Author Archive

-

Triumph Visits Occupy Wall Street

Eddy Elfenbein, November 4th, 2011 at 2:18 pm -

The October Jobs Report

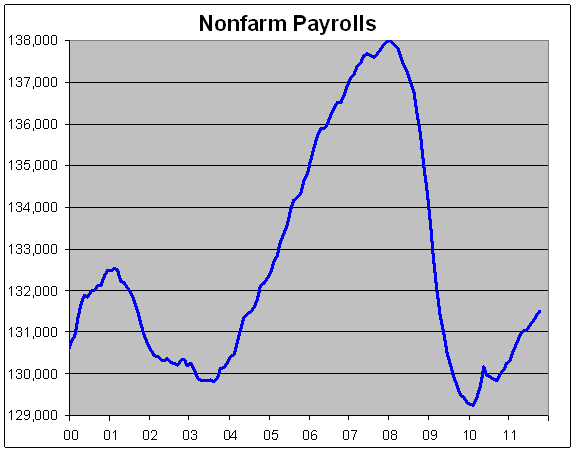

Eddy Elfenbein, November 4th, 2011 at 8:32 amThe economy created 80,000 jobs last month compared with Wall Street’s estimate of 100,000. Private sector jobs increased by 104,000.

The revision for September was plus 102,000.

The unemployment rate dropped 0.1% to 9%. The long-term unemployment number fell by 366,000 to 5.9 million.

Since the recession officially ended 28 months ago, the unemployment rate has dropped from 9.5% to 9%.

-

Moog Earns 83 Cents Per Share

Eddy Elfenbein, November 4th, 2011 at 7:01 amMoog ($MOG-A) just reported earnings for its fiscal fourth quarter of 83 cents per share, ten cents more than Wall Street’s forecast.

For all of 2011, Moog earned $2.95 per share. For 2012, the company sees sales increasing by 8% to $2.52 billion and EPS rising 12% to $3.31. Wall Street had been expecting $3.25 per share.

Moog Inc. announced today fiscal year 2011 sales of $2.33 billion, up 10%. Net earnings were $136 million and earnings per share of $2.95 were up 26% and 25%, respectively compared to last year.

For the fourth quarter, sales of $619 million were up 8% from last year. Net earnings were $38 million, up 18%, and earnings per share of $.83 were 17% higher than last year.

Aircraft sales for the year were $851 million, up 12% from the year previous, driven by very strong military and commercial aftermarket sales. Military sales were $498 million with sales on the F-35 Joint Strike Fighter, V-22 tilt rotor and the Blackhawk helicopter mostly unchanged. Military aftermarket sales were $204 million, a Company record. Commercial aircraft sales for the year of $314 million were 20% higher on stronger sales to Boeing and Airbus. Sales to business jet manufacturers were $33 million, a 24% improvement. Commercial aftermarket revenues of $100 million were 21% higher than a year ago. The Company’s navigation aids product line had sales of $38 million.

In the fourth quarter, Aircraft sales of $228 million were up 13% from the same quarter last year. Military aircraft sales were up 13%, once again the result of higher sales in the aftermarket. Commercial aircraft revenues in the quarter of $81 million were 10% higher. Boeing Commercial revenues were flat while revenues for products sold to business jet manufacturers were slightly higher. Sales to Airbus increased 36% as production increased on existing Airbus programs.

The Space and Defense segment had another strong year. Sales of $356 million were up 9%. Sales of controls on tactical missiles, at $66 million, were up 39% and offset lower sales on satellites. Deliveries for the Driver’s Vision Enhancer (DVE) system were about equal to last year. Security and surveillance product sales were up $21 million, helped by the 2010 Pieper acquisition. Sales to NASA on the Space Launch System and Crew Launch Vehicle development programs were up $10 million to a total of $28 million.

Space and Defense fourth quarter sales were up only slightly from a year ago at $93 million. The growth was mainly driven by NASA programs and security and surveillance products.

Sales for the year in the Industrial Systems segment were $629 million, a 15% increase. Capital equipment market sales were higher, reflecting strong demand for plastics machine controls, metal forming press controls and specialized test equipment. Sales of simulator motion systems were $69 million, up 43%. Wind energy sales, at $132 million, were lower than last year reflecting reduced demand from turbine manufacturers in China.

Industrial sales in the fourth quarter of $173 million were up 8%. Capital equipment sales were up 28% to $52 million and wind energy sales were $39 million.

