Posts Tagged ‘MCD’

-

CWS Market Review – October 24, 2014

Eddy Elfenbein, October 24th, 2014 at 7:12 am“Buy not on optimism, but on arithmetic.” – Benjamin Graham

In last week’s CWS Market Review, I said I thought the market’s panic had reached a peak last Wednesday, and so far, that seems to be the case. The S&P 500 has now rallied for five of the past six days. The only downer was the day of the awful shooting in Ottawa. On Tuesday, the S&P 500 had its best day in more than a year, and the index rose back above its 200-day moving average. By the end of the day on Thursday, the S&P 500 stood 130 points above last Wednesday’s low. That’s quite a turnaround.

Probably a better gauge of the change of sentiment is the Volatility Index ($VIX). The VIX basically doubled in a week, then was halved the following week. I thought it was interesting that stocks fell briefly late Thursday on the news of a possible Ebola case in New York City. The case has since been confirmed. I can’t prove this, but I think that same story would have caused far more damage to the market if it had occurred sometime last week.

Let me caution you that I don’t think we’re out of the woods just yet. The new Ebola case certainly won’t help, but the worst of the market’s nervousness is probably behind us. The market likes to “retest” its lower bound after it goes through a stretch of turbulence. I think there’s a good chance that could happen again.

For now, investors should be focused on third-quarter earnings. The early numbers are quite good. So far, 79% of companies in the S&P 500 have beaten their earnings expectations, while 60% have beaten their revenue estimates. For our Buy List, we had a mixed bag this week. We had good earnings from Microsoft and CR Bard, but poor earnings from IBM. I’ll run down the results in a bit. I’ll also focus on more Buy List earnings for next week. Plus, I’ll update you on Ross Stores and DirecTV. But first, let’s look at the disappointing news from IBM.

Buy List Earnings: Some Good, Some Not So Good

On Sunday evening, IBM ($IBM) had a surprise announcement. The company said it was releasing its Q3 earnings on Monday morning instead of after the bell, as originally planned. Mysteriously, the company also said they had a major business announcement.

The business announcement turned out to be that they’re paying Globalfoundries Inc. $1.5 billion to take their money-losing chip-making business off their hands. Sorry IBM, but that’s not so major.

Then came the earnings report, which was very poor. For Q3, Big Blue earned $3.68 per share, which was 63 cents below expectations. Ugh! IBM also ditched their 2015 earnings target of $20 per share. That goal had been set five years ago by the previous CEO. There was no way they were going to make it.

I don’t know a better way to phrase it, but last quarter was ugly. This was IBM’s tenth-straight quarter showing a decline in revenues. Quarterly revenues came in at $22.4 billion, which was nearly $1 billion below expectations.

The stock dropped 7% on Monday. The plunge cost Warren Buffett nearly $1 billion. I’m very disappointed with IBM, and I doubt they’ll be back on next year’s Buy List. I didn’t realize the problems ran so deep. I’m lowering my Buy Below on IBM to $177 per share.

Unimpressive Results from McDonald’s

IBM wasn’t the only bad earnings report. McDonald’s ($MCD) had a dud, too. On Tuesday, Mickey D’s said that quarterly earnings plunged 30%. Revenue fell 5% to $6.99 billion, which was $20 million below expectations.

Excluding a bunch of charges, the burger giant earned $1.51 per share, which was 14 cents better than expectations. That’s about the only sliver of good news, but the details of MCD’s report aren’t good. Same-store sales fell by 3.3%, which was more than expected. Compare that to Chipotle ($CMG), where same-store sales grew by 19.8%.

In Europe, McDonald’s same-store sales were down 1.4%, and in China, they dropped by 22.7%. There was a scandal in China involving a supplier changing expiration dates (when it rains, it pours…).

