Posts Tagged ‘aapl’

-

Apple’s IPO: 34 Years Ago Today

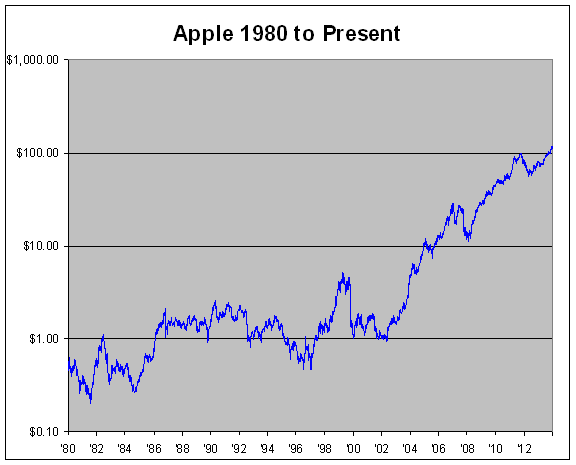

Eddy Elfenbein, December 12th, 2014 at 9:52 amThirty four years ago today, Apple Computer ($AAPL) went public. Today, the company is officially just Apple Inc. The offering was for $22 per share. Since then, Apple has split four times; three times 2-for-1 and once 7-for-1. That adds up to 56-for-1 which means the $22 offering is 39.3 cents split adjusted.

This may sound surprising, but Apple wasn’t a hit. By mid-1982, the shares were going for half the offering price. The stock did have its moment in the sun: In the 26 months prior to the 1987 crash, shares of Apple rose eight-fold.

But overall, Apple was not a hot stock. At its low point in 2003, Apple was lower than where it had been in 1983. Think about that! Twenty years of no gain, and this was well after Steve Jobs had returned.

But in 2003, Apple started one of the most amazing rallies in Wall Street history. In less than ten years, the stock jumped more than 100-fold. To be precise, Apple rose 107-fold (10,603%) in nine years and five months. That includes a brutal 60% drop during the Financial Crisis.

Apple gained back what it lost but suffered another painful correction. From September 2012 to April 2013, Apple shed 44%. That was when we heard the refrain, “Apple doesn’t know how to innovate anymore.” Once again, Apple made back everything it had lost.

Now here are some numbers. Measuring from the offering price 34 years ago, Apple has gained 28,412%. Annualized, that’s 18.1%.

Apple’s single-worst day came on September 29, 2000 when the stock plunged 51.9%. The catalyst was that Apple said they were going to miss earnings. That was also Apple’s highest volume day. It traded over 1.8 billion shares that day.

Apple has suffered other big drops. On the day of the 1987 crash, Apple fell 24.4%. The stock has fallen more than 10% in a single day 26 times, which is nearly once per year.

Apple’s single-best day came on August 6, 1997 when it soared 33.2%. That was the day Steve Jobs announced at a MacWorld trade show that Microsoft was investing $150 million in Apple preferred stock. That moved saved Apple. At the time, people in the crowd booed. Here’s a story from the Seattle Times about the announcement.

A lot of people forget that Apple used to pay a dividend many years ago. They introduced a small quarterly dividend in 1987. Apple raised it four times, and then kept it the same for five years until it expired in 1995. Two years ago, Apple resumed paying a dividend. The current quarterly dividend is 47 cents per share which is a 120% return on the IPO price.

When Apple was founded on April 1, 1976, there were three founders; Steve Wozniak, Steve Jobs and Ronald Wayne. On April 11, Wayne sold his 10% back to the Steves for $800. Apple’s current market value is $655 billion making it the most valuable company in the world.

-

My Views on Apple

Eddy Elfenbein, June 16th, 2012 at 9:51 am -

Looking at Apple’s Value

Eddy Elfenbein, April 25th, 2012 at 10:42 amIf you haven’t heard yet, Apple ($AAPL), which I believe is some sort of fruit company, reported outstanding earnings yesterday. For the last nine years, the shares have gained an average of 1% each week. When looking at this company’s numbers, words really do fail me.

