Posts Tagged ‘bbby’

-

CWS Market Review – May 11, 2012

Eddy Elfenbein, May 11th, 2012 at 7:40 amThe stock market finally broke out of its trading range this week. Unfortunately, it was to the downside. More troubles from Europe, including shake-up elections in France and Greece, helped the S&P 500 close Wednesday at its lowest level in nine weeks. However, the initial jobless claims report on Thursday helped us make up a little lost ground.

In this week’s CWS Market Review, I’ll explain why everyone’s so freaked out (again) by events in Europe. I’ll also talk about the latest revelations from JPMorgan Chase ($JPM). The bank just told investors that it lost $2 effing billion on effing derivatives trades gone effing bad. I’ll have more to say on that in a bit. We also had more strong earnings reports from our Buy List stocks DirecTV ($DTV) and CA Technologies ($CA), and shares of CR Bard ($BCR) just hit a 10-month high.

Greece Is Bad but the Real Story Is Spain

But first, let’s get to Greece. Here’s the 411: The bailout deals reached by Greece required them to get their fiscal house in order. The problem is that no one asked the voters. Now they’ve been asked and the voters don’t like it at all. Actually, I understated that—they’re royally PO’d.

Greece is massively in debt. They owe the equivalent of Switzerland’s entire GDP. Politically, everything has been upended. In Greece, there are two dominant political parties and both got creamed in the recent election. Seventy percent of Greeks voted for parties opposed to the bailouts. Mind you, the supposed beneficiaries of the bailout are the ones most opposed to them.

Since there was no clear-cut winner in the election, folks are scrambling to build a governing coalition. This won’t be easy. Whatever they do come up with probably won’t last long and they’ll need new elections. As investors, we fortunately don’t need to worry about the minutia of Greek politics. The important aspect for us is that the Greek public wants to ditch the austerity measures into the Aegean, but that means giving up all that euro cash that was promised them.

My take is that the bigwigs in Greece will do their best to stay in the euro but try to get the bailout terms renegotiated. That puts the ball in Europe’s court, and by Europe, I mean Germany. Too many people have invested too much to see the European project go down in flames. I think the Europeans will ultimately make some concessions in order to keep the euro going. If one country leaves the euro, it sets a precedent for others to leave—and that could start a flood.

As bad of a shape as Greece is in, they’re small potatoes (olives?). The real story is what’s happening in Spain. For the fourth time, the country is trying to convince investors that its screwed-up banks aren’t screwed-up. The problem is that Spanish banks are loaded down with toxic real estate debt.

The Spanish government is trying to prop up the banks, but it may delay the problem rather than solve it. It just took control of Bankia which itself was formed when the government forced some smaller banks together in an effort to save them. What’s most troubling about the problems in Spain is that the future is so cloudy. I really can’t say what will happen. Nouriel Roubini said that Spain will need an external bailout. If so, that may lead to a replay of what we’re seeing in Greece, except it would be much, much larger.

The immediate impact of the nervousness from Europe is that it spooked our markets. On May 1st, the Dow got to its highest point since 2007. The index then fell for six straight days which was its longest losing streak since August. But here’s the key: not all stocks are falling in the same manner.

Investors have been rushing away from cyclical sectors and towards defensive sectors. For example, the Utilities Sector ETF ($XLU) closed slightly higher on Thursday than it did on May 1st. Low-risk bonds are also doing well. Two months ago, the 30-year Treasury nearly broke above 3.5%. This past week, it dipped below 3%. On Thursday, Uncle Sam auctioned off $16 billion in 30-year bonds and it drew the heaviest bidding in months.

The trend towards defensive stocks is holding back some of our favorite cyclical stocks like Ford ($F), Moog ($MOG-A) and AFLAC ($AFL). Let me assure investors that these stocks are very good buys right now and I expect them to rally once the skies clear up.

JPMorgan Chase Reveals Huge Trading Losses

Now let’s turn to some recent news about our Buy List stocks. The big news came after Thursday’s closing bell when JPMorgan Chase ($JPM) announced a special conference call. CEO Jamie Dimon told investors that the bank took $2 billion in trading losses in derivatives and that it could take another $1 billion this quarter. Jamie, WTF?

For his part, Dimon was clear that the bank messed up. This is very embarrassing for JPM and frankly, I don’t expect this type of mismanagement from them. The stock will take a big hit from this news, but it doesn’t change my positive outlook for the bank. (Matt Levine at Dealbreaker has the best explanation of the losses: “This was not driven by the market moving against them (though it seems to have); it was driven by them getting the math wrong”).

