Posts Tagged ‘bbby’

-

Bed Bath & Beyond Beats and Guides Higher. Again.

Eddy Elfenbein, September 21st, 2011 at 4:36 pmWow! Bed Bath & Beyond ($BBBY) did it again.

The company just reported fiscal Q2 earnings of 93 cents per share which was a full nine cents more than Wall Street was expecting. This was another outstanding quarter for them. Three months ago when the last earnings report came out, the company told us to expect Q2 earnings to range between 77 and 82 cents per share (I had expected a range of 80 to 85 cents per share).

Well, they blew that forecast out of the water! For last year’s Q2, they earned 70 cents per share. For this year’s Q2, net sales rose 8.2% to $2.314 billion. The all-important comparable store sales figure was 5.6%. Those are solid numbers. Year-over-year operating and net margins increased for the 10th-straight quarter.

For Q3, the current quarter, Bed Bath & Beyond projects earnings of 82 to 87 cents per share. The Street was at 86 cents. BBBY also raised their full-year guidance to earnings growth of 22% to 25%.

If you’re keeping score at home, this is the second time that BBBY has raised their full-year growth forecast this year. They went from forecasting an earnings increase of 10% – 15% to a revised range of 15% – 20% to the current range of 22% – 25%.

Let’s look at the numbers: For 2010, Bed Bath & Beyond earned $3.07 per share, so the updated forecast translates to a range of $3.74 – $3.84 per share.

Just to give you an example of how strong business has been, let’s compare this past quarter’s numbers with the one from exactly two years ago. In two years, sales are up 20.8%. Net margins have increased from 7.1% to 9.9%. That turns a 20.8% sales increase into a 69.2% profit increase.

Here’s a look at BBBY’s quarterly numbers for the past few years:

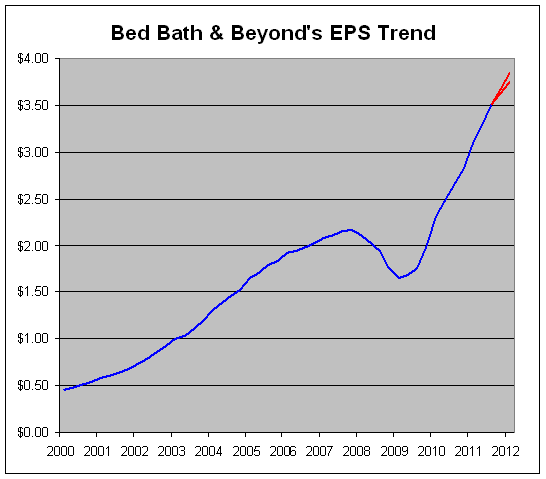

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Here’s a look at the company’s recent trailing four-quarter earnings-per-share trend. As you can see, BBBY has bounced back very well since the recession.

The red lines represents the high and low ends of the company’s forecast. Judging by the trend, today’s forecast seems rather conservative. Earnings for the first half are up 35% so a forecast of 22% – 25% for the entire year seems very doable.

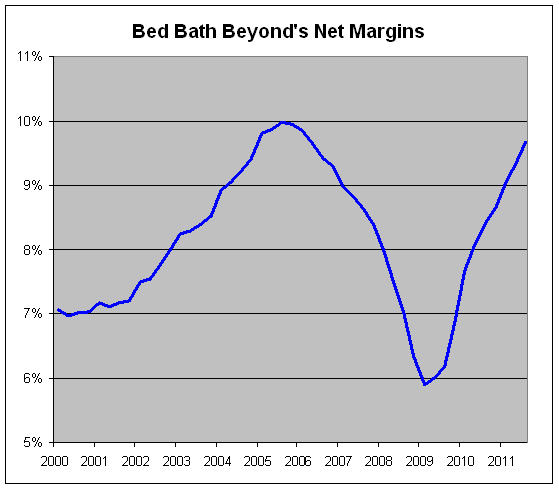

I’m growing slightly cautious about BBBY’s outlook. Not that things are about to go bad. Instead, I think it’s prudent to assume that the company is closer to the top of its business cycle than the bottom. For example, here’s a look at BBBY’s trailing four-quarter net profit margin:

The net margins seem to top off around 10% or so and we’re getting close to that. This means that the enormous tailwind the earnings get from smaller sales increases will start to fade. Also, the company’s sales growth rate, while still healthy, has noticeably decelerated.

