Author Archive

-

Morning News: December 27, 2011

Eddy Elfenbein, December 27th, 2011 at 6:45 amItalians Cut Spending in Worst Christmas in 10 Years

In Europe, Securities Overseer Spreads Gospel of Streamlined Regulation

Currency Agreement for Japan and China

China Investment Wave Unlikely to Swamp EU

Iran Regime Profiting From Sanctions: U.S.

Japan to Ease Ban on Arms Exports

China 2012 Rare-Earth Export Quota Almost Same as This Year

U.S. Rental Demand Lifts Housing Sector

S&P Index in 2011 Moves Least Since 1970

Obama Wins Most Demand for Debt Since 1995

TV Prices Fall, Squeezing Most Makers and Sellers

Sony to Cease Its Flat-Screen Partnership With Samsung

E&Y Audit Panel Says No Violations in Olympus Handover

Howard Lindzon: The Mattress ‘Sell’ Indicator…or What is the Stock Market ‘Sleep Number’

Epicurean Dealmaker: TED’s Greatest Hits of 2011

Be sure to follow me on Twitter.

-

The Decline of Education

Eddy Elfenbein, December 26th, 2011 at 6:43 pmHere’s part of an interesting discussion with Alex Tabarrok and Russ Roberts:

What’s wrong with our education system? Let’s talk about K-12. Here’s two remarkable facts, which have just blown me away. Right now, in the United States, people 55-64 years old, they are more likely to have had a high school education than 25-34 year olds. Just a little bit, but they are more likely.

So, you look everywhere in the world and what do you see? You see younger people having more education than older people. Not true in the United States. That is a shocking claim. Incredible. And the reason is that the drop-out rate has increased? Exactly. So, the high school dropout rate has increased. Now, 25% of males in the United States drop out of high school. And that’s increased since the 1960s, even as the prospects for a high school dropout have gotten much worse.

We’ve seen an increase, 21st century–25% of males not graduating high school. That’s mind-boggling. Why? One of the underlying facts relating to education, which is has stayed true, which is that the more education you get on average–and I’m going to talk about why on average can be very misleading–high school graduates do better than high school dropouts; people with some college do better than high school graduates; people graduating from college do better than people with some college; people with graduate degrees do better than college grads. And the differences are large. Particularly if you compare a college graduate to a high school dropout, there is an enormous difference. So, normally we would say: Well, this problem kind of solves itself. There’s a natural incentive to stay in school, and I wouldn’t worry about it. Why should we be worrying about it? It doesn’t seem to be working. Why isn’t it working and what could be done? I think there’s a few problems. One is the quality of teachers I think has actually gone down. So I think that’s a problem.

-

Morning News: December 26, 2011

Eddy Elfenbein, December 26th, 2011 at 6:30 amFair Trade Proving Anything But in $6 Billion Market

S.Korea Delegation Heads North as Kim Jong Un Elevated

Nigeria Christmas Day Bombings Kill at Least 26

Yuan Hits All-time High, On Track for Over-4% Gain in ’11

China May Establish Credit-Rating Companies

Abu Dhabi Aldar Board to Discuss Sale of Some Assets, Projects This Month

IMF’s Lagarde Warns Global Economy Threatened

China, Japan to Back Direct Trade of Currencies

Turkey, Azerbaijan Agree on 7 Billion Euro Gas Pipeline Plan

American Firms See Europe Woes as Opportunities

A Year of Disappointment at the Movie Box Office

Sony to Sell LCD Venture Stake to Samsung for $940 Million

Fukushima Probe Highlights Nuclear Regulator

Cullen Roche: Will The Shorter Business Cycle Lead To Recession in 2012?

Jeff Miller: Weighing the Week Ahead: A Respite from European Concerns?

Be sure to follow me on Twitter.

-

Merry Everything!

Eddy Elfenbein, December 24th, 2011 at 12:19 pmI want to wish everyone a Merry Christmas and a happy, healthy and profitable New Year.

The past year has been a great one for Crossing Wall Street. Our Buy List is in the black, and the e-letter has grown by leaps and bounds. I want to thank all my readers for their continued support.

I also owe major thanks to Howard Lindzon, Phil Pearlman and the team at StockTwits. I also want to thank Marcia Hippen for her invaluable editing skills and for helping me get the e-letter out each week.

Let’s hope 2012 brings us more profits—in all our endeavors.

-

CWS Market Review – December 23, 2011

Eddy Elfenbein, December 23rd, 2011 at 7:16 amMerry Christmas!

