-

Well, That’s a V-Shaped Recovery

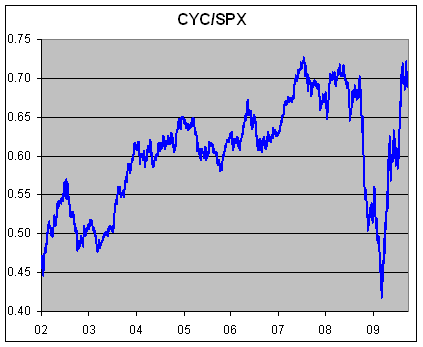

Posted by Eddy Elfenbein on September 28th, 2009 at 3:44 pmI often like to look at how the Morgan Stanley Cyclical Index (^CYC) is performing relative to the S&P 500.

The past year has been a dramatic ride. Cyclicals led the market down, the led them back up. Here’s the CYC divided by the S&P 500.

If the equity market is correct, perhaps we’re in for a V-shaped recovery. -

Zeroing in on Zero Hedge

Posted by Eddy Elfenbein on September 28th, 2009 at 2:13 pmJoe Hagan profiles the financial blog Zero Hedge in New York Magazine. In the past, I’ve defended Zero Hedge from attacks on its decision to use a pseudonym. And that defense, incredibly led to me being attacked on CNBC!

Well, now we know that Dan Ivandjiiski is the man behind Tyler Durden:(A) 30-year-old Bulgarian immigrant banned from working in the brokerage business for insider trading. A former hedge-fund analyst, he’s also a zealous believer in a sweeping conspiracy that casts the alumni of Goldman Sachs as a powerful cabal at the helm of U.S. policy, with the Treasury and the Federal Reserve colluding to preserve the status quo. His antidote? A purifying market crash that leads to the elimination of the big banks altogether and the reinstatement of genuine free-market capitalism.

While many of the posts are excellent, more than a few are—as the passage above suggests—completely off the fringe. They’re poorly reasoned, paranoid and highly conspiratorial.

I wondered why could there be such a difference in the quality of the posts. Apparently, Ivandjiiski is merely the leader but there are up to 40 different people who write under the name Tyler Durden.

I have to agree with Felix, the Durden cell should be broken up. Again, I have no problem with the use of pseudonyms, but we should know which pseudonym wrote what so readers can skip over the Grassy Knoll stuff.

I think ZH’s success underscores the fact that the blogosphere is biased toward sites that express moral outrage. Criticizing people is, apparently, far too tame. No, you need to explain why your opponents are evil. In fact, they’re doubly evil because they know they’re evil yet they do nothing about it. Now that’s evil!

I guess a lot of folks aren’t happy unless they’re upset. And with that we go to today’s poll question: Should we increase welfare payments to illegal immigrants? -

Michael Moore: Jesus Wouldn’t Play the Stock Market

Posted by Eddy Elfenbein on September 28th, 2009 at 1:05 pm

As to the Jesus’ financial views, I’ll have to defer to those with greater Biblical knowledge. The only financial stand I know Jesus had was his expelling the money changers from the Temple.

But I don’t follow the argument that investing in the stock market is itself immoral. In fact, I think preventing capital from getting to prospective entrepreneurs is morally questionable. -

The Five Most Overpaid CEOs

Posted by Eddy Elfenbein on September 28th, 2009 at 12:26 pmCNNMoney.com lists the five most overpaid CEOs. They are:

Michael Jeffries, Abercrombie & Fitch

James W. Stewart, BJ Services Company

Brian Roberts, Comcast Corp.

John Faraci, International Paper

Eugene Isenberg, Nabors Industries

Once again, I didn’t make the list. -

My Thoughts on HR 1207

Posted by Eddy Elfenbein on September 28th, 2009 at 12:24 pmI want to address the issue of HR 1207 and the Fed audit. If I were in Congress, I would support the bill. I say this even though I find the much of the pseudo-populist impulse behind the bill repellent.

I’ve read Mr. Alvarez’s testimony and I think he makes several good points. The problem is that too much of the argument relies on scenarios that are too distant from coming about.

The crux of his argument is that all these bad things will happen once a full audit is allowed. Yes, they could happen but it’s not clear that these are immediate dangers.