Don’t be too afraid of a downturn in the earnings cycle. Bear in mind that the earnings peaked in the last cycle 15 quarters ago. Since then, BBBY’s earnings are up close to 62% which is 13.7% annualized. That’s pretty darn good.

Here’s a key section from the earnings call, courtesy of Seeking Alpha.

The following are our major planning assumptions for the remainder of fiscal 2011: one, including the 24 stores opened so far this year, we anticipate that the total number of new store openings will now be approximately 40 stores across all of our concepts. Currently, we believe our fiscal 2011’s store openings by concept will be substantially similar to fiscal 2010, with a slight shift to several more buybuy BABY stores and slightly fewer Bed Bath & Beyond stores.

As the year progresses, and we gain greater visibility, the total number of stores that we will open may be updated. We will continue to place Harmon Face Values health and beauty care offerings in stores across all of our concepts. As always, we remain flexible to take advantage of real estate opportunities that may arise; two, we expect to continue our program of expanding, renovating and/or relocating a number of our stores in fiscal 2011; three, we are modeling a 2 to 4 percentage increase in comparable store sales for the third and fourth quarters of fiscal 2011; four, based on these comparable store sales assumptions, we are modeling consolidated net sales to increase by 5% to 7% in the third quarter and by 4% to 6% in the fourth quarter; five, assuming these sales levels, in addition to planning the continuation of the shift and the mix of merchandise sold to lower margin categories, we are modeling our operating profit margin to slightly leverage for the fiscal third and fourth quarters; six, the third and fourth quarter tax provisions are estimated in the mid-to high 30s percent range — percentage range, with expected variability as taxable events occur; seven, capital expenditures for fiscal 2011, principally for new stores, existing store refurbishment, information technology enhancements, including increased spending on our interactive platforms and other projects, continue to be planned at approximately $250 million, but may reach as high as $300 million, depending on the composition and ultimate timing of projects; eight, depreciation for fiscal 2011 is now estimated to be in the range of approximately $180 million to $190 million; nine, we expect to generate positive operating cash flow in fiscal 2011 and continue to fund operations entirely from internally-generated sources; 10, we expect to continue our share repurchase program, which may be influenced by several factors, including business and market conditions and continue to model completion of the current authorization to early fiscal 2013.

Based on these and the other planning assumptions, we are now modeling net earnings per diluted share to be in the range of approximately $0.82 to $0.87 for the fiscal third quarter of 2011. For all of fiscal 2011, we are modeling net earnings per diluted share to increase in the range of approximately 22% to 25%, up from the previous model of approximately 15% to 20%.

Before concluding this afternoon’s call, a few additional comments relative to our recently concluded fiscal second quarter. Our balance sheet and cash flows remain strong. We ended the fiscal second quarter with cash and cash equivalents and investment securities of approximately $1.9 billion.

-

CWS Market Review – September 9, 2011

Eddy Elfenbein, September 9th, 2011 at 8:54 amAs ugly as trading has been since mid-summer, the stock market is finally showing some strength lately. I was particularly impressed by Wednesday’s huge rally and by the fact that we didn’t give it all back on Thursday. Up till now, every rally has been met with an equal or greater sell-off.

Over the past month, the S&P 500 has made three major bottoms and each time, we failed to go lower. While that’s certainly no proof that a new up phase is at hand, it may indicate that the worst is past us. Bear in mind that the S&P 500 hasn’t made a new closing low in one month.

In this issue, I want to take a step back and address some issues impacting the broader economy and how they affect the financial markets. Don’t worry. I’ll steer away from any “econospeak,” and I’ll try to make it very easy to understand. First, the good news is that corporate profits have rebounded fairly well since the worst days of the financial crisis three years ago.