As ugly as this is, it’s not a reflection of JPM’s core business operations. Sure, it’s terrible risk-management. But as far as banking goes, JPM is in good shape. Don’t be concerned that JPM faces a similar fate as the banks in Spain. They don’t. In fact, most banks in the U.S. are pretty safe right now. Warren Buffett recently contrasted U.S. banks with European banks when he said that our banks have “liquidity coming out of their ears.” He’s right. JPMorgan Chase remains a very good buy up to $50 per share.

Bed Bath & Beyond ($BBBY) surprised us this week by buying Cost Plus ($CPWM) for a half billion dollars. The deal is all-cash which is what I like to hear. The best option for any company is to pay for an acquisition without incurring new debt.

BBBY said they expect the deal to be slightly accretive. That means that BBBY is “buying” CPWM’s earnings at a price less than the going rate for BBBY’s earnings. As a result, the deal will show a net increase to BBBY’s bottom line for this year. The press release also said: “Bed Bath & Beyond Inc. continues to model a high single digit to a low double digit percentage increase in net earnings per diluted share in fiscal 2012.” I’m keeping my buy price at $75.

Now let’s look at some earnings. On Monday, Sysco ($SYY) had a decent earnings report although the CEO said the results “fell short of our expectations.” Sysco is a perfect example of a defensive stock since the food service industry isn’t adversely impacted by a downturn in the business cycle. The key with investing in Sysco is the rich dividend. The company has increased their payout for 42 years in a row, and I think we’ll get #43 later this year, although it will be a small increase. Going by Thursday’s close, Sysco yields 3.87%. Sysco is a good buy up to $30.

DirecTV ($DTV) reported Q1 earnings of $1.07 per share. That’s a nice jump over the 85 cents per share they earned a year ago. DirecTV’s sales rose 12% to $7.05 billion which was $10 million more than consensus. The company has done well in North America, but they see their future lying in Latin America. DTV added 81,000 subscribers in the U.S. last quarter. In Latin America, they added 593,000. Yet there are more than twice as many current subscribers in the U.S. as there are in Latin America. Last year, revenue from Latin America revenue grew by 42%.

DirecTV has projected earnings of $4 per share for this year and $5 for 2013. This earnings report tells me they should have little trouble hitting those goals. The shares are currently going for less than 11 times this year’s earnings estimate. They’re buying back stock at the rate of $100 million per week. DirecTV is a solid buy below $48 per share.

On Thursday, CA Technologies ($CA) reported fiscal Q4 earnings of 56 cents per share. That’s a good result and it was four cents better than Wall Street’s estimates. For the year, CA made $2.27 per share which is a nice increase over the $1.92 from last year. For fiscal 2013, CA sees revenues ranging between $4.85 billion and $4.95 billion and earnings-per-share ranging between $2.45 and $2.53. I’m impressed with that forecast, but Wall Street had been expecting revenues of $5 billion and earnings of $2.50 per share. The stock was down in the after-hours market on Thursday, but I don’t expect any weakness to last. CA is going for less than 11 times the low-end of their forecast.

A quick note on Oracle ($ORCL): The stock took a hit this week on the news of Cisco’s ($CSCO) lousy outlook. Oracle is also in the middle of a complicated intellectual property trial with Google ($GOOG). I doubt the trial will go Oracle’s way, but the dollar amounts involved are pretty small compared with the size of these two firms. On Thursday, Oracle fell below $27 for the first time since January. That’s a very good price. The stock is a good buy up to $32.

That’s all for now. Wall Street will be focused on Facebook’s massive IPO scheduled for next Friday. The stock might fetch 99 times earnings. I’m steering clear of this one. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Bed Bath & Beyond Buys Cost Plus

Eddy Elfenbein, May 9th, 2012 at 9:13 amBed Bath & Beyond ($BBBY) has opened up their wallet. The company is buying Cost Plus ($CPWM) for $22 per share which works out to $495 million. Based on yesterday’s closing price, that’s a 22% premium. The best part for BBBY shareholders is that the deal is all cash.

Who exactly is Cost Plus? According to the press release:

Cost Plus, Inc., which will continue to be headquartered in Oakland, California following the transaction, is a leading specialty retailer of casual home furnishings and entertainment products in the United States. The company currently operates 259 stores under the names World Market, Cost Plus World Market, Cost Plus Imports, and World Market Stores in 30 states.

