Posts Tagged ‘orcl’

-

CWS Market Review – September 14, 2012

Eddy Elfenbein, September 14th, 2012 at 8:23 amLast week, it was thank you, Mario. This week, it’s thank you, Ben!

The stock market surged to its highest close in four years on Thursday when it was reported that that the Federal Reserve is embarking on another round of quantitative easing. The last time the S&P 500 was this high was on the final day of trading in 2007. The market had a great day on Thursday, and several of our Buy List stocks like Medtronic ($MDT), DirecTV ($DTV), Hudson City ($HCBK) and Harris Corp. ($HCBK) all broke out to new 52-week highs.

I’m also pleased to announce that—after many of you requested it—I’ve added a “Buy Below” column to our Buy List page. I think you’ll like it a lot. Now you’ll be able to know exactly what I think is a good entry point for all the stocks on our Buy List. It’s important for investors to stay disciplined and never chase after stocks. My Buy Below prices will help you do exactly that.

In this week’s CWS Market Review, I’ll explain what the Fed news means, and I’ll try to keep it jargon free. I’ll also discuss what this policy means for the economy and our portfolios. I’ll also highlight upcoming Buy List earnings reports from Oracle ($ORCL) and Bed Bath & Beyond ($BBBY). But first, let’s look at why stocks are so happy with the Bearded One.

The Federal Reserve Embarks on QE-Infinity

I have to confess some embarrassment with the Fed’s news, because I had long been a doubter that the central bank would pursue more quantitative easing. I even said last week that this week’s policy meeting would be a snoozer. In fact, I was afraid the market was setting itself up to be disappointed. Instead, the market celebrated the news.

Now let’s look at what exactly the Federal Reserve did. The central bank said it will buy $40 billion per month of agency mortgage-backed securities (MBS). What will happen is the Fed will swap assets with a bank. The Fed will get a risky MBS while the bank will get low-risk reserves, which, I should add, are held at the Federal Reserve.

Here’s the problem: Since interest rates are already near 0%, the Fed can’t cut them any further. But the hope is that by buying MBS, the Fed can push down mortgage rates, which will boost the housing market, which in turn will boost the overall economy. At least, that’s the plan. Remember that the housing sector is a key driver of new jobs, and I noted on Thursday that the stocks of many homebuilders gapped up on the news.

The Fed Changes Course

The problem with the two earlier rounds of bond purchases is that while they certainly helped the financial markets, their impact on the economy was probably pretty slight. Some critics said that the Fed simply wasn’t being bold enough. What’s interesting is that this round of bond buying is smaller than the previous rounds.

But here’s the key: The Fed said something very different this time.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.

In other words, this time the Fed’s plan is unlimited. Implicit in the above sentence is the Fed’s admission that its previous policy just wasn’t working. With the earlier bond buying, the Fed just said that they’re going to buy X dollar amount of bonds, and that’s that. There was no goal.

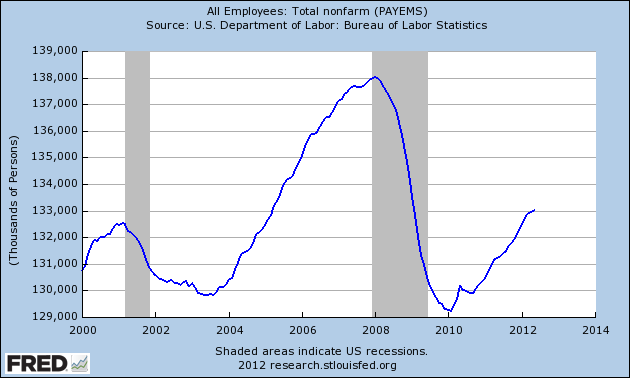

An idea gaining popularity among economists is that the Fed should buy bonds until some metric like the unemployment rate or nominal GDP hits a specific target. With today’s news, the Fed has clearly moved towards that position without expressly saying so. The Fed said that the bond buying would continue until the labor market improved “substantially” and “for a considerable time after the economic recovery strengthens.” The $40-billion-per-month figure is almost irrelevant in context of an open-ended policy. All told, the Fed will be pumping $85 billion into the economy each month.

What This All Means

I may sound overly cynical, but I suspect the Fed will buy bonds until the bond market shuts them off. (Remember when I talked last week about how the Spanish bond market scared the bejesus out of the European Central Bank?)

The Fed also said that it will keep interest rates near 0% through at least 2015. That’s very good news for a company like Nicholas Financial ($NICK). Another buried angle on today’s news is that the Fed is, in my opinion, giving up on the fiction that it has a dual mandate (low inflation and full employment). When it truly matters, the Fed only cares about employment.

Will this QE-Infinity work? I honestly can’t say. One fear is that mortgage rates are already low, and that hasn’t done much to boost the economy. Looking at the track of previous quantitative easings doesn’t make me overly optimistic that a third version will do the trick.

