Posts Tagged ‘msft’

-

CWS Market Review – July 25, 2014

Eddy Elfenbein, July 25th, 2014 at 7:05 am“People always call it luck when you’ve acted more sensibly than they have.”

– Anne TylerLike the honey badger, this stock market just doesn’t care. Was it going to be tripped up by Ukraine? Nope. Gaza? Nope. Fed tapering? Not a chance. The stock market keeps chugging higher. On Thursday, the S&P 500 finished the day at 1,987.98 for its 27th record close this year. Not that long ago, 2,000 for the S&P 500 was a distant hope. Now, it looks like we’ll hit it any day now.

This week has been all about earnings, earnings and more earnings. So far, the earnings have been pretty good. According to the latest numbers from Bloomberg, 77% of the S&P 500 companies that have reported so far have topped Wall Street’s expectations. Also, 64% have beaten their sales expectations. The S&P 500 is currently on track to deliver Q2 earnings growth of 6.2% and sales growth of 3.3%.

Our Buy List has been very busy this week; we had seven earnings reports. Thanks to good earnings, Ford Motor jumped out to a new 52-week high. Even boring CA Technologies rallied 4.5% after a strong earnings report. I’ll review all of our recent earnings in a just a moment. I’ll also highlight four Buy List earnings reports coming next week. I should mention that weekly jobless claims just dropped to an eight-year low, which bodes well for next week’s jobs report. But first, let’s take a closer look at our mass of earnings reports.

Surveying the Earnings Parade

We have a lot to go through, so let’s start with Tuesday’s earnings report from McDonald’s and Microsoft. Unfortunately, the McDonald’s ($MCD) news wasn’t very good. The fast-food joint earned $1.40 for Q2, which was four cents shy of Wall Street’s consensus. In the U.S., same-store sales dropped by 1.5%.

It’s no secret that MCD has made a lot of missteps. This is particularly painful when we see the outstanding results from Chipotle ($CMG), a company MCD used to own. Simply put, McDonald’s ($MCD) is not in a good way right now. As an investor, I like when companies hit rough patches since there’s a good opportunity to find a bargain. The catch, of course, is that the company has to right itself.

I think the folks at MCD understand the position they’re in, although I think the reforms may take a while to impact the business. For now, MCD is indeed a cheap stock. The shares got hit by a bunch of downgrades after the earnings report. Going by Thursday’s close, MCD yields 3.4%. Not many blue chips pay that well. The restaurant said that it’s planning to reform itself over the next 18 months. They’d better get cracking. I’m lowering my Buy Below on McDonald’s to $101 per share.

Except for Nokia, Microsoft Is Looking Good

Microsoft’s ($MSFT) earnings report was a bit confusing, but after giving it a read, traders decided they like it. After the bell on Tuesday, the software giant reported fiscal Q4 earnings of 55 cents per share. That was five cents below consensus. The shares quickly plunged in the after-hours market.

Then more details came out, and it turned out that the results weren’t that bad at all. Microsoft’s quarterly revenue rose a healthy 18% to $23.4 billion. The company also pleased investors last week when they announced big job cuts. It’s not that the market is happy about folks losing their jobs, but they’re pleased to see that MSFT is working to streamline operations. Most of those jobs are from Nokia.

The big problem for Microsoft is that Nokia’s handset business is a money loser. The division could turn into a winner in the long term, but the outlook is rather iffy at the moment. The good news for Microsoft is that their cloud business is going very well. Microsoft remains a good buy up to $48 per share.

Earnings from CA Technologies and Qualcomm

On Wednesday, two of our tech stocks reported results, CA Technologies and Qualcomm. I have to admit that I’ve become quite frustrated with CA Technologies ($CA). However, the company earned itself a temporary respite from my doghouse by reporting decent results. For their fiscal Q1, CA earned 65 cents per share, which was five cents better than estimates. Quarterly revenue dropped 2% to $1.069 billion. This was the ninth quarter in a row of falling revenue.

But the important news was guidance. For fiscal 2015, which ends next March, CA sees revenues falling by 1% to 2%. They also said they expect to see earnings range between $2.42 and $2.49 per share. Apparently this relieved a lot of investors. The shares jumped 4.5% on Thursday to close at $29.64. Even with that rally, we’re still down nearly 12% on the year with CA. The big positive continues to be the 25-cent quarterly dividend. The stock yield now works out to 3.4%. CA remains a buy up to $31 per share.

Technically, Qualcomm ($QCOM) reported amazing earnings for their fiscal third quarter. The company earned $1.44 per share, which crushed estimates by 22 cents per share. In April, they said they were expecting Q3 earnings to range between $1.15 and $1.25 per share. Well, I guess they beat that!

The good news and bad news for Qualcomm is China. The country continues to be a great customer, but several companies there “are not fully complying with their contractual obligations.” As a result, the company had weak guidance for the current quarter. For fiscal Q4, Qualcomm sees earnings ranging between $1.20 and $1.35, which is below Wall Street’s consensus of $1.39 per share.

Thanks to the blow-out earnings Q3 report, Qualcomm raised their full-year EPS range to $5.21 – $5.36, from the earlier range of $5.05 – $5.25. Note that QCOM’s earnings beat was larger than the lower guidance. Nevertheless, traders didn’t like the China news and the shares fell by more than 6% on Thursday. Qualcomm is a buy up to $83 per share.

Ford Motor Is a Buy up to $19 per Share

On Thursday, Ford Motor ($F) reported another strong quarter. This is their first one under their new CEO, Mark Fields. I really like what I’m seeing at Ford. Alan Mulally and his team deserve a lot of credit. The company made 40 cents per share for Q2, which beat consensus by four cents per share. This was Ford’s 20th profitable quarter in a row.

I was also pleased to see Ford stand by its forecast for this year of $7 billion to $8 billion in pre-tax profit. The really good news is that Ford managed to eke out a teeny tiny profit in Europe of $14 million. Of course, $14 million may sound like a lot, but in ROE terms, to an outfit like Ford, it’s peanuts. Still, no one was expecting they’d be at peanuts in Europe this early. Ford is clearly moving in the right direction.

This is a key moment for Ford. They’re introducing a bunch of new vehicles, and that requires a lot of up-front money. Overall, the company is holding the line on costs. One weak spot was South America, where they lost $300 million. Ford earned $2.4 billion in operating profit in North America. That’s a company record. The new Mustang and aluminum F-150 are due later this year, and that could give a nice boost to sales.

On Thursday, the shares jumped as high as $18.12, which is a three-year high (see above). Ford is a solid buy up to $19 per share.

CR Bard Beats Low-Balled Expectations

In April, CR Bard ($BCR) told us to expect Q2 earnings to range between $1.98 and $2.02 per share. Last week, I said I thought they were low-balling us, and sure enough, on Thursday, Bard reported Q2 earnings of $2.06 per share.

I know companies like to lower the bar on earnings and then try to impress us by topping phony expectations. I don’t blame Bard for playing the game, but I’ll let you know it when I see it.

Overall, they had a decent quarter. Quarterly sales rose 9% to $827.1 million. Bard’s chairman and CEO, Timothy M. Ring, said, “Once again we exceeded our expectations for revenue growth this quarter. We continue to believe that executing our investment plan will accelerate the sustainable growth rate of the overall portfolio and put us in a position to provide revenue growth in the mid-to-high single digits with attractive returns for shareholders.”

Now let’s turn to guidance. For Q3, Bard expects earnings to range between $2.07 and $2.11 per share. They shouldn’t have trouble hitting that. Bard also increased their full-year range by five cents at each end. The new range is $8.25 to $8.35 per share.

If you recall, Bard raised their quarterly dividend last month from 21 to 22 cents per share. They’ve raised their dividend every year since 1972. I rate CR Bard as a buy up to $151 per share.

Upcoming Buy List Earnings

We have four earnings reports coming next week. Three of our stocks, AFLAC, Express Scripts and Fiserv, report on Tuesday, July 29. Then DirecTV reports on Thursday, July 31. (Also, earnings from Moog are due out later today. Be sure to check the blog for the latest.)

Shares of AFLAC ($AFL) have improved recently. The supplemental-insurance company has worked to diversify its investment portfolio. The yen/dollar ratio has been fairly stable since February. The company has performed well, but foreign exchange has taken a big chunk out of earnings. Three months ago, AFLAC said to expect Q2 operating earnings between $1.54 and $1.68 per share. Their full-year guidance was $6.06 to $6.40 per share. Both forecasts are based on a yen/dollar exchange rate between 100 and 105. AFLAC is a buy up to $68 per share.

In April, Express Scripts ($ESRX) beat earnings by two cents per share, but they lowered their full-year guidance to $4.82 to $4.94. That was a decrease of six cents per share at each end. Express Scripts remains a buy up to $74 per share. That’s a high Buy Below price. I may lower it after the earnings report.

