Posts Tagged ‘HRS’

-

CWS Market Review – August 2, 2013

Eddy Elfenbein, August 2nd, 2013 at 7:43 am“More money has been lost reaching for yield

than at the point of a gun.” – Raymond DeVoeThis has been one of our best earnings seasons in memory. In the last 27 trading days, our Buy List has soared 10.43%. Not bad! For the year, we’re up 24.25%, which means we currently lead the S&P 500 by more than 4.5%. This should be our seventh market-beating year in a row!

On Thursday, the S&P 500 broke 1,700 for the first time ever. For the day, the index closed at 1,706.87. This has been an amazing time for equity investors, and it has a very good chance of lasting. The Fed this week gave investors more encouraging signals on monetary policy. Not only that, but we had a very strong ISM report, and initial jobless claims reached a five-year low.

In this week’s CWS Market Review, we’ll review the recent slate of outstanding earnings reports. Stocks like Fiserv and Harris continued the trend of Buy List stocks smashing estimates and gapping up to new highs. Fiserv stock rallied 4% after its report and nearly hit $100 this week. Harris beat its estimates by an amazing 26 cents per share, and the stock surged 8% on Tuesday. Both AFLAC and WEX Inc. rallied to new highs on earnings beats as well.

We had one disappointment this week with DirecTV, but it’s been a very good stock for us. I also want to preview the remaining earnings that are due next week. But first, let’s look at this week’s earnings news.

Moog Is a Buy up to $57

We have a lot of earnings to run through, so let’s start with last Friday, when quiet little Moog ($MOG-A), the maker of flight-control systems, reported earnings of 90 cents per share. That topped Wall Street’s view by six cents per share. Quarterly sales rose 10% to $671 million.

I was pleased with Moog’s forward guidance. For the full year, Moog sees earnings coming in at $3.25 per share, but that includes two 15-cent charges. Note that Moog’s fiscal year ends in September, so the June quarter was their fiscal third. For next year (September 2013 to September 2014), Moog sees earnings ranging between $3.90 and $4.10 per share.

That’s a very optimistic outlook. The Street’s consensus for next year had been for $3.90 per share. With a 38.31% gain, Moog is our number-one performer this year. Moog continues to be a very good buy up to $57 per share.

Harris Crushes Earnings and Soars

Then on Tuesday, Harris Corp. ($HRS) absolutely demolished Wall Street’s forecast. For their fiscal fourth quarter, the communications-equipment company pulled in $1.41 per share, which was 26 cents better than consensus! The stock surged 8% on Tuesday and continued to close higher on Wednesday and Thursday as well.

Harris also had very good guidance for next year. For fiscal 2014, which ends next June, Harris sees earnings ranging between $4.65 and $4.85 per share on revenue of $4.95 to $5.05 billion. The Street had been expecting earnings of $4.62 per share on revenue of $5.03 billion.

The success we’re seeing now at Harris is the result of restructuring efforts undertaken earlier this year. Harris had actually been one of our poorer-performing stocks this year, but as is often the case, high-quality stocks eventually deliver the goods. I’m raising my Buy Below on Harris to $62 per share. This is a very solid stock.

I’m Raising my Buy Below on Fiserv to $103

After the bell on Tuesday, Fiserv ($FISV), which had been rallying pretty well going into earnings, had a great earnings report. For the second quarter, Fiserv earned $1.50 per share, which was six cents better than Wall Street’s estimate. Quarterly revenues rose 11.8% to $1.14 billion, which was a bit short of consensus.

Fiserv reiterated its full-year guidance of earnings ranging between $5.84 and $6.03 per share. Always take notice when a good company reiterates guidance. Too many investors see that as being “no news.” Not me. I like to hear that our stocks are still on track for the year. Looking at the numbers, I don’t think Fiserv will have any trouble hitting that range. For the first six months of 2013, Fiserv has earned $2.83 per share. Earnings are up 16% so far this year, and cash flow is up 22%.

Shares of FISV jumped 4% on Wednesday. At one point, the stock came within 12 cents of hitting $100 per share. I’m raising my Buy Below to $103 per share. Fiserv is an excellent buy.

AFLAC Surges Past $63 on Strong Earnings

Our beloved AFLAC ($AFL) reported Q2 operating earnings of $1.62 per share, which was 11 cents better than estimates. I liked that, and so did traders. AFLAC rallied 4.3% over the following two days and reached a new 52-week high.

Let’s dig into the details. Remember that with insurance companies, it’s more important to focus on their operating earnings. Three months ago, AFLAC gave us a range for Q2 of $1.41 to $1.56 per share, so business is going much better than expected. The problem, of course, is the yen/dollar exchange rate, which wound up knocking 22 cents per share off earnings last quarter. Ouch, that stings. But adjusting for that, AFL’s operating earnings rose 14.3%.

For Q3, AFLAC sees operating earnings ranging between $1.41 and $1.51 per share. That’s less than the $1.56 per share Wall Street had been expecting. For the full-year guidance, AFLAC lowered the low end of their range. The previous range was $5.99 to $6.37 per share. Now it’s $5.83 to $6.37 per share. That seems very conservative to me. Even after the rally, AFL is still going for less than 10 times the high end of their forecast.

