Posts Tagged ‘mdt’

-

CWS Market Review – September 14, 2012

Eddy Elfenbein, September 14th, 2012 at 8:23 amLast week, it was thank you, Mario. This week, it’s thank you, Ben!

The stock market surged to its highest close in four years on Thursday when it was reported that that the Federal Reserve is embarking on another round of quantitative easing. The last time the S&P 500 was this high was on the final day of trading in 2007. The market had a great day on Thursday, and several of our Buy List stocks like Medtronic ($MDT), DirecTV ($DTV), Hudson City ($HCBK) and Harris Corp. ($HCBK) all broke out to new 52-week highs.

I’m also pleased to announce that—after many of you requested it—I’ve added a “Buy Below” column to our Buy List page. I think you’ll like it a lot. Now you’ll be able to know exactly what I think is a good entry point for all the stocks on our Buy List. It’s important for investors to stay disciplined and never chase after stocks. My Buy Below prices will help you do exactly that.

In this week’s CWS Market Review, I’ll explain what the Fed news means, and I’ll try to keep it jargon free. I’ll also discuss what this policy means for the economy and our portfolios. I’ll also highlight upcoming Buy List earnings reports from Oracle ($ORCL) and Bed Bath & Beyond ($BBBY). But first, let’s look at why stocks are so happy with the Bearded One.

The Federal Reserve Embarks on QE-Infinity

I have to confess some embarrassment with the Fed’s news, because I had long been a doubter that the central bank would pursue more quantitative easing. I even said last week that this week’s policy meeting would be a snoozer. In fact, I was afraid the market was setting itself up to be disappointed. Instead, the market celebrated the news.

Now let’s look at what exactly the Federal Reserve did. The central bank said it will buy $40 billion per month of agency mortgage-backed securities (MBS). What will happen is the Fed will swap assets with a bank. The Fed will get a risky MBS while the bank will get low-risk reserves, which, I should add, are held at the Federal Reserve.

Here’s the problem: Since interest rates are already near 0%, the Fed can’t cut them any further. But the hope is that by buying MBS, the Fed can push down mortgage rates, which will boost the housing market, which in turn will boost the overall economy. At least, that’s the plan. Remember that the housing sector is a key driver of new jobs, and I noted on Thursday that the stocks of many homebuilders gapped up on the news.

The Fed Changes Course

The problem with the two earlier rounds of bond purchases is that while they certainly helped the financial markets, their impact on the economy was probably pretty slight. Some critics said that the Fed simply wasn’t being bold enough. What’s interesting is that this round of bond buying is smaller than the previous rounds.

But here’s the key: The Fed said something very different this time.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.

In other words, this time the Fed’s plan is unlimited. Implicit in the above sentence is the Fed’s admission that its previous policy just wasn’t working. With the earlier bond buying, the Fed just said that they’re going to buy X dollar amount of bonds, and that’s that. There was no goal.

An idea gaining popularity among economists is that the Fed should buy bonds until some metric like the unemployment rate or nominal GDP hits a specific target. With today’s news, the Fed has clearly moved towards that position without expressly saying so. The Fed said that the bond buying would continue until the labor market improved “substantially” and “for a considerable time after the economic recovery strengthens.” The $40-billion-per-month figure is almost irrelevant in context of an open-ended policy. All told, the Fed will be pumping $85 billion into the economy each month.

What This All Means

I may sound overly cynical, but I suspect the Fed will buy bonds until the bond market shuts them off. (Remember when I talked last week about how the Spanish bond market scared the bejesus out of the European Central Bank?)

The Fed also said that it will keep interest rates near 0% through at least 2015. That’s very good news for a company like Nicholas Financial ($NICK). Another buried angle on today’s news is that the Fed is, in my opinion, giving up on the fiction that it has a dual mandate (low inflation and full employment). When it truly matters, the Fed only cares about employment.

Will this QE-Infinity work? I honestly can’t say. One fear is that mortgage rates are already low, and that hasn’t done much to boost the economy. Looking at the track of previous quantitative easings doesn’t make me overly optimistic that a third version will do the trick.

Let’s look at the probable outcomes for the market. I suspect that in the near term, cyclical stocks and financial stocks will get a nice boost. That’s what happened after the first two rounds of bond buying and Operation Twist. JPMorgan Chase ($JPM), for example, soared to $41.40 on Thursday, which effectively erased its entire loss since the London Whale trading loss was announced in May.

Since the Fed is willing to turn a blind eye toward inflation for the time being, I suspect that hard assets (like gold) and commodity-based stocks will do well. I also think that higher-risk assets will gradually gain favor. For example, spreads between junk bonds and Treasuries will continue to narrow. This will also give a lift to many small-cap stocks, especially small-cap growth stocks. In the long run, I’m not convinced the Fed’s decision this week will have a major impact on the economy. Perhaps the best outcome is that a Fed-induced burst of enthusiasm will give the economy and labor market more time to right themselves. Until then, I urge all investors to own a diversified portfolio of high-quality stocks such as our Buy List.

Earnings from Oracle and BBBY

Next week, we have two earnings reports due. Bed Bath & Beyond ($BBBY) reports on Tuesday, September 18, and Oracle ($ORCL) reports the next day. This will be an interesting report for BBBY because three months ago, traders gave the stock a super-atomic wedgie after the company warned Wall Street that their fiscal Q2 would be below expectations. Wall Street had been expecting $1.08 per share, but BBBY said that earnings would range between 97 cents and $1.03 per share. Traders totally freaked and sent shares of BBBY from $74 all the way down to $58.

