Posts Tagged ‘f’

-

CWS Market Review – October 10, 2014

Eddy Elfenbein, October 10th, 2014 at 7:07 am“There is scarcely an instance of a man who has made a

fortune by speculation and kept it.” – Andrew CarnegieThe stock market decided to get a whole lot more interesting this week. On Thursday, the S&P 500 fell 2.09% for its worst day in six months. This was surprising, considering how calm the markets had been. Earlier this year, there was a three-month stretch when the index never had a 1% day. Now it’s happened four times in the last five days.

During Thursday’s trading, the Volatility Index ($VIX) spiked to over 19. Just a few days ago, it was less than 12. In the last few issues, I’ve talked about the distorting impact that the strong dollar has had on the markets. Now we’re seeing some of the negative fallout. On Thursday, the S&P 500 closed at 1,928.21. That’s a two-month low, and it’s a loss of 4.13% from the all-time high close of September 18. (Notice how the spread between the daily high and low has gradually increased.)

That’s not a big loss, but remember, we haven’t had a 10% correction in three years. I should remind all investors that every few years, stocks go down. It’s just the nature of the beast. But now we’re in earnings season, and this is when every stock is judged by the market. For disciplined investors, we also want to pay close attention to the earnings guidance from our stocks.

In this week’s issue, I’ll walk you through what’s been roiling the market. I’ll also highlight three of our Buy List stocks which have earnings reports coming next week. For the broader market, I’m expecting a mild earnings season. Nothing great, but not terrible either. I’ll also have some updates on our Buy List stocks, but first, let’s look at what has the market so rattled lately.

Volatility Makes a Comeback this Week

Last Friday, the government reported that the U.S. economy created 248,000 jobs last month. That’s a pretty strong number. The Feds also revised higher the figures for July and August, and the unemployment rate dropped down to 5.9%. This was the first time the jobless rate has dipped below 6% since July 2008.

The market briefly enjoyed the good news, and the S&P 500 rallied back over 1,970, but it wasn’t to last. Stocks sunk lower on Monday and Tuesday, but the heated action came on Wednesday and Thursday.

Stocks started out poorly on Wednesday, but that afternoon, the Federal Reserve released the minutes from their last meeting. We never know exactly what happens behind the scenes at these meetings, but three weeks after each one, the Fed releases the minutes. In them, the Fed expressed some concerns about the rising dollar. While a rising dollar carries benefits, it can also impinge on growth and keep inflation down. The Fed has tried desperately to keep the economy afloat, and we know that inflation is running below their target, so you can see their concern.

So does this mean there’s a growing chorus of doves at the Fed? Not exactly. I have to mention that reading the minutes from any Fed meeting is an arcane study in indefinite pronouns; “some participants say” this or “others” say that. In this week’s minutes, the concerns about the strong dollar were aired by “some” and “a couple.” Well, a few of us have a number of concerns some of the time about several of these minutes. What exactly are they saying?

In any case, traders were quite pleased, and the market staged an impressive turnaround on Wednesday afternoon. In fact, it was the best day for the S&P 500 all year. I think they’re correct that the Fed has a bias towards keeping rates low, but we simply can’t say how much they’re weighing the impact of the strong dollar.

Then on Thursday, concerns from Europe sent our stocks lower again. Mario Draghi, the head of the ECB, is clearly frustrated with the European economy. He’s particularly worried about the threat of deflation. The German economy is moving backward and there are concerns about its impact here. The sanctions against Russia aren’t helping either. So we followed the best day of the year with the fourth-worst day of the year. Market historians often tell us that weird things happen in October.

The Fed’s minutes caused a brief pullback from the greenback, but the effects on the strong dollar trade are still evident. Small-caps are doing poorly. The relative strength of the Russell 2000 has been terrible. Gold has been awful, although it got a little bounce this week. Conversely, the dollar fell a little bit, but commodity stocks have lagged badly. The Energy Sector ETF ($XLE) has dropped from over $100 on July 24 to just under $85 on Thursday. The yield on the 10-year Treasury dropped to 2.33%, which is its lowest yield in more than 15 months. At the start of the year, the yield was near 3%. It’s not just Treasuries; 30-year fixed-rated mortgages are back below 4%.

Several of our Buy List stocks got hit hard this week, including some of my favorites. AFLAC ($AFL), CA Technologies ($CA) and Ford Motor ($F) all touched new 52-week lows this week. I was really surprised by the falloff in Ford. The stock had already turned south after the lower guidance, but the selling has continued. A few weeks ago, Ford was closing in on $18 per share, and this week, it dropped below $14 per share. This week, an analyst at Morgan Stanley downgraded the automakers, not because of any weakness in their operations, but because of lower gas prices. The analysts said that cheaper gasoline won’t cause such a rush of buyers to snatch up Ford’s new aluminum trucks. Frankly, I think he’s missing the larger picture. What Ford is doing could be a massive change for the industry. I apologize for the volatility, but I haven’t altered my outlook on Ford. If their forecast for next year is correct, Ford is going for a great price here.

What to do now: Investors should focus on earnings instead of day-to-day volatility. For Q3 earnings season, analysts currently expect profit growth of 4.9%. Three months ago, the expectation was for growth of 7.8%. As I said, I expect mild growth this season. Some of the most attractive Buy List stocks at the moment are Ford Motor ($F), AFLAC ($AFL), eBay ($EBAY), Cognizant ($CTSH) and Microsoft ($MSFT). Now let’s take a look at some earnings reports coming our way next week.

Three Buy List Earnings Reports Next Week

Next week is the start of earnings season for our Buy List. On Tuesday, Wells Fargo ($WFC) will become our first Buy List stock to report. Three months ago, the big bank earned $1.01 per share, which matched expectations. I’ve been impressed by how Wells has managed itself during an important juncture in the industry (see the chart below). Mortgage revenue has plunged, but Wells is well ahead of the curve. The bank has broadened its footprint in credit cards, cars loans and investment banking.

Wells Fargo has managed to increase its earnings for 18 quarters in a row. Until last quarter, they beat expectations for 10 quarters in a row. The consensus on Wall Street is for Wells to earn $1.02 per share for Q3. My numbers say that’s about right. Frankly, the stock isn’t that exciting right now, but that’s a plus in this market. The stock is currently going for 12.4 times earnings, which is quite reasonable. This is a good stock for conservative investors. In a downturn, WFC probably won’t fall as much as other stocks and the dividend is secure. Wells Fargo is a buy up to $54 per share.

On Wednesday, eBay ($EBAY) is due to report. The online auction house has had a rough year, although it’s improved since the spring. The big news recently was the announcement that they’re going to spin off PayPal next year. I think that’s a smart move, and I expect to hear more details about this on the conference call.

For Q2, eBay beat by a penny per share. They said they expect Q3 earnings to range between 65 and 67 cents per share. Since that range is so narrow, I’m assuming that’s what it will be. Honestly, I’m surprised eBay is still below $55 per share. The business looks pretty good right now, and naturally, a stronger economy would help.

