Posts Tagged ‘jnj’

-

S&P 500 Comes Within 1% of 1,500

Eddy Elfenbein, January 22nd, 2013 at 10:37 amThe stock market is holding on to some small gains this morning ahead of some major earnings announcements today. At one point, the S&P 500 got as high as 1,486.34. That’s just 1% away from 1,500.

On Friday, the $VIX plunged down to 12.26 during the day, though it’s back over 13 today. I’ve backed-tested the numbers and found that 13 is the magic number for the VIX; the stock market has performed much better below that number than above it.

One of our former Buy List stocks, Johnson & Johnson ($JNJ), reported earnings above Wall Street’s consensus, but the company guided below analysts’ forecasts for the year. The Street had been expecting $5.49 per share but JNJ said EPS will range between $5.35 and $5.45 for 2013. As much as I like the company, I think shares of JNJ are a bit overpriced here.

-

Johnson & Johnson Earns $1.25 Per Share

Eddy Elfenbein, October 16th, 2012 at 9:43 amGood news for Johnson & Johnson ($JNJ). The company reported third-quarter earnings of $1.25 per share which was four cents more than expectations. JNJ also raised full-year guidance from a range of $5.00 to $5.07 per share, to a new range of $5.05 to $5.10 per share.

Sales of recently approved drugs, including Zytiga for prostate cancer, Xarelto for stroke prevention and Stelara for psoriasis helped push revenue 6.5 percent to $17.1 billion for the quarter, from $16 billion a year earlier. The June purchase of Synthes Inc. with novel financing that used cash that had accumulated outside the U.S. also bolstered the company’s quarterly earnings.

“We continue to see improving fundamentals at J&J across all of its segments,” Derrick Sung, an analyst at Sanford C. Bernstein & Co. in New York, said in an Oct. 12 note to investors. “In pharma, J&J will start seeing contributions this year” from products that could generate nearly $7 billion annually by 2015, he said. “J&J’s competitive position and growth prospects are now strengthened by the closing of the Synthes acquisition.”

For the first nine months of this year, JNJ has earned $3.91 per share. That means they see Q4 coming in between $1.14 and $1.19 per share. The stock has a very good shot of making a new 52-week high today, and then making a run at the all-time high set four years ago.

In July, JNJ lowered their full-year guidance from $5.07 to $5.17 per share to $5.00 to $5.07 per share. So they’re taking back a good deal of that lowering.

The Street currently expects JNJ to earn $5.47 per share for 2013. With today’s earnings report, I think that will be bumped up a few pennies. JNJ remains a very good buy.

-

J&J Is Another Victim of the Dollar

Eddy Elfenbein, July 17th, 2012 at 9:22 amJohnson & Johnson ($JNJ) reported adjusted second-quarter earnings of $1.30 per share this morning which was one penny better than expectations. Sales for the quarter fell by 0.7% to $16.48 billion which was $0.21 billion below Wall Street’s forecast.

While J&J has introduced some promising new drugs recently, sales have been pressured by the loss of patent protection for older drugs, including attention deficit/hyperactivity disorder treatment Concerta.

The health-care giant also recently completed its $19.7 billion acquisition of orthopedic products maker Synthes Inc., which it plans to integrate with its DePuy business. In the latest quarter, Synthes contributed 1.2 percentage points to global sales growth.

The bad news is that Johnson & Johnson is getting squeezed by the strong dollar. The company lowered its full-year forecast today from $5.07 – $5.17 per share to $5.00 – $5.07 per share. In last week’s CWS Market Review I said I think the company has a shot of earnings $5.21 per share this year. I was clearly too optimistic.

The silver lining is that the lower guidance isn’t due to problems with operations but rather due to the foreign exchange rate. I’m not as worried by that since foreign exchange issues come and go. If it’s a problem with the business itself, that’s something much more worrying.

I still like Johnson & Johnson and the stock has performed well in the past month. Going by this morning’s price, the shares yield 3.6%.

-

10-Year Yield Hits All-Time Low

Eddy Elfenbein, July 16th, 2012 at 11:59 amThe stock market dropped early on in today’s trading, but we regrouped and have made back everything we lost. Right now, the S&P 500 is holding on to a small gain.