Let’s look at the probable outcomes for the market. I suspect that in the near term, cyclical stocks and financial stocks will get a nice boost. That’s what happened after the first two rounds of bond buying and Operation Twist. JPMorgan Chase ($JPM), for example, soared to $41.40 on Thursday, which effectively erased its entire loss since the London Whale trading loss was announced in May.

Since the Fed is willing to turn a blind eye toward inflation for the time being, I suspect that hard assets (like gold) and commodity-based stocks will do well. I also think that higher-risk assets will gradually gain favor. For example, spreads between junk bonds and Treasuries will continue to narrow. This will also give a lift to many small-cap stocks, especially small-cap growth stocks. In the long run, I’m not convinced the Fed’s decision this week will have a major impact on the economy. Perhaps the best outcome is that a Fed-induced burst of enthusiasm will give the economy and labor market more time to right themselves. Until then, I urge all investors to own a diversified portfolio of high-quality stocks such as our Buy List.

Earnings from Oracle and BBBY

Next week, we have two earnings reports due. Bed Bath & Beyond ($BBBY) reports on Tuesday, September 18, and Oracle ($ORCL) reports the next day. This will be an interesting report for BBBY because three months ago, traders gave the stock a super-atomic wedgie after the company warned Wall Street that their fiscal Q2 would be below expectations. Wall Street had been expecting $1.08 per share, but BBBY said that earnings would range between 97 cents and $1.03 per share. Traders totally freaked and sent shares of BBBY from $74 all the way down to $58.

For fiscal Q1 (which ended in May), I predicted that BBBY could earn as much as 88 cents per share, which was four cents above Wall Street’s consensus. In fact, the company reported earnings of 89 cents per share. Nevertheless, the weak earnings guidance was too much to overcome.

In the CWS Market Review from June 22, I said that the selling was “way, way WAY overdone.” Fortunately, I was right. Since bottoming out in late-June, shares of BBBY have steadily rallied. On Thursday, the stock closed above $70 for the first time in three months. BBBY is still a good stock, and business is going well, but let’s be smart here and not chase it. I’m keeping my Buy Below price at $70.

Oracle has been one of our best stocks this year. The company beat expectations in March and June, although the stock had a terrible month in May. This earnings report will be for their fiscal Q1. The company said that earnings should range between 51 and 55 cents per share, which is almost certainly too low. They earned 48 cents per share for last year’s Q1. Look for an earnings surprise. I’m raising my Buy Below price on Oracle to $35 per share.

That’s all for now. Don’t forget to check out the new “Buy Below” column on the Buy List page. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Oracle’s Q2 Guidance: 51 to 55 Cents Per Share

Eddy Elfenbein, June 19th, 2012 at 2:58 pmHere’s the key part from Oracle’s conference call — their guidance for Q2:

I’m going to move to the guidance. I will say in advance, obviously, I do read the same newspapers you all do and do keep up with the news of the economy, et cetera, and so I have tried to keep that in mind in my guidance regardless of our achievements in the fourth quarter. So assuming exchange rates remain where they are at current levels, which right now is a negative 5% currency impact on license growth rate and on total revenue growth rate, our guidance for Q1 is as follows. New software license revenue growth on a non-GAAP basis is expected to range, these are in constant dollars, 5% to 15% in constant currency or 10 — 0% to 10% on current rates. On a GAAP basis, we expect new software license growth range to be anywhere from 4% to 14% in constant currency and negative 1% to positive 9% under current rates. Hardware product revenue growth is expected to range from negative 12% to negative 2% in constant currency and negative 17% to negative 7% in current rates, and that doesn’t include the hardware support revenue.

Total revenue growth on a GAAP and non-GAAP basis is expected to range from 3% to 6% in constant currency and negative 2% to positive 1% in current rate. The non-GAAP EPS is expected to be anywhere from $0.54 to $0.58 in constant currency or $0.51 to $0.55 at current rate, up from $0.48 last year. GAAP EPS is expected to be $0.40 to $0.44 in constant currency and $0.37 to $0.41 at current rate. This guidance assumes a GAAP and non-GAAP tax rate of 23.5%. Of course, it may end up being different.

I suspect that Oracle is being conservative with this guidance.

-

Oracle Earns 82 Cents Per Share

Eddy Elfenbein, June 18th, 2012 at 5:11 pmOracle ($ORCL) surprised Wall Street by releasing its earnings report early. For the fiscal fourth quarter, Oracle earned 82 cents per share which is four cents more than Wall Street’s consensus. The company had told us to expect earnings to range between 76 cents and 81 cents per share.

