Posts Tagged ‘WFC’

-

CWS Market Review – March 1, 2013

Eddy Elfenbein, March 1st, 2013 at 6:52 am“Business, more than any other occupation, is a continual dealing with the future;

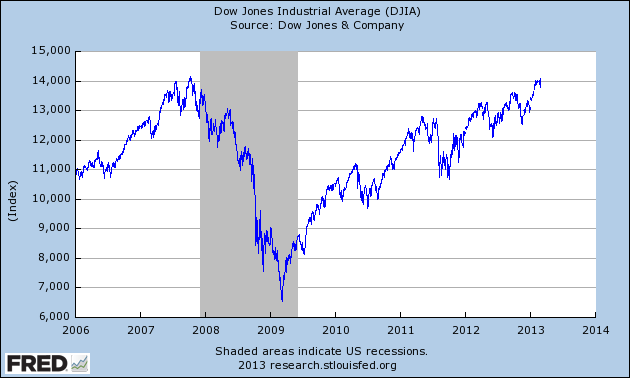

it is a continual calculation, an instinctive exercise in foresight.” – Henry R. LuceThe stock market had a rather raucous few days this week, which included our worst single-day plunge since November, thanks to, of all things, unexpected election results in Italy. But after some good earnings and positive economic reports, plus bullish comments from Mr. Bernanke, the stock market regained its legs; the Dow is now only steps away from an all-time high. You know, it’s a wonder what pumping in a few trillion dollars can do for a market’s spirits.

Here’s an interesting fact: The S&P 500 has risen in both January and February. Since 1945, the S&P 500 has been positive for the first two months of the year 26 times. Every single time that’s happened, the index has closed higher for the year. No exceptions. In fact, it’s usually closed a lot higher. The average total gain, including dividends, has been 24%. If the S&P 500 were to rack up a 24% total return this year, the index would have to be well over 1,700 by the end of the year.

Of course, I’m not predicting such a move. We’re too smart to play the price targets game around here, but I do think this market will continue to be tricky. Frankly, earnings estimates are too high, and I see a lot of lousy stocks gaining ground. That’s not a good sign. On the plus side, the economic recovery is starting to gain some momentum, and our Buy List continues to be an oasis in a troubling climate. As usual, our strategy is to ignore the noise and remain focused on high-quality stocks.

We didn’t have any earnings reports this week, so I’m going to discuss some broader themes impacting the market. First, let’s look at what had the market so grumpy earlier this week.

Reports of the Euro’s Death Are Greatly Exaggerated

The early news on Monday showed that it looked like Pier Luigi Bersani’s left-of-center party was going to win the election in Italy. But as the results came in, both Beppe Grillo and Silvio Berlusconi, who are, respectively, a former comedian and a former Prime Minister, did much better than expected. The better they did, the worse stocks did.

In other words, the ditch-the-euro-and-bury-austerity crowd is still pulling in a lot of votes. As it turns out, Italians prefer governing themselves and not having Germany tell them what to do. Who knew? In fact, Grillo and Berlusconi did so well that due to the rules of Italy’s legislature, probably no one will be able to cobble together a governing coalition. And that probably means it’s back to the polls we go.

So here we are in 2013, with our portfolios noticeably impacted by the decision of a former comedian not to join in the governing of the Italian nation. My friends, we live in interesting times.

Now you might think it’s odd that I’m discussing these election results in a service dedicated to investing, and I have to agree with you—it is odd. But like the proverbial flap of a butterfly’s wing that causes a tornado thousands of miles away, the election results have far-reaching consequences. For one, the S&P 500 dropped 27.75 points on Monday, and it was the worst daily loss since the day after President Obama’s reelection.

Now let me explain what’s really going on and what it means for us: The plan to save Europe was perfectly drawn up and perfectly executed. There was one teeny, tiny, minor, little flaw: no one bothered to ask the voters. Well, technically they did ask, but the pro-euro policies slid by in Greece and other places. Now in Italy, voters are pushing back. That’s why this isn’t just about one election. It’s really a much broader battle, and that’s why our market reacted so dramatically. Bear in mind that the establishment’s candidate wasn’t Bersani; it was the current Prime Minister Mario Monti, and he was totally blown out.

