Author Archive

-

Morning News: January 4, 2012

Eddy Elfenbein, January 4th, 2012 at 6:49 amEuro-Area Inflation Slows, Giving ECB Room

Italy’s UniCredit Offers Heavy Share Discount

Turkish Lira Gains as Central Bank Sells Dollars for Fourth Day

Macau Gambling Revenue Rose 42% Last Year

Oil Trades Near 8-Month High on Iran Tension, Shrinking Supply

Against Euro and Yen, Dollar Defied Reality

Fed Shows Rate Forecasts, Boosts Transparency

Bank Earnings Jump 57% in Analyst Forecasts

Online Sales Buoy U.P.S. and FedEx

France’s Total in $2.3 billion U.S. Shale Gas Deal

Swiss National Bank Chief’s Wife Defends Dollar Trades

WJB Faced 25% Interest on Some Debt Ahead of Brokerage Shutdown

Chinese Retailer Casts Doubt on TV Investigation

Edward Harrison: Krugman, Tabarrok, Cowen and the Bond Vigilante Fallacy

Joshua Brown: UBS: Fed’s New Interest Policy Will Increase Confusion, Not Clarity

Be sure to follow me on Twitter.

-

Fourth-Quarter Earnings Guidance

Eddy Elfenbein, January 3rd, 2012 at 10:44 pmBarron’s has a round-up of Q4 earnings guidance (h/t: Tadas). I counted them up: 27 positive, nine inline and 96 negative.

This is hardly scientific but it tells us that earnings estimates may be coming down in the weeks ahead. Q4 earnings reports will start next week.

-

Ross Stores’ Amazing Record

Eddy Elfenbein, January 3rd, 2012 at 4:08 pmI’m usually a bit wary of investing in retail although there are a few good names. One stock that deserves attention is Ross Stores ($ROST).

I can’t fully stand behind these numbers, but I believe Ross has one of the most impressive dividend records around. The company has increased its dividend for 17 straight years, which is every year that it’s paid one. According to my numbers, the company has raised its dividend by at least 14% for 16 of the last 17 years. I can’t confirm that, but it appears to be correct.

The stock just finished a blowout year and two weeks ago had a 2-for-1 split. In a few weeks, I expect to see another impressive dividend increase.

I don’t believe that last dividend data point on the chart was adjusted for the stock split.

-

Me on Lehman Brothers

Eddy Elfenbein, January 3rd, 2012 at 3:11 pmEvery once in a while I get one right. Six years ago, I listed some thoughts for 2006. Here’s what I said about Lehman Brothers:

There’s something about Lehman Brothers (LEH) that I just don’t get. Every quarter they put up great numbers. I can’t put my finger on it, but I don’t see where all the growth comes from. How can they consistently do what others can’t? Maybe the company really is that good. Maybe not.

True, I didn’t exactly call them out, but I was questioning them when many others were not.

-

Starbucks Is Overpriced at $45

Eddy Elfenbein, January 3rd, 2012 at 1:30 pmI like Starbucks ($SBUX) a lot but I’m afraid the stock has run well past a fair price. The shares closed the year at $46.01 which is 30 times trailing earnings and 25 times the estimate for future earnings. Starbucks is good, but not that good.

The chart below shows SBUX over the last three years along with its P/E Ratio and trailing earnings. Right now, I’d say that a fair price is about $35. By that I mean $35 is fair, not a bargain.

The company said today that it will be raising prices. Earlier, Starbucks had said that higher commodity prices will take 21 cents per share off its earnings for this fiscal year.

(To be fair, I completely missed the great buying opportunity three years ago.)

-

A Look at the Long View

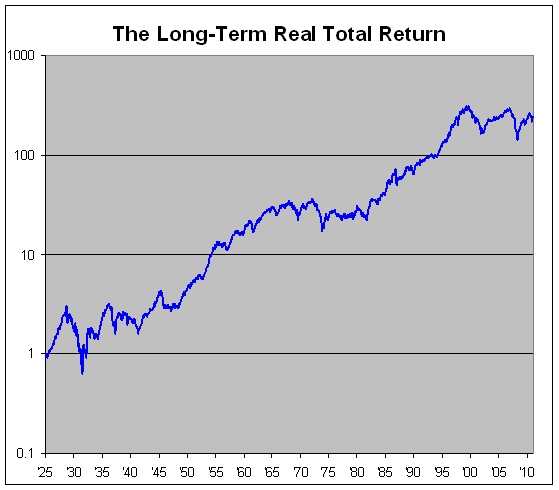

Eddy Elfenbein, January 3rd, 2012 at 11:01 amSince the start of the century (and millennium), the stock market has been a disaster. Taking a step back to look at the numbers, it’s truly remarkable.