Oracle Corporation today announced fiscal 2012 Q4 GAAP total revenues were up 1% to $10.9 billion, while non-GAAP total revenues were up 1% to $11.0 billion. Both GAAP and non-GAAP new software license revenues were up 7% to $4.0 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 5% to $4.2 billion. Both GAAP and non-GAAP hardware systems products revenues were down 16% to $977 million. GAAP operating income was up 5% to $4.6 billion, and GAAP operating margin was 42%. Non-GAAP operating income was up 5% to $5.5 billion, and non-GAAP operating margin was 50%. GAAP net income was up 8% to $3.5 billion, while non-GAAP net income was up 7% to $4.1 billion. GAAP earnings per share were $0.69, up 11% compared to last year while non-GAAP earnings per share were up 10% to $0.82. GAAP operating cash flow for fiscal year 2012 was $13.7 billion, up 23% compared to last year.

Without the impact of the US dollar strengthening compared to foreign currencies, Oracle’s reported Q4 GAAP earnings per share would have been $0.03 higher at $0.72, up 16%, and Q4 non-GAAP earnings per share would have been $0.04 higher at $0.86, up 15%. Both GAAP and non-GAAP total revenues also would have been up 5%, GAAP new software license revenues would have been up 11%, non-GAAP new software license revenues would have been up 12% and both GAAP and non-GAAP hardware systems products revenues would have been down 13%.

For fiscal year 2012, GAAP total revenues were up 4% to $37.1 billion, while non-GAAP total revenues were up 4% to $37.2 billion. GAAP new software license revenues were up 7% to $9.9 billion. Non-GAAP new software license revenues were up 8% to $9.9 billion. GAAP software license updates and product support revenues were up 10% to $16.2 billion, while non-GAAP software license updates and product support revenues were up 9% to $16.3 billion. Both GAAP and non-GAAP hardware systems products revenues were $3.8 billion. GAAP operating income was up 14% to $13.7 billion, and GAAP operating margin was 37%. Non-GAAP operating income was up 8% to $17.2 billion, and non-GAAP operating margin was 46%. GAAP net income was up 17% to $10.0 billion, while non-GAAP net income was up 10% to $12.5 billion. GAAP earnings per share were $1.96, up 18% compared to last year while non-GAAP earnings per share were up 11% to $2.46.

“Our record-breaking fourth quarter featured several all-time highs for Oracle: new software license sales of $4 billion, total software revenue of $8 billion, total revenue of $11 billion, and EPS of 82 cents,” said Oracle President and CFO, Safra Catz. “For the fiscal year, we also set all-time highs for operating margins of 46%, and operating cash flow of $13.7 billion.”

“Our engineered systems business is now operating at well over a billion dollar revenue run rate,” said Oracle President, Mark Hurd. “For the year, the Exadata, Exalogic, Exalytics, SPARC SuperCluster and the Oracle Big Data Appliance product group grew over 100% year-over-year.”

“The development of Oracle Cloud is strategic to increasing the size and profitability of Oracle’s software business,” said Oracle Chief Executive Officer, Larry Ellison. “Our Oracle Cloud SaaS business is nearly at a billion dollar revenue run rate, the same size as our engineered systems hardware business. The combination of engineered systems and the Oracle Cloud will drive Oracle’s growth in FY 2013.”

The Board of Directors also declared a quarterly cash dividend of $0.06 per share of outstanding common stock. This dividend will be paid to stockholders of record as of the close of business on July 13, 2012, with a payment date of August 3, 2012.

Oracle also announced that its Board of Directors authorized the repurchase of up to an additional $10.0 billion of common stock under its existing share repurchase program in future quarters.

After hours, the stock is up to $28.40.

-

CWS Market Review – June 1, 2012

Eddy Elfenbein, June 1st, 2012 at 9:18 amThis morning, the government reported that the U.S. economy created just 69,000 jobs in May. This was well below expectations, and last month’s numbers were revised downward as well. The national employment rate ticked up from 8.1% to 8.2%. That’s just lousy, and it’s yet more data in a run of below-average economic news.

Before anyone gets too worked up over the jobs numbers, let me remind you that these are very imprecise estimates. The media breathlessly reports these figures as if they were handed down from Mount Sinai, but as Jeff Miller notes, the margin of error for these reports is exceedingly wide. The numbers are also subject to large revisions in the coming months.

Still, we have to adjust ourselves to the reality that the economy isn’t doing as well as most folks believed a few weeks ago. The jobs gains simply aren’t there. The other negative economic news this week included a sharp drop in consumer confidence, a rise in first-time claims for unemployment insurance and a negative revision to first-quarter GDP. The last one is old news since we’re already into the back-end of the second quarter.

Treasury Yields Hit an All-Time Low

I can’t say that I find the sluggish economic news surprising. In the CWS Market Review from two weeks ago, I wrote that economically sensitive cyclical stocks had been badly lagging the market. This is an important lesson for investors because by following the relative strength of different market sectors, we can almost see coded messages the market is sending us. In this case, investors were bailing out of cyclical stocks while the overall market wasn’t harmed nearly as much. Now we see why.