I like this deal and it’s a small dent in Bed Bath & Beyond’s checkbook. According to the most recent balance sheet, BBBY is sitting on $1.76 billion in cash, which is $7.61 per share. In terms of BBBY’s stock, that deal is worth about $2.14 per share.

The deal is expected to close during BBBY’s second quarter (June, July and August). BBBY expects the deal to be “slightly accretive.” Let me explain what that means: BBBY is “buying” CPWM’s earnings at a price less than the going rate for BBBY’s earnings. As a result, the deal will show a net increase to BBBY’s bottom line for this year.

The press release notes: “Bed Bath & Beyond Inc. continues to model a high single digit to a low double digit percentage increase in net earnings per diluted share in fiscal 2012.”

Bed Bath & Beyond was down at the open but it’s now up for the day.

-

Jobless Claims Fall…Again

Eddy Elfenbein, April 5th, 2012 at 9:19 amI’m starting to lose count of how many times weekly jobless claims have dropped to a four-year low, but it happened again today. Combined with yesterday’s ADP report, this sets us up for an optimistic jobs report tomorrow. Economists expect to a see nonfarm payroll gain of 230,000.

The futures market currently indicates that the market will open lower today. This looks like it could be the 15th day in a row of the “up, up, down, down, down” trend.

One stock will probably buck the market today. Bed Bath & Beyond ($BBBY) looks to open over $69 per share this morning.

-

From Bed Bath & Beyond’s Earnings Call

Eddy Elfenbein, April 4th, 2012 at 10:04 pmThe transcript is courtesy of Seeking Alpha. Here are some important points:

Before concluding this afternoon’s call, a few additional comments relative to our recently concluded fiscal fourth quarter. Our balance sheet and cash flows remain strong. We ended the fiscal fourth quarter with cash and cash equivalents and investment securities of approximately $1.9 billion. This includes approximately $83.9 million of investments related to auction rate securities.

These securities have an estimated temporary valuation adjustment of approximately $3.7 million to reflect their current lack of liquidity. Since this valuation adjustment is deemed temporary, it did not affect the company’s earnings. As we have said in the past and as we have experienced to date, we believe that given the high credit quality of these investments, we will ultimately recover, at par, all amounts invested in these securities.

Inventories continue to be tailored by store to meet the anticipated demands of our customers and are in good condition. As of February 25, 2012, inventories at cost were approximately $2.1 billion or $57.35 per square foot, an increase of approximately 2.1% on a per square foot basis over last year.

Consolidated shareholders equity at February 25, 2012, was approximately $3.9 billion, which is net of share repurchases, including the approximately $359 million, representing approximately 5.9 million shares repurchased during the fiscal fourth quarter of 2011. As of February 25, 2012, the remaining balance of the current share repurchase program authorized in December 2010 was approximately $919 million.

Cash of $1.9 billion comes to $8 per share. The company may want to consider paying a dividend sometime soon. If Apple can do it, so can BBBY.

-

Bed Bath & Beyond Earns $1.48 Per Share

Eddy Elfenbein, April 4th, 2012 at 4:22 pmWow! A huge earnings beat from Bed Bath & Beyond ($BBBY). For fiscal Q4, the company earned $1.48 per share. That’s 15 cents better than Wall Street’s consensus. The stock is currently up about 6% after hours.

In December, Bed Bath & Beyond told us to expect Q4 results to range between $1.28 and $1.33 per share, so this was much better than expected. The earnings represented a 32% increase over Q4 of 2010. Quarterly sales rose by 9.1% and the key retailing metric, comparable store sales, rose by 6.8%.

For the year, Bed Bath & Beyond earned $4.06 per share which was also a 32% increase over the year before. Sales rose 8.5% to $9.5 billion. Comparable store sales rose by 5.9%.

Now for guidance. For Q1, Bed Bath & Beyond sees earnings ranging between 79 cents and 83 cents per share. For the full-year, they project earnings “to increase by a high single to a low double digit percentage range.” If we take that mean to 10%, that translates to a full-year forecast of $4.47 per share.

This is the twelfth-straight quarter than Bed Bath & Beyond has expanded its net margins. In the three years since fiscal 2009, total sales have grown by 32% but net earnings are up by 133%. The reason is that net profit margins increased from 5.9% in 2009 to 10.4% last year.

This is very good news. BBBY continues to exceed expectations. I said in December that I thought the Street’s forecast for 2012 of $4.39 was too high. Shows what I know.

