-

We, Once Again, Get Results

Posted by Eddy Elfenbein on September 14th, 2010 at 4:46 pmCrossing Wall Street

August 11, 2005Will Cisco Pay a Dividend?

I’m going to make a prediction. No, not like my other lousy predictions. This time, I’m nearly serious. I predict that Cisco will start paying a cash dividend.Los Angeles Times

September 14, 2010Cisco Systems says it will start paying cash dividends

Computer networking titan Cisco Systems said Tuesday it expects to start paying a dividend for the first time. Investors liked the sound of that: Cisco’s shares were up 45 cents, or 2.1%, to $21.71 at about 11:30 a.m. PDT.OK, I was a wee bit early. What do I look like…Nostra-freakin-damus? Here’s what I had to say:

Really, it makes perfect sense. The company generates gobs of cash, but they waste it on buying their own stock (just like everyone else who buys Cisco’s stock).

There are two reasons why Cisco buys so much stock: They issue tons of stock, and they give out tons of options to their employees. They bought nearly $20 billion of stock in the last two years and the stock hasn’t done a thing. Forget fighting the market: just give it to shareholders.

The market simply doesn’t trust Cisco to spend its own money wisely. Here’s a nice little factoid: If you adjust for stock-option expenses, Cisco’s 2004 earnings would have been 45 cents per share, not the 62 cents that the company reported. I think the rumor that Cisco was about to buy Nokia was started by the Street just to get Cisco thinking about how it invests its money. I knew there was no way that Cisco would buy Nokia. Too much of their own cash flow is flowing down the drain. They don’t seem to realize that that’s not a good thing.

John Chambers & Co. must seem baffled by the market’s displeasure with Cisco. After all, the company has reported decent profit growth for the last two years, but the stock hasn’t done much of anything. Just pay a dividend, and the market will forgive you.The company currently has a cash war chest of $40 billion ($7.01 per share). Cisco said it’s looking to yield 1% to 2%. At the current price, that works out to a quarterly dividend of around five to ten cents per share.

-

Reader Feedback

Posted by Eddy Elfenbein on September 14th, 2010 at 4:29 pmHere’s an email from a reader taking the pro-buyback side:

“Microsoft has spent over $78 billion on share buybacks and the stock has done nothing but go down.”

That seems pretty misleading.

That means that MSFT bought back around 3B shares since 2006 (assuming $26/share). They now have about 8.65B shares outstanding. So if they had not bought back any shares and they had paid the money out in dividends instead, their 2010 earnings per share would have been only $1.75, instead of $2.36. As an owner of MSFT, this makes a BIG difference to me. And don’t you think the stock would be a lot lower today if earnings were only $1.75 per share?

Of course it would have been nice to get the dividend, but I hold MSFT in a taxable account, with a marginal tax rate approaching 25% (state and federal). So from my perspective I’d rather have MSFT buy back stock than pay dividends even if the stock was 30% overvalued! (Ignoring capital gains taxes, which I can probably defer almost forever). And of course I don’t think it is 30% overvalued, because then I would sell it, wouldn’t I. If I want to get some cash out of MSFT, I can always sell some shares.

(P.S. – still love the blog, but I really don’t get your antipathy to buybacks.) -

At Least Microsoft Thinks Microsoft is Cheap

Posted by Eddy Elfenbein on September 14th, 2010 at 10:23 amThere’s been heavy speculation that Microsoft (MSFT) is going to sell debt this year in order to buy back its stock and pay dividends. This would be a fascinating move and it shows just how unusual the current market is.

Whatever you think of Microsoft and its future, the company currently generates an astounding amount of cash. According to the latest statement, MSFT has a cash balance of over $36 billion which works out to $4.22 per share. Their long-term debt is roughly $6 billion. Shareholders, not surprisingly, want some of that loot.

The problem with Microsoft’s huge bank account is that it’s mostly held overseas. As a result, MSFT is going to try and raise as much money as possible without affecting its AAA rating. One source said they could probably take in $6 billion.