Components Group sales for the year of $353 million, and for the fourth quarter of $89 million, were slightly lower than last year. Growth in marine, medical and industrial markets offset the weaker military aircraft and space and defense markets. Animatics, a third quarter 2011 acquisition, added $5 million in sales to the year.

The Medical Devices segment generated sales of $142 million, up 12% from last year. The segment showed significantly improved sales in the second half of the year. For the quarter, sales in Medical Devices of $37 million were up 18% from a year ago.

Year-end backlog of $1.3 billion was up $144 million, or 12%, from a year ago.

The Company updated its guidance for fiscal 2012. The current forecast has sales increasing 8% to $2.52 billion, net earnings of $152 million and earnings per share of $3.31, a 12% increase over fiscal 2011.

“Fiscal 2011 was another great year for our company,” said R.T. Brady, Chairman and CEO. “Strong sales growth produced even stronger earnings growth. Many good things are happening. Airplanes that we’ve worked on for years are moving into production. NASA now has a plan. The recovery in our industrial markets continues and our medical business is back on track. We look forward to an even stronger 2012.”

-

CWS Market Review – November 4, 2011

Eddy Elfenbein, November 4th, 2011 at 6:23 amEven though October was the eighth-best month for the S&P 500 of the last 70 years, the market has taken back some of those gains thanks to the recent political chaos in Greece. Here’s what happened: George Papandreou, the Greek Prime Minister, surprised everyone on Monday by putting the euro zone bailout plan up for a referendum. Simply put, that freaked out everyone—and I mean everyone.

For a few hours it looked like Greece was really honestly going to default. Monsieur Sarkozy said that the Greeks wouldn’t get a single cent in aid if they didn’t adhere to the original terms of the bailout. It got so bad that the European bailout fund had to cancel a bond offering. Yields on two-year notes in Greece jumped to 112%.

Yes, 112%.

The ECB, under its new head Mario Draghi, stepped in and cut rates by 0.25% which seemed to calm folks down. At least for a little while. Only after his party revolted against the idea did Papandreou decide to ditch the referendum. That’s what traders wanted to hear. On Thursday, the S&P 500 jumped 1.88%, and the index is now up barely for the year.

So we dodged a bullet for the time being, but we’re not yet out of the woods. I think it’s obvious that Greece will get the aid although the details are still unclear. My fear is that this latest cure only addresses the symptoms and not the underlying problem.

The issue isn’t that Greece mismanaged its finances (which it did) but rather that the euro zone as currently constructed is inherently unworkable. As it now stands, the countries on the periphery of Europe have to run massive trade deficits with the heart of Europe (Germany, mostly), and without the ability to downgrade their currencies, they’re forced to run large public-sector deficits.

The equation boils down to this: The euro zone needs fiscal union or the euro dies. Perhaps a smaller euro zone could make it. If the EU was just a trading club for the rich nations of Western Europe, fine—that might work. But what’s happening now, I fear, is just delaying a problem that can’t be avoided.

The problems in Europe are having an unusual side effect on the stock market here. What we’re seeing is an unusually high correlation among stocks. In other words, nearly every stock is moving in the same direction, whether it’s up or down. It’s important for investors to understand this. The last time correlation was this high was in October 1987 when the market crashed.

Bespoke Investment Group, one of my favorite sites, tracks what it calls “all or nothing days” which is when the advance/decline line for the S&P 500 exceeds plus or minus 400. Since the start of August, more than half of the trading days have been “all or nothing days” which is a rate far greater than seen in previous years. The current market divide has energy, industrial, material and most importantly, financial stocks, soaring on up days, while volatility, gold and bonds rally on down days. The market is behaving like a legislature that has only extremists and no moderates.

I don’t believe the high correlation portends any ugliness for the U.S. market. Instead, I think it reflects the dominance of geo-political events over the market. Though one important side effect is that when everyone moves the same way, it becomes much harder for hedge fund managers to stand out from the crowd. That’s why we’ve seen crazy action in stocks like Amazon.com ($AMZN) and Netflix ($NFLX).

As depressing as the news is from Europe, there’s been more cause for optimism here in the U.S. While the economy is far from strong, it appears that the threat of a Double Dip recession in the near-term has fizzled. Last week, we learned that the economy grew by 2.5% for the third quarter. Job growth, of course, has been distressingly poor.

I’m writing this early Friday morning ahead of the big jobs report. Economists expect that the jobless rate will remain unchanged at 9.1% and that 100,000 new jobs were created last month. Even if we hit that expectation, that’s still pretty poor.