Since February 3rd, the S&P 500 is down by 2.6%, but the Morgan Stanley Cyclical Index (^CYC) is off by more than 11%. Looking at the numbers more closely, we can see that the Energy and Materials sectors have been sustaining the most damage. ExxonMobil ($XOM), for example, lost over $30 billion in market cap in May. The price for oil slid 17% for the month thanks to weak demand from Europe. Interestingly, the Industrials had been getting pummeled, but they’ve started to stabilize a bit in the past few weeks.

Tied to the downturn in cyclical stocks is the amazing strength of Treasury bonds. On Thursday, the yield on the 10-year Treasury bond got as low as 1.54% which is the lowest yield in the history of the United States. The previous low came in November 1945, and that’s when the government worked to keep interest rates artificially low. A little over one year ago, the 10-year yield was over 3.5%. Some analysts are now saying the yield could soon fall under 1%.

Don’t blame the Federal Reserve for the current plunge in yields. While the Fed is currently engaged in its Operation Twist where it sells short-term notes and buys long-term bonds, that program is far too small to have such a large impact on Treasury rates. The current Treasury rally is due to concerns about our economy and the desire from investors in Europe to find a safe haven for their cash. I strongly urge investors to stay away from U.S. Treasuries. There’s simply no reward for you there. Consider that the real return is negative for TIPs that come due 15 years from now. Meanwhile, the S&P 500 is going for 11 times next year’s earnings estimate. That translates to an earnings yield of 9%.

The latest swing in opinion seems to believe that Greece will give staying in the euro another shot. It’s hard to say what will happen since we have new elections in two weeks. Still, I think the country will at least try to keep the euro. The reason is that Greece’s economy is very small compared to the rest of Europe. If it leaves the euro, the headaches involved will be too much to bother with.

The real issue confronting Europe is Spain’s trouble which can’t so easily be swept under the rug. Their banking system is a mess. Think of us as reliving 2008 with Greece being Lehman Brothers and Spain being AIG. The major difference with this analogy is that Europe may not be able to bail out Spain even if it wanted to. So far, the Spanish government is putting up a brave front and is strongly resisting any form of a bailout. The politicians there obviously see how well that played out with public opinion in Greece.

In Germany, the two-year yield just turned negative (ours is still positive by 27 basis points). While much of Europe is in recession (unemployment in the eurozone is currently 11%), and China’s juggernaut is slowing down (this year may be the slowest growth rate since 1999), there’s still little evidence that the U.S. economy is close to receding. We’re just growing very, very slowly.

The stock market performed terribly in May. The Dow only rose five times for the month which is the fewest up days in a month since January 1968. The S&P 500 had its worst month since last April. But we need to remember that the U.S. dollar was very strong last month. It’s probably more correct to say that the dollar is less weak than everybody else, but that still translates to high prices for dollars. So in terms of other currencies, the U.S. equity market didn’t do so poorly.

Jos. A. Bank Clothiers Disappoints

We had one Buy List earnings report this past week: Jos. A. Bank Clothiers ($JOSB). The company had already told us that the quarter was running slow, so that muted my expectations. For their fiscal Q1, Joey Bank earned 53 cents per share which missed Wall Street’s consensus by nine cents per share. Quarterly revenue rose by 4.2% to $208.91 million. But the important metric to watch is comparable stores sales, and that fell by 1%. That’s not good.

Shares of JOSB dropped on Wednesday and stabilized some on Thursday. I’m not happy with how this company is performing and it’s near the top of my list for names to purge from the Buy List for next year. Still, I won’t act rashly. The company has said that this quarter is off to a good start: “So far the second quarter has started out much better than the first quarter. For May, both our comparable store sales and Direct Marketing sales are up compared to the same period last year, continuing the positive trend established in the last five weeks of the first quarter. However, Father’s Day, the most important selling period of the quarter, is still ahead of us.” I’m lowering my buy price from $52 to $48 per share.

Shares of Bed Bath & Beyond ($BBBY) broke out to a new all-time high this past week. On Tuesday, the stock got as high as $74.67. It’s our #1 performer for year and is up nearly 25% YTD. The stock is an excellent buy below $75 per share, but I won’t move the buy price until I see the next earnings report which is due out on June 20th.

Two other Buy List stocks I like right now are Ford ($F) and Oracle ($ORCL). Ford has been doing so well that it’s actually having a hard time keeping up with demand. I’m expecting a strong earnings report from Oracle later this month. The May quarter, which is their fiscal fourth, is traditionally their strong quarter. Oracle is an excellent buy under $30 per share.

Before I go, let me say a quick word about Facebook ($FB). In last week’s CWS Market Review, I told you to stay away from the stock, and I was right as the shares have continued to fall. The stock got as low as $26.83 on Thursday. I don’t think Facebook is an attractive stock to own until it reaches $17 to $20 per share. Until then, keep your distance!