For fiscal Q1 (which ended in May), I predicted that BBBY could earn as much as 88 cents per share, which was four cents above Wall Street’s consensus. In fact, the company reported earnings of 89 cents per share. Nevertheless, the weak earnings guidance was too much to overcome.

In the CWS Market Review from June 22, I said that the selling was “way, way WAY overdone.” Fortunately, I was right. Since bottoming out in late-June, shares of BBBY have steadily rallied. On Thursday, the stock closed above $70 for the first time in three months. BBBY is still a good stock, and business is going well, but let’s be smart here and not chase it. I’m keeping my Buy Below price at $70.

Oracle has been one of our best stocks this year. The company beat expectations in March and June, although the stock had a terrible month in May. This earnings report will be for their fiscal Q1. The company said that earnings should range between 51 and 55 cents per share, which is almost certainly too low. They earned 48 cents per share for last year’s Q1. Look for an earnings surprise. I’m raising my Buy Below price on Oracle to $35 per share.

That’s all for now. Don’t forget to check out the new “Buy Below” column on the Buy List page. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Barron’s: Medtronic Looks Cheap

Eddy Elfenbein, September 12th, 2012 at 12:44 amBarron’s likes Buy List favorite Medtronic ($MDT):

In the 1990s, cutting-edge technology helped make Medtronic one of the market’s fastest growing big-cap medical-device makers.

But that was then. In recent years, Medtronic (ticker: MDT) has morphed into a slow-growing behemoth that has been hobbled by sluggish markets and safety concerns about some of its products.

The stock is currently trading 24% below where it sat five years ago.

But signs of a turnaround are evident as U.S. markets for implantable defibrillators and spinal devices are beginning to stabilize. Meanwhile, Medtronic’s effort to expand sales in emerging markets and launch new products can help it exceed tepid growth expectations.

The stock has gained 25% in the past year yet continues to trade at a cheap valuation. At roughly 11 times forward earnings, Medtronic could deliver 20% returns over the next year if Chief Executive Omar Ishrak can deliver on his promises regarding sales growth.

Add a 2.5% dividend yield, and “Medtronic is a cheap stock with an attractive dividend embarking on measures that can help move the stock price,” says BMO Capital Markets analyst Joanne Wuensch.

Founded in 1949, Medtronic makes devices that treat heart failure, fix damaged spines and monitor diabetes.

Revenue totaled $16 billion during the fiscal year that ended in April 2012, led by its cardiac-rhythm-management unit, which specializes in pacemakers and implantable defibrillators and generated roughly one-third of total sales.

But it’s been a tough time for Medtronic and the medical-device industry. Product prices are falling. A weak economy has hurt hospital admissions. Insurers are pushing back on expensive procedures.

And thanks to competition and government scrutiny of the stent and ICD markets, Medtronic’s former growth engine has run out of gas.

But chief financial officer Gary Ellis told investors Tuesday that Medtronic has reached an inflection point. Sales growth has begun to accelerate. And Ellis told investors at a Morgan Stanley conference that the headwinds facing its top markets “seem to be blowing away,” and allowing growth in other parts of the company to shine through.

Granted, Medtronic executives are playing things cautiously until they see signs that the device market will remain stable.

Last month, the company backed its previous guidance for the current fiscal year, which runs through April 2013, even though it had just reported sales growth for its latest quarter that exceeded its full-year target.

“Even though we were encouraged by [first-quarter results], we recognize that we need to deliver this kind of performance consistently over the long term,” Ishrak told investors during a conference call that same day.

Medtronic sees revenue growing between 2% and 4% this year and expects to earn between $3.62 a share and $3.70 a share, which suggests a 5% to 7% profit increase.

Right now, Medtronic’s biggest advantages remain its scale and the breadth of its portfolio, says T. Rowe Price analyst Mark Bussard.

The company also generates roughly $4 billion in free cash flow annually. And Ishrak plans to return half of it to shareholders through dividends and share repurchases.

Medtronic remains focused on improving profit margins with a goal to cut product costs by $1.2 billion in the next five years. And by then, emerging markets should make up 20% of sales, up from 10% today and new products will hit the market.

A new drug-coated stent called Resolute Integrity received approval from the Food and Drug Administration in February. U.S. sales should reach $384 million for the device, which has already captured 25% market share here and in Europe, according to some estimates.

A new heart valve that can be implanted without open-heart surgery should hit the U.S. market in 2014. And the following year could see the arrival of a novel treatment for uncontrolled hypertension called renal denervation.

By 2015, the Street sees Medtronic’s revenue exceeding $17.4 billion.

Of course, turnaround stories are risky. Investors want proof that Medtronic has turned a corner. So a dip in sales or any further volatility in big device markets will be severely punished by investors.

And a big ship like Medtronic doesn’t turn on a dime.

But for patient investors, Medtronic can deliver potent returns.

-

Bed Bath & Beyond Breaks $70

Eddy Elfenbein, September 11th, 2012 at 10:59 amThe stock market is creeping higher this morning after taking some losses yesterday. All eyes are on the Federal Reserve, which meets tomorrow and on Thursday. Ben Bernanke is also due to meet the press on Thursday after the meeting.