I’m still curious as to what the conspiracy crowd expects to find out. Matt Taibbi writes: “It’s becoming abundantly clear that at some point we’re going to start to hear details about monstrous front-running operations involving the major banks on Wall Street.”

Hmmm. Call me a doubter on that. And if the Fed has been trying to manipulate the market, I’m afraid they’re not doing a very good job. -

Get Your Resumes Ready

Posted by Eddy Elfenbein on September 28th, 2009 at 11:54 amGoldman Sachs is hiring.

It must be part of some plot. -

Gambling on Zombie Stocks

Posted by Eddy Elfenbein on September 28th, 2009 at 11:41 amThe LA Times writes that investors are speculating on busted stocks like Lehman and Washington Mutual that are still trading.

Shares of Lehman have nearly quintupled in the last four weeks despite having some business problem. Some of those problems include having no business or employees.

Still, did I mention the stock? Boo-yah!!

These folks are literally buying shares that are worth less than the paper they’re printed on. If you’ve ever needed clear-cut proof against efficient markets, this is it. -

WaPo Rewrites History

Posted by Eddy Elfenbein on September 28th, 2009 at 11:23 amThe Washington Post runs a very deceptive article today claiming that community groups warned the Federal Reserve about subprime loans and the Fed repeatedly ignored them.

In fact, the groups were complaining about the interest rate charged on the loans, not on the subsequent housing bubble. The Post writes: “Subprime mortgage lending sneaked up on the Federal Reserve.”

Not at all. The Fed knew about subprime and fully encouraged it. Here’s Greenspan quoted four years ago in, of all places, The Washington Post:“Where once-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately,” he said in a speech. “These improvements have led to rapid growth in sub-prime mortgage lending; indeed, sub-prime mortgages account for roughly 10 percent of the number of mortgages outstanding, up from just 1 or 2 percent in the early 1990s.”

That’s not all. In June, Connie Bruck wrote in the New Yorker:

In 1992, a landmark study by the Federal Reserve Bank of Boston made it clear that there were systemic underwriting issues relating to the treatment of African American and Hispanic borrowers. Policymakers called upon the mortgage industry to change their practices and redouble their efforts to better serve minorities and underserved communities.

If the community organizers had their way, the bubble would have been far worse, and their communities would be far more disorganized.

-

Earnings Revisions At Two-Year High

Posted by Eddy Elfenbein on September 28th, 2009 at 10:18 amBespoke notes that analysts are becoming more bullish:

Our daily tracking of analyst revisions for stocks in the S&P 1500 shows that over the last four weeks, 578 companies in the S&P 1500 have seen their earnings estimates increase, while 389 have seen their numbers cut. This works out to a net of 189, or 12.6% of the index. As shown in the chart below, this is the highest level since at least the start of 2008 (red line), and is a major improvement off of where we were six months ago, when the net earnings revision ratio was closer to “-50%”. While analysts are typically thought of as being behind the curve, so far this year they have done a good job of leading the market. When equities bottomed in March (blue line), analyst revisions were already well off their lows of the year.

I should add that analysts aren’t so much as increasing their earnings estimates, they’re softening the earnings plunges. Still, it’s how bull markets start and it’s another reason why this isn’t a bear-market rally.

-

Taleb Watch

Posted by Eddy Elfenbein on September 28th, 2009 at 10:03 amJoe Weisenthal spots bigmouth Nassim Taleb in the news again.

“Bernanke, Geithner and Summers didn’t see the crisis coming so why are they still there?” Taleb told a group of business people in Hong Kong. Bernanke is like “a pilot who didn’t see a hurricane,” he added.

Joe shrewdly notes, “We thought prediction was basically impossible.” Not only is Taleb’s comment silly, which they usually are, but this time Taleb’s metaphor shows a fundamentally misunderstanding of what a central does. And as far as predictions go, Taleb isn’t doing so hot. Just five months, he was saying that today’s crisis is “vastly worse” than the Great Depression.

Now that it looks like the recession has past, the GDP numbers will soon reveal how far off the market Taleb was. He also chimed in on financial regulation.Many people, such as traders, benefit from these black-swan events and it’s up to regulators to ensure rules and disincentives are in place to discourage them from triggering these occurrences, he said.

That’s exactly the wrong approach. The problem is that our regulators have tried to design a system that’s impossible to break. Instead, their focus should be on making a system that’s easy to fix.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His