The good news is that this has been a decent earnings season for the market and especially for our Buy List. The S&P 500 is on track to post record quarterly earnings. The latest numbers show that of the 415 S&P 500 stocks that have reported so far, 288 have beaten expectations, 89 have missed and 38 were in line with estimates. Outside the S&P 500, 64.5% of companies have beaten estimates and that’s better than the previous two quarters. Our Buy List has done even better. Of the 12 Buy List stocks that have reported so far, ten have beaten earnings estimates, one missed and one was inline.

On Tuesday, Fiserv ($FISV) reported third-quarter earnings of $1.16 per share which was two cents better than estimates. The company also raised its full-year guidance (man, I love typing those words) from $4.42 – $4.54 per share to $4.54 – $4.60 per share. Shortly before the earnings report, Fiserv’s stock gapped up to over $61 but then pulled back after the earnings report came out. Fiserv is a good buy up to $62 per share.

Our star for the week and perhaps for the entire earnings season was Wright Express ($WXS). The stock soared 12% on Wednesday after its blowout earnings report. The company, which helps firms track their expenses for their vehicle fleets, reported third-quarter earnings of 99 cents per share which was six cents better than Wall Street’s consensus. That’s a 38% jump over last year. The company also said that it expects between 88 cents and 94 cents per share for the fourth quarter (the Street was expecting 94 cents per share). I was happy to see Wright extend its gain on Thursday as well. I rate Wright Express a buy up to $53.

The big disappointment this week came from Becton, Dickinson ($BDX). For their fiscal fourth quarter, Becton reported earnings of $1.39 per share which was inline with Wall Street’s estimate. The problem was their guidance for the coming year. Becton said that they expect earnings to range between $5.75 and $5.85 per share. That’s far below Wall Street’s forecast of $6.19 per share. I’m disappointed by this news but Becton is still a solid company. Sometime later this month the company will likely raise its dividend for the 39th year in a row. Investors shouldn’t chase this one but if the shares pull back below $65, I think Becton will be a good buy.

I also need to explain what happened to Leucadia National ($LUK) this week. A ratings company downgraded Jefferies ($JEF) in the wake of the immolation of MF Global. Leucadia owns about one-quarter of Jefferies so that impacted their stock as well. However, it’s not clear that Jefferies’s health is anywhere as dire as MF Global’s. Actually, the facts indicate that it’s almost certainly not.

At one point on Thursday, shares of Jefferies were off by more than 20% but cooler heads prevailed and the stock finished the session down by just 2.1%. Leucadia took advantage of the panic and picked up one million shares of JEF. At the end of the day, Leucadia’s stock managed to close six cents higher. The stock remains an excellent buy. By the way, this a good lesson on why you should be careful with stop-losses. Panic can set in and bust you out of good trades.

That’s all for now. In addition to tomorrow’s big jobs report, Moog ($MOG-A) is due to report earnings. Then on Monday, Sysco ($SYY) is scheduled to report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News – November 4, 2011

Eddy Elfenbein, November 4th, 2011 at 5:12 amPapandreou Struggles to Hold on To Power

European Stocks Rise as Greece Abandons Referendum; Hermes Gains

Greek ‘Shocker’ Stiffens Irish, Portuguese Resolve

ECB’s Mario Draghi Offers Hope He Can Do What Europe Needs for Euro

Japan Starts Bailout of Tepco After Fukushima Causes More Losses

French Banking Giant BNP Paribas Writes Down Greek Debt as Earnings Slump

Royal Bank of Scotland Quarterly Profit Falls 63% on EU Crisis

Oil Rises to Three-Month High as Greece Backs Down on Referendum

Jobless Claims in U.S. Fell to a One-Month Low Last Week

As Regulators Pressed Changes, Corzine Pushed Back, and Won

In an I.P.O., a Clamor for Groupon’s Deal

Commerzbank Q3, 2012 Target Hit by Greece Impairment

Starbucks Fourth-Quarter Profit Rises 29% as U.S. Sales Gain

TPG Capital Enters the Fray for Yahoo

Roger Nusbaum: Replacement Rate; Hokum and Hooey

Jeff Miller: Who Gets the Jobs Story Wrong? Everyone!

Be sure to follow me on Twitter.

-

Q3 Earnings Season So Far

Eddy Elfenbein, November 3rd, 2011 at 11:09 amBloomberg’s Wendy Soong has the numbers.