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – May 25, 2012

Eddy Elfenbein, May 25th, 2012 at 7:02 amBoy has May been a frustrating month for stocks! The S&P 500 nearly went for an entire month without two up days in a row. We finally ended that run this week but the mess in Greece seems to be getting worse, and Facebook ($FB) had one of the worst initial public offerings in years. This IPO was a disaster for individual investors.

Fortunately, the stock market regained some of its footing this week. The S&P 500 managed to rise four days in a row and closed at 1,320.68 on Thursday. The index is still down nearly 7% from the four-year high it reached in early April. What’s not getting a lot of attention is that analysts have been increasing their earnings estimates for next year. The S&P 500 is currently going for about 11 times next year’s earnings estimate. That’s a good bargain, but I prefer to be skeptical about earnings estimates that far into the future. Still, it’s an interesting trend to note.

In this week’s CWS Market Review, I’ll talk about some of the issues surrounding Facebook’s IPO and I’ll tell you why I think the stock is a terrible, rotten, awful deal for investors. This IPO almost perfectly captures everything that’s wrong with Wall Street today.

As messy as things seems to be, the good news for us is that well-run companies are still doing well. On our Buy List, for example, we had a very nice earnings report this week from Medtronic ($MDT). In a few weeks, I expect to see the company raise its dividend for the 35th year in a row. Other standouts from our Buy List include Bed Bath & Beyond ($BBBY) which is close to a new all-time high. Also, Reynolds American ($RAI) has snapped back very impressively. But first, let’s take a closer look at the stock that’s on everyone’s mind: Facebook.

Don’t Invest in Facebook

Last Friday, Facebook ($FB) started trading as public company. This was the dream of all the investors who put money into the social networking company that was started in a Harvard dorm room eight years ago. Even before the shares started trading, there were problems. This was the second-largest IPO in U.S. history and the market was flooded with orders. The heavy demand caused trading in FB to be delayed for 30 minutes.

Almost every aspect of this offering was a mess. And what’s especially frustrating is that at every turn, individual investors were punished. Facebook simply got greedy and asked for too much money. However, I can’t put too much blame on a company for trying to get money for cheap. However, I can blame the bankers for not serving the best interest of their clients. The entire syndicate misjudged the interest in Facebook.

We also learned that the underwriters cut their estimates on Facebook in the middle of the roadshow. That’s outrageous! And we still don’t even know why but it apparently led to some major investors jumping ship. It turns out that some institutional investors were told of the downgrade while others were not. Meanwhile, many inexperienced retail investors bought Facebook using market orders. Ugh, that’s a big mistake. These were most likely the orders that were filled as Facebook ran up to $45 shortly after it started trading. Trust me: Never, never, never buy an IPO using a market order. You will get a terrible fill.

The fun in Facebook didn’t last long, and the stock dipped below $31 on Tuesday. Here’s a stat for you: Every penny in FB is worth $5 million for Mark Zuckerberg. Measuring from the stock’s high point, Zuck lost $7 billion. Between you and me, I think he’ll be okay.

Now let’s look at some numbers and we can clearly see that Facebook is wildly over-valued. The Street currently thinks FB can earn 65 cents per share next year. That’s almost certainly too low. To be safe, let’s say that Facebook can earn $1 per share in 2013. The estimated five-year earnings growth rate for Facebook is 35.9%.

If we take my patented “World’s Simplest Stock Valuation Measure,” (PE Ratio = Growth Rate/2 + 8 ) we get a fair value for Facebook of $25.95. This isn’t a precise measure for every stock, but it’s a quick and easy way to get a reasonable estimate. Still, this means that Facebook is over-valued by over 20$. The shares aren’t even close to being a good buy.

I can’t say that Facebook will suddenly plunge to $26, but the true value will eventually win out. My advice is to stay away from Facebook.

Look Forward to Medtronic’s 35th Straight Dividend Increase

On Tuesday, Medtronic ($MDT) reported fiscal Q4 earnings of 99 cents per share. That was one penny more than Wall Street was expecting and a 10% increase over last year. In February, Medtronic told us to expect Q4 earnings to range between 97 cents and $1 per share.

I was impressed by Medtronic this past year. Two years ago, the company had to lower its full-year forecast a few times. Even though the overall downgrade wasn’t that much, the Street was highly displeased. But last year, Medtronic gave us a full-year forecast of $3.43 to $3.50 per share and they stuck with it all year. In the end, the company earned $3.46 for the year which was right in the range.

The good news for Medtronic is that demand is returning for their pacemakers and defibrillators. For Q4, Medtronic’s revenues rose by 4% to $4.3 billion. For 2013, Medtronic sees earnings ranging between $3.62 and $3.70 per share. The Street was expecting $3.66 per share. Officially, that will be reported as “inline guidance” but I’m very pleased with it.

