Posts Tagged ‘orcl’

-

Oracle and CR Bard

Eddy Elfenbein, December 21st, 2011 at 10:03 amThe market is down about 0.5% this morning but there’s some rough news for our Buy List.

Oracle‘s ($ORCL) earnings report wasn’t what I expected and it also fell short of what the company told us. That’s a very bad move on their part. Their shares are getting hacked this morning. Oracle has been as low as $25 per share this morning which is a 14% haircut.

As disappointed as I am in Oracle, I think a three-penny miss shouldn’t translate into a 400-penny sell-off. Today’s selling is very overblown but this is what you get when you mislead the Street.

The other news is for one of our new stocks for 2012, CR Bard ($BCR). In the company’s analyst call yesterday, they lowered their forecast for 2012 due to the impact of buying Lutonix:

Without the impact of Lutonix our guidance would have been 7% to 8% adjusted EPS growth. As our press release noted today’s transaction will dilute the 2012 adjusted EPS by about $0.25 or 400 basis points of growth. So our 2012 all-in guidance is for between 3% and 4% EPS growth excluding items that affect comparability. I would also note that the lack of the R&D tax credit in 2012 cost us about a point of EPS growth.

Bard should earn about $6.38 per share for 2011. So today’s news means that they should earn between $6.57 to $6.63 per share.

-

Oracle Earns 54 Cents Per Share

Eddy Elfenbein, December 20th, 2011 at 4:14 pmA horrible earnings report from Oracle ($ORCL). The company just reported fiscal Q2 earnings of 54 cents per share which was below the company’s range of 56 to 58 cents per share. The Street had been expecting 57 cents and I was expecting at least 60 cents.

Oracle Corporation today announced fiscal 2012 Q2 GAAP and non-GAAP total revenues were up 2% to $8.8 billion. Both GAAP and non-GAAP new software license revenues were up 2% to $2.0 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 9% to $4.0 billion. Both GAAP and non-GAAP hardware systems products revenues were down 14% to $953 million. GAAP operating income was up 12% to $3.1 billion, and GAAP operating margin was 35%. Non-GAAP operating income was up 3% to $3.9 billion, and non-GAAP operating margin was 45%. GAAP net income was up 17% to $2.2 billion, while non-GAAP net income was up 6% to $2.8 billion. GAAP earnings per share were $0.43, up 17% compared to last year while non-GAAP earnings per share were up 6% to $0.54. GAAP operating cash flow on a trailing twelve-month basis was $13.1 billion.

“Non-GAAP operating margins increased to 45% in Q2,” said Oracle President and CFO, Safra Catz, “and we expect those margins to keep growing. Operating cash flow over the last twelve months grew to $13.1 billion; that’s up a remarkable 45% compared to the preceding twelve month period.”

“We have expanded our worldwide sales capacity by adding over 1,700 sales professionals in the first half of this fiscal year,” said Oracle President, Mark Hurd. “We believe that this increase in our field organization combined with innovative new products like Fusion Cloud ERP and Cloud CRM will enable solid organic growth in the second half of this year.”

“Sales of our engineered systems accelerated in Q2,” said Oracle CEO, Larry Ellison. “Exadata growth was well over 100% compared to last year, and Exalogic grew more than 100% on a sequential basis. We shipped our first SPARC SuperCluster in Q2 and expect to begin deliveries of our Exalytics system and the Oracle Big Data Appliance in Q3.”

This report is just ugly. Oracle told investors to expect new software license sales to grow by 6% to 16%. Instead, it was 2%. I knew hardware was going to be rough. Oracle said to expect 0% to -5% sales. Instead, hardware sales dropped by 14%. The stock is down about 8% after hours.

-

CWS Market Review – December 2, 2011

Eddy Elfenbein, December 2nd, 2011 at 8:04 amIf you were expecting a calm, reasoned financial market going into the holidays, I’m afraid you may be disappointed. On Wednesday, the Dow soared 490 points for its single-best day in nearly three years. This came after the stock market suffered its worst Thanksgiving week since 1932.

