Author Archive

-

Dividends Growing at the Fastest Rate in 35 Years

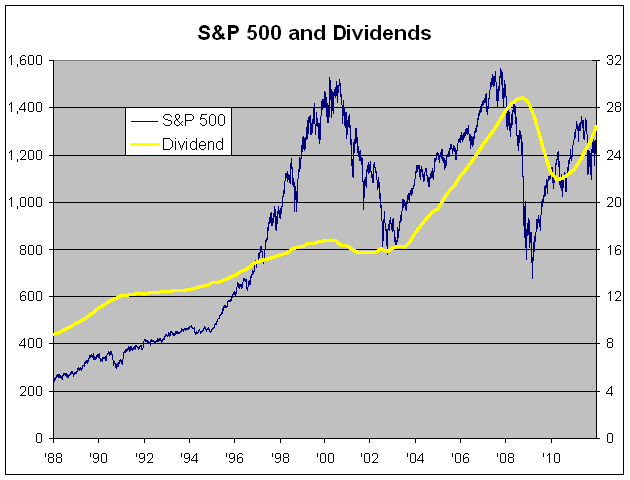

Eddy Elfenbein, January 6th, 2012 at 1:55 pmHere’s another look at how dividends have come back into play. The blue line is the S&P 500 and it follows the left scale. The yellow line is dividends and it follows the right scale. The two lines are scaled at a ratio of 50-to-1 which means that the dividend yield is exactly 2% whenever the lines cross.

What I like about looking at dividends is that dividends don’t lie. Earnings, book value and cash flow can all be distorted. But when a company sends you a check, you can be pretty sure they earned it.

I also like dividends because the dividend line tends to be very stable, especially compared with earnings and stock prices. Companies do not like to cut their dividend payments. They will if they have to, but it’s something they try to avoid.

This last recession was unusual because many financial companies had to slash their dividends or get rid of them entirely. By looking at dividends, you can see how absurdly cheap the market was in early 2009.

Dividends have been growing for the last seven quarters in a row. For Q4, dividends were up 20.62% from a year before. That’s the strongest quarterly growth since Q4 1976. (Note: Howard Silverblatt of S&P notes that due to actual payment days, the increase in Q3 dividends was minor, while Q4 was larger.)

-

106-Year-Old Stockbroker

Eddy Elfenbein, January 6th, 2012 at 12:10 pm(Via: Todd Sullivan)

-

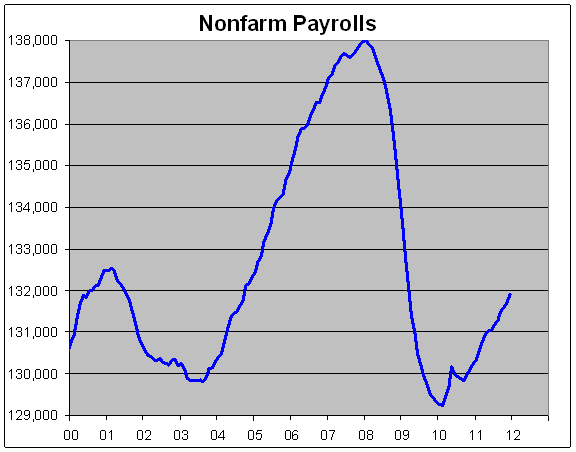

200,000 New Jobs in December

Eddy Elfenbein, January 6th, 2012 at 10:23 amThe unemployment rate drops to 8.5%.

Employment grew solidly last month and the jobless rate dropped to a near three-year low of 8.5 percent, offering the strongest evidence yet of an acceleration in economic activity.

Nonfarm payrolls increased 200,000 last month, the Labor Department said on Friday, the most in three months and way above economists’ expectations for a 150,000 gain.

The economy needs to sustain the current pace of job creation to signal a robust recovery is finally under way.

The unemployment rate dropped from a revised 8.7 percent in November, which was previously reported as 8.6 percent. The jobless rate is now the lowest since February 2009.

Since the recession officially ended 30 months ago, the economy has created 1.4 million jobs. In the 18 months before that, we lost 7.5 million jobs.

-

CWS Market Review – January 6, 2012

Eddy Elfenbein, January 6th, 2012 at 5:20 amThe stock market has gotten off to a good start in 2012. The S&P 500 has risen all three trading days this year and is already in the black by 1.87%. Of course it’s still early, but after all the frustrations of 2011 I’m happy to see some gains.

The S&P 500 closed Thursday at 1,281.06 which is its highest close since October 28th, and it’s a wee 0.33% rally away from hitting a five-month high. Since October 3rd, the index has surged more than 16.5%. There could be more good news ahead—the S&P 500 is currently above both its 50- and 200-day moving averages and that’s often a sign of a strong market.

