Posts Tagged ‘JPM’

-

CWS Market Review – July 5, 2013

Eddy Elfenbein, July 5th, 2013 at 8:08 am“Do you know the only thing that gives me pleasure?

It’s to see my dividends coming in.” – John D. RockefellerThis will be an abbreviated issue of CWS Market Review. Trading this week was shortened due to Independence Day, and most of the fat-cat Wall Streeters are relaxing at their cribs in the Hamptons.

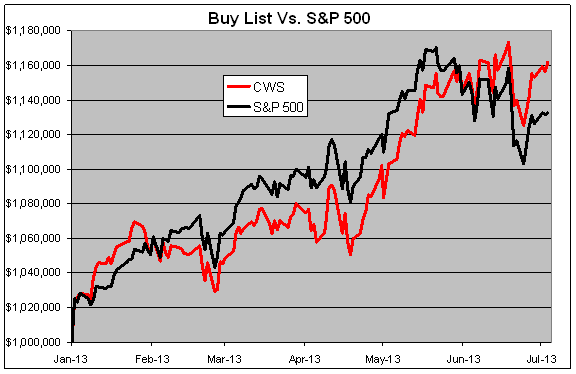

Don’t fear, my friends. My vigilant team and I are still on the watch, protecting you from whatever mayhem comes our way. The good news is that our Buy List continues to do very well. Through Wednesday, our Buy List is up 16.18% for the year compared with 13.27% for the S&P 500. That’s our widest lead all year.

In this week’s CWS Market Review, I’ll discuss the recent good news from Moog and Ford. Both stocks have been big winners for us lately. I’ll also talk about the upcoming Q2 earnings season. JPMorgan Chase and Wells Fargo will be our first stocks to report on Thursday, July 11th. But first, let’s look at why Ford just broke out to a new two-year high.

Good News for Ford and Moog

On Wednesday, shares of Ford ($F) closed at $16.43, which is the automaker’s highest close in 29 months. The catalyst for the move was a very strong sales report for June. Ford reported that sales were up 13% last month. The best news was that sales of F-150 pickups, which are a key moneymaker for Ford, jumped 24%. Ford said that sales in China are up 44% from last year. In May, China sales were up 45%. Ford has been busy playing catch up to GM in China.

Ford is due to report Q2 in a few weeks. The current estimate on Wall Street is for earnings of 36 cents per share, which would be a 20% increase over last year’s Q2. I should add that Ford has been creaming its estimates lately. I like this stock a lot. Ford remains a very solid buy up to $18 per share.

In last week’s CWS Market Review, I raised our Buy Below on Moog ($MOG-A) to $55 per share. That was pretty good timing! This week, Moog said that it’s looking at strategic options for its medical-devices division. That’s Wall Street-ese for “we’re looking to sell it.” I like when companies sell off units, and usually, so do investors. The stock broke $54 on the news, which is an all-time high.

The medical devices unit comprises just 5.7% of Moog’s overall business, but sales were down last year. As much as the market responds to the financial benefits of the divestiture, I think the market appreciates management’s willingness to shake things up. The company is due to report earnings at the end of the month. Wall Street currently expects earnings of 89 cents per share. Moog remains a good buy up to $55 per share.

Second-Quarter Earnings Season Begins Next Week

We’ve heard a lot of talk of how well companies should be doing, but beginning next week, we’ll finally see hard evidence of how well companies have performed. Earnings season is Judgment Day for Wall Street, and we’ll soon learn who’s been pulling their weight and who hasn’t. Fifteen of the 20 stocks on our Buy List ended their quarter on June 30th. This means that three-fourths of our portfolio will report earnings over the next month.

Wall Street is clearly nervous going into this earnings season. The analyst community currently expects index-adjusted earnings of $26.40 for the S&P 500. In the past year, that estimate has been revised downward by $2.50, including more than $1 in the last three months. Citigroup recently noted that negative pre-announcements have been outrunning positive ones by a ratio of 6.5 to 1. That’s the worst ratio since 2009, back when the world was falling apart.

I actually think the pessimists have gotten ahead of themselves here. While earnings expectations did need to come down, I suspect that growth is ramping up in several sectors. I especially think the damage from Europe won’t be as bad as is feared. The big trend recently has been share buybacks. For Q1, buybacks were up 17% from the year before. I think that will continue to be a major theme this year.

Our first two Buy List stocks to report this earnings season will be both of our big banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC). This is fortuitous for several reasons. First, both are excellent stocks. They’re also good bellwethers for the rest of the financial sector. Also, both banks made a decision recently to go all in on the mortgage business, which has been a huge winner for them. Both stocks are 20% winners for us this year.

JPMorgan had an insanely good first quarter. As much as Jamie Dimon annoys me, I have to admit that the bank still gets it done. Q1 earnings came in at $1.59 per share, which was 20 cents more than the Street’s consensus. There was some pushback from traders’ saying that the earnings beat was solely due to a tax benefit and some accounting adjustments.

But don’t let the bears scare you. JPM is doing very well. Wall Street expects Q2 earnings of $1.43 per share, and I think they’ll have little trouble beating that. Thanks to a pullback from the May high of $55.90, JPM is going for just 9.2 times this year’s earnings estimate. Jamie also recently raised the dividend by 26.7% to 38 cents per share. JPM currently yields 2.88%. The stock is an excellent buy up to $56 per share.