For the entire year, eBay sees earnings coming in between $2.95 and $3.00 per share. They see revenues ranging between $18.0 billion and $18.3 billion. I’ll be curious to hear what they have to say about Q4 guidance. Wall Street expects 91 cents per share, but there’s a chance it could be higher. I’m keeping a fairly tight Buy Below here; eBay is a buy up to $55 per share. I may raise it if earnings and guidance are strong.

On Thursday, it’s Stryker’s ($SYK) turn. The orthopedic company rarely surprises us, but they did last earnings season when they lowered the high end of their full-year guidance by ten cents per share. For Q3, they see earnings ranging between $1.12 and $1.16 per share. I think there’s a good chance SYK can top that. For the full year, Stryker projects earnings between $4.75 and 4.80 per share.

I don’t always trust guidance from companies, but in Stryker’s case, I‘m more inclined to believe them. I should also point out that Stryker may be in the works for a merger. I’m not predicting anything will happen, but merger mania seems to be spreading across their industry. If the price is right, a deal might come about. Stryker is a buy up to $87 per share.

Buy List Updates

Shares of Bed Bath & Beyond ($BBBY) spiked higher on Tuesday after rumors broke that Carl Icahn had taken a position in the stock. Let me stress that there’s absolutely zero confirmation that the story is true.

Traders naturally prefer to move first and wait for facts later. Sometimes that works for you, and sometimes it doesn’t. This week, it worked in BBBY’s advantage. Later on in the week, the shares kept their heads while the rest of the market got shaky. I doubt Carl made any move into BBBY, but you never know. Either way, we’re in this for the long term. Despite all the drama in this stock, the company hasn’t altered its long-term guidance. Bed Bath & Beyond remains a buy up to $70 per share.

Earlier this year, Medtronic ($MDT) announced its big “tax inversion” deal with Covidien ($COV), a company based in Ireland. Recently, however, shares of Medtronic pulled back after the Obama administration announced new rules regarding such inversions. Some investors thought that might cause the deal to be scrapped. Not so.

This week, Medtronic said they’re reworking the deal to be in compliance with the new rules. The combined entity will be domiciled on the Emerald Isle, and they’ll probably be able to cut their tax bill as well.

Not to get too technical, but Medtronic was going to use their cash held outside the U.S., and loan that to Covidien to complete the deal. Now Medtronic will use cash from another source. I’ve been impressed by Medtronic’s insistence that they’re doing this deal for operational reasons, not solely for a cheaper tax bill. You’d expect them to say that publicly, but now we have further proof that both companies are on board. Medtronic is a buy up to $67 per share.

That’s all for now. Next week will be about earnings. We’re also going to get important reports on retail sales and industrial production. You can see an earnings calendar for our Buy List stocks. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – July 25, 2014

Eddy Elfenbein, July 25th, 2014 at 7:05 am“People always call it luck when you’ve acted more sensibly than they have.”

– Anne TylerLike the honey badger, this stock market just doesn’t care. Was it going to be tripped up by Ukraine? Nope. Gaza? Nope. Fed tapering? Not a chance. The stock market keeps chugging higher. On Thursday, the S&P 500 finished the day at 1,987.98 for its 27th record close this year. Not that long ago, 2,000 for the S&P 500 was a distant hope. Now, it looks like we’ll hit it any day now.

This week has been all about earnings, earnings and more earnings. So far, the earnings have been pretty good. According to the latest numbers from Bloomberg, 77% of the S&P 500 companies that have reported so far have topped Wall Street’s expectations. Also, 64% have beaten their sales expectations. The S&P 500 is currently on track to deliver Q2 earnings growth of 6.2% and sales growth of 3.3%.

Our Buy List has been very busy this week; we had seven earnings reports. Thanks to good earnings, Ford Motor jumped out to a new 52-week high. Even boring CA Technologies rallied 4.5% after a strong earnings report. I’ll review all of our recent earnings in a just a moment. I’ll also highlight four Buy List earnings reports coming next week. I should mention that weekly jobless claims just dropped to an eight-year low, which bodes well for next week’s jobs report. But first, let’s take a closer look at our mass of earnings reports.

Surveying the Earnings Parade

We have a lot to go through, so let’s start with Tuesday’s earnings report from McDonald’s and Microsoft. Unfortunately, the McDonald’s ($MCD) news wasn’t very good. The fast-food joint earned $1.40 for Q2, which was four cents shy of Wall Street’s consensus. In the U.S., same-store sales dropped by 1.5%.

It’s no secret that MCD has made a lot of missteps. This is particularly painful when we see the outstanding results from Chipotle ($CMG), a company MCD used to own. Simply put, McDonald’s ($MCD) is not in a good way right now. As an investor, I like when companies hit rough patches since there’s a good opportunity to find a bargain. The catch, of course, is that the company has to right itself.

I think the folks at MCD understand the position they’re in, although I think the reforms may take a while to impact the business. For now, MCD is indeed a cheap stock. The shares got hit by a bunch of downgrades after the earnings report. Going by Thursday’s close, MCD yields 3.4%. Not many blue chips pay that well. The restaurant said that it’s planning to reform itself over the next 18 months. They’d better get cracking. I’m lowering my Buy Below on McDonald’s to $101 per share.

Except for Nokia, Microsoft Is Looking Good

Microsoft’s ($MSFT) earnings report was a bit confusing, but after giving it a read, traders decided they like it. After the bell on Tuesday, the software giant reported fiscal Q4 earnings of 55 cents per share. That was five cents below consensus. The shares quickly plunged in the after-hours market.

Then more details came out, and it turned out that the results weren’t that bad at all. Microsoft’s quarterly revenue rose a healthy 18% to $23.4 billion. The company also pleased investors last week when they announced big job cuts. It’s not that the market is happy about folks losing their jobs, but they’re pleased to see that MSFT is working to streamline operations. Most of those jobs are from Nokia.

The big problem for Microsoft is that Nokia’s handset business is a money loser. The division could turn into a winner in the long term, but the outlook is rather iffy at the moment. The good news for Microsoft is that their cloud business is going very well. Microsoft remains a good buy up to $48 per share.

Earnings from CA Technologies and Qualcomm

On Wednesday, two of our tech stocks reported results, CA Technologies and Qualcomm. I have to admit that I’ve become quite frustrated with CA Technologies ($CA). However, the company earned itself a temporary respite from my doghouse by reporting decent results. For their fiscal Q1, CA earned 65 cents per share, which was five cents better than estimates. Quarterly revenue dropped 2% to $1.069 billion. This was the ninth quarter in a row of falling revenue.

But the important news was guidance. For fiscal 2015, which ends next March, CA sees revenues falling by 1% to 2%. They also said they expect to see earnings range between $2.42 and $2.49 per share. Apparently this relieved a lot of investors. The shares jumped 4.5% on Thursday to close at $29.64. Even with that rally, we’re still down nearly 12% on the year with CA. The big positive continues to be the 25-cent quarterly dividend. The stock yield now works out to 3.4%. CA remains a buy up to $31 per share.