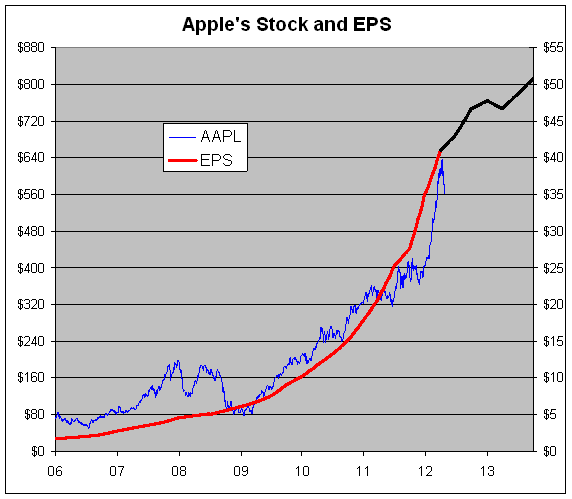

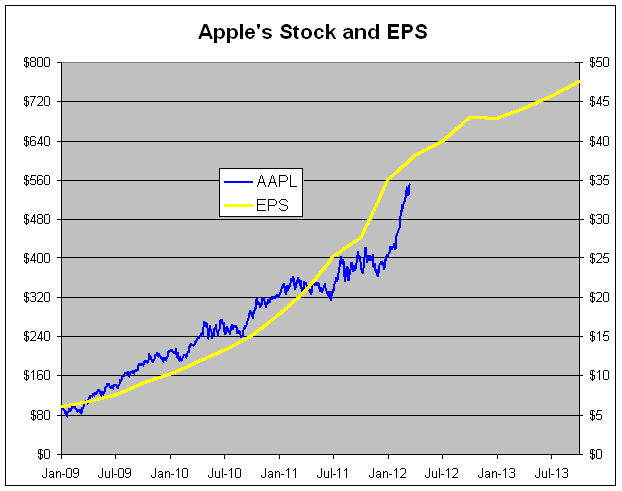

What you can’t do with words you can do with a chart, so below I’ve made a chart of Apple’s stock along with its earnings-per-share. What’s incredible to me is that the stock is still going for a fairly decent price.

The blue line is Apple’s stock and the red line is Apple’s earnings-per-share. The black line is Wall Street’s earnings forecast (I’ll have more on the black line in a moment.) The blue line follows the left scale and the red line follows the right scale.

The two lines are scaled at a ratio of 16 to 1 which means that whenever the lines cross, Apple’s P/E Ratio is exactly 16. I don’t mean to suggest that’s the appropriate multiple for Apple. I used 16 simply because it makes the chart more readable.

About the black line. Apple’s earnings yesterday not only exceeded Wall Street’s forecast but also beat the forecast for the same quarter one year from now. As a result, it appears that Wall Street expects an earnings slowdown. Of course, this isn’t true because analysts will most certainly revise their estimates much, much higher.

For now, I think the best way to view Wall Street’s forecast is to imagine the black line extending from $41 currently to roughly $57 by the end of next fiscal year (September 2013).

With trailing earnings of $41 per share, an earnings multiple of 16 translates to a price of $656. If Apple can earn $57 next fiscal year, then 16 times that comes to $912. I’m not saying Apple will do this, but I believe these are very reasonable assumptions.

Actually, this may understate Apple’s P/E ratio due to the company’s giant pile of cash. The company has an astounding $110 billion in cash. That’s roughly $116 per share. That $116 is probably contributing almost nothing to Apple’s bottom. I mean…have you seen short-term interest rates lately? The only info I have is from the earnings report which lists “other income” of $148 million. Annualized, that’s about 0.5% of Apple’s cash horde.

So to properly look at Apple’s value, we need to apply a multiple to an earnings forecast and then add $116 to that. By the way, Apple will soon start paying a quarterly dividend of $2.65 per share which comes to $10.60 for the year.