Wall Street almost universally expects more quantitative easing. I continue to be a skeptic. Perhaps the Fed will do something, but I doubt it will be much. In fact, I think Wall Street is setting itself up to be disappointed.

The good news is that our Buy List is doing well. I’m happy to see that Bed Bath & Beyond ($BBBY) has finally pierced $70 per share. The company is due to report earnings again on September 18th. I’m also pleased to see our financial stocks are doing well. Hudson City ($HCBK) is up to a new 52-week high, and JPMorgan Chase ($JPM) is close to breaking through $40 per share. Medtronic ($MDT) is also at a new 52-week high.

-

Medtronic’s CEO on CNBC

Eddy Elfenbein, August 21st, 2012 at 2:43 pmHere’s Omar Ishrak, CEO of Medtronic, on CNBC earlier today.

-

Medtronic Earns 85 Cents Per Share

Eddy Elfenbein, August 21st, 2012 at 11:36 amNot much of a surprise from Medtronic ($MDT) this morning. The company reported fiscal Q1 earnings of 85 cents per share which matched Wall Street’s forecast. I was expecting a little more but I’m not at all disappointed by these results. Revenues were up 1.6% to $4.01 billion..

The world’s biggest medical device maker said sales of coronary and vascular devices and structural heart products all improved. Medtronic said revenue from implantable devices like pacemakers and defibrillators decreased, although it said U.S. sales of implantable defibrillators are holding steady.

Bone graft revenue decreased in the wake of safety concerns and a shareholder lawsuit, and revenue from diabetes and surgical technology and other devices increased.

The earnings-per-share figure got a boost thanks to 3% fewer shares outstanding.

Medtronic said revenue from coronary products increased 11 percent to $433 million. Sales of structural heart devices like artificial valves rose 2 percent to $280 million and endovascular revenue, which includes stents, increased 12 percent to $209 million.

Revenue from the company’s restorative therapy business, which makes surgical devices and products used to treat diabetes, nerve disorders, and other conditions rose 3 percent to $1.89 billion. Medtronic said most of its businesses reported better sales than a year ago, but sales of its Infuse bone graft shrank 19 percent to $141 million during the quarter.

In 2011, a medical journal said Medtronic understated the risks of Infuse and did not disclose payments to the authors of studies on the product. In March 2012, Medtronic agreed to pay $85 million to resolve a federal lawsuit brought by shareholders. The U.S. government closed an investigation into Infuse in May. The product contains a genetically engineered protein that can stimulate bone growth. It is approved for use in spinal, oral and dental graft procedures, and it was frequently used in neck surgeries and other procedures.

The most important news is that Medtronic is reaffirming its full-year earnings forecast of $3.62 to $3.70 per share. Earlier today, the shares got to a new 52-week high.

-

CWS Market Review – May 25, 2012

Eddy Elfenbein, May 25th, 2012 at 7:02 amBoy has May been a frustrating month for stocks! The S&P 500 nearly went for an entire month without two up days in a row. We finally ended that run this week but the mess in Greece seems to be getting worse, and Facebook ($FB) had one of the worst initial public offerings in years. This IPO was a disaster for individual investors.

Fortunately, the stock market regained some of its footing this week. The S&P 500 managed to rise four days in a row and closed at 1,320.68 on Thursday. The index is still down nearly 7% from the four-year high it reached in early April. What’s not getting a lot of attention is that analysts have been increasing their earnings estimates for next year. The S&P 500 is currently going for about 11 times next year’s earnings estimate. That’s a good bargain, but I prefer to be skeptical about earnings estimates that far into the future. Still, it’s an interesting trend to note.

In this week’s CWS Market Review, I’ll talk about some of the issues surrounding Facebook’s IPO and I’ll tell you why I think the stock is a terrible, rotten, awful deal for investors. This IPO almost perfectly captures everything that’s wrong with Wall Street today.

As messy as things seems to be, the good news for us is that well-run companies are still doing well. On our Buy List, for example, we had a very nice earnings report this week from Medtronic ($MDT). In a few weeks, I expect to see the company raise its dividend for the 35th year in a row. Other standouts from our Buy List include Bed Bath & Beyond ($BBBY) which is close to a new all-time high. Also, Reynolds American ($RAI) has snapped back very impressively. But first, let’s take a closer look at the stock that’s on everyone’s mind: Facebook.

Don’t Invest in Facebook

Last Friday, Facebook ($FB) started trading as public company. This was the dream of all the investors who put money into the social networking company that was started in a Harvard dorm room eight years ago. Even before the shares started trading, there were problems. This was the second-largest IPO in U.S. history and the market was flooded with orders. The heavy demand caused trading in FB to be delayed for 30 minutes.

Almost every aspect of this offering was a mess. And what’s especially frustrating is that at every turn, individual investors were punished. Facebook simply got greedy and asked for too much money. However, I can’t put too much blame on a company for trying to get money for cheap. However, I can blame the bankers for not serving the best interest of their clients. The entire syndicate misjudged the interest in Facebook.

We also learned that the underwriters cut their estimates on Facebook in the middle of the roadshow. That’s outrageous! And we still don’t even know why but it apparently led to some major investors jumping ship. It turns out that some institutional investors were told of the downgrade while others were not. Meanwhile, many inexperienced retail investors bought Facebook using market orders. Ugh, that’s a big mistake. These were most likely the orders that were filled as Facebook ran up to $45 shortly after it started trading. Trust me: Never, never, never buy an IPO using a market order. You will get a terrible fill.

