-

Duck and Cover for For-Profit Ed

Posted by Eddy Elfenbein on August 3rd, 2010 at 1:50 pmTomorrow, the government will come out with a report on for-profit education. In preparation, a lot of these stocks are trading lower. It’s expected that the Feds will accuse them of all sorts of naughty things and deceptive practices.

This is what I wrote last September about higher ed:

Imagine If Lehman Brothers Had a Football TeamLately it’s been all the rage to complain about companies that are too big to fail. However, there’s another prominent American institution that’s also become too big to fail. It’s bloated, overstaffed and often fails to meet the most basic need of its customers.

Welcome to American higher education.

More Americans are wising up to the fact that college is a big fat waste of money. Sure, if you’re lucky enough, and smart enough, get into a big-name school, college is just fine. But for millions of other students, a four-year degree often puts them in a mountain of debt and doesn’t give them the skills they need in the job market.

First, let’s consider how long it takes many students to finish college. Even after six years, only 54% of college students even get a degree. For high-school students in the bottom 40% of their class and who go to a four-year college, an amazing two-thirds hadn’t earned a diploma after eight-and-a-half years. Sheesh, that’s worse than Bluto! I can’t think of another industry that has such a dismal record.

David Leonhardt recently wrote at the New York Times: “At its top levels, the American system of higher education may be the best in the world. Yet in terms of its core mission—turning teenagers into educated college graduates—much of the system is simply failing.” He’s exactly right.

Still, tuition costs continue to skyrocket. Between 1982 and 2007, tuition and fees rose 439% compared with just 147% for median family income. The trend shows no sign of stopping. One year at Yale now goes for $47,500. The University of Florida system wants to raise tuition by 15%, the maximum allowed.

Much like the housing bubble, the Higher Ed bubble is being driven by cheap, government supported credit. The problem is compounded by the fact that hugely important financial decisions are placed on the backs of 19-year-olds, many of whom simply don’t have the life experience to weigh the implications of a gigantic, 20-year debt load. Heck, at least the irresponsible mortgage borrowers during the crazy days were adults (even though many acted like infants).

One report shows that students from lower-income families need to pay 40% of their family income to enroll in a public four-year college. That’s a lot of coin to have some Marxist feminist theorist tell you about atavistic nature of late-stage capitalism. Please, you can watch the Oscars to learn that. Don’t think community colleges are a bargain, either. The average tuition is up to 49% of the poorest families’ median income from 40% in 1999-2000.

The pro-college crowd likes to repeat the claim that college grads earn $1 million more, on average, over their working lifetime. Sure, this is true, but college grads start out in a big hole. On average, they don’t even catch up to high school grads until age 33.

The debt load piled on students is scandalous. One in five students who graduated in the 1992–93 school with over $15,000 in debt defaulted on his or her loan within 10 years of graduation. We’re setting young people up for failure and ruin credit records. Thanks to the recession defaults are up 43% over the last two years. Many students go to grad school and pile on even more debt. The average law grad owes $100,000. Plus, many schools often use grad students as greatly underpaid professors in order to cut costs. Think of Lehman Brothers. Now imagine if they had a football team.

The loans fall especially hard on minorities since colleges love to boast their “diversity.” For African-American students, the overall default rate is more than one-third. That’s five times higher than white students and over nine times higher than Asian students.

What makes things even worse for many colleges is that the recent bear market put the squeeze on their endowments. Harvard’s endowment dropped by $11 billion and they announced they’re laying off 25% of their investment staff. Cornell’s endowment plunged 27% in the final six months of 2008. Yale lost $5.9 billion, or one-fourth its value. Lower endowments means…you guessed it, higher tuition.

School financing has exploded in recent years, doubling in just ten years. Total student debt now stands at over half a trillion dollars. The average borrow took out a loan worth $19,200. That’s a 58% jump since 1993.

Naturally, the government is set to make a bad situation worse. Last week, the House of Representatives voted to elbow Sallie Mae (SLM) out of the student loan biz and shift all student loans to a government-run, taxpayer financed system. So instead of government subsidized loans run through banks to students, we’ll now have a government monopoly. Hmmm…what could possibly go wrong?

I got a better idea. It’s a real simple government program. I call it, “Dude, you really shouldn’t be going to college.” Best of all, the program is very cheap. The costs are solely a postcard and my consulting fee. If don’t want to listen to me, fine, then listen to the folks at the ACT who say that only 23% of students have the skills to do well in college.

The good news is that Americans are catching on to the college scam. Admissions applications are dropping at elite school. Applications are off by 20% at Williams College. Middlebury saw a 12% decline and Swarthmore had a 10% drop. I believe this is just the beginning.