Usually, when the market does as well as it did on Wednesday, it’s following a big down day. But Wednesday’s move came after a slight rally on Tuesday. The S&P 500 gained 4.33% on Wednesday which was its eighth-best gain following an up day in the last 70 years.

I was pleased to see that stocks only finished modestly lower on Thursday. The S&P 500 is now back above its 50-day moving average and it’s only a small push from breaking above its 200-day moving average.

In this issue of CWS Market Review, I want to delve into some of the reasons for the market’s abrupt about-face. I’ll also tell you how to position your portfolios for the last few weeks of 2011. Remember that historically, the best time of year for stocks is a 17-day run from December 22nd to January 7th. More than 40% of the Dow’s historical gain has come during this period which is less than 5% of the calendar year.

The catalyst for Wednesday’s rally was—we’re told—the news that the Fed teamed up with other central banks to provide more liquidity for the global financial system. Allow me to explain; it’s all very simple. The Federal Reserve and other central banks agreed to lower the pricing on the existing temporary U.S. dollar liquidity swap arrangements from OIS +100 basis points to…ugh…getting sleepy…can’t…stay…awake…zzzzzzzz.

Look, forget all the mumbo-jumbo. The stock market did not see one of its best rallies in decades because some bureaucrats put out a press release. Thankfully, they’re not that important. Instead, the market rallied because the market’s cheap. It’s that simple. The problem is that no one wanted to be first in the pool. I don’t blame them. Playing the bear had been the winning trade for three-straight weeks. Screaming you’re scared from the rooftops is the only trade that’s made anyone any money. Plus, our friends across the pond have been doing their best to show that they’re as clueless on how to run their economies as we are in running ours.

To borrow from Comrade Trotsky, you may not be interested in the European financial crisis but the European financial crisis is interested in you. The news from Europe has been the main driver of the U.S. market for the last several weeks. But as I mentioned in the CWS Market Review from two weeks ago, our markets are slowly disentangling themselves from the mess in Europe.

Just look at the decent economic news we’ve had recently. Please note that I’m not saying “good news,” just that there’s zero evidence of an imminent Double Dip. The fact that we can say that in December would have surprised a lot of folks this summer. For example, this past earnings season was pretty good. Thursday’s ISM report was decent. The Chicago PMI just hit a seven-month high. I’m writing this in the wee hours of Friday morning so I don’t know what the jobs report will say (check the blog for updates), but this week’s ADP report was very encouraging.

Next Friday will be the big EU summit. This is it—Zero Hour. The Germans want more fiscal integration, and I think they’ll get it (of some sort). The Germans finally got religion once one of their bond auctions fizzled. When the country that’s supposed to bail everyone else out can’t get a loan, well…then it’s time to worry.

But now the Germans have stopped dragging their heels. Anyone with a sense of history will have to appreciate the recent quote from Radek Sikorski: “I will probably be the first Polish foreign minister in history to say so, but here it is: I fear German power less than I am beginning to fear German inactivity.” Strange days, no?

For Europe, this is beginning to feel like the fall of 2008. France’s AAA credit rating is on life support. Despite the bond auction disaster, the German one-year note recently went negative meaning that investors would prefer to take a loss just so they can be a creditor to Germany. This is exactly the kind of hysteria that’s been rattling our markets since August. It’s a mystical aura of fear, and that’s masking a truly inexpensive American market (Ford’s at 5.6 times 2012 earnings!)

Now that everyone’s been suitably freaked out, they can finally do something. In fact, we’re starting to get an idea of what the game plan will look like. The basics are that Germany wants the ECB on a tight leash while it wants to set hard rules for how budgeting is done in the Euro zone. No surprises there. I suspect the Germans may give up their opposition to joint euro-bonds if the member states agree to some sort of debt-reduction fund. I’m not sure of the details, but something the market likes will come out of the summit. That’s not a guess. There’s no other alternative.