The business at Wells Fargo tends to be more stable than what we see at JPMorgan, and by extension, it tends to be more predictable. For Q1, Wells saw its earnings rise 22%, and they beat expectations by four cents per share. Their community banking division has been especially strong. Wells rewarded shareholders with a 20% dividend boost. Interestingly, the current yield is 2.91%, which is nearly the same as JPM.

For Q2, the Street expects 92 cents per share for Wells. That sounds about right, maybe a penny or two too low. The important thing for us to see is that business is continuing to improve. I also like that Wells and JPM took advantage of low rates to raise tons of cash from investors. Wells Fargo is a good buy up to $46 per share.

New Buy Belows for WEX and BBBY

I’m again going to raise my Buy Below on WEX Inc. ($WEX). The stock has taunted us long enough! WEX did dip below our $75 Buy Below recently, and it’s started to run up again. I’m raising our Buy Below to $80 per share.

I’m also raising Bed Bath & Beyond ($BBBY) to $75 per share. The stock has responded well to its recent earnings report, and I don’t want it to run away from us. BBBY remains a very good buy.

That’s all for now. I told you this would be a short one. Don’t forget: earnings season kicks off next week. The stock and bond markets are still recuperating from the last Fed meeting. On Wednesday, we’ll finally get a look at the minutes from that meeting. I suspect that these minutes will confirm the view that the Fed is in no rush to shut off the money spigots. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

JPMorgan Chase Raises Dividend

Eddy Elfenbein, May 21st, 2013 at 3:31 pmFresh after winning its vote, Jamie Dimon and JPMorgan Chase ($JPM) raised its quarterly dividend by 26.7% to 38 cents per share. The old dividend was 30 cents per share. Based on the new dividend and this afternoon’s price, JPM yields 2.86%.

-

Jamie Wins

Eddy Elfenbein, May 21st, 2013 at 10:53 amThe New York Times is reporting that shareholders of JPMorgan Chase ($JPM) have voted down a proposal to separate the jobs of Chairman and CEO. I’m disappointed to see this but I’ll be curious to see how large Jamie’s victory margin was. The bank continues to do well (new 52-week high today) but many people are clearly not happy with Mr. Dimon’s leadership.

Update: 32% of shareholders voted against Jamie.

-

CWS Market Review – March 15, 2013

Eddy Elfenbein, March 15th, 2013 at 7:18 amGrace Kelly: Where does a man get inspiration to write a song like that?

Jimmy Stewart: He gets it from the landlady once a month.

– Rear WindowTen days in a row! Through Thursday, the Dow has risen for an amazing ten straight trading days. This is the longest winning streak in more than 16 years. The big question on Wall Street is which will happen first—the Miami Heat will lose or the Dow will fall. This one might be close. It’s true that much of the Dow’s strength has been due to IBM. Thanks to price weighting, Big Blue now makes up more than 11% of the Dow.

For those keeping track, the Dow’s longest-ever winning streak came at the start of 1987 when the index rose for 13 days in a row. In this case, unlucky 13 may have been an omen for what came later that year.

The S&P 500 has been no slouch. That index, which is the one I prefer to follow, has been up for nine of those ten days; it dropped slightly this past Tuesday. The S&P 500 is now just inches away from cracking its all-time high close from October 9th, 2007. Daily volatility continues to be very mild. On Thursday, the VIX finished the day at 11.30 which is its lowest close in more than six years. Since the high point on New Year’s Day, the VIX has been cut in half.

It’s times like this that we need to remind ourselves not to get carried away. Sure, it’s fun watching your stocks go up each day but we have to temper our expectations. Markets don’t always do what they’re told. Remember that since this bull market started four years ago, the S&P 500 has fallen by 10% three separate times. We rode out all of those bumps and were rewarded each time. Our strategy continues to have three prongs—be patient, be disciplined and focus like a laser on high-quality stocks going for decent valuations.

In this issue of CWS Market Review, I want to take a closer look at the economy. The broader economic trends are stronger than many people realize. Although growth was pretty weak during the fourth quarter of 2012, the economy is poised to do fairly well this year, especially during the latter half of the year. Let’s look at some of the recent good news.

The Economic Recovery Is Gaining Strength

When I say that the economy is doing better, I don’t want to overstate my case. There are still 12 million Americans out of work, and Uncle Sam is piling up red ink. But there are concrete signs that the economy is fighting back.

Last Friday, the government reported that the U.S. economy created 236,000 new jobs in February which was 65,000 more than Wall Street had expected. There was actually a net decrease in the number of public-sector jobs by 10,000, so the private sector added 246,000 jobs. We still have a long way to go, but the numbers are moving in the right direction. The jobless rate for February fell to 7.7%, which is the lowest since 2008.

On Wednesday, we got more good news when the Commerce Department reported that retail sales jumped by 1.1% last month. That was more than double the rate economists were expecting. This is good news because it mollifies two concerns. One was the fear that higher payroll taxes would cause Americans to hold off on shopping. That doesn’t appear to be the case. The other concern was that retail sales would only go up due to higher gasoline prices. True, that had an impact, but even after subtracting for gas prices, retail sales still rose by a healthy 0.6%. Economists also like to look at core retail sales which ignore volatile sectors like gasoline, cars and building supplies. For February, core sales had risen by 0.4%. The positive retail-sales report is good news for Buy List stocks like Ross Stores ($ROST) and Bed Bath & Beyond ($BBBY).

