Author Archive

-

The Fed Strikes Back

Eddy Elfenbein, December 6th, 2011 at 1:04 pmLast week, Bloomberg had an article claiming that the Federal Reserve gave $13 billion to banks without telling Congress. Today, Bernanke shot back and sent this letter to the Senate Banking Committee. The language in the letter is surprisingly strong.

-

Breaking Down Oracle

Eddy Elfenbein, December 6th, 2011 at 11:03 amSometime next week Oracle ($ORCL) will probably release its fiscal Q2 earnings report. Wall Street expects the company to report earnings of 57 cents per share. I think it will be closer to 60 cents per share.

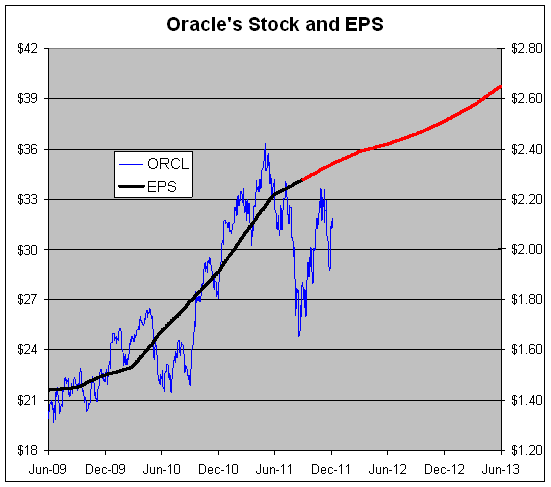

Even if I’m wrong, Oracle is still a fairly inexpensive stock. Below is a chart of Oracle’s stock along with its earnings-per-share. The stock follows the left scale and the earnings follow the right. The two are scaled at a ratio of 15-to-1 which means that the P/E Ratio is exactly 15 whenever the lines cross. The red line is Wall Street’s estimate.

I use 15 not as a projection of what I think the earnings multiple ought to be but simply because that’s been a close enough valuation for the last several quarters. More recently, however, Oracle has fallen to a cheaper valuation.

Using some rough interpolation, Wall Street thinks Oracle can earn $2.52 per share for the entire 2012 calendar year. (Note this is just an estimate, Oracle’s quarters don’t follow the March/June/September/December cycle.) At 15 times that, Oracle’s stock could reach $37.95 by the end of next year which is a 19% rise from here.

This also doesn’t take into account the fact that Oracle has a decent track record of exceeding analysts expectations. You can even see how the red line’s trajectory seems a bit subdued from recent history. Understandably, we want our projections to be somewhat conservative.

A few years ago, Oracle started paying a modest dividend. I wouldn’t call this a major factor in the share price but it’s very possible that the company will bump up the dividend in the next few months. If Oracle raises the quarterly dividend from six cents per share to eight cents per share, the stock will then have a yield of 1%. Not much, but it’s better than nothing.

If Oracle’s earnings trend continues, then I think it’s very possible the share price will hit $40 sometime next year.

-

Morning News: December 6, 2011

Eddy Elfenbein, December 6th, 2011 at 5:32 amMerkel, Sarkozy Unite as S&P Issues Warning

Wal-Mart Debate Rages in India

BNP, Credit Agricole Knocked Off Top Equity Spot

Telecom Italia Sees Tech Lag Hampering Cloud Growth

In Ireland, Austerity Is Praised but Painful

Power in Numbers: China Aims for High-Tech Primacy

S.&P. Warns Euro Zone of Ratings Downgrades

Oil Snaps Two-Day Gain as S&P Threatens European Credit Rating Downgrades

Gold Ends Lower as European Progress Dulls Demand

Geithner to Add U.S. Weight to Euro Zone Talks

It’s Tone, Not Taxes, a Tycoon Tells the President

Afghanistan Taps Aussie Miners

Birinyi Says Buy Iconic Brands to Beat Market

Olympus Remains Delisting Risk After Report, Exchange Says

Jeff Carter: CFTC Might Perpetuate Fraud

Roger Nusbaum: The Slog Continues

Be sure to follow me on Twitter.

-

Highest Close Since Mid-November

Eddy Elfenbein, December 5th, 2011 at 6:24 pmAlthough we gave back some of our gains in the afternoon, this was still a pretty good day for the market. The S&P 500 gained 1.03% to reach its highest close since November 15th. Our Buy List added 1.33% to extend its lead over the overall market. The S&P 500 is still below its 200-day moving average.