But this crazy correlation we’ve had to Europe makes no sense. Here in the U.S., investors are quietly warming up to risk. We’ve already seen high-yield spreads in the U.S. begin to narrow as Treasury yields have climbed. Since December 23rd, the yield on the 30-year Treasury has risen by 30 basis points to 3.12%. The 10-year yield is up to 2.11% which is its highest yield in more than one month. As recently as July 25th, the 30-year was at 4.31%.

Now let’s turn to some recent news from our Buy List. On Tuesday, Jos. A. Bank Clothiers ($JOSB) reported very good earnings for its fiscal third quarter. The company earned 54 cents per share for the three months ending on October 29th, which was three cents better than Wall Street’s estimate.

JOSB’s business continues to hum along: earnings grew by 19% last quarter and revenues rose by more than 20%. The company has now reported higher earnings in 40 of its last 41 quarters including the last 22 in a row. However, there was one hitch. In the earnings report, JOSB warned that the fourth quarter “has started out more slowly than we had planned.”

The market didn’t like that at all and chopped 3.7% off the stock on Wednesday in the face of a big rally plus another 2.4% on Thursday. Until we hear more, I’m inclined to side with Joey Banks. This is a very solid company. Some of you may recall six months ago when the market slammed JOSB for a 13% one-day loss after it missed earnings by—are you ready?—one penny per share. JOSB is a very good buy below $54 per share.

In the CWS Market Review from October 14th, I said that I expected Becton, Dickinson ($BDX) to soon raise its dividend for the 39th year in a row. Sure enough, Becton came through and announced a 9.8% increase dividend increase on November 22nd. The new quarterly dividend is 45 cents per share and based on Thursday’s market close, BDX now yields 2.43%. There aren’t many stocks that can boast a dividend streak like Becton’s. Honestly, the stock is a bit pricey here in the low $70s. My advice is: don’t chase it. Instead, wait for a pullback below $65 before buying BDX.

Last week, Medtronic ($MDT) reported fiscal Q2 earnings of 84 cents per share which was two cents better than estimates. This is pretty much what I expected. Two weeks ago I wrote that “they can beat by a penny or two.” I have to explain that the market has dismally low expectations for Medtronic even though the company is still doing well with pacemakers and insulin pumps. The trouble spot is Infuse, its bone growth product used in spinal fusions. Sales for Infuse dropped by 16% last quarter.

The key for us is that Medtronic also reiterated its full-year EPS forecast of $3.43 to $3.50 per share. This means the stock is going for just over 10 times earnings. I’m raising my buy price for Medtronic to $40 per share.

On November 22nd, Gilead Sciences ($GILD) stunned Wall Street when it announced that it’s buying Pharmasset ($VRUS) for $11 billion. That’s an insanely rich price for a company that doesn’t have any products on the market yet. (I had to reread that sentence just now after typing it. Yep, it’s still nuts.)

So what does Pharmasset have? The company is pretty far along in developing oral drugs for hepatitis C. That could be a very lucrative market. Still, I think this was a terrible move on Gilead’s part. This is a business deal made out of fear rather than trying to spot an opportunity. Gilead was simply nervous that someone else would snatch up Pharmasset. I very much doubt that Gilead will be on our Buy List next year.

You may have noticed that Nicholas Financial ($NICK) has been especially volatile of late. Why? I have no idea. There’s been no news. I suspect that it’s pure market jitters. Of course, it’s the market’s irrationality that helps us find bargains, so that means we have to deal with bad volatility as well. Over the last two weeks, little NICK has gone from $11.75 per share down to $10.01 and then back up to as much as $11.56 yesterday. I don’t have any more to say than “ride out the storm.” NICK is an excellent stock.