McDonald’s realizes they’re in trouble and need to turn themselves around. Their situation isn’t quite as dire as IBM’s, but they need to change course quickly. The stock didn’t get punished too badly, since it was already down so much. The big dividend helps. MCD now yields 3.7%. I’m lowering my Buy Below on MCD to $96 per share.

Good Earnings from CA Technologies, CR Bard and Microsoft

CA Technologies ($CA) reported fiscal Q2 earnings of 65 cents per share. That was three cents better than estimates. Technically, the company raised its earnings guidance, but the currency adjustment nullified that. CA now sees full-year earnings ranging between $2.40 and $2.47 per share. The previous range was $2.42 to $2.49 per share

CA has been a disappointment this year, but the company is still basically hitting its goals. They expect cash flow from continuing operations to rise by 5% to 12%. That’s not bad. I also like the rich dividend yield. CA Technologies is a buy up to $30 per share.

CR Bard ($BCR) had another strong quarter and raised guidance. The medical-equipment company told us to expect Q3 earnings between $2.07 and $2.11 per share. In July, I said they “shouldn’t have trouble hitting that.” It turns out they earned $2.15 per share, and net sales rose 9% to $830 million. Wall Street had been expecting earnings of $2.10 per share and revenue of $818 million.

For Q4, Bard sees earnings ranging between $2.22 and $2.26 per share. Previously Bard said to expect full-year earnings between $8.25 and $8.35 per share. Now they say earnings will range between $8.34 and $8.38 per share, and that includes 10 cents per share lost to forex. The shares gapped up 4.2% on Thursday and hit a fresh 52-week high. CR Bard remains a solid buy up to $160 per share.

After the bell on Thursday, Microsoft ($MSFT) reported fiscal Q1 earnings of 54 cents per share. That topped expectations of 49 cents per share. Revenue came in at $23.2 billion, which was over $1 billion more than expectations.

The results are pretty impressive. Microsoft is doing well across the board. Their cloud business is going especially well (revenues +128%). Shares jumped more than 3% in the after-hours market. I’m raising my Buy Below on Microsoft to $50 per share.

We also have Ford Motor ($F) reporting later today. I’ll have details on the blog.

Four Buy List Earnings Reports Next Week

We have four more earnings reports coming our way next week; three of them are on Tuesday. Here’s an Earnings Calendar of our Buy List stocks for this earnings season.

On Tuesday, AFLAC ($AFL) is due to report third-quarter earnings. The duck stock has been in a difficult position this year because their operations are humming along just fine. AFLAC is hitting its targets and making a steady profit. The problem has been the weak yen. AFLAC does a ton of business in Japan, and the government there has been trying to bring down its currency relative to the U.S. dollar. That means that AFLAC’s profits get stung when the money is translated from yen into dollars.

Last quarter, AFLAC only lost three cents per share due to forex—that’s a lot less than they lost in previous quarters. For Q3, the CEO said he expects operating earnings of $1.38 to $1.47 per share, assuming the yen is between 100 and 105. The exchange rate stayed close to 102 from February to August but gapped as high as 110 a few weeks ago. AFLAC currently expects full-year earnings to range between $6.16 and $6.30 per share, which means the stock is going for less than 10 times this year’s earnings.

One more point: AFLAC has increased its dividend for the last 31 years in a row. You can see why I’m such a fan. Last year, they announced their dividend increase along with their third-quarter earnings report. I doubt AFL will forego a dividend increase this year, but it may be very modest, as in one penny per share. AFLAC currently pays a 37-cent quarterly dividend, which now yields 2.5%.

Express Scripts ($ESRX) was our big winner last earnings season. The pharmacy-benefits manager beat earnings by a penny per share and narrowed their full-year guidance. That was enough to spark a two-day gain of more than 7%. I think some traders had been expecting much worse results, so it was a classic relief rally. Analysts expect Q3 earnings of $1.20 per share. My numbers say it will be a bit higher.