Santa Claus made an early arrival this year as the S&P 500 rallied for the last three days in a row, and we’re one good push from hitting our highest close in six weeks. The stock market will be closed on Monday so there are only five trading days left in 2011. As of now, our Buy List holds a slight lead over the S&P 500. As I’ve mentioned before, this could be our fifth-straight year of beating the market but it looks like it will come down to the wire.

Unfortunately, our Buy List wasn’t helped this week by our two stocks that reported earnings. First, Oracle ($ORCL) got body-slammed for an 11.7% loss on Wednesday after the company reported earnings three cents short of expectations. This is especially embarrassing for me because I told you Oracle would beat expectations by at least three cents per share. Ugh! I’ll have more on Oracle in a bit but I’ll tell you now that I still like the stock and that it is a member of the 2012 Buy List.

The other bad apple was Bed Bath & Beyond ($BBBY) which got a 6.3% haircut on Thursday. However, this story is very different from Oracle’s because I was very impressed with BBBY’s earnings report. They beat their forecast and raised full-year guidance for the third time this year. I’ll go into BBBY’s outlook in more detail in just a bit.

While I’m keeping BBBY on next year’s Buy List, if you’re thinking of starting a new position here, I’d caution you that the stock is on the expensive side. The Street’s estimates for next year’s earnings strike me as overly-optimistic. Still, BBBY is an outstanding company.

Remember that the 2012 Buy List will go into effect on Tuesday, January 3rd (the market will be closed on January 2nd). To reiterate, the new buys are CA Technologies ($CA), Hudson City Bancorp ($HCBK), CR Bard ($BCR), Harris ($HRS) and DirecTV ($DTV). The deletions are Abbott Labs ($ABT), Becton, Dickinson ($BDX), Deluxe ($DLX), Gilead Sciences ($GILD) and Leucadia National ($LUK).

I like to pre-announce the new Buy List so that no one can claim I use any tricks in getting a head start. This is actually hurting me this year. Since I announced the new picks, Harris is up by 7% and Hudson City is up 9%. While these gains don’t count for my 2012 track record, there’s nothing stopping you from getting in on the action.

Now let’s take a closer look at why stocks have been in a better mood lately. The reason is rather simple: the economic news continues to look promising. To be sure, we’re a long way from robust economic health, but things are looking better nearly every week. More importantly, the market is slowly realizing that we can prosper even as our friends across the pond are, shall we say…having difficulties.

Last week, I highlighted the very good jobless claims report. It was even better this week. There were 364,000 claims for initial unemployment insurance which is the lowest number since April 2008. This probably means that about 200,000 net new jobs are being created each month. Goldman Sachs estimates that any jobless claims figure reading below 435,000 indicates that the economy is creating more jobs.

The brighter economic news is having an important effect on consumers. This is crucial because consumer spending makes up 70% of the economy. So much of this is a game of psychology. People spend more when they feel more optimistic, and rising spending leads to greater optimism. (The Q3 GDP report was tepid, but remember that Q3 ended three months ago and that it started six months ago.)

The latest report on consumer confidence showed a big uptick in November, and it’s now at a six-month high. One important reason for greater confidence is probably due to lower gas prices. As difficult as this may be to believe, prices at the pump have been heading lower. According to numbers from GasBuddy.com, the average price for regular gas is down to $3.20 per gallon from close to $4 last spring. Lower gas prices have a big impact on the economy. They act almost like an immediate across-the-board raise for millions of consumers.

More good news may come out shortly. I’m writing this early on Friday and the durable goods and personal spending reports are due out later this morning. There’s even talk that Q4 GDP growth could top 4%. That would get 2012 off to a very nice start. I also noticed that the Volatility Index ($VIX), often called the Fear Index, dropped to 21.16 on Thursday which is its lowest close since July 26th. This is less than half of what it was during some of the hairy periods this fall. How quickly sentiment can change.

Gold, which is probably the ultimate fear trade, has melted down over the past few weeks. The metal recently dipped below its 200-day moving average. This is another signal that investors are growing less fearful. Plus, this may be early speculation that interest rates could go up sooner than expected. If that happens, I would expect to see a major rush out of gold.

Lots of people have foolishly called for a top in the bond market. They’ve all been wrong. So what did I do? Two weeks ago, I finally joined in. I think we’re going to see bond yields gradually move higher and this will be in tandem with renewed economic confidence. The yield on the ten-year bond has already dipped up by 15 basis points since Tuesday. This is a good omen because it will shake loose some of the scared money currently parked in Treasuries.

Take a look at Johnson & Johnson ($JNJ) which currently yields 3.5%. Actually, it really yields even more than that. In April, I expect JNJ to announce its 50th consecutive annual dividend increase. Let’s say JNJ raises their quarterly dividend from 57 cents per share to 59 cents per share. That would give the stock a yield of 3.62% which is roughly four times what a five-year Treasury note gets you. Not to mention that JNJ is rated AAA which Uncle Sam is not. The important takeaway for investors is to understand that the bond versus stock equation clearly favors stocks right now.