Analysts on Wall Street still have pretty optimistic earnings forecasts for the rest of this year and into next year as well. For Q3, analysts see earnings for the S&P 500 coming in at $24.95. For Q4, they see profits of $26.23. That translates to profit growth of 15.72% and 19.61% respectively. In other words, earnings aren’t merely expected to grow but the rate of growth is expected to increase as well. I should caution you that these forecasts aren’t terribly reliable beyond a few months. The other good news is that corporate balance sheets are, as a whole, pretty strong.

The big question, however, is “Why is the economy still doing so poorly, especially on the jobs front?” The answer is that it all comes down to housing. I’m making a huge generalization here, but economic recoveries in this country have often been fueled by the housing sector.

Think of it this way: A developer’s decision to build a new 123-unit housing development or a brand-new 214-unit high-rise glass condo has a major ripple effect on the local economy. Except for a large government project, few things are as economically powerful as a new real estate construction project. You’re getting a big injection of money concentrated in one area all at once. Just think of how the cash flows through the local economy: the local contractors and sub-contractors get work. Those folks, in turn, spend their new cash at local stores and restaurants. What happens is that it starts a virtuous cycle.

It doesn’t end there. The other aspect that feeds off housing is the financial sector. Most Americans have far more invested in their homes than in the stock market. New homeowners take out mortgages, then savers get their interest and the banks get their profits. Once again, the virtuous cycle feeds upon itself and everyone is happy.

Yet this time, the housing sector is a bust because during the housing bubble, we built too many homes. Way too many homes! The Wall Street Journal recently reported, “Sales of newly built homes, which peaked at 1.3 million units in 2005, were running at an annual rate of just 298,000 units in July and are on pace to post the lowest count this year since record keeping began in 1963.”

Obviously, those excess homes won’t get tossed into the garbage, so no one is willing to plunk down the cash to get a new development going. That oversupply of homes is weighing on the housing market like a ton of bricks. And not just the housing market; it also weighs on all those areas that rely on the housing market. Home prices are depressed and many Americans are underwater with their mortgages or barely in the black.

The issue of bad mortgages has put enormous huge strain on banks as well. For example, we recently saw the financial world turn sharply against Bank of America ($BAC). This is an odd perception/reality dynamic because BAC is clearly far from being a sound institution, but it’s very hard to answer the question, “Do they need more capital?” (Bloomberg: Moynihan Tries to Keep Bank of America Intact as Mortgage Loans Fall Apart.) The bank said no, but investors said yes. Take a wild guess who won.

Now we have this strange disconnect in financial markets which I’ve labeled the “Fear Trade.” This is when bonds, gold and volatility are up but stocks are down. Since corporate profits have been decent, P/E Ratios are especially depressed. As I mentioned in last week’s CWS Market Review, a Double Dip recession is far from certain. This week, in fact, we had better-than-expected news for the ISM Services index. We also learned that the trade deficit hit a three-month low. The trade deficit report was so good that Goldman Sachs has said there’s a sizable upside risk to their 1% GDP forecast for Q3.

Strategists on Wall Street currently estimate that the S&P 500 will close this year at 1,353 which is a 14% run from here. One month ago, the consensus was that we’d finished the year at 1,401. So despite the market’s lousy mood, Wall Street really hasn’t pared back its estimates very much.

Now I want to focus on two upcoming earnings reports. On Tuesday, September 20th, Oracle ($ORCL) will report its fiscal first-quarter earnings. I was shocked by how low ORCL’s share price was recently. For a few days, it dipped below $25, but Oracle’s business continues to be very strong. The company told us to expect Q1 earnings between 45 cents and 48 cents per share. Oh, please! That’s obviously too low. The consensus on Wall Street is for 47 cents per share. I’m expecting at least 51 cents per share.

Oracle is a remarkably profitable company, plus they’re sitting on nearly $30 billion in cash. By the way, don’t believe any rumors that Oracle is going to buy Hewlett-Packard ($HPQ). That’s just crazy. My take is that Oracle is a very good buy below $30 per share.