Fiserv ($FISV) is one of my favorite long-term holdings. The company consistently churns out steady profits. In July, Fiserv said they expect full-year earnings to range between $3.31 and $3.37 per share. That’s a nice increase from $2.99 per share last year. Wall Street expects 84 cents per share for Q3. That sounds about right.

Moog ($MOG-A) usually reports its earnings on Friday just after I send you the newsletter, but I don’t want you to feel I’m neglecting this stock. Shares of Moog have been especially hot lately, and they’re not far from hitting a new all-time high. This next report will be for their fiscal Q4. The company said they expect full-year earnings of $3.65 per share. Since Moog already made $2.59 per share for the first three quarters, that means they expect $1.06 per share for Q4. Moog expects earnings growth of another 16% for the current fiscal year. There aren’t many stocks doing that.

Updates on DirecTV and Ross Stores

AT&T ($T) had a poor earnings report and lower guidance, which knocked the stock down. Unfortunately, that also impacts DirecTV ($DTV). According to the merger deal, AT&T will pay $95 per share for each share of DTV. The deal is for cash and AT&T stock, but there’s a collar in place to protect both parties.

Here’s how it works: If AT&T is below $34.90 per share when the deal closes—and we still don’t know when that will be but I assume it will be sometime in 2015—then DTV shareholders get $28.50 in cash plus 1.905 shares of AT&T. With the lower AT&T share price share, that comes to $92.62, going by Thursday’s close.

That’s the problem with using stock in a buyout; you’re tied to the fortunes of the other guy. I won’t venture to guess how low AT&T can fall, but I’ll note that at this lower price, the stock yields nearly 5.5%.

Don’t worry about DirecTV. It’s still doing well. I’m lowering our Buy Below to $90 per share to better reflect the current market. DTV reports earnings on November 6.

Remember all the trouble we had with Ross Stores ($ROST) earlier this year? In July, the stock got as low as $61.83 per share. Fortunately, the earnings report in August was very good, and the deep discounter raised guidance. The shares have been doing very well ever since, and this week, ROST broke above $81 per share. This is why we follow the fundamentals instead of panicking at every blip. This week, I’m raising my Buy Below on Ross Stores to $83 per share. Fiscal Q4 earnings are due in another month.

That’s all for now. The Federal Reserve meets again next week, and they’ll very likely announce the end of QE. Stay turned. The Fed’s decision will come on Wednesday at 2 p.m. On Thursday, we’ll get the initial report of Q3 GDP growth. There’s another durable-goods report on Tuesday, plus many more earnings reports. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – September 26, 2014

Eddy Elfenbein, September 26th, 2014 at 7:05 am“The stock market is designed to transfer money from the active to the patient.”

– Warren BuffettThis market continues to be dominated by the strong U.S. dollar. This is a very important point that all investors need to understand. There’s barely a sector of the market that’s not being impacted by the rallying greenback. The difference is that lately, the market’s no longer going higher.

On Thursday, the stock market had its second-biggest drop in the last 24 weeks. The S&P 500 lost 1.62% to close at 1,965.99. That’s a five-week low. The Dow slipped below 17,000, and the Nasdaq Composite was especially hard hit. That index closed below 4,500 for the first time since mid-August.

It was only one week ago that the market reached its “Alibaba Peak.” Last Friday morning, the S&P 500 touched its all-time intra-day high of 2,019.26, and 122 minutes later, Alibaba made its market debut. That may not be a coincidence.