Some other stocks on our Buy List that look attractive include Oracle ($ORCL), Moog ($MOG-A) and Ford ($F). Oracle should be coming out with its fiscal Q2 earnings in two weeks. Ford just reported a 13% sales increase for November. Also, Reynolds American ($RAI) has recently broken out to a new 52-week high. The stock is currently our top-performing stock for the year (+28%). The shares currently yield 5.37% which is equivalent to 645 Dow points.

That’s all for now. Today is the big jobs report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’m going to unveil the 2012 Buy List on Thursday, December 15th. As usual, I’m only adding and deleting five stocks from the current list. (Low turnover is my BFF.) I won’t start tracking the new Buy List until the start of the year. I like to make the names known publicly beforehand so no one can claim I’m front-running the market somehow.

-

Oracle Is a Good Buy Here

Eddy Elfenbein, November 18th, 2011 at 12:15 pmHere’s a very short post.

Oracle ($ORCL) is a very good buy below $31 per share. People rightfully quibble that Oracle’s earnings are messy due to all their acquisitions. That’s true, but even after that, Oracle has often hit 15 times earnings. At that rate, the stock would hit $36 in six months.

-

CWS Market Review – September 23, 2011

Eddy Elfenbein, September 23rd, 2011 at 8:33 amOne day after the Federal Reserve announced “Operation Twist,” the stock market got absolutely slammed. The Dow was dinged for 391 points on Thursday and this comes on top of a 283-point haircut we took on Wednesday, most of which came after the Fed’s announcement.

In the last two days, the S&P 500 has shed 6%. The index closed Thursday’s trading session at 1,129.56 which is the lowest close in a month. We even hit an intra-day low of 1,114.22 which was below the recent closing low of August 8th (1,119.46). However, we haven’t pierced the intra-day low of 1,101.54 from August 9th. At least, not yet. The $VIX, also known as the Fear Index, shot up more than 10% on Thursday to close at 41.35 which is a one-month high.

So what’s going on?

In this issue of CWS Market Review, I’ll give you the low-down on the Fed’s plans and why the market reacted so negatively. Plus, I’ll update you on two very good earnings reports from our Buy List standouts, Oracle ($ORCL) and Bed Bath & Beyond ($BBBY). More importantly, I’ll highlight some outstanding high-yielding stocks that will help us weather the storm.

First, let’s take a closer look at Bernanke’s new plan to get the economy off the mat. At 2:23 pm on Wednesday, the Federal Reserve released its policy statement from this week’s meeting. In it, the Fed said it’s going to replace $400 billion of short-term debt in its portfolio with long-term Treasury debt.

The idea is to push long-term interest rates down with the hope of spurring more borrowing. Ideally, this will also help get the housing market going again. As I explained in the CWS Market Review from two weeks ago, economic recoveries are often led by the housing sector. The problem this time around is that housing is still flat on its back.

Bernanke & Co essentially downgraded the entire U.S. economy. The Fed aims to sell roughly three-fourths of the amount of short-term debt it holds. Investors concluded that if the Fed is going into long-term bonds, well…they might as well ride that wave. So they dumped stocks and crowded into Treasuries. By “crowded,” I mean a massive buying panic.

On Thursday, the yield on the 30-year Treasury plunged to 2.78%. That’s a drop of roughly 50 basis points from Wednesday afternoon. To put that in context, the Long-Term Bond ETF ($TLT) jumped from $114 to $123 in the same time period. (Remember that these are bonds. They’re supposed to be boring and stable.)

As dramatic as the 30-year bond’s drop was, the 10-year plunged to its lowest yield ever. On Thursday, the yield hit 1.72%. That’s a drop of 150 basis points since July 1st. We’re through the looking glass here, people.

I should point out that this recent action is slightly different from the fear trade that I’ve talked about before. The difference is that gold fell on Wednesday and it got hit hard yesterday which is a reflection that real short-term interest rates may rise from the Blutarsky levels they’re at right now. I doubt they’ll go very high, but the Fed is by far the largest player in the T-bill market.