On Thursday, the Labor Department reported that first-time jobless claims dropped by 10,000 to 332,000. That’s the lowest in two months. Economists were expecting 350,000. This number tends to jump around a lot, so many folks prefer to follow the four-week moving average, which is now at a five-year low.

We even had some bright news on Uncle Sam’s worrisome finances. The Treasury Department said that the monthly budget deficit for February dropped by 12% from a year ago. The CBO now estimates that the deficit for this year will be a mere $845 billion. Pocket change! But seriously, this would be lowest deficit, by far, in four years.

JPMorgan Chase and Wells Fargo Raise Their Dividends

Our Buy List continues to do well, and several of our stocks like Fiserv ($FISV), Oracle ($ORCL) and Stryker ($SYK) are at new 52-week highs. JPMorgan Chase ($JPM) also just touched a new 52-week high, but I need to confess some embarrassment here. In last week’s CWS Market Review, I predicted that House of Dimon would soon raise its dividend to 30 cents per share. The problem was that JPM’s dividend already was 30 cents per share. My goof! What makes this all the more embarrassing is that I correctly predicted that increase a year ago.

At least I was right about a dividend increase. After the closing bell on Thursday, JPMorgan announced that it plans to pay out 30 cents per share for the first quarter and increase that to 38 cents per share for the second quarter. That’s a planned increase of 26.7%. The Federal Reserve gave the bank approval to increase its dividend, but they need to resubmit their capital plans. Unfortunately, the bank is still in the political hot seat due to the London Whale fiasco. JPM remains a very good buy up to $52 per share.

Wells Fargo ($WFC) also raised its quarterly dividend. Their dividend will increase from 25 cents to 30 cents per share, which is a 20% raise. This is the second dividend increase from WFC this year. In January, the bank increased its dividend from 22 cents to 25 cents per share. WFC is a very solid bank. I’m raising the Buy Below on Wells Fargo to $40 per share.

Bed Bath & Beyond Is a Buy up to $62

In the CWS Market Review from four weeks ago, I said that Bed Bath & Beyond ($BBBY) had become a very attractive value. The home-furnishings retailer had been slammed a few times last year after it gave weaker-than-expected guidance. I think the market had overreacted, which is what markets often do.

I was pleasantly surprised to see that last weekend, Barron’s jumped on the BBBY bandwagon. The magazine said that BBBY “could” fetch as much as $85 per share. True, “could” is a rather broad word, but the key fact for us is that BBBY is a very well-run outfit. Barron’s wrote:

Bed Bath has had no direct competition since Linens ‘n Things was liquidated in 2008 after a bankruptcy. It controls an estimated 25% of the domestic home-furnishings market. Department stores offer limited competition because clothing generally generates higher profits per square foot of selling space than housewares.

Bed Bath’s strategy is unlike any other major retailer’s. It rarely advertises and usually avoids markdowns except on seasonal items, while providing excellent customer service. It targets customers with coupons offering a 20% discount, or $5 off, a single item (with a wide number of excluded products) to help drive traffic. As savvy shoppers know, Bed Bath & Beyond generally accepts expired coupons, and it’s known for a liberal returns policy—customers sometimes needn’t present a receipt. And they often present multiple coupons. The approach works because many customers come for a single item and leave with many, as they walk around the “racetrack” layout of the narrow-aisled stores.

Bed Bath & Beyond has zero debt and impressive operating margins. They’re sitting on nearly $4 per share in cash. While they don’t pay a dividend, BBBY is one of a few companies that truly buys back its own shares in an effort to reduce share count. Since 2004, share count has dropped by 100 million to 226 million. The next earnings report is due out in mid-April. I’m raising the Buy Below on BBBY to $62.

Moog Is a Buy up to $50

I’ve also been impressed with Moog ($MOG-A), which is one of our quieter stocks. On Thursday, Moog touched a new high and is now up 15.5% on the year for us. If you recall, the shares fell after the company lowered the high end of its full-year guidance. At the time, I told investors not to worry about Moog, and the stock has already made back everything it lost. The lesson is that good stocks often bend, but they rarely break. Moog is up more than 38% in the last four months. This continues to be a very good stock. I’m raising the Buy Below on Moog to $50.

Next week, we have three earnings reports coming up: Oracle ($ORCL), FactSet Research Systems ($FDS) and Ross Stores ($ROST). I previewed the earnings reports in last week’s issue. I think Oracle is the strongest candidate for a big earnings beat. The company told us to expect earnings to range between 64 and 68 cents per share. I think Oracle made at least 70 cents per share, but I suspect they’ll be conservative with their guidance.

That’s all for now. The Federal Reserve meets on Tuesday and Wednesday of next week, and it will include a Bernanke presser. I’ll be very curious to see any language changes from the Fed. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 1, 2013

Eddy Elfenbein, March 1st, 2013 at 6:52 am“Business, more than any other occupation, is a continual dealing with the future;

it is a continual calculation, an instinctive exercise in foresight.” – Henry R. LuceThe stock market had a rather raucous few days this week, which included our worst single-day plunge since November, thanks to, of all things, unexpected election results in Italy. But after some good earnings and positive economic reports, plus bullish comments from Mr. Bernanke, the stock market regained its legs; the Dow is now only steps away from an all-time high. You know, it’s a wonder what pumping in a few trillion dollars can do for a market’s spirits.

Here’s an interesting fact: The S&P 500 has risen in both January and February. Since 1945, the S&P 500 has been positive for the first two months of the year 26 times. Every single time that’s happened, the index has closed higher for the year. No exceptions. In fact, it’s usually closed a lot higher. The average total gain, including dividends, has been 24%. If the S&P 500 were to rack up a 24% total return this year, the index would have to be well over 1,700 by the end of the year.