At $70 per share and $4.47 for this coming year, the stock is currently going for 15.66 times earnings which isn’t that expensive. Given today’s huge earnings beat, I now have reason to believe that the company’s earnings forecast is on the low side (which is smart given that the fiscal year has just begun).

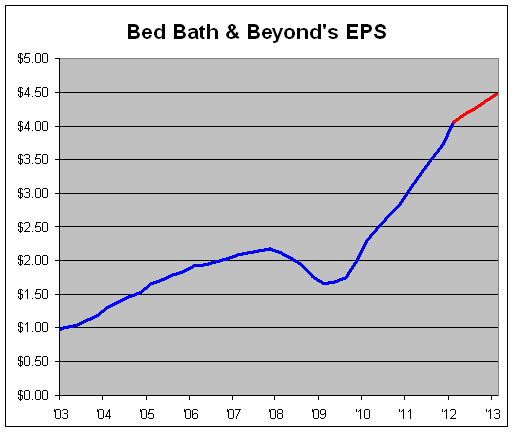

Here’s a look at BBBY’s earnings-per-share along with the company’s forecast in red. Notice how conservative the red line is.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 Feb-12 $2,732,314 $1,163,669 $550,765 $351,043 $1.48 -

Bed Bath & Beyond Surges to 52-Week High

Eddy Elfenbein, March 14th, 2012 at 2:34 pmShares of Bed Bath & Beyond ($BBBY) are rocking today. The stock has been as high as $65.27.

From Seeking Alpha:

Bed Bath & Beyond (BBBY +4.1%) moves up after its comp estimates are raised at Bernstein to 4.6% from 3.3%. Baird cites the company’s improvement in discrete comp drivers and improving sales trends. The company rates the shares at Outperform with an $80 price target.

The company is due to report fiscal Q4 earnings at the beginning of April. I’m looking for a strong report.

-

Bed Bath & Beyond Earns 95 Cents Per Share

Eddy Elfenbein, December 21st, 2011 at 5:05 pmAfter the bell, Bed Bath & Beyond ($BBBY) reported outstanding fiscal Q3 earnings of 95 cents per share. This is a 28% increase over last year’s Q3 result of 74 cents per share. Wall Street had been expecting 89 cents per share. Three months ago, the company told us to expect earnings between 82 and 87 cents per share.

The only weakness is that net sales rose 6.8% to $2.344 billion which was just shy of Wall Street’s forecast of $3.5 billion. Comparable store sales rose by 4.1%.

The best news is that BBBY said that it now sees earnings for 2012 coming in between $3.86 and $3.92 per share. The earlier range was $3.74 to $3.84 per share. This the third time BBBY has raised its full-year forecast.

For the first three quarters, the company has netted $2.60 per share so the full-year forecast implies a Q4 result of $1.26 to $1.32 per share. Wall Street had been expecting $1.30 per share.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 -

S&P 500 = 1,253

Eddy Elfenbein, October 24th, 2011 at 3:11 pmThis is turning into a very good day for the market. The S&P 500 has been as high as 1,256.55 which is another post-August 3rd high. The index’s 200-DMA is well within sight.

The cyclicals are leading today’s rally. I think the good news from Caterpillar ($CAT) helped the entire sector. The Morgan Stanley Cyclical Index ($CYC) is up more than 2.8% bringing it back over 900. The Consumer Index ($CMR), by contrast, is barely positive.

Smaller stocks tend to be more weighted with cyclicals and we’re seeing the small-stock indexes doing much better than their larger-cap cousins today. The Russell 2000 ($RUT) is up more than 3.28% while the Russell 1000 ($RUI) is up just 1.61%.

Our Buy List is now in positive territory for the year. Bed Bath & Beyond ($BBBY) hit another 52-week high. Deluxe ($DLX) and Wright Express ($WXS) have also been very strong. The only weak spots are Abbott Labs ($ABT) whose position is probably due its strength from last week, and Reynolds American ($RAI) which is losing ground after competitors delivered some disappointing earnings reports.

Notice how strong small-caps have been (the black line is the Russell 2000) compared with the large-caps (Russell 1000 in gold) since the middle of the day on Thursday:

-

Bed Bath & Beyond Hits New 52-Week High

Eddy Elfenbein, October 17th, 2011 at 10:07 amThe stock market is down a bit this morning but we’re still holding on to most of the gains we made from Friday’s big push. The S&P 500 is currently down about 5.5 points.

The market is being helped by Citigroup’s ($C) earnings report which was quite good. The bank earned 84 cents per share which was two cents better than estimates.

