brace for Uncertainty

In Flop of H.P. TouchPad, an Object Lesson for the Tech Sector

The Danger of an Attack on Piracy Online

Epicurean Dealmaker: Turn the Page

Howard Lindzon: Starting 2012 – My Gameplan.

Stone Street: 2012 “Predictions” from Stone Street Advisors Team & Friends

Be sure to follow me on Twitter.

-

The 2012 Buy List

Eddy Elfenbein, December 31st, 2011 at 3:29 pmHere’s my 2012 Buy List. For tracking purposes, I assume it’s a $1,000,000 portfolio and that each position is worth $50,000. When I discuss how well the Buy List is doing, I’m referring to this list. Here’s each stock, ticker, starting price, number of shares and starting balance:

Company Ticker Price Shares Balance AFLAC AFL $43.26 1,155.8021 $50,000 Bed Bath & Beyond BBBY $57.97 862.5151 $50,000 CA Technologies CA $20.22 2,472.7992 $50,000 CR Bard BCR $85.50 584.7953 $50,000 DirecTV DTV $42.76 1,169.3171 $50,000 Fiserv FISV $58.74 851.2087 $50,000 Ford Motor Company F $10.76 4,646.8401 $50,000 Harris Corporation HRS $36.04 1,387.3474 $50,000 Hudson City Bancorp HCBK $6.25 8,000.0000 $50,000 Johnson & Johnson JNJ $65.58 762.4276 $50,000 Jos. A. Bank Clothiers JOSB $48.76 1,025.4307 $50,000 JPMorgan Chase JPM $33.25 1,503.7594 $50,000 Medtronic MDT $38.25 1,307.1895 $50,000 Moog MOG-A $43.93 1,138.1744 $50,000 Nicholas Financial NICK $12.82 3,900.1560 $50,000 Oracle ORCL $25.65 1,949.3177 $50,000 Reynolds American RAI $41.42 1,207.1463 $50,000 Stryker SYK $49.71 1,005.8338 $50,000 Sysco SYY $29.33 1,704.7392 $50,000 Wright Express WXS $54.28 921.1496 $50,000 The five new stocks are CA Technologies ($CA), Hudson City Bancorp ($HCBK), CR Bard ($BCR), Harris ($HRS) and DirecTV ($DTV). The deletions are Abbott Labs ($ABT), Becton, Dickinson ($BDX), Deluxe ($DLX), Gilead Sciences ($GILD) and Leucadia National ($LUK).

The average market value is $34 billion. The largest is Johnson & Johnson ($JNJ) at $179 billion. The smallest, by far, is Nicholas Financial ($NICK) which is about one-tenth the size of the second-smallest.

Thirteen of the Buy List stocks pay dividends. The average yield of the dividend payers is 2.85%. The yield for the entire Buy List is 1.85%.

Only five stocks have remained on the Buy List for all six years: AFLAC ($AFL), Bed Bath & Beyond ($BBBY), Fiserv ($FISV), Medtronic ($MDT) and Sysco ($SYY).

The 2011 Buy List

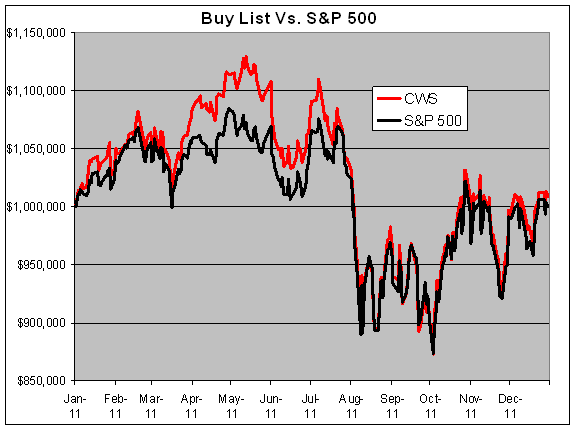

Eddy Elfenbein, December 31st, 2011 at 12:05 pmThe 2011 trading year has come to a close. I’m happy to report that our Buy List had another market-beating year although this one was close. The 20 stocks on the Crossing Wall Street Buy List gained 0.89%. In contrast, the S&P 500 was unchanged at 0.00%. (Splitting out the decimals, the S&P 500 lost 0.00318%, but I round off at two decimal places.) This is the fifth year in a row that we have beaten the market.