Technically, Qualcomm ($QCOM) reported amazing earnings for their fiscal third quarter. The company earned $1.44 per share, which crushed estimates by 22 cents per share. In April, they said they were expecting Q3 earnings to range between $1.15 and $1.25 per share. Well, I guess they beat that!

The good news and bad news for Qualcomm is China. The country continues to be a great customer, but several companies there “are not fully complying with their contractual obligations.” As a result, the company had weak guidance for the current quarter. For fiscal Q4, Qualcomm sees earnings ranging between $1.20 and $1.35, which is below Wall Street’s consensus of $1.39 per share.

Thanks to the blow-out earnings Q3 report, Qualcomm raised their full-year EPS range to $5.21 – $5.36, from the earlier range of $5.05 – $5.25. Note that QCOM’s earnings beat was larger than the lower guidance. Nevertheless, traders didn’t like the China news and the shares fell by more than 6% on Thursday. Qualcomm is a buy up to $83 per share.

Ford Motor Is a Buy up to $19 per Share

On Thursday, Ford Motor ($F) reported another strong quarter. This is their first one under their new CEO, Mark Fields. I really like what I’m seeing at Ford. Alan Mulally and his team deserve a lot of credit. The company made 40 cents per share for Q2, which beat consensus by four cents per share. This was Ford’s 20th profitable quarter in a row.

I was also pleased to see Ford stand by its forecast for this year of $7 billion to $8 billion in pre-tax profit. The really good news is that Ford managed to eke out a teeny tiny profit in Europe of $14 million. Of course, $14 million may sound like a lot, but in ROE terms, to an outfit like Ford, it’s peanuts. Still, no one was expecting they’d be at peanuts in Europe this early. Ford is clearly moving in the right direction.

This is a key moment for Ford. They’re introducing a bunch of new vehicles, and that requires a lot of up-front money. Overall, the company is holding the line on costs. One weak spot was South America, where they lost $300 million. Ford earned $2.4 billion in operating profit in North America. That’s a company record. The new Mustang and aluminum F-150 are due later this year, and that could give a nice boost to sales.

On Thursday, the shares jumped as high as $18.12, which is a three-year high (see above). Ford is a solid buy up to $19 per share.

CR Bard Beats Low-Balled Expectations

In April, CR Bard ($BCR) told us to expect Q2 earnings to range between $1.98 and $2.02 per share. Last week, I said I thought they were low-balling us, and sure enough, on Thursday, Bard reported Q2 earnings of $2.06 per share.

I know companies like to lower the bar on earnings and then try to impress us by topping phony expectations. I don’t blame Bard for playing the game, but I’ll let you know it when I see it.

Overall, they had a decent quarter. Quarterly sales rose 9% to $827.1 million. Bard’s chairman and CEO, Timothy M. Ring, said, “Once again we exceeded our expectations for revenue growth this quarter. We continue to believe that executing our investment plan will accelerate the sustainable growth rate of the overall portfolio and put us in a position to provide revenue growth in the mid-to-high single digits with attractive returns for shareholders.”

Now let’s turn to guidance. For Q3, Bard expects earnings to range between $2.07 and $2.11 per share. They shouldn’t have trouble hitting that. Bard also increased their full-year range by five cents at each end. The new range is $8.25 to $8.35 per share.

If you recall, Bard raised their quarterly dividend last month from 21 to 22 cents per share. They’ve raised their dividend every year since 1972. I rate CR Bard as a buy up to $151 per share.

Upcoming Buy List Earnings

We have four earnings reports coming next week. Three of our stocks, AFLAC, Express Scripts and Fiserv, report on Tuesday, July 29. Then DirecTV reports on Thursday, July 31. (Also, earnings from Moog are due out later today. Be sure to check the blog for the latest.)

Shares of AFLAC ($AFL) have improved recently. The supplemental-insurance company has worked to diversify its investment portfolio. The yen/dollar ratio has been fairly stable since February. The company has performed well, but foreign exchange has taken a big chunk out of earnings. Three months ago, AFLAC said to expect Q2 operating earnings between $1.54 and $1.68 per share. Their full-year guidance was $6.06 to $6.40 per share. Both forecasts are based on a yen/dollar exchange rate between 100 and 105. AFLAC is a buy up to $68 per share.

In April, Express Scripts ($ESRX) beat earnings by two cents per share, but they lowered their full-year guidance to $4.82 to $4.94. That was a decrease of six cents per share at each end. Express Scripts remains a buy up to $74 per share. That’s a high Buy Below price. I may lower it after the earnings report.

Fiserv ($FISV) hit another 52-week high this week. This stock has climbed almost non-stop for the last three years. Wall Street expects Q2 earnings of 80 cents per share. Fiserv is a buy up to $64 per share. I may have to raise that soon.

DirecTV ($DTV) is still our big winner on the year, with a 25% gain. There’s not much to say about DTV since the $95 buyout deal with AT&T. DTV’s volatility has nearly evaporated, and the stock is trading like a zero-coupon bond that matures at $95 at some point. The stock is now almost exactly 10% below its merger price.

That’s all for now. More earnings to come next week. Wall Street will also have an intense 48 hours between Wednesday and Friday. On Wednesday morning, the government will release its first estimate of Q2 GDP. The Fed also meets, and later that day, the FOMC will release its latest policy statement. Friday is Jobs Day, and we’ll also get a look at the ISM report for July. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – August 23, 2013

Eddy Elfenbein, August 23rd, 2013 at 7:13 am“To achieve satisfactory investment results is easier than most people realize;

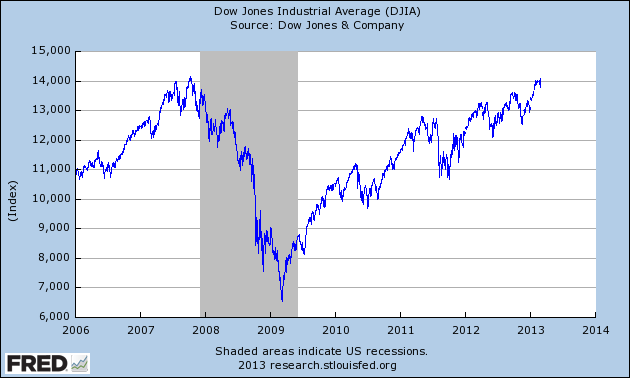

to achieve superior results is harder than it looks.” – Benjamin GrahamWall Street’s been having a tough time so far this August. Through Wednesday, the S&P 500 fell on ten of the previous 13 days. Thanks to the low volatility of late summer, these dips haven’t stung very much. Measuring from the market’s peak on August 2, the index lost nearly 4%, though we gained some of that back on Thursday. Interestingly, the Dow Industrials fell to their lowest level relative to the S&P 500 in five years.