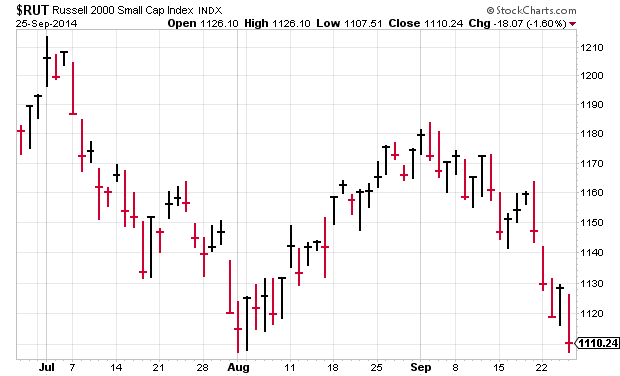

On Thursday, the dollar index broke out to a four-year high, and you can see the evidence everywhere. The yield spread between U.S. and German bonds reached a 15-year high. Gold dropped below $1,210 per ounce for the first time this year, and the small-cap Russell 2000 Index is now down 8.1% since July 3.

In this week’s CWS Market Review, I want to take a closer look at an important issue that has been driving the stock market: share buybacks. For years, Corporate America has been buying back its own shares at an impressive pace. Now, however, the buyback party looks to be coming to an end—and that might be good news. I’ll explain why in a bit.

Later on, we’ll take a look at the solid earnings report from Bed Bath & Beyond. The home-furnishings stores leaped more than 7% on Wednesday after they reported strong quarterly earnings. Speaking of buybacks, a few weeks ago, BBBY went to the bond market to borrow money so they could buy back gobs of their shares, and that’s what helped drive their earnings success. Or I should say their earnings-per-share success. We’ll also take a look at Medtronic’s tax inversion and the dividend increase from McDonald’s (their 38th in a row). But first, let’s look at what’s driving all these buybacks.

Why Share Buybacks Are Beginning to Fade

Anyone else remember when companies used to have lots of shares outstanding? Every quarter, the number of shares has slowly been getting smaller. More and more companies have been using their cash hordes to repurchase their own shares. The benefit for shareholders comes down to simple math. Having fewer shares helps your earnings-per-share, and investors like that. Howard Silverblatt, the main stat guy at S&P, notes that 295 companies in the S&P 500 reduced their share count last quarter.

On one hand, fewer shares is a good thing for investors, as it makes their holdings more valuable. But my take is that I’d prefer to see companies use their cash to expand their operations. That’s the best way to reinvest shareholder money: grow the business. But I can’t fault companies for buying back so much stock. What’s the point of keeping your cash in the bank, where you’d get 0.01%? After all, stocks are cheap and buyback announcements make for great PR.

I have two major complaints with share buybacks. One is that companies shouldn’t be in the stock market game. It’s a great idea to buy back a stock that’s cheap, assuming it rallies later on. But a lot of companies have tossed enormous sums of money at very expensive stocks, only to watch those assets fall. Cisco Systems is a perfect example. Remember a bank called Lehman Brothers? They used to be in the news a lot a few years ago. Anyway, Lehman spent $1 billion buying its own stock during the six months leading up to May 2008. I wince whenever I think about that. The Economist notes, “In all, America’s financial sector repurchased $207 billion of shares between 2006 and 2008. By 2009 taxpayers had had to inject $250 billion into the banks to save them.”

I’m also leery of companies sitting on too much cash. Peter Lynch has referred to this as the “Bladder Theory of Corporate Finance.” Even Apple got complaints from investors like Carl Icahn and David Einhorn for the size of its cash position, and it´s promised to return more money to shareholders. I also don’t like how many companies issue huge amounts of stock options for executive compensation, but they use share buybacks to mask how much they’re diluting their share base. There are exceptions like DirecTV which actually reduce their share count.

But we need to consider the fact that buybacks are popular with investors. Merrill Lynch found that companies with the largest buybacks crushed the market last year. But this year, the biggest repurchasers are performing nearly the same as the rest of the market. Actually, slightly worse. Perhaps, buybacks have lost their cool.

That could be the case. There are early indications that the buyback fever is fading. In Q2, companies in the S&P 500 bought back $116.2 billion worth of stock. That’s a decrease of 1.6% over last year, and a drop of 27.1% from Q1. Of course, stock prices are higher as well.

