-

Junk Stocks Rally

Posted by Eddy Elfenbein on August 7th, 2009 at 10:18 amReuters reports:

The junk-stock rally lives on.

The biggest winners since the U.S. stock market got another dose of bull market fever in mid-July have been the companies with the most beaten-down shares and the ones whose business outlooks are seen as the riskiest within the Standard & Poor’s 500 Index.

This winners’ circle has been dominated by 81 S&P companies with unspectacular credit ratings of “BB” or lower, also categorized as high-yield “junk.”

The stock prices of these junk-rated companies have jumped on average by between 21 percent and 29.5 percent between July 10 and Aug. 4.

In comparison, investment-grade companies rated “BBB” or above have seen their shares rise between 9.50 percent and 19.25 percent, according to data from Bespoke Investment Group, a financial research firm based in Harrison, New York. -

The New York Times Fires Ben Stein

Posted by Eddy Elfenbein on August 7th, 2009 at 10:09 amApparently, you really need to go out of your way to get fired as a columnist at the NYT. This is vindication for Felix Salmon who’s been a constant critic of Stein. My only concern is that Stein wasn’t fired for his content but for appearing in a commercial.

-

Recession Plunges Upper Middle Class Family into the Moderately Upper Middle Class

Posted by Eddy Elfenbein on August 6th, 2009 at 1:27 pmBreak out the world’s smallest violin:

Stacey: It used to be, she’d be bored on a Saturday and she’d say, “Let’s go get our nails done,” and I’d say okay. Now, I’ll sometimes say no — or we’ll go, but we’ll only do our fingers, not our toes.

She used to do gymnastics, which she still wants to do. And she wants to do ice skating. But the cost of these extracurricular activities is so expensive that we can only afford to do the one. Even that one is a strain. Every time she tests for a belt, every six weeks, it’s $45, and sparring equipment is $200.The horror.

Michael: We want the kids to see D.C. And I thought, the zoo — that’s a cheap thing to do. Well we went, and by the time we paid for pizza, two cups of coffee, hot chocolate and parking, it came to $100. We’re not going to D.C. again.

Did he say really parking? They live in Ashburn and they drove to the zoo ignoring the fact that there’s a metro stop by the zoo. They spent $100 on going to the zoo and it’s somehow D.C.’s fault.

-

Spreads Continue to Tighten

Posted by Eddy Elfenbein on August 5th, 2009 at 12:08 pmWant an explanation for the rally? Check out the dramatic widening and closing of the spread between long-term Treasuries and corporates. The gap is still over 300 points and it was often below 200 during 2004 to 2007.

-

Scientists Crack Two-Envelope Problem

Posted by Eddy Elfenbein on August 5th, 2009 at 10:33 amHere’s a fascinating story. Two Australian scientists have cracked the legendary two-envelope problem.

Let’s say that there are two envelopes with money in them, one has twice as much as the other. You can open one see how much is there. You now have the option of switching or holding, what do you do?

The CW says it doesn’t matter, you’re just playing the odds so why bother. Well, these two researchers have a way to beat the odds:The formula relates a particular amount of money (y) found in the first envelope to the probability (P) that you should switch envelopes to gain in the long term.

For example, if you open the first envelope and see $10, the formula might tell you that the probability you should switch envelopes is 0.1 – that is once in every 10 games played.

The formula calculates a smaller probability of switching the larger the original amount (y) is.

Using the previous example, if y is $100, the probably might drop to 0.01, or 1 in every 100 games.

Random strategy

What’s key to this strategy is that the decision when exactly to switch – in which game – must be random, says McDonnell, who studies random processes in telecommunications and the brain.

McDonnell says their solution is different to those that have gone before because of this random element.

“Our solution is to switch randomly,” he says.

“Each time you are offered two envelopes, you observe the amount in one envelope, and then the larger the amount observed, the less likely it is that you should switch, but the choice is still random.”

“The key result is that this kind of random switching leads to a long-run financial gain in comparison with either (i) never switching or (ii) switching randomly in a manner that ignores the observed amount in the opened envelope.”So is there a stock market connection? You betcha.

In real life, the actual gain will obviously depend on how much money is actually put in the envelopes, says McDonnell.

Abbott says the growth in money seen in the two envelope problem appears to have some similarities to a theory known as “volatility pumping”.

“Volatility pumping is a way of switching between poor investments and yet winning an exponentially increasing amount of money,” he says.

“It suggests the power of changing your portfolio of stocks periodically, buying low and selling high.” -

Siegel Responds to Criticisms on Stock Market Data

Posted by Eddy Elfenbein on August 5th, 2009 at 9:57 amProfessor Jeremy Siegel has responded to Jason Zweig’s criticisms of the data he’s used for long-term stock performance.

The problem Zweig highlights is how few stocks comprise the study Siegel relies on. Zweig notes that Siegel ignores 97% of stocks that were trading in that time frame—and most of those stocks he uses were blue chips. All those ignored dud stocks would certainly have lowered the 10% per year number.

Zweig also finds that Siegel raised the average dividend yield from the 1802 to 1870 period from 5% to 6.4%. That’s a huge increase and it alters the long-term results very significantly.Siegel responds by pointing to research by Bill Goetzmann and Roger Ibbotson. I happen to be familiar with that data and I still think Zweig’s larger point holds.