Fiserv ($FISV) hit another 52-week high this week. This stock has climbed almost non-stop for the last three years. Wall Street expects Q2 earnings of 80 cents per share. Fiserv is a buy up to $64 per share. I may have to raise that soon.

DirecTV ($DTV) is still our big winner on the year, with a 25% gain. There’s not much to say about DTV since the $95 buyout deal with AT&T. DTV’s volatility has nearly evaporated, and the stock is trading like a zero-coupon bond that matures at $95 at some point. The stock is now almost exactly 10% below its merger price.

That’s all for now. More earnings to come next week. Wall Street will also have an intense 48 hours between Wednesday and Friday. On Wednesday morning, the government will release its first estimate of Q2 GDP. The Fed also meets, and later that day, the FOMC will release its latest policy statement. Friday is Jobs Day, and we’ll also get a look at the ISM report for July. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – April 25, 2014

Eddy Elfenbein, April 25th, 2014 at 7:10 am“Forecasts may tell you a great deal about the forecaster;

they tell you nothing about the future.” – Warren BuffettWe’re now in the heart of first-quarter earnings season. For the overall market, the earnings reports have been pretty good, but we have to remember that companies are beating much-reduced expectations.

Analysts currently project Q1 earnings growth of 0.7% and sales growth of 2.6%. Only a month ago, the consensus was for earnings growth of 1.9% and sales growth of 3%. So far, 40% of companies in the S&P 500 have reported earnings, and an impressive 76% of them have topped earnings expectations, while 53% have beaten sales expectations. That’s not bad, especially considering how much havoc was wreaked in Q1 by the ugly winter weather.

The good news is that the outlook on Wall Street is clearly improving. Thanks to brighter earnings news, the stock market has recovered from its slump earlier this month. The recent six-day rally was the longest since September. On Thursday, the S&P 500 got within 0.7% of its all-time high, and Wall Street really took notice when Apple, the most valuable company in the world, announced strong earnings and an unusual 7-for-1 stock split. (I think they’re bucking to get in the Dow Jones.)

In this week’s CWS Market Review, I’ll review the recent earnings reports from our Buy List stocks. Microsoft, Qualcomm and CR Bard beat expectations, but Stryker and McDonald’s came in below forecasts. I’ll discuss them in greater detail in a bit, and I have some new Buy Below prices for you. I’ll also highlight more Buy List earnings reports coming our way next week, which include favorites like AFLAC and eBay. But first, let’s take a look at some recent economic news. (Trust me, it’s good.)

The U.S. Economy Is Slowly Improving

The Federal Reserve meets again next week, and another taper decision is about as close as you can get to being a sure thing. While some traders may not like the idea of less bond-buying by the Fed, these taperings are a reflection of good economic news.

Next Friday is a very big day. The Labor Department will release the April jobs report, and there’s a very good chance it will be a strong one. I think the April nonfarm payrolls will top 250,000 jobs which would make it one of best jobs reports in years.

Why am I so confident? Let’s run down some of the good economic news:

On Thursday, the Labor Department reported that initial jobless claims rose to 329,000 last week. Despite the rise, those numbers have been very low recently. The four-week moving average of new claims is down to 316,750, which is near the lowest levels of the past seven years. The jobs market is clearly picking up, and that means more consumers.

Also on Thursday, the Commerce Department reported that orders for durable goods rose by 2.6% in March, and that comes after a 2.1% increase in February. Economists like to look at the demand for “core” capital goods, and that was up 2.2% last month. That was the biggest increase since November, and it’s more evidence that the economy is ramping up from the slow start at the beginning of the year. Excluding transportation, durable-goods orders rose by 2%. That’s the biggest increase in more than a year. This is important because these are “big ticket” items.

Here’s an interesting economic indicator. Property tax collections are rising at their fastest clip in years. The real-estate bust hit a lot of local governments hard, but during the last three months of 2013, property taxes collected nationally rose to $182.8 billion, an all-time high. For all of 2013, property-tax collections increased by 3%, which was the fastest pace since 2009.

On Wednesday, we learned that new-home sales plunged 14.5% last month. That probably reflects some lingering effects from the cold winter, but there are many positives impacting the housing market. The number of delinquent loans continues to decline. Also, there are fewer homes with negative equity, and distressed sales are down. These signs are important because housing often has a big impact on the direction of the economy.

Since the recession, companies have done a good job of cutting costs. That’s good, and profit margins have grown, but you can’t do that forever. At some point, you need to get more shoppers in the doors. Companies have been stockpiling cash, and only now are they beginning to spend it. This week, we learned that Apple reduced its gigantic cash horde. I think 2014 will likely be the best year for economic growth since the recession. The IMF recently said in a report that the U.S. economy is poised to lead global growth this year and next. Now let’s look at some our recent Buy List earnings.

McDonald’s Disappoints, but It’s a Work in Progress

Before the opening bell on Tuesday, we got a disappointing earnings report from McDonald’s ($MCD). The fast-food joint earned $1.21 per share for Q1, which was three cents below estimates. Despite the miss, the stock was mostly unchanged. Perhaps that reflects that market’s sour mood for MCD.

Frankly, McDonald’s is in a difficult position at the moment. The restaurant has made several missteps lately, and we can see that in this earnings report. Sales rose 1.4%, but not as fast as costs, which rose 2.3% (this was due to higher beef prices). Profits dropped 5.2%.

The situation at McDonald’s is very similar to that at IBM. They’re both iconic brands who have slipped in recent years. The fundamental business is good, but they desperately need to revive themselves. This is what Ford did several years ago, and Microsoft did more recently.

My take: The outlook for McDonald’s is brighter than at IBM because management realizes the task at hand. The issues at MCD can be resolved, and I think it can be done rather cheaply. Their business in Europe isn’t that bad; it’s in the U.S. that the problems are. Their menu is far too complicated. This will take time to fix. McDonald’s is a good buy up to $102 per share.

CR Bard Beats by Seven Cents per Share

After the closing bell on Tuesday, CR Bard ($BCR) reported Q1 earnings of $1.91 per share. That beat estimates by seven cents per share. Previously, Bard had told us to expect earnings between $1.83 and $1.87 per share, so this is an impressive beat. Sales rose 8% to $799.3 million.

Timothy M. Ring, Bard’s CEO, said, “The financial results in the first quarter reflect a positive start to the year, as we exceeded our expectations for both sales and earnings per share. The organization is focused on executing our strategic investment plan with the objective of improving the long-term growth profile of the business.”

On the conference call, Bard said to expect Q2 earnings to range between $1.98 and $2.02 per share. I think they’re low-balling us. That’s well below the Street’s consensus of $2.09 per share. On the plus side, Bard reiterated their full-year guidance of $8.20 to $8.30 per share.

The shares got dinged for a 3.2% loss on Wednesday. Despite the lower guidance, I still like this stock. Bard has increased its dividend every year since 1972, and we can expect another increase in a few months. Due to the recent drop, I’m lowering my Buy Below on CR Bard to $145 per share.

Qualcomm Beat and Raised Guidance

Qualcomm ($QCOM) came through for us. On Wednesday, the chip maker said they earned $1.31 per share for their fiscal Q2, which was nine cents better than Wall Street’s consensus. Previously, the company had pegged Q1 earnings to a range of $1.15 to $1.25 per share, so they’re beating their own expectations. Qualcomm also raised their full-year guidance range to $5.05 to $5.25 per share. That’s an increase of five cents at both ends.

Despite the good earnings, the revenue numbers were pretty weak. QCOM posted its smallest top line increase since 2010. Revenues rose 4% to $6.37 billion, which was $100 million below forecasts. What’s happening is that China Mobile is planning to launch a faster network with 4G, so that’s delaying QCOM’s revenue at the moment.

Qualcomm also disclosed that it received a Wells notice from the SEC, which is not a formal investigation. The notice recommends that Qualcomm take enforcement action in relation to bribery charges. For its part, Qualcomm maintains that it what it did wasn’t a violation. No matter, the shares dropped 3.5% on Thursday. Don’t be scared, Qualcomm remains a very good buy, but I’m lowering my Buy Below to $83 per share.

Stryker Missed but Stood by Their Full-Year Guidance

On Wednesday afternoon, Stryker ($SYK) delivered a rare earnings miss. For Q1, the medical-device company earned $1.06 per share, which was two cents below estimates. Quarterly revenue rose 5.3% to $2.31 billion.

More importantly, Stryker reiterated their full-year earnings guidance of $4.75 to $4.90 per share, which means it’s going for about 16 times this year’s earnings. That’s not a bad valuation. The stock initially gapped up on Thursday morning. At one point, SYK hit $80.78 per share, but the stock later pulled back and finished the day down by 0.5%. I like Stryker a lot, but I’m lowering my Buy Below to $85 per share.