Of course, I’m not predicting such a move. We’re too smart to play the price targets game around here, but I do think this market will continue to be tricky. Frankly, earnings estimates are too high, and I see a lot of lousy stocks gaining ground. That’s not a good sign. On the plus side, the economic recovery is starting to gain some momentum, and our Buy List continues to be an oasis in a troubling climate. As usual, our strategy is to ignore the noise and remain focused on high-quality stocks.

We didn’t have any earnings reports this week, so I’m going to discuss some broader themes impacting the market. First, let’s look at what had the market so grumpy earlier this week.

Reports of the Euro’s Death Are Greatly Exaggerated

The early news on Monday showed that it looked like Pier Luigi Bersani’s left-of-center party was going to win the election in Italy. But as the results came in, both Beppe Grillo and Silvio Berlusconi, who are, respectively, a former comedian and a former Prime Minister, did much better than expected. The better they did, the worse stocks did.

In other words, the ditch-the-euro-and-bury-austerity crowd is still pulling in a lot of votes. As it turns out, Italians prefer governing themselves and not having Germany tell them what to do. Who knew? In fact, Grillo and Berlusconi did so well that due to the rules of Italy’s legislature, probably no one will be able to cobble together a governing coalition. And that probably means it’s back to the polls we go.

So here we are in 2013, with our portfolios noticeably impacted by the decision of a former comedian not to join in the governing of the Italian nation. My friends, we live in interesting times.

Now you might think it’s odd that I’m discussing these election results in a service dedicated to investing, and I have to agree with you—it is odd. But like the proverbial flap of a butterfly’s wing that causes a tornado thousands of miles away, the election results have far-reaching consequences. For one, the S&P 500 dropped 27.75 points on Monday, and it was the worst daily loss since the day after President Obama’s reelection.

Now let me explain what’s really going on and what it means for us: The plan to save Europe was perfectly drawn up and perfectly executed. There was one teeny, tiny, minor, little flaw: no one bothered to ask the voters. Well, technically they did ask, but the pro-euro policies slid by in Greece and other places. Now in Italy, voters are pushing back. That’s why this isn’t just about one election. It’s really a much broader battle, and that’s why our market reacted so dramatically. Bear in mind that the establishment’s candidate wasn’t Bersani; it was the current Prime Minister Mario Monti, and he was totally blown out.

If the anti-euro and anti-austerity movement gains power, it could undermine all the work that’s been done to save the eurozone. Remember last summer when Mr. Draghi made his dramatic statement that he was prepared to do whatever it takes to save the euro? Just look at any chart from that period and you’ll see that’s precisely when the lines that had been going down started to rise and when the rising lines started to fall. More specifically, that’s when investors finally stepped away from crowding en masse into U.S. Treasuries and started buying dollar-denominated stocks. That’s also when cyclical stocks started to take the lead. We’ve come a long way, so the recent events in Italy are seen as a big threat.

Here’s my take: This latest round is really a political crisis, whereas the previous episodes were part of a financial crisis. The good news is that bond yields in Europe are down dramatically from where they had been last summer. I think this was another example of investors who had already been looking to exit some U.S. stocks jumping on this excuse to unload their positions. The fundamentals in Europe and the U.S. are much better. Panicky traders, however, will never change. There may be more euro flare-ups to come, but those whom the Bond Market Gods wish to destroy, they first make Greek or Spanish. Maybe Portuguese. But not Italian.

The Equation That’s Been Driving the Market

The other big news this week was the Congressional testimony from Ben Bernanke. The Fed Chairman’s semi-annual testimony used to be a big deal, but since Bernanke allowed at least a little more transparency into a hopelessly opaque institution, the thoughts of Mr. Bernanke aren’t wholly unexpected.

In short, Bernanke said that the economy hit a rough patch late last year but that things are looking better at the start of this year. The part of Bernanke’s remarks that caught my attention was his robust defense of the Fed’s asset purchases. Some folks on Wall Street thought the recent Fed minutes indicated that the central bank was ready to pull the plug on their bond-buying. That ain’t happening. Bernanke made it clear that they want to keep buying bonds until the labor market gets much better. The Bearded One said, “The FOMC has indicated that it will continue purchases until it observes a substantial improvement in the outlook for the labor market in a context of price stability.” Seems pretty clear to me.

Now let me circle back and explain why this is so important. I’ll give you the simple equation to understand the stock market for the last six months or so. The areas that have done exceptionally well are found wherever you see consumers intersecting finance. This is absolutely crucial.

What do I mean by this? It’s not just that consumers are buying more things; it’s that they also need to finance those purchases. That means housing, which has done extremely well. The Homebuilder ETF ($XHB) is up 41% in the last year.

That means cars. Ford Motor ($F) has rallied more than 36% in the last seven months. Nicholas Financial ($NICK) continues to thrive as well. It also means travel and airline stocks. And spillover industries. Home Depot ($HD) just reported very good earnings, plus they raised their dividend by 34%. People buying. People borrowing. Banks lending.

