-

Nicholas Financial (NICK), a $12 Stock

Posted by Eddy Elfenbein on August 24th, 2009 at 10:32 amAlex Bossert is an 18-year-old financial blogger in Minnesota. Check out his take on Nicholas Financial (NICK).

The economic indicator that best correlates to Nicholas’s charge off rate is the unemployment rate. The pre-tax margin for the quarter was 6.34% and the provision for credit losses was 6.16%. Credit losses would have to double from here to bring Nicholas into the red, a very unlikely scenario, given that the provision for credit losses fell from 6.26% of average credit receivables to 6.16% in the current quarter. Net charge offs fell from 8.94% in the fourth quarter to 7.72% in the 1st quarter. Management anticipates losses absorbed as a percentage of liquidation will be in the 11%-16% range during the remainder of the current fiscal year. Losses as a percent of liquidation were 11% in the 1st quarter.

The loans the company is making are getting more profitable as their competition has diminished during the credit crisis. The average discount of new loans purchased has risen to 9.29% from 8.87% a year ago.Alex thinks NICK is a $12 stock and I agree. Even after NICK’s big run this year, it’s still going for around 85% of book value.

-

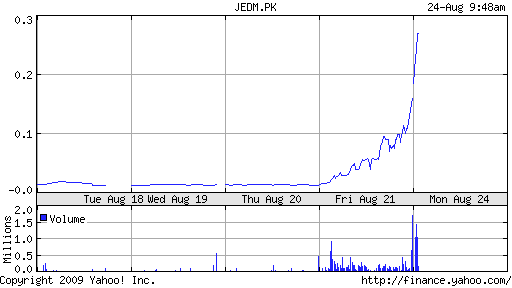

Jedi Mind Inc (JEDM)

Posted by Eddy Elfenbein on August 24th, 2009 at 10:05 amWhat’s the hottest stock on the market? Tim Sykes points us toward shares of pink sheet listed Jedi Mind (JEDM).

Yep, that looks like a nice move.

As best as I can tell, the company makes “software for thought controlled technologies, allowing the user to interact with the computer and other machines through the power of the mind.” CBS’ 60 Minutes ran a story on this technology and that appears to be driving the surge in the stock.

A lot of these pink sheet stocks produce little in the way of products but they’re great at putting out press releases. If a company is serious about its future, it won’t be listed on the pink sheets. Investors like Tim Sykes love watching this marginal stocks skyrocket — they wait until the party gets going, short the stock and often make big gains.

I admit I know nothing about Jedi Mind but I think I know how this story will end. -

What Bloggers Were Saying at the Low

Posted by Eddy Elfenbein on August 24th, 2009 at 9:57 amThe S&P 500 is up again this morning. From our low in March, the index is up nearly 55%.

With such tremendous gains under our belt, the Reformed Broker decided to take a look at what bloggers were saying at the low, and was nice enough to include me in the retrospective.

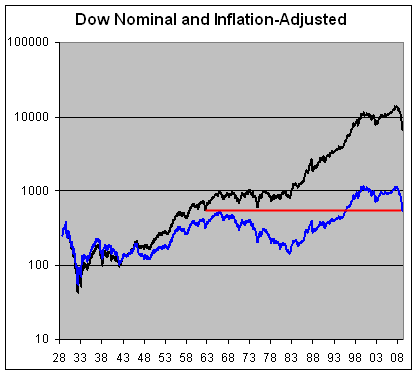

At the time, I ran a chart showing that the inflation adjusted Dow was unchanged over the last 43 years.

The next time that happens, I’ll know that’s a big buying opportunity. -

Sex Drive and the Stock Market

Posted by Eddy Elfenbein on August 21st, 2009 at 9:49 pmIn the study, conducted by researchers from Harvard University, it was determined that stock market traders saw their profit margins rise on days their testosterone was above its median level and that testosterone could influence how financial wizards often make high risk decisions.