Remember, these Buy Below prices aren’t price targets. They’re guidance for current entry.

Microsoft Beats by Five Cents per Share

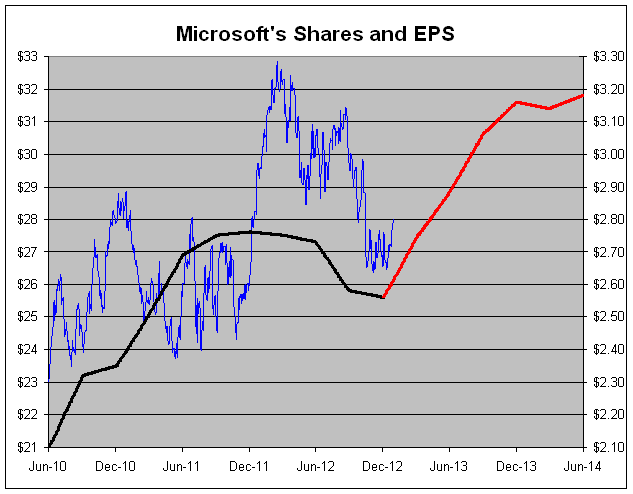

On Thursday, Microsoft ($MSFT) reported fiscal-Q3 earnings of 63 cents per share, which beat estimates by five cents. The software giant did surprisingly well in the cloud space. Microsoft’s CEO Satya Nadella said the earnings “demonstrate the strength of our business, as well as the opportunities we see in a mobile-first, cloud-first world.”

The turnaround at Microsoft still has a ways to go, but they’re headed in the right direction. It’s odd for me to see Nadella get so much good press when Ballmer only got negative press.

Today is an important milestone for Microsoft; they’ll complete their $7.2 billion acquisition of Nokia’s handset business. That should help Microsoft in the U.S. mobile market. On Thursday, the shares traded higher in the after-hours market, and the stock is close to hitting another 52-week high. For now, I’m keeping my Buy Below at $43 per share. Microsoft is clearly hitting its stride.

I’m writing this report early Friday, and both Ford ($F) and Moog ($MOG-A) are due to report earnings later today. Be sure to check the blog for updates.

Four Earnings Reports for Next Week

Next week, we have four earnings report due on Tuesday, April 29: AFLAC, eBay, Express Scripts and Fiserv.

AFLAC ($AFL) had a very good year business-wise in 2013. Unfortunately, the weak yen took a big bite out of their operating earnings. The good news is that the yen has largely stabilized in recent months between 100 and 105 to the dollar.

AFLAC said that if the yen were to stay at 97.54 to the dollar (its average for last year), then its earnings should range between $6.31 and $6.49 per share for 2014. So the stock is going for less than 10 times this year’s estimate. Currently, Wall Street expects Q1 operating earnings of $1.58 per share, which is 11 cents less than what they earned in last year’s Q1. AFLAC remains a good buy up to $68 per share.

eBay ($EBAY) finally ended its silly feud with Carl Icahn. The investing legend wanted them to eBay off PayPal, which they’re adamantly opposed to. The good thing about eBay is that the poor winter weather had little impact on their business. In fact, it probably helped them. The current earnings consensus is for 67 cents per share. That’s almost certainly too low. eBay remains a very good buy up to $62 per share.

Express Scripts ($ESRX) started out the year great for us, but it’s pulled back over the last few weeks. The stock probably got lumped in during the growth-stock rotation. Nevertheless, their business outlook remains very good. For all of 2014, the pharmacy-benefits manager sees earnings ranging between $4.88 and $5 per share. Express Scripts said it is “targeting annual earnings per share growth of 10 per cent to 20 per cent for the next several years.” Not many companies can confidently say that. For Q1, Wall Street expects earnings of $1.01 per share. I’m keeping my Buy Below on ESRX at $83, which is a bit high.

Fiserv ($FISV) is one of those rare stocks that churns out earnings consistently. Last year was their 28th year in a row of double-digit adjusted earnings growth. For 2014, Fiserv sees EPS ranging between $3.28 and $3.37. Wall Street expects Q1 earnings of 74 cents per share. Fiserv is a good buy up to $60 per share.

That’s all for now. Next week will be a busy one. Not only do we have more earnings reports, but the Federal Reserve meets on Tuesday and Wednesday. Expect another taper. Also on Wednesday, we’ll get our first look at Q1 GDP. My take: it won’t be a good number, but Q2 will be much better. The April ISM comes out on Thursday, and on Friday, we’ll get the big jobs report. I think this report could be a really good one. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 28, 2014

Eddy Elfenbein, March 28th, 2014 at 8:28 am“Time is your friend; impulse is your enemy.” – Jack Bogle

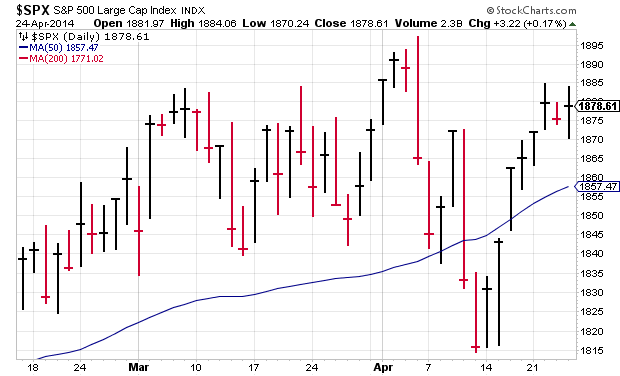

On the surface, the stock market was fairly subdued this week. The S&P 500 meandered lower, but the overall loss wasn’t so bad. On Thursday, the index closed a hair below 1,850, but let’s not forget that one week ago, we touched an all-time intra-day high.

Beneath the surface, however, there’s been a big shake-up in the market. Specifically, momentum names have faltered while value stocks have taken the lead. This is an important development, and investors need to understand what’s happening. High-profile sectors like biotech have gotten hammered, and former market darlings have been in a world of hurt lately.

Anyone remember a company called Netflix? That stock dropped 14 times in a 15-day span. Since March 4, NFLX is off by 20%. Stocks like Tesla and Priceline are getting dinged as well. Bespoke Investment Group recently noted that the best-performing stocks from last year are the worst performers this year.

In this week’s CWS Market Review, I’ll break down the market’s change of leadership and tell you what it means for our stocks. Speaking of our stocks, we had more good news for our Buy List stocks. DirecTV soared 8% on Wednesday after news of a possible merger with DISH. I’ll have more on that in a bit. Also on Wednesday, the stress testers at the Fed said they have no objections to Wells Fargo’s capital plan, which includes a hefty 16.7% dividend increase.

I’m pleased to see that our Buy List tech stocks are doing well. Oracle and Qualcomm are near new long-time highs, and even slumbering IBM has perked up. Big Blue just touched its highest point in six months, and I think we’ll get a dividend increase next month. But first, let’s look at the big internal shakeup on Wall Street.

The Market’s Big Shift towards Value

An important lesson with investing is that the stock market swings in cycles, and this is not just the overall market, but also within the market. For example, economically cyclical stocks will lead for a few years and then lag for a few more. Financial stocks will blossom, and then another year it will be dividend stocks that blossom. There’s a loose relationship between these cycles, and it’s always dangerous to read too much into the market’s notoriously fickle mood.

In the last month, value stocks have started to lead the market, and growth stocks have been the big losers. What’s interesting is that this has happened during a mostly bullish time for stocks. Typically, we would expect value stocks to do well when the overall market is suffering. Then, as the bull market starts to age, we would expect growth stocks to come into their own. If you recall, that’s what happened during the late 1990s. What was so arresting about that market wasn’t that value stocks merely lagged—it’s that they got crushed even though growth stocks soared. Back then, the Growth/Value divergence was a yawning chasm.

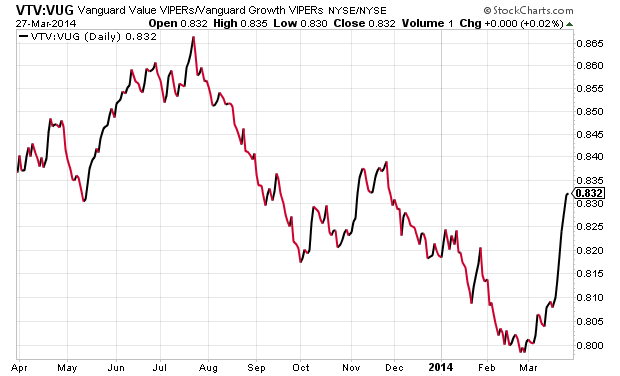

Another interesting aspect about this recent shift to value has been how sharp it’s been. For my Growth proxy, I like to follow the Vanguard Growth ETF ($VUG), and for Value, I look at the Vanguard Value ETF ($VTV). They’re like twin brothers always fighting over mom’s attention. VUG is flashier and has more popular names, while VTV is the quiet, dutiful student. The typical Value/Growth cycle has been distorted in the last few years because the value indexes have been filled with so many toxic financial stocks. (Here’s a chart of the VTV divided by VUG.)

