-

P/E Ratios of Financial Stocks

Posted by Eddy Elfenbein on August 25th, 2010 at 12:01 pmHere’s another look at the P/E Ratios are selected large-cap financial stocks. The P/E Ratios are based on earnings estimates for next year:

Company Ticker Price EPS Est. P/E Ratio Hartford Financial Services HIG $19.21 $3.69 5.2 Lincoln National LNC $21.46 $3.76 5.7 Genworth Financial GNW $10.48 $1.66 6.3 Unum Group UNM $19.59 $3.02 6.5 Allstate ALL $27.59 $4.13 6.7 MetLife MET $36.00 $5.30 6.8 Assurant AIZ $35.63 $5.01 7.1 Torchmark TMK $48.30 $6.75 7.2 XL Group plc XL $17.63 $2.46 7.2 Principal Financial Group PFG $21.75 $2.94 7.4 Morgan Stanley MS $24.88 $3.35 7.4 Prudential Financial PRU $49.13 $6.57 7.5 AFLAC AFL $45.21 $5.98 7.6 SLM Corporation SLM $11.19 $1.48 7.6 Goldman Sachs GS $143.98 $18.76 7.7 JP Morgan Chase JPM $35.86 $4.59 7.8 Citigroup C $3.66 $0.46 8.0 Wells Fargo WFC $23.21 $2.88 8.1 Bank of America BAC $12.53 $1.54 8.1 American International Group AIG $33.94 $4.17 8.1 The NASDAQ OMX Group NDAQ $18.63 $2.24 8.3 Capital One Financial COF $36.95 $4.40 8.4 The Travelers Companies TRV $49.33 $5.84 8.4 Ameriprise Financial AMP $41.93 $4.93 8.5 PNC Financial Services PNC $49.94 $5.87 8.5 Discover Financial Services DFS $13.85 $1.60 8.7 Bank of New York Mellon BK $24.02 $2.64 9.1 State Street STT $34.85 $3.78 9.2 Chubb CB $53.57 $5.65 9.5 U.S. Bancorp USB $21.04 $2.20 9.6 Loews L $35.19 $3.45 10.2 Hudson City Bancorp HCBK $11.68 $1.14 10.2 Moody’s MCO $21.20 $2.06 10.3 NYSE Euronext NYX $27.62 $2.67 10.3 Aon Corporation AON $36.37 $3.51 10.4 BB&T BBT $21.99 $2.06 10.7 Fifth Third Bancorp FITB $10.87 $0.99 11.0 American Express AXP $39.64 $3.58 11.1 Huntington Bancshares HBAN $5.09 $0.45 11.3 Federated Investors FII $20.25 $1.75 11.6 Janus Capital Group JNS $9.46 $0.78 12.1 Kimco Realty KIM $14.38 $1.17 12.3 Progressive PGR $19.30 $1.56 12.4 Marsh & McLennan MMC $23.30 $1.87 12.5 ProLogis PLD $9.99 $0.78 12.8 Franklin Resources BEN $95.17 $7.30 13.0 Legg Mason LM $25.30 $1.94 13.0 Northern Trust NTRS $46.28 $3.50 13.2 Health Care REIT HCN $45.03 $3.40 13.2 Apartment Investment and Manage AIV $19.82 $1.46 13.6 CME Group CME $238.55 $17.39 13.7 Simon Property Group SPG $88.77 $6.32 14.0 M&T Bank MTB $86.33 $6.09 14.2 IntercontinentalExchange ICE $93.18 $6.38 14.6 Host Hotels & Resorts HST $13.25 $0.90 14.7 Charles Schwab SCHW $13.47 $0.91 14.8 HCP, Inc. HCP $34.11 $2.26 15.1 Vornado Realty VNO $80.76 $5.33 15.2 Comerica CMA $33.72 $2.21 15.3 T. Rowe Price TROW $44.47 $2.73 16.3 Cincinnati Financial CINF $26.70 $1.63 16.4 CB Richard Ellis CBG $16.01 $0.96 16.7 Ventas VTR $49.65 $2.96 16.8 E*TRADE Financial ETFC $12.89 $0.75 17.2 Boston Properties BXP $80.64 $4.45 18.1 KeyCorp KEY $7.26 $0.40 18.2 Public Storage PSA $97.36 $5.34 18.2 Equity Residential EQR $44.99 $2.33 19.3 Regions Financial RF $6.41 $0.33 19.4 First Horizon National FHN $10.16 $0.49 20.7 People’s United Financial PBCT $12.73 $0.60 21.2 Plum Creek Timber PCL $33.76 $1.59 21.2 AvalonBay Communities AVB $103.38 $4.30 24.0 SunTrust Banks STI $22.62 $0.83 27.3 Zions Bancorporation ZION $18.06 $0.51 35.4 New M&I Corporation MI $6.08 $0.03 202.7 David Merkel adds: “The key metric, which is hard to measure for financials, is earnings quality. That’s one reason why P/Es are so low.”

