Posts Tagged ‘f’

-

CWS Market Review – February 1, 2013

Eddy Elfenbein, February 1st, 2013 at 7:20 am“There are two times in a man’s life when he shouldn’t speculate:

when he can afford to and when he can’t.” – Mark TwainRemember the panic about the Fiscal Cliff? And the Debt Ceiling? And the Sequester? And about a dozen other things the financial media told us—insisted—that we simply had to worry about?

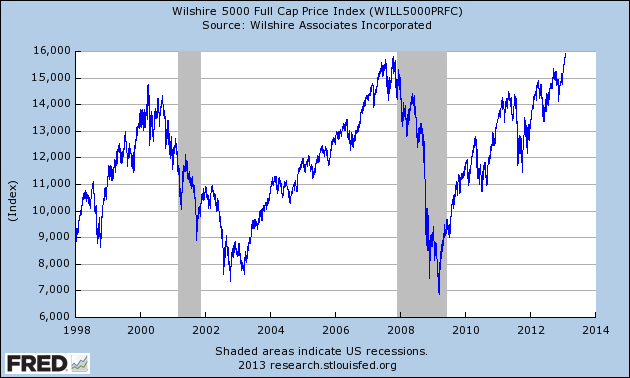

Well, here we are a few weeks later. The Dow Jones Industrial Average just closed out its best January in 19 years. The Wilshire 5000, the broadest measure of the U.S. stock market, is just below its all-time high.

Fortunately, we stuck by our strategy and ignored the noise-making scaremongers on TV. What’s perhaps more impressive is how low the market’s volatility has been. Consider this: On Wednesday, the S&P 500 had a rather minor loss of just 0.39%, and that was its worst loss of the year! Between January 9th and January 25th, the S&P 500 rallied 12 times in 13 sessions, and the only downer was a miniscule 0.09% drop.

But I have to be frank. The rally is beginning to look a little tired. For example, the S&P 500 tried to break 1,510 a few times this week and wasn’t able to bust through. That’s not a good sign. I think it’s very possible the bears may take back control of Wall Street in February. Nothing too serious, mind you, but just enough to scare the bulls away.

This was a mixed week for our Buy List stocks. The earnings reports were quite good, but some of our stocks, like Ford Motor ($F) and Harris ($HRS), didn’t respond well. That’s frustrating, but as you know, we’re in this game for the long haul.

We also had a negative GDP report for Q4, and that spooked a lot of folks. As odd as it may sound, the negative report really wasn’t that bad. When you look past the plunging military spending, the economy is better than it looks, and we’re poised for decent growth in 2013. The other big news this past week was the Fed meeting. We learned that Bernanke & Co. are firmly committed to keeping the money spigots going for a while longer. Some folks misread the December minutes, believing that the Fed was going to pull back soon. Sorry, not a chance.

Now let’s take a look at some of our recent Buy List earnings reports.

Ford Is a Buy up to $15 per Share

In last week’s CWS Market Review, I told you to expect a big earnings beat from Ford Motor ($F). Technically, I was correct. The company earned 31 cents per share, which was 24% higher than the 25 cents per share that Wall Street was expecting.

Despite the earnings beat, Ford warned that its losses in Europe this year would be worse than it had anticipated. Traders overreacted (of course, or they wouldn’t be traders) and brought the stock back below $13 per share. Let me be clear that Ford’s business is doing very well, especially in North America. Their pre-tax earnings in North America soared 110% from Q4 of 2011.

The New York Times described Q4 as a “microcosm of Ford’s recent overall performance.” In other words, strong America, weak Europe. But Ford’s strength in North America didn’t come about quickly. It was part of a painful restructuring process that’s only now paying dividends (literally, as Ford doubled its payout three weeks ago). Ford is employing that same turnaround strategy in Europe today, and the good news is that they’re far ahead of General Motors.

Don’t worry about the pullback in Ford. If you don’t already own it, the stock is a very good deal, especially if you can get it below $13. Thanks to the higher dividend, Ford currently yields 3.1%. I rate Ford a solid buy up to $15 per share.

Lower Guidance from Moog and Harris

On Tuesday, Harris ($HRS), the communications equipment company, reported earnings of $1.25 per share for the December quarter, which is the company’s fiscal Q2. This was five cents ahead of Wall Street’s consensus. Quarterly revenue dropped from $1.31 billion to $1.29 billion.

While Harris’s results were good, the news that has me concerned is that the company lowered its full-year guidance. I find that I often tell investors not to worry about this, or don’t worry about that. But lower guidance is indeed something to worry about. (By the way, I’m very glad we ditched JoS. A Bank from this year’s Buy List. The stock got pounded for a 15% loss on Monday after it gave an ugly earnings warning.)

Previously, Harris saw full-year earnings ranging between $5.10 and $5.30 per share. The company lowered that range by 10 cents per share at both ends. Harris now sees earnings ranging between $5.00 and $5.20 per share. So really, the guidance isn’t that much lower. We have to put this in context of a stock that closed the day on Thursday at $46.20, which is about nine times earnings.

Harris now sees 2013 revenue dropping by 2% to 4%. The previous range was flat to negative 2%. The company blamed the lower guidance on “slower government spending resulting from growing budget uncertainty.” It’s still early in the year, so I’m not giving up on Harris, but I want to see some improvement later this year. Harris remains a good buy up to $53.

Moog ($MOG-A) also joined the lower-guidance club, and like Harris, the news is disappointing but hardly dire. Last Friday, Moog lowered its full-year guidance from a range of $3.50 to $3.70 per share to $3.50 to $3.60 per share.

John Scannell, Moog’s CEO, noted that the company is off to a slow start this year, “The weakness in the major economies around the world is affecting our industrial business. On the other hand, the aircraft market is strong. We have moderated our forecast for the year slightly, but we are still projecting growth in both sales and earnings in 2013, despite the headwinds in our industrial markets.” Interestingly, Scannell’s comment reflects the same news about lower defense spending that we saw in the GDP report.

Moog’s quarterly revenues were up 3% to $621 million. Net earnings dropped 6% to $34 million. On a per-share basis, Moog made 75 cents last quarter. Since no one follows them, I can’t say if that beat or missed expectations. The stock still looks good for the long-term. Moog is a good buy up to $46 per share.