Both Johnson & Johnson ($JNJ) and Reynolds American ($RAI) got to new 52-week highs this morning. Tomorrow we’re going to receive earnings reports from JNJ and Stryker ($SYK). It will be interesting to hear what they have to say.

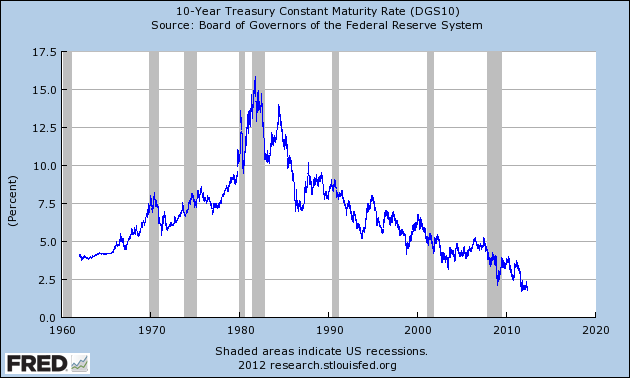

The yield on the 10-year Treasury dropped to an all-time low today. The yield got to 1.442%.

-

Stocks Modestly Higher on Alcoa’s Earnings

Eddy Elfenbein, July 10th, 2012 at 10:35 amThe stock market is just slightly higher this morning. There’s some optimism that a German court will approve the eurozone’s new bailout fund. The bad news is that China’s trade growth plunged in June.

After yesterday’s close, Alcoa ($AA) reported earnings of six cents per share which was one penny ahead of expectations. Since Alcoa is usually the first Dow component to report, its earnings report gets a lot of attention. The problem is that Alcoa is hardly representative of the larger economy.

On Friday, we’ll get a better idea of how earnings season is going when JPMorgan Chase ($JPM) reports earnings. Obviously, we’ll also get an idea of how badly the bank has been shaken by the big trading losses that came from their London office.

Bespoke Investment Group has a chart showing how Wall Street has chopped its earnings expectations for JPM. In May, the Street had been expecting $1.24 for JPM’s second quarter. Today it’s down to 79 cents per share. There have been similar drops from Morgan Stanley, Goldman Sachs and other big Wall Street firms.

I’m hesitant to make any forecasts for JPM’s earnings report because the company has been very tight-lipped about what exactly happened. The key for us will be to see how well the bank’s fundamental business has performed. For the most part, that’s been good this year.

On the Buy List, I see that Reynolds American ($RAI) has matched its 52-week high this morning. Johnson & Johnson ($JNJ) is only a few pennies away from hitting a fresh 52-week high. JNJ is up by more than 10% since its June 1st close. Not many people saw that rally coming.

-

CWS Market Review – May 18, 2012

Eddy Elfenbein, May 18th, 2012 at 7:20 amWall Street’s spring slide got even uglier this past week. The S&P 500 has now dropped for five days in a row and for ten of the last 12. On Thursday, the index closed at its lowest level since January. Measuring from the recent peak on May 1st, the S&P 500 is down 7.18%. Bespoke Investment notes that in the last two months, more than $4 trillion has been erased from global markets.

I know it’s scary, but let me assure you—there’s no need to panic. In this week’s CWS Market Review, I want to focus on the two events that have rattled Wall Street’s nerves: the massive trading losses at JPMorgan and the growing possibility that Greece will exit the euro. The really interesting angle is that these two events are partially connected. I’ll have more on that in a bit.

I’ll also talk about how we can protect our portfolios during times of trouble: by focusing on high-quality stocks with generous dividends. Right now, six of our Buy List stocks yield more than 3.4% which is double the going rate for a 10-year Treasury bond. Reynolds American ($RAI), for example, yields a hefty 5.8%. There aren’t many top-notch stocks that can say that. But first, let’s talk about the god-awful mess at JPMorgan.