Sometime next month, I expect Medtronic will raise its quarterly dividend. The current payout is 24.25 cents per share which works out to a yearly dividend of 97 cents per share (or 2.62%). If I had to guess, I think it will be a modest increase—to 25 or 26 cents per share. This will mark their 35th-straight dividend increase. Medtronic is a solid buy anytime the stock is below $40 per share.

Looking at some of our other Buy List stocks, Ford ($F) had some very good news when Moody’s raised their debt to investment grade. This will help lower their borrowing costs. Few things can cut into a company’s profit margin like escalating borrowing costs. Three years ago, Ford needed to sell 3.4 million units in North America to break even. Today that figure is down to 1.8 million. I think Ford should be a $20 stock.

In last week’s CWS Market Review, I highlighted some of our higher-yielding stocks. I’m happy to see that Reynolds American ($RAI) responded by reaching its highest closing price in two months. RAI currently yields 5.63%.

The media paid a lot of attention to a patent trial that Oracle ($ORCL) brought against Google ($GOOG). I never thought this was a big deal. Oracle claimed that Google infringed on some of their patents with the Android software. The jury said no. One expert said the trial was “something like a near disaster for Oracle.” Financially, this is minor. Oracle continues to be a very strong buy here.

That’s all for now. The stock exchange will be closed on Monday for Memorial Day. I hope everyone has an enjoyable three-day weekend. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – May 11, 2012

Eddy Elfenbein, May 11th, 2012 at 7:40 amThe stock market finally broke out of its trading range this week. Unfortunately, it was to the downside. More troubles from Europe, including shake-up elections in France and Greece, helped the S&P 500 close Wednesday at its lowest level in nine weeks. However, the initial jobless claims report on Thursday helped us make up a little lost ground.

In this week’s CWS Market Review, I’ll explain why everyone’s so freaked out (again) by events in Europe. I’ll also talk about the latest revelations from JPMorgan Chase ($JPM). The bank just told investors that it lost $2 effing billion on effing derivatives trades gone effing bad. I’ll have more to say on that in a bit. We also had more strong earnings reports from our Buy List stocks DirecTV ($DTV) and CA Technologies ($CA), and shares of CR Bard ($BCR) just hit a 10-month high.

Greece Is Bad but the Real Story Is Spain

But first, let’s get to Greece. Here’s the 411: The bailout deals reached by Greece required them to get their fiscal house in order. The problem is that no one asked the voters. Now they’ve been asked and the voters don’t like it at all. Actually, I understated that—they’re royally PO’d.

Greece is massively in debt. They owe the equivalent of Switzerland’s entire GDP. Politically, everything has been upended. In Greece, there are two dominant political parties and both got creamed in the recent election. Seventy percent of Greeks voted for parties opposed to the bailouts. Mind you, the supposed beneficiaries of the bailout are the ones most opposed to them.

Since there was no clear-cut winner in the election, folks are scrambling to build a governing coalition. This won’t be easy. Whatever they do come up with probably won’t last long and they’ll need new elections. As investors, we fortunately don’t need to worry about the minutia of Greek politics. The important aspect for us is that the Greek public wants to ditch the austerity measures into the Aegean, but that means giving up all that euro cash that was promised them.

My take is that the bigwigs in Greece will do their best to stay in the euro but try to get the bailout terms renegotiated. That puts the ball in Europe’s court, and by Europe, I mean Germany. Too many people have invested too much to see the European project go down in flames. I think the Europeans will ultimately make some concessions in order to keep the euro going. If one country leaves the euro, it sets a precedent for others to leave—and that could start a flood.

As bad of a shape as Greece is in, they’re small potatoes (olives?). The real story is what’s happening in Spain. For the fourth time, the country is trying to convince investors that its screwed-up banks aren’t screwed-up. The problem is that Spanish banks are loaded down with toxic real estate debt.

The Spanish government is trying to prop up the banks, but it may delay the problem rather than solve it. It just took control of Bankia which itself was formed when the government forced some smaller banks together in an effort to save them. What’s most troubling about the problems in Spain is that the future is so cloudy. I really can’t say what will happen. Nouriel Roubini said that Spain will need an external bailout. If so, that may lead to a replay of what we’re seeing in Greece, except it would be much, much larger.

The immediate impact of the nervousness from Europe is that it spooked our markets. On May 1st, the Dow got to its highest point since 2007. The index then fell for six straight days which was its longest losing streak since August. But here’s the key: not all stocks are falling in the same manner.

Investors have been rushing away from cyclical sectors and towards defensive sectors. For example, the Utilities Sector ETF ($XLU) closed slightly higher on Thursday than it did on May 1st. Low-risk bonds are also doing well. Two months ago, the 30-year Treasury nearly broke above 3.5%. This past week, it dipped below 3%. On Thursday, Uncle Sam auctioned off $16 billion in 30-year bonds and it drew the heaviest bidding in months.