Now a 4% haircut isn’t much of a downswing. It’s only a minor dent in the rally we’ve had this year. However, the big concern on everyone’s mind is that Ben Bernanke and his friends at the Fed are finally going to start “tapering” their bond purchases next month. I’ll have more on that in a bit. Wall Street had more headaches yesterday as “technical issues” caused trading to be halted on the Nasdaq for three hours.

But the action that’s caught my attention hasn’t been in the stock market. It’s in the bond market. Interest rates have spiked dramatically in the U.S., and the long bond is near its worst selloff in 13 years. In early May, the 10-year Treasury was yielding 1.63% (see chart below). On Thursday, the yield got as high as 2.92%, and a lot of folks expect us to break 3% any day now.

In this week’s CWS Market Review, we’ll take a closer look at what’s causing bond traders so much grief. We’ll also take a look at recent Buy List earnings reports from Medtronic ($MDT) and Ross Stores ($ROST). (Ross beat consensus by five cents per share and looks to break out soon.) But first, let’s focus on the dramatic rise in bond yields.

Why Are Rates Rising? It’s the Economy

The stock and bond markets have a rather unusual relationship. The two markets can basically be described as “frenemies.” On one level, they’re competitors for investors’ capital. Money will go wherever it’s treated best. The catch is that neither market will prosper for long if the other one is suffering. After all, the bond market is debt, and if companies have to shell out higher interest costs, that will cut into their bottom line. Meanwhile, if companies aren’t making a profit, then they can’t pay back their loans. Stocks and bonds are rivals under the same flag.

Sometimes the two markets move together as if they’re waltzing partners, and other times they act in near-perfect opposition. As a very general rule of thumb, the bond market leads the stock market by about six months to a year.

Long-term interest rates officially hit their low thirteen months ago, but the decline since then was rather slight. That is, until this May, when the rout really got going. The 10-year yield is now where the 20-year yield was in June, and where the 30-year yield was in May. So the question to ask is, why is the bond market falling so sharply?

The popular answer is that it’s due to the Federal Reserve pulling out of its bond buying. But I’m not so sure. Let’s review the situation: The Fed meets again in mid-September, and the central bank has successfully convinced Wall Street to expect a scaling-back of asset purchases. This week, in fact, the Fed released the minutes of its last meeting, and those minutes indicated that the other FOMC members are on board with Bernanke’s tapering plan. Personally, I think it’s too early to start tapering. If they do announce a tapering, and they probably will, I expect it to be modest, which means the Fed hasn’t left the bond market at all: they’re simply buying less. This really shouldn’t be a big deal.

That’s why I don’t believe the taper talk is the reason for higher interest rates. Other people think the higher rates are due to inflation. The gold market has rebounded lately, but that’s coming after a pretty rough year. The yellow metal is still off more than $500 an ounce since last year’s high. The CPI reports continue to be quite tame. Also, the yield on the 10-year TIPs, the inflation-protected bonds, has climbed largely in step with the regular 10-year bond (see chart below). In other words, investors aren’t demanding a greater inflation discount for their bonds. They just want a higher yield.

The influence of the Fed does show up in the middle part of the yield curve. For example, the spread between the two- and three-year Treasuries was only 10 basis points on May 6. Now it’s up to 40 points. That’s probably investors factoring in a short-term rate increase down the road. Interestingly, spreads among longer-dated bonds have actually tightened up a bit.

This leads me to believe that the reason for the higher rates is an improving economy. The key fact in favor of this thesis is that the dollar has been fairly stable. If yields were rising as the dollar was falling, then I’d be more concerned. I’ve also been impressed by how economically cyclical stocks have held up, and that’s despite a weak market for tech stocks. We also got encouraging earnings reports this week from broad-based retailers like Best Buy ($BBY) and TJX ($TJX). Also, Home Depot ($HD) had a good report plus they raised guidance.

The most intriguing bit of evidence in favor of the stronger-economy view is that junk-bond spreads have narrowed. In an unusual twist, AA-rated bonds are now yielding less than AAA bonds. But that’s not due to the market’s irrationality (which we can never completely discount). Rather, it’s due to the fact that investors want the shorter maturities that AA bonds usually carry. So investors want still bonds; they’re simply less willing to get locked into long positions.

Mortgage rates have climbed as well, and I am concerned that that could disrupt the housing market. The recent reports, however, show that housing is doing quite well. Our Buy List member Wells Fargo ($WFC) made news this week when they announced they’re eliminating 2,300 mortgage jobs. But that’s due to a decline in refinancings, not fewer originations.

The takeaway for investors is to not be too concerned about any taper talk. Its influence on the market is easily overstated. If bond traders are right, the economy is due for a rebound later this year and into 2014. That will be very good for our Buy List. Now let’s turn to our recent earnings reports.

Medtronic Hits Earnings Consensus on the Nose

On Tuesday, Medtronic ($MDT) reported fiscal first-quarter earnings of 88 cents per share, which was in line with expectations. Revenues rose to $4.08 billion, which was $40 million short of estimates.

Shares of Medtronic pulled back after the earnings report, but I think it was a fine quarter. Demand for defibrillators was a bit weak, as was the demand for MDT’s InFuse bone-growth product. Interestingly, Medtronic said they’re planning to expand beyond medical devices and into health services. I think that’s a smart move.

Medtronic’s CEO, Omar Ishrak, said, “We delivered on the bottom line, overcoming a number of challenges through strong operating discipline.” The best news was that MDT reiterated its full-year forecast of $3.80 to $3.85 per share. That’s for fiscal 2014, which ends next April. They made $3.75 per share last year and $3.46 per share the year before. In June, Medtronic raised its dividend for the 36th year in a row. Business is still going well here, and I think they can easily hit their full-year guidance. Ishrak said they’re looking to generate $25 billion in free cash flow over the next five years. Medtronic remains a solid buy up to $57 per share.

Ross Stores Delivers a Solid Earnings Report

After the close on Thursday, Ross Stores ($ROST) showed very strong fiscal Q2 earnings of 98 cents per share. That was five cents better than Wall Street’s consensus. It was even better than Ross’s own projections. After the last earnings report in May, Ross said to expect Q2 earnings to range between 89 and 93 cents per share.

Quarterly sales rose 9% to $2.551 billion. The important metric for retailers, comparable-store sales, rose 4% last quarter. That’s a very good number. ROST’s CEO, Michael Balmuth, said, “Operating margin for the second quarter grew to a record 13.6%, up from 12.8% in the prior year.” For Q2, Balmuth said he sees earnings coming in between 75 cents and 78 cents per share. That’s below Wall Street’s consensus of 79 cents per share, but Balmuth noted that it’s a cautious outlook.

For Q4, Ross sees earnings ranging between 99 cents and $1.03 per share. Wall Street had been expecting $1.10 per share. The guidance for Q3 and Q4 is based on comparable-store sales growth of 2% to 3%, which is very conservative. Add it all up, and Ross sees full-year earnings of $3.80 to $3.87 per share. Note that last year’s fiscal year included 53 weeks. Adjusting for that, Ross is projecting earnings growth of 11% to 13%.