Profit Machine at Nicholas Financial Continues to Hum

On Wednesday, Nicholas Financial ($NICK), our favorite used-car loan company, reported quarterly earnings of 37 cents per share. But the results were distorted by taxes on their ginormous dividend late last year. Not including that, Nicholas earned 43.6 cents per share. Frankly, that’s a bit lower than I was expecting (around 45 cents per share), but not by much. I’m not a fan of NICK’s escalating operating costs, and I hope that doesn’t become a problem.

Our larger thesis for NICK still holds: that the company can rather easily churn out 45 cents per share every quarter. As long as rates are low and the economy is improving, NICK will do well. The math is pretty straightforward. Any company that’s pulling in, say, $1.80 per share per year should be going for at least $15, and possibly closer to $17. I think investors see NICK as a shaky subprime play. It’s not. In fact, NICK has gotten more conservative over the past few years. Like Ford, NICK pulled back below $13. Again, don’t be alarmed. NICK is a solid buy up to $15.

One more late earnings report. After the close on Thursday, CR Bard ($BCR), the medical technology firm, reported earnings of $1.70 per share, which beat consensus by three cents per share. Bard made $6.57 per share for all of 2012, which is up from $6.40 per share in 2011. I like that kind of growth. The downside is that Bard warned that 2013 will be rough, but they see extra-strong growth coming in 2014 and beyond. For now, I’m lowering my Buy Price on Bard to $102.

More Buy List Earnings Next Week

We’re now heading into the back end of earnings season, and the results have been good so far. The latest numbers show that of 237 companies in the S&P 500 that have reported, 74% have beaten earnings expectations, and 66% have beaten sales expectations.

Next week, we have four more Buy List earnings reports due: AFLAC ($AFL), Cognizant Technology Solutions ($CTSH), Fiserv ($FISV) and WEX Inc. ($WXS). I’m curious to hear what AFLAC has to say. Three months ago, they told us that Q4 earnings will range between $1.46 and $1.51 per share. That means full-year 2012 earnings between $6.58 and $6.63 per share. The problem is that AFLAC’s bottom line has probably been squeezed by the low yen. The question how is, how much? AFLAC has said to expect 2013 earnings to rise by 4% to 7%, but that’s on a currency-neutral basis. I like AFL up to $57.

Cognizant publicly said they expect earnings of 91 cents per share, and their forecast is usually very close. For this year, I think they can make $4 per share. I’m looking to see what kind of guidance they provide for 2013. CTSH remains a good buy up to $83.

Two weeks ago, Fiserv guided lower for Q4 but higher for all of 2013. I think this stock has some room to run. Fiserv is a good buy up to $88. Before I go, I wanted to highlight Microsoft ($MSFT). The shares are an especially good buy if you can get them below $28.

That’s all for now. Stay tuned for more earnings reports next week. We’ll also get important reports on factory orders and productivity. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Our old friend Russell Wasendorf, Sr. was just sentenced to 50 years in prison for massive fraud. Here’s our post from this summer on ol’ Russ, and tips for how you can spot financial fraud.

-

Ford Motor Beats Earnings for Q4

Eddy Elfenbein, January 29th, 2013 at 9:01 amFord Motor ($F) posted strong quarterly results this morning. For Q4, the company earned 31 cents per share, which was six cents per share more than expectations. Ford earned 20 cents per share during Q4 of 2011.

Quarterly revenue rose from $32.6 billion to $34.5 billion. Wall Street had been expecting $32.94 billion. In terms of net earnings, Ford earned $1.59 billion last quarter compared with $1.03 billion the year before. For the entire year, Ford raked in $5.66 billion on revenue of $134.3 billion.

The equation continues to be the same: they’re doing well in North America, but not so well in Europe. During 2012, Ford lost $1.75 billion in Europe. To give you an idea of how rough that is, they only lost $27 million there in 2011. In fact, the company said today that it’s expecting to lose $2 billion in Europe this year. Previously Ford had said they expected the same loss for this year as they had last year. Pre-tax earnings in North America rose 110%.

The New York Times described Ford’s Q4 as a “microcosm of Ford’s recent overall performance.” That’s a nice way of putting it. Alan Mulally, the head honcho, said, “We are well positioned for another strong year in 2013, as we continue our plan to serve customers in all markets around the world with a full family of vehicles.”

As bleak as things look in Europe, I like the steps that Ford is taking there. They’re being very aggressive, and they’re way ahead of GM. Basically, Ford is doing in Europe today what they did in North America a few years ago. Namely, restructure, reorganize and streamline operations. It’s painful in the short-term as we’re seeing in Europe today. But it’s very profitable in the long-term as we can see in Ford’s North American results today.

The stock looks to pull back a little today. Don’t be alarmed. Ford continues to do very well.

-

CWS Market Review – January 25, 2013

Eddy Elfenbein, January 25th, 2013 at 8:18 am“Most investors want to do today what they should have done yesterday.”

– Larry SummersIn the CWS Market Review from two months ago, I wrote: “But with the election behind us, the clouds have cleared, and I see a strong year-end rally ahead of us. In fact, I think the S&P 500 can break 1,500 by the early part of 2013.” Well, it took the index just 24 days into 2013 to vindicate our prediction.

On Thursday, the S&P 500 indeed broke through the 1,500 barrier for the first time since December 12, 2007. The index has now risen for seven days in a row, which is its longest winning streak since 2006. The Dow is off to its best start in more than a quarter of a century.

In this week’s CWS Market Review, I want to focus on the Q4 earnings parade which continues to help our Buy List beat the market. Through Thursday, we’re up 6.62% for the year, which is 1.81% ahead of the S&P 500. All 20 of our stocks are up for the year, and five have already logged double-digit gains.

But I have to warn you: I think the market’s rally is starting to look a bit tired in the near-term. I don’t see any major problems on the horizon, but I don’t want investors thinking the last few weeks are “normal.” They’re not. There’s still a lot of trouble out there for stocks that can’t deliver. An example would be Apple’s $250 plunge since September. Our Buy List is doing well, and it’s not due to luck: it’s due to quality.

Buy CA Technologies up to $27 per Share

Last week, I said that CA Technologies ($CA) should be able to beat Wall Street’s earnings forecast, and that’s exactly what happened. On Tuesday, CA reported fiscal Q3 earnings of 63 cents per share, which was two cents better than Wall Street’s forecast. Quarterly revenue came in at $1.2 billion, which was also ahead of the Street at $1.17 billion.