When debt is expensive and equity is cheap, the rational choice for companies is to do exactly what Microsoft is doing—issue debt to buy stock. I’d be very curious as to the interest rate MSFT would land.

The company currently pays a 13-cent quarterly dividend which comes out to an annual yield of 2.07%. The dividend, however, is fairly modest compared to Wall Street’s current earnings estimate of $2.36 per share.

In May 2009, MSFT went to the bond market and floated $2 billion at 2.95% for 5-year notes, $1 billion at 4.2% for 10-year notes and $750 million at 5.2% for 30-year bonds. I think they can easily get much lower than that today.

Microsoft is in the lucky position of having its debt rated AAA by Moody’s and S&P. That saves them a lot of money in borrowing costs. Last year, the software had an amazing $22 billion in free cash flow. About half of that came from the United States.

Of course, there’s the question of whether or not a company should be trying to make money by shifting pieces of paper around. As David Merkel says, “Why pay money for financial engineering? Better you should look for genuine organic growth.” He’s got a good point. When I invest in a company I want them to do what they do best. Let me worry about if their stock is a good buy or not.

Since FY 2006, Microsoft has spent over $78 billion on share buybacks and the stock has done nothing but go down. The company is currently in the middle of a $40 billion buyback program that runs through 2013.

The other option is for Microsoft to spend its cash on acquisitions. Still, we’re back to the company being a money manager more than a software firm. To quote Biggie Smalls, “Mo Money, Mo Problems.” -

Poll Shows Investors Distrust

Posted by Eddy Elfenbein on September 14th, 2010 at 9:46 amThe latest poll run by CNBC and AP shows widespread investor distrust of the stock market. Here are some bullets:

61% said the market’s recent volatility has made them less confident about buying and selling individual stocks.

55% said the market is fair only to some investors.

More than 60% said they had paid attention to news reports about swings in the stock market.

Among those with assets of at least $250,000, more than half blamed computerized trading for the big swings, compared with about a third of those with a net worth of less than $50,000.

Nearly 90% of those with portfolios of less than $50,000 said the market is unfair to small investors.

More than 75% of investors worth at least $250,000 say the market is unfair to the little guy.

Just 8% expressed strong confidence in regulators. Half expressed little or no confidence, including 16% with no confidence at all.

Asked to rate six investment options as a way to build wealth, mutual funds were the favorite, with 62% calling them a good investment.

ETFs finished at the bottom, endorsed by just over a quarter of those polled. About half had no feelings either way about these funds.

Drawing the highest number of negative reviews were real estate and savings accounts. Both were considered bad investments by about 1 in 4 people.

About three quarters of those earning at least $100,000 annually rated mutual funds as good investments, compared with 58% of those making less than $50,000.

As for individual stocks, more than 60% of investors with assets of $250,000 or more favored them, compared with less than half of those worth under $50,000.

Sixty percent of those with investments worth less than $50,000 liked savings accounts, compared with 35% with assets of $250,000 and up.

Nearly 80% of those surveyed said the best way to make money in the stock market is to buy stocks and hold them for a long time before selling. -

Morning News: September 14, 2010

Posted by Eddy Elfenbein on September 14th, 2010 at 9:12 amOracle to Acquire Major IT Services Firm, In Our Opinion

5 Little-Known Facts About Social Security

Why stocks are likely heading higher

Yen Rises to 15-Year High on Kan Hopes; Asian Stocks Fluctuate

Beware starting trade war, China economist tells U.S.

Bunds Extend Gain After ZEW Shows Investor Confidence Drop; Yield at 2.37% -

Quick Notes

Posted by Eddy Elfenbein on September 13th, 2010 at 4:08 pmToday was a big day for small-caps. While the S&P 500 (^SPX) was up by 1.11%, the S&P Small-Cap 600 (^SML) and Russell 2000 (^RUT) were up by 2.36% and 2.49% respectively.

Gold is up to $1,245.10. When it hits $1,250 that it means it’s an even $20,000 a pound.