Now let’s return to Oracle ($ORCL). First, I must apologize for my awful prediction. Three months ago, Oracle said it expected to earn between 56 and 58 cents per share for their fiscal second quarter. Instead, they earned 54 cents per share. Sales came in at $8.81 billion which was well below the $9.23 billion expected by Wall Street. The plunge on Wednesday was Oracle’s biggest drop since 2002.

What went wrong? Part of this was due to foreign exchange which the company can’t do much about. Part was also due to the weak economy which may have already passed, especially in tech. Part of this was surely due to poor execution on Oracle’s part.

The company’s hardware business isn’t very strong at all. However, Larry Ellison said that hardware could start growing as early as next quarter. In recent years, Oracle has relied heavily on acquisitions. The problem now is that the company has been hurt as the approval process has been taking longer. That sounds like a lame excuse, but that’s what they said.

I’m still an Oracle fan. The company is very profitable. Gross margins increased last quarter and they generated $2.3 billion in cash flow. Historically, Oracle has bounced back strongly whenever it’s had disappointing results. On the conference call, Oracle said that sales will grow between 1% and 5% this quarter which was below analysts’ estimates of 7.4%. The company also said it expects to earn between 55 and 58 cents per share. Wall Street was at 59 cents. Those really aren’t awful numbers. Right now, the Street is angry at Oracle because they missed their own numbers. I’m not pleased either, but I see the larger picture. I’m lowering my buy price on Oracle to $30 per share. This is a very good stock.

The drop in Bed, Bath & Beyond’s ($BBBY) stock is a little harder to understand. The company had an outstanding quarter. For the three months ending in November, BBBY earned 95 cents per share which was six cents more than analysts expected. In September, the company told us to expect EPS between 82 and 87 cents per share.

The only possible weak spot was that sales grew by 6.8% which was below Wall Street’s estimate. The important metric is comparable store sales and that was up by 4.1% which is a drop-off from previous quarters.

I’ve been very impressed by the way BBBY has expanded its profit margins. The company has increased its year-over-year net margins for the last 11 quarters in a row. For the trailing four quarters, net margins are roughly at 10% and I doubt that can go much higher. In other words, the easy gains in pricing have already been made. That’s going to be a lot tougher from now on.

The best news was that BBBY raised its full-year forecast for the third time this year. The company now sees fiscal 2012 earnings-per-share coming in between $3.86 and $3.92. Wall Street currently thinks the company will earn $4.39 for fiscal 2013. I’m not so convinced. I suspect it will be closer to $4.25 but I realize I’m being conservative.

The current quarter is the biggie for BBBY. On their earnings call, the company said they expect to earn $1.26 to $1.32 per share. That’s up from $1.12 per share a year ago. I’m keeping my buy price on Bed Bath & Beyond at $60 per share. I still like this company a lot but I want to hear what kind of outlook they have for next year before I feel that this is one of our most compelling buys. I should add that oftentimes our top-performing stocks in a given year are ones I thought were slightly overpriced. That’s precisely why we have a broadly diversified Buy List.

I’m pleased to see that Nicholas Financial ($NICK) has started to perk up lately. The stock got as high as $12.90 on Tuesday. Expect another strong earnings report in another month. Abbott Labs ($ABT) also broke out to a new 52-week high on Thursday. Although ABT won’t be sticking around the Buy List next year, it’s handed us a nice 16.2% gain for this year (or 20.5% when we include the dividend).

For an improving economy, I expect to see healthy gains from Buy List stocks like Ford ($F) and Moog ($MOG-A). Also, don’t overlook some of the high-yielding stocks on the Buy List like Reynolds American ($RAI) or Sysco ($SYY). Reynolds is our top-performing stock this year.

That’s all for now. The stock market will be closed on Monday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 23, 2011

Eddy Elfenbein, December 23rd, 2011 at 7:15 amItaly to Kick the Cash Habit as Monti Cracks Down

In Europe, Juggling Image and Capital

IMF Urges Members to Boost Funding Under 2010 Plan

China’s CIC to Get $50 Billion Boost

Bank Of Russia Unexpectedly Cuts Refinancing Rate

Egypt Misses Bills Sale Target as Yields Rise After Moody’s Cut

Fed’s Once-Secret Data Released to Public

Jobless Claims Drop, but 3rd-Quarter Growth Is Revised Down

U.S. Consumer Spending Probably Increased on Autos

Retailers Are Slashing Prices Ahead of Holiday

Petronas in Talks With Oil Majors for Petchem Tie-up

Netflix CEO Hastings’ Yearly Stock Option Allowance Cut 50%

Akamai To Buy Network-Software Maker Cotendo For $268 Million

Jeff Carter: Investors Do Create Jobs-Millions of Them

Phil Pearlman: Quick Take on Yahoo Here: Rumors and Tumors

Be sure to follow me on Twitter.