The reason I’m so confident is that these are boom times for the for-profit education sector. Long derided as diploma mills, these companies are raking it. Already this decade, shares of Strayer Education (STRA) are up over 1,000% and shares of ITT Educational Services (ESI) are up over 1,300%.

Business is so strong that the schools are having difficulty even making earnings estimates. In January, ESI issued 2009 EPS guidance of $6.25 to $6.45 which well above the Street’s view of $5.73. Since then, the company raised guidance three times. The current EPS range is now $7.55 to $7.85. In other worlds, no bailouts needed here.

These schools are ideal for older students who are attending school on their own initiative instead of doing what their parents expect. Many of the schools have comprehensive programs but students often go there to take a few courses to round out their job qualifications. Businesses also like to use the schools for employee training. The graduation rates tend to be high and the default rates are low (though still not ideal as some members of Congress have noted).

I also like the fact that the school has an efficient business mode. Operating margins tend to be high and they businesses don’t drain capital.

Look at the success of a company like Lincoln Educational Services (LINC). A few weeks ago, Lincoln reported blowout Q2 earnings. Check out these digits. Revenue rose 51% and earnings-per-share jumped an astounding 440%. The company netted 27 cents a share which schooled the Street’s consensus of 19 cents a share. On top of that, Lincoln boosted its full-year EPS guidance to a range between $1.40 and $1.45 from their prior range of $1.25 to $1.30. Who’s laughing at the diploma mill now?

Lincoln is hardly alone. Last month, Corinthian Colleges (COCO) issued 2010 EPS guidance of $1.30 to $1.36 which was well above the Street’s view of $1.14. If COCO hits their range, then we’re talking about a growth rate of over 50%.

The big kid on the block is Apollo Group (APOL) owner of the University of Phoenix which has more than 200 campuses and over 400,000 students. Apollo has a market cap of $10 billion and it’s one of the two for-profit ed stocks in the S&P 500 (DeVry being the other). The shares have vaulted nearly 100-fold since the IPO 15 years ago. Apollo is doing more than any bureaucrat to reshape the landscape of American higher education. Make no mistake how serious they are. Three years ago, the company shelled out $150 million to turn the home of the Arizona Cardinals into the University of Phoenix stadium.

The for-profit sector still contains many risks. Loan defaults rates are a problem which doesn’t look so good considering the schools have healthy operating margins. The industry was dreading a recent GAO report which turned out to be milder than expected.

Of all the for-profit schools, I think Lincoln Educational Services offers the best value right now. The company just gave a big earnings boost and the shares are now going for about 12 times 2010’s forecast. Strayer, on the other hand, is the one to avoid. The stock is up to 23 times next year’s consensus. For a school stock, that’s not very smart.

-

No Comment

Posted by Eddy Elfenbein on August 3rd, 2010 at 10:45 am“I’ve never seen the type of animosity between the government and Wall Street,” Greenspan said, adding he was “not sure where it comes from.”

-

Cognizant Soars on Earnings

Posted by Eddy Elfenbein on August 3rd, 2010 at 10:24 amOne of my fundamental rules of investing is to not worry what happens to stocks after you sell them. Still, it’s hard to ignore “what could have been.”

Last year, Cognizant Technology Solutions (CTSH) was a huge winner for us on our Buy List. The stock was up 151%. for us.

I didn’t want to be greedy so I dropped it off this year’s Buy List.

Thanks to the blow-out earnings report, CTSH is up 10% today and over 34% for the year.Cognizant Technology Solutions Corp. booked a 22 percent jump in net income Tuesday, benefiting from a surge of pent up demand.

The results, as well as Cognizant’s forecast for the rest of the year, topped Wall Street forecasts and sent the company’s shares up 12 percent ahead of regular trading.

Cognizant, which provides consulting and information technology outsourcing, earned $172.2 million, or 56 cents per share, in the three months ended June 30.

That’s up from $141.3 million, or 47 cents per share, a year ago and better than the 52 cents per share analysts expected, according to Thomson Reuters.

Revenue jumped 42 percent to $1.11 billion, beating the average forecast of $1.02 billion.

“Our clients are investing again in discretionary programs to foster growth and innovation,” CEO Francisco D’Souza said in a statement. “We saw particular strength in our financial services segment, which had previously been hard hit by the global credit crisis.”

The company’s forecast for the quarter ending in September was equally upbeat.

It expects earnings of at least 59 cents per share and revenue of $1.18 billion, while analysts were looking for 54 cents per share on $1.06 billion.

For the full year, Cognizant said earnings should come to at least $2.26 per share with revenue of at least $4.46 billion. The average forecast calls for $2.13 per share $4.14 billion.Grrrrr.

