Author Archive

-

CWS Market Review – December 30, 2011

Eddy Elfenbein, December 30th, 2011 at 7:39 amThere’s just one trading day left in 2011. I, for one, am happy to see this market year end. There’s been way too much Sturm und Drang, not to mention Bernanke und Trichet, for my taste. The next time I read about “European spreads,” I really hope it’s about Nutella.

There has been, of course, one bright spot to this year and that’s been our Buy List. Through Thursday, our Buy List holds a small lead over the S&P 500. For the year, our Buy List is up 1.32% (3.18% including dividends) while the S&P 500 is up 0.43% (2.55% including dividends).

True, that’s hardly a big lead, but remember that the large majority of money managers don’t get this far. Unless disaster strikes on Friday, this will be our fifth year in a row of beating the overall market. In this issue of CWS Market Review, I want to talk about the market’s current mood and explain why our Buy List has stayed so close to the S&P 500.

But first, I want to remind you that on Tuesday, January 3rd, the new Buy List takes the field. The stock exchange will be closed on Monday for New Year’s Day so Tuesday will be the first trading day of the new year. Five new faces will be joining us: CA Technologies ($CA), Hudson City Bancorp ($HCBK), CR Bard ($BCR), Harris ($HRS) and DirecTV ($DTV). Let’s hope 2012 will be our sixth market-beating year in a row! (And let’s hope for a much bigger lead at the end as well.)

One of the frustrating aspects of this market is that stocks have been unusually highly correlated with each other this year. This is a crucial point and every investor needs to understand what’s been happening. Let me explain it in a user-friendly way: Typically most stocks move up and down together but there’s often a minority that swims against the stream. Money managers love to key in on these “dispersion” stocks because they want to show their clients that they can stand apart from the crowd, preferably in a good way. When everybody else is zigging, the big money is going to find the guys who can zag.

The problem is that when there’s too much correlation going on, as there is now, the non-correlated area gets far too much attention. As Yogi Berra once said of a popular restaurant, “No one goes there anymore. It’s too crowded.” In more concrete terms, this helps explain why we‘re seeing such absurd valuations for stocks like Amazon.com ($AMZN) or Starbucks ($SBUX). They’re two of the few zaggers in town, so everybody has latched on.

Earlier this year, shares of Netflix ($NFLX) got a super-atomic wedgie after the company tried to…well, I’m not exactly sure. But it was pretty dumb whatever it was. Anyway, the stock got destroyed. Here’s the key part I want you to understand: The attention is going to the crash but the real story is why anyone was paying $300 for this stock in the first place (that’s 77 times trailing earnings).

That’s nuts especially when you compare it with many stodgy blue chips. For too long, Netflix was one of the few stocks that was “working.” Meanwhile, if the S&P 500 was up, say, 1% on a given day, you could be pretty sure that GE ($GE) or Walmart ($WMT) or Microsoft ($MSFT) was doing pretty much the same thing. That’s frustrating—and frustrated investors are bad investors.

Why has correlation been so high this year? It all comes down to what’s euphemistically called “headline risk,” which is better known as Europe’s unholy mess. As the problems in Europe have grown, the market has increasingly treated our market less as a market of individual equities and more as one giant mass that has a cash flow in U.S. dollars. In this case, the importance of U.S. dollars is that they’re not euros.

What happened is that the dollar trade became highly correlated with every other asset (often negatively), and within assets, stocks have become highly correlated with each other. Ideally, stocks should trade on, oh you know, things like earnings and dividends. Instead, they’re trading on what Angela Merkel may or may not do at the next five summits which will decide on how to lay out an agenda for the next 73 summits. Sorry, but that ain’t much fun. Of course, if you’re an investor in European bonds, then you probably have all the dispersion you can handle.

Since I build the Buy List for long-term performance, I don’t give a whit about being correlated or not. If you’re focused on the long-term, that’s something that comes and goes. In 2011, it’s been here in a big way and it explains why our Buy List is sticking so closely to the S&P 500. It’s just something that you have to deal with. This, too, shall pass.

While high correlation makes stock-picking harder, it also means we should focus on fundamentals all the more, since high correlation is a fleeting thing. The Chicago Board Options Exchange actually has an index that tracks implied correlation. Fortunately, in recent weeks, this index has slowly started to fall, but make no mistake, correlation is still very high.