The other earnings report will come from Bed Bath & Beyond, ($BBBY) on the following day. Three months ago, the company gave us an outstanding earnings report, plus they raised their full-year forecast which shows you that good companies can prosper during rough times. For the upcoming earnings report, BBBY told us to expect earnings to range between 77 and 82 cents per share. My numbers say that 82 cents is about right.

For this fiscal year (ending in May), BBBY should earn about $3.70 per share. I want to caution you that the stock has already done pretty well (it’s our second-best performer this year), so it’s not a screaming bargain right now. I’m going to hold my buy price on BBBY at $58 per share.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – July 1, 2011

Eddy Elfenbein, July 1st, 2011 at 6:45 amThe first half of 2011 is now on the books and our Buy List had a very good showing. For the first six months of this year, our Buy List gained 7.27% which is a nice lead over the S&P 500 which gained 5.01% (or 5.0094%, to be precise).

(As a side note, let me add that I’m pretty impressed at how well the 200-day moving average served as a lower bound for the S&P 500. We had two bounces and a rally. The S&P 500 just closed above 1,320 for the first time in a month. Technical analysis may have little academic respect, but it’s oddly important because everyone else thinks everyone thinks it’s important.)

When we include dividends, our Buy List gained 8.13% compared with 6.02% for the S&P 500. Bear in mind that we did this without making one single change to our Buy List for the entire year. Absolutely zero trading.

Frankly, one of the smart moves we made is that our Buy List has a good weighting of healthcare stocks, and healthcare was the top-performing sector for the second quarter. It’s also the best-performing sector for the year so far. If our Buy List keeps delivering, 2011 will be the fifth-straight year that our set-and-forget Buy List has beaten the market. Once again, sloth and patience are an investor’s best friends.

Also, being well-diversified helped us out. Seventeen of the Buy List’s twenty stocks are up for the year while only Ford (F), AFLAC ($AFL) and JPMorgan Chase ($JPM) are in the red. Our top-performing stock for the year is Jos. A. Banks ($JOSB), which I never would have expected. JOSB is up 24.03% for the year, and that includes the stock’s big 13.3% one-day plunge from a month ago. Fortunately, the shares have recovered a little bit and they closed above $50 for the first time since the last earnings report.

For those of you keeping score, JOSB dropped over $11 after missing earnings by one penny per share. That’s 1,100 pennies lost due to a one-penny-per-share miss. I thought this was a dramatic over-reaction and the market apparently agrees. Now that JOSB has hit my $50 buy price, I’m raising it this week to $53 per share. JOSB is a good buy.

In last week’s issue, I highlighted Bed Bath & Beyond’s ($BBBY) great earnings report and higher guidance. The shares have rallied impressively ever since. Not only did BBBY take out its 52-week high from April, but the stock also broke $58 per share which was my new buy price from last week. The stock has managed to become our second-best performer for the year, up 18.76%. For now, I’m going to hold off raising the buy price. BBBY continues to be a very strong buy up to $58 per share.

The other stock I highlighted last week was Oracle ($ORCL). I feel vindicated because I said that it released a very good earnings report although the market dumped the shares in the very short term. During the after-hours session from last Thursday, Oracle got as low as $30. The shares have so far closed higher every day this week, and on Thursday ORCL came very close to breaking the $33 barrier. Thank you, patience and sloth! Oracle continues to be a very good buy up to $34.

I’ve also been impressed with how some of our quieter stocks have performed. Abbott Labs ($ABT), for example, is up nearly 10% for the year and that doesn’t include its very generous dividend (now yielding 3.65%). Wright Express ($WXS) is up over 10% in the last nine trading sessions. Johnson & Johnson ($JNJ) is inches away from a new 52-week high.

Now that the second quarter is behind us, earnings season will start soon. The upcoming earnings season has a very good shot of being an all-time record for the S&P 500. The previous record was set during the second quarter of 2007. Despite the fact that corporate profits are returning to the same level of four years ago, the S&P 500 is down over 12% over that same time. Furthermore, interest rates are much lower so you would expect earnings multiples to be higher, not lower.