The research data collected by Goetzmann and Ibbotson is impressive but I see it as only a start. For example, for months between 1815 and 1834, the data set comprises only a handful of stocks. It’s often less than 20 stocks and sometimes less than 10. The dividend series begins in 1825 and some years it includes less than 20 stocks. I don’t think we should rely on research with so little data.

The problem is that the stock market wasn’t close to a market in the sense we regard it. In fact, common stocks were viewed as similar to bonds. The shares would trade around par value and each year you’d find out what the dividend was. The idea of constant capital gains is a 20th century notion.

Siegel writes:Researchers agree that the biggest source of uncertainty in early stock data is the dividend yield, which was not always reported. As a result, G-I formed two series of dividend yields, one assuming that those stocks for which they could not find dividends had zero dividends (3.77%), and another which uses the dividend yield of those stocks for which they could find dividends (9.27%). They conclude “The true dividend return to a capital-weighted investment in all NYSE stocks is undoubtedly somewhere in between these two extremes.” My dividend yield, which the article claims is unrealistically high, is 6.4%, actually less than the midpoint of their two estimates.

Pointing out those two data sets that are so far apart is precisely the problem. Selecting a number between them doesn’t help. Sure, 5% and 6.4% are within the bookends, but the difference between the two is extreme, especially when compounded over decades. The fact is that Siegel is basing his arguments on very thin data sources.

-

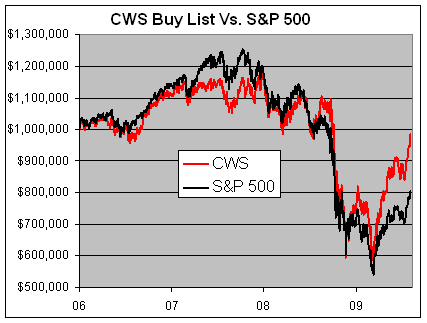

The Total Track Record

Posted by Eddy Elfenbein on August 4th, 2009 at 8:27 pmHere’s a look at the complete record of the Buy List for the last three years, seven months and four days. Not including dividends, we’re down 1.43% compared with a loss of 19.44% for the S&P 500. From the market’s peak on October 9, 2007, our Buy List is off by 15.09% while the S&P 500 is down 35.75%.

-

Cognizant Technology Solutions Delivers Huge Earnings Beat, Guides Higher

Posted by Eddy Elfenbein on August 4th, 2009 at 11:38 amThe Buy List continues to roll. Cognizant Technology Solutions (CTSH) just reported a huge earnings beat, plus it guided higher. For the second quarter, CTSH earned 50 cents a share which is an amazing 13 cents over estimates.

The company now sees Q3 coming in at 44 cents per share, five cents above consensus. For all of 2009, Cognizant expects EPS of $1.80 versus Wall Street’s consensus of $1.54.

These numbers are great. Shares of CTSH have been up by as much as 10% today, and it’s up over 83% for the year. The stock is an excellent buy. -

Goldman Sachs Imitates Goodfellas

Posted by Eddy Elfenbein on August 4th, 2009 at 9:41 amFrom the NY Post:

Goldman Sachs CEO Lloyd Blankfein has warned his employess to avoid making big-ticket, high-profile purchases as the gold-plated Wall Street firm hunkers down amid a firestorm of public and political anger over outsize bonus payments.

According to sources at the bank, Blankfein has Goldman in particular, should be toned down in light of the billions in bailout money that banks, including Goldman, have gotten from Uncle Sam.

A source within the bank said Blankfein first began calling for an end to the conspicuous consumption late last year, but has stepped up his campaign in recent weeks as the White House has sought to rein in compensation and as the firm has gotten dinged by a pair of high-profile magazine articles.

“This is a sensitive time for us, and [Blankfein] wants to make sure that we’re not being seen living high on the hog,” said one Goldman exec.

(Via: The Stimulist) -

Timmy Blows Top

Posted by Eddy Elfenbein on August 4th, 2009 at 9:35 amThis actually makes me think higher of Geithner, though that’s not saying much.

Treasury Secretary Timothy Geithner blasted top U.S. financial regulators in an expletive-laced critique last Friday as frustration grows over the Obama administration’s faltering plan to overhaul U.S. financial regulation, according to people familiar with the meeting.

The proposed regulatory revamp is one of President Barack Obama’s top domestic priorities. But since it was unveiled in June, the plan has been criticized by the financial-services industry, as well as by financial regulators wary of encroachment on their turf.

Mr. Geithner told the regulators Friday that “enough is enough,” said one person familiar with the meeting. Mr. Geithner said regulators had been given a chance to air their concerns, but that it was time to stop, this person said.

Among those gathered in the Treasury conference room were Federal Reserve Chairman Ben Bernanke, Securities and Exchange Commission Chairman Mary Schapiro and Federal Deposit Insurance Corp. Chairman Sheila Bair.

Friday’s roughly hourlong meeting was described as unusual, not only because of Mr. Geithner’s repeated use of obscenities, but because of the aggressive posture he took with officials from federal agencies generally considered independent of the White House. Mr. Geithner reminded attendees that the administration and Congress set policy, not the regulatory agencies.Man, I’m curious who the source was. The article quotes one guy at Treasury and only for him specifically adds that he declined to comment “on Mr. Geithner’s tone and language.”

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His