Some of our Buy List stocks are also enjoying a nice rally. Through Thursday, JPMorgan Chase ($JPM) is up 7.31% for the year. Hudson City ($HCBK), one of our new picks, is up 6.72% and Ford ($F), a big under-performer last year, is up by 7.71%. It’s interesting that many of our poorer-performing stocks from 2011 are leading the charge so far in 2012.

In this issue of CWS Market Review, I want to explain an important market development in more depth. Namely, the U.S. market continues to divorce itself from the mess in Europe. I’ve talked about this in recent issues of CWS Market Review, but we’re really seeing this trend accelerate.

Putting it in basic terms, a weaker euro no longer automatically means a weak U.S. stock market. From mid-September until mid-December, the weak euro/weak market connection had been the rule. But as the Santa Claus Rally arrived and boosted U.S. stocks, the euro continued to sink like a…well, European Union currency. The euro just hit a 15-month low against the U.S. dollar.

What really caught my eye was on Thursday when Italian bond yields jumped back above 7% despite buying by the ECB. Seven percent is considered to be the point at which people who worry about such things start to worry. Not too long ago, 7% rates in Italy would have almost surely triggered selling in our market. But not this time. U.S. stocks took the news in stride.

So why is the U.S. market disentangling itself from Europe? The reason is that the economic news continues to look promising. For example, Tuesday’s ISM report came in at 53.9 which was above expectations. That’s the 29th report in a row signaling an economic expansion. Earlier this year the ISM plunged, and that was one of the signs Double Dippers took for an imminent recession. They were wrong. The ISM quickly stabilized itself and the December report was the highest in six months.

I like to keep a close eye on the monthly ISM report because it has a good tracking record of lining up with recessions and expansions. For now, a reading of 53.9 is well inside the safe zone. The ISM has fallen between 53.0 and 55.0 a total of 100 times and just two of those have been official recessions.

As hard as it may be to believe, even U.S. manufacturing is coming back to life. But the most encouraging economic news came on Thursday when the private payroll company ADP ($ADP) said that the U.S. economy created 325,000 new jobs last month. That was a huge shocker. Wall Street was expecting 178,000.

I have to explain that the ADP report is just the pre-game show. The big kahuna is the official Labor Department report which comes out Friday morning (be sure to check the blog for the latest). The ADP report is welcome news because the jobs market has been one area of the economy that has shown almost zero improvement. Let me caution you that the ADP report isn’t always an accurate bellwether of the government’s report. But if it is, then this would be one of the best jobs reports in years. The consensus on Wall Street is for an increase of 150,000 in nonfarm payrolls.

I want to be clear that the economy is still in very bad shape and millions of Americans are without jobs, but after three years we may finally have evidence of good news. Green shoots, at last.

So what does this mean for us investors? One outcome would be higher bond yields. Actually, that’s already happening as Treasury yields have gradually climbed higher since December 19th. On Thursday, the 30-year T-bond got to 3.06% which is the highest yield in nearly a month. The yield on the 10-year has soared all the way to—are you sitting down?—2.03%. Ok, ok, that’s still very low, but bear in mind that it’s an increase of 30 basis points since September 22nd. (By the way, I think September 2011 may have marked a generational low in bond yields).

Another effect of stronger economic data is that the underperformance of cyclical stocks has most likely passed. Last year, I warned investors to steer clear of stocks of companies whose businesses are heavily tied to the economic cycle (energy, transports, industrials, etc.). Early in 2011 cyclicals started to underperform, and by the summer, the bottom fell out. In less than three months, the Morgan Stanley Cyclical Index (^CYC) lost one-third of its value. Now, however, cyclicals aren’t nearly as dangerous. For us, this means that Buy List stocks like Ford ($F), Harris ($HRS) and Moog ($MOG-A) have a good shot of being our top performers this year.

Earlier I mentioned how some of last year’s duds now look like star performers. It’s not just happening on our Buy List. Look at the Homebuilder ETF ($XHB) which has soared 44% in the last three months. This is a sector that’s seen almost nothing but bad news for years. Even the financials, particularly the non-bank financials, are showing some life. Since December 19th, the Financials ETF ($XLF) has added 10%.

While the macro-economy is getting better, I need to explain one apparent contradiction and that’s that the news for corporate profits won’t be as good. Corporate profits had been the one area of the economy that was doing fairly well. For the last several quarters, companies consistently beat analysts’ expectations.

But now companies have been busy lowering expectations. Just this week, both Target ($TGT) and Eli Lilly ($LLY) gave lower earnings guidance. Part of this is about managing expectations. But another part is that many companies have run out of room to increase profit margins. Until now, they’ve increased margins not by raising prices but by cutting costs. In other words, laying people off. Oddly enough, the corporate earnings story is the opposite side of the coin of the jobs story.