The last Value cycle topped out in mid-2006, and Growth has been in the driver’s seat ever since (with a few false starts for Value). This means that Value underperformed during both the bear market and the bull market. That’s quite a feat. A lot of people have anticipated a Value resurgence, but each attempt has failed. Or I should say each attempt so far.

Since February 27, VTV is up 1.08%, while VUG is down 2.73%. That may not sound like much, but within the ongoing battle between Value and Growth, that’s a major short-term move, and it may continue for some time. VTV has beaten VUG for the last seven days in a row, and 10 of the last 11.

So What Does This Value Shift Mean?

When the market moves towards Value, it typically means that investors are nervous and seeking safety in cheaper names. This time around, it’s not so much that investors want Value. No, it’s that they’re fleeing Growth. An orderly exit is turning into a mad dash. Probably the best example of this has been with biotech stocks. The main Biotech ETF ($IBB) has dropped sharply over the past month. Since February 25, the IBB is off by 13.6%, and a lot of biotech names are down much more than that. Of course, we have to remember that biotech had been in an astounding rally over the past two years.

“So the last shall be first, and the first last” is a quote from the Bible, but it also could serve as a recent stock market report. Look at Tesla ($TSLA), a high-flyer which could do no wrong. The stock went from $35 one year ago to as high as $265 last month. But the past few days have been a different story. Tesla is currently 22% off its high. On the flip side, look at boring Long-Term Treasuries ($TLT). They’re supposed to be dead money, right? But the TLT is at its highest level in eight months. When the current shifts, it can be rough.

I also think the market’s shift towards Value is a reflection of what I talked about last week—investors are getting prepared for the probability of higher short-term interest rates. Last week, the bond market woke up to this idea, and the shift to Value is the stock market’s turn.

Overall, the renewed emphasis on Value is a benefit for our Buy List. In the short term, some of the prominent growth stocks like Cognizant Technology ($CTSH) have suffered in the backlash. I don’t expect that to last. Now let’s take a look at some recent Buy List news.

Wells Fargo Raises Dividend 16.7%

Last week, the Federal Reserve said that Wells Fargo ($WFC) aced its most recent stress test. I had no doubts they’d pass. It’s hardly a secret that WFC is one of the best-run big banks around.

The second part of the Fed’s test came this week to see if they’d approve their capital plans. Once again, Wells Fargo easily passed. The Federal Reserve said they had no objections to WFC’s capital plans. That includes a 16.7% increase in their dividend. The quarterly payout will rise from 30 to 35 cents per share. Last week, I said that I was expecting an increase but only of two cents. Shows what I know!

The shares jumped after the announcement. Using the new dividend and going by Thursday’s close, Wells now yields 2.85%. The board also approved a 350 million-share increase in their buyback plan.

By the way, this stress test wasn’t a cakewalk. Zion’s failed, and Citigroup’s dividend request was shot down. Six years after Bear Stearns collapsed, Citi still pays a quarterly dividend of one penny per share even though Wall Street expects them to earn $5.78 per share next year. Citigroup is still a mess, and I’m glad we have a top-tier name like Wells Fargo. Look for another good earnings report in two weeks. WFC remains a very good buy up to $54 per share.

Will DirecTV Merge with Dish?

On Wednesday afternoon, news broke that the CEO of Dish Network ($DISH) had spoken to the CEO of DirecTV ($DTV) to talk about a possible merger. Honestly, this isn’t a big surprise. Folks have talked about a merger between the two for years. In fact, they tried to merge 12 years ago, but the Federales blocked it. Today, I think DTV is the stronger company, but I have to give credit to Dish for holding its own.

Clearly, the recent merger announcement between Time Warner Cable and Comcast has changed the game, and the two satellite guys have to start thinking seriously about their future. A merger makes sense, but at what price? That’s hard to say. I think DirecTV holds the upper hand here, and it’s interesting to note that Dish’s CEO made the call. Still, DirecTV would be wise to consider an offer. DirecTV has 20 million subscribers, while DISH has 14 million (check out the amazing growth of DTV below).

A lot of this will depend on how regulators rule on the Comcast/TWC deal. If the Feds say yes to that, it will be hard for them to say no to the Direct/Dish deal. DirecTV’s CEO, Mike White, has seemed hesitant about a deal, but he hasn’t ruled it out. I think that’s the right attitude. Frankly, I think these two will get together at some point. I just don’t know when.

The immediate benefit of the merger talk is that shares of DTV jumped as much as 8% on Wednesday, although the stock pulled back as the excitement wore off. DirecTV remains an excellent buy up to $84 per share.

New Buy Below Prices

I want to update a few of our Buy Below Prices. IBM ($IBM) has been doing well lately. This week, the shares got above $195 for the first time since September. I’m expecting a dividend increase from Big Blue sometime next month. I’m raising my Buy Below to $197 per share.

On Thursday, Qualcomm ($QCOM) closed at another multi-year high. The company raised their dividend by 20% just a few weeks ago. This week, I’m bumping up my Buy Below to $83 per share.

CR Bard ($BCR) has been one of our top performers this year. I’ve already raised my Buy Below on BCR a few times, and I’ve purposely held off in the past few weeks. With the Q1 earnings season just around the bend, I feel more confident in BCR’s outlook. Bard has beaten earnings for the last six quarters, and I think they’ll do it again. I’m raising my Buy Below on BCR to $147 per share.

I’m keeping my Buy Below for Microsoft ($MSFT) at $43 per share, but I wanted to highlight the CEO’s plans for the company. For the first time in years, investors are optimistic for MSFT. Keep watching this story – it’s going to get better.

Two of our tech stocks have had a rough month: CA Technologies ($CA) and Cognizant Technology Solutions ($CTSH). I still like both stocks, but I want my Buy Below to better reflect the market’s current judgment. I’m lowering my Buy Below on CA to $34 per share, and I’m lowering Cognizant to $52 per share. Going by Thursday’s close, CA’s dividend works out to 3.28%. Both stocks are very good buys.

That’s all for now. The first quarter ends on Monday; after that, we’ll get our regular beginning-of-the-month reports. ISM comes out on Tuesday. The ADP jobs report comes out on Wednesday. Then on Friday, the government releases the big jobs report for March. With the Fed committed to tapering, I actually think the monthly jobs reports aren’t quite as important as they were last year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – March 21, 2014

Eddy Elfenbein, March 21st, 2014 at 8:56 am“…something on the order of six months.” – Janet Yellen

With those words, the new Fed Chairwoman sent world markets into a tizzy. How could that be, and what, pray tell, did she mean?

Fear not, gentle reader, for I am well versed in the convoluted sub-dialect of Fed-speak, and I’ll lead you through Wall Street’s latest hissy fit. The bottom line, as I’ll explain later, is not to worry. Traders are freaking out over nothing special.

After six painful years, the economy is slowly returning to something approaching normal. Soon, workers will be able to demand higher wages, and consumer prices will rise. This is good news—it’s what we want to happen. A side effect is that we’re soon going to return more traditional monetary policies, and that will apparently take some getting used to. In this week’s CWS Market Review, I’ll explain what you need to know.

I’ll also walk you through the latest earnings report from Oracle. The bottom line number was a tad disappointing, but that was more than made up for by rather rosy guidance. I expect the enterprise software giant soon to hit $40 per share, which it last touched 14 years ago. I’ll break it down in a bit, but first, let’s look at this week’s Fed meeting and why everyone’s scratching their heads.

The Fed Ditches the Evans Rule

Before I get into this week’s Federal Reserve meeting, let’s back up a bit and explain how we got where we are. When the economy plunged into recession, the Federal Reserve responded by dramatically cutting interest rates in an attempt to cushion the blow and hopefully turn things around. Soon, the Fed got to 0% and couldn’t cut any more. Many of the top economic models said that short-term interest rates should be negative—pay people to borrow money!

The Fed decided the best way to get below 0% was to buy bonds. Lots and lots of bonds. The fancy term for this is Quantitative Easing or QE. They tried this a few times for limited periods, but it wasn’t enough. Finally, they threw up their hands and said, “we’re going to buy bonds until things get better.” Specifically, the plan was to purchase $85 billion each month in Treasuries and mortgage-backed bonds.

The market loved the plan, and stock prices soared. But investors wanted to know: How long would the bond-buying party last? The idea floated by Charles Evans of the Chicago Fed was to lay out a specific unemployment number and say, “we won’t end QE until we hit this number.” The Fed adopted the Evans Rule and said that 6.5% unemployment was their threshold. (The Evans Rule also included 2.5% for inflation, but we’re a long way from that.)