How JPMorgan Chase Lost $2 Billion Without Trying

Last week, JPMorgan Chase ($JPM) stunned Wall Street by announcing an unexpected trading loss of $2 billion. This was especially disappointing because JPM had been one of the best-run banks around. Despite the massive loss, JPM is still on a solid financial footing. Mostly, this is a huge embarrassment for the firm and their

loudmouthoutspoken CEO Jamie Dimon.I honestly don’t know how much longer Dimon can last at JPM. He shouldn’t be on the New York Fed Board, either. In my opinion, bank CEOs shouldn’t draw attention to themselves. Ideally, they should be very dull and very competent. Dimon is half that equation and I fear he’s become a liability for shareholders.

So what the heck happened? I’ll try to explain this in an easy-to-understand way. First, we have to talk about “hedging.” When an investor wants to hedge a bet, this means they want to take positions that offset each other in order to get rid of some aspect of risk.

Let’s say you’re a bookie. You don’t care who wins the game; you only want to make sure that you’ve taken in the same amount of money from both sides. Now let’s say that your “clients” have bet $1,000 on the Lions and $900 on the Bears. Oops, you’re caught with some risk. No worries, you can place a $100 bet on the Bears with another bookie and presto, you’re back to even (minus some vig costs of course).

Now back to JPM. Last year the bank wanted to hedge their overall credit risk. The problem is that this isn’t so easy when you’re the size of JPM, so they shorted credit indexes. Or more specifically, they mimicked doing that by buying credit protection on baskets of credit. Now for the other side of the trade, JPM sold protection on an index of credit default swaps called CDX.NA.IG.9. I know that sounds like a George Lucas film, but trust me, it really exists.

With me so far? The problem with this hedge is that JPM had to sell a lot more protection on the CDS index than they bought on the credit baskets. For a while this worked fine. But late last year, the European Central Bank flooded the credit markets with tons of liquidity. The two sides of the hedge started to move together, not separately. In effect, the Lions and Bears were both winning and JPM had bet against both. Once again, the financial modelers had accurately predicted the past, but they weren’t so hot at predicting the future.

The bank dug the hole deeper for itself by ratcheting up on the CDS index side of the hedge. Soon hedge funds started to notice the prices getting seriously out of whack. What really struck them was that whoever was on the other side of this trade seemed to have limitless funds. This dude never gave in. They jokingly called him “the London Whale,” and it didn’t take long for people to suspect he was at JPM. Eventually the news broke that it was a French trader in JPM’s London office named Bruno Iksil.

Now the story gets a little murky. Last week, Jamie Dimon announced the trading losses on a special conference call. To Dimon’s credit, he said it was a massive mistake by the bank. On the call, Dimon said that the bank could incur another $1 billion in losses over the next few quarters as the trade is gradually unwound. It seems that the hedge funds smelled blood, figured out the specifics of the hedge and attacked. Hard. So instead of taking another $1 billion in losses over a few quarters, that got squeezed down to four days. There could be more losses to come.

What to Do With JPMorgan?

Shares of JPMorgan are down from over $45 in early April to just $33.93 based on Thursday’s close. As frustrating as the past week has been, I’m sticking with the bank. I’m furious with JPM’s management and their careless risk management. But with investing, we need to shut off our emotions and stick with the facts.

Let’s run through some numbers: Last year, JPM made $4.48 per share. For the first quarter, they made $1.31 per share which was 13 cents better than estimates. Those are impressive results. If the bank loses a total of $3 billion in this fiasco, that will come to about 80 cents per share. In other words, this is a punch in the face but it’s not a dagger to the heart.

At $34, JPM is clearly a bargain. When it will recover is still a mystery, but time is on the side of patient investors. Due to the recent events, I’m going to lower my buy price on JPM from $50 to $38. At the current price, the stock yields 3.54%. Make no mistake: This is a cautious buy, but the price is very good.

Euro So Beautiful

The other issue that’s got Wall Street worried is Greece. The politicians there haven’t been able to form a governing coalition, so they’re going to have elections again next month. The only issue that unites voters is anger at the bailouts. My guess is that some left-wing anti-austerity coalition will eventually prevail.

On Thursday, Fitch downgraded Greece’s debt to junk. Actually, it was already junk, but now it’s even junkier junk. For a long time, I didn’t think it was possible for Greece to leave the euro. Now it seems like a real possibility, but it will be a costly one. Greek savers have already been pulling their money out of banks because they want to hold on to euros. Their fear is that if Greece changes over to drachmas, the new currency will be worth a lot less and I can hardly blame them.