This is considered to be a rather dull company, and some people think it’s behind the times. But I see a good value. The day after the earnings report, the shares responded by rallying as high as $25.57 before pulling back some. If you recall from last week’s issue, I raised the Buy Below price from $24 to $27. This is a solid stock, and it pays a generous dividend, but I don’t want you chasing it if it continues to rally. I’m keeping my Buy Below price where it is. CA Technologies remains a good buy up to $27 per share.

We got more good news on Tuesday when Wells Fargo ($WFC) announced that it’s increasing its dividend by 14% (I also saw this coming). The bank is raising the quarterly payout from 22 cents to 25 cents per share. Bear in mind that the Federal Reserve still has many of these banks on double-secret probation, so any dividend increase must be approved by Bernanke and Friends. Earlier this month, Wells reported record quarterly earnings, and it beat Wall Street’s forecast. Wells Fargo currently yields 2.84% and is a solid buy up to $37.

Stryker ($SYK), the orthopedic implant maker, reported very good quarterly earnings on Wednesday. To be fair, the company had already told us to expect good news, yet the market continues to reward shares of SYK. With a 15.74% YTD gain, it’s the #1-performing stock on our Buy List. Consider this fact: Shares of Stryker have lost ground only twice in the last 17 trading days.

For Q4, Stryker earned $1.14 per share, which was two cents more than Wall Street’s estimate. For all of 2012, the company made $4.06 per share, which is a healthy increase over the $3.72 per share from 2011. That’s very good growth for a sluggish economy.

I was particularly impressed that Stryker reiterated its full-year forecast for earnings to range between $4.25 and $4.40 per share. Frankly, that’s probably too conservative, but it’s smart to play it safe so early on in the year. Don’t be surprised to see higher guidance from Stryker later this year.

Two weeks ago, I raised my Buy Below on Stryker to $62 per share. Even though the stock has run beyond that, I’m going to hold my Buy Below here. Again, I don’t want investors to chase after good stocks. As always, our investment strategy involves discipline.

Microsoft Isn’t the Disaster Everyone Thinks

After the closing bell on Thursday, Microsoft ($MSFT) reported fiscal Q2 earnings of 76 cents per share, which was a penny ahead of expectations. I think these results were decent despite widespread claims that Windows 8 has been a bust.

For the quarter, Microsoft’s profits dropped by 4% compared with last year. Quarterly revenue rose 3% to $21.46 billion, which was just shy of Wall Street’s forecast of $21.53 billion. The Windows division makes up about one-quarter of Microsoft’s overall business, and sales there rose by 11%. However, the company is getting slammed in its entertainment and office divisions.

To be sure, Microsoft has its share of problems. The online division is a financial black hole, and Xbox revenue is falling rapidly. On the plus side, Microsoft is doing better with business customers. That’s often been a tough nut for MSFT to crack. They were able to sign up more customers to long-term contracts, which bodes well for future business.

The problems Microsoft is having are plaguing the entire PC sector, and that’s one of the reasons why the company has joined a possible deal to take Dell ($DELL) private. I think one analyst summed it up well when he said, “Microsoft is evolving really into an enterprise software company.”

The bottom line is that Microsoft is a company with a lot of problems. But the share price is well beneath the fair value. The stock is currently going for less than 10 times this fiscal year’s earnings. Microsoft remains a good buy up to $30.

More Buy List Earnings Next Week

We had some more good news this week from other Buy List stocks. I was pleased to see Bed Bath & Beyond ($BBBY) get a 4.4% lift on Thursday thanks to an upgrade from Oppenheimer. BBBY is still a good buy up to $60 per share.

Ross Stores ($ROST) got a 3.5% boost on Thursday after it was upgraded to outperform by Credit Suisse. They raised their price target on ROST from $60 to $68. Ross Stores is an excellent buy up to $62.

I’m writing this early Friday, and later today Moog ($MOG-A) will report earnings. In the CWS Market Review from November 16, when Moog was going for $34, I said it could “be a $45 stock within a year.” Try within ten weeks. Moog just broke $45, but don’t chase it if it crosses $46.

Next week, we get earnings reports from Ford ($F), Harris ($HRS) and CR Bard ($BCR). I’m especially looking forward to strong results from Ford. The consensus on Wall Street is for earnings of 26 cents per share, and Ford should beat that by a lot. I haven’t heard details yet from Nicholas Financial ($NICK), but it’s very likely they’ll also report next week.

That’s all for now. Earnings season continues next week. The government will also give us a first look at Q4 GDP report. Next Friday will be the important jobs report. The jobless claims reports have been quite good recently, so that may be a harbinger of a strong jobs number. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Cognizant Technology Hits 52-Week High

Eddy Elfenbein, January 11th, 2013 at 11:06 amIn addition to the record earnings from Wells Fargo ($WFC), more good Buy List news is that Cognizant Technology ($CTSH) is at a new high this morning thanks to strong earnings from one its rivals. Generally, good news from one stock in a sector helps everyone in the sector. Infosys (INFY) beat earnings expectations and the shares are currently up 17% today. CTSH is up about 4% and it’s due to report earnings in another month.

In other Buy List news, Ford Motor ($F) announced that it’s hiring 2,200 white collar workers. This is the biggest such increase in over a decade. The stock broke $14 this morning. The last time Ford was over $14 was July 7, 2011.

-

CWS Market Review – January 11, 2013

Eddy Elfenbein, January 11th, 2013 at 7:42 am“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

I’ll sum up this market up in four words: Fear is melting away. Wall Street continues to rally as the fear that gripped the market so intensely slowly fades away. This has been great news for the broader market—and especially for our new Buy List.

On Thursday, the S&P 500 closed at its highest level in more than five years. What’s even more impressive is that the Volatility Index ($VIX), also known as the Fear Index, recently dropped to its lowest level in five-and-a-half years. After seven days of trading, our Buy List is already up 4.34% for the year, which is 1.12% ahead of the S&P 500.

Earnings season is about to start, and we’ve had a flurry of good news this week. Both Stryker ($SYK) and Medtronic ($MDT) raised the low end of their full-year guidance. DirecTV ($DTV) rallied after the company said it had added 100,000 new subscribers in Q4.

How about Nicholas Financial ($NICK)? The little powerhouse came close to breaking through $14 per share. On Thursday, Oracle ($ORCL), Fiserv ($FISV) and Stryker ($SYK) all made fresh 52-week highs. (Is it me, or didn’t Oracle just break $30 a few weeks ago—and it’s already closing on $35?)