Can you believe AFLAC was going for $43 a year ago? This has been such an impressive stock. This week, I’m raising my Buy Below on AFLAC to $67 per share. Excellent stock.

WEX Inc. Is a Buy up to $93

On Wednesday, WEX Inc. ($WEX) reported Q2 earnings of $1.05 per share, which was one penny better than expectations. For Q3, they see earnings between $1.16 and $1.23 per share. Wall Street had been expecting $1.18 per share. For all of 2013, WEX now sees earnings ranging between $4.27 and $4.37. The Street’s consensus was at $4.31 per share.

Traders liked the earnings news a lot. On Thursday, WEX got as high as $91.84. That’s nearly a 40% run in three months. In fact, my Buy Below prices are having trouble keeping up. This week, I’m raising WEX to $93 per share. Let’s hope I have to raise it again soon.

DirecTV Was Our Big Miss This Week

We had one disappointment this week with DirecTV ($DTV). For the second quarter, DTV earned $1.18 per share, which was 16 cents below expectations. Revenues rose 6.6% to $7.7 billion, which was slightly below forecasts. It’s actually not as bad as it sounds.

The big problem for the satellite-TV company was Latin America. Analysts were expecting Latam subscriber count to rise by more than 420,000. Instead, it rose by just 165,000. To put this into context, last year, DTV added 645,000 new subscribers in the region. DirecTV said that macroeconomic conditions were partly to blame, especially in Brazil. In the U.S., subscriber count fell by 84,000.

The stock pulled back 3% after the earnings report, which isn’t so bad. While the Q2 report wasn’t what I was expecting, I still like DirecTV. DTV is a good buy up to $67 per share.

Earnings Next Week from NICK and Cognizant Technology

I still don’t know when Nicholas Financial ($NICK) will report, but it will probably be soon. I’m expecting earnings around 40 cents per share. To me, what’s more important will be any dividend increase announced at their annual meeting later this month. I said last week that I think NICK can raise their quarterly payout to 15 cents per share, which is a 25% increase. Nicholas Financial remains a very good buy up to $16 per share.

Next Tuesday, Cognizant Technology Solutions ($CTSH) is due to report its second-quarter earnings. CTSH beat impressively for Q1 and guided higher for Q2. The company projected earnings of $1.06 per share for Q2. For all of 2013, they foresee earnings of $4.31 per share. CTSH is a good buy up to $76 per share.

That’s all for now. We’re finally heading into the back end of earnings season. Except for earnings, next week should be a fairly light week for news. I suspect traders will be digesting the news from Friday’s big jobs report. With the dearth of news, I wouldn’t be surprised to see the Volatility Index ($VIX) drop to a multi-year low next week. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Harris Jumps Nearly 8%

Eddy Elfenbein, July 30th, 2013 at 10:04 amThe S&P 500 broke above 1,693 this morning. Thanks to its great earnings report, Harris Corp. ($HRS) has jumped to $56.95 which is a 7.8% gain. After the close, we’ll get earnings reports from AFLAC ($AFL) and Fiserv ($FISV).

Second-quarter earnings season is going well so far. Exactly 300 of the 500 stocks in the S&P 500 have reported, and 73% have beaten on sales while 55% have beaten on earnings. Of course, expectations for Q2 had been falling for more than a year.

Today is the first day of the Fed’s two-day meeting. The policy statement will come out tomorrow. This is interesting because this meeting isn’t expected to be very important but the following meeting, in September, is expected to be very important. A growing number of Fed watchers think the central bank will announce its first tapering of its bond buying program. There may be some hints in tomorrow’s statement, but I doubt it will contain much.

In March, I noted that Coach ($COH) had dropped to $48.43 per share which was cheap on a valuation basis, but there were good reasons for the low valuation. Since then, the stock has rallied to $60 per share. Today, however, the shares are getting slammed thanks to poor results in North America. Profits for the quarter fell 12%. Shares of COH are currently down $5 or 8.7%. I don’t think the problems are close to being fixed.

-

Harris Reports Great Earnings

Eddy Elfenbein, July 30th, 2013 at 9:05 amThis morning, Harris Corp. ($HRS) reported fiscal fourth-quarter earnings of $1.41 per share which was 26 cents better than expectations. That’s a huge beat. Quarterly revenue dropped 5.3% to $1.36 billion which still topped estimates of $1.31 billion.

Harris also had very good guidance for next year. For fiscal 2014, which ends in June of 2014, Harris sees earnings ranging between $4.65 to $4.85 per share on revenues of $4.95 to $5.05 billion. The Street had been expecting earnings of $4.62 per share on revenues of $5.03 billion. For the year, Harris earned $4.90 per share compared with $5.20 per share last year. Much of the decline was due to the government sequester.