Stock prices continued to climb, and the unemployment rated started to fall. Then some investors got nervous because we were getting close to 6.5% on jobs, but the economy obviously needed more QE. The reason is that so many people had left the workforce, and as a result weren’t counted as part of that 6.5%. In other words, the economy is weaker than that unemployment number suggests. As a result, the belief was that the Fed would soon abandon the Evans Rule (I first mentioned this in January), and that’s exactly what happened this week. The Fed ditched the Evans Rule.

Yellen Confuses the Market

Now that leads us to the next step, and here’s where things get a little complicated. Last June, the Fed signaled that it was planning to pare back on its bond purchases. The market, predictably, freaked out. This was the famous Taper Tantrum. In four months, the three-year Treasury jumped from 0.3% to nearly 1%.

Investors believed, incorrectly, that the entire rally was due to QE, so once that was gone, the market was toast. Not only did they get that wrong, but they completely misjudged the timing of the Fed’s taper decision (to be fair, the miscommunication was mostly the Fed’s fault). Ultimately, it wasn’t until December that the Fed decided to taper its monthly bond-buying by $10 billion. In January, the Fed tapered by another $10 billion, and they did it again this week.

The Fed had said they wouldn’t raise interest rates until they were done with bond-buying. Sure, that makes sense. But now that they’re tapering, here’s the big question: How long will it be between the ending of QE and the first rate increase? In Wednesday’s policy statement, the Fed said “a considerable time,” so when Janet Yellen faced the media at her press conference, someone asked, “Well…what does a considerable time mean?” Her answer was “something on the order of six months.”

The next logical question is, “Six months from when?” Yellen said of QE’s end, “we would be looking at next fall.” That totally confused reporters. Did she mean fall of 2015? Nope, Yellen clarified by saying she meant this fall. Now six months from this fall means…a rate hike next spring? Hold on! That’s earlier than the market was expecting.

As a result, stocks dropped on Wednesday, and the middle part of the yield curve bulged. The three-year Treasury yield rose by 16 basis points, and the five-year jumped by 19 points (the chart above). The two- and three-year Treasuries’ yields reached six-month highs. Utility stocks, which are highly sensitive to interest rates due to their rich yields, took a beating. On the forex market, the yen dropped against the dollar, and that took a 1.5% bite out of AFLAC’s ($AFL) stock during Wednesday’s trading. Gold, which had been doing well, has lost more than 4% this week.

When Will the Fed Raise Rates?

But does Yellen’s timetable make sense? With this latest taper, the Fed will be buying $55 billion in bonds starting with April. Follow me on this. The Fed meets again in April (they meet every six or seven weeks), so presumably another $10 billion taper would bring us down to $45 billion. Then we’d go to $35 billion at the June meeting. For July, we’d be down to $25 billion. Then in September, we’re down to $15 billion.

The next meeting would be on October 28-29. If the Fed wiped out the last $15 billion in one move, that would mean QE wraps up in November, which is indeed in the fall, as Yellen mentioned. But if the Fed tapers by only $10 billion in October, that leaves $5 billion on the table to tapered at the December meeting. That would mean that QE would be done by the end of the year. Counting six months from that, it means we’d see the first rate increase by the middle of 2015. That’s more in line with what the futures market had been expecting.

The market got tripped up by Yellen’s mention of “the fall” and “six months.” So here’s my take: I think this was a rookie mistake by Janet Yellen. I strongly doubt there’s anything close to a majority at the FOMC that thinks interest rates will rise next spring. The economy is getting better, but we still have a way to go, and the CPI numbers are barely moving.

Let’s also bear in mind that we’re only talking about one measly rate increase. On Wednesday, the one-year Treasury yield skyrocketed all the way up to the highest yield in five months—0.15%! For an investment of $1 million, that works out to about $4 per day.

Make no mistake: higher interest rates are like Kryptonite to a bull market. I think the market is paranoid that a hawkish Fed is suddenly going to spring on them. It’s as if they’ve adopted an attitude of “prove to me that you’re going to let me down.” That, combined with a few misstatements from Chairwoman Yellen, explains what happened. Higher rates are truly something to worry about, but for now, they’re still a long way off.

Stocks rebounded impressively on Thursday. In fact, the S&P 500 barely budged between Tuesday’s and Thursday’s close. But we’re in a new world. Investors need to realize that the Fed will tighten at some point. It’s no longer a distant hypothetical. Currently most FOMC members think short-term rates will be at 1% by the end of next year and at 2.25% by the end of 2016. In other words, the Fed Funds rate will still be less than inflation for a good while more.

Let me add one more point. The FOMC’s policy statements have gotten ridiculously long. Dear Lord, they run on and on, with lots of garbage text. Please. Just tell us the basics. A Fed statement should be no more than 300 words. Period.

Oracle Misses Earnings, but Don’t Fret

After the closing bell on Tuesday, Oracle ($ORCL) reported fiscal Q3 earnings of 68 cents per share. This was two cents below Wall Street’s consensus. It was also at the bottom of Oracle’s own guidance. The stock dropped sharply in the after-hours market. But as I said last week, what was more important than the actual earnings report would be Oracle’s guidance for the current quarter.

On the conference call, Oracle said to expect fiscal Q4 earnings to range between 92 and 99 cents per share. The Street had been expecting 96 cents per share, so that left open the possibility of an earnings beat.

On the revenue side, Oracle said it sees Q4 revenues coming in between $11.3 billion and $11.7 billion. Wall Street had expected $11.5 billion. New software sales and subscriptions would range from 0% to 10%. The best news was that hardware sales rose by 8%. That’s Oracle’s first increase since they bought Sun Microsystems four years ago. Total revenue climbed 4% to $9.31 billion, which was $50 million shy of Wall Street’s forecast.

At the start of Wednesday’s trading, shares of ORCL opened down more than $1. Gradually, traders realized that their guidance wasn’t so bad, and Oracle rallied throughout the day. Oracle finally made it into the green and got as high as a 12-cent gain on the day. The rally was later undone by Janet Yellen’s comments, but Oracle moved largely in line with the rest of the market.

Oracle’s business still needs to improve, but I think they’re making the right moves. I expect the shares soon to break $40, which the stock last hit 14 years ago. Oracle remains a good buy up to $41 per share.

Buy List Updates

Our Buy List continues to hold up well. I have a few updates to pass along. Microsoft ($MSFT) closed above $40 per share for the first time since 2000 (notice how a lot of tech stocks are hitting 14-year highs). The software king is planning to release Office for the iPad, and Morgan Stanley had good things to say about their prospects. I’m raising my Buy Below on Microsoft to $43 per share.

The Federal Reserve just completed its latest bank “stress test,” and Wells Fargo ($WFC) passed with flying colors. The Fed wants to make sure that if things go kablooey, the large banks won’t come running back to Uncle Sam for more bailout cash. Since Wells is so well run, there wasn’t any doubt it would do well.

The next part of the Fed’s decision comes next week when they say who’s allowed to increase their dividend. Again, I’m sure Wells will get whatever they ask for. WFC currently pays 30 cents per share each quarter. I’m expecting that to rise to 32 cents per share, give or take. Shares of WFC just broke out to another new 52-week high. I’m raising my Buy Below on Wells Fargo to $54 per share.

Shares of Qualcomm ($QCOM) have been doing well lately. The stock just hit—take a wild guess—a 14-year high. There’s a chance we might get a dividend increase soon. I’m bumping up my Buy Below on QCOM to $82 per share. This is a very good stock.

That’s all for now. Next week is the final full week of the first quarter. We’re going to be getting more economic reports that aren’t tainted by the inclement weather. On Wednesday, the Department of Commerce will release its latest report on durable goods. Then on Thursday, the government will revise the Q4 GDP report. Last month, the original report was revised downward from 3.2% to 2.4%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Do you know the difference between the different types of stock orders? Don’t be embarrassed. Many experienced investors don’t. Check out my handy guide to the different types of stock orders.

-

CWS Market Review – August 23, 2013

Eddy Elfenbein, August 23rd, 2013 at 7:13 am“To achieve satisfactory investment results is easier than most people realize;

to achieve superior results is harder than it looks.” – Benjamin GrahamWall Street’s been having a tough time so far this August. Through Wednesday, the S&P 500 fell on ten of the previous 13 days. Thanks to the low volatility of late summer, these dips haven’t stung very much. Measuring from the market’s peak on August 2, the index lost nearly 4%, though we gained some of that back on Thursday. Interestingly, the Dow Industrials fell to their lowest level relative to the S&P 500 in five years.