Including dividends, our Buy List gained 2.75% compared with 2.11% for the S&P 500. The dividend yield for the Buy List worked out to 1.84% while it was 2.11% for the S&P 500. For the year, our beta was 1.0340.

Over the six-year history of the Buy List, we’ve gained 37.72% to the S&P 500’s 14.34%. Our annual turnover has been just 25% which means we’ve only changed five stocks per year. The six-year beta is 0.9420.

I’ll restate the rules of the Buy List. I choose a portfolio of 20 stocks at the beginning of the year. After that, the Buy List is locked for the year and I can’t make any changes until the following year. For tracking purposes, I assume that the Buy List is a $1 million portfolio equally divided among the 20 stocks. You can check the performance of the Buy List anytime at our Buy List page.

My goal is to show investors that by choosing stocks wisely and by sticking with high-quality stocks, they can beat the market—and that’s exactly what we’ve done. I try to beat the market by a few percentage points and to do it with less risk.

Our top-performing stock in 2011 was also our highest yielder. Reynolds American ($RAI) stock gained 26.98% in 2011, and with dividends it was up 34.44%. Other big winners were Abbott Labs ($ABT), Jos. A. Bank Clothiers ($JOSB) and Nicholas Financial ($NICK).

Here’s how each stock performed:

Stock Number of Shares 12/31/10 Beginning 12/30/11 Ending Profit/Loss ABT 1,043.6235 $47.91 $50,000.00 $56.23 $58,682.95 17.37% AFL 886.0535 $56.43 $50,000.00 $43.26 $38,330.67 -23.34% BDX 591.5760 $84.52 $50,000.00 $74.72 $44,202.56 -11.59% BBBY 1,017.2940 $49.15 $50,000.00 $57.97 $58,972.53 17.95% DLX 2,172.0243 $23.02 $50,000.00 $22.76 $49,435.27 -1.13% FISV 853.8251 $58.56 $50,000.00 $58.74 $50,153.69 0.31% F 2,977.9631 $16.79 $50,000.00 $10.76 $32,042.88 -35.91% GILD 1,379.6909 $36.24 $50,000.00 $40.93 $56,470.75 12.94% JNJ 808.4074 $61.85 $50,000.00 $65.58 $53,015.36 6.03% JOSB 1,240.0794 $40.32 $50,000.00 $48.76 $60,466.27 20.93% JPM 1,178.6893 $42.42 $50,000.00 $33.25 $39,191.42 -21.62% LUK 1,713.5024 $29.18 $50,000.00 $22.74 $38,965.04 -22.07% MDT 1,348.0723 $37.09 $50,000.00 $38.25 $51,563.77 3.13% MOG-A 1,256.2814 $39.80 $50,000.00 $43.93 $55,188.44 10.38% NICK 4,882.8125 $10.24 $50,000.00 $12.82 $62,597.66 25.20% ORCL 1,597.4441 $31.30 $50,000.00 $25.65 $40,974.44 -18.05% RAI 1,532.8020 $32.62 $50,000.00 $41.42 $63,488.66 26.98% SYK 931.0987 $53.70 $50,000.00 $49.71 $46,284.92 -7.43% SYY 1,700.6803 $29.40 $50,000.00 $29.33 $49,880.95 -0.24% WXS 1,086.9565 $46.00 $50,000.00 $54.28 $59,000.00 18.00% Total $1,000,000.00 $1,008,908.23 0.89% Here’s how the Buy List performed throughout the year:

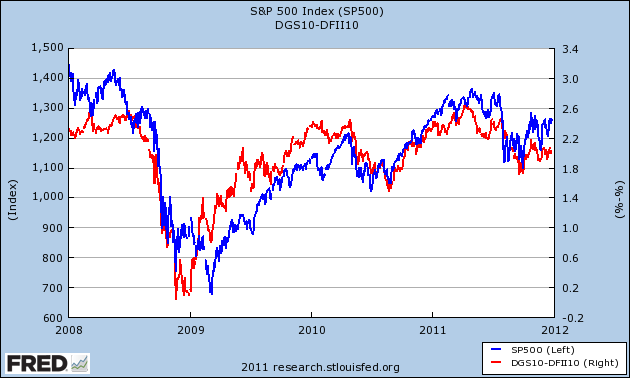

Overlooked Chart of the Year

Eddy Elfenbein, December 30th, 2011 at 1:19 pmHere’s my entry for Overlooked Chart of the Year. It shows how the S&P 500 (in blue) and the market’s inflation expectations (the 10-year TIPs spread in red) have been waltzing partners for the last four years.

Favorite Moments of 2011

Eddy Elfenbein, December 30th, 2011 at 10:20 amSeeing this last February was one of my favorite moments in 2011. At the time, Netflix ($NFLX) was at $247. Today it’s at $69.

Ford’s Sales Reach Four-Year High

Eddy Elfenbein, December 30th, 2011 at 10:01 amFrom the AP:

Ford Motor Co. said Friday that its U.S. sales this year have passed the two million mark. It’s the first time that’s happened since 2007.

Sales through November were up 18 percent from the first 11 months of 2010. Ford said sales of small cars this year are on pace to rise more than 20 percent, while utility vehicles are tracking up more than 30 percent.

On Dec. 1 the company said it had sold nearly 1.94 million vehicles in 2011. In December of last year, it sold 190,976 vehicles. Sales totaled 166,865 vehicles in November.

Ford sales have been improving this year as people replace the cars and trucks they held onto during the economic slump. In November buyers were lured by deals, improving confidence in the economy and the need to trade in older cars. An early blitz of holiday advertising also helped convince some people that it was a good time to buy.

Ford ($F) had a rough 2011 but the stock closed yesterday at $10.68 which is 6.7 times the earnings estimate for 2012.

CWS Market Review – December 30, 2011

Eddy Elfenbein, December 30th, 2011 at 7:39 amThere’s just one trading day left in 2011. I, for one, am happy to see this market year end. There’s been way too much Sturm und Drang, not to mention Bernanke und Trichet, for my taste. The next time I read about “European spreads,” I really hope it’s about Nutella.

There has been, of course, one bright spot to this year and that’s been our Buy List. Through Thursday, our Buy List holds a small lead over the S&P 500. For the year, our Buy List is up 1.32% (3.18% including dividends) while the S&P 500 is up 0.43% (2.55% including dividends).

True, that’s hardly a big lead, but remember that the large majority of money managers don’t get this far. Unless disaster strikes on Friday, this will be our fifth year in a row of beating the overall market. In this issue of CWS Market Review, I want to talk about the market’s current mood and explain why our Buy List has stayed so close to the S&P 500.

But first, I want to remind you that on Tuesday, January 3rd, the new Buy List takes the field. The stock exchange will be closed on Monday for New Year’s Day so Tuesday will be the first trading day of the new year. Five new faces will be joining us: CA Technologies ($CA), Hudson City Bancorp ($HCBK), CR Bard ($BCR), Harris ($HRS) and DirecTV ($DTV). Let’s hope 2012 will be our sixth market-beating year in a row! (And let’s hope for a much bigger lead at the end as well.)

One of the frustrating aspects of this market is that stocks have been unusually highly correlated with each other this year. This is a crucial point and every investor needs to understand what’s been happening. Let me explain it in a user-friendly way: Typically most stocks move up and down together but there’s often a minority that swims against the stream. Money managers love to key in on these “dispersion” stocks because they want to show their clients that they can stand apart from the crowd, preferably in a good way. When everybody else is zigging, the big money is going to find the guys who can zag.