But that’s not all. Ironically, this could be an optimistic sign, because it means that companies are spending more money on growing their operations. Or, as crazy as this may sound, actually giving raises to their employees! When the financial crisis hit, buybacks were a no-brainer. Also, companies tend to be conservative with their dividend increases because it looks especially bad if you have to cut them later on. It’s generally assumed that a company will maintain its current dividend indefinitely.

There´s basic economics at work here. The U.S. economy has added close to nine million jobs in the last five years (we’ll get another jobs report next week). Those new jobs are an investment in a company’s future, and it’s encouraging to see firms take a more optimistic view of their future. A few days ago, Tesla said it’s building a new battery factory in Nevada. In response, the stock soared. In retrospect, the buyback craze was a result of low prices, low interest rates and a dragging economy. That’s coming to an end, and so, too, is the buyback frenzy. Now let’s take a look at a slumbering Buy List stock that’s taken full advantage of share buybacks.

Bed Buyback & Beyond

After the closing bell on Tuesday, Bed Bath & Beyond ($BBBY) reported earnings for its fiscal second quarter. Earnings announcements have been rather nerve-wracking for the home-furnishings chain; the stock has plunged after the last three earnings reports.

I’m pleased to say that that streak has come to an end. Shares of BBBY jumped more than 7.4% on Wednesday after Bed Bath & Beyond reported quarterly earnings of $1.17 per share. The company had previously said that earnings would range between $1.08 and $1.16 per share. Last week, I said that I expected earnings in the top end of that range, so the results were even better than I was expecting.

What’s interesting about BBBY’s earnings is the impact of buybacks. The company has been gobbling up its own shares at a furious pace. Net earnings fell 10.2% from the same quarter one year ago; however, there were 10.7% fewer shares. Presto! Earnings-per-share rose.

Bed Bath & Beyond recently floated a $1.5 billion bond offering to fund its share buybacks. Last quarter, BBBY spent $1 billion to buy back 16.9 million shares. Working out the math, that means they paid less than $60 per share on average, so they’re already in the money. Once again, it’s basic economics. The bond deal cost BBBY 4.38%, so it’s not exactly a back breaker. In fact, Standard & Poor raised their rating on Bed Bath & Beyond to AAA- from BBB+.

I’ve often said that I’m not a big fan of share buybacks, but I’ll give credit to BBBY for being another firm that´s actually reducing its share count. The company isn’t finished with buybacks either. There’s still another $1.8 billion remaining in the current buyback program. BBBY projects its share count will fall by another 13 million by the end of the fiscal year.

Bed Bath & Beyond gave us guidance for Q3 and Q4. For the third quarter, which ends in November, Bed Bath sees earnings ranging between $1.17 and $1.21 per share. For Q4, which is the all-important holiday season, they see earnings ranging between $1.78 and $1.83 per share. For the entire year, their earnings forecast is $5.00 to $5.08. BBBY sees comparable-store sales rising by 2% to 3% in Q3 and 4% to 5% in Q4.

The full-year forecast is the first time they’ve given us a specific EPS range, but it exactly comports with the “mid-single-digits” language they’ve used for several months. Not once have they budged from that forecast. Since the company made $4.79 per share last year, the current EPS guidance translates to annualized growth of 4.4% to 6.1%.

Adding up the two quarterly guidance ranges gives us a full-year range of $5.04 to $5.13. I’m probably reading too much into that, but it’s something to note. Overall, this was a solid quarter for BBBY. The stock remains a good buy up to $70 per share.

Medtronic Down on Tax-Inversion Rules

This week, Medtronic ($MDT) learned an important lesson that many of us have known for a long time—you simply can’t become Irish because you feel it. Shares of MDT dropped close to 3% on Tuesday, and still more on Wednesday and Thursday, after the government announced new rules for “tax inversions.” That’s what Medtronic is trying to do as it buys Ireland’s Covidien ($COV) and moves its HQ to the Emerald Isle. The move would cut their tax bill by a good amount.