Now a 4% haircut isn’t much of a downswing. It’s only a minor dent in the rally we’ve had this year. However, the big concern on everyone’s mind is that Ben Bernanke and his friends at the Fed are finally going to start “tapering” their bond purchases next month. I’ll have more on that in a bit. Wall Street had more headaches yesterday as “technical issues” caused trading to be halted on the Nasdaq for three hours.

But the action that’s caught my attention hasn’t been in the stock market. It’s in the bond market. Interest rates have spiked dramatically in the U.S., and the long bond is near its worst selloff in 13 years. In early May, the 10-year Treasury was yielding 1.63% (see chart below). On Thursday, the yield got as high as 2.92%, and a lot of folks expect us to break 3% any day now.

In this week’s CWS Market Review, we’ll take a closer look at what’s causing bond traders so much grief. We’ll also take a look at recent Buy List earnings reports from Medtronic ($MDT) and Ross Stores ($ROST). (Ross beat consensus by five cents per share and looks to break out soon.) But first, let’s focus on the dramatic rise in bond yields.

Why Are Rates Rising? It’s the Economy

The stock and bond markets have a rather unusual relationship. The two markets can basically be described as “frenemies.” On one level, they’re competitors for investors’ capital. Money will go wherever it’s treated best. The catch is that neither market will prosper for long if the other one is suffering. After all, the bond market is debt, and if companies have to shell out higher interest costs, that will cut into their bottom line. Meanwhile, if companies aren’t making a profit, then they can’t pay back their loans. Stocks and bonds are rivals under the same flag.

Sometimes the two markets move together as if they’re waltzing partners, and other times they act in near-perfect opposition. As a very general rule of thumb, the bond market leads the stock market by about six months to a year.

Long-term interest rates officially hit their low thirteen months ago, but the decline since then was rather slight. That is, until this May, when the rout really got going. The 10-year yield is now where the 20-year yield was in June, and where the 30-year yield was in May. So the question to ask is, why is the bond market falling so sharply?

The popular answer is that it’s due to the Federal Reserve pulling out of its bond buying. But I’m not so sure. Let’s review the situation: The Fed meets again in mid-September, and the central bank has successfully convinced Wall Street to expect a scaling-back of asset purchases. This week, in fact, the Fed released the minutes of its last meeting, and those minutes indicated that the other FOMC members are on board with Bernanke’s tapering plan. Personally, I think it’s too early to start tapering. If they do announce a tapering, and they probably will, I expect it to be modest, which means the Fed hasn’t left the bond market at all: they’re simply buying less. This really shouldn’t be a big deal.

That’s why I don’t believe the taper talk is the reason for higher interest rates. Other people think the higher rates are due to inflation. The gold market has rebounded lately, but that’s coming after a pretty rough year. The yellow metal is still off more than $500 an ounce since last year’s high. The CPI reports continue to be quite tame. Also, the yield on the 10-year TIPs, the inflation-protected bonds, has climbed largely in step with the regular 10-year bond (see chart below). In other words, investors aren’t demanding a greater inflation discount for their bonds. They just want a higher yield.

The influence of the Fed does show up in the middle part of the yield curve. For example, the spread between the two- and three-year Treasuries was only 10 basis points on May 6. Now it’s up to 40 points. That’s probably investors factoring in a short-term rate increase down the road. Interestingly, spreads among longer-dated bonds have actually tightened up a bit.

This leads me to believe that the reason for the higher rates is an improving economy. The key fact in favor of this thesis is that the dollar has been fairly stable. If yields were rising as the dollar was falling, then I’d be more concerned. I’ve also been impressed by how economically cyclical stocks have held up, and that’s despite a weak market for tech stocks. We also got encouraging earnings reports this week from broad-based retailers like Best Buy ($BBY) and TJX ($TJX). Also, Home Depot ($HD) had a good report plus they raised guidance.

The most intriguing bit of evidence in favor of the stronger-economy view is that junk-bond spreads have narrowed. In an unusual twist, AA-rated bonds are now yielding less than AAA bonds. But that’s not due to the market’s irrationality (which we can never completely discount). Rather, it’s due to the fact that investors want the shorter maturities that AA bonds usually carry. So investors want still bonds; they’re simply less willing to get locked into long positions.

Mortgage rates have climbed as well, and I am concerned that that could disrupt the housing market. The recent reports, however, show that housing is doing quite well. Our Buy List member Wells Fargo ($WFC) made news this week when they announced they’re eliminating 2,300 mortgage jobs. But that’s due to a decline in refinancings, not fewer originations.

The takeaway for investors is to not be too concerned about any taper talk. Its influence on the market is easily overstated. If bond traders are right, the economy is due for a rebound later this year and into 2014. That will be very good for our Buy List. Now let’s turn to our recent earnings reports.

Medtronic Hits Earnings Consensus on the Nose

On Tuesday, Medtronic ($MDT) reported fiscal first-quarter earnings of 88 cents per share, which was in line with expectations. Revenues rose to $4.08 billion, which was $40 million short of estimates.

Shares of Medtronic pulled back after the earnings report, but I think it was a fine quarter. Demand for defibrillators was a bit weak, as was the demand for MDT’s InFuse bone-growth product. Interestingly, Medtronic said they’re planning to expand beyond medical devices and into health services. I think that’s a smart move.

Medtronic’s CEO, Omar Ishrak, said, “We delivered on the bottom line, overcoming a number of challenges through strong operating discipline.” The best news was that MDT reiterated its full-year forecast of $3.80 to $3.85 per share. That’s for fiscal 2014, which ends next April. They made $3.75 per share last year and $3.46 per share the year before. In June, Medtronic raised its dividend for the 36th year in a row. Business is still going well here, and I think they can easily hit their full-year guidance. Ishrak said they’re looking to generate $25 billion in free cash flow over the next five years. Medtronic remains a solid buy up to $57 per share.

Ross Stores Delivers a Solid Earnings Report

After the close on Thursday, Ross Stores ($ROST) showed very strong fiscal Q2 earnings of 98 cents per share. That was five cents better than Wall Street’s consensus. It was even better than Ross’s own projections. After the last earnings report in May, Ross said to expect Q2 earnings to range between 89 and 93 cents per share.

Quarterly sales rose 9% to $2.551 billion. The important metric for retailers, comparable-store sales, rose 4% last quarter. That’s a very good number. ROST’s CEO, Michael Balmuth, said, “Operating margin for the second quarter grew to a record 13.6%, up from 12.8% in the prior year.” For Q2, Balmuth said he sees earnings coming in between 75 cents and 78 cents per share. That’s below Wall Street’s consensus of 79 cents per share, but Balmuth noted that it’s a cautious outlook.

For Q4, Ross sees earnings ranging between 99 cents and $1.03 per share. Wall Street had been expecting $1.10 per share. The guidance for Q3 and Q4 is based on comparable-store sales growth of 2% to 3%, which is very conservative. Add it all up, and Ross sees full-year earnings of $3.80 to $3.87 per share. Note that last year’s fiscal year included 53 weeks. Adjusting for that, Ross is projecting earnings growth of 11% to 13%.

This was an excellent quarter for Ross. Don’t let the tepid forecast bother you. They’re just being conservative. Ross Stores is an excellent buy up to $70 per share.

Before I go, I want to highlight three especially good buys on our Buy List. Ford ($F) looks very good below $17. The stock actually dipped below $16 earlier this week. The last earnings report was outstanding. Cognizant Technology ($CTSH) is a very good buy if you can get it below $73 per share. The recent earnings report and guidance was also very good. Keeping with tech, Microsoft ($MSFT) is a bargain below $33 per share. The stock currently yields 2.84%, and you can expect a dividend increase next month.

That’s all for now. Next week is the final week of summer. It went by fast, didn’t it? I expect trading activity to remain subdued until after Labor Day. On Monday, the census Bureau will report on durable orders. The report will come on Wednesday, when the government will revise the Q2 GDP growth numbers. The initial report was a sluggish 1.7%, but the subsequent trade numbers suggest a strong upward revision. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – July 12, 2013

Eddy Elfenbein, July 12th, 2013 at 7:06 am“I guess I should warn you, if I turn out to be particularly clear,

you’ve probably misunderstood what I’ve said.” – Alan GreenspanWhat a difference six days make. The S&P 500 has rallied for the last six days in a row, and on Thursday, the index reached an all-time high close, although we’re still a bit short of the all-time intra-day high. The small-cap Russell 2000 is at an all-time high and the Nasdaq Composite is at its highest point in 13 years. Check out how poorly the S&P 500 has performed compared with the Russell 2000.

What’s the cause for the about-face? It all comes down to the Federal Reserve—or more specifically, people’s expectation of what the Fed is thinking. After throwing a minor temper tantrum, Wall Street has apparently reconciled itself to the fact that the Fed will start tapering its bond purchases in September.