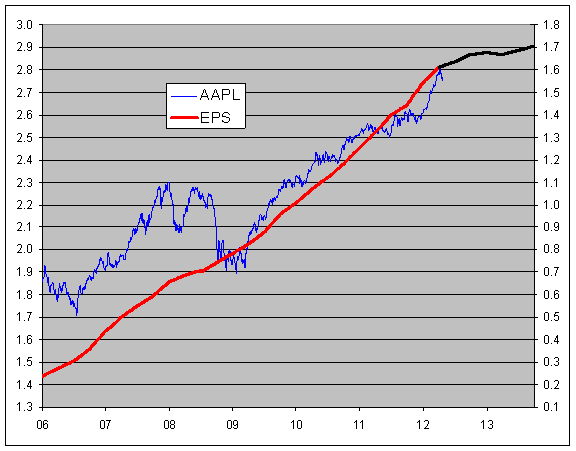

Addendum: Here’s the same chart but with a log scale. I apologize but I don’t know how to make a readable log chart excel chart, so you’ll have to do with seeing the log value on the y-axis. It gets the point across since you can see the earnings line climbing at a consistent rate.

Notice how slightly the recession impacted Apple. You can also see how conservative the earnings estimates are compared with Apple’s earnings trend.

(Instead of a ratio of 16 to 1, this chart has a log spread of 1.2 which comes to a ratio of 15.85 to 1, so it’s nearly the exact same.)

-

Dividends Are Making a Comeback

Eddy Elfenbein, April 3rd, 2012 at 11:04 amNow that the first quarter is over, we have some stats on dividends. The S&P 500 paid out 7.09 in dividends (that’s the number adjusted for the index) which is a 15.06% increase over the first quarter of 2011.

I think this will be a very good year for dividends, especially with the dividend news from Apple ($AAPL). The market also responded very well to the five-fold dividend increase from CA Technologies ($CA), plus the recent increase at JPMorgan ($JPM). So far this year, there have been 122 dividend increases in the S&P 500, plus seven new dividend payers. Only three companies have lowered their payouts.

Looking at dividends has been a surprisingly good way of valuing the market over the past few years. You can never be quite sure about a company’s earnings or cash flow since accounting rules allow for enormous latitude. But if a company is willing to send shareholders a check, you can be pretty certain those numbers are legit (though not always).

Dividends also tend to be very stable. Once a company raises its quarterly dividend, there’s an implicit understanding that that’s the new level. Shareholders will put up with a lot, but they do not like cuts in dividends, and woe be unto the company that lowers their payout. The recent recession, however, saw an unusually higher number of cut dividends or suspended payouts altogether. In 2009, annual dividends dropped by 21%. Contrast this with 2001 when the stock market crash led to dividends falling by just 3%.

The lower dividends this time around have been largely concentrated in the financial sector. Part of this is due to rules around receiving TARP payments. I don’t have the exact numbers for the financial sector but the quarterly dividends for the Financial Sector ETF ($XLF) fell about 70%. The Financial Sector currently makes up 15% of the S&P 500.

The good news is that higher profits are leading to higher dividends. Dividends are on pace to hit a new record this year. On top of that, the dividend payout ratio—the percent of profits paid out as dividends—is still below 30% which is far below normal.

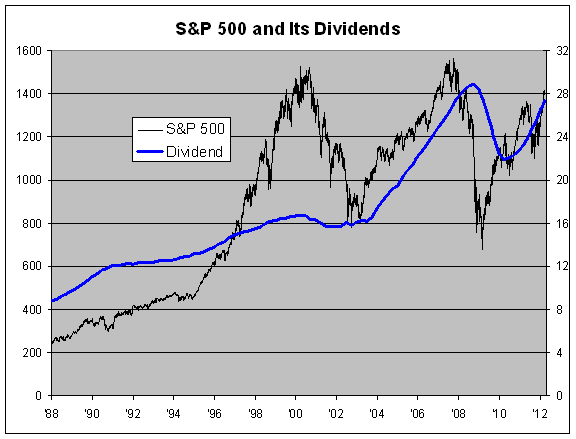

Here’s a look at the S&P 500 in the black line along with its dividends in the blue line. The black line follows the left scale and the blue line follows the right. The two lines are scaled at a ratio of 50-to-1 which means that the S&P 500 yields exactly 2% whenever the lines cross.