Of the 500 companies in the S&P 500, 415 have reported earnings so far. Of that, 288 have beaten estimates, 89 missed and 38 were inline.

Earnings are growing at 18% and are on track to hit $25.19 which would be an all-time record. Excluding financials, earnings are up 20% from one year ago.

-

Blast from the Past

Eddy Elfenbein, November 3rd, 2011 at 9:05 amFrom the New York Times, April 2, 1998:

Joining Euro A Dim Hope For Greece

Greece never had a prayer of joining the first round of countries eligible for Europe’s common currency, so its exclusion from the list of 11 countries ready to adopt the euro in 1999 was not an issue here.

Instead, the question is whether Greece, despite its belated efforts to trim its debts and shrink its overindulged state sector, is going to make it into the euro club in 2001 — a goal firmly held by the Socialist Government of Prime Minister Costas Simitis and cherished by many Greeks.

For Greece, joining the euro is much like the dream many members of the former Soviet bloc have of joining NATO or the European Union. The tangible benefits of being admitted into the charmed circle may be debatable, but being left out is hell.

”It is already a negative thing to be out of the 11,” said Dimitri Papadimoulis, spokesman for the Coalition of the Left, an opposition party. ”But if we stay out after 2001 the cost will be painful. Now we are the European country in the Balkans. Then we would be another Balkan country in the Balkans.”

With the devaluation in March of the drachma by 14 percent — the Greek currency is now part of a European exchange rate structure that is a prerequisite for future euro members — the Simitis Government is convinced that Greece is on its way.

According to Finance Minister Yiannos Papantoniou, Greece has accepted prodding from its European partners to do in 18 months what it had already promised to do in three years: tackle its bloated public sector with the privatization of 11 publicly held companies, including several state banks, by the end of 1999.

”We have a mutual interest in succeeding,” Mr. Papantoniou said, speaking of Greece’s pledges to the other members of the European Union. ”At this point, I don’t see major risks. We are on the right way.”

But here and in the rest of Europe, there is some lingering skepticism about the ability of the Simitis Government — heir to the left-wing political machine built by the late Andreas Papandreou — to meet the harsh criteria set down for euro membership, and survive politically.

As the poorest country in the European Union, with a per capita gross domestic product half that of Germany, an economy that is even more dependent on a corrupt and inefficient public sector than many ex-Communist countries, and a reputation for squandering European Union subsidies, Greece’s chances of meeting the monetary union’s criteria are far from guaranteed.

”The next two years are going to be critical,” said Costas Stambolis, editor of an economic newsletter. ”The Government will have to undertake wage freezes, a shrinking of the public sector, restructuring. It will create a lot of unrest, and they will have to cope with it.”

The devaluation of the drachma, considered inevitable by many analysts, was presented, and for the most part received, as a bold and confident sign of the Government’s commitment to Europe. The Athens stock market soared, while foreign investors were cheered by the Government’s tough-talking pledges to move swiftly ahead with privatization and hold down public spending.

But critics have since found reason to worry. Initially at least, the devaluation has put Greece, if anything, further away from the fiscal goals set for euro membership. In a country heavily dependent on imports, devaluation has led to a slight surge in inflation, and a slowing of the decrease in public debt, much of which is held in foreign currencies.

Mostly, the doubts have to do with the Government’s ability to follow through on its promises. ”Verbally they are doing extremely well,” said Stefanos Manos, a former Finance Minister. ”But I am not convinced this Government will reach the euro criteria in time. The social base that elects this Government is in the public sector. Simitis will not cut off the branch he is sitting on.”

The Simitis Government has scored notable successes in bringing its fiscal affairs in order. Inflation, which was in the double digits a few years ago, was down to 4.3 percent in February, while Greece’s budget deficit, which was at an all-European high of 13.9 percent in 1993, had fallen to 4.2 percent in 1997, on its way to the 3 percent level set for entry into the euro.

But many analysts see the final test of Greece’s eligibility to join the euro — to take place in the summer of 2000 — as one that is as political as it is economic.

”If we don’t make it by 2001, we will never make it, and Greece will be pushed out of Europe,” Mr. Manos said. ”Greece will have proved itself to be too different from the rest of Europe.”