-

More on Stocks Vs. Bonds

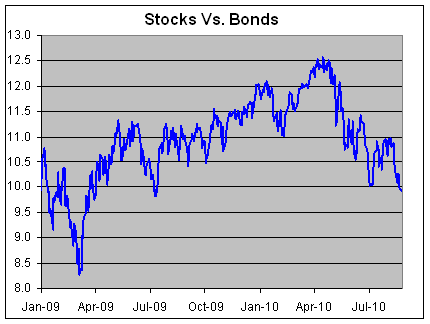

Posted by Eddy Elfenbein on August 24th, 2010 at 3:49 pmHere’s another quick-and-dirty view of how badly bonds have been beaten stocks recently. This shows the Vanguard 500 Index Investor Fund (VFINX) divided by the Vanguard Long-Term Investment-Grade Fund (VWESX):

I’m using Vanguard’s main S&P 500 index fund as a proxy for stocks and it’s main corporate bond fund as a proxy for bonds. It’s not perfect but it suits our purposes.

As you can see, bonds have beaten stocks consistently since mid-April (meaning, the ratio is falling). The ratio is about where it was 13 months ago, and it’s not terribly far from it’s very low reading from March 2009.

According to this reading, bonds have outperformed stocks since April 1988. It could be older, but the data only goes back to November 1987. -

Time for US Treasury Consols?

Posted by Eddy Elfenbein on August 24th, 2010 at 1:00 pmWith Treasury yields being so low, here’s an idea to consider—let’s have the U.S. Treasury consider floating some long-term debt, some very long-term debt, like a 100-year bond. Hey, Norfolk Southern (NSC) just floated some 100-year paper and the yield was under 6% so why not Uncle Sam? Perhaps not a big auction at first, but it’s certainly worth dipping our toes in the water to see what demand is like (in other words, will China approve?). This could save taxpayers huge amounts of money.

In fact, why stop at 100 years? In the 18th century, the British government issued consol bonds which are perpetuities—bonds that never mature. The word consol refers to the fact that the issue consolidated all of the governement’s debt into one issue. The bonds are callable and the British government has lowered the coupon a few times over the past 250 years. The yield is so low now (2.5%) that they’re not worth redeeming which means the Brits did well off them.

I say let’s float some Treasury perpetuities. Start with a small auction at first to see how it goes. We used to have redeemable Treasury bonds although none is currently outstanding. But for political cover, we can say that these perpetuities aren’t callable for the next, say, 50 years. We could even call them “Obama Bonds.” I wouldn’t be surprised if we could lock-in 4%.

Students of finance will also be happy because once the maturity of a bond becomes infinite, the yield-to-maturity equation gets a whole lot easier. Just divide the coupon by the price and you’re done. -

Bond 36,000

Posted by Eddy Elfenbein on August 24th, 2010 at 11:21 amThe bond boom continues. The yield on the 10-year T-bond briefly dropped below 2.5% this morning:

Nortfolk Southern just sold $250 million in 100-year bonds.The interest rate on Norfolk Southern’s new debt is 6% for a yield of 5.95%, about 0.90 percentage points more than where the company’s outstanding 30 year debt was trading Monday. It was the lowest yield for 100-year debt bankers could recall, breaking through the 6% yield on the company’s 100-year issue in 2005.

What’s the point of even having a stock market if investors only want debt? Just float debt and buy back all your stock.

-

Medtronic Falls on Lower Guidance

Posted by Eddy Elfenbein on August 24th, 2010 at 10:32 amShares of the Medtronic (MDT) are getting bashed this morning after the company lowered its earnings guidance for fiscal 2011. In my opinion, the market is overeacting but of course, that’s what markets do.

Here are the facts. Medtronic earlier said to expect EPS for FY 2011 (which ends in April 2011) to range between $3.45 and $3.55 with revenue growth ranging between 5% and 8%. Now they’ve lowered that to a range of $3.40 and $3.48, with revenue growing between 2% and 5%.

If we take the midpoints of the EPS forecasts, then the downward revision is just 1.7%. The shares, however, have been down by as much as 11.5% today. I am concerned that one lowered forecast often leads to another (and another and another….).

Still, let’s not get ahead of ourselves. Medtronic just reported pretty good earnings for their fiscal Q1 of 80 cents per share. That hit the Street’s forecast on the nose. In June, the company said to expect EPS between 79 and 81 cents which at the time was lower than the Street’s view of 84 cents per share.