I think the chart shows some interesting facts. For example, you can see how different the market crashes of 2000-01 and 2008-09 were. In the first, prices soared above fundamentals. In the latter, fundamentals crumbled beneath the price. From 2003 to 2007, stock prices generally followed the trend in dividends. We can also see how much investors panicked during the financial crisis. In March 2009, the S&P 500’s dividend yield eventually reached 4%.

I asked Howard Silverblatt, the head stat guy at S&P, to tell me the dividend estimate for this year. He said it’s $29.70. To equal a dividend yield of 2%, the S&P 500 needs to get to 1,485 which is a 4.6% jump by the end of the year.

-

Apple to Initiate Dividend

Eddy Elfenbein, March 19th, 2012 at 9:52 amLast week, I took a look at Apple’s ($AAPL) valuation. I noted the company has a gigantic cash horde but I said that I doubted a dividend would be coming soon.

Shows what I know! Apple announced today that it will start paying a dividend of $2.65 each quarter. That works out to $10.60 per year. Based on Friday’s closing price of $585.57, that works out to a yield of 1.81%. Apple also said it will buy back up to $10 billion of its own stock.

I’m impressed when a company gives its profits to its shareholders who, after all, are the owners of the company. When companies get too much money, problems can happen. Investment manager Peter Lynch referred to this as the Bladder Theory of corporate finance. For some reason, too many CEOs see the need to merge and acquire. Too much cash is a certain catalyst for a bad acquisition idea. You can never go wrong with giving the cash to the owners.

If you had bought shares of Apple three years ago, you’d now be yielding 10.4% from your purchase price. If you had bought Apple nine years ago today, the dividend yields would be 141.9%.

Apple’s annual dividend works out to roughly 1.09 points on the S&P 500. To put that in context, last year the index paid out 26.425 in dividends.

On Thursday, by the way, Apple got as high as $600.01 per share. Last week, I had said that the fair price was $600.36.

-

How Much Is Apple Worth?

Eddy Elfenbein, March 13th, 2012 at 8:55 amApple‘s ($AAPL) stock just hit another all-time high yesterday. The shares have been going up, up and up, yet they’re still under-priced.

Today, let’s take a cold look at Apple’s valuation. For this, I’m just going to use a dispassionate analysis of the numbers. No fancy New Age metrics. First, I have to say that Apple is a ridiculously profitable company. The firm generates cash flow to a mind-boggling extent. Think about this: Apple earned more money last quarter than the company was worth eight years ago. They have nearly $100 billion sitting in their bank account (which is causing a chorus demanding a dividend).

In January, Apple reported earnings for its fiscal first quarter (October, November and December) of $13.87 per share. That demolished Wall Street’s estimate of $10.16 per share.

The chart below shows Apple’s stock along with its trailing four-quarter earnings-per-share. The future part of the line is Wall Street’s consensus. As you can see, the consensus is very conservative compared with the recent earnings trend. Apple is notorious for low-balling its estimates.

The company is now worth more than half-a-trillion dollars and there’s talk that it could soon be worth $1,000 per share. (The board has so far shot down the idea of a stock split.)

Let’s break down the numbers. Over the last two years, Apple’s stock has traded at an average of 16 times earnings. Thanks to the great earnings report, the earnings multiple has actually gone down. If the stock were to trade at 16 times earnings today, Apple would be worth $600.36 per share. That’s an 8.8% jump from here.

While the odds are that Apple will exceed Wall Street’s conservative earnings estimates, it’s best not to spend that much just yet. Instead, let’s make Apple continue to prove its value.

I think the board will eventually concede to a stock split. It’s true that splits by themselves don’t add value but shareholders seem to like them. I doubt Apple could get away with trying to build a Berkshire-like share price. Warren Buffett can do that because he’s Warren Buffett. Tim Cook can’t. Plus, Apple has already split its stock three times before so they’re not holding to some long-held tradition.