This was an excellent quarter for Ross. Don’t let the tepid forecast bother you. They’re just being conservative. Ross Stores is an excellent buy up to $70 per share.

Before I go, I want to highlight three especially good buys on our Buy List. Ford ($F) looks very good below $17. The stock actually dipped below $16 earlier this week. The last earnings report was outstanding. Cognizant Technology ($CTSH) is a very good buy if you can get it below $73 per share. The recent earnings report and guidance was also very good. Keeping with tech, Microsoft ($MSFT) is a bargain below $33 per share. The stock currently yields 2.84%, and you can expect a dividend increase next month.

That’s all for now. Next week is the final week of summer. It went by fast, didn’t it? I expect trading activity to remain subdued until after Labor Day. On Monday, the census Bureau will report on durable orders. The report will come on Wednesday, when the government will revise the Q2 GDP growth numbers. The initial report was a sluggish 1.7%, but the subsequent trade numbers suggest a strong upward revision. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

“It’s Getting Crowded in Here”

Eddy Elfenbein, August 7th, 2013 at 11:17 amFord ($F) is hiring even more people:

Ford is expanding again.

This time, the country’s second-largest automaker is adding 800 jobs, primarily in vehicle development.

The move means Ford will add a total of 3,000 white collar jobs this year, with most of them located at the company’s headquarters in Dearborn, Mich.

“It’s getting crowded in here,” one Ford worker said at company headquarters. “I remember when there used to be a lot of empty desks and a lot of long faces.”

Not anymore. As Ford has expanded, it has filled those desks and turned massive losses into record profits.

-

CWS Market Review – July 26, 2013

Eddy Elfenbein, July 26th, 2013 at 7:38 am“The investor of today does not profit from yesterday’s growth.” – Warren Buffett

Second-quarter earnings season has been a big winner for us so far (although we had one major dud with Microsoft). In last week’s CWS Market Review, I told you that Ford Motor would easily beat its earnings estimate, and sure enough, that’s exactly what happened. Thanks to the great earnings report, Ford’s stock gapped up to another 52-week high, and it’s nearly doubled for us in the last year.

We also had strong earnings reports this week from CR Bard ($BCR) and CA Technologies ($CA). In this week’s CWS Market Review, I’ll highlight our recent Buy List earnings news, and I’ll preview what’s ahead next week (be sure to check out our Earnings Calendar). We have some important reports coming our way from Buy List stalwarts like AFLAC ($AFL), WEX Inc. ($WEX) and Fiserv ($FISV). Also next week, the Federal Reserve has a meeting, the government will provide its initial estimate of Q2 GDP on Wednesday and the big jobs report is on Friday. But first, let’s look at Ford’s blow-out earnings report.

Ford Smashes the Street—Again

In last week’s newsletter, I wrote:

Of all the companies reporting next week, I’m the most optimistic about Ford Motor (F). In April, the automaker earned 41 cents per share, which was four cents more than consensus. This time around, Wall Street again expects 37 cents per share. I think Ford will easily beat that.

I was right. Ford ($F) earned 45 cents per share, which was eight cents more than Wall Street’s consensus, and the stock surged as high as $17.68 per share. I’d like to say that this was due to magical predictive powers on my part. Alas, that’s not the case. Truthfully, it was nothing more than simple math. Yet it’s surprising how often that skill set is a major advantage in investing.

The facts are clear. Ford’s business is strong, and most of it is due to truck buyers in North America. Fusion has also been a key area of strength. Let’s run through some of the numbers. Ford’s net earnings surged 19% last quarter to $1.2 billion. Their revenues rose 15% to $38.1 billion. This was Ford’s 16th-straight profitable quarter. Furthermore, unlike some other American car companies I could name, Ford was not bailed out by Uncle Sam.

Ford made a cool $2.3 billion in North America. Sales of their F-Series trucks rose 26% to 198,643. I think this is closely tied to a lot of the emerging manufacturing rebound we’ve seen in some economic statistics. (By the way, the durable-goods report on Thursday was quite strong).

The problem child is still Europe. Ford had a pre-tax loss of $348 million in the Old World. Of course, a loss was expected. We know that Europe has been a drag on Ford, but they’re quickly working to economize their European operations. I think we’re going to see much better results in Europe in future quarters.

I was very pleased to hear that Ford offered improved guidance for the rest of the year. They now see pre-tax earnings clearing $8 billion for 2013. Before, they said they had expected to hit $8 billion. So far, they’ve made $4.7 billion in the first half of the year, so the new guidance seems quite reasonable. In Europe, Ford said they expect to lose $1.8 billion instead of the earlier projected $2 billion. That’s ugly, but not as ugly.

Ford also had a blow-out quarter in Asia. The company makes a big deal about this, but Asia is a very small part of their business. That could change. Ford plans to introduce 15 new vehicles in China by 2015. I’d like to see Ford raise its dividend by 20% to 25%. They can easily afford it. Ford remains an excellent buy up to $18 per share.

Strong Earnings from CR Bard and CA Technologies

After the closing bell on Tuesday, CR Bard ($BCR) announced Q2 earnings of $1.42 per share for Q2 which was four cents more than expectations. The medical-equipment company saw revenues rise by 2.3% to $759.9 million, beating expectations by $9.8 million. I was impressed by the turnaround in their oncology and surgery divisions.

Bard’s CEO said, “Our operating results this quarter exceeded our expectations. We continue to focus on the execution of our investment plan, which we believe will shift the mix of our portfolio to faster-growing products and geographies and contribute to long-term sustainable leadership positions in our markets.”

For Q3, Bard sees earnings between $1.37 and $1.41 per share. This is a quiet, steady winner. Bard may not make the headlines, but they do deliver results. Bard remains a solid buy up to $115 per share.

After the bell on Wednesday, CA Technologies ($CA) reported Q2 earnings of 78 cents per share, which was also four cents better than Wall Street’s consensus. I was really impressed by this report. CA’s results are a nice improvement from the 63 cents per share they earned a year ago (technically, the June quarter is their fiscal first quarter).

CA’s CEO said, “We did better than expected on the revenue line and were able to capitalize on organizational efficiencies, expense management and a tax benefit to drive earnings growth. Our cash flow from operations was down, but that was expected and we are confident in meeting our full-year outlook in all areas.”

For the full year, CA expects earnings to range between $2.90 and $3.00 per share. Wall Street had been expecting $2.99 per share. On Thursday, the stock got as high as $30.30 per share, which is a new 52-week high. CA is now a 35% winner on the year for us. CA Technologies is a very good buy up to $31 per share.

More Earnings Coming Next Week

We have five more earnings reports due next week. We may have a sixth in Nicholas Financial ($NICK), but I haven’t heard back from them yet. Last year, NICK’s earnings report came on August 2nd, so I expect it around then this year.