Nicholas Financial ($NICK) briefly touched $12 per share. We also saw decent gains from Stryker ($SYK) and Medtronic ($MDT). Some of the medical supply companies were hit hard late last week. On the Buy List, every stock but Johnson & Johnson ($JNJ) and Fiserv ($FISV) was up today.

Leucadia ($LUK) just announced its annual dividend of 25 cents per share. I’m not sure why they even bother. The dividend amounts to just over 1%.

-

“Essentially Identical”

Eddy Elfenbein, December 5th, 2011 at 4:14 pmConsider the following:

Banks pour huge amounts of money into one particular asset class. They are encouraged to do this by public policymakers, although there is some dispute about whether that was the main reason for their decisions. These assets have a long tradition of doing well, although a close look at the evidence would have raised red flags. The asset market in question suddenly takes a big dive as default risk increases sharply. This drags down many large banks, forcing policymakers to provide assistance.

What have I just described? The sub-prime fiasco or the PIGS sovereign debt fiasco? I’d say both. I’d say these two crises are essentially identical. (I should clarify that by “essentially identical” I mean in essence, not in every detail.)

-

The S&P 500 Is Up to 1,265

Eddy Elfenbein, December 5th, 2011 at 10:40 amThe market is rallying again today. The S&P 500 has been as high as 1,265 this morning. That’s a gain of 9.1% since the Friday after Thanksgiving which was only six trading days ago.

Keep a close eye on 1,264.56. That’s the average of the last 199 days so if we close above that, we’ll be above the 200-DMA.

The market now has a real shot of making a four-month high soon. The current high close of the last four months was 1,285.09 from October.

The financials and Energy sectors are leading the charge. On our Buy List, the standouts are Ford ($F), JPMorgan Chase ($JPM) and Medtronic ($MDT). AFLAC ($AFL) is about to poke its head above $45 per share. Ten weeks ago, AFL was trading near $31.

The next earnings report for the Buy List will be from Oracle ($ORCL) and that should come some time next week, though I don’t know which day. Wall Street expects earnings of 57 cents per share compared with 51 cents per share one year ago. I think that’s a little low. My numbers say that Oracle should earn 60 cents per share. I think this company is doing very well right now.

-

Morning News: December 5, 2011

Eddy Elfenbein, December 5th, 2011 at 6:01 amMerkel Heads to Paris as EU Leaders Seek Debt Strategy

Monti’s Austerity Debut Risks Italian Wrath

U.K. Service-Sector Job Losses Gather Pace

Indian Retailers Slump as Singh May Suspend FDI Decision

China Signals Reluctance to Rescue E.U.

China’s Stocks Decline, Extending Fourth Weekly Loss, on Property Concerns

Faulty Forecasts Roil Corn Market

Zynga Lets Bing Gordon Turn $35 Million Into $650 Million

British Airways Bid for BMI to Plug Asia Gaps

SAP Sheds M&A Shyness as Oracle Rivalry Moves to the Cloud

SAP to Buy SuccessFactors for $3.4 Billion

Commercial Metals Rejects Icahn’s $1.7 Billion Bid

Troubled Bank Dexia Gets New Financing Lifeline

Rich-Poor Divide Is Widening, OECD Says

Howard Lindzon: Bring on 2012…The Abundance Showdown!

Stone Street: (O’)Taylor Rules!

Be sure to follow me on Twitter.

-

November Unemployment Drops to 8.6%

Eddy Elfenbein, December 2nd, 2011 at 8:48 amNon-farm payrolls rose by 120,000 in November, and 140,000 private sector jobs were created. Since the labor participation rate dropped, the unemployment number dropped down to 8.6% which is a big move considering the economy didn’t create that many jobs. I looked at the details and the jobless number actually comes out to 8.645%. I’m not exaggerating when I say that if November had been 12 hours shorter, the figure could have rounded up to 8.7%.

The October NFP was revised to a gain of 100,000 while the September number was revised to a gain of 218,000.

Over the last four years, the civilian non-institutional population has grown by 7.5 million. The labor force has grown by 38,000. Since the recession ended 29 months ago (officially), NFP has increased by 0.93%

Stock futures look pretty strong this morning.

-

CWS Market Review – December 2, 2011

Eddy Elfenbein, December 2nd, 2011 at 8:04 amIf you were expecting a calm, reasoned financial market going into the holidays, I’m afraid you may be disappointed. On Wednesday, the Dow soared 490 points for its single-best day in nearly three years. This came after the stock market suffered its worst Thanksgiving week since 1932.

Usually, when the market does as well as it did on Wednesday, it’s following a big down day. But Wednesday’s move came after a slight rally on Tuesday. The S&P 500 gained 4.33% on Wednesday which was its eighth-best gain following an up day in the last 70 years.