I’ll be honest with you—I don’t know what impact the new rules will have on the MDT/COV deal, and it sounds like no one else knows at this point either. The lawyers are still looking it over. The key issue is a company’s holding of cash outside the United States. In Medtronic’s case, they hold close to $14 billion outside the country. Medtronic wants to loan some of that to their new parent, but the new rules might stop that.

Bloomberg reported that Medtronic released a statement saying, “We are studying the Treasury’s actions. We will release our perspective on any potential impact on our pending acquisition of Covidien following our complete review.” Don’t let the recent sell-off rattle you. Medtronic remains a buy up to $67 per share.

McDonald’s Raises Its Dividend for the 38th Year in a Row

I wanted to say a quick word about McDonald’s ($MCD), which has been a problem child this year. The company has been trying to right itself after several missteps. The results don’t yet reflect this, and the last sales report was truly terrible.

In the CWS Market Review from three weeks ago, I said I was concerned that Mickey D’s wouldn’t raise their dividend this year. I’m pleased to say that that wasn’t the case. Last week, McDonald’s announced that they’re raising their quarterly dividend from 81 to 85 cents per share. The burger giant aims to return $18 billion to $20 billion to shareholders from 2014 through 2016. The new dividend is payable on December 15 to shareholders of record as of December 1. Going by the new dividend and Thursday’s closing price, McDonald’s now yields 3.61%. McDonald’s remains a conservative buy up to $101 per share.

Two more things to mention. DirecTV ($DTV) shareholders approved the AT&T merger with 99% of the vote. Also, Cognizant Technology Solutions ($CTSH) is very cheap at the moment. The shares are at a seven-week low. If you can pick up CTSH below $45, that’s a very good purchase.

That’s all for now. The third quarter comes to a close next Tuesday. After that, we’ll get the important turn-of-the-month economic reports. The September ISM report comes out on Wednesday. There’s a chance it could hit a 10-year high. Also on Wednesday, we’ll get the ADP jobs report. Then on Friday will be the official jobs report from the government. The last report was on the weak side. I doubt that’s the start of a trend. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – January 17, 2014

Eddy Elfenbein, January 17th, 2014 at 7:12 am“It is not the crook in modern business that we fear, but the honest

man who doesn’t know what he is doing.” – Owen D. YoungEarnings season is finally here. We’ve already had one good earnings report from Wells Fargo ($WFC). The big bank beat earnings by two cents per share, and after a delayed reaction, the shares broke out to a new 52-week high. This week, I’m raising my buy below on WFC (more on that in a bit).

Things are about to get very busy for our Buy List. Next week, we’re due to have six earnings reports including heavyweights like IBM, McDonald’s and Microsoft. In this week’s CWS Market Review, I’ll preview our upcoming earnings, and I’ll break down the results from Wells Fargo.

Looking at this earnings season, the consensus on Wall Street is that earnings rose 4.9% last quarter. That’s kind of blah, but going into this earnings season, there were some serious concerns. Before earnings season even started, there were 95 earnings warnings in the S&P 500, compared with just 15 good-news surprises. But most of those warnings have been about rather minor adjustments. Actually, the market seems unusually sedate. A few times this week, the Volatility Index ($VIX) dropped below 12, which brought the “Fear Index” to some of its lowest levels in the past seven years. Fortunately, the stock market continues to hold up well, and the S&P 500 reached an all-time high close on Wednesday. We edged out the previous high close of December 31 by 0.00108%.

The economic news continues to be mostly positive, with a few bumps. This week, the Federal Reserve released its Beige Book report, which looks at regional economies across the country. The reports were mostly good, and I think we can expect more tapering when the Fed meets again at the end of this month. Janet Yellen officially becomes the new Fed Chairman on February 1.