-

Pfizer Beats By 10 Cents a Share

Posted by Eddy Elfenbein on August 3rd, 2010 at 9:01 amCongratulations to Pfizer (PFE)! They just had a very good earnings report this morning. For the second quarter, PFE earned 62 cents a share which is ten cents more than Wall Street’s consensus.

Pfizer’s revenue increased 58 percent to $17.3 billion, boosted by the addition of Wyeth’s pneumonia vaccine Prevnar and Enbrel rheumatoid arthritis treatment. Pfizer is counting on products gained from the acquisition to help offset losses next year when generic copies of its top-selling Lipitor cholesterol pill enter the market. The New York-based drugmaker also is slashing costs by firing 19,000 employees, closing eight manufacturing plants and shutting six research centers.

“With the acquisition of Wyeth completed during the fourth quarter, Pfizer is now in the initial stages of integrating yet another big pharma company, its third in 10 years,” said Tim Anderson, an analyst with Sanford C. Bernstein & Co., in a July 13 note to clients. “Large amounts of cost-cutting and share repurchases should help keep earnings per share flattish.”Will this report be enough to get the shares moving? It’s hard to say but it seems like PFE has been stuck in the mud for some time. Pfizer said that it expects earnings-per-share of $2.10 to $2.20 for this year, and $2.25 to $2.35 for 2012.

By any reasonable measure, Pfizer is a cheap stock. The quarterly dividend of 18 cents a share translates to a yield of 4.8%. Yesterday’s closing price of $15.48 gives the stock a forward P/E of around seven.

I was greatly tempted to add Pfizer to this year’s Buy List, but I held off. Despite the low price, I’m wary of Pfizer. The company spent $68 billion acquiring Wyethe and now it’s laying off people left and right. Large-scale mergers make for great press releases but there are often unexpected troubles after a company digests a competitor. On top of that, the highly profitable drug Lipitor goes off patent next year and Pfizer’s new drugs have mostly bombed recently.

Pfizer might be worth a buy soon, but I want to see a few more earnings reports like this one.

-

Meet Li Lu, A Possible Successor to Warren Buffett

Posted by Eddy Elfenbein on August 3rd, 2010 at 8:22 amWarren Buffett turns 80 soon and the world has often speculated on who will succeed him as chairman and CEO of Berkshire Hathaway (BRKA). Charlie Munger, Buffett’s alter-ego, may have let the cat out of the bag when he said that the choice of Li Lu is a “foregone conclusion.”

So who is Li Lu?The Chinese-American investor already has made money for Berkshire: He introduced Mr. Munger to BYD Co., a Chinese battery and auto maker, and Berkshire invested. Since 2008, Berkshire’s BYD stake has surged more than six-fold, generating profit of about $1.2 billion, Mr. Buffett says. Mr. Li’s hedge funds have garnered an annualized compound return of 26.4% since 1998, compared to 2.25% for the Standard & Poor’s 500 stock index during the same period.

Mr. Li’s ascent on Wall Street has been no less dramatic. He spent his childhood shuttling between foster families after his mother and father were sent to labor camps during the Cultural Revolution. After the Tiananmen Square protest, he escaped to France and came to the U.S. Investors in his hedge fund have included a group of senior U.S. business executives and the musician Sting, who calls Mr. Li “hardworking and clever.”

Mr. Li’s investing strategy represents a significant shift for Mr. Buffett: Mr. Li invests chiefly in high-technology companies in Asia. Mr. Buffett typically has ignored investments in industries he says he doesn’t understand.

Mr. Buffett says Berkshire’s top investing job could be filled by two or more managers who would be on equal footing and divide up responsibility for managing Berkshire’s $100 billion portfolio. David Sokol, chairman of Berkshire unit MidAmerican Energy Holdings, is considered top contender for CEO. Mr. Sokol, 53, joined MidAmerican in 1991 and is known for his tireless work ethic.

In an interview, Mr. Buffett declines to comment directly on succession plans. But he doesn’t rule out bringing in an investment manager such as Mr. Li while still at Berkshire’s helm.

“I like the idea of bringing on other investment managers while I’m still here,” Mr. Buffett says. He says he doesn’t preclude making a move this year, though he adds that there is no “goal” to bring on an additional manager that quickly either. Mr. Buffett says he envisions a team approach in which the Berkshire investment officials would be “paid as a group” from one pot, he says. “I don’t want them to compete.”