I was pleased to see that stocks only finished modestly lower on Thursday. The S&P 500 is now back above its 50-day moving average and it’s only a small push from breaking above its 200-day moving average.

In this issue of CWS Market Review, I want to delve into some of the reasons for the market’s abrupt about-face. I’ll also tell you how to position your portfolios for the last few weeks of 2011. Remember that historically, the best time of year for stocks is a 17-day run from December 22nd to January 7th. More than 40% of the Dow’s historical gain has come during this period which is less than 5% of the calendar year.

The catalyst for Wednesday’s rally was—we’re told—the news that the Fed teamed up with other central banks to provide more liquidity for the global financial system. Allow me to explain; it’s all very simple. The Federal Reserve and other central banks agreed to lower the pricing on the existing temporary U.S. dollar liquidity swap arrangements from OIS +100 basis points to…ugh…getting sleepy…can’t…stay…awake…zzzzzzzz.

Look, forget all the mumbo-jumbo. The stock market did not see one of its best rallies in decades because some bureaucrats put out a press release. Thankfully, they’re not that important. Instead, the market rallied because the market’s cheap. It’s that simple. The problem is that no one wanted to be first in the pool. I don’t blame them. Playing the bear had been the winning trade for three-straight weeks. Screaming you’re scared from the rooftops is the only trade that’s made anyone any money. Plus, our friends across the pond have been doing their best to show that they’re as clueless on how to run their economies as we are in running ours.

To borrow from Comrade Trotsky, you may not be interested in the European financial crisis but the European financial crisis is interested in you. The news from Europe has been the main driver of the U.S. market for the last several weeks. But as I mentioned in the CWS Market Review from two weeks ago, our markets are slowly disentangling themselves from the mess in Europe.

Just look at the decent economic news we’ve had recently. Please note that I’m not saying “good news,” just that there’s zero evidence of an imminent Double Dip. The fact that we can say that in December would have surprised a lot of folks this summer. For example, this past earnings season was pretty good. Thursday’s ISM report was decent. The Chicago PMI just hit a seven-month high. I’m writing this in the wee hours of Friday morning so I don’t know what the jobs report will say (check the blog for updates), but this week’s ADP report was very encouraging.

Next Friday will be the big EU summit. This is it—Zero Hour. The Germans want more fiscal integration, and I think they’ll get it (of some sort). The Germans finally got religion once one of their bond auctions fizzled. When the country that’s supposed to bail everyone else out can’t get a loan, well…then it’s time to worry.

But now the Germans have stopped dragging their heels. Anyone with a sense of history will have to appreciate the recent quote from Radek Sikorski: “I will probably be the first Polish foreign minister in history to say so, but here it is: I fear German power less than I am beginning to fear German inactivity.” Strange days, no?

For Europe, this is beginning to feel like the fall of 2008. France’s AAA credit rating is on life support. Despite the bond auction disaster, the German one-year note recently went negative meaning that investors would prefer to take a loss just so they can be a creditor to Germany. This is exactly the kind of hysteria that’s been rattling our markets since August. It’s a mystical aura of fear, and that’s masking a truly inexpensive American market (Ford’s at 5.6 times 2012 earnings!)

Now that everyone’s been suitably freaked out, they can finally do something. In fact, we’re starting to get an idea of what the game plan will look like. The basics are that Germany wants the ECB on a tight leash while it wants to set hard rules for how budgeting is done in the Euro zone. No surprises there. I suspect the Germans may give up their opposition to joint euro-bonds if the member states agree to some sort of debt-reduction fund. I’m not sure of the details, but something the market likes will come out of the summit. That’s not a guess. There’s no other alternative.

But this crazy correlation we’ve had to Europe makes no sense. Here in the U.S., investors are quietly warming up to risk. We’ve already seen high-yield spreads in the U.S. begin to narrow as Treasury yields have climbed. Since December 23rd, the yield on the 30-year Treasury has risen by 30 basis points to 3.12%. The 10-year yield is up to 2.11% which is its highest yield in more than one month. As recently as July 25th, the 30-year was at 4.31%.

Now let’s turn to some recent news from our Buy List. On Tuesday, Jos. A. Bank Clothiers ($JOSB) reported very good earnings for its fiscal third quarter. The company earned 54 cents per share for the three months ending on October 29th, which was three cents better than Wall Street’s estimate.