If the anti-euro and anti-austerity movement gains power, it could undermine all the work that’s been done to save the eurozone. Remember last summer when Mr. Draghi made his dramatic statement that he was prepared to do whatever it takes to save the euro? Just look at any chart from that period and you’ll see that’s precisely when the lines that had been going down started to rise and when the rising lines started to fall. More specifically, that’s when investors finally stepped away from crowding en masse into U.S. Treasuries and started buying dollar-denominated stocks. That’s also when cyclical stocks started to take the lead. We’ve come a long way, so the recent events in Italy are seen as a big threat.

Here’s my take: This latest round is really a political crisis, whereas the previous episodes were part of a financial crisis. The good news is that bond yields in Europe are down dramatically from where they had been last summer. I think this was another example of investors who had already been looking to exit some U.S. stocks jumping on this excuse to unload their positions. The fundamentals in Europe and the U.S. are much better. Panicky traders, however, will never change. There may be more euro flare-ups to come, but those whom the Bond Market Gods wish to destroy, they first make Greek or Spanish. Maybe Portuguese. But not Italian.

The Equation That’s Been Driving the Market

The other big news this week was the Congressional testimony from Ben Bernanke. The Fed Chairman’s semi-annual testimony used to be a big deal, but since Bernanke allowed at least a little more transparency into a hopelessly opaque institution, the thoughts of Mr. Bernanke aren’t wholly unexpected.

In short, Bernanke said that the economy hit a rough patch late last year but that things are looking better at the start of this year. The part of Bernanke’s remarks that caught my attention was his robust defense of the Fed’s asset purchases. Some folks on Wall Street thought the recent Fed minutes indicated that the central bank was ready to pull the plug on their bond-buying. That ain’t happening. Bernanke made it clear that they want to keep buying bonds until the labor market gets much better. The Bearded One said, “The FOMC has indicated that it will continue purchases until it observes a substantial improvement in the outlook for the labor market in a context of price stability.” Seems pretty clear to me.

Now let me circle back and explain why this is so important. I’ll give you the simple equation to understand the stock market for the last six months or so. The areas that have done exceptionally well are found wherever you see consumers intersecting finance. This is absolutely crucial.

What do I mean by this? It’s not just that consumers are buying more things; it’s that they also need to finance those purchases. That means housing, which has done extremely well. The Homebuilder ETF ($XHB) is up 41% in the last year.

That means cars. Ford Motor ($F) has rallied more than 36% in the last seven months. Nicholas Financial ($NICK) continues to thrive as well. It also means travel and airline stocks. And spillover industries. Home Depot ($HD) just reported very good earnings, plus they raised their dividend by 34%. People buying. People borrowing. Banks lending.

On the other side of the financing, the big banks have done well. This has been great for JPMorgan Chase ($JPM) and Wells Fargo ($WFC), both of whom made a conscious decision to focus on mortgages. Stocks like Visa ($V) and MasterCard ($MA) have also been big winners. All of these stocks have benefited from the same effect: Consumers buying things with money they don’t have at the moment but plan to get soon. This is why Bernanke’s defense of QE, and his dismissal of its risks, is so important. This trend isn’t nearly over, either. Mortgage rates are still very low, and housing inventory is getting pretty thin as well. Monetary policy does eventually work, though it may tarry.

Two Buy Below Adjustments

I want to make two small adjustments to our Buy Below prices. I’m going to bump up FactSet Research’s ($FDS) Buy Below to $96. Fiscal Q2 earnings are due out in mid-March, and I’m expecting good news. The Street’s looking for $1.11 per share. I also want to raise Stryker’s ($SYK) Buy Below to $64. Stryker is our #1 performer this year, with a YTD gain of 16.5%. Despite the recent rally, the shares are still quite reasonably priced.

That’s all for now. Next week, the government will revise its productivity report, plus we’ll get the Fed’s important Beige Book report. But the most important event will be next Friday’s jobs report. Remember what Bernanke said about “a substantial improvement.” Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Wells Fargo Raises Dividend By 14%

Eddy Elfenbein, January 22nd, 2013 at 4:26 pmAfter the close, Wells Fargo ($WFC) announced that it’s raising its quarterly dividend from 22 cents to 25 cents per share. The bank will now pay out $1 for the whole year. Going by today’s close, that’s a yield of 2.85%.

Wells Fargo & Company (WFC) today announced a quarterly common stock dividend of $.25 per share, an increase of three cents, or 14 percent, per share from the prior quarter. The dividend is payable March 1, 2013, to stockholders of record on February 1, 2013, as approved today by the Wells Fargo board of directors. Wells Fargo has approximately 5.3 billion shares outstanding.

