Author Archive

-

Morning News: December 20, 2011

Eddy Elfenbein, December 20th, 2011 at 7:02 amGerman Push to Remodel Europe May Backfire

E.C.B. Warns of Dangers Ahead for Euro Zone Economy

Spanish Yields Drop at T-Bill Auction

Lenders Losing Battle of ‘Basel’

Bankers Seek to Debunk ‘Imbecile’ Attack on Top 1%

FBI Runs ‘Perfect Hedge’ to Nab Inside Traders

U.S. Backs Apple in Patent Ruling That Hits Google

AT&T Left With Few Options After T-Mobile Bid

Deutsche Telekom silent on Plan B for T-Mobile USA

Lockheed Wins Japanese Order for F-35 Fighters

Bi-Lo to Buy Winn-Dixie for $560 Million

Spanish Oil Major Repsol to Buy 10% Of Own Shares

Saab Files for Liquidation After G.M. Balks at China Deal

Stone Street: Two New ZAGG Datapoints

James Altucher: How to Have a BIG Idea

Howard Lindzon: The Year 2012…Sales Matter even for Web Startups

Be sure to follow me on Twitter.

-

AT&T and T-Mobile

Eddy Elfenbein, December 19th, 2011 at 5:30 pmJust a quick note about the news that AT&T ($T) is ditching its plans to buy T-Mobile. I thought this might happen. I like AT&T a lot and I strongly considered adding it to next year’s Buy List, but the T-Mobile issue was too much to bear.

Even without the deal, AT&T will still take a $4 billion charge.

The charge is part of a break-up fee agreement, giving Deutsche Telekom a cash payment of $3 billion, roaming services agreement and a package of mobile licenses for T-Mobile USA.

Ultimately, AT&T made the right decision. I just wish it didn’t cost so much money.

-

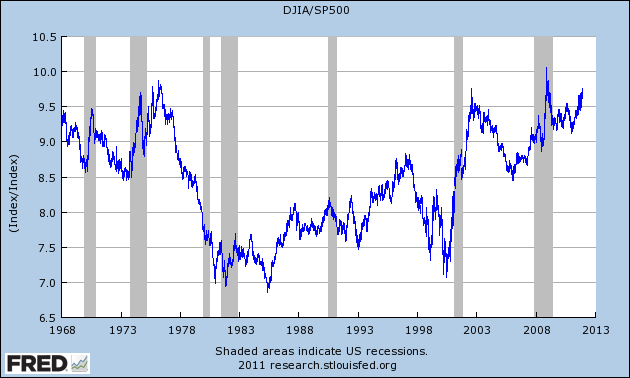

The Dow-To-S&P 500 Ratio

Eddy Elfenbein, December 19th, 2011 at 1:44 pmThe Dow has been beating up the S&P 500 this year. The two indexes generally follow each other, but some gaps do open up.

The Dow is currently 9.758 times the S&P 500 (I mean index values, not market value). This is close to the highest level in three years. As a very general rule, the ratio rises as economic recessions approach.

On November 20 and 21, 2008, the Dow-to-S&P 500 Ratio closed above 10. That was the first time it happened since November 1966. If the next two months are like the last two, we might break 10 again very soon.

-

Dividends Have Been Big Winners This Year

Eddy Elfenbein, December 19th, 2011 at 11:14 amBloomberg notes that dividend stocks have done well this year:

In a year when American companies piled up record amounts of cash, the worst stocks were the savers and the best gave the money back to investors with dividends and buybacks.

Companies that hoarded cash such as CareFusion Corp. (CFN), Western Digital Corp. and 18 other members of the Standard & Poor’s 500 Index lost an average 15 percent in 2011, according to data compiled by Bloomberg. The 40 that repurchased the most stock or offered the biggest dividends climbed 5.7 percent, led by DirecTV and Reynolds American Inc. (RAI), the data show.

Bulls say gains in companies that returned money will help unlock almost $1 trillion of cash that chief executive officers have been hoarding for three years. Thomas Lee, the chief U.S. equity strategist at JPMorgan Chase & Co., says distributions should increase 28 percent to $1.1 trillion into next year. Bears say dividends and buybacks will be insufficient to keep the rally going as mandated budget cuts curb growth.

When investors get nervous, they seek stability and that means higher dividends. What’s also attractive about dividends is that they’re easy to understand and somewhat easy to project. Dividend payments tend to be much more stable than earnings.