Perhaps the best news of all came from Ford ($F). The automaker said it’s doubling its dividend. In the CWS Market Review from a month ago, I said it is possible Ford could sweeten its dividend, but honestly, I was expecting something minor. Not doubling! This is an excellent sign of confidence from Ford. The stock got as high as $13.94 on Thursday, which is an 18-month high.

The End of the Fear Trade

Before we get too carried away, I want to warn you that this is a tricky market. Last week, I mentioned that we’re witnessing a “high-beta rally,” which means that a lot of bad stuff is getting pulled along with the good stuff. Fortunately, we have the good stuff.

What’s interesting is that the most-hated stocks on Wall Street, meaning those that are “shorted” the most, have been doing the best. The folks who have been short this market have been getting squeezed. This means they have to cover their shorts, and that’s propelling those hated stocks even higher.

I’ll explain what’s going on with a simple example. Let’s say you have two stocks that are perfectly equal in every way. Same industry, same finances, same logos, you name it, they’re exactly alike. Both are expected to earn $1 per share this year. However, there’s one difference. Stock A is expected to earn $1 per share, plus or minus two cents per share, while Stock B is expect to earn $1 per share, plus or minus 30 cents per share.

So which stock is going to be worth more? The answer is that in most cases Stock A will be worth more. It’s not entirely logical, but investors are more scared of the downside than they are optimistic for the upside.

But here’s the important part investors need to understand: While Stock A will usually be worth more than Stock B, that gap will fluctuate a lot. Sometimes, the crowd turns fearful and the A/B gap will open wide. But other times, when folks are more confident, that gap will narrow. The A/B gap will move according to the crowd’s fear level.

Now let’s bring our thought exercise back to the real world. What happened over the past few years is that the whole world got terrified. The A/B gap opened to ridiculous levels. Any investment that wasn’t a surefire guarantee got dumped. It wasn’t just stocks: we saw it in bonds as well. High-grade corporates lagged Treasuries, and junk bonds lagged high-grades.

As the fear is slinking away, the fear gap is closing up. As a result, the Stock Bs of the world are outperforming the Stock As. Meaning that anything that’s seen as carrying higher risk has been doing well. In the real world, we can see that in the fact that small-cap indexes like the Russell 2000 ($RUT) and S&P Small-Cap 600 (^SML) have recently hit all-time highs, even though the S&P 500 still has a way to go to match its all-time high. Even the Mid-Cap 400 (^MID) is at a new high. Last week, I showed you how well the High-Beta ETF ($SPHB) has performed.

This chart shows you that since mid-November, small-caps have done the best, followed by the mids, followed by large. Performance has been perfectly ordered by size (or risk, B to A).

Let me caution investors not to be too impressed by some of the stocks that they’ll see rally. Facebook ($FB), for example, is back over $30. FB is horribly overpriced, and there are lots of stocks rallying that are even worse. Don’t chase them. Instead, investors should stick with high-quality stocks like the names you’ll find on our Buy List. Now let’s look at some of the recent good news from our stocks.

Stryker and Medtronic Raise Guidance

Even though earnings season hasn’t begun yet for our Buy List, two of our stocks got ahead of the game by raising their full-year guidance forecasts. I should add that I like stocks that provide full-year forecasts. Companies aren’t required to do this, so it’s nice to see firms give more information to the public.

On Monday, Medtronic ($MDT) raised its full-year forecast to a range of $3.66 to $3.70 per share. That’s an increase of four cents per share to the low end. Medtronic has stuck by its original forecast since May, which is commendable. The increase is due to a research tax credit.

Note that Medtronic’s fiscal year ends in April, so Q3 earnings are due in about six weeks. For the first six months of this fiscal year, Medtronic earned $1.73 per share. That means we can expect $1.93 to $1.97 for the back end. Medtronic earned $3.46 per share last year. Medtronic remains a good buy up to $44 per share.

On Wednesday, Stryker ($SYK) raised the low end of their full-year guidance by one penny per share. The company now sees full-year earnings ranging between $4.05 and $4.07 per share. Stryker also said that sales for Q4 rose by 5.5%, while the Street had been expecting an increase of 2%. For 2013, Stryker reiterated its full-year forecast for earnings of $4.25 to $4.40 per share. Wall Street is expecting $4.30 per share. Earnings are due out on January 22nd. The shares closed Thursday at $58.84, which is a new 52-week high. I’m raising my Buy-Below on Stryker to $62.

Ford Doubles Dividend

After the South Sea Bubble went ka-blamo in the early 18th century, Sir Isaac Newton famously said, “I can predict the movement of heavenly bodies, but not the madness of crowds.” Ike, my man, I feel you.

Long-term readers of CWS Market Review know how much I like Ford ($F). When the stock dropped below $9 last summer, I thought either Wall Street or I had lost our marbles. Possibly both.

The numbers said Ford was cheap, and we stuck to our guns. Today, suddenly Ford is one of the hottest stocks on Wall Street. The stock got another big boost this week when the automaker said that it’s doubling its quarterly dividend from five cents to ten cents per share. The dividend hasn’t been this high in seven years. Going by Thursday’s close, Ford yields 2.89%. The stock jumped to an 18-month high. I rate Ford an excellent buy up to $15.

New Buy Below Prices

Thanks to our Buy List’s strong performance, I want to adjust several of our Buy Below prices. Remember, these aren’t price targets; they’re guidance for what’s a good entry point. This week, I’m raising Oracle’s ($ORCL) Buy Below by $2 to $37 per share. As I mentioned earlier, I’m raising Stryker ($SYK) to $62. I’m also raising Fiserv ($FISV) to $88 and WEX ($WXS) to $82. Quiet, unassuming Moog ($MOG-A) is our third-best performer this year, with a 7.24% YTD gain. Moog’s new Buy Below is $46. I’m raising CR Bard ($BCR) to $108.

JPMorgan Chase ($JPM) is due to report earnings next Wednesday, January 16th. The Street currently expects earnings of $1.20 per share. My numbers say that’s too low. For now, I’ll raise my Buy Below to $47 per share, which is just above the current price. Let’s see how the earnings shake out before we make a larger move.

That’s all for now. Earnings season starts to heat up next week. Remember JPM reports on Wednesday. We’ll also get important reports on inflation and industrial production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – January 4, 2013

Eddy Elfenbein, January 4th, 2013 at 8:17 am“You get recessions, you have stock market declines. If you don’t understand

that’s going to happen, then you’re not ready, you won’t do well in the markets.”