Make no mistake, earnings are still good. They just won’t be quite as good as many people thought a few weeks ago. Wall Street currently expects the S&P 500 to earn $24.31 for Q4. That’s an increase of 10.85% over a year ago, but it’s a drop of 3.88% from Q3. (I should also mention that what’s left of AIG will have an unusual impact on overall earnings.) If that forecast is right, it would bring the full-year total for 2011 to $97.02. Again, let’s look at the big picture: that’s a 70% increase from two years before.

There are lots of good bargains on the Buy List. Wright Express ($WXS) looks good. CA Technologies ($CA), one of our new stocks, also looks good here. AFLAC ($AFL) got as high as $45.27 on Thursday which is its highest price in a month. Plus, shares of Ford ($F) look like they’re about to break out above $12. The upcoming earnings season should be a big help for us.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: January 6, 2012

Eddy Elfenbein, January 6th, 2012 at 5:19 amGermany is Biggest Obstacle to Emergency Fund: Knot

Hungary Pledges Compromise on IMF Loan

French Debt Costs Rise at Bond Sale as AAA Decision Looms

IMF’s Lagarde: Euro Likely to Survive 2012

Pay Jumps 25% for Brazilian Investment Bankers

Crude Oil Futures Head for Weekly Gain on U.S. Economy, Iranian Tensions

Samsung Profit Rises to Record on Galaxy Sales

Alcoa Earnings Estimates Plunge After Aluminum Drop

Barnes & Noble Considers Spinning Off Its Nook Unit

Private Equity Firm Sees a Future in Flatware

Japan Retailer Seven & I Q3 Profit Rises, Aeon Falls

Former Chief Ends a Bid for Overhaul at Olympus

Caroline Baum: Fed’s New Wordplay to Yield Negligible Results

Paul Kedrosky: Airline Safety Soars

Be sure to follow me on Twitter.

-

2011: The Year of the Dividend

Eddy Elfenbein, January 5th, 2012 at 1:29 pmForget the protestors or Bin Laden or Gaddafi or Arab Spring, 2011 was “The Year of the Dividend.” I saw this press release from S&P and thought I’d share it with you:

S&P Indices announced today that dividend increases reached $50.2 billion in 2011, an 89.2% rise over the $26.5 billion in dividend increases posted in 2010. For the full year, S&P Indices reported 1,953 dividend increases – a 13.0% jump over the 1,729 dividend increases reported in 2010. Only 101 companies, of the approximately 7,000 publicly that report dividend information, decreased their dividend in 2011 versus 145 in 2010.

“Dividends had a great year in 2011, with actual cash payments increasing over 16% and the forward indicated dividend rate up 18%,” says Howard Silverblatt, Senior Index Analyst at S&P Indices. “Payout rates (which historically average 52%) remain near their lows at under 30%, yields remain relatively high compared to alternative investments, and companies have strong cash-flow and cash reserves giving them considerable room to increase payments. At this point, we expect 2012 to set a new record for dividend payments, with the indicated rate surpassing the old record set in June of 2008.”

For the fourth quarter of 2011, dividend increases decline 6.8% with 649 issues increasing their dividends versus the 698 that did so during the fourth quarter of 2010. The percentage of issues paying a dividend increased in the fourth quarter, with 41.4% of the issues paying a cash dividend, up from 40.0% at the end of the third quarter. Silverblatt also determined that yields for paying issues decreased to 2.80% at the end of the fourth quarter, compared to 2.99% at the end of the third quarter.

“Yields still remain relatively high, with the quarterly decline due mostly to the 11% price increase,” notes Silverblatt. “The fourth quarter decline in dividend increases was the result of a sharp 44% increase in Q4 2010, as the market entered a recovery period.”

Additionally, Silverblatt reports that individual investors have saved $314 billion on qualified dividend tax cuts from 2003 through 2011, with another $44 billion in saving expected in 2012 before the legislation expires. “As Washington works through revenue requirements and expenditures, the post 2012 tax outlook treatment for dividends is very much in play,” adds Silverblatt.

“For 2012, we expect to see dividend increases continue across the board for all sectors with another double-digit gain in actual cash payments. Given underlying fundamentals, low payouts and cash reserves, we expect 2012 to set a new record for dividends despite lingering concerns over the economy.”

