-

The 10 stupidest tech company blunders

Posted by Eddy Elfenbein on August 18th, 2009 at 9:52 amInfoWorld runs down the 10 stupidest blunders from tech companies. Here’s a sample and it’s one I never knew about:

2. Real Networks Punts on the iPod

People think Steve Jobs invented the iPod. He didn’t, of course. Jobs merely said yes to engineer Tony Fadell after the folks at Real Networks rejected Fadell’s idea for a new kind of music player in the fall of 2000. (Fadell’s former employer Philips also turned him down.)

By then MP3 players had been around for years, but Fadell’s concept was slightly different: smaller, sleeker, and focused on a content-delivery system that would give music lovers an easy way to fill up their “pods.” (Jobs is famous for driving the design of the iPod.)

Today that content-delivery system is known as iTunes, and Apple controls some 80 percent of the digital music market. Fadell worked at, and eventually ran, Apple’s iPod division until November 2008. Real Networks is still a player in the streaming-media world, but its revenues are a fraction of what Apple makes from iTunes alone.Um…sorry.

-

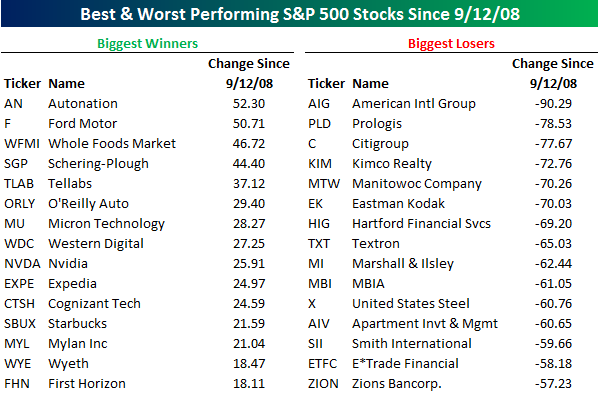

S&P 500 Stocks Above Pre-Lehman Levels

Posted by Eddy Elfenbein on August 18th, 2009 at 9:41 amBespoke finds the very small list of stocks that are above their level prior to Lehman Brothers going kablooey. Only 55 stocks are up and just 27 are up by more than 10%.

-

Insiders Are Dumping Stock

Posted by Eddy Elfenbein on August 18th, 2009 at 8:51 amFrom Reuters:

A massive rally in U.S. stocks since March has reawakened bullish spirits, but insiders are jumping out of the market in a sign the run up is getting stretched.

Company executives are selling stock at a rate not seen in two years after a near 50 percent rise in the S&P 500 from a March 9 low. That suggests directors and managers may think stock prices are nearing the top end of their range in the current economic climate.

There has been a decline in short interest — borrowed shares sold but not yet repurchased — which some analysts see as a warning. Some investors sell short to profit from price declines, and some say the recent rally has been supported by the reversing of short positions.After a 50% rally, I think a sharp pullback is necessary. When it will happen and by how much is still a question. However, I don’t think the market really experienced a rally as much as we saw an unwinding of a vicious bear market.

The rally has been led by junk stocks which is really due to investors fleeing all investments which held any type of risk. The low-quality rally is mirrored by what’s been happening in the bond market with the closing of the gigantic spreads between corporates and Treasuries. -

This Explains A Lot

Posted by Eddy Elfenbein on August 17th, 2009 at 3:26 pmThe Onion reports:

ENGLEWOOD CLIFFS, NJ—Citing a need to provide quality programming 24 hours a day, CNBC has extended an invitation to anyone who owns a suit to drop by the financial news network and be a guest expert, cohost a show with Larry Kudlow, or do whatever. “Don’t worry about what kind of shape your suit is in,” said CNBC president Mark Hoffman, who explained that his network’s studio has an iron and some old phone books that people can press their jackets on. “Just come on down, run a comb through your hair, and if you’re here by 8 a.m., we’ll have you on Squawk Box at 8:15 making stock picks. But don’t forget your suit!” Hoffman added that men of ruddy complexion with neck sizes exceeding 19 inches are not required to wear a tie.

-

Well, That Changes Things

Posted by Eddy Elfenbein on August 17th, 2009 at 2:38 pmFrom CNBC’s Correction page:

An earlier version of this story misstated the amount of Goldman Sachs earnings, listing them as $344 billion when it should have read $3.44 billion.

In other news, CNBC has a corrections page?

-

Abby Joseph Cohen: Recession Ending Now

Posted by Eddy Elfenbein on August 17th, 2009 at 10:39 amAbby Joseph Cohen jumps on the Dennis Kneale bandwagon:

The U.S. recession is ending “right now,” said Abby Joseph Cohen, a senior investment strategist at Goldman Sachs Group Inc.

The economy may grow by 3 percent in the next couple of quarters and expand by 1.5 percent to 2 percent next year, Cohen said. While consumer spending is likely to rise, it probably won’t increase as fast as at the end of prior periods when the U.S. was emerging from a recession, she said.