Eighteen of the 20 stocks on the Buy List closed higher today. The Buy List was up 1.53% today and it’s up 2.35% for the year.

Today was the 82nd day in a row that the S&P 500 closed between 1020 and 1130, but we’re getting close to the upper bound. We’re just 0.53% from our highest close in 17 weeks. -

The Fed’s Gold Stash

Posted by Eddy Elfenbein on September 13th, 2010 at 1:35 pmAlea brings up a very good point. The Federal Reserve’s gold holdings are marked at a price of $42.22 an ounce by law. The current market price is about $1250 an ounce.

According to Alea, going to mark-to-market “would force the Federal Reserve to disgorge more than $300 billion in exceptional profits to the Treasury. Germany did it 13 years ago, no reason for the US not to follow.” -

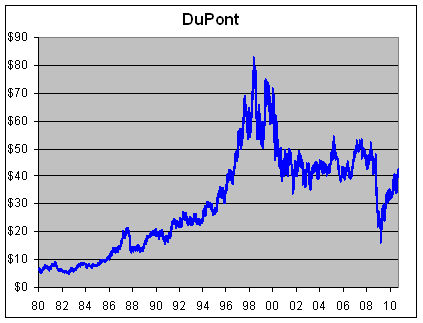

DuPont Hits new 52-Week High

Posted by Eddy Elfenbein on September 13th, 2010 at 12:51 pmJust a quick note on DuPont (DD). Here’s another good example of a boring company that can be a great buy.

Back when the world blew up, the stock dropped as low as $16 a share. But let’s look at the recent earnings trend. Last quarter, DD beat Wall Street’s forecast by 24%. The quarter before that, they beat by 17%. Then by “just” 7%. But the two before that were earnings beats of 36% and 15%. That’s a great run.

When the last earnings report came out, DuPont raised their full-year guidance range from $2.50 to $2.70 per share to $2.90 to $3.05 per share. That’s a hefty increase.

In June, DuPont’s CFO spoke of the company’s bold goals:Fanandakis reaffirmed the company’s commitment to deliver about 20 percent compound annual earnings growth for the 2009-2012 periods. By executing on priorities, DuPont expects to generate about 10 percent top-line compound annual growth for the 2009-2012 periods. As previously disclosed, the company also plans to capture $1 billion in fixed cost productivity and $1 billion in working capital productivity gains during the 2010-2012 timeframe.

-

AFLAC’s Strange Ride

Posted by Eddy Elfenbein on September 13th, 2010 at 10:48 amThis is shaping up to be a very good morning. All 20 Buy List stocks are up. AFLAC (AFL) has been as high as $52.35 which is the highest price in over four months.

By the way, let’s take a step back and laugh at Wall Street for a moment. AFLAC reported Q2 earnings-per-share of $1.35 on July 27. That was two cents better than expectations. In April, they said to expect Q2 to range between $1.33 and $1.38 per share. In other words, this last earnings report was hardly a major surprise.

Yet, how did AFLAC’s shares respond to the earnings report? They sold off! The stock closed at $50.41 on July 27. The next day, they dropped 2.3%. By late August, the stock was off by more than 12%. Then, suddenly, everything turned around. AFLAC not only gained back everything it lost but it’s actually higher than where it was before the earnings report. This makes no sense. There’s been no critical news between then and now. We’ve simply seen traders push a staid stock down and up by a few billion dollars for really no reason. Remember that next time you place a buy order. -

Morning News: September 13, 2010

Posted by Eddy Elfenbein on September 13th, 2010 at 10:06 amWhy Some Gloomy Investors are Bullish on Stocks

Bank Stocks Climb as Basel Gives Firms Eight Years to Comply

At Goldman, Partners Are Made, and Unmade

Asian Shares Gain on Economic Optimism

Geithner Urges Action on Economy

Consumers Will Pay More for Goods They Can Touch

U.S. Debt Fund Shuns Dubai World Debt Deal

The Era of Expert Failure

- Tweets by @EddyElfenbein

-

-

Archives

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His