NICK’s last earnings report was a bit low, but I’m not at all worried. I’m expecting earnings to range somewhere between 40 and 45 cents per share. If there’s any news about the buyout offer, I expect that it’s been rejected. In August, NICK will hold its annual meeting, and I think there’s a good chance we’ll get another dividend increase. I think the board can go as high as 15 cents per share, which would most likely give the stock a nice shot in the arm. Nicholas Financial is a great buy up to $16 per share.

On Tuesday, AFLAC ($AFL), Fiserv ($FISV) and Harris ($HRS) are due to report. AFLAC has been heating up recently. The stock broke $61 per share. The last earnings report was very good. AFLAC earned $1.69 per share, which was seven cents better than estimates. The stock has rallied more than 17% since then. For Q2, AFLAC said it expect earnings to range between $1.41 and $1.56 per share. While the falling yen has cramped some of AFLAC’s earnings, much of the yen’s damage has receded. The company may update its full-year guidance as well. AFLAC is still going for less than 10 times this year’s expected earnings. AFLAC remains a very good buy up to $63 per share.

Fiserv’s ($FISV) earnings are like clockwork. In fact, the last earnings report was a big surprise because they missed expectations by a single penny per share. The stock gapped since the news was so unexpected. Nevertheless, Fiserv made up everything it lost and this week hit a new 52-week high. Fiserv’s most recent full-year guidance was for EPS growth of 15% to 19%, which translates to a range between $5.84 and $6.03. FISV is a buy up to $95 per share.

Business at Harris ($HRS) has been impacted by the government sequester, but overall business is still strong. The Street expects $1.15 for Q2. In April, Harris said to expect full-year earnings between $4.60 and $4.70 per share. Harris is boring, which is why I like it. HRS is a good buy up to $53. The stock has trended above my Buy Below price recently, so don’t chase it.

On Wednesday, WEX Inc. ($WEX) is due to report. Three months ago, WEX beat estimates by two cents per share, but the full-year guidance was well below the Street. The stock got clobbered for a 10% loss that day. The lower guidance caught me off guard, but not as much as what happened next—WEX went on a furious rally! Measuring from the post-earnings crush to Thursday’s close, WEX has jumped more than 30%. Three months ago, the company said to expect 98 cents to $1.04 per share for Q2. Don’t chase WEX. It’s a good buy up to $86 per share.

On Thursday, DirecTV ($DTV) will report. The satellite-TV company had great reports for Q1 and Q4 before that, and the stock has responded very well. I’m not expecting a huge beat like before, but I think DTV can top Wall Street’s current estimate of $1.33 per share. The secret here is that Latam business. DirecTV is a buy anytime you see it below $67 per share.

Before I go, I want to lower my Buy Below price on Microsoft ($MSFT) to $35 per share. I still like MSFT, but we have to face facts that last week’s earnings report was a major dud. But remember how quickly high-quality stocks can bounce back. We’ve seen that many times with our Buy List stocks, most recently Cognizant Technology ($CTSH) and WEX Inc. ($WEX) I also think we’ll see a nice dividend increase from Microsoft later this year.

That’s all for now. Next week will be a very busy news week. Of course, there are still more earnings coming our way. Also, the Fed meets again, and the policy statement will come out Wednesday afternoon. That morning, the government will give us their first estimate of Q2 GDP growth. Plus, the government plans to completely revise all the historical GDP numbers. If that’s not enough, Friday is the big jobs report. Expect jittery traders to be even more jittery. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Ford Surges on Strong Results

Eddy Elfenbein, July 24th, 2013 at 10:17 amFord Motor ($F) has done it again. Net earnings for Q2 jumped 19% to $1.2 billion. Revenues rose 15% to $38.1 billion. This was Ford’s 16th-straight profitable quarter. On a per-share basis, Ford made 45 cents which easily beat the 37-cent estimate Wall Street had.

Once again, North America was the main driver of results. Ford made $2.3 billion in North America thanks to rising truck sales. F-Series sales rose 26% in Q2. And once again, Europe was the weak line in Ford’s business chain. The automaker had a pre-tex loss of $348 million in the Old World.

The good news is that Ford offered improved guidance for the rest of the year. They now see pre-tax earnings clearing $8 billion for the year. Before, they said they had expected to hit $8 billion. In Europe, Ford said they expect to lose $1.8 billion instead of the earlier projected $2 billion.

Ford also had a blow-out quarter in Asia. The company makes a big deal about this, but Asia is a very small part of their business. The stock has been as high as $17.49 this morning which is a two-and-half year high.

-

CWS Market Review – July 5, 2013

Eddy Elfenbein, July 5th, 2013 at 8:08 am“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.” – John D. RockefellerThis will be an abbreviated issue of CWS Market Review. Trading this week was shortened due to Independence Day, and most of the fat-cat Wall Streeters are relaxing at their cribs in the Hamptons.

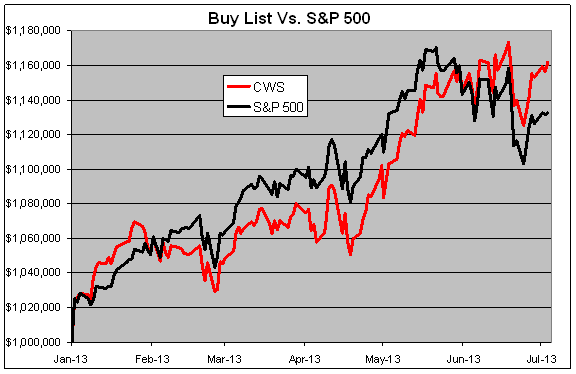

Don’t fear, my friends. My vigilant team and I are still on the watch, protecting you from whatever mayhem comes our way. The good news is that our Buy List continues to do very well. Through Wednesday, our Buy List is up 16.18% for the year compared with 13.27% for the S&P 500. That’s our widest lead all year.

In this week’s CWS Market Review, I’ll discuss the recent good news from Moog and Ford. Both stocks have been big winners for us lately. I’ll also talk about the upcoming Q2 earnings season. JPMorgan Chase and Wells Fargo will be our first stocks to report on Thursday, July 11th. But first, let’s look at why Ford just broke out to a new two-year high.

Good News for Ford and Moog

On Wednesday, shares of Ford ($F) closed at $16.43, which is the automaker’s highest close in 29 months. The catalyst for the move was a very strong sales report for June. Ford reported that sales were up 13% last month. The best news was that sales of F-150 pickups, which are a key moneymaker for Ford, jumped 24%. Ford said that sales in China are up 44% from last year. In May, China sales were up 45%. Ford has been busy playing catch up to GM in China.

Ford is due to report Q2 in a few weeks. The current estimate on Wall Street is for earnings of 36 cents per share, which would be a 20% increase over last year’s Q2. I should add that Ford has been creaming its estimates lately. I like this stock a lot. Ford remains a very solid buy up to $18 per share.

In last week’s CWS Market Review, I raised our Buy Below on Moog ($MOG-A) to $55 per share. That was pretty good timing! This week, Moog said that it’s looking at strategic options for its medical-devices division. That’s Wall Street-ese for “we’re looking to sell it.” I like when companies sell off units, and usually, so do investors. The stock broke $54 on the news, which is an all-time high.