This past Tuesday, the Census Bureau released the December retail-sales report, which showed an increase of 0.2%. December is obviously a huge month for retail. While the report wasn’t outstanding, economists were expecting a gain of 0.1%. Also, the big increase for November was revised downward from 0.7% growth to 0.4%.

These are important numbers because consumers drive most of the economy. Also, retail stocks have been hit hard this year. I still like our Buy List retailers, Ross Stores ($ROST) and Bed Bath & Beyond ($BBBY). However, their most recent quarterly reports included sales through November, and not the holiday season. Once the dust settles in the retail sector, I expect our stocks to flourish.

Of course, it’s still very early, but our Buy List is already slightly ahead of the S&P 500 this year. We’ve done that despite a horrible start for Bed Bath & Beyond, which is now down over 16% for the year. Ouch! The lesson here is that diversification works. I should also note that you’ll often see the worst stock in your portfolio dropping more than the gain from your best stock. Stock performance tends to be asymmetrical. In plain English, the bad ones are worse than the best are good. That’s a key insight, and ultimately, it’s what makes value investing so effective. Now let’s look at Wells Fargo.

Wells Fargo Is a Buy up to $50 per Share

On Tuesday, Wells Fargo ($WFC) reported fourth-quarter earnings of $1 per share. That beat Wall Street’s consensus by two cents per share. Strangely, the shares initially dropped after the earnings report (yep, we know how melodramatic traders can be). Then on Wednesday, it was as if rationality and math suddenly dawned on everyone, and the nervous traders got squeezed out. Before the closing bell, WFC had rallied to a new 52-week high.

Lesson: Don’t trust the market’s first reaction. Actually, keep a wary eye on the second and third ones as well.

Now that I’ve had a chance to look at the earnings from Wells, I can say that I’m impressed. Net income for Q4 rose 10% over last year’s Q4. For the entire year, Wells’s net income rose 16% to $21.9 billion. This was their fifth-straight record year. Last year, Wells made more money than JPMorgan Chase (sorry, Jamie).

I was particularly impressed with the efforts of CEO John Stumpf and his team to trim overhead. (Notice how good companies don’t wait to cut costs; they’re always looking for excess fat they can cut.) Quarterly revenue dropped 6% to $20.7 billion. For banks, you want to see where their “efficiency ratio” is. That’s a good measure of how well they’re managing their operations. For Wells, their efficiency ratio actually ticked up a bit last quarter. That’s not bad, coming in the wake of lower revenue.

Wells’s mortgage-originations business got shellacked last quarter, but there wasn’t much they could do about that. In that sector, you’re at the mercy of the Mortgage Rate Gods. On the plus side, Wells’s wealth and brokerage business did very well. One big benefit for Wells is that they don’t have the legal bills that many of the other big banks have.

I like Wells Fargo a lot. The bank is going for less than 11 times this year’s earnings estimate. I expect another dividend increase this spring. This week, I’m raising my Buy Below on WFC to $50 per share.

Next Week’s Buy List Earnings Reports

Next Tuesday, two of our big tech stocks, IBM and CA Technologies, report earnings. I want to warn you ahead of time that IBM ($IBM) may fall below expectations. The Street expects $5.99 per share, which could be just a bit too high. I’ll tell you ahead of time not to worry about a slight earnings miss. New additions to our Buy List are often dented merchandise, and Wall Street bears have been out to get IBM. They may not be done just yet. Either way, IBM is a solid value at this price. My take: IBM is a good buy anytime you see it below $195 per share.

Three months ago, CA Technologies ($CA), the shy kid, blew the doors off its earnings report. CA netted 86 cents per share for Q3, which was 13 cents more than estimates. Wall Street expects 71 cents for Q4, which is probably a wee bit too low. There’s also a chance that CA might sweeten its quarterly dividend. CA Technologies remains a solid buy up to $35 per share. I have much love for CA.