-

Morning News: January 5, 2012

Eddy Elfenbein, January 5th, 2012 at 4:31 amFrance Seeks Lower Yield at Bond Sale

UniCredit CEO Confident on Success of Rights Issue

Deeper Cuts Needed to Save Greece: Papademos

Japan Chain Pays Record $730,000 For Tuna

Oil Trades Near 8-Month High as Iran Tension Counters Europe Debt Crisis

Oil Price Would Skyrocket if Iran Closed the Strait of Hormuz

Q+A: Why the Fed is Publishing Interest Rate Forecasts

Good Year for Autos, but a Test Waits in ’12

Toyota’s 2011 Sales in China Increase 4%

Fiat Raises Chrysler Stake to 58.5 % With New Dodge in Step Toward Merger

Yahoo’s New CEO Aims at Turnaround as Outlook Dims

Starbucks Raises Prices in U.S. Northeast, Sunbelt

Harder for Americans to Rise From Lower Rungs

Aleph Blog: Stock Prices Versus Implied Inflation

Jeff Miller: Bespoke Investment Group and Forecasting Follies

Be sure to follow me on Twitter.

-

Coast to Coast

Eddy Elfenbein, January 4th, 2012 at 8:33 pm -

My Watch List

Eddy Elfenbein, January 4th, 2012 at 2:10 pmI’m often asked how I go about picking stocks for my Buy List. The answer is really quite simple. I don’t have a magic formula and I hate stock screeners.

Instead, I have a Watch List of about 100 stocks that I try to follow. These are what I would call “really good companies.” They’re in the top tier of Corporate America. It’s taken me years to build up this list and I change it often.

The Watch List serves as the minor leagues for my Buy List. It’s from this list that almost all candidates for the Buy List come, and it’s where they return after they’ve been deleted.

Let me make it clear that I’m not recommending any of these stocks listed below. That’s what the Buy List is for. I just wanted to show you which stocks make the first cut in the process. If a stock is a on this list, you can be pretty sure it’s a decent company (the price may not be).

My secret formula is nothing more than watching really good companies and making a move when the price looks good.

Company Symbol Abbott Laboratories ABT AmerisourceBergen ABC AT&T T AutoZone AZO Balchem BCPC Ball BLL Baxter International BAX Becton Dickinson BDX Biogen Idec BIIB C.H. Robinson Worldwide CHRW Cerner CERN Charles Schwab SCHW Church & Dwight CHD Clorox CLX Coach COH Coca-Cola KO Cognizant Technology Solutions CTSH Colgate-Palmolive CL Community Health Systems CYH Compuware CPWR Costco Wholesale COST Cummins CMI CVS Caremark CVS Danaher DHR Darden Restaurants DRI DaVita DVA Deluxe DLX Dentsply International XRAY Dolby Laboratories DLB Donaldson DCI Expeditors International EXPD Express Scripts ESRX FactSet Research Systems FDS Fair Isaac FICO Fastenal FAST FLIR Systems FLIR Flowers Foods FLO Flowers Foods FLO FMC Technologies FTI Forest Laboratories FRX General Dynamics GD Gilead Sciences GILD Graco GGG Hasbro HAS Hormel Foods HRL Hospira Inc HSP Humana HUM IBM IBM Infosys Limited INFY Intel INTC IntercontinentalExchange ICE Internationa Flavors & Fragrances IFF Intuit INTU Intuitive Surgical ISRG Iron Mountain IRM J.M. Smucker SJM L-3 LLL Lincare LNCR ManTech MANT McCormick MKC McDonald’s MCD Microsoft MSFT Nike NKE Progressive PGR Public Storage PSA Quest Diagnostics DGX Raven Industries RAVN RLI Corp. RLI Ross Stores ROST Seaboard SEB SEI Investments SEIC Seneca Foods SENEA Sigma-Aldrich SIAL Snap-On SNA St. Jude Medical STJ Starbucks SBUX State Street STT Stericycle SRCL Target TGT Teradata TDC Thermo Fisher TMO Tiffany TIF TJX TJX U.S. Bancorp USB United Technologies UTX V.F. Corporation VFC Varian Medical Systems VAR Visa V W.W. Grainger GWW Walgreen WAG Waters WAT WellPoint WLP Wells Fargo WFC Western Union WU Weyco WEYS Yum! Brands YUM Zimmer ZMH Ford’s Impressive 2011

Eddy Elfenbein, January 4th, 2012 at 1:30 pmShares of Ford ($F) are doing well today on the news that the company reported very good sales for 2011. Here are some highlights from today’s press release:

U.S. sales of the Ford brand totaled 2,062,915 vehicles in 2011, sealing its first three-point market share gain over three consecutive years since 1970

Ford brand small car sales were up 25 percent in 2011, with 244,291 vehicles sold, while utilities increased 31 percent with 579,626 sales. Ford sold 584,917 F-Series pickups in 2011, making it the best-selling truck for 35 consecutive years and the best-selling vehicle for 30 years

Ford posts best December retail sales month since 2005; total company sales in December were up 10 percent

The company said it expects the U.S. economy to expand by 2% to 3% this year. The stock got as high as $11.53 today which is a two-month high.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His