The big change in recent years is that so many financial stocks slashed their dividends or got rid of them entirely. The Financial Sector ETF ($XLF), for example, used to pay more than 90 cents per share a year in dividends. That dropped as low as 17 cents per share but should start climbing higher as the Fed allows more dividend payments.

-

Investing Tips

Eddy Elfenbein, December 19th, 2011 at 10:43 amFrom The Onion:

Invest everything in Morton Salt, then run around screaming, “The Slug-men are coming! The Slug-men are coming!”

Before choosing a brokerage firm, carefully study the TV commercials of several firms. Go with the one with the most impressive ads.

When your stock begins to drop, gesticulate wildly to coax it back in the right direction. (Note: Also works in bowling.)

Instead of investing in stocks, why not invest your time and energy in your community? You will reap dividends far more precious than wealth.

Stock-market losses are only losses on paper. Use Wite-Out to your advantage.

Keep a close eye on Dan Aykroyd and Eddie Murphy. They may try to outfox you and your cold-hearted brother.

Diversify your portfolio with some colored yarn or pictures clipped from magazines.

Many small, privately held companies are now issuing IPOs, often with incredible success. Among those rumored to be going public: The West End Valu-Shopper, The Marzipan Bunny Sweet Shoppe, and www.geocities.com/chadspage/favekornpics.html.

Wait until stocks are just about to soar in value, then buy lots of them. When they’ve gone as high as they’re going to go, sell them all.

Take your screeching trophy wife’s advice: Invest all your money in designer handbags.

If at all possible, start out with $80 million. This will reduce both the pressure on you and the risks involved.

Ask your company if it offers an employee stock plan. If it doesn’t, consider working for a different gas station.

Go to a financial advisor and act as if you understand and are carefully weighing what they say, then blindly do whatever they tell you.

Invest in your friends’ band. They rock.

When examining the balance sheet of a corporation, a good sign of health is an assets-to-liabilities ratio of two to one. Then again, if you understand that, you’re probably a rich prick who doesn’t need any more money.

-

Hudson City Pays Off Debt Early

Eddy Elfenbein, December 19th, 2011 at 10:14 amOur Buy List is doing well so far this morning. While the S&P 500 is up 0.20%, our Buy List is up 0.49%. Stocks like Moog ($MOG-A), Jos A Bank ($JOSB) and Deluxe ($DLX) are particularly strong. I also see that Nicholas Financial ($NICK) is now trading above $12 per share.

I would think the departure of the world’s most gruesome person would be a positive for the market. I think it’s interesting that three main points of the yield curve are now separated by 1%; the five-year yields 0.81%, the ten-year is at 1.85% and the 30-year yields 2.84%. I really doubt if those low yields will hang around much longer.

On Friday, one of our new stocks for 2012, Hudson City Bancorp($HCBK), jumped 3.8%. I’d like to think this was on the news that it’s joining my Buy List. Alas, the news that the bank is paying off $4.3 billion in structured debt before it’s due probably played a much larger role in the rally.

Unfortunately for me (but not for you), since the 2012 Buy List doesn’t go into effect for another two weeks, none of the positive move in HCBK will go towards helping my tracking record.

-

Bed Bath & Beyond’s Upcoming Earnings Report

Eddy Elfenbein, December 19th, 2011 at 9:27 amI had a mistake in Friday’s CWS Market Review. I said that Oracle ($ORCL) is the only Buy List company to report earnings this week. That’s not right; Bed Bath & Beyond ($BBBY) will report its fiscal third-quarter earnings on Wednesday, December 21st.

This was a bad oversight on my part because BBBY had a great earnings report three months ago. In September, the company said it earned 93 cents per share which was nine cents more than Wall Street’s expectations. They had told investors to expect fiscal Q2 earnings to range between 77 and 82 cents per share.

For the third quarter, BBBY projects earnings between 82 and 87 cents per share. The company also raised their full-year guidance to earnings growth of 22% to 25%.

This is the second time that BBBY has raised their full-year growth forecast this year. They went from forecasting an earnings increase of 10% – 15% to a revised range of 15% – 20% to the current range of 22% – 25%. For 2010, Bed Bath & Beyond earned $3.07 per share, so the updated forecast translates to a range of $3.74 – $3.84 per share.