The trend towards defensive stocks is holding back some of our favorite cyclical stocks like Ford ($F), Moog ($MOG-A) and AFLAC ($AFL). Let me assure investors that these stocks are very good buys right now and I expect them to rally once the skies clear up.

JPMorgan Chase Reveals Huge Trading Losses

Now let’s turn to some recent news about our Buy List stocks. The big news came after Thursday’s closing bell when JPMorgan Chase ($JPM) announced a special conference call. CEO Jamie Dimon told investors that the bank took $2 billion in trading losses in derivatives and that it could take another $1 billion this quarter. Jamie, WTF?

For his part, Dimon was clear that the bank messed up. This is very embarrassing for JPM and frankly, I don’t expect this type of mismanagement from them. The stock will take a big hit from this news, but it doesn’t change my positive outlook for the bank. (Matt Levine at Dealbreaker has the best explanation of the losses: “This was not driven by the market moving against them (though it seems to have); it was driven by them getting the math wrong”).

As ugly as this is, it’s not a reflection of JPM’s core business operations. Sure, it’s terrible risk-management. But as far as banking goes, JPM is in good shape. Don’t be concerned that JPM faces a similar fate as the banks in Spain. They don’t. In fact, most banks in the U.S. are pretty safe right now. Warren Buffett recently contrasted U.S. banks with European banks when he said that our banks have “liquidity coming out of their ears.” He’s right. JPMorgan Chase remains a very good buy up to $50 per share.

Bed Bath & Beyond ($BBBY) surprised us this week by buying Cost Plus ($CPWM) for a half billion dollars. The deal is all-cash which is what I like to hear. The best option for any company is to pay for an acquisition without incurring new debt.

BBBY said they expect the deal to be slightly accretive. That means that BBBY is “buying” CPWM’s earnings at a price less than the going rate for BBBY’s earnings. As a result, the deal will show a net increase to BBBY’s bottom line for this year. The press release also said: “Bed Bath & Beyond Inc. continues to model a high single digit to a low double digit percentage increase in net earnings per diluted share in fiscal 2012.” I’m keeping my buy price at $75.

Now let’s look at some earnings. On Monday, Sysco ($SYY) had a decent earnings report although the CEO said the results “fell short of our expectations.” Sysco is a perfect example of a defensive stock since the food service industry isn’t adversely impacted by a downturn in the business cycle. The key with investing in Sysco is the rich dividend. The company has increased their payout for 42 years in a row, and I think we’ll get #43 later this year, although it will be a small increase. Going by Thursday’s close, Sysco yields 3.87%. Sysco is a good buy up to $30.

DirecTV ($DTV) reported Q1 earnings of $1.07 per share. That’s a nice jump over the 85 cents per share they earned a year ago. DirecTV’s sales rose 12% to $7.05 billion which was $10 million more than consensus. The company has done well in North America, but they see their future lying in Latin America. DTV added 81,000 subscribers in the U.S. last quarter. In Latin America, they added 593,000. Yet there are more than twice as many current subscribers in the U.S. as there are in Latin America. Last year, revenue from Latin America revenue grew by 42%.

DirecTV has projected earnings of $4 per share for this year and $5 for 2013. This earnings report tells me they should have little trouble hitting those goals. The shares are currently going for less than 11 times this year’s earnings estimate. They’re buying back stock at the rate of $100 million per week. DirecTV is a solid buy below $48 per share.

On Thursday, CA Technologies ($CA) reported fiscal Q4 earnings of 56 cents per share. That’s a good result and it was four cents better than Wall Street’s estimates. For the year, CA made $2.27 per share which is a nice increase over the $1.92 from last year. For fiscal 2013, CA sees revenues ranging between $4.85 billion and $4.95 billion and earnings-per-share ranging between $2.45 and $2.53. I’m impressed with that forecast, but Wall Street had been expecting revenues of $5 billion and earnings of $2.50 per share. The stock was down in the after-hours market on Thursday, but I don’t expect any weakness to last. CA is going for less than 11 times the low-end of their forecast.

A quick note on Oracle ($ORCL): The stock took a hit this week on the news of Cisco’s ($CSCO) lousy outlook. Oracle is also in the middle of a complicated intellectual property trial with Google ($GOOG). I doubt the trial will go Oracle’s way, but the dollar amounts involved are pretty small compared with the size of these two firms. On Thursday, Oracle fell below $27 for the first time since January. That’s a very good price. The stock is a good buy up to $32.

That’s all for now. Wall Street will be focused on Facebook’s massive IPO scheduled for next Friday. The stock might fetch 99 times earnings. I’m steering clear of this one. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Discussion of Oracle’s Earnings

Eddy Elfenbein, March 21st, 2012 at 9:27 am -

Oracle’s Q4 Guidance

Eddy Elfenbein, March 21st, 2012 at 1:10 amThis is from today’s earnings call:

So here goes with the guidance. New software license revenue growth is expected to range from 1% up to 11% up in constant currency. Subtracting the 3 points, you get to negative 2% to 8% in U.S. dollars currently. Now the Hardware business has not turned out to be very seasonal, in fact. So I’m going to give my guidance really sequentially. And what we’re seeing for next quarter is hardware revenues a little more — basically, the low end of my range would be somewhere about where it is this past quarter, Q3, to potentially as much as $100 million to $110 million above where we closed this past quarter. That would be somewhere between I guess $870 million, let’s say, to as high as $980 million.

