-

S&P 500 Breaks 200DMA

Posted by Eddy Elfenbein on September 16th, 2010 at 1:45 pmThe S&P 500 recently broke above its 200DMA. Here’s a look:

Last year I looked at the evidence of how well the indicator has worked:So does the 200DMA work? The evidence suggests that it’s a pretty good indicator of future price performance. When the S&P 500 has been below the 200DMA, it’s dropped a total of about 20% over the equivalent of 27 years. In other words, the S&P 500 has been below its 200DMA about one-third of the time.

Historically, the best time to invest has been when the S&P is less than 1.7% below the 200DMA.

When the index is above the 200DMA, well, then everything looks much brighter. All of the market’s gain (and then some) have happened when we’re above the 200DMA which occurs about two-thirds of the time.Although we’re above the 200DMA, the S&P 500 runs into a brick wall around 1227. I’ve mentioned the 1020/1130 trading range before, but it’s really making a strong stand.

-

Phil Maymin On the Nature of Genius

Posted by Eddy Elfenbein on September 16th, 2010 at 12:44 pm -

11 Stocks to Short from Tim Sykes

Posted by Eddy Elfenbein on September 16th, 2010 at 12:26 pmTimothy Sykes is an investor who follows questionable stocks that pump up their share prices with a blizzard of press releases. When the time is right, Timmy goes in and shorts them for fun and profit.

Here’s his latest list of short candidates:Go Solar USA (GSLO)

RXi Pharmaceuticals (RXII)

RadNet (RDNT)

Liquidmetal Technologies (LQMT)

Texas Pacific Land Trust (TPL)

Vringo (VRNG)

Revolutions Medical (RMCP)

CrowdGather (CRWG)

Kraig Biocraft Laboratories (KBLB)

China Sun Group High Tech (CSGH)

Sunvalley Solar (SSOL)Tim titled the post “10 Good Small Cap Stocks To Buy & Short Sell” although I counted 11. Be sure to read his comments because he doesn’t suggest shorting them all immediately.

-

Stock Pickers Aren’t Dead Just Yet

Posted by Eddy Elfenbein on September 16th, 2010 at 11:57 amHerb Greenberg has a great column on the last of a dying breed, the stock-picker — a group that includes yours truly. I admit that the machines are much faster than us, but we humans still have many advantages, namely the irrationality of our fellow humans.

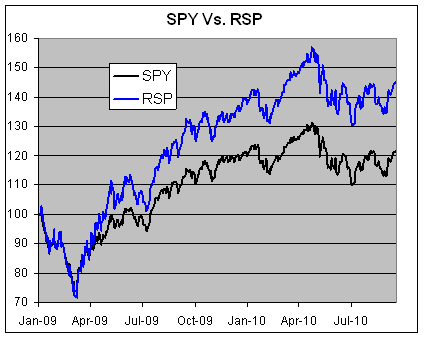

Despite the hand-wringing, this has been a very good time to be a stock-picker. Let’s look at the Rydex S&P 500 Equal Weighted ETF (RSP) compared with the S&P 500 Spyders (SPY):

In other words, the average stock has beaten the index by a good margin.

Will this divergence continue? It’s hard to say. I think one factor that will help is the persistence of low inflation, if not deflation.

When the pricing environment is so hostile to price increases, this may place a greater premium on companies that are more efficient or that offer something unique. The more diversity there is in rewards, the more opportunity there is for stock-pickers to find above-average profit opportunities.

When anybody can make a buck, anybody will and then you’re much better off going with the indexes.

What’s also going on right now is that many equity classes are correlating with one another. This means that if the drugs stocks go up, say, 1% one day, then the tech stocks are also going up by about that amount.

When the stock groups behave too similarly, it gets hard for money managers to set themselves apart — and that’s how they make their money. They want to see lots of divergences.“That’s not a healthy market. The mathematical benefits of diversification require assets that exhibit low-to-no correlation amongst themselves. When everything moves in synch, asset allocators have to pull in their horns,” Colas writes. “Wonder why investors are shunning risk and buying bonds? Part of the reason is clearly that the historically proven benefits of diversification just are not working as well as they once did.”