– Peter LynchHappy New Year! This has been an exciting week: the Fiscal Cliff is done and gone, stocks are near multi-year highs and our Buy List officially beat the market for the sixth year in a row!

For the last several weeks, I’ve been telling investors not to get caught up in all the ridiculous hype surrounding the Fiscal Cliff. What else can I say but that the financial media behaved irresponsibly in stoking the fears of this manufactured crisis? Congress was even worse. At some point, I believed, a deal would be reached—and that’s exactly what happened.

The market celebrated the deal on Wednesday with its strongest rally in more than a year. In just two days, the Volatility Index ($VIX), also known as the Fear Index, plunged by one-third, and the S&P 500 made back everything it had lost since mid-October. Before a late-day sell-off on Thursday, the index was flirting with its highest close since 2007. On top of that, our 2013 Buy List has already grabbed a slight lead over the S&P 500.

It’s times like this I’m glad we’re long-term investors. I can’t imagine what it’s like trading through all these vacuous pronouncements during the Fiscal Cliff debate. The math is still very much on the side of stocks. Six weeks ago, I told you I thought the S&P 500 would break 1,500 sometime early this year. At the time, that seemed like a bold forecast. Now it looks more like a cakewalk. The index is currently less than 3% away from topping 1,500.

In this week’s CWS Market Review, we’ll take a look at what’s driving the current rally. Plus, Q4 earnings season is only days away and I’m expecting solid results from our Buy List stocks. In fact, one of the newbies on our Buy List is already making waves. Ross Stores ($ROST) soared 8% on Thursday on higher earnings guidance! This came exactly one day after an analyst at Citigroup downgraded Ross. Now let’s take a look at the current market.

The High-Beta Rally

The big two-day surge we just had was interesting because it comprised the final trading day of one year and the opening day of the next. This past December 31st was the single-best final-day gain since 1974.

But this hasn’t been a standard rally. It’s been what traders call a “high-beta” rally. These are rallies that have concentrated on the most volatile stocks (or more technically, it’s correlated volatility). That’s why we’ve seen small-cap stocks and tech stocks do the best. The Russell 2000 ($RUT), which is a widely-followed index of small-cap stocks, just broke out to a new all-time high. The Equal Weighted version of the S&P 500 also hit an all-time high. The regular S&P 500 is weighted by market cap, so the mega-caps, which have been lagging of late, have greater weight.

Here’s a chart showing a High-Beta ETF ($SPHB) compared with the S&P 500, and you can see that’s been crushing the market lately.

Cyclical stocks also tend to do well during high-beta rallies. In essence, what the market is doing is shifting towards riskier assets. This is good news because investors need to be rewarded for being willing to shoulder more risk. It’s the willingness to put your money down that helps the entire economy move along. The move has been slow, but the market is becoming more risk-friendly. High-yield spreads, for example, are at an 18-month low, and high-dividend stocks were laggards in 2012.

When the world economy went kablooey a couple of years ago, everyone ran screaming to the most secure assets. Gold and U.S. Treasuries soared as stocks and junk bonds plunged into the abyss. Banks and businesses just sat on their cash. But a major turning point came last summer when Mario Draghi made his now-famous statement: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” My friends, that’s what we call a game-changer.

Even though this was an announcement from a European central banker, it sent shock waves around the world, and investors here in the U.S. took this as a signal to move towards risk. When I use the word “risk” here I don’t mean to use it with the negative connotations of recklessness or imprudence. Rather, I mean areas that have a longer time horizon to pay off. For example, I have a pretty good idea where Treasury bill yields will be in a week, but I have no idea what AFLAC’s ($AFL) stock will do. Yet over the next, say, two or three years, I have a very high level of confidence that AFLAC will still be pulling down a sizeable profit despite a fluctuating stock market. The latter investment simply needs more time to pay off.

I should also point out that it isn’t so much that investors are becoming riskier. Instead, it’s that investors are moving from a state of extreme risk-phobia to a more normal state of affairs. The day before Dragi’s statement, the yield on 10-year Treasury bonds hit an historic low of 1.4%. Since then, they’ve soared all the way to a still-puny 1.9%. Put it this way: Microsoft ($MSFT), which is a new member of the Buy List, is one of the largest and best-known blue chips stocks in the world, yet its yield is nearly double that of the 10-year.

The rotation towards risk got another big boost a few weeks after Draghi’s announcement when the Federal Reserve said it would pursue its QE Infinity policy. I should add that I was completely and totally wrong about this announcement. For weeks beforehand, I had said that the Fed was in no way pursing such a policy. Shows what I know!

Fortunately, our Buy List was perfectly poised to ride the market’s rotation. One great example is Ford Motor ($F). In the CWS Market Review from August 24th, I highlighted Ford as a good bargain. I wrote: “I don’t see how the stock can go for less than $10, but it is.” Just a few days before I wrote that, I remember that Ford had even dropped below $9. But patience once again paid off for us. Yesterday, shares of Ford got as high as $13.70. The stock is up more than 52% from its summer low.

The company just announced that December sales rose 1.9%. It was Ford’s best December since 2006. Look for another solid earnings report later this month. Ford remains an excellent buy up to $15 per share.

Ross Stores Soar 8% on Higher Guidance

One of the new stocks on this year’s Buy List is Ross Stores ($ROST). This is a very solid retailer. On Thursday, one day after an analyst at Citigroup downgraded the stock, ROST reported outstanding sales and guided higher for Q4. December sales rose 11% to $1.276 billion.

The key metric for a retailer is comparable-store sales. Wall Street was expecting ROST to report an increase of 2.7%. Instead, it was 6%. The company also raised its earnings guidance for Q4 (which ends in one month). Before, Ross was expecting earnings of 99 cents to $1.04 per share. Now they expect earnings of $1.04 to $1.05 per share. Ross expects comparable-store sales to rise between 1% and 2% for January. This is excellent news. The shares gapped up 7.97% on Thursday to close at $58.78. Thanks to the rally, I’m raising my Buy Below on Ross to $62 per share. Expect to see their 19th-straight annual dividend increase in a few weeks.

Before I go, I want to point out some good bargains on the Buy List. Bed Bath & Beyond ($BBBY) has dropped down recently. My Buy Below price is currently $60, but if you can get BBBY below $57, that’s a really good deal for the long-term. CA Technologies ($CA) is pretty cheap. At its price, CA yields 4.42%. Also, Microsoft ($MSFT) continues to be the stock everyone loves to hate, but it looks very attractive below $28 per share. Actually, one of the reasons why I like it is that everyone else hates it so much. MSFT currently yields 3.38%.