The fun in Facebook didn’t last long, and the stock dipped below $31 on Tuesday. Here’s a stat for you: Every penny in FB is worth $5 million for Mark Zuckerberg. Measuring from the stock’s high point, Zuck lost $7 billion. Between you and me, I think he’ll be okay.

Now let’s look at some numbers and we can clearly see that Facebook is wildly over-valued. The Street currently thinks FB can earn 65 cents per share next year. That’s almost certainly too low. To be safe, let’s say that Facebook can earn $1 per share in 2013. The estimated five-year earnings growth rate for Facebook is 35.9%.

If we take my patented “World’s Simplest Stock Valuation Measure,” (PE Ratio = Growth Rate/2 + 8 ) we get a fair value for Facebook of $25.95. This isn’t a precise measure for every stock, but it’s a quick and easy way to get a reasonable estimate. Still, this means that Facebook is over-valued by over 20$. The shares aren’t even close to being a good buy.

I can’t say that Facebook will suddenly plunge to $26, but the true value will eventually win out. My advice is to stay away from Facebook.

Look Forward to Medtronic’s 35th Straight Dividend Increase

On Tuesday, Medtronic ($MDT) reported fiscal Q4 earnings of 99 cents per share. That was one penny more than Wall Street was expecting and a 10% increase over last year. In February, Medtronic told us to expect Q4 earnings to range between 97 cents and $1 per share.

I was impressed by Medtronic this past year. Two years ago, the company had to lower its full-year forecast a few times. Even though the overall downgrade wasn’t that much, the Street was highly displeased. But last year, Medtronic gave us a full-year forecast of $3.43 to $3.50 per share and they stuck with it all year. In the end, the company earned $3.46 for the year which was right in the range.

The good news for Medtronic is that demand is returning for their pacemakers and defibrillators. For Q4, Medtronic’s revenues rose by 4% to $4.3 billion. For 2013, Medtronic sees earnings ranging between $3.62 and $3.70 per share. The Street was expecting $3.66 per share. Officially, that will be reported as “inline guidance” but I’m very pleased with it.

Sometime next month, I expect Medtronic will raise its quarterly dividend. The current payout is 24.25 cents per share which works out to a yearly dividend of 97 cents per share (or 2.62%). If I had to guess, I think it will be a modest increase—to 25 or 26 cents per share. This will mark their 35th-straight dividend increase. Medtronic is a solid buy anytime the stock is below $40 per share.

Looking at some of our other Buy List stocks, Ford ($F) had some very good news when Moody’s raised their debt to investment grade. This will help lower their borrowing costs. Few things can cut into a company’s profit margin like escalating borrowing costs. Three years ago, Ford needed to sell 3.4 million units in North America to break even. Today that figure is down to 1.8 million. I think Ford should be a $20 stock.

In last week’s CWS Market Review, I highlighted some of our higher-yielding stocks. I’m happy to see that Reynolds American ($RAI) responded by reaching its highest closing price in two months. RAI currently yields 5.63%.

The media paid a lot of attention to a patent trial that Oracle ($ORCL) brought against Google ($GOOG). I never thought this was a big deal. Oracle claimed that Google infringed on some of their patents with the Android software. The jury said no. One expert said the trial was “something like a near disaster for Oracle.” Financially, this is minor. Oracle continues to be a very strong buy here.

That’s all for now. The stock exchange will be closed on Monday for Memorial Day. I hope everyone has an enjoyable three-day weekend. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Medtronic Earns 99 Cents Per Share

Eddy Elfenbein, May 22nd, 2012 at 9:47 amMedtronic ($MDT) is keeping it real. For its fiscal Q4, the company reported earnings of 99 cents per share. That’s a penny ahead of expectations and a 10% increase from a year ago. In February, the medical equipment company told us to expect Q4 earnings between 97 cents and $1 per share. Quarterly revenues rose 4% to 4.3 billion.

Demand for pacemakers and defibrillators, the company’s biggest product category, is starting to return, said Rick Wise, a Leerink Swann & Co. analyst in New York. U.S. approval of the Resolute Integrity stent in February to treat clogged heart arteries and the conclusion of a Justice Department investigation into the Infuse bone strengthening product should pave the way for faster growth next year, analysts said.

Now let’s look at the full-year numbers because this was a good year for Medtronic. Earnings rose from $3.37 to $3.46 per share. A year ago, they gave us full-year guidance of $3.43 to $3.50 per share which was dead on target. In 2010, Medtronic cut their forecast several times, but this year they held firm throughout the year.

For 2013, Medtronic sees earnings ranging between $3.62 and $3.70 per share. The Street was expecting $3.66 per share. Officially, that will be reported as “inline guidance” but I’m very pleased with it.

Sometime next month, I expect Medtronic will raise its quarterly dividend. The current payout is 24.25 cents per share which works out to a yearly dividend of 97 cents per share (or 2.57%). If I had to guess, I think it will be a modest increase — to 25 or 26 cents per share. This will mark their 35th-straight dividend increase.

-

How Much is Facebook Worth?

Eddy Elfenbein, May 21st, 2012 at 8:26 amSo now that Facebook ($FB) is public, is the stock a good buy?

The short answer is no. The longer answer is noooooooo.