With today’s earnings, MDT technically earned 76 cents per share plus there were four cents per share in charges. Revenue fell by 4% to $3.77 billion but some of that was due to currency conversion. I don’t worry so much about variables that are out of the company’s hands.

What’s causing Medtronic’s problem? CEO Bill Hawkins said, “Although we have experienced a slowdown in the markets of our largest businesses, the investments we are making in emerging markets and emerging therapies will allow us to achieve market-leading performance over the long-term.”

The AP notes:The world’s largest medical-device company said global sales for its Cardiac and Vascular Group fell 5 percent to $2.03 billion in the quarter. Those sales actually increased 1 percent when adjusted for foreign currency and the extra week last year.

Spinal revenue dropped 9 percent to $829 million due to growing pricing pressures and weaker procedure growth, the company said.

Spinal devices make up Medtronic’s second-largest franchise. Medtronic spent nearly $4 billion to acquire spinal implant maker Kyphon in 2007, though many analysts say the unit is not living up to expectations.If you own MDT, I know today’s news seems very bad, but the stock is still a very attractive buy. With today’s downturn, MDT is going for about nine times the lower bound of the revised forecast. Plus, the dividend yield is up to 2.9%.

Here are the sales and earnings numbers going back a few quarters:Quarter EPS Sales in Millions Jul-01 $0.28 $1,456 Oct-01 $0.29 $1,571 Jan-02 $0.30 $1,592 Apr-02 $0.34 $1,792 Jul-02 $0.32 $1,714 Oct-02 $0.34 $1,891 Jan-03 $0.35 $1,913 Apr-03 $0.40 $2,148 Jul-03 $0.37 $2,064 Oct-03 $0.39 $2,164 Jan-04 $0.40 $2,194 Apr-04 $0.48 $2,665 Jul-04 $0.43 $2,346 Oct-04 $0.44 $2,400 Jan-05 $0.46 $2,531 Apr-05 $0.53 $2,778 Jul-05 $0.50 $2,690 Oct-05 $0.54 $2,765 Jan-06 $0.55 $2,770 Apr-06 $0.62 $3,067 Jul-06 $0.55 $2,897 Oct-06 $0.59 $3,075 Jan-07 $0.61 $3,048 Apr-07 $0.66 $3,280 Jul-07 $0.62 $3,127 Oct-07 $0.58 $3,124 Jan-08 $0.63 $3,405 Apr-08 $0.78 $3,860 Jul-08 $0.72 $3,706 Oct-08 $0.67 $3,570 Jan-09 $0.71 $3,494 Apr-09 $0.78 $3,830 Jul-09 $0.79 $3,933 Oct-09 $0.77 $3,838 Jan-10 $0.77 $3,851 Apr-10 $0.90 $4,196 Jul-10 $0.80 $3,733 -

Pujols and the Triple Crown

Posted by Eddy Elfenbein on August 24th, 2010 at 9:56 amLast night, Albert Pujols went three-for-four; he hit a single, a double and a three-run home run which was the 399th of his career.

Pujols now leads the National League with 33 home runs, 92 runs batted in, and he’s third in batting average at .319. Pujols trails only Joey Votto (.323) and Martin Prado (.320). In 18 games this August, Pujols is hitting .425 with nine home runs and 20 RBI.

All this means that Pujols has a good chance of becoming the first major leaguer to win the Triple Crown since Carl Yastrzemski in 1967. In fact, no one has really come close since then. In all that time, perhaps the next closest is Joey Votto this year who, as mentioned, is leading the league in batting, and he’s second in RBI and third in home runs.

Even if Pujols win the Triple Crown, there’s a good chance that Votto might edge him out for MVP. Votto’s Reds are currently 2.5 games head of Pujols’ Cardinals in the NL Central.

In my book, Hank Aaron is still the home run king. When he does hit his next home run, Pujols will be the third youngest to 400. I’ll be strongly rooting for him to get to 756. -

The War for Potash

Posted by Eddy Elfenbein on August 23rd, 2010 at 10:39 amIf it’s Monday and it’s 2010, then the market is probably up and wouldn’t you know it, it is! Right now, 19 of our 20 Buy List stocks are trading higher and Nicholas Financial (NICK) is unchanged with just 100 shares traded. Once again, the cyclical stocks are trailing the overall market. I think that’s going to be a major theme going forward.

The big news today is that Potash (POT) has officially rejected the $39 billion buyout bid it got from BHP Billiton (BHP) last week. Now Potash is looking around for a “white knight” to rescue them, but it won’t be easy. Billiton’s bid is $130 per share which is pretty rich. The Street expects Potash to make $5.50 per share this year, so the BHP bid is 23.6 times that. Plus, you know the old saying, “$39 billion in hand is better than nothing in the bush.” Interesting tidbit: In any deal, Potash’s CEO will walk away a cool half billion. That’s not bad for saying “yes.’