As you might expect, the major losers on Thursday were the cyclical stocks. The Morgan Stanley Cyclical Index (^CYC) dropped 5.22% on Thursday to close at 762.10. Two months ago, the index was at 1,071.84. Both the Energy Sector ETF ($XLE) and Materials Sector ETF ($XLB) lost more than 5.6% on Thursday while defensive areas like Consumer Staples ($XLP) and Healthcare ($XLV) lost “only” 1.90% and 2.02% respectively. (That’s exactly why we call them defensive.)

The folks at Bespoke Investment Group point out that more than half of the stocks in the S&P 500 now yield more than the 10-year Treasury bond.

Some analysts on Wall Street are saying that Operation Twist is a really covert bailout of the big banks. I’m not cynical enough to say that’s the Fed intent, but it will certainly help the banks offload their holdings on Treasury bonds. But I’m doubtful that Operation Twist will spur more mortgage lending or even get people to refinance. Mortgage rates are already at 60-year lows. I don’t see how a few more basis points will help out troubled homeowners.

To be perfectly frank, I think this whole episode shows how limited the Fed’s powers really are. (At the Fed’s website, they included an FAQ on Operation Twist). David Kelly of JPMorgan Funds said, “Ben Bernanke is at least trying to do the right thing. He just doesn’t know what the right thing is.” Ouch!

Still, some of the big banks like Goldman Sachs ($GS) and Morgan Stanley ($MS) plunged to multi-year lows. Bank of America ($BAC) closed at $6.06 on Thursday; Warren Buffett’s warrants have a strike price of $7.14. Our Buy List mega-bank, JPMorgan Chase ($JPM), fell below $30 per share and it now yields 3.42%. JPM is still, by far, the healthiest of the major banks.

I honestly don’t see how Operation Twist will boost the economy, but I’m still not in the Double Dip camp. I think the most likely scenario is that the economy will bounce along at a 1% to 2% growth rate: not enough to get the labor market going but not slow enough to be an official recession.

As rough as this week was for the stock market, I’m happy to say that we had two very good earnings report from our Buy List. After the close on Tuesday, Oracle ($ORCL) reported earnings of 48 cents per share which was two cents better than Wall Street’s forecast.

I was actually expecting even more from Oracle. My mistake was that I didn’t foresee how weak their hardware business would be. Despite my over-optimism, the market reacted positively to the earnings report. On Wednesday, the shares got as high as $30.96. (Bear in mind that they were under $25 just one month ago.) The stock only broke down once the rest of the market did.

Oracle continues to be a very profitable company. Over the past 12 months, Oracle’s cash flow is up 46%. Wall Street was mostly upbeat on the earnings report. For their fiscal second-quarter, which ends in November, Oracle forecasts earnings of 56 – 58 cents per share. That’s a surprisingly narrow range. The Q2 from last year came in at 51 cents per share and that was a very strong quarter; Oracle cautioned investors that the comparisons are much tougher. I continue to rate Oracle a strong buy up to $30 per share.

While I was overly-optimistic on Oracle, I wasn’t optimistic enough on Bed Bath & Beyond ($BBBY). On Wednesday, the company reported fantastic second-quarter earnings of 93 cents per share. That was nine cents more than Wall Street was expecting.

This comes on top of a blow-out earnings report last quarter. BBBY also raised their full-year guidance for the second time this year. Originally, the company told us to expect earnings to grow by 10% – 15% for this year. Then after the big earnings report in June, they raised that forecast to 15% – 20%. Now they’ve bumped that up to 22% – 25%. That translates to full-year earnings of $3.74 – $3.84 per share. In business, good news often leads to good news. Businesses aren’t like ball players who have an “off night” or a “hot hand.” If there’s something good going on, it will tend to last.

At one point on Thursday, BBBY was one of only two stocks in the S&P 500 to be higher for the day. Thanks to Bed Bath & Beyond’s strong earnings and higher guidance, I’m raising my buy price to $60 per share. This is a very solid company.

