Author Archive

-

The New Buy List

Eddy Elfenbein, December 28th, 2011 at 8:52 amTo reiterate, here’s the Buy List for next year. This list will go into effect on Tuesday, January 3rd which is the first day of trading next year.

For tracking purposes, I assume the Buy List is a $1 million portfolio equally dividend into 20 positions of $50,000 each based on the closing price of December 30, 2011.

AFLAC ($AFL)

Bed, Bath & Beyond ($BBBY)

CR Bard ($BCR)

CA Technologies ($CA)

DirecTV ($DTV)

Fiserv ($FISV)

Ford ($F)

Harris ($HRS)

Hudson City Bancorp ($HCBK)

Johnson & Johnson ($JNJ)

Jos. A. Bank Clothiers ($JOSB)

JPMorgan Chase ($JPM)

Moog ($MOG-A)

Medtronic ($MDT)

Nicholas Financial ($NICK)

Oracle ($ORCL)

Reynolds American ($RAI)

Stryker ($SYK)

Sysco ($SYY)

Wright Express ($WXS)

-

J&J Breaks $66

Eddy Elfenbein, December 28th, 2011 at 8:48 amThe big European news story today was a major bond auction held in Italy and it went much better than feared, though people were fearing the worst. The Italian government sold nine billion euros’ worth of six-month debt. The rate was 3.25% which is a huge drop from last month’s auction at 6.5%.

The S&P 500 has been up for the last five trading days, and the futures are currently pointing towards a sixth rally. The market turned on October 3rd so the S&P 500 is looking to close out its best fourth quarter since 1999.

Although Abbott Labs ($ABT) will soon depart our Buy List, the stock just did a Jerome Simpson to a new 52-week high. Johnson & Johnson ($JNJ) which is an amazingly stable stock, is starting to drift higher. Yesterday, the shares closed above $66 for the first time in more than five months.

-

Morning News: December 28, 2011

Eddy Elfenbein, December 28th, 2011 at 7:27 amItaly’s Borrowing Costs Drop Sharply at Auction

NYSE, Deutsche Boerse Merger Date Extended

Afghanistan Signs Major Oil Deal with China’s CNPC

ECB Says Banks Increased Overnight Deposits

U.S. Declines to Say China Is Manipulator in Yuan ‘Quarrel’

Calgary Oil Turns Canada Into Energy Superpower

Wendy’s Adds Foie Gras Burger in Japan Return

Bernanke Drive for Openness May Include More Briefings

No Relief in Report on Housing

MetLife to Sell Bank Unit to GE Capital

A Great Divide Over Oil Riches

Times Co. Agrees to Sell Regional Newspaper Group

The High Cost of Failing Artificial Hips

‘Mismanaged’ Sears Loses Customers to Macy’s

Joshua Brown: Your Tax Dollars at Work: Case-Shiller Edition

Be sure to follow me on Twitter.

-

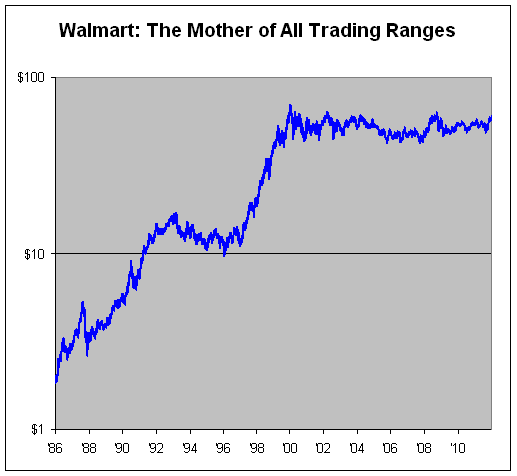

Walmart: The Mother of All Trading Ranges

Eddy Elfenbein, December 27th, 2011 at 3:28 pmOn Friday, Walmart ($WMT) closed at $59.99 and the stock doesn’t look like it will close above $60 today. That’s not too surprising. The stock of the giant retailer has been stuck in a trading range for nearly 12 years.

Think about this: Not once in over 3,000 trading days has WMT closed above $64 or below $42. The last time it did was on January 19, 2000 when it closed at $64.06.