Speaking of which, perhaps the most important event of the past few days has been the mass exodus out of the bond market. To be precise, this isn’t a new move in the market. Instead, it’s a sign that the dramatic reaction to the problems in Greece is slowly unwinding. What happened is that nervous investors crowded into trades like the Swiss franc and mid-term U.S. Treasuries. Investors also shied away from many financial stocks, and both AFL and JPM were causalities. Now that the worst fears are passing, these trades are fading as well. AFL, for example, just popped over $46. Most surprisingly, the euro is actually higher (!!) which I thought might never happen again.

Over the last four days, the yield on the three-year Treasury jumped by 24 basis points. The five- and seven-year notes increased by 36 and 37 basis points, respectively. That’s a very big move for such a short period of time. Some folks think this is due to the completion of the Fed’s QE2 policy. I doubt that. We all knew QE2 would end some day, plus the Fed will still be a big buyer of Treasuries.

What’s really going on is that investors are now more willing to take on more risk. The big beneficiary is the U.S. stock market. The four-day rally has added more than 4% to the S&P 500, and the index just closed at its highest level in nearly a month. This was our best four-day move in nine months. On top of that, this is a seasonally strong time of the year for the stock market.

Lately, Wall Street has had a tough time getting a good read on the economy. What happened is that a lot of economists had been overly optimistic with their economic projections. As a result, they lowered their forecasts. But now, the numbers keep topping those lowered projections. It’s a combination of over-reaction and reading long-term trends into only a few points of data.

The upcoming ISM report, which comes out Friday morning, and next Friday’s employment report will tell us a lot about where the economy is headed. If these numbers are strong, I think the third quarter will be a very good one for stocks and our Buy List.

Be sure to keep visiting the blog for daily updates. The stock market will be closed on Monday for July 4th. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Bed Bath & Beyond’s Earnings Trend

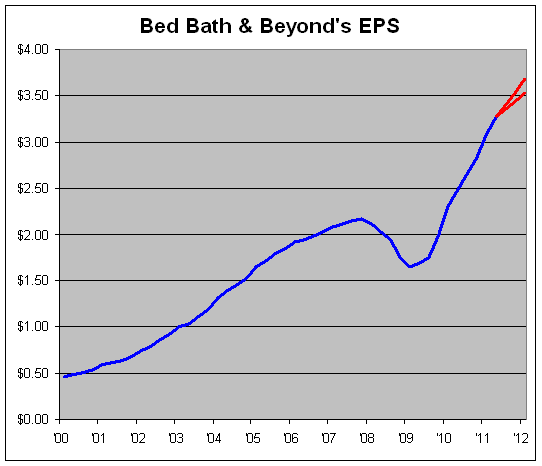

Eddy Elfenbein, June 23rd, 2011 at 10:15 amShares of Bed Bath & Beyond ($BBBY) jumped as much as 5.4% this morning. Here’s a look at the company’s earnings trend along with their updated earnings forecast. Just by looking at the chart, you see that the upper-end of the forecast is still well within the recent trend.

Year-over-year net profit margins have now increased for nine-straight quarters. For the last four quarters, net margins are running at 9.3% which is closing in on the company’s peak of 10% reached in 2005.

Courtesy of Seeking Alpha, here’s part of yesterday’s earnings call where the company details its forecast for the rest of this year:

The following are our major planning assumptions for the remainder of fiscal 2011.

One, including the 12 stores open so far this year, we anticipate that the total number of new store openings will be approximately 40 to 45 stores across all of our concepts. Currently, we believe that fiscal 2011 store openings by concept will be substantially similar to fiscal 2010 with a slight shift to several more buybuy BABY stores and slightly fewer Bed Bath & Beyond stores. As the year progresses and we gain greater visibility, the total number of stores that we will open may be updated. We will continue to place Harmon Face Values health and beauty care offerings in stores across all of our concepts. As always, we remain flexible to take advantage of real estate opportunities that may arise.