Some other stocks on my Buy List that look particularly attractive right now (thanks to their high yields) include Abbott Labs ($ABT, yields 3.79%), AFLAC ($AFL, yields 3.75%), Johnson & Johnson ($JNJ, yields 3.68%), Reynolds American ($RAI, yields 5.85%), Sysco ($SYY, yields 4.00%) and Nicholas Financial ($NICK, yields 4.13%).

That’s all for now. Be sure to keep checking the blog for daily updates. Next week is the final week of the third quarter. We’ll also get another revision to the second-quarter GDP report. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Oracle’s Earnings Call

Eddy Elfenbein, September 21st, 2011 at 5:15 pmHere’s the guidance portion from yesterday’s earnings call from Oracle ($ORCL), courtesy of Seeking Alpha:

Now to the guidance. And as many of you remember, we had a great second quarter last year with New License up 21% on a non-GAAP basis and up 33% and GAAP EPS up 27%. So let me just say that again. New License was up 21%, non-GAAP EPS was up 33% and GAAP EPS was up 27%. So those are pretty tough comparisons, and we don’t expect much help from currency because at this point, it looks like only 1% stays where it is.

New Software License revenue growth is expected to range from 6% to 16% in growth. Hardware Product revenue growth is expected to range from flat to negative 5%. However, we do expect gross margins and profitability of our overall Hardware business to improve during the quarter as we continue to move away from selling low-margin commodity servers and focus on selling engineered systems like Exadata, Exalogic and SPARC Solaris system.

Total revenue growth on a non-GAAP basis is expected to range from 4% to 8%. On a GAAP basis, we expect total revenue growth of 5% to 9%. Non-GAAP EPS is expected to be somewhere between $0.56 and $0.58, up from $0.51 last year. GAAP EPS is expected to be $0.44 to $0.46. This guidance assumes a GAAP and non-GAAP tax rate of 27%. Of course, it may end up being different.

-

Oracle Breaks $30

Eddy Elfenbein, September 21st, 2011 at 10:34 amDespite my over-optimism, shares of Oracle ($ORCL) are having a good morning so far. The stock opened at $29.84 and has been as high as $30.63. Currently, the stock is at $30.21 which is a 6.56% gain from yesterday’s close. I’m still keeping my buy price at $30 per share.

-

Brent Thill on Oracle

Eddy Elfenbein, September 20th, 2011 at 7:55 pmHere’s a good discussion on Oracle‘s ($ORCL) earnings report. The stock is up to $29.29 after hours.

-

Oracle Earns 48 Cents Per Share

Eddy Elfenbein, September 20th, 2011 at 4:06 pmOracle ($ORCL) just reported its fiscal Q1 earnings of 48 cents per share. In my eyes, this was a disappointment. I was expecting earnings of at least 51 cents per share. The Street’s consensus was for 46 cents per share.

The next event will be the company’s earnings call which will contain the forecast for the current quarter. Three months ago, Oracle told us to expect earnings to range between 45 cents and 48 cents per share.

Revenue rose to $8.4 billion which was ahead of the Street’s forecast of $8.35 billion. In the past 12 months, Oracle’s cash flow is up 46%.

While Oracle fell short of my very optimistic forecast, the company still delivered solid results. In the after-hours market, the stock is slightly above today’s close (although the stock dropped 2.3% during the day).

Here are more details from today’s press release:

REDWOOD SHORES, CA–(Marketwire -09/20/11)- Oracle Corporation (NASDAQ: ORCL – News) today announced fiscal 2012 Q1 GAAP total revenues were up 12% to $8.4 billion, while non-GAAP total revenues were up 11% to $8.4 billion. Both GAAP and non-GAAP new software license revenues were up 17% to $1.5 billion. GAAP software license updates and product support revenues were up 17% to $4.0 billion, while non-GAAP software license updates and product support revenues were up 16% to $4.0 billion. Both GAAP and non-GAAP hardware systems products revenues were down 5% to $1.0 billion. GAAP operating income was up 40% to $2.7 billion, and GAAP operating margin was 32%. Non-GAAP operating income was up 21% to $3.6 billion, and non-GAAP operating margin was 42%. GAAP net income was up 36% to $1.8 billion, while non-GAAP net income was up 16% to $2.5 billion. GAAP earnings per share were $0.36, up 34% compared to last year while non-GAAP earnings per share were up 14% to $0.48. GAAP operating cash flow on a trailing twelve month basis was $12.8 billion, up 46% from last year.