Mr. Li fits the bill in some important ways, Mr. Buffett says. “You want someone” who “can think about problems that haven’t yet existed before,” he says. Mr. Li is a contrarian investor, loading up on BYD shares when they were beaten down. And he’s a big fan of Berkshire, which may also help his cause. “We don’t want them unless they have special feelings about Berkshire,” Mr. Buffett says. -

ISM Lifts Stocks

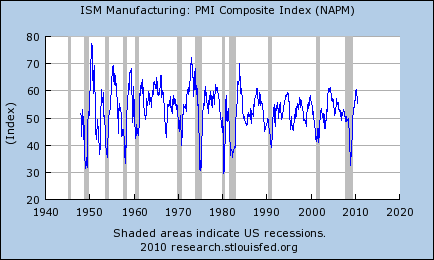

Posted by Eddy Elfenbein on August 2nd, 2010 at 12:21 pmThe market is getting August off to a very good start. After Friday’s lousy GDP report, I wasn’t exactly looking forward to today’s ISM number. Fortunately, the index came in at 55.5 which is a decent number. The Street was expecting 54.2.

If you’re not familiar with the ISM, it’s the Institute for Supply Management index that comes out at the beginning of each month. It’s one of the best measurements for how well the economy is doing. If the number is above 50, then the economy is growing. Below 50, it’s not. Today’s report is the 12th straight month of 50+ reports. What I like about the ISM is that it comes out early and that it’s not revised endlessly like GDP data.

Are we heading for a double-dip? It’s hard to say. For now, I would say that the odds are low but they’re increasing. The problem is that the outlook for the future is cloudy, even more than usual. What concerns me most is that the GDP numbers are very poor. Businesses have been growing earnings by growing their margins. That’s nice to see, but at some point you need to see growing sales as well.

The Buy List is having a very nice day. As of now, all 20 stocks are higher. Reynolds American (RAI) just hit a new 52-week high. Here’s a quick investing lesson. The other day, Wright Express (WXS) came out with decent earning and the stock sold off. Here we are a few days later and it’s gained back all it lost and then some. Sometimes stock prices just make no darn sense. -

Well, At Least Someone Is Making Money

Posted by Eddy Elfenbein on July 31st, 2010 at 9:07 pmBernanke made some coin last year:

Federal Reserve Chairman Ben Bernanke’s personal finances recovered in 2009, disclosure forms released by the central bank on Friday showed.

Bernanke listed assets in a range of $1.2 million to $2.5 million. They had slipped to between $822,011 to $1.8 million in the previous year, from $1.7 million and $2.5 million in 2007.

Bernanke’s assets included annuities, mutual funds and money market funds. His two largest holdings were annuities from the TIAA-CREF financial services company worth between $500,001 and $1 million each. -

Moog Beat By a Penny

Posted by Eddy Elfenbein on July 30th, 2010 at 8:39 pmOne more Buy List stock report. Moog (MOG-A) earned 64 cents per share which beat Wall Street’s estimates by a penny a share.

In 2008, Moog earned $2.75 per share and that dropped to $1.98 per share last year. Last November, Moog said to expect EPS for this fiscal year (ending in September) between $2.15 and $2.35. They reiterated that in February. Then in May, Moog said to expect $2.35 per share which they reiterated today. On top of that, they gave an estimate for FY 2011 of $2.70 a share.

The CEO also had something interesting to say:With third-quarter profits up 83.6 percent and earnings per share rocketing 73 percent, respectively, Robert Brady, the chairman of Moog, declared the recession is over for the aerospace and defense manufacturer.

The stock was up 2.8% today and it’s our third best-performing stock this year.

-

Mad Men: Lie Vs. Lay

Posted by Eddy Elfenbein on July 30th, 2010 at 1:29 pm -

Recession Receded Worst Than Previously Thought

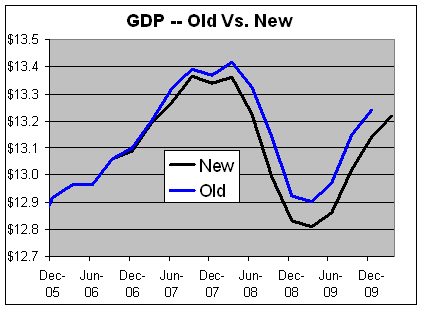

Posted by Eddy Elfenbein on July 30th, 2010 at 11:15 amToday’s Q2 GDP report came out and it was ugly. The economy grew by just 2.4% in real terms for the second three months of the year. That was below the Street’s forecast of 2.6%.

The Commerce Department also revised the GDP numbers going back to Q4 of 2006 and it turns out that the recession was even worse than they thought.

Check out the old numbers versus the new ones:

Nothing is as surprising as the past.

- Tweets by @EddyElfenbein

-

-

Archives

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His