How did the researchers figure this out? They took saliva samples from a group of men ages 18 to 23 and then had the men play a game having to do with investing. Given $250, they had to choose an amount between $0 and $250 to invest. They got to keep the money that they didn’t invest. If the participant lost a coin toss, their money for investing was lost. But, if they won the coin toss they’d get two and a half times the amount of their investment. At the end of the study, one person was selected by lottery to receive cash equal to their investment, so there was some real incentive. To make a long study finding short, the researchers found that the men with higher testosterone levels invested 12 percent more in a risky investment than the more average men did.

So, they determined, there is a biological basis why some men are inclined to more risky behavior than others. While that might not sound terribly revealing, the study represents one of the first times that research has determined that typically male behavior extends to the financial world. Say the researchers: “Men may be more willing to take financial risks because the payoffs, in terms of attracting mates, could be higher for them. This is because women value wealth more than men when choosing for a mate.”(Via: Carney)

-

Stocks Keep On Rising

Posted by Eddy Elfenbein on August 21st, 2009 at 4:18 pmToday was another strong day for stocks. The S&P 500 made another high for the year.

Our Buy List also made a new high. We’re up nearly 30% for the year which is well more than twice the S&P 500. Every stock on the Buy List was up today, and Cognizant Technology Solutions (CTSH) is closing in on a double for the year.

Here’s today’s speech from Ben Bernanke from the annual Jackson Hole shindig. It’s long but I recommend reading the whole thing. I continue to think that Bernanke has been an outstanding Fed chairman. -

Nouriel Roubini, the Prophet

Posted by Eddy Elfenbein on August 20th, 2009 at 2:22 pmI think I’ve been too critical of Nouriel Roubini. He’s a very bright guy and well worth listening to. However, as Damien Hoffman points out, Roubini wasn’t exactly perfect on predicting the credit crisis.

As we can see, in March 2005 Roubini started by predicting a crisis caused by Foreign Central Banks diversifying out of US Dollars. (See: ‘Does Overseas Appetite for Bonds Put the U.S. Economy at Risk?’) In February 2006, Roubini still solely focused on foreigners diversifying out of US Treasury debt and further incorrectly predicted that “our current patterns of spending above our incomes” would cause a crisis by 2013. (See: ‘Taste of the Future‘.) Given that the credit markets (which Roubini never mentions until others show him the light) imploded recently, I think we can conclude that “spending above our incomes” doesn’t have to do the crisis perp walk. During the same month as The Washington Post article, Roubini’s press releases peppered the New Yorker with his message: “Roubini is among those who fear that America’s profligacy will eventually create a crisis of confidence on the part of its creditors, leading to a run on the dollar, an upward spike in interest rates, and a deep recession.” (See: ‘Moneyman’ and ‘Ominous Warnings and Dire Predictions of the World’s Financial Experts’.)

At a transition point in August 2006 (most likely when Roubini realized he picked the wrong causes), he threw the entire kitchen sink into the center of the causation ring. The USA Today reported, “He [Roubini] spells out a long list of potential risks that could push the country into trouble. Among them: unregulated hedge funds, housing, foreign trade uncertainty, the need to finance the nation’s huge trade deficit, Middle East unrest and the potential for terrorism.” In another article, Roubini added to his laundry list by adding just about everything under the sun: “Among other factors, Roubini cites ‘trade protectionism and asset protectionism; hedgy and trigger-happy investors and rising geopolitical risks; the risk of a disorderly fall in the U.S. dollar; a slush of financial derivatives that are a black box that no-one understands … frothy markets where years of too easy money have created bubbles galore – the latest in housing – that are ready to burst; a bubble of thousands of new hedge funds with inexperienced managers … a housing market whose rout may trigger systemic effects …’” (See: ‘Is Economy Headed to a Soft Landing?’ ‘Surprise: Bears still growling about 1987′ and ‘Recession Isn’t My Greatest Fear’.) How about adding to that list butterflies flapping their wings on the other side of the world, or an attack of the flying space monkeys?I didn’t know it a few years, but apparently everyone was predicting a credit crisis. I wish someone had told me.