“New software license sales grew 17%,” said Oracle President and CFO, Safra Catz. “This strong organic growth coupled with disciplined business management enabled yet another increase in our operating margin in Q1. Operating cash flow increased this quarter to $5.4 billion, up $1.6 billion from $3.8 billion in Q1 of last year.”

“Our high-end server business — Exadata, Exalogic, and SPARC M-Series — delivered solid double digit revenue growth in Q1,” said Oracle President, Mark Hurd. “In contrast, revenue declined in our low-end server business. By moving away from low-margin commodity hardware and focusing on high-end servers, we increased our hardware gross margins from 48% to 54%. Our strategy to grow the profitable parts of our hardware business is paying off.”

“Next week Oracle will announce a new high-performance SPARC microprocessor, and a new high-end server called a SPARC SuperCluster,” said Oracle CEO, Larry Ellison. “The new SPARC T4 microprocessor is up to 5 times faster than the T3 microprocessor it replaces. The new SuperCluster is engineered to use the SPARC T4 microprocessor and the Exadata flash and disk storage system to deliver extreme record-breaking performance.”

In the earnings call, Oracle said it expects fiscal Q2 earnings (ending in November) of 56 to 58 cents. Wall Street was expecting 57 cents per share.

Oracle notes that the comparisons are very tough. The Q2 from last year was very strong. They earned 51 cents per share which was five cents better than expectations.

-

Expect at Least 51 Cents Per Share from Oracle

Eddy Elfenbein, September 20th, 2011 at 10:18 amAfter being down sharply for most of the day yesterday, the stock market rallied back in the afternoon. So far, we’re holding on to those gains this morning. As of now, we’re up slightly.

The big news today is the beginning of the Federal Reserve’s two-day meeting in Washington. With every two-day meeting, Ben Bernanke holds a press conference on the second day. The Fed is widely expected to announce its “operation twist” which involves selling the short-term debt in its portfolio in order to buy longer-term debt. We’ve already seen the 30-year Treasury bond fall to the lowest yields in nearly three years.

On our Buy List, Oracle ($ORCL) will report its fiscal Q1 earnings after the close. Three months ago, the company told us to expect Q1 earnings to range between 45 cents and 48 cents per share. My numbers say that’s way too low. I’m expecting at least 51 cents per share. One month ago, the stock dropped below $25 per share which was very cheap. Since then, Oracle has gradually climbed higher. Today, the shares have been as high as $29.36. I still rate Oracle a strong buy up to $30 per share.

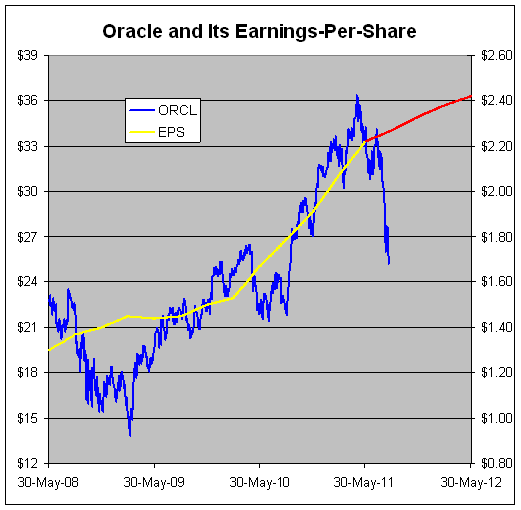

Here’s a chart I did last month looking at Oracle’s valuation.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His