In this week’s CWS Market Review, we’ll take a closer look at what this means and how it impacts our portfolios. We’ll also take a look at some upcoming earnings reports for our Buy List. Speaking of which, our Buy List has been en fuego lately. Just look at Cognizant Technology ($CTSH). Two weeks ago, I spotlighted CTSH as an especially good buy, and the stock is up 13% since then. I’m raising my Buy Below for Cognizant to $76 per share. Thanks to the rally, I have several more updated Buy Below prices. Before we get to those, let’s look at why the markets are so happy this week.

Bernanke Calms the Market’s Panic Attack—Which He Created

In last week’s CWS Market Review, I said traders were on the lookout for this week’s release of the minutes from the Fed’s June meeting. It was in June that Ben Bernanke’s post-meeting press conference sent the stock market into a quick dizzy spell.

Traders read far too much into the Fed’s caution that their bond buying program will, at some point, slowly wind down. Ever since that press conference, the central bank has been hard at work trying to calm the market down. Ben and Friends want to make it absolutely clear that they’re not going to pull the rug out from the economy.

One piece of encouraging news came last Friday when the government reported that the economy created 195,000 new jobs in June. That was 30,000 more than expected. How’s this for consistency: According to the government, 199,000 jobs were created in April, and 195,000 were created in May. These are decent numbers, though there’s a lot of room for improvement. Still, we had a seven-month run last year where every report was less than 170,000.

An improving labor market is important for several reasons. It obviously means more folks drawing paychecks who are eager to buy more things. While Corporate America has done a great job cutting back on expenses, you can’t improve profit margins forever. At some point, you need more bodies in the door.

Mr. Bernanke has often pointed out that helping the jobs market is part of the Fed’s mandate, and he’s pledged to add monetary stimulus until there’s substantial improvement in the economy. In a Q&A on Wednesday, Bernanke said that the current unemployment rate probably understates the strength of the jobs market due to low workforce participation. In English, that means we don’t really know how bad things are, because a lot of folks have simply stopped looking for work.

Bernanke also did something interesting in those remarks. He made it clear that short-term interest rates will remain low for a long time after any bond buying starts to taper off. I think he sees rates staying low into 2015, and perhaps beyond. Of course, this will be long after he’s left D.C. The important thing is that QE is not the same as holding down short-term rates, and the Fed sees these as two distinct policies.

A lot of market watchers have been concerned about the rapid run-up in long- and intermediate-term interest rates. The five-year Treasury jumped 95 basis points in two months. In effect, the economy is tightening credit on itself. Bernanke is clearly concerned about this, but any concerns that the housing market is about to be slammed shut are very premature (although there have been some big cracks in a number of mortgage finance stocks).

The odd thing is that a lot of investors have reacted as if the Fed has suddenly changed its game plan. That’s not the case at all. Looking at the details, the central bank has been pretty consistent. The market’s reaction, however, has been wildly inconsistent. While the stock market has made back all of its losses, the five-year Treasury has fallen only 20 basis points from its 95-point surge.

Looking at the makeup of the market also gives us some clues. For example, the Consumer Discretionary Sector ($XLY) has now risen for 12 days in a row. That’s exactly what we would expect to see when knowing that the Fed is on the side of the stock market. The Discretionaries include companies like Bed Bath & Beyond ($BBBY) and Ford Motor ($F). Basically, it’s stuff that people would like to buy, not what they have to buy. This is important because strength here points to broader optimism.

The message from Bernanke is crystal clear even though some folks are desperate to hear something different. The Federal Reserve will continue to be on the side of stocks and not bonds. Bernanke just watched a big drop in bonds and did nothing to stop it. What does that tell you? Keep focusing on our Buy List names, and ignore any market hiccups. That’s just part of being an investor. This will be another good earnings season for us. Now let’s look at our Buy List.

Our Buy List Is up 21.27% for the Year

Our Buy List has been punching like champ lately. We’re now up 21.27% for the year, and it’s not even the All-Star Break yet. I want to run down some of our big winners and give you some new Buy Below prices. Our #1 performer this year is quiet little Moog ($MOG-A), which is inches away from being our first 40% winner for the year. Of our 20 stocks on the Buy List, 13 are up more than 20% this year, including six that are up more than 30%. This week, I’m raising my Buy Below on Moog to $57.

Several of our stocks have been hitting new highs lately, like Ford Motor ($F). On Thursday, shares of F came within one penny of hitting $17 per share. The upcoming earnings report could be a home run. Ford continues to be a great buy up to $18 per share.

It seems like it was only a week ago that I raised my Buy Below on WEX Inc. ($WEX) and Bed, Bath & Beyond ($BBBY). Actually, it was only a week ago, but both stocks have powered right through to new highs. This week, I’m raising WEX to $86, and BBBY to $79.

AFLAC ($AFL) continues to do well for us. On Thursday, the stock got as high as $59.38, which is the highest price in more than two years. AFL is still going for less than 10 times this year’s earnings estimate. I’m looking forward to another good earnings report at the end of this month. I’m raising AFL’s Buy Below to $63 per share.

Last month, traders panicked due to our FactSet’s ($FDS) terrible, awful, horrible earnings. In other words, FactSet merely met the Street’s earnings forecast. At the time, I said FDS “is doing just fine.” Sure enough, the stock has since made back everything it lost and broken out to another new high. (If it weren’t for panicky traders, we wouldn’t have any traders at all.) I’m raising our Buy Below on FactSet to $112 per share.

I have three more Buy Below changes: I’m raising CA Technologies ($CA) to $31 per share, Harris ($HRS) to $53 and CR Bard ($BCR) to $115. Earnings for all three will be coming soon.

I also want to mention that DirecTV ($DTV) is bidding to buy Hulu, which is an online video service. This is a pretty high-profile bidding war for Hulu. I don’t have any new info, but I’ll add that DTV tends to be pretty conservative in these matters, and I know they’re not afraid to walk away from a deal if it’s not a good fit.

I’ll warn you that the bidding war may cause some near-term volatility for DTV. If they lose, which is probable, the stock will probably rally. Incidentally, DTV got a nice bump on Thursday when Liberty Media’s Chairman John Malone said that DISH and DTV should merge. I really don’t see that happening. Either way, DirecTV remains an excellent buy up to $67 per share.

Upcoming Earnings from Microsoft and Stryker

Before we get to the next week’s earnings, I have to make a correction. Last week, I said that JPMorgan ($JPM) and Wells Fargo ($WFC) were due to report earnings on Thursday, July 11th. That’s incorrect. Both banks will report on Friday, the 12th, which is just after the deadline for this week’s issue. No need to worry. I’ll cover the earnings report in next week’s CWS Market Review. Also, I previewed the earnings in last week’s issue, which you can see here. My apologies for any confusion.

Assuming my calendar is right, this Thursday, July 18th, Microsoft ($MSFT) and Stryker ($SYK) are due to report Q2 earnings. For Microsoft, the June quarter is the fourth quarter of their fiscal year. Both have been excellent stocks for us this year.

In April, Microsoft had a very good earnings report, and this news came at a time when a lot of big-name firms were disappointing Wall Street. The software giant earned 72 cents per share, which was four cents more than estimates.

It’s true that MSFT is being hurt by slower PC sales, and Windows 8 didn’t blow people away. But lots of other areas are going well for them. Microsoft’s corporate business is picking up, and Xbox biz looks quite good. The company generates an astounding cash flow.

On Thursday, Microsoft announced a major reorganization. They’re revamping their eight divisions into four. The new structure is designed to offer more collaboration and diminish rivalries. Steve Ballmer has said he wants Microsoft to be known as a “devices and services” firm.

I tend to be a bit skeptical about high-profile reorganizations. They can be done, but reorgs are usually more difficult than originally assumed. On Thursday, MSFT came within one penny of a new 52-week high. Wall Street currently expects 75 cents per share for next week’s earnings report. That’s almost certainly too low. I’m going to bump up my Buy Below price to $38 per share. Microsoft remains a very good buy.

Stryker exploded out of the gate for us this year. SYK was up 16% before the end of January. The medical-devices company has said that it expects $4.25 to $4.40 per share this year. It’s still early, but I think SYK should easily clear $4.30 per share this year. Stryker earned $1.03 per share for Q1, and their result for Q2 is usually very close to what they earned in Q1. Sure enough, Wall Street’s consensus for Q2 is for $1.03. Stryker remains a very good buy up to $71 per share.