Fourth quarter results were solid in a tough government spending environment,” said William M. Brown, president and chief executive officer. “Performance benefited from our commitment to operational excellence and ongoing cost-reduction efforts, including restructuring actions announced in April that were executed faster than expected and generated fourth quarter cost savings. As we enter fiscal 2014, we now expect that restructuring and other actions will generate net annualized cost savings of approximately $60 million.”

“We were particularly encouraged by the strong new orders momentum in the international tactical radio market. With a tactical book-to-bill of 1.49 and greater than one in both international and U.S. markets, tactical backlog increased substantially in the fourth quarter.”

Harris is another good example of a high-quality stock delivering results after sluggish performance of its stock. Shares of Harris are only up 8% YTD which makes it one of the poorer performers on our Buy List. But what hasn’t changed is that it’s still a very well-run outfit.

-

CWS Market Review – May 3, 2013

Eddy Elfenbein, May 3rd, 2013 at 8:31 am“They say you never go broke taking profits. No, you don’t. But neither do

you grow rich taking a four-point profit in a bull market.” – Jesse LivermoreI’m starting to feel a bit sorry for the bears. All the headlines have been in their favor (Debt Ceiling! Fiscal Cliff! Cyprus!), but stock prices don’t seem to be cooperating. On Thursday, the S&P 500 closed at—I hope you’re sitting down—yet another all-time high. April marked the index’s sixth consecutive monthly gain, and we’ve rallied for ten of the last eleven months.

But I have to confess that I’m starting to grow more cautious about this rally. We’ve gone a long way up so we’re probably due for bumps soon. Mind you, I don’t think we’re anywhere close to the danger zone. Instead, I think we’ll see more subdued gains for the rest of the year.

Fortunately, our style of investing doesn’t rely on broad market predictions. Trust me, those “forecasts” are a sucker’s game. Instead, we focus on good stocks going for favorable prices. Just look at our two top-performing stocks this year, Bed Bath & Beyond and Microsoft. Both are excellent examples of how we profited by picking good stocks when the market had soured on them.

In the February 22nd issue of CWS Market Review, I highlighted Microsoft ($MSFT) as an exceptionally good buy. Since then, the software giant has climbed more than 20%, and it just touched a five-year high. This week, I’m raising my Buy Below on MSFT to $35 per share.

In our February 15th issue, I said that Bed Bath & Beyond ($BBBY) was finally looking cheap. The stock has since rallied 18%, and it’s close to cracking $70 per share. This week, I’m raising my Buy Below on BBBY to $72 per share.

The lesson isn’t that every beaten stock eventually goes up. It’s that high-quality stocks that have been beaten down have a very good chance of going back up. Make sure your portfolio has enough of these, and you’re tilting the odds in your favor. That’s the heart of all sound investing.

In this week’s issue of CWS Market Review, I’ll cover our recent Buy List earnings reports and highlight the last batch for next week. Before I get to that, let’s look at how the market has been behaving recently.

The Market’s Leadership Has Changed

The stock market has responded well since its recent low on April 18th. The S&P 500 has rallied for eight of its last 10 days. What’s interesting is that up until the 18th, many of the defensive sectors had been leading the market. By defensive, I mean sectors like healthcare, consumer staples and utilities. That’s rather usual, but not unheard of. Typically, cyclical stocks lead the rallies, and defensive stocks take charge when the market sours (meaning, they fall the least).

So what’s going on? My take is that the recent rout of commodities, gold in particular, helped give the lead to defensive sectors. Energy and Material stocks have been laggards this year. I don’t think we can say yet whether this is a precursor of a broad decline in the economy, but it’s true that some of the recent economic data has been weak. The jobs report for March was lackluster, and last Friday’s GDP was decent but far from strong. But those reports covered periods earlier this year. We’re now well into Q2 and since April 18th, the market has been rallying on strength from cyclical stocks. Technology has been particularly strong.

The Federal Reserve’s policy statement this week specifically said that “fiscal policy is restraining economic growth.” The Fed also said that it may increase or reduce its bond buying to help the economy. I take this to mean that rates will remain very low. As a result, the math continues to be very favorable for stocks. Stocks may be less cheap but they’re still a lot cheaper than bonds. Just look at Apple. The company made news this week with its massive bond offering. Apple was able to issue five-year bonds with a negative real interest rate. Apple’s dividend yield is higher than their cost to borrow, so it wouldn’t make sense not to borrow.

What to do now: Investors should concentrate on high-quality stocks and particularly those that pay generous dividends.

Good News from Harris, Bad News from WEX Inc.

Last Friday, Moog ($MOG-A), the maker of flight control systems, reported first-quarter earnings of 80 cents per share which was two cents better than analysts’ estimates. The CEO said that the first half of this year has been difficult but the second-half should be better for them.

Moog now sees full-year earnings coming in between $3.40 and $3.50 per share but that includes a 15-cent charge for restructuring costs. Not counting the restructuring charge, this is an increase in their guidance. Originally, Moog said they saw full-year earnings ranging between $3.50 and $3.70 per share. Then they took the top end down to $3.60 per share. Now Moog sees earnings, without the charge, between $3.55 and $3.65 per share. This was a good quarter for them. Moog remains a solid buy up to $50 per share.