The standard line in Europe is that no one wants Greece to leave the euro, but also no one seems willing to do what’s needed to keep them in. The Greek economy isn’t strong enough to pay back their debt because the debt is so heavy that it’s weighing down the economy (Mr. Circle meet Mr. Vicious). There’s simply not much time left. Greece’s deputy prime minister said the country will run out of money in a few weeks. If Greece ditches the euro, Ireland and Spain might be right behind. In fact, foreigners are even pulling their money out of Italian banks. This is getting worse by the day.

How exactly would Greece leave the euro? Eh…that’s a good question and I really don’t know. But if Greece were to leave the euro, a lot of eurozone banks would take a major hit. I don’t think the damage would necessarily be as bad as feared, assuming the banks were recapitalized. If enough people want this done, it can be done.

The standard line is that this is what Argentina did several years ago. The difference is that the global economy was much stronger then. I think the best path for countries like Greece, Portugal, Ireland and Italy is to go full Iceland: to depreciate their currencies. It’s painful in the short-run, but it’s a much sounder strategy. Interestingly, Iceland has actually been doing rather well lately.

So with Europe already in recession and China slowing down, what’s the impact for investors? One impact is that the euro has been plunging against the dollar. The currency is down five cents this month to $1.27. I think it will head even lower.

Another impact is that U.S. Treasuries are surging as investors head for cover. On Thursday, the yield on the 10-year Treasury closed at 1.69% which is at least a 59-year low. The Fed’s data only goes back to 1953. The intra-day low from last September was slightly lower. The bond rally has lured money away from stocks, but that may soon end.

A further impact is that the stock sell-off has been felt most heavily among cyclical stocks. Over the last two months, the Morgan Stanley Cyclical Index (^CYC) is down nearly 15%. The Morgan Stanley Consumer Index (^CMR), however, is down less than 3% over the same time span. That’s a big spread. You can see the impact of this trend by looking at Buy List stocks such as Ford ($F) and Moog ($MOG-A).

Protect Yourself by Focusing on Yield

The market’s recent drop has given us several good bargains on our Buy List. AFLAC ($AFL), for example, is now below $40. It was only three weeks ago that the company beat earnings by nine cents per share. Here’s a shocking stat: The tech sector has dropped for 12 days in a row. Oracle ($ORCL) is now going for less than 10 times next year’s earnings. That would have been unthinkable during the Tech Bubble.

This week, I want to highlight some of our higher-yielding stocks on the Buy List. I always urge investors to look out for stocks that pay good dividends. Their shares are more stable, and they hold up much better whenever the market gets jittery.

For example, look at CA Technologies ($CA). This was another company with a solid earnings report and the stock now yields 3.90%. Nicholas Financial’s ($NICK) yield is up 3.21%. I think NICK can easily raise its dividend by 30% to 50% this year.

I already mentioned JPM’s yield, but check out another bank: Hudson City ($HCBK) which yields 5.23%. Last month, Johnson & Johnson ($JNJ) raised its dividend for the 50th year in a row. JNJ now yields 3.84%.

Sysco ($SYY), which also beat earnings, now yields 3.89%. Harris ($HRS) raised its dividend by 18% earlier this year. The shares yield 3.39%. Our highest-yielder is Reynolds American ($RAI). Just two weeks ago, the tobacco stock bumped up its quarterly dividend by three cents per share. RAI currently yields a sturdy 5.80%. These are all excellent buys and they’ll work to protect your portfolio during downdrafts while having enough growth to prosper during a rally.

That’s all for now. I’m looking for a relief rally next week as traders get ready for Memorial Day. On Monday, Medtronic ($MDT) is due to report earnings. They’ve already told us to expect earnings between 97 cents and $1 per share. I also expect Medtronic to increase its dividend for the 35th year in a row very soon. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Johnson & Johnson Raises Dividend

Eddy Elfenbein, April 26th, 2012 at 11:37 amFor the 50th year in a row, Johnson & Johnson ($JNJ) raised its dividend. The company boosted its quarterly dividend from 57 cents to 61 cents per share. At the current price, the yield works out to 3.77%.