I suspect that in 2012, we’re going to see more “dispersion trades” fall apart and many won’t be pretty. In fact, that may be happening right now with gold. It recently made a six-month low and I won’t be surprised to see a few hedge funds go under because they were heavily invested in gold and silver futures. The gold sell-off may also signal that the Fed’s “extended period” policy for low interest rates may not be so extended. But it’s just too early to say.

Another emerging “dispersion” story could be in healthcare. In this case, it’s slowly getting stronger. On Thursday, Medtronic ($MDT) closed at its highest level in nearly six months. If you recall, the company had a solid earnings report a few weeks ago and it reiterated its full-year forecast. On Tuesday, Johnson & Johnson closed above $66 for the first time since July. And even though Abbott Labs ($ABT) is set to depart our Buy List, it hit a fresh 52-week high on Thursday.

Frankly, not much has been going on this week on Wall Street. Trading volume is very low. On the economic front, the consumer confidence report was very good and the pending home sales figure was particularly strong.

The slow news will end soon as we have fourth-quarter earnings season on the horizon. Our first Buy List stock to report will be JPMorgan Chase ($JPM) on January 13th. I’m particularly looking forward to a strong earnings report from Ford ($F). Plus, the company will soon pay out its first dividend to shareholders in five years.

That’s all for now. Over the weekend, I’ll post the final numbers for this year’s Buy List. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 30, 2011

Eddy Elfenbein, December 30th, 2011 at 7:38 amEuro Set for First Consecutive Annual Drop Since 2001

Exchange Merger Deals Worth $37B Fail to Close

Italian Premier Outlines Plan to Stimulate Growth in a Struggling Economy

Spain Set to Fire Opening Salvos in Austerity Drive

Egypt’s Long-Term Currency Debt Downgraded

Oil Heads for Third Yearly Gain on Iran Tension, U.S. Economy Speculation

Tax Benefits From Options as Windfall for Businesses

AMR Delisted From NYSE a Month After Bankruptcy Filing

The Top of the Class in Deal-Making

BofA ‘Circus’ Set to Top List of 2011 Laggards

Dawn of a Year of Trading Dangerously

Google Backing Israel Entrepreneurs Amid Funding Gap

An Uproar on the Web Over $2 Fee by Verizon

TCW, Gundlach Settle Suit Over Firing, Trade Secret Theft Claims

Cullen Roche: What Really Caused the Recession?

Joshua Brown: Media: Skip the Builders, Stick With Remodeling Plays

Be sure to follow me on Twitter.

-

One Day to Go

Eddy Elfenbein, December 29th, 2011 at 6:21 pmWith one day to go, our Buy List is up 1.32% for the year to 0.43% for the S&P 500. Including dividends, our Buy List is up 3.18% to 2.55% for the S&P 500.

Unless something goes horribly wrong tomorrow, our Buy List will finish just ahead of the market. I’ll have more details tomorrow.

-

Is the 30-year Bull Market for Treasuries Already Over?

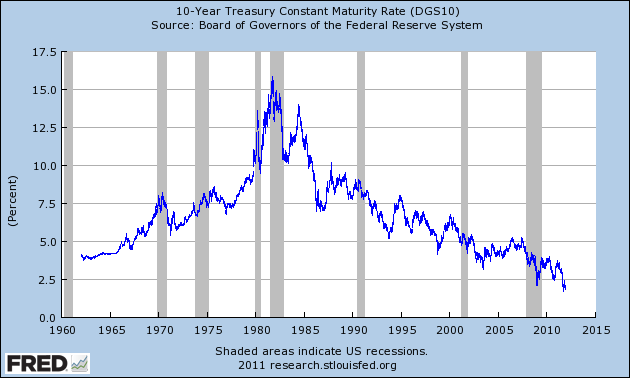

Eddy Elfenbein, December 29th, 2011 at 11:16 amI’m curious if the bond market passed an important and in fact, generational moment and few people realized it. We may look back at September 2011 as the peak of a 30-year bull market in U.S. Treasuries.

On September 16th, the one-, two- and three-year Treasuries yielded, respectively, 0.08%, 0.16% and 0.29%. Those were the lowest yields for those securities in decades.

Three days later, on September 19th, we saw generational lows in the five-, seven, 10-, and 20-year Treasuries. The respective yields were 0.79%, 1.24%, 1.72% and 2.48%. (The 30-year T-bond deserves a slight asterisk because it reached it lowest yields in late 2008.)