First we have to consider the fact that no company has ever gone public because they thought their share price was too low. That shouldn’t dismiss every initial public offering, but it’s an important consideration to keep in mind. As a general rule, IPOs are bad buys.

The other fact is that it’s very difficult to evaluate the prospects of a young company in a new industry. I have a pretty good idea of how quickly Medtronic ($MDT) will grow its earnings over the next few years. I can’t say the same for Facebook. More than 12 years after its peak, Yahoo’s ($YHOO) share price is barely one-eighth its price. Things didn’t turn out as they were planned.

We also know that FB’s underwriters spent enormous amounts of money trying to keep the stock price above $38 on Friday.

Some market participants said that the underwriters had to absorb mountains of stock to defend the $38 level and keep the market from dipping below it.

The firm did this by tapping into a 63 million share over-allotment option, or greenshoe, according to sources familiar with the deal.

As an indication of the cost, had Morgan Stanley bought all of the shares traded around $38 in the final 20 minutes of the day, it would have spent nearly $2 billion. Underwriters are not obligated to prop up a stock on debut, but typically do.

Morgan Stanley declined to comment.

I don’t see why it’s so embarrassing for FB to drop below its offering price. Or at least why that embarrassment is worth more than $2 billion. As a side note, I’m also not bothered by the delay in starting trading in Facebook. That’s slightly embarrassing, but I’d rather that they get it right rather than get it on time. Big deal; traders can wait 20 minutes.

Now let’s look at some of the projections about Facebook and we’ll use our World’s Simplest Stock Valuation Method. Wall Street currently thinks the company will earn 60 cents per share next year. Henry Blodget thinks that’s way too low and that FB can earn $1 per share in 2013. I think that’s a much more reasonable assumption.

I haven’t seen any estimates of Facebook’s five-year growth rate so we’ll have to use some creativity here. We do know that Facebook’s growth rate is falling, but of course that’s from unsustainable levels to more realistic ones. One hint is that last quarter the company grew its revenue by 44%.

To be safe, let’s use a 50% earnings growth rate for the next five year. That’s almost certainly too high, but again, we’re being safe.

The World Simplest Stock Valuation Method is:

Price/Earnings Ratio = Growth Rate/2 + 8

So that works out to:

33 = 50/2 + 8

And with a $1 per share estimate for next year, that works out to a fair value of $33. So by using numbers very favorable to Facebook we can see that the stock is overpriced. On top of that, as a prudent investor, I wouldn’t be interested in Facebook unless it’s going for 30% below Fair Value. That’s about $23 per share.

For now, I’m keeping my distance from Facebook.

-

CWS Market Review – May 18, 2012

Eddy Elfenbein, May 18th, 2012 at 7:20 amWall Street’s spring slide got even uglier this past week. The S&P 500 has now dropped for five days in a row and for ten of the last 12. On Thursday, the index closed at its lowest level since January. Measuring from the recent peak on May 1st, the S&P 500 is down 7.18%. Bespoke Investment notes that in the last two months, more than $4 trillion has been erased from global markets.

I know it’s scary, but let me assure you—there’s no need to panic. In this week’s CWS Market Review, I want to focus on the two events that have rattled Wall Street’s nerves: the massive trading losses at JPMorgan and the growing possibility that Greece will exit the euro. The really interesting angle is that these two events are partially connected. I’ll have more on that in a bit.

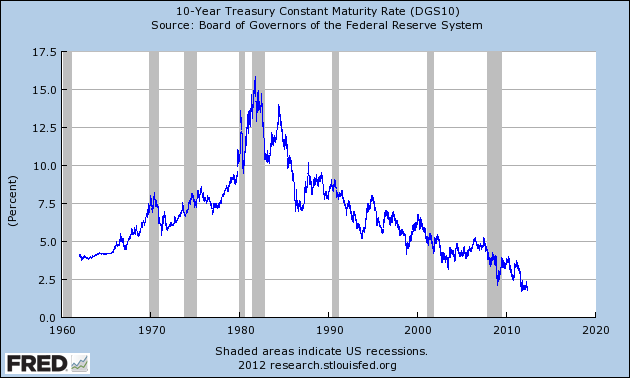

I’ll also talk about how we can protect our portfolios during times of trouble: by focusing on high-quality stocks with generous dividends. Right now, six of our Buy List stocks yield more than 3.4% which is double the going rate for a 10-year Treasury bond. Reynolds American ($RAI), for example, yields a hefty 5.8%. There aren’t many top-notch stocks that can say that. But first, let’s talk about the god-awful mess at JPMorgan.

How JPMorgan Chase Lost $2 Billion Without Trying

Last week, JPMorgan Chase ($JPM) stunned Wall Street by announcing an unexpected trading loss of $2 billion. This was especially disappointing because JPM had been one of the best-run banks around. Despite the massive loss, JPM is still on a solid financial footing. Mostly, this is a huge embarrassment for the firm and their

loudmouthoutspoken CEO Jamie Dimon.I honestly don’t know how much longer Dimon can last at JPM. He shouldn’t be on the New York Fed Board, either. In my opinion, bank CEOs shouldn’t draw attention to themselves. Ideally, they should be very dull and very competent. Dimon is half that equation and I fear he’s become a liability for shareholders.

So what the heck happened? I’ll try to explain this in an easy-to-understand way. First, we have to talk about “hedging.” When an investor wants to hedge a bet, this means they want to take positions that offset each other in order to get rid of some aspect of risk.