That’s all for now. Earnings season starts next week. Our first Buy List stock to report will be Wells Fargo ($WFC) on Friday, January 11th. Wall Street currently expects 90 cents per share, which sounds about right. Wells is a good buy up to $37. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. It’s official. I’m very happy to report that our Buy List beat the S&P 500 for the sixth year in a row in 2012. The 20 stocks on the Crossing Wall Street Buy List gained 14.56%, while the S&P gained 13.41%. Including dividends, our Buy List gained 17.85%, compared with 16.00% for the S&P.

-

CWS Market Review – December 28, 2012

Eddy Elfenbein, December 28th, 2012 at 8:44 am“Never buy at the bottom, and always sell too soon.” – Jesse Livermore

The stock market seems to be limping towards the finish line. Thursday was the fourth-straight down day for the S&P 500. We’ve nearly given back one month’s worth of gains in the last four days. This was the worst four-day Christmas stretch in at least 60 years. Still, the market has had a good year, and the indexes are well above where they were six weeks ago.

There was some excitement late in the day on Thursday as stocks spiked after the news that House Speaker John Boehner is going to convene a Sunday session of the House of Representatives. In one hour, the U.S. equity markets gained $150 billion in market value. This appears to be one final attempt to resolve the dreaded Fiscal Cliff before the end of the year. I’ll have more to say on that in a bit (here’s a sneak preview: ignore the hype).

In this week’s CWS Market Review, we’ll take a closer look at what’s impacting the market right now. There’s a lot going on just below Wall Street’s radar. For example, the Japanese stock market is exciting for the first time in more than two decades. Implied volatility is also slowly creeping higher. I’ll also have more to say on the 2013 Buy List, which will go into effect on Wednesday. But first, let’s look at all the hot air about the Fiscal Cliff.

Don’t Buy the Fiscal Cliff Hype

I haven’t said much about the vastly over-hyped Fiscal Cliff story because I thought this was a distraction for investors. I still believe that today. The American people have just gone through a long election campaign, and I don’t believe they have much patience for a drawn-out battle over taxes.

I haven’t addressed this phony issue in detail because I think it’s much ado about nothing. Or rather, it’s a great deal of bluster and posturing about nothing. The latest ruckus merely means that we might to have to wait until January for a compromise. Big deal.

Let’s be clear about the facts—there’s no point of no return. None at all. It’s really more of a fiscal slope than a cliff. Waiting a few days into January isn’t going to push us into a recession, a fact which ought to put to rest the silly notion of a Fiscal Cliff. And I won’t even go into those absurd countdown clocks on CNBC. I suspect that Fiscal Cliff worries are harming consumer confidence somewhat, but that’s about it. Ideally, I wish we had a better-functioning political system that avoided such theatrics, but unfortunately we don’t.

As I mentioned before, the latest news is that House Speaker John Boehner will convene the House of Representatives for a special session this Sunday. Just that announcement caused the S&P 500 to leap 15 points in a single hour late Thursday. That should tell you that the market wants this nonsense resolved. I should caution investors to expect, before this mess ends, one or two days with sharp drop-offs (but no more than 2%) as the political players try to sway the markets to their side. We all know how the market loves to be the drama queen.

Events have gotten so bizarre that the markets actually rallied when Senator Scott Brown posted on his Facebook account that the White House was proposing a last-minute offer. The markets then dropped after journalist John Harwood tweeted that the White House was denying Brown’s Facebook post. Our political system has been reduced to communicating via tweets and Facebook? This is just too silly to comprehend. I’m hardly an expert on political matters, but I think President Obama will ultimately be able to get most of what he wants. There’s too much to lose if this drama drags on.

All Eyes Are Focused on the December Jobs Report

The economic news continues to be—not so horrible. This week, we learned that new home sales rose 4.4% in November. That’s the fastest rate in two-and-a-half years, and new homes sales are up 15.3% over the last 12 months. On Wednesday, the Case-Shiller Index indicated that home values are up 4.3% from last year.

On the jobs front, initial unemployment claims continue to drop. The latest report showed 350,000. Since there tends to be a lot of “noise” in this report, economists prefer to focus on the four-week average. Well, that just hit a five-year low. This also means that the effects of Hurricane Sandy have probably passed.

We’ll learn a lot more about the jobs market next Friday, when the Labor Department releases the December jobs report. Remember that the Fed has specifically said that it expects rates to remain low until the unemployment rate hits 6.5%. We’re currently at 7.7%.

Wall Street currently forecasts that real GDP growth for Q4 will be pretty anemic. Goldman Sachs recently lowered their forecast to just 1% growth. But much of this is a short-term concern because it’s due to firms working off their inventories. In layman’s terms, companies aren’t building a lot of new stuff. Instead, they’re letting their customers buy what’s left on their shelves. This is probably due to the uncertainty coming from Washington. But at some point, companies will want to restock their shelves, so they’ll get back to building again.

We’re only a few weeks from the start of earnings season. Wall Street currently expects earnings of $25.33 for the S&P 500 (the earnings number adjusted to the index). As recently as six months ago, analysts were expecting $28. Despite the slashed estimates, the current forecast would be an increase of 6.74% over last year’s fourth quarter. It would also be the highest growth rate in three quarters and perhaps the first evidence that not only are earnings growing, but the rate of growth is increasing. For all of 2013, Wall Street’s consensus is for earnings of $112. 82. That means the S&P 500 is currently going for just over 12.5 times forward earnings. That’s not a bad deal.

The Yen’s Impact on AFLAC

In the last six weeks, the Japan Nikkei has soared nearly 20%. It’s been two decades since investors were excited about Japan. Put it this way: the index is still 73% below its all-time high from 23 years ago. That’s about the time that The Simpsons premiered in the United States. The game changer for Japan is that the new Prime Minister, Shinzo Abe, wants to force the Japanese Fed to be more aggressive in fighting deflation.

The effect of this is that the Japanese yen has lost ground against the U.S. dollar, and it will probably continue to do so. I wanted to alert investors that a weaker yen takes a bite out of AFLAC’s ($AFL) earnings since the company does most of its business there. It breaks down something like this: Every additional yen in the yen/dollar exchange rate costs AFLAC about five cents per share in annualized operating earnings. In other words, the weaker yen hurts AFLAC, but it’s not a back-breaker. I like AFLAC a lot, and it’s done well for us in 2012. I’m looking forward to another good year in 2013. AFLAC is an excellent buy up to $57 per share.