Within the stock market, the Sector SPDR family of ETFs that carve up the S&P 500 offers a striking example of the herd behavior.

“U.S. equity correlations among the 10 industrial sectors of the S&P 500 remain near historical highs, as 7 out of the 10 sector ETFs show correlations with the S&P 500 in excess of 90%,” according to the strategist. “Only Healthcare (XLV), Utilities (XLU) and Consumer Staples (XLP) are lower, and they’re stuck in the 80% range, which is still very high.”I disagree that this is “dangerous.” It just means that alpha isn’t so easy to come by.

-

Interview With Bill Miller

Posted by Eddy Elfenbein on September 16th, 2010 at 9:34 amHere are some interesting insights from an interview with Bill Miller:

But here is a topical example: Hewlett Packard has $15bn of cash on its balance sheet. It will generate $10bn of free cash this year and is probably overpaying this $3bn for 3PAR and ArcSight for $1.5. But even so, it will not make much of a dent in its free cashflow for this year alone.

So HP could take 100% of its free cashflow and pay it out as dividends. While they would never do that, if they did the stock would have a 10% yield on it. Can you think of any companies out there with a 10% yield and can grow? So where would it trade? It might trade to a 5% yield.

It would probably go up 50% immediately and many people would be wondering whether what was going on was secure. But eventually it would be capitalised at a rate higher than a utility or a Reit because it can grow faster. That is the opportunity we currently have in the market. -

Morning News: September 16, 2010

Posted by Eddy Elfenbein on September 16th, 2010 at 9:02 amYields inch up, Yen moves Watched

Futures Dip Ahead of Jobless Data, FedEx Results

China Yuan Rises To New High Before Geithner Testimony

Obama Reportedly to Name Warren Special Adviser

Pimco Makes $8.1 Billion Bet Against `Lost Decade’ of Deflation

Goldman Sachs Fund of Ex-Prop Traders Said to Return 3% in 2010

India Hikes Interest Rate More Than Expected

E.U. to Ratify First Free Trade Deal With Asian Partner

Wright Express Completes Australian Buyout

Buffett Buys More Shares Of Becton

Baby Bonobos! -

One National Capital, Two Cities

Posted by Eddy Elfenbein on September 15th, 2010 at 9:58 pmWho’s up for some DC primary statistical analysis blogging?

I thought so! (I admit, I’m a pale imitation of Nate Silver, but here goes.)

Yesterday was the Democratic primary for mayor of Washington, DC. Vincent Gray beat the incumbent mayor Adrian Fenty 54% to 45%.

The vote trend was incredibly split with the black-majority precincts going heavily for Gray while the affluent SWPL precincts went strongly for Fenty.

The split wasn’t just big; it was massive. I think the pronounced racial/geographic divide is the major under-reported story of this election.

There were precious few “swing” precincts. Consider this: Of the 143 precincts, the standard deviation of Fenty’s vote was over 25%.

Check out the distribution of Fenty’s vote:Lower Bound Upper Bound # of Precincts Over 85% 1 80% 85% 14 75% 80% 16 70% 75% 8 65% 70% 2 60% 65% 2 55% 60% 5 50% 55% 5 45% 50% 4 40% 45% 10 35% 40% 7 30% 35% 7 25% 30% 9 20% 25% 10 15% 20% 26 10% 15% 17 A majority of DC voters live in a precinct that went 75% or more for one candidate. In just 12 of the 143 precincts did both candidates come within 5% of their city-wide total. The results also suggest that votes were more polarized than polling indicated — perhaps an odd double Bradley Effect.