JOSB’s business continues to hum along: earnings grew by 19% last quarter and revenues rose by more than 20%. The company has now reported higher earnings in 40 of its last 41 quarters including the last 22 in a row. However, there was one hitch. In the earnings report, JOSB warned that the fourth quarter “has started out more slowly than we had planned.”

The market didn’t like that at all and chopped 3.7% off the stock on Wednesday in the face of a big rally plus another 2.4% on Thursday. Until we hear more, I’m inclined to side with Joey Banks. This is a very solid company. Some of you may recall six months ago when the market slammed JOSB for a 13% one-day loss after it missed earnings by—are you ready?—one penny per share. JOSB is a very good buy below $54 per share.

In the CWS Market Review from October 14th, I said that I expected Becton, Dickinson ($BDX) to soon raise its dividend for the 39th year in a row. Sure enough, Becton came through and announced a 9.8% increase dividend increase on November 22nd. The new quarterly dividend is 45 cents per share and based on Thursday’s market close, BDX now yields 2.43%. There aren’t many stocks that can boast a dividend streak like Becton’s. Honestly, the stock is a bit pricey here in the low $70s. My advice is: don’t chase it. Instead, wait for a pullback below $65 before buying BDX.

Last week, Medtronic ($MDT) reported fiscal Q2 earnings of 84 cents per share which was two cents better than estimates. This is pretty much what I expected. Two weeks ago I wrote that “they can beat by a penny or two.” I have to explain that the market has dismally low expectations for Medtronic even though the company is still doing well with pacemakers and insulin pumps. The trouble spot is Infuse, its bone growth product used in spinal fusions. Sales for Infuse dropped by 16% last quarter.

The key for us is that Medtronic also reiterated its full-year EPS forecast of $3.43 to $3.50 per share. This means the stock is going for just over 10 times earnings. I’m raising my buy price for Medtronic to $40 per share.

On November 22nd, Gilead Sciences ($GILD) stunned Wall Street when it announced that it’s buying Pharmasset ($VRUS) for $11 billion. That’s an insanely rich price for a company that doesn’t have any products on the market yet. (I had to reread that sentence just now after typing it. Yep, it’s still nuts.)

So what does Pharmasset have? The company is pretty far along in developing oral drugs for hepatitis C. That could be a very lucrative market. Still, I think this was a terrible move on Gilead’s part. This is a business deal made out of fear rather than trying to spot an opportunity. Gilead was simply nervous that someone else would snatch up Pharmasset. I very much doubt that Gilead will be on our Buy List next year.

You may have noticed that Nicholas Financial ($NICK) has been especially volatile of late. Why? I have no idea. There’s been no news. I suspect that it’s pure market jitters. Of course, it’s the market’s irrationality that helps us find bargains, so that means we have to deal with bad volatility as well. Over the last two weeks, little NICK has gone from $11.75 per share down to $10.01 and then back up to as much as $11.56 yesterday. I don’t have any more to say than “ride out the storm.” NICK is an excellent stock.

Some other stocks on our Buy List that look attractive include Oracle ($ORCL), Moog ($MOG-A) and Ford ($F). Oracle should be coming out with its fiscal Q2 earnings in two weeks. Ford just reported a 13% sales increase for November. Also, Reynolds American ($RAI) has recently broken out to a new 52-week high. The stock is currently our top-performing stock for the year (+28%). The shares currently yield 5.37% which is equivalent to 645 Dow points.

That’s all for now. Today is the big jobs report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’m going to unveil the 2012 Buy List on Thursday, December 15th. As usual, I’m only adding and deleting five stocks from the current list. (Low turnover is my BFF.) I won’t start tracking the new Buy List until the start of the year. I like to make the names known publicly beforehand so no one can claim I’m front-running the market somehow.

-

Morning News: December 2, 2011

Eddy Elfenbein, December 2nd, 2011 at 5:20 amEU Push for Budget Policing Meets Resistance

Germany’s Merkel Says Euro Crisis Is Like a ‘Marathon’

French President Warns of Dire Consequences if Euro Crisis Goes Unsolved

Banks Vie With Nations to Sate $2 Trillion Funding Need

Analysis: Japan’s Silent Majority May Find Voice Over Olympus

For Jobless, Little Hope of Restoring Better Days

Regulators Pledge New Rules After MF Global’s Demise

For Wall Street Watchdog, All Grunt Work, Little Glory

G.M. Offers to Buy Back Hybrid Volts From Owners

Netflix is ‘Broken’ With No Fix in Sight, Analyst Says

Cullen Roche: Swap Lines – Not a Panacea

Howard Lindzon: Financial Wisdoms Daily from Stocktwits

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His