-

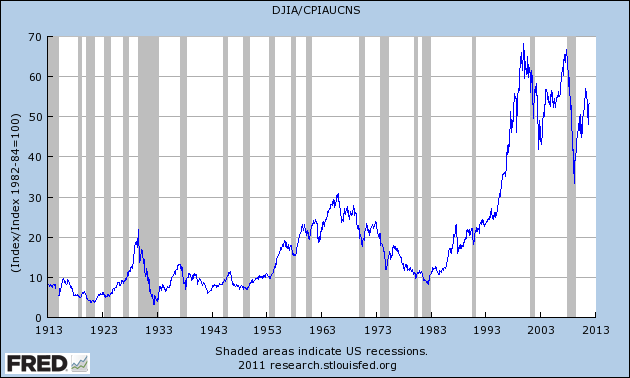

The Dow Adjusted for Inflation

Eddy Elfenbein, December 22nd, 2011 at 3:51 pmHere’s the Dow divided by the Consumer Price Index over the last century. Of course, this doesn’t include dividends. Still, it’s interesting to see that in real terms, the market’s capital gain hasn’t been terribly much.

While the Dow is still well below its inflation-adjusted high from 12 years ago, that’s not unprecedented. There have been other times when the Dow has wallowed for decades at a real loss.

Of course we don’t know this yet, but it will be interesting to see if that March 2009 low turns out to be a generational low.

-

Peter Schiff’s 2011

Eddy Elfenbein, December 22nd, 2011 at 12:19 pmLiterally, every prediction was wrong.

I don’t say this to be mean. After all, I just missed big time on Oracle’s earnings. Instead, I encourage investors to be wary of broad market forecasts.

The sad fact is that extreme bearish forecasts are rarely held to account. You can make a big splash by calling for the end of the world.

And hey, if it doesn’t happen, you can always push back the date.

-

Q3 GDP Revised Down to 1.8%

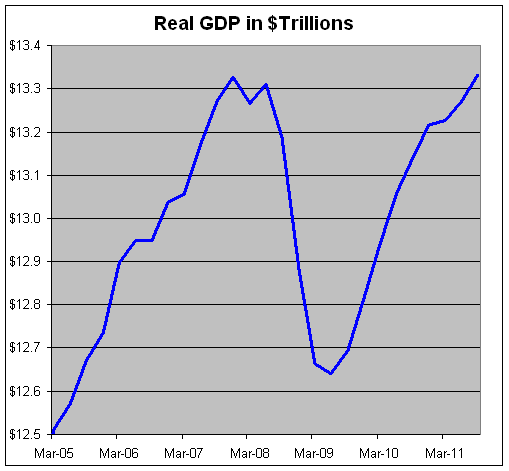

Eddy Elfenbein, December 22nd, 2011 at 11:03 amThe Commerce Department lowered its third-quarter estimate of real GDP growth from 2% to 1.8%.

The numbers are sobering. Over the last 15 quarters, the U.S. economy has grown by a total of 0.04%. The economy has grown less over the last 11 years than in the four years before that.

ZeroHedge adds: “And yet it added only $395 billion in debt over those four years, and $9.5 trillion over the 11.”

-

Morning News: December 22, 2011

Eddy Elfenbein, December 22nd, 2011 at 7:06 amGreece’s Creditors Resist Push From IMF for More Losses

European Bank in Strong Move to Loosen Credit

S&P Downgrades Hungary to Junk

Trieste Threatens Hamburg as Port Exploits Rail

Carbon Emission Fees for Flights Upheld

Oil Rises for Fourth Day as U.S. Supplies Drop Most in a Decade

Signs Point to Economy’s Rise, but Experts See a False Dawn

U.S. Faces Fitch AAA Downgrade By End of 2013 Unless Deficit Cuts Made

After a Year of Disasters, Toyota Sees Record Sales

Yahoo to Consider Sale of Asian Assets

Countrywide Will Settle a Bias Suit

BA Bags Lufthansa’s BMI, Heathrow Slots, With $271 Million Deal

Finding Success in a Lifelong Passion for Fighting Monopolies

Edward Harrison: On The ECB’s Long-Term Refinancing Operation and 2012 Macro Ideas For Investors

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His