-

Morning News: November 3, 2011

Eddy Elfenbein, November 3rd, 2011 at 5:39 amEuro Crisis Shifts Mood for G-20

Greece’s Euro Membership to be Put to Vote

Draghi Faces Maelstrom on Debut as ECB President

G-20 Leaders Mull Whether to Press for Yuan Flexibility

French Banking Giant BNP Paribas Net Hit By Sovereign Debt

Treasuries Rise as Europe Withholds Greek Aid

Bernanke Gives Push to New Stimulus

Fed Lowers Its Forecast for Growth, but Takes No Steps

Private Employers Added More Jobs Than Expected in October

NYSE Euronext Posts Profit Hike Amid Deal Talks

Kraft Foods 3Q Net Up 22%, Lifts Full-Year View

Unilever Sales Up As Emerging Markets Surge

BMW Q3 Profit Gains on 5-Series, X3 Demand

Cable TV and Movies Buoy News Corp. Profits

Real Estate Services Giant Jones Lang LaSalle’s 3Q Net Off 8.7% On Acquisition Costs; Revenue Up

Jeff Carter: CME Statement Regarding MF Global

James Altucher: How to Change the World (Or…How to Occupy Yourself)

Be sure to follow me on Twitter.

-

Great Day for Wright Express

Eddy Elfenbein, November 2nd, 2011 at 9:49 pmSo I guess the market liked the earnings report. Shares of Wright Express ($WXS) soared 12% today.

Of course, we know better than to take one day’s move as a confirmation or rejection of our position. After all, Becton Dickinson ($BDX) was down 4.6% today.

Still, it’s nice to see Wright get some market love. As Winston Churchill said on V-E Day, “We may allow ourselves a brief period of rejoicing.”

Huzzah!

-

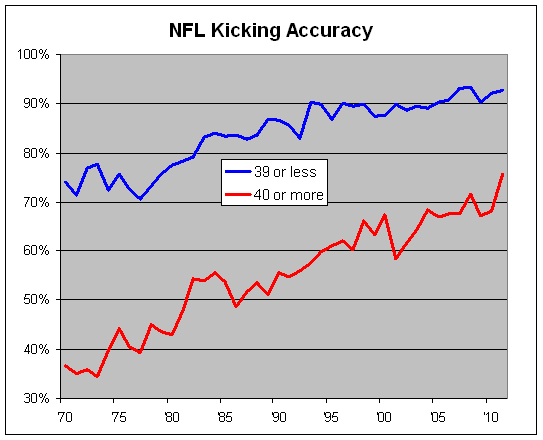

A Short Post on NFL Kicking Accuracy

Eddy Elfenbein, November 2nd, 2011 at 2:50 pmRemember when NFL kickers used to miss?

Well, they still miss of course, but kickers miss a lot less than they used to. Nowadays, a field goal attempt from anywhere less than 40 yards out is assumed to be automatic. But it wasn’t always so.

We’re nearly halfway through the season and kickers have made a stunning 85.9% of their field goal attempts. In just ten years, kickers have increased their accuracy by nearly 10%.

Not only that, but they’re kicking longer as well. So far this season, kickers have made 78% of their attempts between 40 and 49 yards. That’s better than the NBA’s league-wide accuracy from the free throw line (76.3%).

And the numbers from attempts over 50 yards out are even more impressive. This season, kickers have nailed 45 of their 63 attempts from 50 yards or more. That’s more accurate than the league was from any distance 25 years ago. Since 1994, long-range accuracy has doubled and long-range attempts-per-game are up by more than 63% from just five years ago.

Improved kicking is rapidly changing football strategy. In fact, this season is on track to be the highest-scoring season since the AFL-NFL merger, and kickers deserve a lot of the credit. Touchdowns-per-game are nearly identical to where they were 30 years ago, but field goals-per-game are up by 45%.

This high-octane accuracy is completely new to football. In 1974, the first year when the uprights were placed at the back of the end zone, kickers made just four of 30 field goals from 50 or more yards. Jan Stenerud, the only pure placekicker in the Hall of Fame, made 66.8% of his career field goal attempts. Today that’s good enough for 105th place in career accuracy. Nearly every player in the top 30 for career accuracy is currently active.

It’s not just field goals, either. NFL kickers have only missed two of their 546 extra-point attempts this year. That’s a success rate of 99.63% which would also be a league record. Think about this: There will probably be one-tenth as many missed extra-points this year as there were 25 years ago.

Can it really be called a sport when a play is more accurate than the purity of Ivory Soap? I don’t think so. Perhaps it’s time to narrow the goal posts from 18 feet 6 inches to 15 feet.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His