The medical devices unit comprises just 5.7% of Moog’s overall business, but sales were down last year. As much as the market responds to the financial benefits of the divestiture, I think the market appreciates management’s willingness to shake things up. The company is due to report earnings at the end of the month. Wall Street currently expects earnings of 89 cents per share. Moog remains a good buy up to $55 per share.

Second-Quarter Earnings Season Begins Next Week

We’ve heard a lot of talk of how well companies should be doing, but beginning next week, we’ll finally see hard evidence of how well companies have performed. Earnings season is Judgment Day for Wall Street, and we’ll soon learn who’s been pulling their weight and who hasn’t. Fifteen of the 20 stocks on our Buy List ended their quarter on June 30th. This means that three-fourths of our portfolio will report earnings over the next month.

Wall Street is clearly nervous going into this earnings season. The analyst community currently expects index-adjusted earnings of $26.40 for the S&P 500. In the past year, that estimate has been revised downward by $2.50, including more than $1 in the last three months. Citigroup recently noted that negative pre-announcements have been outrunning positive ones by a ratio of 6.5 to 1. That’s the worst ratio since 2009, back when the world was falling apart.

I actually think the pessimists have gotten ahead of themselves here. While earnings expectations did need to come down, I suspect that growth is ramping up in several sectors. I especially think the damage from Europe won’t be as bad as is feared. The big trend recently has been share buybacks. For Q1, buybacks were up 17% from the year before. I think that will continue to be a major theme this year.

Our first two Buy List stocks to report this earnings season will be both of our big banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC). This is fortuitous for several reasons. First, both are excellent stocks. They’re also good bellwethers for the rest of the financial sector. Also, both banks made a decision recently to go all in on the mortgage business, which has been a huge winner for them. Both stocks are 20% winners for us this year.

JPMorgan had an insanely good first quarter. As much as Jamie Dimon annoys me, I have to admit that the bank still gets it done. Q1 earnings came in at $1.59 per share, which was 20 cents more than the Street’s consensus. There was some pushback from traders’ saying that the earnings beat was solely due to a tax benefit and some accounting adjustments.

But don’t let the bears scare you. JPM is doing very well. Wall Street expects Q2 earnings of $1.43 per share, and I think they’ll have little trouble beating that. Thanks to a pullback from the May high of $55.90, JPM is going for just 9.2 times this year’s earnings estimate. Jamie also recently raised the dividend by 26.7% to 38 cents per share. JPM currently yields 2.88%. The stock is an excellent buy up to $56 per share.

The business at Wells Fargo tends to be more stable than what we see at JPMorgan, and by extension, it tends to be more predictable. For Q1, Wells saw its earnings rise 22%, and they beat expectations by four cents per share. Their community banking division has been especially strong. Wells rewarded shareholders with a 20% dividend boost. Interestingly, the current yield is 2.91%, which is nearly the same as JPM.

For Q2, the Street expects 92 cents per share for Wells. That sounds about right, maybe a penny or two too low. The important thing for us to see is that business is continuing to improve. I also like that Wells and JPM took advantage of low rates to raise tons of cash from investors. Wells Fargo is a good buy up to $46 per share.

New Buy Belows for WEX and BBBY

I’m again going to raise my Buy Below on WEX Inc. ($WEX). The stock has taunted us long enough! WEX did dip below our $75 Buy Below recently, and it’s started to run up again. I’m raising our Buy Below to $80 per share.

I’m also raising Bed Bath & Beyond ($BBBY) to $75 per share. The stock has responded well to its recent earnings report, and I don’t want it to run away from us. BBBY remains a very good buy.

That’s all for now. I told you this would be a short one. Don’t forget: earnings season kicks off next week. The stock and bond markets are still recuperating from the last Fed meeting. On Wednesday, we’ll finally get a look at the minutes from that meeting. I suspect that these minutes will confirm the view that the Fed is in no rush to shut off the money spigots. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Ford Expands Production

Eddy Elfenbein, May 22nd, 2013 at 9:39 amSo many things are going right for Ford ($F) these days. A few years ago, the company was worrying about staying alive. Today, it’s worried about keeping up with demand.

The WSJ reports:

Ford Motor Co. plans to increase its North American manufacturing capacity by 200,000 vehicles in 2013 through a series of production-line expansions and a shortening of its normal summer shutdown by a week at several plants.

The Dearborn, Mich., auto maker won’t say what its total capacity is, but the company built 2.8 million vehicles in the region last year and was working near full capacity.

Ford will reduce its normal summer shutdown to one week from two at most of its North American plants. That alone will add 40,000 units of capacity, the company said. Also, it plans to speed up production at other plants to meet demand.

Ford recently said it would add a third shift to its Kansas City, Mo., F-150 pickup truck plant, adding 900 workers. It also is adding a shift of workers to an assembly plant near Detroit that will make the Fusion sedan as well as the Mustang.

After spending years closing plants and battling with its U.S. unions to get cost-savings, Ford is adding back production and is running at nearly full capacity, said Jim Tetreault, Ford’s North American manufacturing chief.

“We have three-quarters of our plants running on three crews,” Mr. Tetreault said. Three shifts at a plant is considered beyond “full capacity,” which typically is two shifts running 40 hours a week. Going around the clock makes plants more efficient and profitable.

I think Ford is a $20 stock.

-

Ford’s Sales Rose 6% Last Month

Eddy Elfenbein, April 2nd, 2013 at 2:18 pmShares of Ford ($F) are back over $13 on news of strong sales:

Ford Motor reported a healthy March sales gain of 6% as buyers embraced its redesigned Fusion sedan, Escape SUV and its truck models.

Fusion and Escape both had their best month of sales and best quarter ever, Ford said.

Explorer SUV was up 33% from a year ago, posting its best month since the redesign in 2010.

F-series truck boomed, up 16%, tallying the best first quarter since 2007, when the auto slump began.

Wall Street analyst Ryan Brinkman at J.P. Morgan noted that “sales were particularly strong for several of Ford’s more profitable models, including the Explorer and F-series.”

Ford-brand vehicles sold well enough to outweigh a disastrous showing by Ford’s upmarket Lincoln brand. It was down 22.5%, mustering a minuscule 6,825 sales.

Ford is trying to revive the brand by pitching it as the Lincoln Motor Co., but so far the marketing move has no traction.

Lincoln had no gainers. Every model fell considerably. Together, Lincoln cars — MKZ and MKS — were off 31.1%. SUVs — MKX, MKT and Navigator — dropped 22.5%

Overall, Ford said car sales were about even with a year ago, trucks were up 6% and SUVs rose 14%.