“Clearly the economy is on the mend,” Cohen said in an interview with Bloomberg Radio. “We do think that profit growth will be more substantial going forward.”

Cohen, known for her optimistic forecasts for stocks during the 1990s stock-market rally, was replaced in March 2008 as the bank’s chief forecaster for the U.S. equity market. She predicted in a May 1 interview that the Standard & Poor’s 500 Index might jump 20 percent to 1,050 in the next 6 to 12 months. The index climbed 15 percent to 1,010.48 through Aug. 7 before retreating 0.6 percent last week. -

Warren Buffett’s New Buy

Posted by Eddy Elfenbein on August 17th, 2009 at 9:58 amWe were very pleased to see that Warren Buffett’s Berkshire Hathaway (BRKA) has added Becton, Dickinson (BDX), one of our Buy List stocks, to his portfolio. Obviously, Warren must be a regular reader.

There is one thing that troubles us. On the SEC filing, the company is listed as Beckton Dickson & Co.

See for yourself. -

The Market’s Excessive P/E Ratio

Posted by Eddy Elfenbein on August 17th, 2009 at 9:37 amThere’s recently been some commentary on the stock market’s elevated P/E Ratio (see here and here).

I think this is a good instance where the P/E Ratio fails to tell us much. We have to remember that the P/E Ratio is an unusual statistic because it looks at the relationship between two different kinds of the numbers. A stock’s price is a fixed-point number, which means you know exactly what a price is at any given time, but earnings is a rate, meaning it must be defined at something that only exists between two certain points in time.

There’s nothing inherently wrong about combining two different kinds of numbers though we should be bear in mind its limitations and this is one such time. The reason is that earnings took such a bath in the fourth quarter of 2008. Operating earnings for the S&P 500 were $-0.09 for Q4 of 2008 and reported earnings were $-23.25. As long as we’re carrying that dud quarter in our trailing four quarters, earnings will look very depressed.

Those losses are massive outliers. The good news is that they’re also past us. At the end of the third quarter, the S&P’s trailing four-quarter operating earnings will probably be around $40, at by the end of the fourth quarter, they’ll vault up to $55. That’s simply because we’re subtracting an awful quarter and adding on a more typical quarter. We can expect that the market’s P/E Ratio will dramatically plunge, but that won’t mean that the market is suddenly becoming a good value. -

Play the Federal Reserve Game

Posted by Eddy Elfenbein on August 14th, 2009 at 9:02 pmThe San Francisco Fed has created perhaps the wonkiest video game world history—it’s the Federal Reserve Game!

Haven’t you always wanted to test your monetary policy skillz online? Well, now you can! Set rates too high and you’ll cause a recession. Go too low and inflation will creep up.

See if you have….

the cool judgment of an Arthur Burns.

the sober confidence of a William McChesney Martin

or the raw sexuality of a Marriner Eccles

Note: I tried to audit the game but kept getting an error message.

(Via: Economix via Carney) -

16 Companies that Have Raised Their Dividend by 10% or More for the Last Nine Years

Posted by Eddy Elfenbein on August 14th, 2009 at 5:15 pmLet me add a disclaimer at the start of this post. This is the result of a data dump so the numbers may not be correct. I searched for companies that have increased their dividend by at least 10% for the last nine straight years. I haven’t doubled-checked the data off another source, but here are the initial results.

Federated Investors (FII)

Linear Technology (LLTC)

Bank of Kentucky Financial (BKYF)

C.H. Robinson Worldwide (CHRW)

Expeditors International of Washington (EXPD)

AFLAC (AFL)

TJX Cos. (TJX)

Brown & Brown (BRO)

Novo Nordisk (NVO)

Fastenal (FAST)

John Wiley & Sons (JW-A)

Johnson & Johnson (JNJ)

Pfizer (PFE)

Mercury General (MCY)

Polaris Industries (PII)

LSB Financial (LSBI)

The current year isn’t included since we’re not done, but a few stocks may fall off the list by year’s end.

The ones that really stand out are Pfizer, Johnson & Johnson and AFLAC. According to my data, these have raised their dividend by 10% or more for at least 18 years. Pfizer cut its dividend in half this year so it’s due to fall off the list.

The smallest dividend increase for AFLAC has been 12%. The company has already raised its dividend by 16% this year, plus the stock is going for about nine times this year’s earnings forecast (not the Street’s forecast, but AFL’s).

J&J increased its dividend by only 6.5% earlier this year so it’s also in trouble. The company has, however, raised its dividend for 47 straight years.

Let me add a special shout out to LSB Financial which is the holding company for Lafayette Savings Bank. This isn’t a micro-cap, it’s a nano-cap. It’s a 140-year-old Indiana-based thrift with a market cap of just $17 million. That’s about 25 minutes worth of sales at Wal-Mart (WMT). LSBI has no analysts who follow it. Sadly, it will fall off the list this year — like many financial firms, the thrift chopped its dividend in half.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His