The problem is that when there’s too much correlation going on, as there is now, the non-correlated area gets far too much attention. As Yogi Berra once said of a popular restaurant, “No one goes there anymore. It’s too crowded.” In more concrete terms, this helps explain why we‘re seeing such absurd valuations for stocks like Amazon.com ($AMZN) or Starbucks ($SBUX). They’re two of the few zaggers in town, so everybody has latched on.

Earlier this year, shares of Netflix ($NFLX) got a super-atomic wedgie after the company tried to…well, I’m not exactly sure. But it was pretty dumb whatever it was. Anyway, the stock got destroyed. Here’s the key part I want you to understand: The attention is going to the crash but the real story is why anyone was paying $300 for this stock in the first place (that’s 77 times trailing earnings).

That’s nuts especially when you compare it with many stodgy blue chips. For too long, Netflix was one of the few stocks that was “working.” Meanwhile, if the S&P 500 was up, say, 1% on a given day, you could be pretty sure that GE ($GE) or Walmart ($WMT) or Microsoft ($MSFT) was doing pretty much the same thing. That’s frustrating—and frustrated investors are bad investors.

Why has correlation been so high this year? It all comes down to what’s euphemistically called “headline risk,” which is better known as Europe’s unholy mess. As the problems in Europe have grown, the market has increasingly treated our market less as a market of individual equities and more as one giant mass that has a cash flow in U.S. dollars. In this case, the importance of U.S. dollars is that they’re not euros.

What happened is that the dollar trade became highly correlated with every other asset (often negatively), and within assets, stocks have become highly correlated with each other. Ideally, stocks should trade on, oh you know, things like earnings and dividends. Instead, they’re trading on what Angela Merkel may or may not do at the next five summits which will decide on how to lay out an agenda for the next 73 summits. Sorry, but that ain’t much fun. Of course, if you’re an investor in European bonds, then you probably have all the dispersion you can handle.

Since I build the Buy List for long-term performance, I don’t give a whit about being correlated or not. If you’re focused on the long-term, that’s something that comes and goes. In 2011, it’s been here in a big way and it explains why our Buy List is sticking so closely to the S&P 500. It’s just something that you have to deal with. This, too, shall pass.

While high correlation makes stock-picking harder, it also means we should focus on fundamentals all the more, since high correlation is a fleeting thing. The Chicago Board Options Exchange actually has an index that tracks implied correlation. Fortunately, in recent weeks, this index has slowly started to fall, but make no mistake, correlation is still very high.

I suspect that in 2012, we’re going to see more “dispersion trades” fall apart and many won’t be pretty. In fact, that may be happening right now with gold. It recently made a six-month low and I won’t be surprised to see a few hedge funds go under because they were heavily invested in gold and silver futures. The gold sell-off may also signal that the Fed’s “extended period” policy for low interest rates may not be so extended. But it’s just too early to say.

Another emerging “dispersion” story could be in healthcare. In this case, it’s slowly getting stronger. On Thursday, Medtronic ($MDT) closed at its highest level in nearly six months. If you recall, the company had a solid earnings report a few weeks ago and it reiterated its full-year forecast. On Tuesday, Johnson & Johnson closed above $66 for the first time since July. And even though Abbott Labs ($ABT) is set to depart our Buy List, it hit a fresh 52-week high on Thursday.

Frankly, not much has been going on this week on Wall Street. Trading volume is very low. On the economic front, the consumer confidence report was very good and the pending home sales figure was particularly strong.

The slow news will end soon as we have fourth-quarter earnings season on the horizon. Our first Buy List stock to report will be JPMorgan Chase ($JPM) on January 13th. I’m particularly looking forward to a strong earnings report from Ford ($F). Plus, the company will soon pay out its first dividend to shareholders in five years.

That’s all for now. Over the weekend, I’ll post the final numbers for this year’s Buy List. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His