From the end of 1999 to the end of 2011, the S&P 500 dropped 13.58%. Dividends added 23.59%. But over those 12 years inflation was 34.69%. That adds up to a real total return of -20.70%.

You would often hear money managers say that the real long-term return of the stock market was 8%, and that’s what it was from 1925 to 1999. But the last 12 years have been so bad that it’s taken that 8% number down to 6.58%.

This means that historically, the stock market more than doubles your money in real terms every 12 years, but over the last 12 years, it’s down 20%.

-

And…We’re Off!

Eddy Elfenbein, January 3rd, 2012 at 10:28 amThe 2012 trading year is underway and it looks to be a very good day. The S&P 500 has been as high as 1,284.41 today. We’re very close to our highest close since August 1st which was 1,285.09 from October 28th.

The ISM Index report for December came out today at 53.9. It was 52.7 in November. This was the 29th-straight month that the ISM was over 50. Wall Street was expecting 53.2.

Our Buy List is rocking it so far. AFLAC ($AFL) is above $45. JPMorgan Chase ($JPM) is up close to 5%. The whole list is up about 2% so far.

-

Morning News: January 3, 2012

Eddy Elfenbein, January 3rd, 2012 at 5:42 amWorld’s Biggest Economies Face $7.6 Trillion Debt

In Euro Zone’s Crisis, Technocrat in Paris Works Behind the Scenes

German Jobless Rate Sees Surprise Fall

Nigeria Braces for Gas-Price Protests

President Hu: West Is Using Cultural Means to Divide China

Crude Advances in New York Amid Manufacturing Expansion, Tension Over Iran

Same-store Sales Seen Up 4.3 Percent in December

For 2012, Signs Point to Tepid Consumer Spending

On Wall Street, a Renewed Optimism for Deals

Total Buys $2.32 Billion Shale Stake, Helping Chesapeake Pare Its Debt

Exxon’s Pursuit of Venezuelan Cash ’Not Over Yet’ After Ruling

Macau Gambling Revenue Rose 42% in 2011

VW’s Bentley 2011 Sales Jump 37% on China

NYTimes Dealbook: Raising a Glass to 2011

Jeff Carter: Stimulus and Debt are Manna From Heaven

James Altucher: My Last Death Threat in 2011

Be sure to follow me on Twitter.

-

Morning News: January 2, 2012

Eddy Elfenbein, January 2nd, 2012 at 6:30 amEuro Leaders Aim to Buy Time to Save Currency

Austerity Reigns Over Euro Zone as Crisis Deepens

China Export Orders Show Threat From Europe

India PMI Expands at Fastest Pace in 6 Months

South Korea Manufacturing Falls

Venezuela Is Ordered to Pay $900 Million to Exxon Mobil

Nigeria to End Gasoline Subsidy Accounting for 25% of Government Spending

India to Allow Individual Foreign Investors to Buy Local Shares Directly

U.S. Consumer in the Slow Lane

Samsung, Hyundai Workers Brace for Uncertainty

In Flop of H.P. TouchPad, an Object Lesson for the Tech Sector

The Danger of an Attack on Piracy Online

Epicurean Dealmaker: Turn the Page

Howard Lindzon: Starting 2012 – My Gameplan.

Stone Street: 2012 “Predictions” from Stone Street Advisors Team & Friends

Be sure to follow me on Twitter.

-

The 2012 Buy List

Eddy Elfenbein, December 31st, 2011 at 3:29 pmHere’s my 2012 Buy List. For tracking purposes, I assume it’s a $1,000,000 portfolio and that each position is worth $50,000. When I discuss how well the Buy List is doing, I’m referring to this list. Here’s each stock, ticker, starting price, number of shares and starting balance:

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His