I also doubt a dividend will be coming soon despite the large cash position. Apple is playing the long game so its good to have that money there. The firm will also have tax issues if they repatriate much of their foreign-held money. For now, that money isn’t doing any harm.

-

Half a Trillion Watch

Eddy Elfenbein, February 27th, 2012 at 11:50 amI’m officially putting shares of Apple ($AAPL) on my “Half a Trillion Watch.” By my math, once the stock gets to $536.27 per share, the market value will be $500 billion. We’re getting pretty close; shares of Apple have been as high as $524.74 today.

-

After Market Updates

Eddy Elfenbein, February 21st, 2012 at 9:54 pmUltimately, the stock market gave back some of its gains this afternoon. The S&P 500 closed at 1,362.21 which was just shy of the post-crash high close of 1,363.61 from May 2nd of last year.

Today’s market was split between large-cap stocks which fared the best and small-cap stocks which fared the worst. The small-cap Russell 2000 was down 0.66% today while the S&P 500 was up 0.98 points or 0.07%. The mega-cap S&P 100 was up 0.27%.

Interestingly, shares of Apple ($AAPL) gained $12.73 or 2.54%. That’s a market cap gain of $11.87 billion. Each point in the S&P 500 is worth $9.05 billion. That means that Apple’s gain was worth 1.31 points in the S&P 500. The index gained 0.98 points so without Apple, the index would have closed just slightly lower today.

In Buy List news, Johnson & Johnson‘s ($JNJ) CEO resigned:

William C. Weldon, who presided over Johnson & Johnson during one of the most tumultuous periods in its history, will step down as chief executive in April, the company announced Tuesday.

Alex Gorsky, head of the medical device and diagnostics business, will take over as chief executive. Mr. Weldon will remain as chairman.

The news of Mr. Weldon’s retirement comes as Johnson & Johnson has struggled to emerge from a swarm of product recalls, manufacturing lapses and government inquiries that tarnished the name of a company that was once one of the nation’s most trusted household brands. In 2010, the company recalled millions of bottles of liquid children’s Tylenol and other medications, as well as tens of thousands of artificial hips and millions of contact lenses.

Much of the blame for Johnson & Johnson’s stumbles fell on Mr. Weldon, the son of a Broadway stagehand and seamstress who became chief executive in 2002 after spending his entire career at the company. Critics said the company’s once-vaunted attention to quality slipped under his watch. The company said in a statement that neither Mr. Weldon nor Mr. Gorsky was available for comment.

Oracle ($ORCL) was downgraded by JMP Securities. They’re paring back their earnings estimates but they add that the stock is not unreasonably valued.

WSJ‘s “Market Beat” notes that DirecTV ($DTV) may soon join the streaming bandwagon.

-

Apple Breaks $500

Eddy Elfenbein, February 13th, 2012 at 10:55 amShares of Apple ($AAPL) broke $500 today. The computer company has edged out ExxonMobil ($XOM) for being the largest company in the world (although XOM’s profit is larger). Three years ago, Apple was at $100 per share.

I should remind investors that from the beginning of 1983 and continuing through the end of 1997, the S&P 500 increased more than six-fold while Apple’s stock lost money. Price matters. Since July 2009, boring Caterpillar ($CAT) has outperformed Apple.

-

It’s All Been Apple

Eddy Elfenbein, February 8th, 2012 at 11:11 amJonathan Golub of UBS claims that Apple‘s ($AAPL) earnings have distorted the entire earnings picture. He says that if you take away Apple’s results, earnings for the S&P 500 are up just 1.6%.

Apple’s report “obfuscates the fact that the underlying earnings trend is really weak,” Golub said. “It’s a terrific company, but it’s also important you get a sense of how the average stock, the average company is doing. You want to make sure you don’t distort that view.”

Analysts project income for S&P 500 companies climbed 4.9 percent in the fourth quarter, according to data compiled by Bloomberg. Out of 280 companies that have reported since Jan. 9, 68 percent have exceeded analysts’ estimates by an average 2.9 percent, while profit has gained 3.5 percent.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His