On the other side of the financing, the big banks have done well. This has been great for JPMorgan Chase ($JPM) and Wells Fargo ($WFC), both of whom made a conscious decision to focus on mortgages. Stocks like Visa ($V) and MasterCard ($MA) have also been big winners. All of these stocks have benefited from the same effect: Consumers buying things with money they don’t have at the moment but plan to get soon. This is why Bernanke’s defense of QE, and his dismissal of its risks, is so important. This trend isn’t nearly over, either. Mortgage rates are still very low, and housing inventory is getting pretty thin as well. Monetary policy does eventually work, though it may tarry.

Two Buy Below Adjustments

I want to make two small adjustments to our Buy Below prices. I’m going to bump up FactSet Research’s ($FDS) Buy Below to $96. Fiscal Q2 earnings are due out in mid-March, and I’m expecting good news. The Street’s looking for $1.11 per share. I also want to raise Stryker’s ($SYK) Buy Below to $64. Stryker is our #1 performer this year, with a YTD gain of 16.5%. Despite the recent rally, the shares are still quite reasonably priced.

That’s all for now. Next week, the government will revise its productivity report, plus we’ll get the Fed’s important Beige Book report. But the most important event will be next Friday’s jobs report. Remember what Bernanke said about “a substantial improvement.” Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

JPMorgan Investor Day

Eddy Elfenbein, February 26th, 2013 at 9:06 amJPMorgan Chase ($JPM) has its annual investor day today. You can see a lot of info at their website. The bank said that it’s looking to cut costs by $1 billion, and JPM wants to reduce headcount by 4,000 this year.

-

CWS Market Review – January 18, 2013

Eddy Elfenbein, January 18th, 2013 at 8:18 am“Good investing is boring.” – George Soros

Last week, I told you how fear was slowly melting away from this market. That trend continued into this week. Major stock indexes hit five-year highs. The small- and mid-cap indexes made all-time highs. Volatility dropped to a five-year low. So did initial unemployment claims. Poor home construction and industrial production; they only made four-and-a-half year highs.

Here’s what investors need to understand: The denouement of the Fed’s Quantitative Easing policy is the market’s embracing of riskier assets. That’s helped our Buy List tremendously, and it’s precisely why I wrote in the CWS Market Review from five weeks ago, “(t)he risk right now is finding yourself getting left behind.” Our Buy List is already up 5.1% on the year, and we’re barely halfway through January.

Of course, as patient investors, we know that the stock market can quickly take back what’s it’s given us, so that’s why we’re focused on the long-term. I urge all investors to pay close attention to our Buy Below prices. Too often, a bull market makes investors lazy. Mr. Soros is right: “good investing is boring.”

In this week’s CWS Market Review, I want to focus on the strong earnings report from JPMorgan Chase ($JPM). Last week, I told you to expect an earnings beat, and that’s exactly what happened. We also had record earnings from Wells Fargo ($WFC) last Friday. Next week, we have three earnings reports on tap: CA Technologies ($CA), Stryker ($SYK) and Microsoft ($MSFT). I’ll get to those in a bit. But first, let’s look at what’s happening at the legendary House of Morgan.

Buy JPMorgan Chase up to $50

I wish I could take massive amounts of credit for predicting JPMorgan’s ($JPM) earnings beat earlier this week, but honestly, it wasn’t hard to see. Anyone paying attention could see how their business was improving.

For the fourth quarter, JPM earned $1.39 per share, which was up from 90 cents per share in the fourth quarter of 2011. It was also well above Wall Street’s consensus of $1.20 per share. This was a strong quarter across the board. CEO Jamie Dimon said, “The firm’s results reflected strong underlying performance across virtually all our businesses for the fourth quarter and the full year, with strong lending and deposit growth,”

Breaking down the numbers, quarterly revenue jumped 10% to $21.5 billion. For the year, JPM made a profit of $21.3 billion from revenue of $97 billion. This bank is absolutely enormous. It’s more than 1,000 times larger than our beloved Nicholas Financial ($NICK). I’m showing you these numbers because much of the true story about JPMorgan gets lost in the headlines.

Let me explain. Earlier this year, the bank took a $6 billion bath thanks to bone-headed trading out of its London office from the infamous “London Whale.” Yes, that was a terrible, terrible episode, and heads should roll. The point I tried to make last year is that even a gigantic loss like that is still manageable for a titan like JPM.

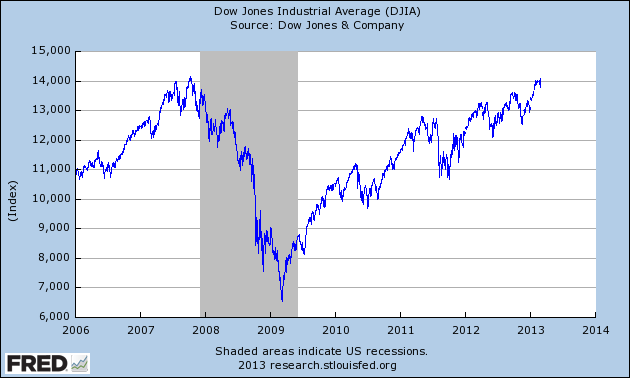

But when the London Whale news broke, investors panicked and rushed for the exits. In just five weeks, the shares plunged from $44 to $31 (see the chart above). Bear in mind that this was only a few weeks after the company quintupled its dividend. Fortunately, we held on and JPM has been a big winner for us. As well as it’s done for us, I still think the stock is a bargain.