Here’s a look at WMT’s closing prices by range:Lower Upper Count $42 $44 64 $44 $46 181 $46 $48 335 $48 $50 481 $50 $52 362 $52 $54 581 $54 $56 451 $56 $58 270 $58 $60 204 $60 $62 49 $62 $64 25 More than 78% of the time, the stock been between $48 and $59.99.

Walmart has, of course, paid a dividend over the last 12 years. Since January 2000, the dividend has added 18.1% towards its total return.

Looking at Factor Investing

Eddy Elfenbein, December 27th, 2011 at 1:02 pmThe Wall Street Journal has an interesting article on the growth of “factor investing.” I think this is a fascinating area and I’ve been interested in it since before it even had a name.

I never cared much for the traditional Capital Asset Pricing Model. Instead, I’ve been interested in areas where this model fails—and there are many. Value stocks, for example, have a long-proven ability to outperform the broader market. Low volatility is another area. The response from academics has been to assert that the model indeed still works, but we need to adjust things for these “factors” like value and low vol.

I’m afraid they’re stretching things out too far and would be best served by ditching their model. Personally, I don’t care about all about preserving models but I like the idea of keying in on factors that have shown their ability to beat the market. The question is, can we isolate these factors and invest in them reliably?

What the article fails to mention is that the important thing isn’t the factor itself. Instead, it’s the characteristic. Let me explain.

Factor investors try to isolate the particular zig and zag shape of, say, most value stocks. What they want to find is anything that correlates to that line. That’s the factor, but that’s not what’s truly important. Instead, it’s the value characteristic that’s important. Even value stocks that don’t correlate with the value factor have shown themselves to be superior performers.

Last month, Eric Falkenstein wrote:

Daniel and Titman documented that it was the characteristic, rather than the factor, that generated the value and size effects. They did an ingenious study in that they took all the small stocks, and then separated them into those stocks that were correlated with the statistical size factor Fama and French constructed, and those that weren’t. That is, of all the small stocks, some were merely small, and weren’t correlated with the size factor of Fama-French, and the same is true for some high book-to-market stocks.

Remember, in risk it is only the covariance of a stock to some factor that counts. Daniel and Titman found that the pure characteristic of being small, or having a high book-to-market ratio, was sufficient to generate the return anomaly, independent of their loading on the factor proxy. In the APT or SDF, the covariance in the return with something is what makes it risky. In practice, it is the mere characteristic that generates the return lift.

(…)

The standard equity groupings of size, value/growth, and now volatility, are best done directly, and not via an exposure to factor-mimicking portfolios.

This is pretty damaging to the standard model because it claims that you can only beat the market by paying for it with more risk. That risk can only be found by correlating with the factor. But it’s not the factor that’s beating the market, it’s the characteristic.

This is a reason why, despite my interest in factor investing, I think investors are wise to steer clear of these products. There’s no magic formula out there besides “focus on good stocks and wait.”

Consumer Confidence Surges In November

Eddy Elfenbein, December 27th, 2011 at 11:05 amI hope everyone had a nice three-day weekend. On Friday, the stock market closed at its highest level in six weeks. That’s especially impressive to see investors willing to hold stocks over the long weekend. We also broke above the 200-day moving average.

The S&P 500 is modestly higher this morning, although this should be a very quiet week of trading. The only major news is that shares of Sears ($SHLD) are getting clocked for a 20% loss this morning on the news that it’s closing 120 stores due to poor sales.

I have a feeling that at the end of this week, the S&P 500 won’t be terribly far from 1257, which is where the index started the year.

On Friday, the government reported that personal income and consumer spending both rose by 0.1% last month. Frankly, that’s pretty tepid but it basically fits with my view that the economy is recovering at a slow pace. The durable goods report was a bit stronger. It showed a 3.8% increase for November, which is the biggest gain in four months.

Today’s consumer confidence report was very strong. The index popped from 55.2 to 64.5. Wall Street was expecting 59.