-

Morning News: December 19, 2011

Eddy Elfenbein, December 19th, 2011 at 6:59 amKim Jong Il, North Korea’s Dictator, Dies

Stocks Fall as Dollar Gains on Kim’s Death

EU Ministers Seek Crisis IMF Funding Deal

European Leaders Face Bundesbank Hurdle Over IMF Funds

Germany Says Full ESM Payment in 2012 Not Very Likely

ECB’s Draghi Puts Hopes on EFSF Bailout Fund, Rules

Instability a New Fear for Investors in Russia

S&P Cut Proves Absurd as Investors Prefer U.S.

S.E.C. Accuses Fannie and Freddie Ex-Chiefs of Deception

Goldman Sachs Winning CEOs as Global No. 1

Private Investment Rounds Weaken I.P.O.’s

Microsoft Shrinking Margins Loom on Cloud Push

Saudi Prince Buys $300 Million Stake in Twitter

Saab Runs Out of Road as Lengthy Rescue Quest Fails

Jeff Miller: Weighing the Week Ahead: What Should We Expect From Santa?

Phil Pearlman: Institutional Journalism and the Race to Zero

Cullen Roche: 10 Outrageous Predictions for 2012

Be sure to follow me on Twitter.

-

Most Mutual Funds Are Down for the Year

Eddy Elfenbein, December 19th, 2011 at 12:34 amUSA Today reports that most stock mutual funds are down for the year:

The average diversified U.S. stock mutual fund has fallen 5.9% this year, vs. a 1.4% loss for the Standard & Poor’s 500-stock index, says Lipper, which tracks the funds. Out of 8,036 funds, 7,399, or 92%, are showing a loss — and some are doozies.

(…)

One reason the average fund has lagged so badly: expenses. The average fund charges about 1.3% a year to pay for salaries, offices and other costs, according to Morningstar. Stock indexes have no expenses.

Also, stock funds tend to invest in midsize and small companies, which have lagged behind the S&P 500. The Russell 2000 small-cap index, for example, has fallen 8.4% this year.

Another reason is technical: Lipper’s average U.S. stock fund figure includes many new funds that use futures and options to amplify gains and losses. Without those funds, the average loss for U.S. stock funds would have been 4.1%.

Thanks to the European crisis, international funds have been smacked even harder: The average large-company international fund has plunged 15.5%.

Some specialized funds have tanked even more. Direxion Daily Real Estate Bear 3X, which uses futures and options to amplify performance up and down, plunged 57.7%.

It’s not all bad news. Virtus Small-Cap Sustainable Growth leads the pack among diversified U.S. funds, jumping 16.5%. And Direxion Daily India Bear 3X, an amped-up single-country fund, soared 58.8%.

Continued market volatility has sent investors fleeing stock funds this year. Investors have yanked out $133 billion more than they have put in to stock funds this year, according to the Investment Company Institute, the funds’ trade group.

Last year through October, investors pulled $37.2 billion from stock funds, vs. $84.5 billion the same period this year.

Few investors put all their money in stock funds, however, so the year hasn’t been a total wash. The average bond fund that invests in U.S. Treasury securities has soared 14.7% this year, as investors flocked to government securities for safety.

Funds that invest in Treasury Inflation Protected Securities, or TIPS, have surged 11% even though the consumer price index, the government’s main gauge of inflation, has risen only 3.4% the 12 months ended November.

-

AFLAC “Way Ahead of Target”

Eddy Elfenbein, December 16th, 2011 at 12:22 pmAflac Inc. (AFL), the health insurer that gets about three-quarters of its sales in Japan, will continue to beat goals in that country, said Chief Executive Officer Dan Amos.

“We have achieved all of our targets and our sales are actually running way ahead of target, as we said in the third quarter, and we expect them to continue,” Amos told Tom Keene and Ken Prewitt during an interview on “Bloomberg Surveillance” today.

Customers who bought policies through banks drove a 14 percent gain in Japanese sales for the nine months ended Sept. 30, Aflac said last week. The world’s biggest provider of policies supplementing work and government health coverage has prospered as the Japanese market has “pretty much gone back to normal” since the March 11 earthquake and tsunami, Amos said.

“It’s amazing, the adaptability of the Japanese and how they were able to transform,” Amos said. “We as Americans would find this more difficult.”

Here’s the audio.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His