Let’s say you’re a bookie. You don’t care who wins the game; you only want to make sure that you’ve taken in the same amount of money from both sides. Now let’s say that your “clients” have bet $1,000 on the Lions and $900 on the Bears. Oops, you’re caught with some risk. No worries, you can place a $100 bet on the Bears with another bookie and presto, you’re back to even (minus some vig costs of course).

Now back to JPM. Last year the bank wanted to hedge their overall credit risk. The problem is that this isn’t so easy when you’re the size of JPM, so they shorted credit indexes. Or more specifically, they mimicked doing that by buying credit protection on baskets of credit. Now for the other side of the trade, JPM sold protection on an index of credit default swaps called CDX.NA.IG.9. I know that sounds like a George Lucas film, but trust me, it really exists.

With me so far? The problem with this hedge is that JPM had to sell a lot more protection on the CDS index than they bought on the credit baskets. For a while this worked fine. But late last year, the European Central Bank flooded the credit markets with tons of liquidity. The two sides of the hedge started to move together, not separately. In effect, the Lions and Bears were both winning and JPM had bet against both. Once again, the financial modelers had accurately predicted the past, but they weren’t so hot at predicting the future.

The bank dug the hole deeper for itself by ratcheting up on the CDS index side of the hedge. Soon hedge funds started to notice the prices getting seriously out of whack. What really struck them was that whoever was on the other side of this trade seemed to have limitless funds. This dude never gave in. They jokingly called him “the London Whale,” and it didn’t take long for people to suspect he was at JPM. Eventually the news broke that it was a French trader in JPM’s London office named Bruno Iksil.

Now the story gets a little murky. Last week, Jamie Dimon announced the trading losses on a special conference call. To Dimon’s credit, he said it was a massive mistake by the bank. On the call, Dimon said that the bank could incur another $1 billion in losses over the next few quarters as the trade is gradually unwound. It seems that the hedge funds smelled blood, figured out the specifics of the hedge and attacked. Hard. So instead of taking another $1 billion in losses over a few quarters, that got squeezed down to four days. There could be more losses to come.

What to Do With JPMorgan?

Shares of JPMorgan are down from over $45 in early April to just $33.93 based on Thursday’s close. As frustrating as the past week has been, I’m sticking with the bank. I’m furious with JPM’s management and their careless risk management. But with investing, we need to shut off our emotions and stick with the facts.

Let’s run through some numbers: Last year, JPM made $4.48 per share. For the first quarter, they made $1.31 per share which was 13 cents better than estimates. Those are impressive results. If the bank loses a total of $3 billion in this fiasco, that will come to about 80 cents per share. In other words, this is a punch in the face but it’s not a dagger to the heart.

At $34, JPM is clearly a bargain. When it will recover is still a mystery, but time is on the side of patient investors. Due to the recent events, I’m going to lower my buy price on JPM from $50 to $38. At the current price, the stock yields 3.54%. Make no mistake: This is a cautious buy, but the price is very good.

Euro So Beautiful

The other issue that’s got Wall Street worried is Greece. The politicians there haven’t been able to form a governing coalition, so they’re going to have elections again next month. The only issue that unites voters is anger at the bailouts. My guess is that some left-wing anti-austerity coalition will eventually prevail.

On Thursday, Fitch downgraded Greece’s debt to junk. Actually, it was already junk, but now it’s even junkier junk. For a long time, I didn’t think it was possible for Greece to leave the euro. Now it seems like a real possibility, but it will be a costly one. Greek savers have already been pulling their money out of banks because they want to hold on to euros. Their fear is that if Greece changes over to drachmas, the new currency will be worth a lot less and I can hardly blame them.

The standard line in Europe is that no one wants Greece to leave the euro, but also no one seems willing to do what’s needed to keep them in. The Greek economy isn’t strong enough to pay back their debt because the debt is so heavy that it’s weighing down the economy (Mr. Circle meet Mr. Vicious). There’s simply not much time left. Greece’s deputy prime minister said the country will run out of money in a few weeks. If Greece ditches the euro, Ireland and Spain might be right behind. In fact, foreigners are even pulling their money out of Italian banks. This is getting worse by the day.

How exactly would Greece leave the euro? Eh…that’s a good question and I really don’t know. But if Greece were to leave the euro, a lot of eurozone banks would take a major hit. I don’t think the damage would necessarily be as bad as feared, assuming the banks were recapitalized. If enough people want this done, it can be done.

The standard line is that this is what Argentina did several years ago. The difference is that the global economy was much stronger then. I think the best path for countries like Greece, Portugal, Ireland and Italy is to go full Iceland: to depreciate their currencies. It’s painful in the short-run, but it’s a much sounder strategy. Interestingly, Iceland has actually been doing rather well lately.

So with Europe already in recession and China slowing down, what’s the impact for investors? One impact is that the euro has been plunging against the dollar. The currency is down five cents this month to $1.27. I think it will head even lower.

Another impact is that U.S. Treasuries are surging as investors head for cover. On Thursday, the yield on the 10-year Treasury closed at 1.69% which is at least a 59-year low. The Fed’s data only goes back to 1953. The intra-day low from last September was slightly lower. The bond rally has lured money away from stocks, but that may soon end.