After the closing bell on Tuesday, Fiserv ($FISV) reported Q1 earnings of $1.33 per share which was one penny below consensus. Due to the earnings miss, the stock got hit for a 4.5% loss on Wednesday. Fiserv has done very well for us, and last week I cautioned you not to chase it. Honestly, I’m not at all worried about Fiserv. A one-penny miss is meaningless for a company like this. In the short-term, of course, it’s not pleasant, but let’s look at the larger picture.

For last year’s Q1, Fiserv made $1.15 per share so earnings are growing quite nicely. Fiserv’s CEO, Jeffery Yabuki, said the company is “on-track to achieve our targeted results for the year.” For the entire year, Fiserv expects adjusted revenue growth in excess of 10%, and earnings-per-share are expected to rise between 15% and 19% to a range of $5.84 to $6.03. The Street had been expecting $5.97 per share. For now, I’m keeping my Buy Below price at $88 per share.

On Tuesday morning, Harris ($HRS) reported fiscal Q3 earnings of $1.12 per share which matched Wall Street’s estimate. I think this was a big relief for traders who were expecting something much worse. The shares got a nice spike after the earnings report.

The most important news was that Harris reiterated its full-year earnings guidance of $4.60 to $4.70 per share. If you recall, the company originally expected earnings between $5.00 and $5.20 per share but lowered guidance due to the federal government’s sequester. Shares of HRS currently yield 3.2%. I’m raising my Buy Below on Harris to $47 per share.

WEX Inc. ($WEX) is turning into our problem child for the year. The stock got hammered this week after the company lowered its full-year guidance. So what’s causing them trouble? The Maine-based company processes fuel payments for fleet vehicles and they’re being impacted by lower fuel costs and unfavorable exchange rates.

First-quarter earnings came in at 98 cents per share which was two cents better than estimates. The results were also better than the range the company gave us three months ago of 89 to 96 cents per share. That’s the good news.

Their guidance, however, was lousy. For Q2, WEX expects earnings to range between 98 cents and $1.05 per share. That’s well below Wall Street’s consensus $1.11 per share. WEX also lowered their full-year guidance from $4.30 to $4.50 per share to $4.20 to $4.35 per share. The stock dropped over 10% on Wednesday. Frankly, the numbers here are pretty ugly. I’m very disappointed with WEX and I’m dropping my Buy Below down to $70 per share.

Four More Earnings Reports Next Week

Next week is the final big week for our Buy List stocks this year earnings season. On Tuesday, May 7th, CA Technologies and DirecTV are due to report. Cognizant Technology Solutions follows on Wednesday, May 8th. Nicholas Financial should also report next week but I don’t know which day.

CA Technologies ($CA) got off to a great start this year but has pretty much stagnated ever since. In January, I predicted the company would beat earnings, and that’s exactly what happened. On the surface, CA appears to be a dull company, but don’t let that fool you. The stock currently yields just over 4%. Wall Street expects earnings of 55 cents per share. I’m holding my Buy Below at $27 per share.

Shares of Cognizant Technology Solutions ($CTSH) recently shed 21% in two weeks. Traders are clearly nervous that a lousy earnings report is coming. For one, Infosys ($INFY), a similar company to CTSH, gave terrible guidance. IBM ($IBM) also had a big earnings miss. Plus, there are also concerns that new legislation will impact the status of foreign workers. But all of this is speculation. The company hasn’t reported yet. Wall Street currently anticipates earnings of 93 cents per share. My analysis says CTSH should beat that. Last week, I lowered my Buy Below to $70 per share.

Three months ago, DirecTV ($DTV) had a monster earnings report. The satellite TV operator crushed earnings by 28 cents per share. The company said they see earnings for this coming in at $5 or more. I’m not a fan of share buybacks, but DTV is a company that truly uses them to lower the amount of outstanding shares instead of a cover for executive compensation. Wall Street expects $1.09 per share for Q1. On Thursday, DTV hit a fresh 52-week high. DTV is a buy up to $59 per share.

There’s still not a single analyst on Wall Street who follows Nicholas Financial ($NICK) so I can’t say what the earnings estimate is. But I can speak for myself. Honestly, I don’t care what NICK’s bottom line is as long as it’s somewhere close to 45 cents per share (excluding any charges). A few pennies per share here or there don’t matter. What does matter is that they’re business continues to deliver steady earnings.

I also expect an update on the buyout offer. It’s been a while so I’ll be curious to hear what they have to say. Unfortunately, if a buyout offer falls through, which is fine by me, the stock will probably take a short-term hit. Nicholas Financial continues to be a good buy up to $15 per share.

Before I go, I want to raise my Buy Below price for AFLAC ($AFL) to $57 per share. The stock has responded well to its last earnings report. The underlying business continues to do well. On Thursday, AFL got over $55 for the first time in two years. Our patience is starting to pay off.