What will Potash do? Beats me. Maybe some private equity guys will link up. Maybe the Chinese. Maybe the Brazilians. It’s an open game. I also think Billiton will up their bid just to play nice because they may go hostile.

Honestly, I’m not so interested in who will win but who’s willing to play. I still think that the bond market has far outrun the stock market so we should be seeing more aggressive plays like this. The Potash bid is good for the market and I’d like to see some more players join in.

We saw almost the exact same story three years ago when Billiton went after Rio Tinto (RTP), who had just snagged Alcan. Rio shot down the offer so BHP went hostile. Soon after, the world economy exploded and Billiton threw in the towel. When BHP first made the offer in November 2007, shares of Rio surged from $84 to $103. Today, Rio is at $52. Ouch! -

Another Down Friday

Posted by Eddy Elfenbein on August 20th, 2010 at 1:02 pmThe market is down again on a Friday which has been the trend this year. And once again, the cyclical stocks are leading us lower.

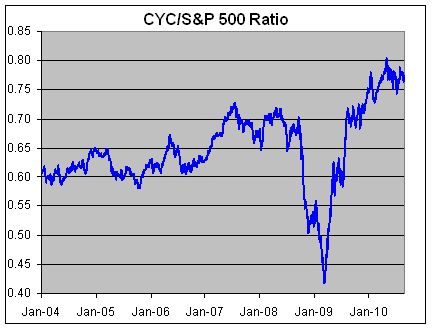

Every so often I like to look at ratio of the Morgan Stanley Cyclical Index (^CYC) divided by the S&P 500. This is a quick-and-dirty way of telling us where we are—or at least where the market thinks we are—in the economic cycle.

As you might expect, this ratio often moves in a cycle. Cyclical stocks tend to lead the market up out of a recession and conversely, lead us lower at the beginning of a recession.

I’ve said before that cyclical stocks, as a whole, probably aren’t a good place to be right now. This graph of the ratio shows how elevated the ratio is:

You can also see how dramatic the ninth-month period was from September 2008 to August 2009. The ratio closed at an all-time high of 0.803 on April 26 of this year, exactly one session after the market’s highest close in nearly two years. Since then, the S&P 500 has given back about 12% while the CYC is off by more than 16.5%. Although I think the broad market will recover, I still believe that cyclical stocks will be laggards. -

Jos. A Bank Clothiers Split 3-for-2

Posted by Eddy Elfenbein on August 19th, 2010 at 6:27 pmThere’s one small housekeeping announcement. Jos. A Bank Clothiers (JOSB) split 3-for-2 today.

For tracking purposes, I assume the Buy List is a $1 million portfolio starting on January 1 of each year. That means all 20 stocks are equal positions of $50,000 each. On January 1, our position on JOSB was 1,185.115 shares at the buy price of $42.19.

With the 3-for-2 split, our JOSB position is 1,777.6725 shares at a starting price of $28.1267. -

Is There a Bond Bubble?

Posted by Eddy Elfenbein on August 19th, 2010 at 12:40 pmLately, there’s been a lot of talk among financial bloggers of a Bond Bubble. There very well could be but the key question is, a bubble relative to what?

Compared with stocks, yes, I think bond yields are far too low. My hope is that stocks will rise to bring the two into better balance. You can think of investing as a perpetual battle between stocks and bonds. Is it better to raise money by borrowing, or taking on new partners? Understanding that key fact is to see how the market works.

The plus of borrowing is that when you’re done renting someone else’s money, it’s over. Taking on new partners never goes away unless you by them out. The negative of borrowing is that you have to pay interest, so whatever you sell, a few pennies in price goes towards paying interest. The positive of equity financing is that there’s no up-front cost.

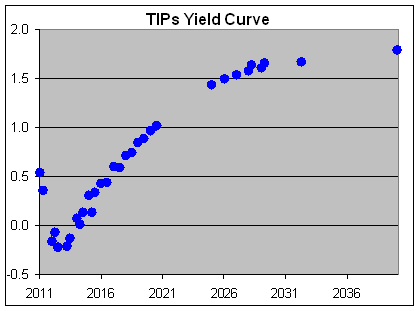

Right now, I believe bond yields are very, very low, even adjusting for inflation. Just look at the TIPs yield curve.

The TIP coming due in July 2010 currently yields just 1% over inflation (or rather, over the CPI). In my opinion, that’s awful.

I don’t, however, believe that bond yields will plummet like dot-com stocks did 10 years ago. Rather, I think investors are unduly fond of the security of Treasury bonds. Sure, they’re safe but that safety comes at a price. One percent real yield for 10 years is too rich for me. The good news is that our massive debt can be financed rather cheaply.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His