-

CWS Market Review – March 1, 2013

Eddy Elfenbein, March 1st, 2013 at 6:52 am“Business, more than any other occupation, is a continual dealing with the future;

it is a continual calculation, an instinctive exercise in foresight.” – Henry R. LuceThe stock market had a rather raucous few days this week, which included our worst single-day plunge since November, thanks to, of all things, unexpected election results in Italy. But after some good earnings and positive economic reports, plus bullish comments from Mr. Bernanke, the stock market regained its legs; the Dow is now only steps away from an all-time high. You know, it’s a wonder what pumping in a few trillion dollars can do for a market’s spirits.

Here’s an interesting fact: The S&P 500 has risen in both January and February. Since 1945, the S&P 500 has been positive for the first two months of the year 26 times. Every single time that’s happened, the index has closed higher for the year. No exceptions. In fact, it’s usually closed a lot higher. The average total gain, including dividends, has been 24%. If the S&P 500 were to rack up a 24% total return this year, the index would have to be well over 1,700 by the end of the year.

Of course, I’m not predicting such a move. We’re too smart to play the price targets game around here, but I do think this market will continue to be tricky. Frankly, earnings estimates are too high, and I see a lot of lousy stocks gaining ground. That’s not a good sign. On the plus side, the economic recovery is starting to gain some momentum, and our Buy List continues to be an oasis in a troubling climate. As usual, our strategy is to ignore the noise and remain focused on high-quality stocks.

We didn’t have any earnings reports this week, so I’m going to discuss some broader themes impacting the market. First, let’s look at what had the market so grumpy earlier this week.

Reports of the Euro’s Death Are Greatly Exaggerated

The early news on Monday showed that it looked like Pier Luigi Bersani’s left-of-center party was going to win the election in Italy. But as the results came in, both Beppe Grillo and Silvio Berlusconi, who are, respectively, a former comedian and a former Prime Minister, did much better than expected. The better they did, the worse stocks did.

In other words, the ditch-the-euro-and-bury-austerity crowd is still pulling in a lot of votes. As it turns out, Italians prefer governing themselves and not having Germany tell them what to do. Who knew? In fact, Grillo and Berlusconi did so well that due to the rules of Italy’s legislature, probably no one will be able to cobble together a governing coalition. And that probably means it’s back to the polls we go.

So here we are in 2013, with our portfolios noticeably impacted by the decision of a former comedian not to join in the governing of the Italian nation. My friends, we live in interesting times.

Now you might think it’s odd that I’m discussing these election results in a service dedicated to investing, and I have to agree with you—it is odd. But like the proverbial flap of a butterfly’s wing that causes a tornado thousands of miles away, the election results have far-reaching consequences. For one, the S&P 500 dropped 27.75 points on Monday, and it was the worst daily loss since the day after President Obama’s reelection.

Now let me explain what’s really going on and what it means for us: The plan to save Europe was perfectly drawn up and perfectly executed. There was one teeny, tiny, minor, little flaw: no one bothered to ask the voters. Well, technically they did ask, but the pro-euro policies slid by in Greece and other places. Now in Italy, voters are pushing back. That’s why this isn’t just about one election. It’s really a much broader battle, and that’s why our market reacted so dramatically. Bear in mind that the establishment’s candidate wasn’t Bersani; it was the current Prime Minister Mario Monti, and he was totally blown out.

If the anti-euro and anti-austerity movement gains power, it could undermine all the work that’s been done to save the eurozone. Remember last summer when Mr. Draghi made his dramatic statement that he was prepared to do whatever it takes to save the euro? Just look at any chart from that period and you’ll see that’s precisely when the lines that had been going down started to rise and when the rising lines started to fall. More specifically, that’s when investors finally stepped away from crowding en masse into U.S. Treasuries and started buying dollar-denominated stocks. That’s also when cyclical stocks started to take the lead. We’ve come a long way, so the recent events in Italy are seen as a big threat.

Here’s my take: This latest round is really a political crisis, whereas the previous episodes were part of a financial crisis. The good news is that bond yields in Europe are down dramatically from where they had been last summer. I think this was another example of investors who had already been looking to exit some U.S. stocks jumping on this excuse to unload their positions. The fundamentals in Europe and the U.S. are much better. Panicky traders, however, will never change. There may be more euro flare-ups to come, but those whom the Bond Market Gods wish to destroy, they first make Greek or Spanish. Maybe Portuguese. But not Italian.

The Equation That’s Been Driving the Market

The other big news this week was the Congressional testimony from Ben Bernanke. The Fed Chairman’s semi-annual testimony used to be a big deal, but since Bernanke allowed at least a little more transparency into a hopelessly opaque institution, the thoughts of Mr. Bernanke aren’t wholly unexpected.

In short, Bernanke said that the economy hit a rough patch late last year but that things are looking better at the start of this year. The part of Bernanke’s remarks that caught my attention was his robust defense of the Fed’s asset purchases. Some folks on Wall Street thought the recent Fed minutes indicated that the central bank was ready to pull the plug on their bond-buying. That ain’t happening. Bernanke made it clear that they want to keep buying bonds until the labor market gets much better. The Bearded One said, “The FOMC has indicated that it will continue purchases until it observes a substantial improvement in the outlook for the labor market in a context of price stability.” Seems pretty clear to me.

Now let me circle back and explain why this is so important. I’ll give you the simple equation to understand the stock market for the last six months or so. The areas that have done exceptionally well are found wherever you see consumers intersecting finance. This is absolutely crucial.

What do I mean by this? It’s not just that consumers are buying more things; it’s that they also need to finance those purchases. That means housing, which has done extremely well. The Homebuilder ETF ($XHB) is up 41% in the last year.

That means cars. Ford Motor ($F) has rallied more than 36% in the last seven months. Nicholas Financial ($NICK) continues to thrive as well. It also means travel and airline stocks. And spillover industries. Home Depot ($HD) just reported very good earnings, plus they raised their dividend by 34%. People buying. People borrowing. Banks lending.

On the other side of the financing, the big banks have done well. This has been great for JPMorgan Chase ($JPM) and Wells Fargo ($WFC), both of whom made a conscious decision to focus on mortgages. Stocks like Visa ($V) and MasterCard ($MA) have also been big winners. All of these stocks have benefited from the same effect: Consumers buying things with money they don’t have at the moment but plan to get soon. This is why Bernanke’s defense of QE, and his dismissal of its risks, is so important. This trend isn’t nearly over, either. Mortgage rates are still very low, and housing inventory is getting pretty thin as well. Monetary policy does eventually work, though it may tarry.

Two Buy Below Adjustments

I want to make two small adjustments to our Buy Below prices. I’m going to bump up FactSet Research’s ($FDS) Buy Below to $96. Fiscal Q2 earnings are due out in mid-March, and I’m expecting good news. The Street’s looking for $1.11 per share. I also want to raise Stryker’s ($SYK) Buy Below to $64. Stryker is our #1 performer this year, with a YTD gain of 16.5%. Despite the recent rally, the shares are still quite reasonably priced.

That’s all for now. Next week, the government will revise its productivity report, plus we’ll get the Fed’s important Beige Book report. But the most important event will be next Friday’s jobs report. Remember what Bernanke said about “a substantial improvement.” Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His