That’s all for now. Next week is the last big week for earnings. We have four Buy List earnings reports coming. Also, on Tuesday, the Federal Reserve will release its report on consumer credit. Then on Thursday, the Commerce Department will report on wholesale trade. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Harris Earns $1.12 Per Share

Eddy Elfenbein, April 30th, 2013 at 8:30 amThis morning, Harris ($HRS) reported fiscal third-quarter earnings of $1.12 per share which was inline with expectations. As the company warned us, the sequester is putting the squeeze on them. Those issues aside, the business fundamentals are strong.

“Third quarter results were in line with our preliminary release issued April 11 and weaker than previously expected primarily due to U.S. and international tactical radio procurement delays,” said William M. Brown, president and chief executive officer. “U.S. Government funding constraints resulting from the continuing resolution were magnified when sequestration was triggered. Additionally, in the international market several key tactical radio orders have been pushed to later in the year or early next fiscal year.”

“We recently announced company-wide restructuring actions that are expected to generate net annualized cost savings of approximately $40 to $50 million. These cost savings, combined with benefits from our ongoing focus on operational excellence and reduced discretionary spending, will allow us to be successful in a challenging government market environment while continuing to invest in R&D and fund strategic growth initiatives.”

Harris reiterated its full-year guidance of $4.60 to $4.70 per share.

-

CWS Market Review – February 1, 2013

Eddy Elfenbein, February 1st, 2013 at 7:20 am“There are two times in a man’s life when he shouldn’t speculate:

when he can afford to and when he can’t.” – Mark TwainRemember the panic about the Fiscal Cliff? And the Debt Ceiling? And the Sequester? And about a dozen other things the financial media told us—insisted—that we simply had to worry about?

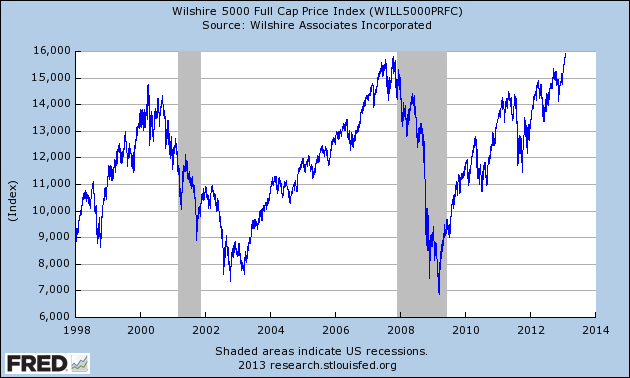

Well, here we are a few weeks later. The Dow Jones Industrial Average just closed out its best January in 19 years. The Wilshire 5000, the broadest measure of the U.S. stock market, is just below its all-time high.

Fortunately, we stuck by our strategy and ignored the noise-making scaremongers on TV. What’s perhaps more impressive is how low the market’s volatility has been. Consider this: On Wednesday, the S&P 500 had a rather minor loss of just 0.39%, and that was its worst loss of the year! Between January 9th and January 25th, the S&P 500 rallied 12 times in 13 sessions, and the only downer was a miniscule 0.09% drop.

But I have to be frank. The rally is beginning to look a little tired. For example, the S&P 500 tried to break 1,510 a few times this week and wasn’t able to bust through. That’s not a good sign. I think it’s very possible the bears may take back control of Wall Street in February. Nothing too serious, mind you, but just enough to scare the bulls away.

This was a mixed week for our Buy List stocks. The earnings reports were quite good, but some of our stocks, like Ford Motor ($F) and Harris ($HRS), didn’t respond well. That’s frustrating, but as you know, we’re in this game for the long haul.

We also had a negative GDP report for Q4, and that spooked a lot of folks. As odd as it may sound, the negative report really wasn’t that bad. When you look past the plunging military spending, the economy is better than it looks, and we’re poised for decent growth in 2013. The other big news this past week was the Fed meeting. We learned that Bernanke & Co. are firmly committed to keeping the money spigots going for a while longer. Some folks misread the December minutes, believing that the Fed was going to pull back soon. Sorry, not a chance.

Now let’s take a look at some of our recent Buy List earnings reports.

Ford Is a Buy up to $15 per Share

In last week’s CWS Market Review, I told you to expect a big earnings beat from Ford Motor ($F). Technically, I was correct. The company earned 31 cents per share, which was 24% higher than the 25 cents per share that Wall Street was expecting.

Despite the earnings beat, Ford warned that its losses in Europe this year would be worse than it had anticipated. Traders overreacted (of course, or they wouldn’t be traders) and brought the stock back below $13 per share. Let me be clear that Ford’s business is doing very well, especially in North America. Their pre-tax earnings in North America soared 110% from Q4 of 2011.

The New York Times described Q4 as a “microcosm of Ford’s recent overall performance.” In other words, strong America, weak Europe. But Ford’s strength in North America didn’t come about quickly. It was part of a painful restructuring process that’s only now paying dividends (literally, as Ford doubled its payout three weeks ago). Ford is employing that same turnaround strategy in Europe today, and the good news is that they’re far ahead of General Motors.