Digging deeper in the earnings report, I was particularly impressed by JPM’s strength in the mortgage sector. Fees from their mortgage business climbed from $723 billion in Q4 of 2011 to just over $2 billion in Q4 of 2012. Bernanke and Co. are clearly making a difference. JPM set aside a smaller amount for mortgage loan losses than Wall Street had expected. This line in the income statement always seems to drive some folks batty, but making provisions for loan losses is what banks do. They can either do too much or too little. They’re never going to be exactly right. I’m going to give a bank that didn’t report a single quarterly loss during the financial crisis the benefit of the doubt.

I also noticed that in JPM’s credit-card business, loans delinquent over 30 days fell from 2.81% a year ago to 2.1% now. That’s a very good sign. On the negative side, the bank took a big $700 million charge in Q4 for the mortgage-abuse settlement that was announced recently.

Here’s how I see JPMorgan. It’s a solid bank. The stock is cheap. Business is doing well, and profits are growing. The problem is that the bank has a poor reputation, and not all of that is unfair. Jamie Dimon is a talented leader, but he’s a loudmouth. He was a good leader during a crisis, but now I think Jamie should depart so JPM can work on rebuilding its image. He can still be on the board, but the bank needs a new public face. Preferably one that’s a little boring.

On Thursday, shares of JPM got as high as $46.87, which is the highest level since April 13, 2011. Due to this strong earnings report, I’m raising my Buy Below on JPM to $50. This is an excellent stock. One more thing: Expect to see a dividend increase in a few weeks.

Fiserv Raises Full-Year Earnings Guidance

There was some rather bizarre news surrounding Fiserv ($FISV) this week. The company announced that it was buying Open Solutions for $850 million. That’s not the odd part. The same day, Fiserv was downgraded by an analyst due to the Open Solutions deal, although an analyst at Oppenheimer upped his price target to $89.

In the very same press release announcing the Open Solutions deal, Fiserv guided higher for all of 2013. Specifically, the company sees 12% earnings growth for 2012, and another 15% to 18% growth for 2013. Since Fiserv earned $4.58 per share in 2011, their guidance translates to earnings of $5.13 per share for 2012, and $5.90 to $6.05 per share for 2013. The Street had been expecting $5.78 for 2013.

The 2012 forecast works out to $1.38 per share for Q4 (which is the only missing piece), and this is four cents below the Street. That, combined with the analyst downgrade, was enough to cause a 3% drop in Fiserv’s stock on Tuesday. Yet the company raised guidance! That’s just silly. Fiserv remains an excellent buy any time you see it below $88 per share.

Three Buy List Earnings Reports Next Week

Next week, three of our Buy List stocks are reporting earnings. The most important will be Microsoft ($MSFT), which Wall Street has turned against recently. MSFT’s last earnings report was a complete dud, and the stock took another hit in November, when the head of Windows abruptly left.

For the upcoming earnings report, Wall Street expects 75 cents per share, which would be a decrease of three cents from one year ago. Unlike the situation with JPM, I can’t so easily say that MSFT will beat earnings. The lower share value, however, has taken a lot of the risk out of owning the stock. Microsoft below $28 has the potential to be a big winner for us, but it’s not in the bag just yet. Let’s be conservative here and rate it a good buy up to $30 per share.

The other reports next week are from Stryker ($SYK) and CA Technologies ($CA). Interestingly, Stryker is our #1 performer for 2013, with a 10.6% gain. If you recall, the company recently raised the low end of its 2012 guidance by a penny per share, and reiterated its full-year forecast of $4.25 to $4.40 per share. I like this stock a lot. Stryker remains a good buy up to $62.

CA Technologies is our second-best performer for 2013, +10.2%. After a horrible slide late last year, CA has impressively recovered lost ground. Wall Street currently expects earnings of 57 cents per share. I think CA should be able to beat that. I’m raising my Buy Below on CA Technologies to $27.

In addition to raising JPM to $50 and CA to $27, I’m also bumping up Cognizant Technology (CTSH) to $81 and Medtronic ($MDT) to $48.

That’s all for now. Remember that the stock market will be closed on Monday in honor of Dr. Martin Luther King’s birthday. We’ll also have a few more earnings reports next week. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

JPMorgan Chase Earns $1.39 Per Share

Eddy Elfenbein, January 16th, 2013 at 11:31 amBefore the bell, JPMorgan Chase ($JPM) reported very strong fourth-quarter earnings of $1.39 per share, which easily topped Wall Street’s forecast. CEO Jamie Dimon said, “The firm’s results reflected strong underlying performance across virtually all our businesses for the fourth quarter and the full year, with strong lending and deposit growth.” This was a very good report.

Overall revenue rose 10% to $23.7 billion. I was particularly impressed with JPM’s mortgage business. Revenue in that sector jumped to $2 billion from $723 million in Q4 of 2011. Clearly, the housing rebound is also spilling over to financial services.

Trading results, which were hurt in the third quarter as the price of bank debt rose, were similarly affected in the last three months of 2012. The bank booked a $567 million pretax loss from a so-called debt-valuation adjustment in the fourth quarter as the price of the bank’s debt rose, compared with a $211 million loss in the third quarter.

Fixed-income and equity-markets revenue climbed to $4.07 billion from $3.43 billion a year earlier and declined from $4.77 billion in the third quarter, the company said. Investment-banking and trading revenue is estimated to have jumped 44 percent across the industry from the same quarter in 2011, according to Betsy Graseck, a Morgan Stanley analyst in New York.

(…)

The investment bank’s fixed-income trading book, which contains the remaining credit derivatives position, generated $3.18 billion in revenue compared with $2.63 billion in the fourth quarter of 2011.