Citi’s losses from bad loans fell 41 percent during the quarter to $4.5 billion as defaults fell from its credit card loans for Citi-branded cards. That allowed Citi to add $1.4 billion to its earnings from credit reserves it set aside for deeper losses.

The bank’s international consumer business increased 10 percent due to growth in Asia and Latin America. Its North American consumer business fell 9 percent from a year ago due mainly to lower average balances on its credit cards. Revenue in the card business also fell due to regulations that limit the ways banks can increase interest rates and fees.

Citi said its stock and bond trading business was hurt by uncertainty in financial markets due to the debt crisis in Europe and a downgrade of the U.S. government’s credit rating in August.

It could have been a lot worse. A lot. The shares are currently up about $1.

I was very impressed by the recent fall in the $VIX and I suspect that to continue. Earlier this year, the $VIX had dropped below 15 and I think that will happen again over the next few months.

On our Buy List, Bed Bath & Beyond ($BBBY) just broke out to another new 52-week high. The stock has been as high as $61.69 today.

The other good news is that the UAW rank-and-file seem to favor the recent deal with Ford Motor ($F).

UAW members at Ford went from voting 53 percent against the proposed contract on the morning of Oct. 14 to 62 percent in favor by yesterday at 8:30 p.m. New York time. The union said 14,845 members at Ford had cast ballots in favor of the labor deal while 9,076 voted against. Ford’s 40,600 U.S. hourly workers will conclude balloting tomorrow.

If the deal wasn’t approved, there was a chance that Ford could have faced its first nationwide strike in 35 years. One analyst said the strike would have cost Ford $71 million per day.

-

CWS Market Review – September 23, 2011

Eddy Elfenbein, September 23rd, 2011 at 8:33 amOne day after the Federal Reserve announced “Operation Twist,” the stock market got absolutely slammed. The Dow was dinged for 391 points on Thursday and this comes on top of a 283-point haircut we took on Wednesday, most of which came after the Fed’s announcement.

In the last two days, the S&P 500 has shed 6%. The index closed Thursday’s trading session at 1,129.56 which is the lowest close in a month. We even hit an intra-day low of 1,114.22 which was below the recent closing low of August 8th (1,119.46). However, we haven’t pierced the intra-day low of 1,101.54 from August 9th. At least, not yet. The $VIX, also known as the Fear Index, shot up more than 10% on Thursday to close at 41.35 which is a one-month high.

So what’s going on?

In this issue of CWS Market Review, I’ll give you the low-down on the Fed’s plans and why the market reacted so negatively. Plus, I’ll update you on two very good earnings reports from our Buy List standouts, Oracle ($ORCL) and Bed Bath & Beyond ($BBBY). More importantly, I’ll highlight some outstanding high-yielding stocks that will help us weather the storm.

First, let’s take a closer look at Bernanke’s new plan to get the economy off the mat. At 2:23 pm on Wednesday, the Federal Reserve released its policy statement from this week’s meeting. In it, the Fed said it’s going to replace $400 billion of short-term debt in its portfolio with long-term Treasury debt.

The idea is to push long-term interest rates down with the hope of spurring more borrowing. Ideally, this will also help get the housing market going again. As I explained in the CWS Market Review from two weeks ago, economic recoveries are often led by the housing sector. The problem this time around is that housing is still flat on its back.

Bernanke & Co essentially downgraded the entire U.S. economy. The Fed aims to sell roughly three-fourths of the amount of short-term debt it holds. Investors concluded that if the Fed is going into long-term bonds, well…they might as well ride that wave. So they dumped stocks and crowded into Treasuries. By “crowded,” I mean a massive buying panic.

On Thursday, the yield on the 30-year Treasury plunged to 2.78%. That’s a drop of roughly 50 basis points from Wednesday afternoon. To put that in context, the Long-Term Bond ETF ($TLT) jumped from $114 to $123 in the same time period. (Remember that these are bonds. They’re supposed to be boring and stable.)

As dramatic as the 30-year bond’s drop was, the 10-year plunged to its lowest yield ever. On Thursday, the yield hit 1.72%. That’s a drop of 150 basis points since July 1st. We’re through the looking glass here, people.

I should point out that this recent action is slightly different from the fear trade that I’ve talked about before. The difference is that gold fell on Wednesday and it got hit hard yesterday which is a reflection that real short-term interest rates may rise from the Blutarsky levels they’re at right now. I doubt they’ll go very high, but the Fed is by far the largest player in the T-bill market.