-

CWS Market Review – April 20, 2012

Eddy Elfenbein, April 20th, 2012 at 5:16 amWe’re entering the high tide of the first-quarter earnings season, and so far earnings have been quite good. Of course, expectations had been ratcheted down over the past several months, but there have still been fears on Wall Street that even the lowered expectations were too high.

According to the latest figures, 103 companies in the S&P 500 have reported earnings and 82% have beaten Wall Street’s expectations. That’s very good. If this “beat rate” keeps up, it will be the best earnings season in at least ten years.

Earnings for our Buy List stocks are doing especially well. JPMorgan Chase, Johnson & Johnson and Stryker all beat expectations. Plus, J&J did something I always love to see: raise their full-year forecast.

Next week is going to be another busy earnings week for us; we have five Buy List stocks scheduled to report earnings. In this week’s issue, I’ll cover the earnings outlook for our Buy List. I’m expecting more great results from our stocks. I’ll also let you know what some of the best opportunities are right now (I doubt AFLAC will stay below $43 much longer.) But before I get to that, let’s take a closer look at our recent earnings reports.

Three Earnings Beats in a Row

In last week’s CWS Market Review, I said that I expected JPMorgan Chase ($JPM) to slightly beat Wall Street’s consensus of $1.14 per share. As it turned out, the House of Dimon did even better than I thought. On Friday, the bank reported earnings of $1.31 per share. Interestingly, JPM’s earnings declined slightly from a year ago, but thanks to stock repurchases, earnings-per-share rose a bit.

The stock reacted poorly to JPM’s earnings—traders knocked the stock down from $45 to under $43—but I’m not too worried. The bank had a very good quarter and Jamie Dimon has them on a solid footing. Last quarter was better than Q4 and this continues to be one of the strongest banks on Wall Street. (If you want more details, here’s the CFO discussing JPM’s earnings.) Don’t be scared off; this is a very good stock to own and all the trends are going in the right direction. I rate JPMorgan Chase a “strong buy” anytime the shares are less than $50.

On Tuesday, Stryker ($SYK) reported Q1 earnings of 99 cents per share which matched Wall Street’s forecast. Last week, I said that 99 cents “sounds about right.” I was pleased to see that revenues came in above expectations and that gross margins improved. That’s often a good sign that business is doing well.

Stryker’s best news was that it reiterated its forecast for “double-digit” earnings growth for this year. I always tell investors to pay attention when a company reiterates a previous growth forecast. I think too many investors tend to ignore a reiteration as “nothing new,” but it’s good to hear from a company that its business plan is still on track. I suspect that Stryker will raise its full-year forecast later this year. Stryker is an excellent buy up to $60.

Last week, I said that Johnson & Johnson ($JNJ) usually beats Wall Street’s consensus by “about three cents per share.” This time they beat by two cents which is probably more of a testament to how well the company controls Wall Street’s expectations. For Q1, J&J earned $1.37 per share. I’ve looked at the numbers and this was a decent quarter for them.

For the first time in a while, I’m excited about the stock. A new CEO is about to take over, and the company will most likely announce their 50th-consecutive dividend increase. The company also won EU approval for its Synthes acquisition. But the best news is that the healthcare giant raised its full-year guidance by two cents per share. The new EPS range is $5.07 to $5.17. Johnson and Johnson is a good stock to own up to $70 per share.

Focusing on Next Week’s Earnings Slate

Now let’s take a look at next week. Tuesday, April 24th will be a busy day for us as AFLAC ($AFL), Reynolds American ($RAI) and CR Bard ($BCR) are all due to report. Then on Wednesday, Hudson City ($HCBK) reports and on Friday, one of our quieter but always reliable stocks, Moog ($MOG-A), will report earnings.

Let’s start with AFLAC ($AFL) since that continues to be one of my favorite stocks and because it has slumped in recent weeks. AFLAC has said that earnings-per-share for this year will grow by 2% to 5% and that growth next year will be even better. Considering that the insurance company made $6.33 per share last year, that means they can make as much as $6.65 this year and close to $7 next year.