That’s all for now. Earnings season rolls on next week. We’ll get reports from Microsoft and Stryker. There will also be several key economic reports. Retail sales is on Monday; on Tuesday, we’ll get a look at consumer inflation; and industrial production is on Wednesday. Then housing starts on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – May 3, 2013

Eddy Elfenbein, May 3rd, 2013 at 8:31 am“They say you never go broke taking profits. No, you don’t. But neither do

you grow rich taking a four-point profit in a bull market.” – Jesse LivermoreI’m starting to feel a bit sorry for the bears. All the headlines have been in their favor (Debt Ceiling! Fiscal Cliff! Cyprus!), but stock prices don’t seem to be cooperating. On Thursday, the S&P 500 closed at—I hope you’re sitting down—yet another all-time high. April marked the index’s sixth consecutive monthly gain, and we’ve rallied for ten of the last eleven months.

But I have to confess that I’m starting to grow more cautious about this rally. We’ve gone a long way up so we’re probably due for bumps soon. Mind you, I don’t think we’re anywhere close to the danger zone. Instead, I think we’ll see more subdued gains for the rest of the year.

Fortunately, our style of investing doesn’t rely on broad market predictions. Trust me, those “forecasts” are a sucker’s game. Instead, we focus on good stocks going for favorable prices. Just look at our two top-performing stocks this year, Bed Bath & Beyond and Microsoft. Both are excellent examples of how we profited by picking good stocks when the market had soured on them.

In the February 22nd issue of CWS Market Review, I highlighted Microsoft ($MSFT) as an exceptionally good buy. Since then, the software giant has climbed more than 20%, and it just touched a five-year high. This week, I’m raising my Buy Below on MSFT to $35 per share.

In our February 15th issue, I said that Bed Bath & Beyond ($BBBY) was finally looking cheap. The stock has since rallied 18%, and it’s close to cracking $70 per share. This week, I’m raising my Buy Below on BBBY to $72 per share.

The lesson isn’t that every beaten stock eventually goes up. It’s that high-quality stocks that have been beaten down have a very good chance of going back up. Make sure your portfolio has enough of these, and you’re tilting the odds in your favor. That’s the heart of all sound investing.

In this week’s issue of CWS Market Review, I’ll cover our recent Buy List earnings reports and highlight the last batch for next week. Before I get to that, let’s look at how the market has been behaving recently.

The Market’s Leadership Has Changed

The stock market has responded well since its recent low on April 18th. The S&P 500 has rallied for eight of its last 10 days. What’s interesting is that up until the 18th, many of the defensive sectors had been leading the market. By defensive, I mean sectors like healthcare, consumer staples and utilities. That’s rather usual, but not unheard of. Typically, cyclical stocks lead the rallies, and defensive stocks take charge when the market sours (meaning, they fall the least).

So what’s going on? My take is that the recent rout of commodities, gold in particular, helped give the lead to defensive sectors. Energy and Material stocks have been laggards this year. I don’t think we can say yet whether this is a precursor of a broad decline in the economy, but it’s true that some of the recent economic data has been weak. The jobs report for March was lackluster, and last Friday’s GDP was decent but far from strong. But those reports covered periods earlier this year. We’re now well into Q2 and since April 18th, the market has been rallying on strength from cyclical stocks. Technology has been particularly strong.

The Federal Reserve’s policy statement this week specifically said that “fiscal policy is restraining economic growth.” The Fed also said that it may increase or reduce its bond buying to help the economy. I take this to mean that rates will remain very low. As a result, the math continues to be very favorable for stocks. Stocks may be less cheap but they’re still a lot cheaper than bonds. Just look at Apple. The company made news this week with its massive bond offering. Apple was able to issue five-year bonds with a negative real interest rate. Apple’s dividend yield is higher than their cost to borrow, so it wouldn’t make sense not to borrow.

What to do now: Investors should concentrate on high-quality stocks and particularly those that pay generous dividends.

Good News from Harris, Bad News from WEX Inc.

Last Friday, Moog ($MOG-A), the maker of flight control systems, reported first-quarter earnings of 80 cents per share which was two cents better than analysts’ estimates. The CEO said that the first half of this year has been difficult but the second-half should be better for them.

Moog now sees full-year earnings coming in between $3.40 and $3.50 per share but that includes a 15-cent charge for restructuring costs. Not counting the restructuring charge, this is an increase in their guidance. Originally, Moog said they saw full-year earnings ranging between $3.50 and $3.70 per share. Then they took the top end down to $3.60 per share. Now Moog sees earnings, without the charge, between $3.55 and $3.65 per share. This was a good quarter for them. Moog remains a solid buy up to $50 per share.

After the closing bell on Tuesday, Fiserv ($FISV) reported Q1 earnings of $1.33 per share which was one penny below consensus. Due to the earnings miss, the stock got hit for a 4.5% loss on Wednesday. Fiserv has done very well for us, and last week I cautioned you not to chase it. Honestly, I’m not at all worried about Fiserv. A one-penny miss is meaningless for a company like this. In the short-term, of course, it’s not pleasant, but let’s look at the larger picture.

For last year’s Q1, Fiserv made $1.15 per share so earnings are growing quite nicely. Fiserv’s CEO, Jeffery Yabuki, said the company is “on-track to achieve our targeted results for the year.” For the entire year, Fiserv expects adjusted revenue growth in excess of 10%, and earnings-per-share are expected to rise between 15% and 19% to a range of $5.84 to $6.03. The Street had been expecting $5.97 per share. For now, I’m keeping my Buy Below price at $88 per share.

On Tuesday morning, Harris ($HRS) reported fiscal Q3 earnings of $1.12 per share which matched Wall Street’s estimate. I think this was a big relief for traders who were expecting something much worse. The shares got a nice spike after the earnings report.

The most important news was that Harris reiterated its full-year earnings guidance of $4.60 to $4.70 per share. If you recall, the company originally expected earnings between $5.00 and $5.20 per share but lowered guidance due to the federal government’s sequester. Shares of HRS currently yield 3.2%. I’m raising my Buy Below on Harris to $47 per share.

WEX Inc. ($WEX) is turning into our problem child for the year. The stock got hammered this week after the company lowered its full-year guidance. So what’s causing them trouble? The Maine-based company processes fuel payments for fleet vehicles and they’re being impacted by lower fuel costs and unfavorable exchange rates.

First-quarter earnings came in at 98 cents per share which was two cents better than estimates. The results were also better than the range the company gave us three months ago of 89 to 96 cents per share. That’s the good news.

Their guidance, however, was lousy. For Q2, WEX expects earnings to range between 98 cents and $1.05 per share. That’s well below Wall Street’s consensus $1.11 per share. WEX also lowered their full-year guidance from $4.30 to $4.50 per share to $4.20 to $4.35 per share. The stock dropped over 10% on Wednesday. Frankly, the numbers here are pretty ugly. I’m very disappointed with WEX and I’m dropping my Buy Below down to $70 per share.

Four More Earnings Reports Next Week

Next week is the final big week for our Buy List stocks this year earnings season. On Tuesday, May 7th, CA Technologies and DirecTV are due to report. Cognizant Technology Solutions follows on Wednesday, May 8th. Nicholas Financial should also report next week but I don’t know which day.

CA Technologies ($CA) got off to a great start this year but has pretty much stagnated ever since. In January, I predicted the company would beat earnings, and that’s exactly what happened. On the surface, CA appears to be a dull company, but don’t let that fool you. The stock currently yields just over 4%. Wall Street expects earnings of 55 cents per share. I’m holding my Buy Below at $27 per share.

Shares of Cognizant Technology Solutions ($CTSH) recently shed 21% in two weeks. Traders are clearly nervous that a lousy earnings report is coming. For one, Infosys ($INFY), a similar company to CTSH, gave terrible guidance. IBM ($IBM) also had a big earnings miss. Plus, there are also concerns that new legislation will impact the status of foreign workers. But all of this is speculation. The company hasn’t reported yet. Wall Street currently anticipates earnings of 93 cents per share. My analysis says CTSH should beat that. Last week, I lowered my Buy Below to $70 per share.

Three months ago, DirecTV ($DTV) had a monster earnings report. The satellite TV operator crushed earnings by 28 cents per share. The company said they see earnings for this coming in at $5 or more. I’m not a fan of share buybacks, but DTV is a company that truly uses them to lower the amount of outstanding shares instead of a cover for executive compensation. Wall Street expects $1.09 per share for Q1. On Thursday, DTV hit a fresh 52-week high. DTV is a buy up to $59 per share.

There’s still not a single analyst on Wall Street who follows Nicholas Financial ($NICK) so I can’t say what the earnings estimate is. But I can speak for myself. Honestly, I don’t care what NICK’s bottom line is as long as it’s somewhere close to 45 cents per share (excluding any charges). A few pennies per share here or there don’t matter. What does matter is that they’re business continues to deliver steady earnings.

I also expect an update on the buyout offer. It’s been a while so I’ll be curious to hear what they have to say. Unfortunately, if a buyout offer falls through, which is fine by me, the stock will probably take a short-term hit. Nicholas Financial continues to be a good buy up to $15 per share.