So total revenue growth on a non-GAAP basis is expected to range from 1% to 5% in constant currency, subtracting the 3 points, it would be negative 2% to 2% in U.S. dollars. On a GAAP basis, we expect total revenue growth from 1% — sorry about that. Non-GAAP EPS is expected — oh, excuse me. On a GAAP basis, we expect total revenue growth basically in the same range as non-GAAP. Non-GAAP EPS is expected to be somewhere between $0.78 and $0.83 in constant currency. That would be up from $0.75 last year or $0.76 to $0.81 in reported dollars. GAAP EPS is expected to be $0.65 to $0.70 in constant currency. That would be up from $0.62 last year, and $0.62 to $0.67 in U.S. dollars. This guidance assumes a GAAP tax rate of 25% and a non-GAAP rate of 24.5%. That would be up from a little over 23%, I think, last year.

-

Oracle Earns 62 Cents Per Share

Eddy Elfenbein, March 20th, 2012 at 4:08 pmNice earnings. The Street was expecting 56 cents per share.

Oracle Corporation today announced fiscal 2012 Q3 GAAP total revenues were up 3% to $9.0 billion, and non-GAAP total revenues were up 3% to $9.1 billion. Both GAAP and non-GAAP new software license revenues were up 7% to $2.4 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 8% to $4.1 billion. Both GAAP and non-GAAP hardware systems products revenues were down 16% to $869 million. GAAP operating income was up 11% to $3.3 billion, and GAAP operating margin was 37%. Non-GAAP operating income was up 8% to $4.2 billion, and non-GAAP operating margin was 46%. GAAP net income was up 18% to $2.5 billion, while non-GAAP net income was up 13% to $3.1 billion. GAAP earnings per share were $0.49, up 20% compared to last year while non-GAAP earnings per share were up 15% to $0.62. GAAP operating cash flow on a trailing twelve-month basis was $13.5 billion.

“Oracle is on track to deliver the highest operating margins in our history this year,” said Oracle President and CFO, Safra Catz. “Oracle can achieve these record margins as an integrated hardware and software company because we are focusing on high margin systems where hardware and software are engineered to work together.”

I was wrong about the quarterly dividend. It’s still at six cents per share. The stock is up 2.8% after hours.

-

After Market Updates

Eddy Elfenbein, February 21st, 2012 at 9:54 pmUltimately, the stock market gave back some of its gains this afternoon. The S&P 500 closed at 1,362.21 which was just shy of the post-crash high close of 1,363.61 from May 2nd of last year.

Today’s market was split between large-cap stocks which fared the best and small-cap stocks which fared the worst. The small-cap Russell 2000 was down 0.66% today while the S&P 500 was up 0.98 points or 0.07%. The mega-cap S&P 100 was up 0.27%.

Interestingly, shares of Apple ($AAPL) gained $12.73 or 2.54%. That’s a market cap gain of $11.87 billion. Each point in the S&P 500 is worth $9.05 billion. That means that Apple’s gain was worth 1.31 points in the S&P 500. The index gained 0.98 points so without Apple, the index would have closed just slightly lower today.

In Buy List news, Johnson & Johnson‘s ($JNJ) CEO resigned:

William C. Weldon, who presided over Johnson & Johnson during one of the most tumultuous periods in its history, will step down as chief executive in April, the company announced Tuesday.

Alex Gorsky, head of the medical device and diagnostics business, will take over as chief executive. Mr. Weldon will remain as chairman.

The news of Mr. Weldon’s retirement comes as Johnson & Johnson has struggled to emerge from a swarm of product recalls, manufacturing lapses and government inquiries that tarnished the name of a company that was once one of the nation’s most trusted household brands. In 2010, the company recalled millions of bottles of liquid children’s Tylenol and other medications, as well as tens of thousands of artificial hips and millions of contact lenses.

Much of the blame for Johnson & Johnson’s stumbles fell on Mr. Weldon, the son of a Broadway stagehand and seamstress who became chief executive in 2002 after spending his entire career at the company. Critics said the company’s once-vaunted attention to quality slipped under his watch. The company said in a statement that neither Mr. Weldon nor Mr. Gorsky was available for comment.

Oracle ($ORCL) was downgraded by JMP Securities. They’re paring back their earnings estimates but they add that the stock is not unreasonably valued.

WSJ‘s “Market Beat” notes that DirecTV ($DTV) may soon join the streaming bandwagon.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His