Two, we expect to continue our program of expanding, renovating and/or relocating a number of our stores in fiscal 2011.

Three, we are modeling a 2 to 4 percentage increase in comparable store sales for the second quarter and full fiscal year.

Four, based on these comparable store sales assumptions, we are modeling consolidated net sales to increase by 5% to 7% in the second quarter and full year of fiscal 2011.

Five, assuming these sales levels, in addition to planning the continuation of the shift in the mix of merchandise sold to lower margin categories, we are modeling our operating profit to be in the range of flat to slightly leveraged for the fiscal second quarter and to be slightly leveraged for the full year.

Six, interest income is expected to be relatively flat versus fiscal 2010.

Seven, the second quarter and full year tax provision are estimated in the mid- to high-30s percent range with expected variability as taxable events occur.

Eight, capital expenditures for fiscal 2011, principally for new stores, existing store refurbishments, information technology enhancements, including increased spending on our interactive platforms and other projects, continue to be planned at approximately $250 million, which of course, remains subject to the timing of projects.

Nine, depreciation for fiscal 2011 is estimated to be approximately $190 million.

Ten, we expect to generate positive operating cash flow in fiscal 2011 and continue to fund operations entirely from internally generated sources.

Eleven, in the first quarter, we completed our $1 billion share repurchase program and, thereafter, began our $2 billion program authorized in December 2010, which we continue to model to be completed in approximately 2 years. Our share repurchase program may be influenced by several factors, including business and market conditions.

Based on these and the other planning assumptions, we are modeling net earnings per diluted share to be in the range of approximately $0.77 to $0.82 for the fiscal second quarter of 2011. For all of fiscal 2011, we are modeling net earnings per diluted share to increase by approximately 15% to 20%.

-

Bed Bath & Beyond Raises Full-Year Forecast

Eddy Elfenbein, June 22nd, 2011 at 4:35 pmWowie! Bed Bath & Beyond ($BBBY) just had an outstanding earnings report for their fiscal Q1.

Let’s go over the numbers. For Q1, they earned 72 cents per share. When the last earnings report came out, they told us to expect earnings to range between 58 cents and 61 cents per share. I knew that was low and in last week’s CWS Market Review, I said I was expecting modest earnings of around 63 cents per share.

Turns out, I wasn’t optimistic enough. The shares are up about 2% after hours.

I also said that I was looking forward to Q2 guidance of 80 to 85 cents per share. They gave us guidance of 77 cents to 82 cents per share. So I was still in the ballpark.

This was a great earnings report. The best news of all is that the company also revised their full-year forecast higher. The numbers here aren’t as clear. At the start of the year, BBBY told us to expect an earnings increase for the entire year of 10% to 15%. For 2010, they earned $3.07 which came to $3.38 to $3.53 per share.

Now BBBY has upped that full-year forecast to 15% to 20%. That translates to a range of $3.53 to $3.68 per share.

Bed Bath & Beyond Inc. today reported net earnings of $.72 per diluted share ($180.6 million) in the fiscal first quarter ended May 28, 2011, an increase of approximately 38% versus net earnings of $.52 per diluted share ($137.6 million) in the same quarter a year ago. Net sales for the fiscal first quarter of 2011 were approximately $2.110 billion, an increase of approximately 9.7% from net sales of approximately $1.923 billion reported in the fiscal first quarter of 2010. Comparable store sales in the fiscal first quarter of 2011 increased by approximately 7.0%, compared with an increase of approximately 8.4% in last year’s fiscal first quarter.

During the fiscal first quarter of 2011, the Company repurchased approximately $245 million of its common stock representing approximately 4.8 million shares. This included the completion of the $1 billion share repurchase program authorized in 2007. As of May 28, 2011, the balance remaining of the share repurchase program authorized in December 2010 was approximately $1.892 billion dollars.

The Company is now modeling net earnings per diluted share to be approximately $.77 to $.82 for the fiscal second quarter of 2011 and to increase by approximately 15% to 20% for all of fiscal 2011.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His