Fewer consumers fell behind on their credit-card payments in the fourth quarter compared with the same period in 2011. Loans at least 30 days overdue, a signal of future write- offs, fell to 2.1 percent from 2.81 percent in the fourth quarter of 2011. Write-offs dropped to 3.5 percent from 4.29 percent the prior year and 3.57 percent in the previous quarter.

Consumer banking, which includes home loans and checking accounts, earned $2.01 billion in the fourth quarter, up 28 percent from $1.57 billion a year earlier. Net interest margin, which measures the profit margin on lending, narrowed to 2.4 percent from 2.7 percent a year earlier.

A lot of the headlines around today’s earnings are focusing on the big trading loss from the London Whale. The government is rightly taking the company to task for this. The bank also took a charge of $700 million as part of a settlement for mortgage abuse allegations. In response to the London Whale debacle, JPM’s board slashed Jamie Dimon’s pay in half from $23 million to $11.5 million. On a per-share basis, that’s miniscule. It works out to 0.6 cents per share being cut to 0.3 cents per share.

As I’ve said before, Jamie Dimon gets a great deal of attention but that blurs the fact of how large JPM really is. For the year, the bank earned $21 billion on revenue of $97 billion. The London Whale loss amounted to $6 billion. Yes, it was awful, but hardly life-threatening. In just a few weeks last year, the stock plunged from $43 to $31.

The stock initially dropped this morning after the earnings came out, which is an odd reaction. Since then, however, JPM has steadily rallied and it’s at a new 21-month high.

-

Boehner Breaks the Stalemate

Eddy Elfenbein, December 17th, 2012 at 9:58 amThe stock market has started the week on the up side. The most prominent news is that House Speaker John Boehner seems willing to accept a compromise in which tax rates for the wealthy have to rise. People who watch these sorts of things believe Boehner’s move is a tipping point. My take is that the real negotiations have begun. Up till now, it’s mostly been posturing.

In Japan, the Liberal Democratic Party won a big election landslide and the stock market there responded positively. The S&P 500 had an unusual week last where it slowly rallied during the first half and slowly sank at the back half. The turning point came Wednesday afternoon after the Fed’s policy statement came out.

So far, the big banks are the top-performers today. Our own JPMorgan Chase ($JPM) is up over 1% (which is actually one of the poorer performers among the big banks).

-

CWS Market Review – December 14, 2012

Eddy Elfenbein, December 14th, 2012 at 7:42 amThe stock market is a giant distraction to the business of investing. – Jack Bogle

The S&P 500 rose for six straight days, and on Thursday, for the 13th time in a row, the index failed to extend a six-day winning streak into a seven-day streak. Nevertheless, the market continues to do well, which is exactly as I suspected. I’m still holding to my view that the market will rally well into 2013; this is a good time to be an investor.

This was an eventful week. On Wednesday, the Federal Reserve made news by announcing economic triggers for its interest rate policy. The stock market responded by surging to a two-month high. I’ll explain what it all means for investors in just a bit. Perhaps the best news of the week was that Nicholas Financial ($NICK) joined the special dividend parade by announcing a monster $2-per-share dividend. Percentagewise, that’s a big deal, and the stock surged.

Let me also remind you that next week, I’ll unveil our 2013 Buy List. I won’t start tracking the new list until the start of the year. I’m happy to report that the current Buy List is ending the year on a strong note. Since August 2nd, our Buy List has more than doubled the S&P 500, 9.2% to 4%. It looks like we’re going to narrowly beat the S&P 500 for our sixth-straight market-beating year. Now let’s take a look at the Fed’s announcement this week and what it means for us.

The Fed Lays Its Card on the Table

Meetings of central bankers are usually rather dull affairs, and that’s probably how it ought to be. This past week, however, the Federal Reserve actually did something interesting. For the first time, the Fed laid out specific trigger points for its interest rate policy.

Let me explain, and I’ll try to avoid any econo-speak. When the economy went into the toilet, the Fed responded by slashing interest rates. In fact, they even cut rates to 0%. After all, that’s what models say you should do. The problem was that the model even said to go into negative rates. The Fed responded by doing the equivalent—they started buying bonds—or as economists call it, “Quantitative Easing” (QE if you want to sound cool).

The Fed then ran into another problem. The central bank was simply announcing a bond-buying program with a price tag. Once that ran out, they announced another. Then another. Then in September, the Fed took a step back and said “Look, this isn’t working. Forget these dollar amounts and deadlines. We’re going to keep buying bonds and we’re not going to stop until things get better. That’s that.”

To be more specific, the Fed said it was going to buy $40 billion of agency mortgage-backed securities (MBS) each month. In practical terms, the Fed swaps assets with a bank. The Fed gets a risky MBS, while the bank gets low-risk reserves, which, I should add, are held at (guess where?) the Federal Reserve.

The game-changer in September wasn’t the $40 billion number. It’s that the Fed said it was going to go all in until things got better. By taking a time horizon off the table, the Fed sent a clear signal to investors that it was going to do what it had to in order to help the economy. But there was still the question “how will we know when things get better?” That’s where this week’s news comes in. But first let me quote the CWS Market Review from September 21:

An idea gaining popularity among economists is that the Fed should buy bonds until some metric like the unemployment rate or nominal GDP hits a specific target. With today’s news, the Fed has clearly moved towards that position without expressly saying so. The Fed said that the bond buying would continue until the labor market improved “substantially” and “for a considerable time after the economic recovery strengthens.”