So why are the shares near $42 which is less than seven times earnings? I really don’t know. AFLAC has made it clear that they shed their lousy investments in Europe. Wall Street’s consensus for Q1 earnings is $1.65 per share which is almost certainly too low. I think results will be closer to $1.70 per share but I’ll be very curious to hear any change in AFLAC’s full-year forecast. Going by Thursday’s close, AFLAC now yields more than 3.1% which is a good margin of safety. AFLAC continues to be an excellent buy up to $53 per share.

I’ve been waiting and waiting for CR Bard ($BCR) to break $100. The medical equipment stock has gotten close but hasn’t been able to do it just yet. Maybe next week’s earnings report will be the catalyst. Three months ago, Bard said to expect Q1 earnings to range between $1.53 and $1.57. That sounds about right. I like this stock a lot. Bard has raised its dividend every year for the last 40 years. It’s a strong buy up to $102.

With Reynolds American ($RAI), I’m not so concerned if the company beats or misses by a few pennies per share. The important thing to watch for is any change in the full-year forecast of $2.91 to $3.01 per share. If Reynolds stays on track to meet its forecast, I think we can expect the tobacco company to bump up the quarterly dividend from 56 cents to 60 cents per share.

Reynolds American has been a bit of a laggard this year. It’s not due to anything they’ve done. It’s more of a result of the theme I’ve talked about for the past few weeks: investors leaving behind super-safe assets for a little more risk. It’s important to distinguish if a stock isn’t doing well due to poor fundamentals or due to changing market sentiment. Reynolds is still a very solid buy. The shares currently yield 5.4%.

Hudson City Bancorp ($HCBK) raced out to a big gain for this year, but it’s given a lot back in the past month. The last earnings report was a dud, but the bank is still in the midst of a recovery. Some patience here is needed. Wall Street’s consensus for Q1 is for 15 cents per share. I really don’t know if that’s in the ballpark or not, but what’s more important to me is the larger trend. Hudson City is cheap and a lot of folks would say there’s a good reason. I think the risk/reward here is very favorable. At the current price, Hudson City yields 4.8%. The shares are a good buy up to $7.50.

As I mentioned before, Moog ($MOG-A) is one of our most reliable stocks. The company has delivered a string of impressive earnings reports. Moog has said that it sees earnings for this year of $3.31 per share (note that their fiscal year ends in September). That gives the stock a price/earnings ratio of 12.2. I think Moog can be a $50 stock before the year is done.

There are three Buy List stocks due to report soon but the companies haven’t told us when: Ford ($F), DirecTV ($DTV) and Nicholas Financial ($NICK). Ford and Nicholas are currently going for very good prices. They usually report right about now, so the earnings report may pop up any day now. I think both stocks are at least 30% undervalued.

That’s all for now. Next week will be a busy week for earnings. We’re also going to have a Fed meeting plus the government will release its first estimate for Q1 GDP growth. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Johnson & Johnson Earns $1.37 Per Share

Eddy Elfenbein, April 17th, 2012 at 9:14 amThis morning, Johnson & Johnson ($JNJ) reported first-quarter earnings of $1.37 per share. That beat Wall Street’s consensus by two cents per share. On the top line, J&J’s revenue fell 0.2% to $16.14 billion which was short of Wall Street’s consensus of $16.28 billion. But the best news is that the healthcare giant raised its full-year forecast by two cents per share. The new EPS range is $5.07 to $5.17.

Revenue rose 1.2 for prescription drugs, to $6.13 billion from $6.06 billion, as sales from new medicines made up for lower sales from two medicines that got generic competition last spring, Levaquin for serious infections and Concerta for attention deficit disorder.

But revenue was down in J&J’s other two businesses. Sales of medical devices and diagnostic equipment, the company’s biggest segment, slumped 0.3 percent to $6.41 billion. Consumer product sales fell 2.4 percent, to $3.6 billion, due to the many products still not back in stores due to product recalls.

This earnings report is good news for J&J. The company has run into a mess of problems recently with a seemingly endless series of recalls. I’m glad to see that a new CEO will be taking over at the shareholder meeting on April 26th.