As you might expect, the major losers on Thursday were the cyclical stocks. The Morgan Stanley Cyclical Index (^CYC) dropped 5.22% on Thursday to close at 762.10. Two months ago, the index was at 1,071.84. Both the Energy Sector ETF ($XLE) and Materials Sector ETF ($XLB) lost more than 5.6% on Thursday while defensive areas like Consumer Staples ($XLP) and Healthcare ($XLV) lost “only” 1.90% and 2.02% respectively. (That’s exactly why we call them defensive.)

The folks at Bespoke Investment Group point out that more than half of the stocks in the S&P 500 now yield more than the 10-year Treasury bond.

Some analysts on Wall Street are saying that Operation Twist is a really covert bailout of the big banks. I’m not cynical enough to say that’s the Fed intent, but it will certainly help the banks offload their holdings on Treasury bonds. But I’m doubtful that Operation Twist will spur more mortgage lending or even get people to refinance. Mortgage rates are already at 60-year lows. I don’t see how a few more basis points will help out troubled homeowners.

To be perfectly frank, I think this whole episode shows how limited the Fed’s powers really are. (At the Fed’s website, they included an FAQ on Operation Twist). David Kelly of JPMorgan Funds said, “Ben Bernanke is at least trying to do the right thing. He just doesn’t know what the right thing is.” Ouch!

Still, some of the big banks like Goldman Sachs ($GS) and Morgan Stanley ($MS) plunged to multi-year lows. Bank of America ($BAC) closed at $6.06 on Thursday; Warren Buffett’s warrants have a strike price of $7.14. Our Buy List mega-bank, JPMorgan Chase ($JPM), fell below $30 per share and it now yields 3.42%. JPM is still, by far, the healthiest of the major banks.

I honestly don’t see how Operation Twist will boost the economy, but I’m still not in the Double Dip camp. I think the most likely scenario is that the economy will bounce along at a 1% to 2% growth rate: not enough to get the labor market going but not slow enough to be an official recession.

As rough as this week was for the stock market, I’m happy to say that we had two very good earnings report from our Buy List. After the close on Tuesday, Oracle ($ORCL) reported earnings of 48 cents per share which was two cents better than Wall Street’s forecast.

I was actually expecting even more from Oracle. My mistake was that I didn’t foresee how weak their hardware business would be. Despite my over-optimism, the market reacted positively to the earnings report. On Wednesday, the shares got as high as $30.96. (Bear in mind that they were under $25 just one month ago.) The stock only broke down once the rest of the market did.

Oracle continues to be a very profitable company. Over the past 12 months, Oracle’s cash flow is up 46%. Wall Street was mostly upbeat on the earnings report. For their fiscal second-quarter, which ends in November, Oracle forecasts earnings of 56 – 58 cents per share. That’s a surprisingly narrow range. The Q2 from last year came in at 51 cents per share and that was a very strong quarter; Oracle cautioned investors that the comparisons are much tougher. I continue to rate Oracle a strong buy up to $30 per share.

While I was overly-optimistic on Oracle, I wasn’t optimistic enough on Bed Bath & Beyond ($BBBY). On Wednesday, the company reported fantastic second-quarter earnings of 93 cents per share. That was nine cents more than Wall Street was expecting.

This comes on top of a blow-out earnings report last quarter. BBBY also raised their full-year guidance for the second time this year. Originally, the company told us to expect earnings to grow by 10% – 15% for this year. Then after the big earnings report in June, they raised that forecast to 15% – 20%. Now they’ve bumped that up to 22% – 25%. That translates to full-year earnings of $3.74 – $3.84 per share. In business, good news often leads to good news. Businesses aren’t like ball players who have an “off night” or a “hot hand.” If there’s something good going on, it will tend to last.

At one point on Thursday, BBBY was one of only two stocks in the S&P 500 to be higher for the day. Thanks to Bed Bath & Beyond’s strong earnings and higher guidance, I’m raising my buy price to $60 per share. This is a very solid company.

Some other stocks on my Buy List that look particularly attractive right now (thanks to their high yields) include Abbott Labs ($ABT, yields 3.79%), AFLAC ($AFL, yields 3.75%), Johnson & Johnson ($JNJ, yields 3.68%), Reynolds American ($RAI, yields 5.85%), Sysco ($SYY, yields 4.00%) and Nicholas Financial ($NICK, yields 4.13%).

That’s all for now. Be sure to keep checking the blog for daily updates. Next week is the final week of the third quarter. We’ll also get another revision to the second-quarter GDP report. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His