Of course, Mr. Bernanke and his friends have been aiding the latest surge into bonds, but let’s add some context. Almost 30 years to the day before, the 10-year hit its peak yield. On September 30, 1981, the ten-year yielded 15.84%.

Last week, the 20-year TIPs yield dropped to 0.43%. In February, it was going for 2%. The 10-year TIPs is still slightly negative.

I don’t expect to see dramatically higher yields in 2012, but it makes sense to see yields rise. Investing in Treasuries has been a winning trade for so long that I think investors may have forgotten that it doesn’t always go this way.

-

Morning News: December 29, 2011

Eddy Elfenbein, December 29th, 2011 at 7:23 amItaly Sells 7 Billion Euros of Bonds as Yields Fall

Italy’s Long-Term Borrowing Costs Decline

India to Exceed Its Record Borrowing Target

In Solar Power, India Begins Living Up to Its Own Ambitions

Tough India IPO Market Drives Deals Between Private Equity Funds

Putin’s Urals Ambitions Seen in Rotterdam Tanks

China Speeds Up QFII Approvals Amid Signs of Capital Outflow

Oil Prices Predicted to Stay Above $100 a Barrel Through Next Year

Retail Sales Resilient in Final Holiday Stretch

Global Takeovers Slump to Lowest in Year

Despite RIM Takeover Talk, Hurdles Would Be High

For IPOs, the Comeback Never Came

Mu Sigma: Is The Firm the New Wunderkind of Outsourcing?

Peugeot Joins Fiat in Sales Slump in Europe

Cavium Outlook Cut Sends EZchip to 8-Month Low

Morgan Stanley to Cut 580 Jobs in New York

Stone Street: Rolling Up Our Sleeves on Jos. A Bank

Roger Nusbaum: It’s The End of the World and Paul Farrell Knows It

Be sure to follow me on Twitter.

-

What Do You Like?

Eddy Elfenbein, December 28th, 2011 at 10:00 pmIn keeping with the refined, civilized and high-brow content of this website, I certainly hope you don’t find anything humorous in this clip.

I’m absolutely ashamed at you.

-

The Give and Take of Volatility

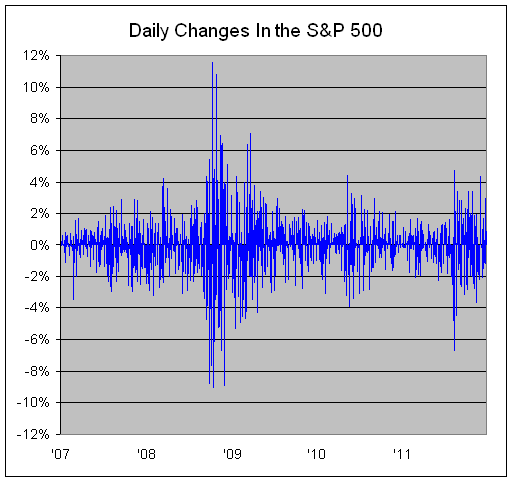

Eddy Elfenbein, December 28th, 2011 at 1:34 pmHere’s a look at all the daily changes of the S&P 500 over the last five years:

I’ve said before that volatility is used incorrectly as a scare word by many in the financial media. Volatility is rarely good or bad, especially if you’re focused on the long-term as we are. In fact, I prefer a little volatility since it helps us spot bargain stocks.

What the chart shows us — and what to keep in mind — is that volatility comes and goes. I’m not trying to sound flippant or dismissive; the numbers back it up.

We had very little volatility before the financial crisis; then we had historic volatility. Since then, volatility has flared up twice, once in the summer of 2010 and again last summer. That latest flare-up is still going, but I suspect it’s rapidly fading.

There wasn’t a single move, up or down, greater than 2.3% between September 2, 2010 and August 1, 2011. Since August 2nd, there have been 25 such moves. Like the others, this too shall pass.

I think the best way to look at volatility is as a struggle in the market for competing theses. The sharper the conflict, the greater the volatility. Once the market settles on a theme, then stability quietly returns.

-

The S&P and Sector P/E Ratios

Eddy Elfenbein, December 28th, 2011 at 1:01 pmHere’s a look at the S&P 500 plus the ten sectors along with their earnings estimates for next year and Price/Earnings Ratios.

Financials are still cheap but how much can we trust that earnings forecast?

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His