I also expect to see the company announce its 50th-straight dividend increase. The current quarterly dividend is 67 cents per share. I think the new dividend will be 70 cents per share.

-

CWS Market Review – April 13, 2012

Eddy Elfenbein, April 13th, 2012 at 8:20 amThat money talks, I’ll not deny, I heard it once: It said, ‘Goodbye’.

-Richard ArmourAfter sliding for five days in a row, the stock market has started to right itself. On the first trading day of April, the S&P 500 closed at a 46-month high but promptly broke up like a North Korean rocket and shed 4.26% in a week. That’s not a major pullback, but it’s one of the biggest slumps we’ve seen in months. Thanks to rallies on Wednesday and Thursday, the market has already made back half of what it lost (in fact, the traceback has been almost exactly 50%).

What’s most surprising about the market so far in April is the recrudescence of volatility on extremely low volume. Consider this: In the first 64 trading days of 2012, the S&P 500 suffered just one daily drop of more than 1%. In 2011, that happened 48 times. Then suddenly, we had three 1% drops in four days. Yet average daily trading volume last month was the lowest since December 2007. What gives?

In this issue of CWS Market Review I want to look at why the market has gotten so jittery all of a sudden. But more importantly, I want to take a look at the first-quarter earnings season. Over the next month, 16 of our Buy List companies are due to report earnings. As always, earnings season is the equivalent of Judgment Day for Wall Street. I’m expecting good news for our stocks, but the outlook may not be so sunny for the rest of Wall Street.

Sorry, Folks. QE3 Is Not Coming

Part of the reason why the stock market got a sudden case of the worries is what I mentioned in the previous two editions of CWS Market Review. Wall Street has been focused on the March jobs report and first-quarter earnings season. The jobs report wasn’t so hot and the market took its pound of flesh. Earnings season is the next hurdle.

Interestingly, the stocks that dropped the most during the five-day selloff were often the ones that rallied the most on Wednesday and Thursday. These tended to be cyclical stocks and financials. It’s also interesting to note that the Morgan Stanley Cyclical Index (^CYC) had peaked on March 19th, two weeks before the rest of the market. This means, the cyclicals had already started to erode before the jobs report pullback.

The stock market was given a boost on Thursday when two Fed officials, Janet Yellen and William Dudley, said that rates will have to stay low for a while longer. That‘s not a big surprise. Let me add a quick note on QE3. Some folks think the weak jobs report will cause Bernanke and his buddies at the Fed to jump in with a third round quantitative easing. Do not believe any of this. We often forget that the C in FOMC stands for “committee” and it’s obvious that the policy-makers are very far from a consensus on this issue. The media has been searching for any hint, no matter how trivial, that QE3 is on the way. It’s not. Plus, the jobs report was hardly a harbinger of a new recession. For now, the talk of QE3 is pure nonsense.

Although the selloff was initially triggered by the jobs report, it was kept alive by bad news from Europe and China. The yield spreads in Europe (specifically, between any country and Germany) have been inching upward, particularly in Spain. I think it’s somewhat amusing that Monsieur Sarkozy is using the example of Spain to scare French voters from supporting the socialist opposition in next month’s election.

The wider spreads signal some nervousness from investors but it’s important to note that we’re a long way from the frenzy we had last year. I want to urge investors not to be carried away by these renewed concerns from Europe. The fears of Spain not being able to pay her bills are greatly overblown. Europe will not sink the U.S. stock market.

Q1 Earnings: The Story Is About Margins

Last earnings season was disappointing. This time around, investors don’t expect much. The numbers vary but the consensus is that first-quarter earnings will be about the same as they were last year. In other words, zero profit growth. How times have changed. Not that long ago, analysts were expecting double-digit earnings growth for Q1.

One of the problems facing many companies is that higher fuel costs are cutting into profits. All 10 sectors of the S&P 500 will see higher sales numbers, but at least seven of those sectors will have a hard time turning those top-line dollars into bottom-line profits.