This dividend increase for the first quarter of 2013 was part of the company’s 2012 Capital Plan that the Federal Reserve did not object to in March, 2012. Wells Fargo submitted its 2013 Capital Plan on January 4, 2013, and it is currently under review by the Federal Reserve.

“The dividend increase approved by our board today was included in our 2012 Capital Plan and reflected the confidence we have in our company’s performance,” Chairman and CEO John Stumpf said. “We remain committed to returning more capital to our shareholders. We requested an increase in capital distributions in our 2013 Capital Plan as compared to our 2012 plan, subject to review and non-objection by the Federal Reserve Board.”

The Fed still needs to sign off on these dividend increases for many banks. Wells will have no trouble covering this dividend. If the earnings projections for this year are correct, Wells is passing on just 27% of its profits in the form of dividends.

-

Wells Fargo Reports Record Earnings

Eddy Elfenbein, January 11th, 2013 at 10:47 amThis morning, Well Fargo ($WFC) reported record quarterly earnings of 91 cents per share which was two cents more than Wall Street’s consensus. Profits rose 24% to $5.1 billion.

Wells Fargo, unlike many of its rivals, has been able to steadily increase its revenue. The first bank to release fourth-quarter earnings, Wells Fargo reported $21.95 billion in revenue in the fourth quarter, up 7 percent from a year earlier.

Much of the revenue gains stemmed from the bank’s consumer lending business, as borrowers jumped on record low interest rates to refinance their mortgages. Wells Fargo, which dominates the market as the nation’s largest mortgage lender, notched $125 billion in mortgage originations, up from $120 billion in the fourth quarter of 2011. Refinancing applications accounted for nearly 75 percent of that total.

The big profit in the group came from the extra money that Wells Fargo makes bundling the mortgages into bonds and selling them to the government. In the fourth quarter, the bank reported $2.8 billion of so-called net gains on its mortgages activities, up 51 percent from the previous year.

Under the tenure of its chief executive, John G. Stumpf, Wells Fargo has aggressively expanded into the mortgage market, a strategy that might help the bank surpass its rivals in profits, notably JPMorgan Chase.

(…)

Wells Fargo is the reigning titan in the mortgage industry, generating roughly a third of all the mortgages across the United States. Mortgage originations continued to climb, up 4 percent to $125 billion.

Adding to its mortgage-related profit, Wells Fargo reported a $926 million profit from its servicing business, in which the bank collects payments from homeowners. That’s up roughly 6 percent from a year earlier.

Alongside the consumer loan business, Wells Fargo had gains in its wealth management business, a particular focus for the bank to defray the impact of federal regulations that dragged down profits elsewhere.

This was a solid earnings report. Wells is doing many of the right things. I think the bank will raise its dividend at some point, but the Feds need to sign off on that first. The stock is currently down in today’s trading about 1.5%.

-

The Market Is Down on News from…Slovakia?

Eddy Elfenbein, October 11th, 2011 at 9:38 amThe stock market looks to open lower this morning. Once again, investors are looking at events in Europe. Each country needs to approve a deal to increase the size of the European bailout fund. The only country left is Slovakia. I can’t remember the last time investors in the U.S. were concerned about events in Slovakia, but here we are.

After today’s close, Alcoa ($AA) will be the first major company to report earnings. Wall Street expects 22 cents per share compared with nine cents one year ago.

Interestingly, while many large “capital markets” banks are feeling the squeeze, many retails banks are doing quite well. Goldman Sachs ($GS) may report a quarterly loss in a few days, but banks like Wells Fargo ($WFC) are thriving. Every stock in the KBW Bank Index ($BKX) is down for the year.

On Thursday, JPMorgan Chase ($JPM) will report its third-quarter earnings. Here are some interesting comments from Bloomberg:

The split between Wall Street businesses and other types of banking will be demonstrated by JPMorgan, the second-biggest U.S. bank by assets. The New York-based company will report 95 cents of earnings per share for the quarter, just 6 percent lower than a year earlier, according to the average estimate of 30 analysts surveyed by Bloomberg.

Those earnings, the lowest in six quarters, may reflect gains in consumer lending and credit-card revenue as well as declines at the investment bank. James Staley, 54, who runs the investment bank, said at an investor presentation on Sept. 13 that “markets revenue” will decline about 30 percent from the second quarter and that fees from investment banking will be about $1 billion.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His