Morning News: December 27, 2011

Eddy Elfenbein, December 27th, 2011 at 6:45 amItalians Cut Spending in Worst Christmas in 10 Years

In Europe, Securities Overseer Spreads Gospel of Streamlined Regulation

Currency Agreement for Japan and China

China Investment Wave Unlikely to Swamp EU

Iran Regime Profiting From Sanctions: U.S.

Japan to Ease Ban on Arms Exports

China 2012 Rare-Earth Export Quota Almost Same as This Year

U.S. Rental Demand Lifts Housing Sector

S&P Index in 2011 Moves Least Since 1970

Obama Wins Most Demand for Debt Since 1995

TV Prices Fall, Squeezing Most Makers and Sellers

Sony to Cease Its Flat-Screen Partnership With Samsung

E&Y Audit Panel Says No Violations in Olympus Handover

Howard Lindzon: The Mattress ‘Sell’ Indicator…or What is the Stock Market ‘Sleep Number’

Epicurean Dealmaker: TED’s Greatest Hits of 2011

Be sure to follow me on Twitter.

The Decline of Education

Eddy Elfenbein, December 26th, 2011 at 6:43 pmHere’s part of an interesting discussion with Alex Tabarrok and Russ Roberts:

What’s wrong with our education system? Let’s talk about K-12. Here’s two remarkable facts, which have just blown me away. Right now, in the United States, people 55-64 years old, they are more likely to have had a high school education than 25-34 year olds. Just a little bit, but they are more likely.

So, you look everywhere in the world and what do you see? You see younger people having more education than older people. Not true in the United States. That is a shocking claim. Incredible. And the reason is that the drop-out rate has increased? Exactly. So, the high school dropout rate has increased. Now, 25% of males in the United States drop out of high school. And that’s increased since the 1960s, even as the prospects for a high school dropout have gotten much worse.

We’ve seen an increase, 21st century–25% of males not graduating high school. That’s mind-boggling. Why? One of the underlying facts relating to education, which is has stayed true, which is that the more education you get on average–and I’m going to talk about why on average can be very misleading–high school graduates do better than high school dropouts; people with some college do better than high school graduates; people graduating from college do better than people with some college; people with graduate degrees do better than college grads. And the differences are large. Particularly if you compare a college graduate to a high school dropout, there is an enormous difference. So, normally we would say: Well, this problem kind of solves itself. There’s a natural incentive to stay in school, and I wouldn’t worry about it. Why should we be worrying about it? It doesn’t seem to be working. Why isn’t it working and what could be done? I think there’s a few problems. One is the quality of teachers I think has actually gone down. So I think that’s a problem.

Morning News: December 26, 2011

Eddy Elfenbein, December 26th, 2011 at 6:30 amFair Trade Proving Anything But in $6 Billion Market

S.Korea Delegation Heads North as Kim Jong Un Elevated

Nigeria Christmas Day Bombings Kill at Least 26

Yuan Hits All-time High, On Track for Over-4% Gain in ’11

China May Establish Credit-Rating Companies

Abu Dhabi Aldar Board to Discuss Sale of Some Assets, Projects This Month

IMF’s Lagarde Warns Global Economy Threatened

China, Japan to Back Direct Trade of Currencies

Turkey, Azerbaijan Agree on 7 Billion Euro Gas Pipeline Plan

American Firms See Europe Woes as Opportunities

A Year of Disappointment at the Movie Box Office

Sony to Sell LCD Venture Stake to Samsung for $940 Million

Fukushima Probe Highlights Nuclear Regulator

Cullen Roche: Will The Shorter Business Cycle Lead To Recession in 2012?

Jeff Miller: Weighing the Week Ahead: A Respite from European Concerns?

Be sure to follow me on Twitter.

Merry Everything!

Eddy Elfenbein, December 24th, 2011 at 12:19 pmI want to wish everyone a Merry Christmas and a happy, healthy and profitable New Year.

The past year has been a great one for Crossing Wall Street. Our Buy List is in the black, and the e-letter has grown by leaps and bounds. I want to thank all my readers for their continued support.

I also owe major thanks to Howard Lindzon, Phil Pearlman and the team at StockTwits. I also want to thank Marcia Hippen for her invaluable editing skills and for helping me get the e-letter out each week.

Let’s hope 2012 brings us more profits—in all our endeavors.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His