The 2013 Crossing Wall Street Buy List

With just two trading days left, our 2012 Buy List is up 14.02% for the year, while the S&P 500 is up 12.76%. Including dividends, we’re up 16.47%, while the S&P 500 is up 15.33%.

Once again, here are the 20 stocks for our 2013 Buy List:

AFLAC ($AFL)

Bed Bath & Beyond ($BBBY)

CA Technologies ($CA)

Cognizant Technology Solutions ($CTSH)

CR Bard ($BCR)

DirecTV ($DTV)

FactSet Research Systems ($FDS)

Fiserv ($FISV)

Ford ($F)

Harris Corporation ($HRS)

JPMorgan Chase ($JPM)

Medtronic ($MDT)

Microsoft ($MSFT)

Moog ($MOG-A)

Nicholas Financial ($NICK)

Oracle ($ORCL)

Ross Stores ($ROST)

Stryker ($SYK)

Wells Fargo ($WFC)

WEX Inc. ($WXS)Please note that I had the incorrect ticker symbol for WEX Inc. in last week’s email. The correct ticker symbol is WXS.

I want to address a few points that people have asked since I announced the Buy List changes last week. For those of you who have followed for a while, the Buy List changes weren’t a big surprise, and I supposed that’s how it should be. A few of you even guessed my changes correctly ahead of time. Still, some of you were surprised that Bed Bath & Beyond ($BBBY) is on the list. I know BBBY disappointed us with their lower guidance, but I’m willing to give them the benefit of the doubt. They’ve weathered worse storms.

Some of you were surprised to see Microsoft ($MSFT) on the Buy List. This is where I should explain that oftentimes good investments look a bit banged up on the outside. After all, that’s why the price is so good. I agree with Microsoft’s critics, but at $27 and with a 3.4% dividend, the stock is worth owning.

Two of our new stocks, Cognizant Technology Solutions ($CTSH) and FactSet Research Systems ($FDS), are former members of the Buy List. At $73, I admit that CTSH is rather pricey, but I’m not a pure value investor. There are occasions where we need to pay for strong growth, and I think this is one.

With the addition of Wells Fargo ($WFC), we now have two large banks on the Buy List (the other being JPM). Of course, if I hadn’t deleted Hudson City, we were going to get shares of M&T Bank anyway. The Buy List is slightly tilted toward financials, but I don’t believe unreasonably so. Based on next year’s earnings estimate, the financial sector is valued 10% less than the market as a whole. There are some bargains in this sector. In fact, I doubt many active investors will be able to beat the Financial Sector ETF ($XLF) next year.

I’ll have my Buy Below prices for the five new stocks in next week’s CWS Market Review. Until then, you can consider all five to be very good buys at their current prices. I’m also raising my Buy Below prices on Ford ($F) to $15, on Moog ($MOG-A) to $43, and on Harris ($HRS) to $53. On Thursday, Ford touched an eight-month high. Six weeks ago, I highlighted Moog as an outstanding buy, and the shares have rallied 18% since then.

That’s all for now. The market will be closed on Tuesday for New Year’s Day. I’ll crunch the numbers and post the complete year-end Buy List stats then. Remember, the 2013 Buy List will take effect at the open on Wednesday. We’ll also get the big jobs report on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – November 2, 2012

Eddy Elfenbein, November 2nd, 2012 at 8:28 am“Success or failure in business is caused more by the mental attitude even than by mental capacities.” – Walter Scott

In last week’s CWS Market Review, I mentioned how I saw the market heading for “rough waters.” Of course, I meant that as a metaphor but it came literally true this week as Hurricane Sandy pounded the New York area. For the first time in more than 120 years, the New York Stock Exchange closed for two days in a row due to weather. I hope everyone survived the storm intact.

Despite the abbreviated trading this week, our Buy List continues to do well. I told you in last week’s issue to “look for an earnings beat” from Ford ($F), and that’s exactly what we got. The automaker smashed Wall Street’s expectations by 33%. Once trading resumed on Wednesday, the stock gapped up nearly 8%, and it pushed even higher on Thursday to reach its highest close in six months. Also on Thursday, shares of AFLAC ($AFL) closed at their highest level since May 17, 2011.

However, not all of our earnings reports have been great. Nicholas Financial ($NICK) had a mildly disappointing report, and WEX Inc. ($WXS), the new name for Wright Express, fell six cents shy of estimates. I still want investors to position themselves defensively. We’re not out of the woods just yet, but we are getting close.

In this week’s issue, I’ll survey our recent Buy List earnings reports; plus I’ll discuss the final batch of earnings reports due next week. But first, let’s look at the remarkable turnaround at Ford Motor.

Ford Is a Strong Buy Up to $13

I have to admit that I had been baffled by the steady erosion in Ford’s ($F) share price since the beginning of last year. The company was clearly doing well and all of the problems negatively affecting their business were out of their control. Sure, their European sales were going down the drain, but they’ve been working to cut back production there.

On Tuesday, we got the results and they were very good. For the third quarter, Ford earned 40 cents per share which was 10 cents more than Wall Street’s consensus. This was despite a 4% drop in overall revenues. I’ve looked over Ford’s numbers and what’s most impressive is that they got their profit margins in North America up to 12%. That’s outstanding.

The success of this earnings report was laid a few years ago when the company dramatically restructured itself. Ford worked to cut costs and change its operations. That’s basically what Ford is planning to do in Europe today. Looking at the numbers, we can see that Europe was clearly Ford’s weak spot. The company lost $468 million in Europe.

Ford is doing amazingly well in North America and that drove the strong results. On Wednesday, Ford jumped 7.7% to $11.16. On Thursday, the stock rose another nine cents to $11.25. The last time the stock was this high was on April 30th. Despite the rally, shares of Ford are still attractively priced. I think Ford can earn as much as $1.62 per share next year which means the stock is going for less than seven times next year’s earnings. I’m raising my Buy-Below on Ford to $13 per share.

Nicholas Financial Earns 42 Cents Per Share

I had been eagerly waiting for Nicholas Financials’ ($NICK) earnings report but the results were a slight disappointment. For the third quarter, the used-car financier made 42 cents per share. Their results were hurt by higher operational costs and for their interest rate swaps. I don’t want to overstate my disappointment. The company is still doing very well and my long-term view of the company hasn’t changed. With short-term interest rates poised to remain low for the next few years, plus a slowly recovering economy, the future looks bright for NICK. I think the company can continue to earn about 45 cents per share (give or take) for the next several quarters. Don’t let any short-term bumps rattle you, NICK is doing well. The stock continues to be a strong buy up to $15.