Don’t worry about the pullback in Ford. If you don’t already own it, the stock is a very good deal, especially if you can get it below $13. Thanks to the higher dividend, Ford currently yields 3.1%. I rate Ford a solid buy up to $15 per share.

Lower Guidance from Moog and Harris

On Tuesday, Harris ($HRS), the communications equipment company, reported earnings of $1.25 per share for the December quarter, which is the company’s fiscal Q2. This was five cents ahead of Wall Street’s consensus. Quarterly revenue dropped from $1.31 billion to $1.29 billion.

While Harris’s results were good, the news that has me concerned is that the company lowered its full-year guidance. I find that I often tell investors not to worry about this, or don’t worry about that. But lower guidance is indeed something to worry about. (By the way, I’m very glad we ditched JoS. A Bank from this year’s Buy List. The stock got pounded for a 15% loss on Monday after it gave an ugly earnings warning.)

Previously, Harris saw full-year earnings ranging between $5.10 and $5.30 per share. The company lowered that range by 10 cents per share at both ends. Harris now sees earnings ranging between $5.00 and $5.20 per share. So really, the guidance isn’t that much lower. We have to put this in context of a stock that closed the day on Thursday at $46.20, which is about nine times earnings.

Harris now sees 2013 revenue dropping by 2% to 4%. The previous range was flat to negative 2%. The company blamed the lower guidance on “slower government spending resulting from growing budget uncertainty.” It’s still early in the year, so I’m not giving up on Harris, but I want to see some improvement later this year. Harris remains a good buy up to $53.

Moog ($MOG-A) also joined the lower-guidance club, and like Harris, the news is disappointing but hardly dire. Last Friday, Moog lowered its full-year guidance from a range of $3.50 to $3.70 per share to $3.50 to $3.60 per share.

John Scannell, Moog’s CEO, noted that the company is off to a slow start this year, “The weakness in the major economies around the world is affecting our industrial business. On the other hand, the aircraft market is strong. We have moderated our forecast for the year slightly, but we are still projecting growth in both sales and earnings in 2013, despite the headwinds in our industrial markets.” Interestingly, Scannell’s comment reflects the same news about lower defense spending that we saw in the GDP report.

Moog’s quarterly revenues were up 3% to $621 million. Net earnings dropped 6% to $34 million. On a per-share basis, Moog made 75 cents last quarter. Since no one follows them, I can’t say if that beat or missed expectations. The stock still looks good for the long-term. Moog is a good buy up to $46 per share.

Profit Machine at Nicholas Financial Continues to Hum

On Wednesday, Nicholas Financial ($NICK), our favorite used-car loan company, reported quarterly earnings of 37 cents per share. But the results were distorted by taxes on their ginormous dividend late last year. Not including that, Nicholas earned 43.6 cents per share. Frankly, that’s a bit lower than I was expecting (around 45 cents per share), but not by much. I’m not a fan of NICK’s escalating operating costs, and I hope that doesn’t become a problem.

Our larger thesis for NICK still holds: that the company can rather easily churn out 45 cents per share every quarter. As long as rates are low and the economy is improving, NICK will do well. The math is pretty straightforward. Any company that’s pulling in, say, $1.80 per share per year should be going for at least $15, and possibly closer to $17. I think investors see NICK as a shaky subprime play. It’s not. In fact, NICK has gotten more conservative over the past few years. Like Ford, NICK pulled back below $13. Again, don’t be alarmed. NICK is a solid buy up to $15.

One more late earnings report. After the close on Thursday, CR Bard ($BCR), the medical technology firm, reported earnings of $1.70 per share, which beat consensus by three cents per share. Bard made $6.57 per share for all of 2012, which is up from $6.40 per share in 2011. I like that kind of growth. The downside is that Bard warned that 2013 will be rough, but they see extra-strong growth coming in 2014 and beyond. For now, I’m lowering my Buy Price on Bard to $102.

More Buy List Earnings Next Week

We’re now heading into the back end of earnings season, and the results have been good so far. The latest numbers show that of 237 companies in the S&P 500 that have reported, 74% have beaten earnings expectations, and 66% have beaten sales expectations.

Next week, we have four more Buy List earnings reports due: AFLAC ($AFL), Cognizant Technology Solutions ($CTSH), Fiserv ($FISV) and WEX Inc. ($WXS). I’m curious to hear what AFLAC has to say. Three months ago, they told us that Q4 earnings will range between $1.46 and $1.51 per share. That means full-year 2012 earnings between $6.58 and $6.63 per share. The problem is that AFLAC’s bottom line has probably been squeezed by the low yen. The question how is, how much? AFLAC has said to expect 2013 earnings to rise by 4% to 7%, but that’s on a currency-neutral basis. I like AFL up to $57.

Cognizant publicly said they expect earnings of 91 cents per share, and their forecast is usually very close. For this year, I think they can make $4 per share. I’m looking to see what kind of guidance they provide for 2013. CTSH remains a good buy up to $83.