A further impact is that the stock sell-off has been felt most heavily among cyclical stocks. Over the last two months, the Morgan Stanley Cyclical Index (^CYC) is down nearly 15%. The Morgan Stanley Consumer Index (^CMR), however, is down less than 3% over the same time span. That’s a big spread. You can see the impact of this trend by looking at Buy List stocks such as Ford ($F) and Moog ($MOG-A).

Protect Yourself by Focusing on Yield

The market’s recent drop has given us several good bargains on our Buy List. AFLAC ($AFL), for example, is now below $40. It was only three weeks ago that the company beat earnings by nine cents per share. Here’s a shocking stat: The tech sector has dropped for 12 days in a row. Oracle ($ORCL) is now going for less than 10 times next year’s earnings. That would have been unthinkable during the Tech Bubble.

This week, I want to highlight some of our higher-yielding stocks on the Buy List. I always urge investors to look out for stocks that pay good dividends. Their shares are more stable, and they hold up much better whenever the market gets jittery.

For example, look at CA Technologies ($CA). This was another company with a solid earnings report and the stock now yields 3.90%. Nicholas Financial’s ($NICK) yield is up 3.21%. I think NICK can easily raise its dividend by 30% to 50% this year.

I already mentioned JPM’s yield, but check out another bank: Hudson City ($HCBK) which yields 5.23%. Last month, Johnson & Johnson ($JNJ) raised its dividend for the 50th year in a row. JNJ now yields 3.84%.

Sysco ($SYY), which also beat earnings, now yields 3.89%. Harris ($HRS) raised its dividend by 18% earlier this year. The shares yield 3.39%. Our highest-yielder is Reynolds American ($RAI). Just two weeks ago, the tobacco stock bumped up its quarterly dividend by three cents per share. RAI currently yields a sturdy 5.80%. These are all excellent buys and they’ll work to protect your portfolio during downdrafts while having enough growth to prosper during a rally.

That’s all for now. I’m looking for a relief rally next week as traders get ready for Memorial Day. On Monday, Medtronic ($MDT) is due to report earnings. They’ve already told us to expect earnings between 97 cents and $1 per share. I also expect Medtronic to increase its dividend for the 35th year in a row very soon. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – December 2, 2011

Eddy Elfenbein, December 2nd, 2011 at 8:04 amIf you were expecting a calm, reasoned financial market going into the holidays, I’m afraid you may be disappointed. On Wednesday, the Dow soared 490 points for its single-best day in nearly three years. This came after the stock market suffered its worst Thanksgiving week since 1932.

Usually, when the market does as well as it did on Wednesday, it’s following a big down day. But Wednesday’s move came after a slight rally on Tuesday. The S&P 500 gained 4.33% on Wednesday which was its eighth-best gain following an up day in the last 70 years.

I was pleased to see that stocks only finished modestly lower on Thursday. The S&P 500 is now back above its 50-day moving average and it’s only a small push from breaking above its 200-day moving average.

In this issue of CWS Market Review, I want to delve into some of the reasons for the market’s abrupt about-face. I’ll also tell you how to position your portfolios for the last few weeks of 2011. Remember that historically, the best time of year for stocks is a 17-day run from December 22nd to January 7th. More than 40% of the Dow’s historical gain has come during this period which is less than 5% of the calendar year.

The catalyst for Wednesday’s rally was—we’re told—the news that the Fed teamed up with other central banks to provide more liquidity for the global financial system. Allow me to explain; it’s all very simple. The Federal Reserve and other central banks agreed to lower the pricing on the existing temporary U.S. dollar liquidity swap arrangements from OIS +100 basis points to…ugh…getting sleepy…can’t…stay…awake…zzzzzzzz.

Look, forget all the mumbo-jumbo. The stock market did not see one of its best rallies in decades because some bureaucrats put out a press release. Thankfully, they’re not that important. Instead, the market rallied because the market’s cheap. It’s that simple. The problem is that no one wanted to be first in the pool. I don’t blame them. Playing the bear had been the winning trade for three-straight weeks. Screaming you’re scared from the rooftops is the only trade that’s made anyone any money. Plus, our friends across the pond have been doing their best to show that they’re as clueless on how to run their economies as we are in running ours.

To borrow from Comrade Trotsky, you may not be interested in the European financial crisis but the European financial crisis is interested in you. The news from Europe has been the main driver of the U.S. market for the last several weeks. But as I mentioned in the CWS Market Review from two weeks ago, our markets are slowly disentangling themselves from the mess in Europe.

Just look at the decent economic news we’ve had recently. Please note that I’m not saying “good news,” just that there’s zero evidence of an imminent Double Dip. The fact that we can say that in December would have surprised a lot of folks this summer. For example, this past earnings season was pretty good. Thursday’s ISM report was decent. The Chicago PMI just hit a seven-month high. I’m writing this in the wee hours of Friday morning so I don’t know what the jobs report will say (check the blog for updates), but this week’s ADP report was very encouraging.

Next Friday will be the big EU summit. This is it—Zero Hour. The Germans want more fiscal integration, and I think they’ll get it (of some sort). The Germans finally got religion once one of their bond auctions fizzled. When the country that’s supposed to bail everyone else out can’t get a loan, well…then it’s time to worry.

But now the Germans have stopped dragging their heels. Anyone with a sense of history will have to appreciate the recent quote from Radek Sikorski: “I will probably be the first Polish foreign minister in history to say so, but here it is: I fear German power less than I am beginning to fear German inactivity.” Strange days, no?