Wednesday: Earnings from Stryker and eBay

On Wednesday, we get earnings reports from Stryker and eBay. If you recall, Stryker ($SYK) raised its dividend by 15% last month. The company missed earnings by two cents in its last report. That was mostly due to currency effects, and I said not to worry about SYK. Indeed, the stock just hit another 52-week high. This time around, Wall Street expects $1.22 per share in earnings, but I’m more interested in what they’ll have to say about 2014. Wall Street currently expects full-year earnings of $4.56 per share for 2014. Stryker remains a very good buy up to $79 per share.

eBay ($EBAY)’s earnings tend to be very consistent. So far this year, their earnings are up 14%. If we apply a 14% increase over the Q4 earnings from 2012 (70 cents per share), that gives us 80 cents per share, which is, not surprisingly, exactly what Wall Street expects. eBay is a very good buy up to $58 per share.

Thursday: Earnings from McDonald’s and Microsoft

On Thursday, we get two more blue-chip earnings reports: McDonald’s and Microsoft.

Three months ago, Microsoft ($MSFT) surprised a lot of folks on Wall Street with an outstanding earnings report. The software giant earned 62 cents per share, which was eight cents more than estimates. Sales rose 16% to $18.5 billion. Microsoft generated sales that were $700 million more than expectations. I think people forget that MSFT is a very profitable company, especially with its business clientele. For the December quarter, the expectation is for MSFT to earn 68 cents per share, which is down from 76 cents the year before. That sounds about right. We should remember that in September, MSFT raised its dividend by 22%. Microsoft is very attractive below $40 per share.

Like IBM, McDonald’s ($MCD) has been rather sluggish lately. This one may take some time before we see solid results. The consensus on the Street is for earnings of $1.39, which is only one penny more than last year’s Q4. The burger giant is coming off a lackluster year, but you should never count Ronald and his friends out. McDonald’s is a good buy up to $102 per share.

That’s all for now. The stock market will be closed on Monday in honor of Dr. Martin Luther King’s 85th Birthday. Next week will be all about earnings. In fact, there’s not much in the way of economic reports. An important note: With these earnings reports, we want to pay attention to forward guidance as much as to the actual results. I think a lot of traders are nervous about this year, especially with the Fed’s tapering plans, so any optimism from companies will go a long way. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

The Day After the Day After

Eddy Elfenbein, November 8th, 2012 at 10:34 amThe market is weakly recovering today after the second-worst sell-off this year. Yesterday’s 2.37% loss for the S&P 500 was only exceeded by a 2.46% plunge on June 1st. Right now, we’re up by about two points.

This morning we learned that weekly jobless claims fell 8,000 to 355,000 however this data set over the next few weeks will be impacted by the effects of Hurricane Sandy. We may see a bump up in jobless claims in another month, but for now, the numbers look good.

The government also reported that the trade deficit fell by 5.1% in September. The trade deficit is now close to its lowest levels in two years. Of course, much of this isn’t due to strength here, but weakness there.

Speaking of which, the biggest news today came from the Bernanke of Europe, Mario Draghi. The head of the European Central Bank said he’s ready to buy bonds as the European economy continues to get worse. The ECB met today and decided to leave interest rates at 0.75%.

The concern now for the Europeans is that Germany is beginning to look weak. Until now, that country had been holding things together. Now some analysts think that an ECB rate cut will come before the end of the year.

The big area of concern now is Spain. This is one of the reasons why I told investors to expect a difficult market this autumn. Spain needs to ask for a bailout but they haven’t done so yet. The problem is that the political leaders see what’s going on in Greece where folks are rioting over forced austerity. As a result, Spain wants the best deal it can get. The problem gets worse because the ECB can’t make any hard promises before the fact. An economy is a dynamic system and facts on the ground can change quickly.

There at least was some good news for Americans today. Monthly sales at McDonald’s ($MCD) fell for the first time in nine years. We’re either getting healthier, or perhaps, going to Arby’s.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His