Two weeks ago, Fiserv guided lower for Q4 but higher for all of 2013. I think this stock has some room to run. Fiserv is a good buy up to $88. Before I go, I wanted to highlight Microsoft ($MSFT). The shares are an especially good buy if you can get them below $28.

That’s all for now. Stay tuned for more earnings reports next week. We’ll also get important reports on factory orders and productivity. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Our old friend Russell Wasendorf, Sr. was just sentenced to 50 years in prison for massive fraud. Here’s our post from this summer on ol’ Russ, and tips for how you can spot financial fraud.

-

Harris Beats But Lowers Full-Year Guidance

Eddy Elfenbein, January 29th, 2013 at 10:26 amBesides Ford Motor ($F), we had another Buy List earnings report this morning. Harris Corp. ($HRS), the communications equipment company, reported earnings of $1.25 per share for the December quarter which is the company’s fiscal second quarter. The consensus on Wall Street was for earnings of $1.20 per share. Revenue dropped from $1.31 billion to $1.29 billion.

While these results were good, the news that has me concerned is that Harris lowered its full-year guidance. Before, the company saw earnings ranging between $5.10 and $5.30 per share. Harris lowered that range by 10 cents at both ends. The company now sees earnings ranging between $5 and $5.20 per share. Harris sees revenue dropping by 2% to 4%. The previous range was flat to negative 2%. The company blamed the lower guidance on “slower government spending resulting from growing budget uncertainty.”

Shares of Harris are currently down about 2.2% today.

-

Harris Earns $1.14 Per Share

Eddy Elfenbein, October 29th, 2012 at 8:11 pmBy the way, we did have one earnings report today. Harris Corp. ($HRS) said that quarterly revenue dropped from $1.34 billion to $1.26 billion. For the quarter, Harris earned $138 million or $1.14 per share. That beat Wall Street’s estimate by two cents per share.

“Harris first quarter results were solid in a challenging government spending environment,” said William M. Brown, president and chief executive officer. “We were awarded a number of large contracts in both RF Communications and in Government Communications Systems, and revenue in Government Communications Systems increased 5 percent over the prior year. First quarter operating performance was positive with operating margin flat compared to the prior year, despite lower revenue and higher R&D investment. Harris generates strong free cash flow, and in the first quarter we increased the dividend by 12 percent, the second increase this calendar year.”

The most important news is that Harris is sticking by its full-year guidance of $5.10 to $5.30 per share. If the next three quarters are like the first, Harris should have no trouble hitting that target.

-

Lazard Lowers Harris to Sell

Eddy Elfenbein, October 15th, 2012 at 12:20 pmShares of Harris Corp. ($HRS) are down today after Lazard Capital lowered their rating on the stock to “Sell.” The stock has been down as much as 4.7% today. This comes after a drop of 4% on Friday.

Let me caution investors not to get too rattled by this sell-off. I think Lazard is way off base here but let’s remember that Harris has had a very strong run since the summer. I had purposely kept my buy-below price at $50 even though the stock had cleared that hurdle. It even broke $52 per share recently. We want to stay disciplined and wait for good stocks to come to us.

Good stocks can bounce around like that. In fact, Harris lost 15.6% between April 30 and May 18 of this year. Despite that, it’s still up over 30% on the year for us. That’s just how the stock market works.

Harris is going for less than 10 times earnings, and the lower share price gives the dividend a yield of 3.15%. Only a few weeks ago, Harris raised their dividend by 12%. I expect another good earnings report in a few weeks. Harris remains a very solid buy.

-

CWS Market Review – August 31, 2012

Eddy Elfenbein, August 31st, 2012 at 8:02 am“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham

Even though the stock market is still in its late-summer doldrums, our Buy List stocks made some very impressive headlines this week. First, Hudson City ($HCBK) jumped 15% in one day after it announced a $3.7 billion merger agreement with M&T Bank ($MTB). Then JoS. A. Bank Clothiers ($JOSB) soared 14% thanks to a very strong earnings report. Looking at the numbers, our Buy List has had a very good August. In the last four weeks, the Buy List gained 5.9%, which is more than double the gains of the S&P 500.

As Churchill said on V-E Day, “We may allow ourselves a brief period of rejoicing.” While this month was great for our Buy List, let’s not get overconfident. This is a tough market, and there are many stocks, such as Amazon.com ($AMZN), that are extremely dangerous to own. The bond market looks shaky as well. As always, patience and discipline are our keys to success.

In this week’s CWS Market Review, I’ll bring you up to speed on the latest developments. Plus, I’ll tell you the best way to position yourself in the weeks ahead. We also had a pleasant 12.1% dividend increase from Harris Corp. ($HRS). This quiet little stock just had a remarkable run, rallying on 18 out of 21 days—and it’s still going for less than 10 times earnings. Now let’s take a closer look at the news from Hudson City and Joey Bank.

Hudson City Agrees to Merge with M&T

At the start of the week, Hudson City Bancorp said it had agreed to merge with M&T Bank ($MTB) in a deal worth $3.7 billion. Shares of HCBK jumped 15.7% on Monday.