For Europe, this is beginning to feel like the fall of 2008. France’s AAA credit rating is on life support. Despite the bond auction disaster, the German one-year note recently went negative meaning that investors would prefer to take a loss just so they can be a creditor to Germany. This is exactly the kind of hysteria that’s been rattling our markets since August. It’s a mystical aura of fear, and that’s masking a truly inexpensive American market (Ford’s at 5.6 times 2012 earnings!)

Now that everyone’s been suitably freaked out, they can finally do something. In fact, we’re starting to get an idea of what the game plan will look like. The basics are that Germany wants the ECB on a tight leash while it wants to set hard rules for how budgeting is done in the Euro zone. No surprises there. I suspect the Germans may give up their opposition to joint euro-bonds if the member states agree to some sort of debt-reduction fund. I’m not sure of the details, but something the market likes will come out of the summit. That’s not a guess. There’s no other alternative.

But this crazy correlation we’ve had to Europe makes no sense. Here in the U.S., investors are quietly warming up to risk. We’ve already seen high-yield spreads in the U.S. begin to narrow as Treasury yields have climbed. Since December 23rd, the yield on the 30-year Treasury has risen by 30 basis points to 3.12%. The 10-year yield is up to 2.11% which is its highest yield in more than one month. As recently as July 25th, the 30-year was at 4.31%.

Now let’s turn to some recent news from our Buy List. On Tuesday, Jos. A. Bank Clothiers ($JOSB) reported very good earnings for its fiscal third quarter. The company earned 54 cents per share for the three months ending on October 29th, which was three cents better than Wall Street’s estimate.

JOSB’s business continues to hum along: earnings grew by 19% last quarter and revenues rose by more than 20%. The company has now reported higher earnings in 40 of its last 41 quarters including the last 22 in a row. However, there was one hitch. In the earnings report, JOSB warned that the fourth quarter “has started out more slowly than we had planned.”

The market didn’t like that at all and chopped 3.7% off the stock on Wednesday in the face of a big rally plus another 2.4% on Thursday. Until we hear more, I’m inclined to side with Joey Banks. This is a very solid company. Some of you may recall six months ago when the market slammed JOSB for a 13% one-day loss after it missed earnings by—are you ready?—one penny per share. JOSB is a very good buy below $54 per share.

In the CWS Market Review from October 14th, I said that I expected Becton, Dickinson ($BDX) to soon raise its dividend for the 39th year in a row. Sure enough, Becton came through and announced a 9.8% increase dividend increase on November 22nd. The new quarterly dividend is 45 cents per share and based on Thursday’s market close, BDX now yields 2.43%. There aren’t many stocks that can boast a dividend streak like Becton’s. Honestly, the stock is a bit pricey here in the low $70s. My advice is: don’t chase it. Instead, wait for a pullback below $65 before buying BDX.

Last week, Medtronic ($MDT) reported fiscal Q2 earnings of 84 cents per share which was two cents better than estimates. This is pretty much what I expected. Two weeks ago I wrote that “they can beat by a penny or two.” I have to explain that the market has dismally low expectations for Medtronic even though the company is still doing well with pacemakers and insulin pumps. The trouble spot is Infuse, its bone growth product used in spinal fusions. Sales for Infuse dropped by 16% last quarter.

The key for us is that Medtronic also reiterated its full-year EPS forecast of $3.43 to $3.50 per share. This means the stock is going for just over 10 times earnings. I’m raising my buy price for Medtronic to $40 per share.

On November 22nd, Gilead Sciences ($GILD) stunned Wall Street when it announced that it’s buying Pharmasset ($VRUS) for $11 billion. That’s an insanely rich price for a company that doesn’t have any products on the market yet. (I had to reread that sentence just now after typing it. Yep, it’s still nuts.)

So what does Pharmasset have? The company is pretty far along in developing oral drugs for hepatitis C. That could be a very lucrative market. Still, I think this was a terrible move on Gilead’s part. This is a business deal made out of fear rather than trying to spot an opportunity. Gilead was simply nervous that someone else would snatch up Pharmasset. I very much doubt that Gilead will be on our Buy List next year.

You may have noticed that Nicholas Financial ($NICK) has been especially volatile of late. Why? I have no idea. There’s been no news. I suspect that it’s pure market jitters. Of course, it’s the market’s irrationality that helps us find bargains, so that means we have to deal with bad volatility as well. Over the last two weeks, little NICK has gone from $11.75 per share down to $10.01 and then back up to as much as $11.56 yesterday. I don’t have any more to say than “ride out the storm.” NICK is an excellent stock.

Some other stocks on our Buy List that look attractive include Oracle ($ORCL), Moog ($MOG-A) and Ford ($F). Oracle should be coming out with its fiscal Q2 earnings in two weeks. Ford just reported a 13% sales increase for November. Also, Reynolds American ($RAI) has recently broken out to a new 52-week high. The stock is currently our top-performing stock for the year (+28%). The shares currently yield 5.37% which is equivalent to 645 Dow points.

That’s all for now. Today is the big jobs report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’m going to unveil the 2012 Buy List on Thursday, December 15th. As usual, I’m only adding and deleting five stocks from the current list. (Low turnover is my BFF.) I won’t start tracking the new Buy List until the start of the year. I like to make the names known publicly beforehand so no one can claim I’m front-running the market somehow.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His