The story here isn’t that a slowdown is upon us. Rather, it’s that business costs are rising after being held back for so long. Part of this is the cost for new employees, which is a good thing. As I’ve said before, the story here is about margins, not a weakening economy. Even with as much as earnings growth estimates have fallen, the stock market hasn’t responded in kind. That’s because Wall Street correctly sees this as a temporary issue. In fact, the current view is that earnings growth will reaccelerate later this year as Europe comes back online.

The important point for us is that even with little earnings growth, the stock market is still a very good value compared with the competition. Bond yields have climbed, but they’re still way too low. As long as the migration away from super-safe assets continues, our Buy List will thrive.

Now I want to focus on some upcoming earnings reports for our Buy List stocks (you can see an earnings calendar here). Unfortunately, not all of our companies have said when earnings will come out yet.

Expect an Earnings Beat at JPMorgan

On Friday, JPMorgan Chase ($JPM) will be our first Buy List stock to report earnings. With a 34.86% year-to-date gain, the bank is our top-performing stock this year. That’s not bad for a little over three months’ work. (It’s always a surprise to me who the #1 stock will be.) What’s remarkable is that even with as well as the stock has done, the shares are still going for less than 10 times this year’s earnings estimate.

Wall Street currently expects JPM to report earnings of $1.14 per share for Q1. That’s down a little from one year ago. That estimate, however, has been climbing in recent weeks while estimates for many other companies have been pared back. I’ve looked at the numbers and I expect a small earnings beat from JPM. But I’ll be curious to hear what CEO Jamie Dimon has to say about the bank’s business.

Not only is JPM a big report for us, but it’s also a bellwether for the entire financial sector. Jamie Dimon likes to see himself as the unofficial spokesman for the banking world and a lot of investors want to hear what he has to say. JPM even moved up their earnings call so Jamie could hit the stage before Wells Fargo ($WFC).

I agree with Dimon’s assessment that the last earnings report was “modestly disappointing.” One of the concerns this time around is investment banking, but Jamie has been clear that the division will rebound. For Q1, trading profits will probably be down from a year ago but better than Q4. This is a solid bank and I was particularly impressed by the 20% dividend increase. Bottom line: I’m sticking with Jamie, and I’m raising my buy price on JPMorgan Chase from $45 to $50 per share.

Johnson & Johnson: 50 Straight Years of Dividend Increases

Next Tuesday, we’ll get two more earnings reports—Johnson & Johnson ($JNJ) and Stryker ($SYK). I’m afraid that J&J has been a weak performer this year. In January, the healthcare giant said that earnings-per-share for 2012 will range between $5.05 and $5.15. Wall Street had been expecting $5.21.

J&J has been dogged by a series of quality control problems, and the stock has lagged. Later this month, Alex Gorsky will take over as the new CEO. I think that’s a good choice particularly since he helped the company tackle its internal problems. Wall Street’s consensus for Q1 is for $1.35 per share which is exactly what Johnson & Johnson made one year ago. The stock usually beats by about three cents per share, but I’m not going to get worked up by a result that’s within a few pennies of $1.35. What I want to see is solid proof of a turnaround, although I realize it may take some time.

The best part about J&J is the rich dividend. Going by Thursday’s close, the stock yields 3.55%. But the yield to investors is probably even higher. Later this month, I expect the company to announce its 50th-straight dividend increase. But coming after January’s lower guidance, the quarterly dividend will probably rise from 57 cents to 60 cents per share. If that’s right, J&J now yields 3.74%. I’m keeping my buy price at $70.

Stryker Is a Good Buy Up to $60

Shares of Stryker ($SYK) haven’t done much for the past several weeks which is puzzling because the business has been strong. Stryker has said that it sees “double digit” earnings growth for 2012. I doubt they’ll have trouble hitting that forecast. In fact Stryker is probably low-balling us, but that’s understandable since the year is still so young.

For Q1, the Street expects earnings of 99 cents per share which sounds about right. Stryker rallied last earnings season after they met expectations. The business tends to be very stable. I think the stock is a good value here and I’m raising my buy price to $60 per share.

Before I go, I want to highlight some other good values on the Buy List. Among the financials, AFLAC ($AFL), Nicholas Financial ($NICK) and Hudson City ($HCBK) are all going for a good price. I also think that Ford ($F) has drifted down to bargain territory as well.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His