Fiserv ($FISV) has been a great stock for this year (+28.35% YTD). Except for a dip in May, the stock has climbed nearly every month this year. On Tuesday, the company reported third-quarter earnings of $1.27 per share which was inline with Wall Street’s consensus. Fiserv also reiterated its full-year forecast of earnings growth of 11% to 14% which comes to $5.05 to $5.20 per share. Earnings for the first three quarters were up 13% to $3.75 per share so Fiserv should have little trouble hitting their full-year target. In fact, I think they have a shot of slightly beating that. Fiserv remains a very good buy. I’m raising my Buy-Below price to $80 per share.

For such a quiet stock, Harris ($HRS) has been very volatile recently. The shares got knocked down by 8% over two days in mid-October due to a downgrade. On Monday, the company reported quarterly earnings of $1.14 per share which was two cents more than expectations. The most important news is that Harris is sticking by its full-year guidance of $5.10 to $5.30 per share. If the next three quarters are like the first, Harris will hit that target easily. When trading resumed on Wednesday, the stock dropped, which I found puzzling. Sure enough, the shares rallied back strongly on Thursday to reach a three-week high. Harris remains a good buy up to $50.

WEX Inc. ($WXS), which used to be known as Wright Express, reported third-quarter earnings of $1.08 per share which was six cents below estimates. Revenues rose 6% to $161 million. WXS sees Q4 earnings ranging between $1.01 and $1.08 per share. The Street had been expecting $1.10 per share. Despite the earnings miss and poor guidance, the shares are holding up well. WXS is a good buy anytime the shares are below $75.

The Last Batch of Q3 Earnings Reports

We have three more Buy List earnings reports coming up. Moog ($MOG-A) reports on Friday, November 2. The results are probably out by the time you’re reading this. Unfortunately, Moog’s stock has been a dud this year. It’s the single worst-performing stock on our Buy List.

The problem is that Moog makes flight control systems for commercial and military aircraft. That whole sector has been…well, a no-fly zone this year. Wall Street expects earnings of 89 cents per share (this will be for Moog’s fiscal Q4). I’ll be curious to see if Moog reiterates their guidance for FY 2013 (which we just started). Earlier Moog had said it expects fiscal year earnings of $3.50 to $3.70 per share. The good news is that the stock’s lagging performance has made it an attractive buy. I rate Moog a strong buy up to $45 per share.

On Monday, November 5th, Sysco ($SYY) is due to report earnings, and DirecTV ($DTV) follows on Tuesday, November 6th, which is also Election Day. Sysco is expected to earn 50 cents per share which sounds about right. The stock currently yields 3.42% which is a very good deal. Here’s the thing: Sysco has raised its dividend for the last 42 years in a row. Even though their earnings were about the same as last year’s, I think they’ll want to keep the dividend streak alive, so look for a penny-per-share increase in the quarterly dividend very soon. Sysco is a good buy up to $32.

That’s all for now. Obviously the big news next week will be the election. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Ford Earns 40 Cents Per Share

Eddy Elfenbein, October 30th, 2012 at 11:38 amAlthough the stock market is closed again, we still have earnings reports coming out. This morning, Ford Motor ($F) released an outstanding earnings report. For the third quarter, the automaker made 40 cents per share. That was 10 cents more than Wall Street had been expecting.

The story is very simple—North America is strong and Europe is weak. The company has done a very good job of expanding its margins.

For Q3, Ford had profits of $2.2 billion which was up from $1.9 billion, or 34 cents per share, for the same quarter last year. Total revenue dropped 4%, from $32.1 billion to $30.9 billion.

Its Asia and Africa operations posted a pre-tax profit of $45 million, compared with a loss of $43 million. Ford said the unit benefitted from the launch of its new Ranger pick up and redesigned Focus compact in the region. Ford is investing heavily in Asia and the investment, along with a sluggish Chinese market, is damping profitability.

South American operations posted a pre-tax profit $9 million, compared with $276 million pre-tax profits a year earlier. Ford said the region should post a profit for the year.

In North America, Ford made $2.3 billion; but in Europe, Ford lost $468 million. The company expects to see more losses going forward. Over the last few years, Ford has cut capacity in North America and we’re seeing the fruits of those efforts today. They need to use the same strategy in Europe.

-

Durable Goods Orders Jump 9.9%

Eddy Elfenbein, October 25th, 2012 at 10:09 amThe stock market is gaining back some lost territory this morning. The S&P 500 is currently up about 10 points. Yesterday, the index closed at a seven-week low.

This morning, the Labor Department reported that jobless claims dropped by 23,000. I should caution you that that number has been swinging wildly in recent weeks. Economists have been closely watching the jobs figures for any sign confirming the improving trend in employment. Next Friday, we’ll get the jobs report for October and that will tell us a lot more.

Also this morning, the Commerce Department said that orders for durable goods soared 9.9% last month. That’s the biggest jump since January 2010.

The market is intensely focused on Apple’s ($AAPL) earnings which will come out after the close. I think the financial media greatly distorts the impact of well-known stocks. Apple is certainly important but please, there’s still another 97% of the stock market.

A few items for our Buy List.

Ford ($F) said it’s going to lose $1.5 billion in Europe this year. That’s much higher than their previous forecasts. The company is working to restructure its European operations which include shutting down a plant in Belgium in 2014. This is unfortunate but it has less to do with Ford and more to do with the weakness in Europe.

Medtronic ($MDT) is under fire this morning. The company is accused of manipulating studies on bone growth after spinal surgery.

The doctors and researchers who were the authors of the studies were part of a $210 million consulting and royalty payments program by Minneapolis-based Medtronic and never disclosed their ties or the company’s influence in their papers, the panel said in its report.

“Medtronic’s actions violate the trust patients have in their medical care,” Senator Max Baucus, a Montana Democrat and committee chairman, said in a statement. “Medical journal articles should convey an accurate picture of the risks and benefits of drugs and medical devices, but patients are at serious risk when companies distort the facts the way Medtronic has.”

I can’t speak to the accusation but Medtronic has strongly denied doing anything wrong. The stock is currently up this morning.

Lastly, CA Technologies ($CA) will report after the close.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His