I have to confess some embarrassment, since I had actually been down on HCBK and recently lowered the stock to a “hold.” The board members at M&T apparently aren’t subscribers to CWS Market Review. The merger between MTB and HCBK is interesting for several reasons. One is that this is the largest bank merger since Dodd-Frank came into effect. I think banks have been understandably reluctant to do any large deals since the financial crisis. Regulators certainly will be paying extra-close attention to any merger.

The merger agreement allows shareholders of Hudson City to take cash or 0.08403 shares of MTB for each share of HCBK they own. Given where MTB closed last Friday, that values HCBK at $7.22 per share. Here’s another interesting twist. The acquisitor in any large deal normally sees its stock drop. But this time, shares of MTB rallied 4.6% on Monday. That really caught Wall Street’s attention. Plus, when MTB rises, it values HCBK even more. M&T closed the day on Thursday at $87 per share, which translates to $7.31 for HCBK (note that HCBK is slightly discounted relative to the merger ratio). If MTB can get to $95, which is a very fair valuation (12.4 times next year’s earnings estimate), then that would value HCBK just shy of $8. I’m not saying it will happen, but it’s a very plausible scenario.

The merger agreement calls for the total payment from MTB to be 60% in stock and 40% in cash, so individual shareholders may not get the exact allocation they want. It all depends on what the balance of HCBK shareholders say (here’s a transcript of the conference call).

My recommendation for HCBK holders is to take shares of MTB. That’s what we’re going to do on the Buy List. M&T is a good bank, and it pays a decent dividend. M&T hasn’t had a losing quarter in 36 years. They were also one of the very few large banks to maintain their dividend through the financial crisis.

Bear in mind that we’re not in any hurry to exchange our shares. According to the conference call, the banks are looking to wrap up the deal by the second quarter of next year. That’s between seven and ten months away. I should remind you that any deal, no matter how solid it looks, does have a chance of falling apart. It’s certainly not likely, but the odds aren’t zero either. On the conference call, management said they hope to maintain Hudson’s dividend, but they need to hear from the regulators. For now, I rate Hudson City a good buy any time the shares are below $7.50.

Joey Bank Soars on Strong Earnings

On Wednesday, JoS. A. Bank Clothiers stunned everybody, including me, by reporting very strong earnings. The stock vaulted 14% that day, which came on the heels of a 3.5% rally on Tuesday. If you recall from last week’s CWS Market Review, I was rather skeptical of this earnings report.

For JOSB’s fiscal second quarter, they earned 83 cents per share, which was 10 cents more than Wall Street’s consensus. At one point on Wednesday, JOSB was up close to 19%. If you recall, the last earnings report was a dud. While the recent rally is impressive, JOSB is really taking back a lot of the ground it lost during the spring. It appears that short-sellers were ganging up on JOSB, and once the strong earnings came out, they got routed. The shorts then had to cover their positions and that drove the stock even higher, which in turn caused more shorts to scramble for the exits. That’s not a fun game to play.

Looking at the numbers in the earnings report, JOSB did quite well. Total sales rose by 12.9% to $260.3 million. That was almost $10 million more than Wall Street had been expecting. Sales at JOSB’s direct marketing segment, which includes internet sales, rose over 39%. The important metric in retailing, same-store sales, saw an impressive rise of 6.1%.

I was pleased to hear that JoS. A. Bank has very ambitious plans for the future. The company hopes to open 45 to 50 stores this fiscal year and next year as well. I’m going to raise my buy price on JOSB to $50. I also want to warn you to expect a bit of volatility from this stock. If that unnerves you, it may be best to stay away.

Harris Corp. Is a Buy up to $50

One of the biggest surprises this year has been the performance of Harris Corp. ($HRS). The company, which makes communication equipment, was a new addition to this year’s Buy List, but I don’t think I could have imagined that it would be our best-performing stock so far this year. Through Thursday’s trading, Harris is up 30.7% since the start of the year for us.

On Wednesday, Harris announced that it’s raising its quarterly dividend by 12.1%. This is their second dividend increase this year. Six months ago, Harris raised its dividend from 28 cents to 33 cents per share. Now it’s rising to 37 cents per share. That makes the current yield 3.1%, which is more than a 30-year Treasury.

Some Buy-List Bargains

As I said last week, I’m expecting a minor pullback over the next few weeks. Nothing big, but we may shed a few points here and there. In fact, the S&P 500 closed just below 1,400 on Thursday. There are good buys out there. I want to highlight a few stocks on our Buy List that look especially good right now.

Oracle’s ($ORCL) earnings, for example, are only a few weeks away. I’m expecting more good news. Ford ($F) and Moog ($MOG-A) are pretty cheap here. If volatility doesn’t bother you, then JPMorgan Chase ($JPM) is a strong buy.

That’s all for now. The stock market will be closed on Monday for Labor Day. Next week, we’ll get some important economic reports, such as the ISM and productivity reports, and the big jobs report comes next Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His