(Note: These numbers are based on the unofficial returns that were listed on the DC Board of Election’s website earlier today. Here’s a spreadsheet of the results.) -

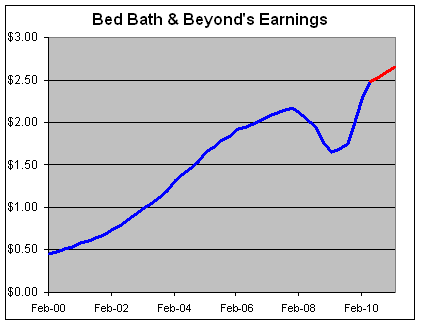

Looking Ahead to Bed Bath & Beyond’s Earnings

Posted by Eddy Elfenbein on September 15th, 2010 at 2:35 pmNext week, Bed Bath & Beyond (BBBY) will report its fiscal Q2 earnings. I like this company a lot and I’ve long admired their highly efficient operations.

When the last earnings report came out in June, BBBY said it expects earnings for Q2 to range between 59 cents and 63 cents per share. The Street was expecting 63 cents per share so this announcement was a disappointment.

The shares fell 5.6% the next day and continued to fall. For most of July and August, the stock bounced around in the upper-$30s. I had said after the earnings report that “if you can get this stock below $40, you’re getting a good deal.”

For the moment, it looks like I was right. With the beginning of September, the stock came back to life. BBBY smashed through $40 and even broke $42 yesterday.

I think the investing community mistakenly believes that BBBY is a housing stock. Yes, it’s impacted by housing but don’t get the idea that buying BBBY is anything like buying Lennar (LEN). I like to find situations where most people think the situation is X, but it’s really only partially X.

I wouldn’t be surprised to see BBBY smash earnings next week. The stock could even make as much as 70 cents per share (look at me being all bold). The big positive is that their margins are looking much better. The last report showed that net margins have improved for five quarters in a row.

Put it this way: When your margins improve from 6% to 8%, which is the case for BBBY, a 12% rise in sales translates to a 50% increase in profits. And that’s a good thing.

My only warning is that if you don’t already own the stock, I would be leery of starting a position over $40 per share. The company will probably earn about $2.70 to $2.75 per share for this year, give or take. That means $40 is a reasonable price but it’s not what I would call “a steal.” -

Eager…Now Not So Eager

Posted by Eddy Elfenbein on September 15th, 2010 at 9:59 amUSA Today

April 6, 2009Tech firms eager to gobble stimulus funds

“This is a once-in-a-lifetime deal,” says Sean Maloney, chief sales and marketing officer at Intel, which is working on broadband projects with governments in the U.S., Japan, Vietnam and others. “This dwarfs the Marshall Plan and the New Deal. It is unimaginably large, and will never happen again. It is incumbent on us to spend it wisely.”Huffington Post

September 14, 2010Paul Otellini, Intel CEO: The Stimulus Didn’t Work

Intel CEO Paul Otellini doesn’t buy into the idea that the White House is anti-business, but he does believe the administration “just doesn’t get it” when it comes to creating jobs.

Otellini, in an exclusive interview with CNN Money at the Intel Developers Forum in San Francisco on Tuesday, said the U.S. should not only forgo spending the second half of Obama’s $787 billion stimulus package, but completely axe Obama’s newly proposed $350 billion economic recovery plan.(Via: Yglesias)

-

Morning News: September 15, 2010

Posted by Eddy Elfenbein on September 15th, 2010 at 9:46 amWho Played the Largest-Ever Arbitrage?

Japan Intervenes for the First Time Since 2004 as Yen Surge Threatens Recovery

Best Buy Rings ‘Em Up

Silver Prices Surging With Gold

Gold Hits a Record as Econ Worries Rise Again

EU Proposes Curb on ‘Wild West’ Trading

Production in U.S. Probably Cooled as Automakers Scaled Back

Sinochem Says Not Keen on Potash Buy

Dodd: Limited Will for Senate Vote on Fed Nominees

- Tweets by @EddyElfenbein

-

-

Archives

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His