Roubini clearly knew something bad was coming — what and when was hard to pin down. Hoffman writes:This specific tactic — expanding the “prediction” data set of possibilities — may be the most popular for false prophets and psychics. Usually, there will be a group willing to hang on to the one correct cause out of the many incorrectly asserted. Then, afterward, the charlatan works tirelessly to rewrite history or distract his victims from what was exactly said in the past. It’s like a fake shaman warning the villagers of rain (an inevitable fate) by means of angry gods when in fact the true cause was heavy cloud droplets. Yet, once the rain falls he quickly raises his voice about how he “predicted” the rain. Yes, rain followed the shaman’s warning, but this is not a “prediction” for obvious reasons.

As I’ve often said, perma-bears and never held to the same level of accountability as perma-bulls. If you want to get a reputation as a prophet, it’s easy — just be very bearish and very vague.

-

Since 1970, All of the Market’s Gain Has Come When Gold is Below $455

Posted by Eddy Elfenbein on August 20th, 2009 at 8:08 amI was playing around with some data and I came with an interesting stat: All of the stock market’s gain since 1970 has come when the price of gold is below $455.

OK, now let me explain a little. I took two monthly files; one with the closing price of gold from 1970 though this past May. The other with the dividend reinvested index for the S&P 500 over the same time period.

I then looked at how well the S&P did based on the closing price of gold for the previous month. The results show that the index was net flat whenever gold closed the previous month higher than $455.50.

There were basically three times when gold gave its sell signal. The first was in late 1979 to mid-1981. The second came in mid-1987 to mid-1988 (very good timing there!). The third has been continuous since September 2005. For gold to give another buy signal, it would have to plunge by more than 50%.

Let me add that I don’t see this as a market-timing tool. I just think it’s interesting how the market has behaved. -

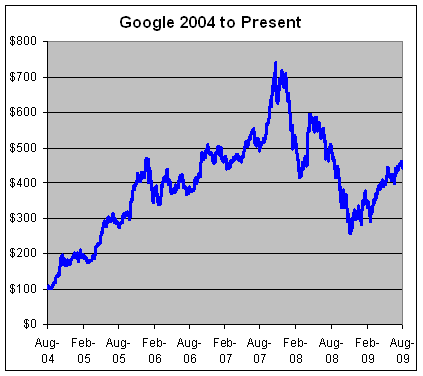

Google’s Stock Turns Five

Posted by Eddy Elfenbein on August 19th, 2009 at 3:37 pmIt was five years ago today that shares of Google (GOOG) went public. The stock ended its first day of trading at $100.34. It peaked at $747.24 in November 2007 and is currently at $442.16. Over the same time, the S&P 500 is down by about 9%.

-

Comrade, Have I Got a Deal for You!

Posted by Eddy Elfenbein on August 19th, 2009 at 1:38 pmLine of the day: “There are more brokerage account holders than Communist Party members in China.”

Something tells me that they’re not mutually exclusive.

(Via: Kedrosky) -

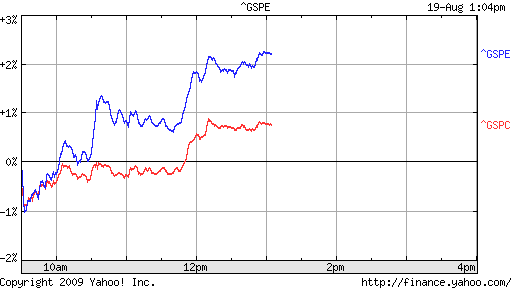

Energy Leads Turnaround

Posted by Eddy Elfenbein on August 19th, 2009 at 1:04 pmA fairly flat day has suddenly become a good day for stocks, and it’s mostly thanks to energy stocks.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His