In this week’s policy statement, the Fed gave us an answer. They said they won’t raise interest rates as long as the unemployment rate is over 6.5% (we’re currently at 7.7%) and inflation is under 2.5%. Basically, this means that rates are going to stay low for a long while more.

There are a few key takeaways: This is especially good news for financial stocks. Nicholas Financial ($NICK), for example, borrows money at the short end of the yield curve. The lower rates are, the better it is for them. In fact, I think a lot of the major banks are going for good values. Given the current conditions, I think JPMorgan Chase ($JPM) will have a very profitable 2013.

The housing market should also continue to get better. This has been an underreported story this year. A key difference between the current “Quantitative Easing” and the previous attempts is that back then, the housing market was still in free fall. Now it’s gaining strength, and in turn, that’s helping consumers. We don’t have the numbers in yet, but this may turn out to be a good holiday shopping season. We just got the retail sales report for November, and it was pretty good. The initial jobless claims report came very close to hitting a five-year low (which means the spike from Hurricane Sandy has now passed).

This new Fed policy will also be good for economically sensitive “cyclical” stocks. These are sectors like energy, transportation and heavy industry. There’s also a key “double whammy” effect with cyclicals since they tend to outperform the market when the market itself is doing well. I like to follow how the Morgan Stanley Cyclical Index ($CYC) performs relative to the S&P 500, and it’s improved very nicely since the summer. The CYC-to-S&P 500 ratio is close at an eight-month high. I should warn you that Q4 GDP will probably be a dud (0% to 1% growth), but we may see greater than 3% growth toward the latter half of 2013.

This week’s Fed news is a clear signal that the Fed is in the investors’ corner and is willing to boost the economy for several more quarters. The risk right now is finding yourself getting left behind. Now let’s look at my second-favorite NICK of the holiday season.

Nicholas Financial’s Special Dividend

On Tuesday, Nicholas Financial ($NICK) announced a special $2-per-hare dividend. In previous issues, I’ve talked about how companies have announced special dividends before the end of the year so they won’t get hit by higher taxes, which are almost certainly on their way next year.

The major difference with NICK is that this is a pretty large dividend. It works out to be about 15% of the stock’s value. The dividend will be paid out on December 28th to shareholders of record as of December 21st. Also note that NICK is a Canadian company, so there may be foreign tax withholdings (please consult your tax advisor).

I want to clear up a few things about this dividend. This news, by itself, doesn’t do anything to boost NICK’s value. It’s simple math: Once the dividend is paid out, we can expect the shares to fall by $2. Since the dividend works out to be roughly one year’s worth of profits, we shouldn’t expect any dividends next year.

While the special dividend doesn’t add value to NICK, the perception did, as the value of the stock rallied nicely on Wednesday, getting as high as $14.14 per share. Why did it rally? That’s hard to say exactly, but it was probably an appreciation of the company’s boldness. Think of it this way: You’re not going to pull a big move like that unless you’re pretty darn confident about your business’s ability to rake in cash. Traders took notice. NICK continues to be a very good buy.

Earnings from Oracle and Bed, Bath & Beyond

Next week, we’ll get earnings reports from Oracle ($ORCL) and Bed, Bath & Beyond ($BBBY). Also, BBBY will lay out some important planning assumptions for next year. Both of these companies wrapped up the end of their quarter in November.

Oracle made news last week by announcing that they’re going to pay out their next three dividends before the end of the year in order to avoid the taxman. The company will report its fiscal Q2 earnings on Tuesday, December 18th. In September, Oracle told us to expect earnings to range between 59 and 63 cents per share. The Street expects 61 cents per share, which Oracle should be able to beat.

Last quarter, Oracle got dinged by currency costs. That’s frustrating, but I’m not particularly worried, since those tend to be transient concerns. I’d be much more concerned by a downturn in their overall business, and Oracle isn’t experiencing that. I’ll be interested to hear what Ellison & Co. have to say about fiscal Q3 and how badly Europe is hurting then. I continue to like Oracle a lot and rate it a good buy up to $35 per share.

Bed Bath & Beyond is due to report on Wednesday, December 19th. In June, BBBY surprised Wall Street (and me) by guiding lower for their August quarter. The stock got hammered, and analysts quickly slashed their forecasts. When the results came out in September, BBBY still came in four cents below consensus. It was just an ugly quarter, which is very uncharacteristic of BBBY.

The problem is that Bed Bath & Beyond had become overly reliant on coupons to get feet in the door. I understand the temptation, but a retailer can’t discount their way to sales for the long-term. I’m not giving up on BBBY. This is a very well-run outfit, and they’ve already steered their way though an historic housing bust. I think they can handle this.

Interestingly, the guidance for Q3 was 99 cents to $1.04 per share, which really isn’t that bad. What traders seemed to overlook is that the company stood by its previous full guidance of earnings growth between the high single digits and low double digits. BBBY also has a rock-solid balance sheet. I currently rate BBBY a buy up to $62 per share. This is a solid company, and the shares are going for a good value.

Before I go, I want to make two adjustments to our Buy Below prices. Fiserv ($FISV) has been a monster for us this year. I’m raising our Buy Below price to $83 per share. Moog ($MOG-A) has been a lousy stock this year, but I think it’s an exceptionally good value. I’m raising the Buy Below on Moog to $40 per share.

That’s all for now. Next week, we’ll get earnings from Oracle and Bed, Bath and Beyond. The government will also update the Q3 GDP report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His